Uncategorized

“Optimism Is Being Shaken”: US Futures, Global Markets Slide Ahead Of $1.8 Trillion OpEx

"Optimism Is Being Shaken": US Futures, Global Markets Slide Ahead Of $1.8 Trillion OpEx

US futures and global equities extended Thursday’s…

US futures and global equities extended Thursday's selloff as a global wave of risk aversion swept across the markets after two of the Fed's most hawkish (nonvoting) policymakers - Loretta Mester and James Bullard - signaled they may favor returning to bigger, 50bps rate hikes in the future, while European Central Bank Executive Board member Isabel Schnabel also warned that markets may be underestimating inflation, and the risk that the ECB “may have to act more forcefully” against it. S&P 500 futures fell 0.7% as of 7:30 a.m. in New York as the risk-off tone continues with MegaCap Tech underperforming, Nasdaq 100 contracts slide 0.9%. The Bloomberg Dollar Spot Index traded near the day’s highs, pressuring all Group-of-10 currencies. Treasury yields climbed across the curve, mirroring moves in Europe and the UK. Commodities are mixed with base metals rallying, energy and ags weaker; oil and gold fall while Bitcoin slides for the first time in four days, retreating from the key $25,000 level. Otherwise, it's a quiet end to the week with just import prices and leading indicators on deck; we also get two Fed speakers: Barkin abd Bowman.

Ahead of the 3-day weekend, today we also get a relatively modest $1.8 trillion option expiration (full preview here) in the form of $740bn SPX am, $600bn of ETF + SPX pm, and $380bn of single stock, and which will see dealers would lose a significant portion of their left tail “long gamma” positioning and which could present an opportunity for vol to go bid, i.e., VIX may spike from its recent subdued range.

In premarket trading, DoorDash advanced 6.7% after the food delivery company published results that showed resilient consumer appetite, with order growth exceeding expectations despite the cost-of-living squeeze. Moderna shares fall 6.5% after mixed results for its mRNA-1010 flu vaccine candidate. Analysts note the drug missed on the B-strains in the study and now all eyes will turn to upcoming efficacy data to give an indication on the approvability of the drug. Here are other notable premarket movers:

- Tesla shares slip in US premarket trading, leaving them set to extend Thursday’s losses after the electric-vehicle maker recalled hundreds of thousands of cars over a crash risk in its automated-driving software.

- DoorDash jumps 6.7% after the food delivery company published results that showed resilient consumer appetite, with order growth exceeding expectations despite the cost-of-living squeeze.

- Applied Materials shares edge 0.6% higher after the biggest maker of semiconductor- manufacturing equipment’s current quarter sales forecast beat expectations.

- Cryptocurrency-exposed stocks fall, as the price of Bitcoin declines amid jitters over a regulatory clampdown and hawkish comments from Fed officials. Coinbase (COIN US) -1.8%, Stronghold Digital (SDIG US) -5.8%, Bit Digital (BTBT US) -3.4%, Block (SQ US) -1.5%

- DraftKings shares rise 7.8% after the sports-betting company reported better-than-expected fourth- quarter revenue. Analysts responded positively to the beat, with many highlighting the structural improvements and strong customer trends as the main drivers.

- Watch Nvidia’s stock as its price target was raised to $280 from $220 at KeyBanc Capital Markets, which cited long-term growth opportunity in artificial intelligence and machine learning.

Risk assets were hammered after two of the Fed’s most hawkish policymakers signaled they may favor returning to bigger interest-rate hikes in the future. Their comments followed data that showed US producer prices rebounded in January by more than expected, following consumer price data earlier this week that didn’t slow by as much as forecast. The double whammy of higher prices and hawkish Fed speakers jolted markets that have been rebounding from 2022’s selloff. After leading the rally in 2023, US tech stocks led Thursday’s losses as bond yields advanced. On a longterm horizon, the relative level of US tech stocks still looks elevated even after last year’s brutal selloff. The Nasdaq 100 Index isn’t far off historic highs versus the S&P 500 Index and is still trading near the peak that marked the implosion of the dot-com bubble.

“We still think that interest rates will peak at a higher level than 5%. It’s going to be very data-dependent,” Frederique Carrier, head of investment strategy at RBC Wealth Management, said on Bloomberg TV. “We dont want to be victims to changes in sentiment, so we are positioned in a neutral way.”

The delayed arrival of a US recession will weigh on stocks in the second half of the year, according to Bank of America's Michael Hartnett who says a resilient economy thus far means interest rates will stay higher for longer. Hartnett is predicting a scenario known as “no landing” in the first half of the year, where economic growth will stay robust and central banks will likely remain hawkish for longer. That will probably be followed by a “hard landing” in the latter part of 2023, they wrote in a note dated Feb. 16. Meanwhile, investors continued to shun US equities in the week through Feb. 15, with outflows totaling $2.2 billion, Hartnett said in the note, citing EPFR data. On the flip side, Europe saw inflows of $1.5 billion, while emerging-market stocks attracted $100 million.

“It’s taken a lot but it would appear investors’ eternal optimism is being shaken, with the latest PPI figures finally driving the message home that bringing the economy in for a soft landing will be extraordinarily challenging and there’ll likely be plenty of turbulence along the way,” said Craig Erlam, senior market analyst at Oanda Europe.

European stocks snapped a four-day winning streak, and retreated after rising to the highest level in a year yesterday, amid renewed concerns about bigger interest-rate hikes from the Federal Reserve. The Stoxx Europe 600 Index was 0.6% lower with technology and energy underperforming. Among prominent stock moves, NatWest Group Plc slumped after issuing 2023 guidance that disappointed, while Mercedes-Benz Group AG climbed as a share buyback and strong fourth-quarter earnings helped offset its outlook that earnings will decline slightly this year. Here are some other notable European movers:

- NatWest slides as much as 9.5% after the British lender reported higher costs and guided for profit below what some analysts had expected.

- Allianz falls as much as 3.6% with Citi noting the lack of a new buyback and saying that the new guidance from the German insurer is about in line with consensus.

- Hermes International slips as much as 2.1% from near-record levels, as Citi flags the group’s expensive valuation and a lack of special dividend despite a record cash position.

- GTT falls as much as 9.8% after the French engineering company’s forecast for profit this year missed the average estimate.

- Eutelsat shares fall as much as 7.1% to a record low after the satellite operator trimmed its revenue outlook, citing impact from sanctions against Russian and Iranian channels.

- NCAB falls as much as 21%, the most since its 2018 IPO, after the Swedish printed circuit- board maker reported a 5% drop in order intake year-on- year.

- Mercedes gains as much as 3.2%, the best performer on the Stoxx 600 Automobiles and Parts Index, after reporting strong fourth-quarter results that beat estimates.

- Air France-KLM advances as much as 9.8% after delivering a 4Q beat to consensus with a strong top-line boosting operating income and solid performance in unit revenue

- Kingspan rises as much as 7.4% in early trading after the Irish insulation and building-products maker reported full-year revenue in line with estimates.

- Segro gains as much as 4.7% after results, as analysts say the group remains well-positioned and will continue to deliver good rental growth, with its operational performance robust.

Earlier in the session, Asian stocks also dropped following a slump on Wall Street, as comments from two Federal Reserve officials weigh on the region’s tech shares. The MSCI Asia Pacific Index fell as much as 1.3%, set for a three-week decline that would be its longest losing streak since October. Hong Kong and South Korea were the region’s worst performers, with benchmarks for mainland China, Australia and India also falling. Tech shares including TSMC and Tencent slid after Fed Bank of Cleveland President Loretta Mester said she had seen a “compelling economic case” for rolling out another 50 basis-point hike. St. Louis President James Bullard said he would not rule out supporting a half-percentage-point increase in March. “Markets in general have been too sanguine year to date in terms of the prospect of imminent Fed pivot,” Helen Zhu, managing director and chief investment officer at NH Trinity, said in an interview with Bloomberg TV. Asia’s benchmark has fallen nearly 5% from a late-January peak, as concerns over higher rates and geopolitical tensions replaced optimism about China’s reopening. Speculation toward potential US rate cuts in the second half of this year was probably “overdone,” Zhu said, adding that Chinese equities may be worth buying on dips to build exposure for the rest of the year.

Japanese stocks followed U.S. shares downwards after hawkish commentary from Federal Reserve officials. The Topix Index fell 0.5% to 1,991.93 as of market close Tokyo time, while the Nikkei declined 0.7% to 27,513.13. Sony Group Corp. contributed the most to the Topix Index decline, decreasing 2.4%. Out of 2,163 stocks in the index, 715 rose and 1,331 fell, while 117 were unchanged. The Fed officials’ comments came after US producer prices rebounded in January by the most since June. “Hawkish comments from Fed officials or economic indicators that concern the Fed would be negative for stock prices,” said Yasuhiro Kano, senior investment manager at Sompo Asset Management.

Australian stocks posted a second weekly loss amid bets for rate hikes; the S&P/ASX 200 index fell 0.9% to close at 7,346.80, weighed by losses in technology and mining shares. Australia’s labor market is “still very tight” and price pressures remain surprisingly strong, Reserve Bank Governor Philip Lowe said, making the case for further interest-rate increases. In New Zealand, the S&P/NZX 50 index fell 0.1% to 12,144.66.

In FX, the Dollar Index is up 0.6% leaving it poised for its third weekly advance; the greenback advanced against all of its Group-of-10 peers as traders rushed to add to the pricing of Fed hikes; the New Zealand dollar and Norwegian krone are the worst-performers among the G-10’s.

- The euro fell to a six-week low of $1.0630 despite hawkish repricing of the ECB after Executive Board member Isabel Schnabel said she saw risks that markets will underestimate inflation. Investors rushed to offload German bonds and money markets amped up rate-hike wagers

- The pound shrugged off data showing that UK retail sales unexpectedly rose 0.5% last month after post-Christmas discounting brought people into stores. Economists had expected a drop of 0.3%

- The yen fell to 135.03, its weakest level in almost three months; the currency’s volatility term structure peaks on the three-week tenor that captures the next Bank of Japan meeting, yet one-week implieds turn bid Friday

- Australian and New Zealand dollars traded fell to six-week lows on the back of a stronger greenback. Aussie yields rose both in sympathy with Treasury moves and after a hawkish senate testimony from Reserve Bank Governor Philip Lowe

- Sweden’s krona extended declines in the European session even after data showed the adjusted unemployment rate fell back to 7.3% in January, from a revised 7.4% in December, increasing the likelihood that the country’s central bank will continue raising rates in response to soaring inflation. The median estimate in a Bloomberg survey of economists was 7.5%

In rates, treasuries extend losses with yields cheaper by 3bp-5bp across the curve vs Thursday’s closing levels. 10-year Treasury yields were around 3.88%, cheaper by ~3bp on the day but outperforming bunds and gilts by 0.5bp and 2bp in the sector; US front-end underperforms on the curve, flattening 2s10s spread by ~1bp. Bunds and gilts are firmly in the red, with 10-year yields in both countries rising 5bps. Core European rates lead the selloff following hawkish comments from ECB’s Schnabel and German PPI data. Germany’s front-end lags as traders fully price a 3.75% ECB rate peak for the first time after Executive Board member Isabel Schnabel said she saw risks that markets will underestimate inflation.

In commodities, Crude futures decline with WTI down 2.4% to trade near $76.60. Qatar Energy set April-loading Al-Shaheen crude term price at a premium of USD 2.58/bbl above Dubai quotes, according to traders cited by Reuters. Russian President Putin says demand for natural gas will increase; half of the demand will come from APAC, mainly China. China's Dalian Commodity Exchange says price fluctuations of commodities, including iron ore, are relatively huge; alerts investors to participate rationally. Base metals are slumping on the USD's upside with spot gold down to a sub-1820/oz trough and LME Copper falling further below USD 9k/T..

In crypto, the SEC filed a securities fraud lawsuit against Terraform Labs and founder Do Hyeong Kwon which alleged that the defendants perpetrated a fraudulent scheme that led to at least USD 40bln of losses in market value, according to Reuters. Senior BoJ official Uchida said the BoJ decided to launch a pilot program this April on a CBDC which aims to test technical feasibility, as well as utilise skills and insights of private businesses.

Looking at the day ahead, data releases include Import price index and the Leading Index. Central bank speakers include the ECB’s Villeroy, and the Fed’s Barkin and Bowman.

Market Snapshot

- S&P 500 futures down 0.5% to 4,079.25

- MXAP down 1.2% to 162.48

- MXAPJ down 1.3% to 529.74

- Nikkei down 0.7% to 27,513.13

- Topix down 0.5% to 1,991.93

- Hang Seng Index down 1.3% to 20,719.81

- Shanghai Composite down 0.8% to 3,224.02

- Sensex down 0.6% to 60,963.95

- Australia S&P/ASX 200 down 0.9% to 7,346.77

- Kospi down 1.0% to 2,451.21

- STOXX Europe 600 down 0.6% to 462.23

- German 10Y yield little changed at 2.55%

- Euro down 0.1% to $1.0658

- Brent Futures down 1.4% to $83.91/bbl

- Gold spot down 0.7% to $1,823.73

- U.S. Dollar Index up 0.45% to 104.32

Top Overnight News from Bloomberg

- China on Friday delivered the largest one-day cash injection into the economy since record keeping started in 2004 as it works to meet rising liquidity needs for the post-COVID economic rebound. SCMP

- China's top tech banker Bao Fan went missing, unnerving the finance industry. Bao's been out of contact with China Renaissance for about two days, a person familiar said. His family was told he's assisting an investigation. Shares plunged 28%. Meanwhile, China is said to be poised to name regulatory veterans known for strict campaigns against financial wrongdoing as new heads of the banking and securities watchdogs. BBG

- One of the ECB’s most senior officials said that investors risk underestimating the persistence of inflation, and the response needed to bring it under control. “We are still far away from claiming victory,” Executive Board member Isabel Schnabel said in an interview with Bloomberg, citing the strength of underlying price pressures and faster wage increases. The economy’s reaction to interest-rate increases may prove weaker than in prior episodes, and if that transpires, “we may have to act more forcefully.” BBG

- Germany’s PPI comes in above the St consensus for Jan (+17.8% vs. the St +16.4%), the latest hot inflation number out this week. RTRS

- UK retail sales rose unexpectedly last month after post-Christmas discounting brought people into stores. The volume of goods sold in stores and online rose 0.5% in January after a 1.2% decline in December, the Office for National Statistics said Friday. Economists had expected a drop of 0.3%. BBG

- The SEC accused crypto fugitive Do Kwon and his Terraform Labs of fraud. It alleged they offered and sold unregistered securities, including the failed TerraUSD stablecoin, and carried out a scheme that erased at least $40 billion of market value. In the Mt Gox bankruptcy, the top creditor opted for an early payout in Bitcoin rather than fiat currency, avoiding years of litigation, a person familiar said. BBG

- GIR is adding another 25bp in June to our fed baseline following firmer growth & inflation news: Yesterday’s PPI marked the 3rd beat in a string of strong US data prints this week (along with CPI, Retail Sales), which taken together have suggested that the Fed’s work is still not finished, and that the risks of a longer cycle are rising. Tuesday’s CPI report confirmed that underlying inflation remains elevated, and the retail sales report was strong evidence of robust US consumer demand. We had noted that a fading drag from Fed tightening on growth and tight labor market had left greater upside risks to our Fed path, and with comments from the Fed yesterday (Mester in particular, Bullard too) biased in the same way, our economists have added a further 25bp rate hike to their forecasts, now expecting 3 more 25bp hikes in March, May & June for a peak funds rate of 5.25-5.5. GIR

- Deere reported strong FQ1 results, and they raised the net income guidance for the year. EPS came in at 6.55 (a full $1 ahead of the St consensus) while the revenue beat was more modest ($11.4B vs. the St $11.22B). Results benefited from ongoing demand strength, coupled with improved operating/supply chain conditions. RTRS

- The United Arab Emirates’ national energy company plans to sell a stake of about 4% of its natural-gas business in an initial public offering that it hopes will raise $2 billion, as Middle East petrostates increase plans to supply Europe. WSJ

- Yen traders looking to navigate a smooth handover of power at the Bank of Japan face an added complication from fiscal year-end flows which traditionally weigh on the currency

- An economy Putin once wanted to make one of the world’s five biggest is on a path to lose $190 billion in gross domestic product by 2026 relative to its prewar trajectory, according to Bloomberg Economics, roughly the equivalent of the entire annual GDP of countries like Hungary or Kuwait

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded negatively as the regional bourses took their cues from the weak performance stateside after firmer-than-expected PPI data and hawkish Fed rhetoric. ASX 200 was dragged lower by weakness in tech following the underperformance of the Nasdaq in the US and with sentiment also dampened as the RBA Governor Lowe reiterated the view for higher rates. Nikkei 225 suffered from the tech rout and as earnings began to quieten, although Bridgestone was among the best performers after a jump in revenue and forecasts for a 12% increase in FY23 profits. Hang Seng and Shanghai Comp. declined with Hong Kong pressured by tech losses and with frictions stoked after China unveiled sanctions against US firms related to Taiwan arms sales, while the mainland initially bucked the trend after a substantial liquidity injection by the PBoC.

Top Asian News

- PBoC injected CNY 835bln via 7-day reverse repos at 2.00% for a CNY 632bln net injection.

- RBA Governor Lowe said high inflation is damaging and that they will do what is necessary to make sure inflation returns to the target range, while he noted the Board expects that further increases will be needed over the months ahead. Lowe also reiterated that they are not on a predetermined path on interest rates and have an open mind but their assessment is that they have to go up further on rates. Furthermore, he added that they will slow down on rates if needed and that rates could start to come down next year if they get on top of inflation but a few things would have to go right for that to happen.

European bourses & US futures are pressured amid a myriad of hawkish factors, Euro Stoxx 50 -1.0% & ES -0.8%, with more Fed officials scheduled. Sectors are predominantly in the red, with only Autos bucking the trend following earnings from Mercedes-Benz while Tech slumps on elevated yields. Stateside, futures are all in the red and given the session's action has been driven by hawkish developments, the NQ -1.0% is underperforming.

Top European News

- ECB's Schnabel says it is not easy to say if policy is already restrictive, via Bloomberg. Wage growth is up strongly, may be more persistent; risk markets will underestimate inflation. QT could be sped up after June, nothing has been decided yet. The broad disinflation process has not even started yet. 50bp hike in March is needed under virtually all scenarios. Weaker transmission may require more forceful action.

- Diplomats in Brussels suggest a deal on the Northern Ireland Protocol "isn't quite there, yet", according to BBC's Parker; Northern Ireland Alliance party leader says that after meeting UK PM Sunak, it seems that "things are gradually moving towards a protocol deal", though adds “We are not over the line yet - there is still heavy lifting to do,”

- Allianz’s Muted Outlook Takes Shine Off Dividend, Record Profit

- European Bonds Drop Sharply as ECB Peak Bets Close In on 3.75%

- Ex-Warburg Banker’s Cum-Ex Suit Rejected by Top German Court

- KBW More Bullish on Italian Banks, Upgrades Intesa, BAMI

FX

- The USD is bolstered with multiple hawkish factors in play, DXY holding just under 104.50 within 104.15-104.51 parameters.

- As such, peers are lower across the board with Antipodeans lagging given the double-whammy of USD and commodities weighing; AUD/USD near 0.68 and NZD/USD sub 0.62.

- Additionally, the comparatively lower-yielding nation's FX are towards the bottom of the pile with CHF and JPY above 0.93 and 135.0 respectively vs the USD.

- Next up, and despite domestic hawkish factors, EUR and GBP are lower though faring much better than their aforementioned peers given some of the USD's upside has been offset by ECB's Schnabel/German PPI and UK Retail Sales.

- PBoC set USD/CNY mid-point at 6.8659 vs exp. 6.8674 (prev. 6.8519)

Fixed Income

- Core benchmarks are under marked pressure as Bullard, German PPI and Schnabel weigh ahead of Fed's Bowman and Barkin.

- Specifically, Bunds down to a 133.67 trough post-Schnabel while Gilts slipped and pricing for a 25bp BoE hike in March lifted slightly on Retail Sales.

- Similarly, the EGB periphery is downbeat and interestingly the action has seen the BTP-Bund spread widen to near 190bp, the widest for several weeks given Schnabel's overt hawkishness.

- Stateside, USTs slump as Bullard and GS' latest FFR call continue to weigh, yields elevated across the curve which is slightly flatter given the short-term implications of the referenced drivers; Bowman & Barkin ahead.

Commodities

- The commodity complex is under pressure given the above risk tone and as the USD picks up.

- WTI and Brent are subdued with the benchmarks at the lower end of circa. USD 2/bbl parameters and Nat Gas contracts are lower both side of the pond.

- Qatar Energy set April-loading Al-Shaheen crude term price at a premium of USD 2.58/bbl above Dubai quotes, according to traders cited by Reuters.

- Russian President Putin says demand for natural gas will increase; half of the demand will come from APAC, mainly China.

- China's Dalian Commodity Exchange says price fluctuations of commodities, including iron ore, are relatively huge; alerts investors to participate rationally.

- Similarly, metals are slumping on the USD's upside with spot gold down to a sub-1820/oz trough and LME Copper falling further below USD 9k/T.

Geopolitics

- Pentagon's top China official Michael Chase will visit Taiwan in the coming days, according to FT sources; subsequently, clarified that Chase has arrived in Taiwan.

- Ukrainian President Zelensky has ruled out giving up any of Ukraine's territory in a potential peace deal with Russia, according to the BBC.

- North Korea said planned US-South Korean military drills will lead to increased tensions in the region and warned that the US and South Korea will face an unprecedently strong response if they go ahead with planned military drills, while it will also consider additional military action in protest against US pressure at the UN Security Council, according to KCNA.

- Chinese Foreign Ministry, on President Biden suggesting he will speak to his Chinese counterpart Xi, says the US cannot ask for communications and dialogue while escalating the crisis.

- Japan, US, Australia, and India are to hold a foreign ministers' meeting in March, according to Japanese press Sankei.

US Event Calendar

- 08:30: Jan. Import Price Index ex Petroleum, est. -0.2%, prior 0.8%

- 08:30: Jan. Import Price Index MoM, est. -0.1%, prior 0.4%

- 08:30: Jan. Import Price Index YoY, est. 1.4%, prior 3.5%

- 08:30: Jan. Export Price Index YoY, est. 2.8%, prior 5.0%

- 08:30: Jan. Export Price Index MoM, est. -0.2%, prior -2.6%

- 10:00: Jan. Leading Index, est. -0.3%, prior -0.8%

Fed Speakers

- 08:30: Fed’s Barkin Discusses the US Labor Market

- 08:45: Fed’s Bowman Speaks at Banking Conference

DB's Jim Reid concludes the overnight wrap

Markets took a knock over the last 24 hours, with rates rising and equities selling off thanks to strong inflation data and hawkish central bank rhetoric, as some Fed officials even floated the prospect they might resume 50bp hikes. That saw the S&P 500 shed -1.38%, with sharp losses into the close, whilst the 10yr Treasury yield rose another +5.6bps to 3.86%, which is its highest level so far in 2023. Indeed, the 10yr yield is now up by +46.8bps over the last 10 trading sessions, marking the fastest increase over two weeks since September. All these moves show how we’ve seen a significant change in the market narrative since the jobs report, with much stronger-than-expected numbers on inflation and the economy raising the prospect that the Fed will keep hiking rates for some time yet.

This narrative got a fresh boost from the latest data on US producer prices in January, which surprised well on the upside of expectations. For instance, the monthly headline number came in at a 7-month high of +0.7% (vs. +0.4% expected), which meant that the year-on-year total only declined to +6.0% (vs. +5.4% expected). The core numbers didn’t look promising either, with the total excluding food and energy and trade services up by a 10-month high of +0.6% (vs. +0.3% expected). So purely based on the January numbers, we’ve now seen inflation accelerate on both the CPI and PPI measures relative to where things stood in Q4.

Time will tell how this plays out, but in the meantime we got another round of hawkish commentary from Fed officials yesterday. In fact, Cleveland Fed President Mester said that she even “saw a compelling economic case for a 50 basis-point increase” at the most recent meeting, when they opted to downshift hikes back to 25bps. Furthermore, she said that 25bps were not inevitable and that “we can move faster, and we can do bigger at any particular meeting.” That was then followed up by St Louis Fed President Bullard, who said he wouldn’t rule out supporting a 50bp hike in March as well, and said that his judgement was “it will be a long battle against inflation.”

On the back of those comments, investors moved to price in a growing probability that the Fed might choose to move by more than 25bps at the next meeting in March. Indeed, looking at Fed funds futures, a +28.2bps hike is now priced in for the next meeting, which is the highest to date, and means at least a small chance is priced that they might opt for a bigger move. On top of that, expectations of the terminal rate now stand at their highest to date, at 5.29% in July. That said, we’ve still got plenty of data coming out before that next decision, including the jobs report and CPI print for February, so all eyes will be on those releases.

Against this backdrop, Treasuries struggled once again, with the 10yr yield up +5.6bps to 3.86%, which has been followed up by a further +2.3bps increase overnight to 3.88%. Higher inflation breakevens have been the driver over the last couple of sessions, with the 10yr breakeven up +3.2bps yesterday to 2.38%, whilst the 2yr breakeven was up another +0.4bps to 2.87%. The 2yr breakeven had closed as low as 2.04% as recently as January 18, so it’s clear that investors are moving to reappraise the near-term inflation profile in light of the recent data.

Elsewhere, US equities had a rough session of their own yesterday, although the S&P 500 was initially down as much as -1.36%, before recovering to only be down -0.27%, before then falling sharply following the Bullard comments to close -1.40%. The declines were pretty broad-based, with every sector group in the S&P losing ground. Other indices also struggled too, including the NASDAQ (-1.78%) and the Dow Jones (-1.26%).

Those equity declines followed a bunch of data that painted a more downbeat view on the rest of the US economy. For instance, housing starts fell by more than expected to an annualised rate of 1.309m in January (vs. 1.356m expected). That takes them to their lowest since June 2020, when the economy was still recovering from the initial Covid-19 wave, and means that housing starts have fallen for 5 consecutive months for the first time since 2009. Elsewhere, we also had the Philadelphia Fed’s business outlook, which fell down to -24.3 (vs. -7.5 expected). Bear in mind as well that in available data back to 1968, the index has never been this low without a recession following within months.

Over in Europe however, the picture has remained comparatively upbeat. In fact the STOXX 600 (+0.19%) closed at a one-year high yesterday, with its YTD gains now standing at +9.50%, albeit that was before the Bullard comments. It was a similar story for some of the other indices, with the DAX (+0.18%) and the CAC 40 (+0.89%) also closing at one-year highs of their own, whilst the UK’s FTSE 100 (+0.18%) reached an all-time high as it closed above the 8,000 mark for the first time.

Whilst European equities put in a decent performance, sovereign bonds lost a bit of ground like in the US. For instance, yields on 10yr bunds saw a modest +0.3bps increase to close at their highest level of 2023 so far, at 2.47%, and yields on 2yr German debt hit a post-2008 high. That followed a collection of ECB speakers across the hawk-dove spectrum. For instance, the Executive Board’s Panetta (a dove) said that “we now need to take into account the risk of overtightening alongside the risk of doing too little”, and also that “we face so much uncertainty in both directions, I would consider it unwise to move very fast”. But on the other hand, Bundesbank President Nagel said that “I can’t see that we’re in restrictive territory right now”. As in the US though, there was evidence that inflation expectations were creeping higher, since the 5y5y forward inflation swap for the Euro Area (which looks at inflation over the 5 years starting in 5 years’ time) hit its joint highest closing level since May yesterday, at 2.41%.

Staying on Europe, next week DB Research’s CEEMEA team will be hosting a webinar on the war in Ukraine next week. They’ll be joined by Michael Kofman, the Research Director of the Russia Studies Program at the CAN, and will be discussing the latest developments in the conflict, the likely next steps in the war effort, the implications of recent sanctions, the prospects of a peace agreement, and the risks of escalation. That’s taking place on Tuesday at 1pm London time, and the link to sign up is here.

Overnight in Asia, equity markets are under pressure this morning, following up those overnight losses on Wall Street. As we go to press, the KOSPI (-0.77%), the Nikkei (-0.64%), the Hang Seng (-0.58%), the CSI (-0.48%) and the Shanghai Composite (-0.16%) have all lost ground. And on the FX side, the Japanese Yen has weakened to 134.71 per US Dollar, its weakest level since the BoJ’s surprise move to adjust their yield curve control policy in December. That comes amidst firming expectations the Fed will stick to their hawkish stance, and the broader dollar index is also at its strongest since early January. Elsewhere, the S&P/ASX 200 (-0.78%) is trading lower after the Reserve Bank of Australia’s Governor Lowe reiterated warnings of inflation risks while pointing to further rate hikes in coming months. This negative sentiment is being seen elsewhere too, with US stock futures indicating further losses today, including those for the S&P 500 (-0.50%) and NASDAQ 100 (-0.68%).

To the day ahead now, and data releases include UK retail sales and German PPI for January, whilst in the US there’s also the Conference Board’s leading index for January. Otherwise, central bank speakers include the ECB’s Villeroy, and the Fed’s Barkin and Bowman.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

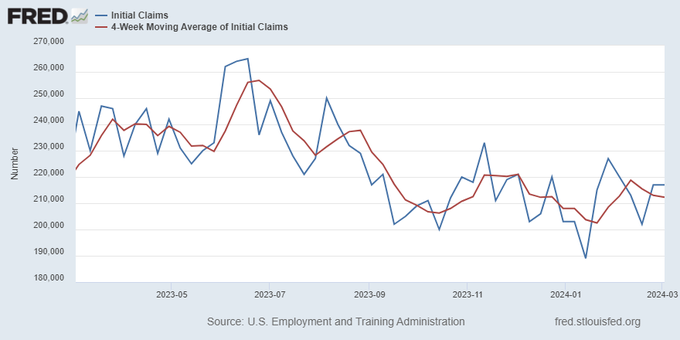

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

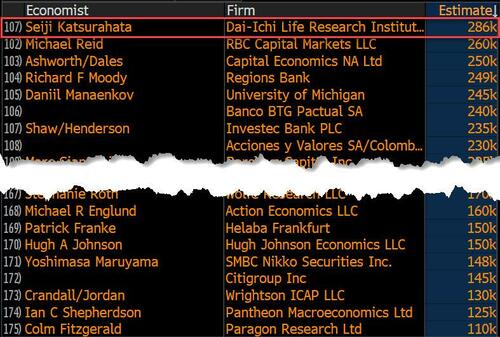

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex