Government

Pelosi Vows To Avert Shutdown As Dems Reportedly Cave To “Republican Blockade”

Pelosi Vows To Avert Shutdown As Dems Reportedly Cave To "Republican Blockade"

Yesterday, when we laid out the dynamics behind Biden’s game of debt limit chicken, we quoted Rabobank which explained why the stand-off between Democrats and…

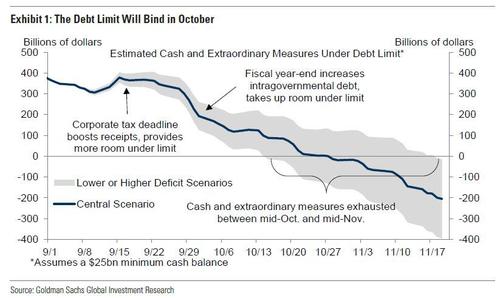

Yesterday, when we laid out the dynamics behind Biden's game of debt limit chicken, we quoted Rabobank which explained why the stand-off between Democrats and Republicans ahead of the debt ceiling Drop Dead Date (the date when all emergency funding measures are exhausted and which falls some time in late October) is so precarious: unlike previous occasions, neither side has to back down due to political or ideological purposes. In fact the side that is seen as conceding first will likely be punished by its electorate; it's also why Goldman has repeatedly warned that the odds of a catastrophic outcome are especially high.

Worse, the closer we get to the Drop Dead Date without a deal, the more likely a freefall outcome becomes as the two sides dig in with the only hope then becoming a deal after the fact.

However, today a ray of hope emerged when Bloomberg reported that Nancy Pelosi signaled Democrats will avert a government shutdown by passing a stopgap spending bill without a debt ceiling increase in it, amid Republican opposition to linking the two measures.

“Whatever it is, we will have a CR that passes both houses by September 30," Pelosi said at a press briefing Thursday, referring to the continuing resolution that will be needed to fund the federal government at the start of the new fiscal year on Oct. 1.

The House passed a stopgap spending measure this week that would keep the government open until Dec. 3 and suspend the debt ceiling until Dec. 16, 2022, but that measure is dead in the Senate where it needs 60 votes to move ahead and Republicans are expected block it in.

At a news conference that included Treasury Secretary Janet Yellen and Senate Majority Leader Chuck Schumer, Pelosi said that the conversation on the debt limit would continue. Schumer separately announced that Democrats have a “framework” for a deal to pay for President Joe Biden’s economic plan, though neither he nor Pelosi provided any details.

Adding to the confusion, due to the irregularity of Treasury revenues and outlayws, it is not yet clear when the US Treasury could be on the brink of a default, adding uncertainty to how quickly Congress has to act. Yellen has said the government will probably exhaust its ability to avoid breaching the limit at some point in October, which is in line with Goldman's estimate of D-Date falling around October 27.

Meanwhile, confirming that Senate republicans won't touch the debt limit vote, top senate republican Mitch McConnell said Democrats have plenty of time to use a partisan approach to raise the debt ceiling without Republican votes. He also said that it would take Democrats “about a week or a little more” to use the budget reconciliation procedure to raise the debt limit (reconciliation bills bypass the filibuster, removing the need for GOP votes in the 50-50 Senate, but have required procedures that take time to go through).

Senate Democrats have so far resisted deploying that tactic, saying that the effort should be bipartisan as Democrats realize that raising the debt ceiling on their own could hurt the Democrats in the midterm elections in 2022, so they prefer sharing the blame with the Republicans by forcing them to support a suspension of the debt limit. In .

“This may inconvenient for them, but it is totally possible,” McConnell said. “This Democratic government must not manufacture an avoidable crisis.”

For once he was actually right: as Rabobank explained, "the Democrats have the power to raise the debt ceiling and adopt a spending patch, through budget reconciliation, without any Republican vote. Therefore it will be difficult to blame a government shutdown or even a default on the Republicans. The mainstream media may try to do so anyway, but conservative media – which are relevant to Republican voters – will explain the realities to their audience. Therefore, there is no electoral need for the Republicans to blink. If they have the stomach for it, they can win this game and force the Democrats to “own” their spending spree. What’s more, if the Democrats fail to stick together under pressure, Biden’s ambitious legislative agenda could dissolve in October."

McConnell’s comments challenge House Budget Committee Chairman John Yarmuth, who said Wednesday that Democrats probably do not have enough time to raise the U.S. debt ceiling on their own using the fast-track budget process before the default date. Actually they do - here is a calendar of fiscal policy deadlines courtesy of Rabo:

An impartial budget expert agreed with McConnell’s view of the timetable: “They could do it in less than two weeks,” said former Senate Budget Committee staff director Bill Hoagland, now with the Bipartisan Policy Center. “It would be tight but I believe they could do it.”

To be sure, not all Democrats are opposed to using the partisan path to raising the debt limit. House Ways and Means Committee Chairman Richard Neal said in an interview with CNN he’d be open to using reconciliation.

“If we had to do it, I would do that,” Neal said, according to CNN. “I mean that the idea that America would default on debt is so far removed from everything I’ve ever entertained or thought of since I’ve been here.”

Other Democrats on Thursday suggested the same: “I don’t draw lines in the sand. I want to get this done,” Maryland Senator Benjamin Cardin said.

Virginia Senator Tim Kaine said Democratic leadership is exploring alternatives for the debt limit. “I’m not going to let the government default,” Kaine said, adding that Democrats have voted under Republican presidents to suspend the debt ceiling. “But if they’re not going to be responsible, we still will be,” he added.

Senator Richard Shelby of Alabama, the top Republican on the Appropriations Committee, said he expects “at the end of the day” the Senate will pass a stopgap government funding bill that doesn’t have a debt limit increase on it and that Democrats will move the debt-limit increase through reconciliation.

Yet not everyone is confident that a debt ceiling deal will be reached on time, starting first and foremost with the market, where today's 4-week and 8-week Bill auctions showed a dramatic preference for the latter at the expense of the former, which mature right around the Drop Dead Date and may suffer repayment complications if the US is in technical default. As shown below, the discount rate on the 4-Week Bills came 1.5bps higher than the 8-Week Bill, the widest differential since the March 2020 covid crisis.

Additionally, there was a collapse in Indirect demand for 4-week bills, with Indirects taking down just 21.3% while taking home a much higher 67.3% of the eight-week offering, the most since June 17.

Finally, one reason why Pelosi may be less than credible is because earlier today, WaPo reported that the White House budget office (OMB) told federal agencies on Thursday to begin preparations for the first shutdown of the U.S. government since the pandemic began.

While administration officials stressed the request is in line with traditional procedures seven days ahead of a shutdown and not a commentary on the likelihood of a congressional deal, the market did not seem to accept that explanation. Both Democrats and Republicans have made clear they intend to fund the government before its funding expires on Sept. 30, but time is running out and lawmakers are aiming to resolve an enormous set of tasks to in a matter of weeks.

More importantly, WaPo confirmed Bloomberg's report reporting that privately Democrats also began to acknowledge they are unlikely to prevail in the face of what the Washington Post called, a Republican blockade: "Democrats have started discussing the mechanics of how to sidestep Republicans as soon as next week, according to lawmakers and aides, as they maintain they will not allow the government to shut down in a pandemic or the country to default for the first time in history."

In a sign of the early scramble to avoid a shutdown, the Senate’s two top appropriators — Chairman Patrick J. Leahy (D-Vt.) and top Republican Richard C. Shelby (Ala.) — are set to huddle at a meeting later Thursday to discuss issues potentially including a short-term agreement to keep the government funded. Such a measure could be moved independently of an increase in the debt ceiling, since Republicans including McConnell have an expressed an openness to supporting such a solution.

Meanwhile Bill Hoagland, a senior vice president at the Bipartisan Policy Center and former Republican staff director for the Senate Budget Committee, pointed out that parts of the Centers for Disease Control and Prevention and the National Institutes of Health would be closed as part of the government shutdown. Hoagland said a very brief shutdown may occur but said he doubted it would go on for “any length of time.”

“This would be the first shutdown during a declaration of national emergency,” Hoagland said. “In the midst of an ongoing pandemic and non-resolved issues related to the delta virus, to have a shutdown of some of the major federal agencies would add unbelievable complications to our ability to recover.”

Government

“Are you better off than you were four years ago?”

– by New Deal democratNo economic news today, so let me take a look at the supposed killer recent GOP meme that they claim is completely unanswerable:…

- by New Deal democrat

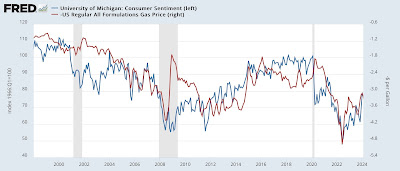

No economic news today, so let me take a look at the supposed killer recent GOP meme that they claim is completely unanswerable: “Are you better off today than you were four years ago?”

International

AI can help predict whether a patient will respond to specific tuberculosis treatments, paving way for personalized care

People have been battling tuberculosis for thousands of years, and drug-resistant strains are on the rise. Analyzing large datasets with AI can help humanity…

Tuberculosis is the world’s deadliest bacterial infection. It afflicted over 10 million people and took 1.3 million lives in 2022. These numbers are predicted to increase dramatically because of the spread of multidrug-resistant TB.

Why does one TB patient recover from the infection while another succumbs? And why does one drug work in one patient but not another, even if they have the same disease?

People have been battling TB for millennia. For example, researchers have found Egyptian mummies from 2400 BCE that show signs of TB. While TB infections occur worldwide, the countries with the highest number of multidrug-resistant TB cases are Ukraine, Moldova, Belarus and Russia.

Researchers predict that the ongoing war in Ukraine will result in an increase in multidrug-resistant TB cases because of health care disruptions. Additionally, the COVID-19 pandemic reduced access to TB diagnosis and treatment, reversing decades of progress worldwide.

Rapidly and holistically analyzing available medical data can help optimize treatments for each patient and reduce drug resistance. In our recently published research, my team and I describe a new AI tool we developed that uses worldwide patient data to guide more personalized and effective treatment of TB.

Predicting success or failure

My team and I wanted to identify what variables can predict how a patient responds to TB treatment. So we analyzed more than 200 types of clinical test results, medical imaging and drug prescriptions from over 5,000 TB patients in 10 countries. We examined demographic information such as age and gender, prior treatment history and whether patients had other conditions. Finally, we also analyzed data on various TB strains, such as what drugs the pathogen is resistant to and what genetic mutations the pathogen had.

Looking at enormous datasets like these can be overwhelming. Even most existing AI tools have had difficulty analyzing large datasets. Prior studies using AI have focused on a single data type – such as imaging or age alone – and had limited success predicting TB treatment outcomes.

We used an approach to AI that allowed us to analyze a large and diverse number of variables simultaneously and identify their relationship to TB outcomes. Our AI model was transparent, meaning we can see through its inner workings to identify the most meaningful clinical features. It was also multimodal, meaning it could interpret different types of data at the same time.

Once we trained our AI model on the dataset, we found that it could predict treatment prognosis with 83% accuracy on newer, unseen patient data and outperform existing AI models. In other words, we could feed a new patient’s information into the model and the AI would determine whether a specific type of treatment will either succeed or fail.

We observed that clinical features related to nutrition, particularly lower BMI, are associated with treatment failure. This supports the use of interventions to improve nourishment, as TB is typically more prevalent in undernourished populations.

We also found that certain drug combinations worked better in patients with certain types of drug-resistant infections but not others, leading to treatment failure. Combining drugs that are synergistic, meaning they enhance each other’s potency in the lab, could result in better outcomes. Given the complex environment in the body compared with conditions in the lab, it has so far been unclear whether synergistic relationships between drugs in the lab hold up in the clinic. Our results suggest that using AI to weed out antagonistic drugs, or drugs that inhibit or counteract each other, early in the drug discovery process can avoid treatment failures down the line.

Ending TB with the help of AI

Our findings may help researchers and clinicians meet the World Health Organization’s goal to end TB by 2035, by highlighting the relative importance of different types of clinical data. This can help prioritize public health efforts to mitigate TB.

While the performance of our AI tool is promising, it isn’t perfect in every case, and more training is needed before it can be used in the clinic. Demographic diversity can be high within a country and may even vary between hospitals. We are working to make this tool more generalizable across regions.

Our goal is to eventually tailor our AI model to identify drug regimens suitable for individuals with certain conditions. Instead of a one-size-fits-all treatment approach, we hope that studying multiple types of data can help physicians personalize treatments for each patient to provide the best outcomes.

Sriram Chandrasekaran receives funding from the US National Institutes of Health.

treatment genetic pandemic covid-19 spread russia ukraine world health organizationGovernment

QE By A Different Name Is Still QE

The Fed added Quantitative Easing (QE) to its monetary policy toolbox in 2008. At the time, the financial system was imploding. Fed Chair Ben Bernanke…

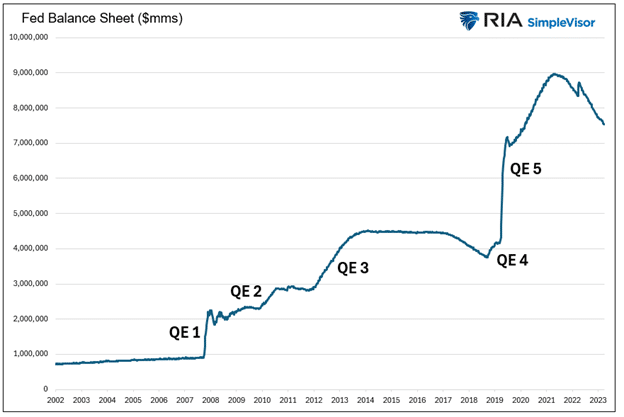

The Fed added Quantitative Easing (QE) to its monetary policy toolbox in 2008. At the time, the financial system was imploding. Fed Chair Ben Bernanke bought $1.5 trillion U.S. Treasury and mortgage-backed securities to staunch a financial disaster. The drastic action was sold to the public as a one-time, emergency operation to stabilize the banking system and economy. Since the initial round of QE, there have been four additional rounds, culminating with the mind-boggling $5 trillion operation in 2020 and 2021.

QE is no longer a tool for handling a crisis. It has morphed into a policy to ensure the government can fund itself. However, as we are learning today, QE has its faults. For example, it’s not an appropriate policy in times of high inflation like we have.

That doesn’t mean the Fed can’t provide liquidity to help the Treasury fund the government’s deficits. They just need to be more creative. To that end, rumors are floating around that a new variation of QE will help bridge potential liquidity shortfalls.

The Sad Fiscal Situation

The Federal government now pays over $1 trillion in interest expenses annually. Before they spend a dime on the military, social welfare, or the tens of thousands of other expenditures, one-third of the government’s tax revenue pays for the interest on the $34 trillion in debt, representing deficits of years and decades past.

There are many ways to address deficits and overwhelming debt, such as spending cuts or higher taxes. While logical approaches, politicians favor more debt. Let’s face it: winning an election on the promise of spending cuts and tax increases is hard. It’s even harder to keep your seat in Congress if you try to enact such changes.

More recently, the Federal Reserve has been forced to help fund today’s deficits and those of years past. We can debate the merits of such irresponsible behavior all day, but for investors, it’s much more critical to assess how the Fed and Treasury might keep the debt scheme going when QE is not an option.

Borrowing For Deficits

Before spreading rumors about a new variation of QE, let’s review the problem. The graph below shows the widening gap between federal spending and tax receipts. Literally, the gap between the two lines amounts to the cumulative Federal deficit. Instead of plotting deficit data, we prefer outstanding total federal debt as it better represents the cumulative onus of deficits.

The graph below shows the Treasury debt has grown annually for the last 57 years by about 1.5% more than the interest expense. Such may not seem like a lot, but 57 years of compounding makes a big difference.

Declining interest rates for the last 40+ years are to thank for the differential. The green line shows the effective interest rate has steadily dropped until recently. Even with the current instance of higher interest rates, the effective interest rate is only 3.00%.

Fiscal Dominance

The Fed has been increasingly pressed to help the U.S. Treasury maintain the ability to fund its debt at reasonable interest rates. In addition to presiding over lower-than-normal interest rates for the last 30 years, QE helps the cause. By removing Treasury and mortgage-backed securities from the market, the market can more easily absorb new Treasury issuance.

Fiscal dominance, as we are experiencing, occurs when monetary policy helps the Treasury fund its debts. Per The CATO Institute:

Fiscal dominance occurs when central banks use their monetary powers to support the prices of government securities and to peg interest rates at low levels to reduce the costs of servicing sovereign debt.

2019 Revisited

In 2019, before the massive pandemic-related deficits, government spending ramped up over the prior few years due to higher spending and tax cuts. In September 2019, the repo markets strained under the pressure of the growing Treasury demands. The banks had plenty of securities but no cash to lend. For more information on the incident and the importance of liquidity in maintaining financial stability, please read our article, Liquidity Problems.

When a bank, broker, or investor can’t borrow money despite being willing to post U.S. Treasury collateral, that is a clear sign that the banking system lacks liquidity. That is exactly what happened in 2019.

The Fed came to the rescue, offering QE and lowering interest rates.

Shortly later, in March 2020, government spending blossomed with the pandemic, and the Fed was quick to help. As we shared earlier, the Fed, via QE, removed over $5 trillion of assets from the financial markets. That amount was on par with the surge of government debt.

The Fed is mandated to manage policy to achieve maximum employment and stable prices. Mandated or not, recent experiences demonstrate the Fed has become the de facto lender to the Treasury, albeit indirectly.

The Fed Is In Handcuffs

While Jerome Powell and the Fed might like to help the government meet their exorbitant funding needs with lower interest rates and QE, they are shackled. Higher inflation resulting from the pandemic and fiscal and monetary policies force them to reduce their balance sheet and keep rates abnormally high.

Unfortunately, as we wrote in Liquidity Problems, the issuance of Treasury debt rapidly drains excess liquidity from the system.

While the Fed hesitates to cut rates or do QE, they may have another trick up their sleeve.

Spreading Rumors

The following is based on rumors from numerous sources about what the Fed and banking regulators may do to alleviate funding pressures and liquidity shortfalls.

Banks have regulatory limits on the amount of leverage they can employ. The amount is set by the type and riskiness of assets they hold. For instance, U.S. Treasuries can be leveraged more than a loan to small businesses. A dollar of a bank deposit may allow a bank to buy $5 of a Treasury note but only lend $3 to a riskier borrower.

The regulatory structure currently recognizes eight Global Systematically Important Banks (GSIB). They are as follows: Bank of America, The Bank of New York, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, State Street, and Wells Fargo & Company.

Rumor has it that the regulators could eliminate leverage requirements for the GSIBs. Doing so would infinitely expand their capacity to own Treasury securities. That may sound like a perfect solution, but there are two problems: the banks must be able to fund the Treasury assets and avoid losing money on them.

BTFP To The Rescue Again

A year ago, the Fed created the Bank Term Funding Program (BTFP) to bail out banks with underwater securities. The program allowed banks to pledge underwater Treasury assets to the Fed. In exchange, the Fed would loan them money equal to the bond’s par value, even though the bonds were trading at discounts to par.

Remember, since 2008, banks no longer have to book gains or losses on assets unless they are impaired or sold.

In a new scheme, bank regulators could eliminate the need for GSIBs to hold capital against Treasury securities while the Fed reenacts some version of BTFP. Under such a regime, the banks could buy Treasury notes and fund them via the BTFP. If the borrowing rate is less than the bond yield, they make money and, therefore, should be very willing to participate, as there is potentially no downside.

The Fed still uses its balance sheet in this scheme, but it could sell it to the public as a non-inflationary action, as it did in March 2023 when the BTFP was introduced.

Summary

The federal government’s escalating debt and interest expenses underscore the challenges posed by prolonged deficit spending. The problem has forced the Fed to help the Treasury meet its burgeoning needs. The situation becomes more evident with each passing day.

The recently closed BTFP program and rumors about leverage requirements provide insight into how the Fed might accomplish this tall task while maintaining its hawkish anti-inflationary policy stance.

The post QE By A Different Name Is Still QE appeared first on RIA.

treasury securities bonds repo markets pandemic monetary policy qe fed federal reserve government debt congress interest rates-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex