The University of Virginia’s Center for Engineering in Medicine now supports faculty fellowships that embed engineering faculty members within the UVA School of Medicine.

Sustained, firsthand observation of the clinical environment and regular conversations with clinical colleagues spark ideas for new ways to merge engineering, technology and medicine and solve complex health care challenges. Engineers and clinicians make progress in ways that would not be possible if they were not working in an immersive collaboration; researchers can also move ideas from concept to clinical translation more quickly, all of which is great news for patients.

“Faculty Fellowships are a unique opportunity to allow individual faculty to take a deep dive into a field they are not familiar with,” said Dr. Mark Sochor, associate director of the UVA Center for Engineering in Medicine and the vice-chair for research at the UVA Department of Emergency Medicine. “This cross-pollination of engineers and clinicians allows communication and idea generation that would not normally come about with a chance encounter. This is the water cooler conversation on steroids.”

Embedding faculty is part of the center’s $10 million effort to promote innovation and the exchange of ideas at the nexus of engineering and medicine. The center’s faculty fellowships come with a small amount of funding that allows faculty to separate from their busy academic schedules and engage in an intensive research experience.

“When accomplished researchers who already have core areas of expertise are able to join forces to solve a problem, the reservoir of experience and information they can tap into is huge,” Sochor said. “Faculty embedding creates a research-ideas portfolio that leads to a long-term relationship between the engineering and medical teams and bears fruit for years to come.”

One of the first to take advantage of the embedded fellowship was electrical engineer Scott Acton, who began applying biomedical imaging analysis to research on devastating neuro-immune disorders such as Alzheimer’s disease with neuroscientist Jonathan Kipnis.

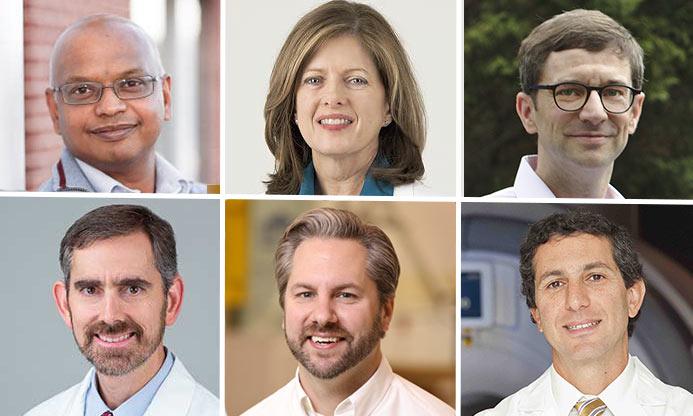

The newest cohort of embedded faculty, whose research is poised to help millions of U.S. patients, includes:

- Matthew B. Panzer, the deputy director of the Center for Applied Biomechanics, an associate professor of mechanical and aerospace engineering and a member of the UVA Brain Injury and Sports Concussion Center, who researches the biomechanics of concussion, an injury that occurs over 3 million times in the United States each year. He is also studying how the cumulative effects of sub-concussive head impacts may lead to long-term neurodegeneration, a condition that may explain some of the cognitive deficits observed in retired professional football players. For his faculty fellowship, Panzer is shadowing clinicians at the UVA Acute Concussion Evaluation Clinic, including neuropsychologist and co-director Dr. Donna Broshek, to gain a clinical perspective on how the forces from motor vehicle collisions affect symptom presentation in brain injury patients. Through this faculty fellowship, he is developing an end-to-end model for studying traumatic brain injury by forging links between his own area of expertise — injury prevention and impact biomechanics — with neuroradiology and neuropsychology, fields that are traditionally unconnected to biomechanics. By using this comprehensive, multidisciplinary approach, Panzer and UVA collaborators hope to gain deeper insight into traumatic brain injury and its effects, with the aim of helping clinicians improve patients’ treatment.

- Anil Vullikanti, a professor of computer science and a member of the UVA Biocomplexity Institute, is researching C. diff., a hospital-acquired infectious bacterium that can harm patients’ treatment and recovery. C. diff. affects over half a million people in the United States each year. For this fellowship, Vullikanti is creating a way to combine multiple specialties in medicine with different tools from artificial intelligence, machine learning and statistics to detect C. diff spread and design interventions for minimizing outbreaks. Vullikanti is collaborating with Dr. Costi Sifri, the director of hospital epidemiology at UVA, and Dr. William Petri, vice-chair for research in the Department of Medicine and a professor of infectious diseases and international health. The team’s research has already been recognized by the UVA Global Infectious Disease Institute, which awarded them a grant to expand their research using this method and design solutions that go beyond traditional disease control methods. In addition, Vullikanti is using the same approach to develop proposals for studying other hospital-acquired infections and even address opioid addiction related to hospital anesthesiology. Vullikanti also applies this same expertise in his new role as the scientific coordinator on a $10M National Science Foundation grant that aims to thwart future pandemics.

- Tom Fletcher, an associate professor with joint appointments in the departments of Electrical and Computer Engineering and Computer Science, is working with Dr. Jeffrey Elias, director of stereotactic and sunctional neurosurgery at UVA, to help tremor patients. Fletcher is using diffusion MRI imaging and data analysis techniques to help understand the causes of tremors and to create a better means for pre-operative planning and postoperative evaluation of tremor patients. Tremor disorders affect over 10 million people annually in the United States. Fletcher has already teamed with radiologists and technicians to recalibrate the MRI machine settings so the diffusion images are optimized to collect better data for planning and evaluation. In addition, when enough data is collected, he will have developed a type of brain map that could help customize care to patient groups who have similar brain imaging patterns. Fletcher envisions that future applications may go beyond pre- and post-op uses and provide real-time data for decision-making during surgery.

“I’m still experiencing the impact of my faculty fellowship,” said Acton, the center’s first faculty fellow. “After we launched our first projects, we continued to collaborate and map the human brain and its immune system. We’ve published several papers, including two high-impact papers — in Nature and the Journal of Experimental Medicine — which currently have over 300 combined citations.

“I also believe my embedding and close cross-disciplinary collaborations with the med school gave me the experience I needed to become a National Science Foundation Program Director for Smart and Connected Health. In this role, I’m managing research that deals with viruses, including COVID-19 and how to prevent future pandemics. So, in addition to contributing to ground-breaking scientific discoveries with Kipnis, now I’m able to be on the frontlines helping to solve an urgent large-scale public health problem. I believe that advances in computing, coupled with breakthroughs in biology, are keys to avoiding future global health crises.”