Penny Stocks and Small-Caps, What to Know About Trading This Week

How to trade penny stocks in 2021? Here’s a few tips to use with your strategy.

The post Penny Stocks and Small-Caps, What to Know About Trading This Week appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

3 Penny Stock How To’s And What To Know About Trading in May 2021

As we enter into the last week of May, penny stocks are heating up. Now, it has been a slow few months, but this can be attributed to a correction as a result of intense gains in the past year. Because of this correction, however, many investors are looking for the best and potentially undervalued penny stocks to watch for their lists.

And, right now, there are plenty that could be worth buying. But as always, it’s important to do your research and due diligence to make the best list of penny stocks out there. Additionally, investors should always know that buying and selling penny stocks is completely dependent on their investing style and volatility threshold.

With that in mind, there are a few things that all investors should know about trading right now. This includes the pandemic and reopening penny stocks, cryptocurrency and its relation to small caps, and how to benefit from market corrections.

[Read More] 5 Hot Penny Stocks To Buy? Check These Out For May 2021These three items heavily apply to trading penny stocks in May 2021, and they could go even further than that. Additionally, given that this is a short trading week due to Memorial Day, we could see more volume than usual as traders look to find intra-week value. Considering all of this, let’s take a look at three penny stock trading how-to’s and what to know about trading in May 2021.

3 Penny Stock How To’s For Trading in May 2021

- The Pandemic and Reopening Penny Stocks

- Cryptocurrency and Small Caps

- How to Benefit From Market Corrections

1. The Pandemic and Reopening Penny Stocks

During the early days of the pandemic, most blue chips and penny stocks fell sharply in value. This made sense as retail shopping was down, travel was down, and for the most part, the world economy has shut down. However, as we got used to the regulations surrounding Covid, slowly the world began to open back up, while albeit in a different way.

This resulted in many companies shooting up in value as they related to the pandemic. For example, many marijuana penny stocks climbed, as the demand for cannabis was exponentially higher. In addition, e-commerce companies, and those offering work-from-home and educate-from-home solutions, also pushed up dramatically.

So now, with vaccine rates higher than ever and increasing by the day, in the U.S. at least, the pandemic seems to be coming to a close. This means that those companies that were severely impacted by the pandemic, are now beginning to shoot back up in value.

This includes travel companies, energy producers, and retail businesses to name a few. Because of this, there are a lot of ways to benefit. And, given that Summer is a time when travel typically heightens alongside retail sales, many analysts expect correlating companies to see higher demand.

While this may take some time, we will likely begin to see positive economic data in the coming months. And for that reason, it’s important to stay up to date with what is going on in the U.S. as it relates to the pandemic. So this week, penny stock investors should look out for companies that could have a role in economic reopening.

2. Cryptocurrency and Small Caps

Ah, cryptocurrency. The future of the transactional economy and a way to invest in an extremely volatile financial instrument. Ever since the rise of DogeCoin this year, many penny stock investors have turned their eyes to cryptocurrency. This includes the likes of Bitcoin and Ethereum, as well as more underground cryptos such as SafeMoon and others.

While cryptocurrency and penny stocks do not necessarily have a lot to do with one another, because they both tend to be relatively cheap, often they can speak volumes about the other. When penny stocks are up, investors will look to crypto to see if there is a corresponding spike and vise versa. The past week saw a major correction with most cryptocurrencies. This was quickly followed by a large spike, and then mostly sideways trading.

And while it may be difficult to draw comparisons between the two at times, some penny stocks are directly related to crypto. This includes those that mine cryptocurrency or produce the machines that are used in mining.

It’s important to note, however, that the more pure-play a crypto or blockchain penny stock is, the more volatile it will be. This means that if a company has a major involvement in crypto and cryptocurrency holdings, for example, it most likely will rise and fall with the price of popular coins.

However, there are also a lot of opportunities for investors to find. Many believe that we are just reaching the surface of what crypto can do. And because of this, there could be a lot of growth left to occur with both crypto and penny stocks that relate to it. Considering this, investors should watch out for what cryptocurrencies and small caps do this week.

3. How to Benefit From Market Corrections

Benefitting from market corrections is one of the best ways to see short-term gains (or losses) in your portfolio. This goes along with the classic saying of ‘buy the dip’. Because the stock market tends to move up and down in a natural ebb and flow, there are always ways for investors to take advantage.

[Read More] 7 Penny Stocks to Watch With Crypto News Sparking a Market DipThe first step is to find companies that could be undervalued or those that have just made sizable downward jumps. On a side note, these downward trends should be only due to volatility and not due to any poor company news.

The next step is to make a penny stocks watchlist, consisting of these companies. This is the best way to keep track of which small caps could be worth watching and which are not. Lastly, it’s time to put in the effort and research a company as much as you can. This is the only way to know exactly what you are getting into with a given investment.

Because a market correction such as the one we are in right now, has not occurred in months, now is the time to brush up on your forward strategy. And as always, things could turn around and come back even stronger than before. With this in mind, using market corrections to your advantage will always be a great tool in your arsenal.

3 Penny Stocks to Watch

- MICT Inc. (NASDAQ: MICT)

- BRF S.A. (NYSE: BRFS)

- Vinco Ventures Inc. (NASDAQ: BBIG)

Are Penny Stocks Worth It?

At the end of the day, investing in penny stocks is all about your strategy and your threshold for volatility. If you don’t like stocks that swing wildly during the day, penny stocks may not be right for you.

[Read More] 3 Robinhood Penny Stocks Under $2 to Watch Next WeekHowever, if you are looking to find stocks that make large short-term spikes or drops then stocks under $5 could be worth it. But, knowing where you stand and what your investing goals are will always be the best way to identify which penny stocks, if any, are worth adding to your portfolio. Considering all of this, are penny stocks worth it? The choice is yours.

The post Penny Stocks and Small-Caps, What to Know About Trading This Week appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

nasdaq stocks pandemic cryptocurrency bitcoin ethereum blockchain crypto penny stocks crypto small capsUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

International

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

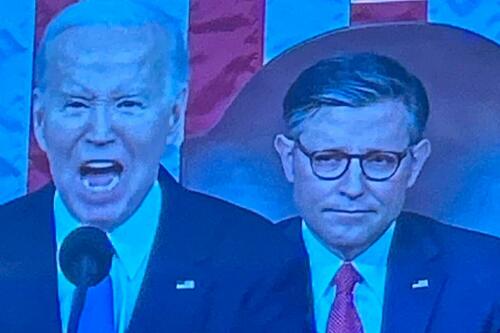

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International12 hours ago

International12 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges