International

NIH ‘very concerned’ about serious side effect in AstraZeneca’s PhIII Covid-19 trial

NIH ‘very concerned’ about serious side effect in AstraZeneca’s PhIII Covid-19 trial

The FDA is weighing whether to follow British regulators in resuming a coronavirus vaccine trial that was halted when a participant suffered spinal cord damage, even as the NIH has launched an investigation of the case.

Avindra Nath

Avindra Nath“The highest levels of NIH are very concerned,” said Avindra Nath, intramural clinical director and a leader of viral research at the National Institute for Neurological Disorders and Stroke, an NIH division. “Everyone’s hopes are on a vaccine, and if you have a major complication the whole thing could get derailed.”

A great deal of uncertainty remains about what happened to the unnamed patient, to the frustration of those avidly following the progress of vaccine testing. AstraZeneca, which is running the global trial of the vaccine it produced with Oxford University, said the trial volunteer recovered from a severe inflammation of the spinal cord and is no longer hospitalized.

AstraZeneca has not confirmed that the patient was afflicted with transverse myelitis, but Nath and another neurologist said they understood this to be the case. Transverse myelitis produces a set of symptoms involving inflammation along the spinal cord that can cause pain, muscle weakness and paralysis. Britain’s regulatory body, the Medicines and Healthcare Products Regulatory Agency, reviewed the case and has allowed the trial to resume in the United Kingdom.

AstraZeneca “need[s] to be more forthcoming with a potential complication of a vaccine which will eventually be given to millions of people,” said Nath. “We would like to see how we can help, but the lack of information makes it difficult to do so.”

Any decision about whether to continue the trial is complex because it’s difficult to assess the cause of a rare injury that occurs during a vaccine trial — and because scientists and authorities have to weigh the risk of uncommon side effects against a vaccine that might curb the pandemic.

“So many factors go into these decisions,” Nath said. “I’m sure everything is on the table. The last thing you want to do is hurt healthy people.”

The NIH has yet to get tissue or blood samples from the British patient, and its investigation is “in the planning stages,” Nath said. US scientists could look at samples from other vaccinated patients to see whether any of the antibodies they generated in response to the coronavirus also attack brain or spinal cord tissue.

Such studies might take a month or two, he said. The FDA declined to comment on how long it would take before it decides whether to move forward.

Jesse Goodman

Jesse GoodmanJesse Goodman, a Georgetown University professor and physician who was chief scientist and lead vaccine regulator at the FDA during the Obama administration, said the agency will review the data and possibly consult with British regulators before allowing resumption of the US study, which had just begun when the injury was reported. Two other coronavirus vaccines are also in late-stage trials in the US.

If it determines the injury in the British trial was caused by the vaccine, the FDA could pause the trial. If it allows it to resume, regulators and scientists surely will be on the watch for similar symptoms in other trial participants.

A volunteer in an earlier phase of the AstraZeneca trial experienced a similar side effect, but investigators discovered she had multiple sclerosis that was unrelated to the vaccination, according to Elliot Frohman, director of the Multiple Sclerosis & Neuroimmunology Center at the University of Texas.

Neurologists who study illnesses like transverse myelitis say they are rare — occurring at a rate of perhaps 1 in 250,000 people — and strike most often as a result of the body’s immune response to a virus. Less frequently, such episodes have also been linked to vaccines.

The precise cause of the disease is key to the decision by authorities whether to resume the trial. Sometimes an underlying medical condition is “unmasked” by a person’s immune response to the vaccine, leading to illness, as happened with the MS patient. In that case, the trial might be continued without fear, because the illness was not specific to the vaccine.

William Schaffner

William SchaffnerMore worrisome is a phenomenon called “molecular mimicry.” In such cases, some small piece of the vaccine may be similar to tissue in the brain or spinal cord, resulting in an immune attack on that tissue in response to a vaccine component. Should that be the case, another occurrence of transverse myelitis would be likely if the trial resumed, said William Schaffner, an infectious disease specialist at the Vanderbilt University School of Medicine. A second case would shut down the trial, he said.

In 1976, a massive swine flu vaccination program was halted when doctors began diagnosing a similar disorder, Guillain-Barré syndrome, in people who received the vaccine. At the time no one knew how common GBS was, so it was difficult to tell whether the episodes were related to the vaccine.

Eventually, scientists found that the vaccine increased the risk of the disorder by an additional one case among every 100,000 vaccinated patients. Typical seasonal flu vaccination raises the risk of GBS in about one additional case in every 1 million people.

“It’s very, very hard” to determine if one rare event was caused by a vaccine, Schaffner said. “How do you attribute an increased risk for something that occurs in one in a million people?”

Before allowing US trials to restart, the FDA will want to see why the company and an independent data and safety monitoring board (DSMB) in the UK felt it was safe to continue, Goodman said. The AstraZeneca trial in the United States has a separate safety board.

FDA officials will need to review full details of the case and may request more information about the affected study volunteer before deciding whether to allow the US trial to continue, Goodman said. They may also require AstraZeneca to update the safety information it provides to study participants.

Amesh Adalja

Amesh AdaljaIt’s possible that the volunteer’s health problem was a coincidence unrelated to the vaccine, said Amesh Adalja, a senior scholar at the Johns Hopkins Center for Health Security. Studies aren’t usually stopped over a single health problem, even if it’s serious.

Yet many health leaders have expressed frustration that AstraZeneca hasn’t released more information about the health problem that led it to halt its UK trial.

“There is just so little information about this that it’s impossible to understand what the diagnosis was or why the DSMB and sponsor were reassured” that it was safe to continue, Goodman said.

AstraZeneca has said it’s unable to provide more information about the health problem, saying this would violate patient privacy, although it didn’t say how.

But there’s an exceptional need for transparency in a political climate rife with vaccine hesitancy and mistrust of the Trump administration’s handling of the Covid-19 response, leading scientists say.

“While I respect the critical need for patient confidentiality, I think it would be really helpful to know what their assessment of these issues was,” Goodman said. “What was the diagnosis? If there wasn’t a clear diagnosis, what is it that led them to feel the trial could be restarted? There is so much interest and potential concern about a Covid-19 vaccine that the more information that can be provided, the more reassuring that would be.”

The FDA will need to balance any possible risks from an experimental vaccine with the danger posed by Covid-19, which has killed nearly 200,000 Americans.

“There are also potential consequences if you stop a study,” Goodman said.

If the AstraZeneca vaccine fails, the U.S. government is supporting six other Covid vaccines in the hope at least one will succeed. The potential problems with the AstraZeneca vaccine show this to be a wise investment, Adalja said.

“This is part of the idea of not having just one vaccine candidate going forward,” he said. “It gives you a little more insurance.”

Schaffner said researchers need to remember that vaccine research is unpredictable.

“The investigators have inadvisedly been hyping their own vaccine,” Schaffner said. “The Oxford investigators were out there this summer saying, ‘We’re going to get there first.’ But this is exactly the sort of reason … Dr. [Anthony] Fauci and the rest of us have been saying, ‘You never know what will happen once you get into large-scale human trials.’” — Arthur Allen and Liz Szabo

For a look at all Endpoints News coronavirus stories, check out our special news channel.

This KHN story first published on California Healthline, a service of the California Health Care Foundation.

Government

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

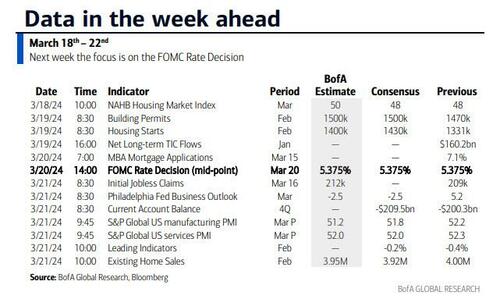

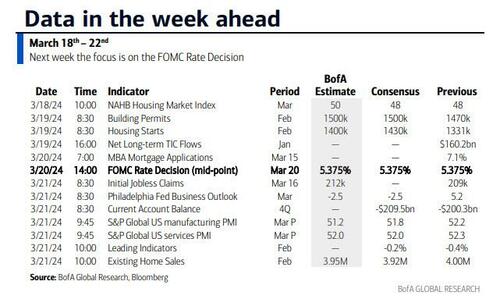

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

Government

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

International

AI vs. elections: 4 essential reads about the threat of high-tech deception in politics

Using disinformation to sway elections is nothing new. Powerful new AI tools, however, threaten to give the deceptions unprecedented reach.

It’s official. Joe Biden and Donald Trump have secured the necessary delegates to be their parties’ nominees for president in the 2024 election. Barring unforeseen events, the two will be formally nominated at the party conventions this summer and face off at the ballot box on Nov. 5.

It’s a safe bet that, as in recent elections, this one will play out largely online and feature a potent blend of news and disinformation delivered over social media. New this year are powerful generative artificial intelligence tools such as ChatGPT and Sora that make it easier to “flood the zone” with propaganda and disinformation and produce convincing deepfakes: words coming from the mouths of politicians that they did not actually say and events replaying before our eyes that did not actually happen.

The result is an increased likelihood of voters being deceived and, perhaps as worrisome, a growing sense that you can’t trust anything you see online. Trump is already taking advantage of the so-called liar’s dividend, the opportunity to discount your actual words and deeds as deepfakes. Trump implied on his Truth Social platform on March 12, 2024, that real videos of him shown by Democratic House members were produced or altered using artificial intelligence.

The Conversation has been covering the latest developments in artificial intelligence that have the potential to undermine democracy. The following is a roundup of some of those articles from our archive.

1. Fake events

The ability to use AI to make convincing fakes is particularly troublesome for producing false evidence of events that never happened. Rochester Institute of Technology computer security researcher Christopher Schwartz has dubbed these situation deepfakes.

“The basic idea and technology of a situation deepfake are the same as with any other deepfake, but with a bolder ambition: to manipulate a real event or invent one from thin air,” he wrote.

Situation deepfakes could be used to boost or undermine a candidate or suppress voter turnout. If you encounter reports on social media of events that are surprising or extraordinary, try to learn more about them from reliable sources, such as fact-checked news reports, peer-reviewed academic articles or interviews with credentialed experts, Schwartz said. Also, recognize that deepfakes can take advantage of what you are inclined to believe.

2. Russia, China and Iran take aim

From the question of what AI-generated disinformation can do follows the question of who has been wielding it. Today’s AI tools put the capacity to produce disinformation in reach for most people, but of particular concern are nations that are adversaries of the United States and other democracies. In particular, Russia, China and Iran have extensive experience with disinformation campaigns and technology.

“There’s a lot more to running a disinformation campaign than generating content,” wrote security expert and Harvard Kennedy School lecturer Bruce Schneier. “The hard part is distribution. A propagandist needs a series of fake accounts on which to post, and others to boost it into the mainstream where it can go viral.”

Russia and China have a history of testing disinformation campaigns on smaller countries, according to Schneier. “Countering new disinformation campaigns requires being able to recognize them, and recognizing them requires looking for and cataloging them now,” he wrote.

3. Healthy skepticism

But it doesn’t require the resources of shadowy intelligence services in powerful nations to make headlines, as the New Hampshire fake Biden robocall produced and disseminated by two individuals and aimed at dissuading some voters illustrates. That episode prompted the Federal Communications Commission to ban robocalls that use voices generated by artificial intelligence.

AI-powered disinformation campaigns are difficult to counter because they can be delivered over different channels, including robocalls, social media, email, text message and websites, which complicates the digital forensics of tracking down the sources of the disinformation, wrote Joan Donovan, a media and disinformation scholar at Boston University.

“In many ways, AI-enhanced disinformation such as the New Hampshire robocall poses the same problems as every other form of disinformation,” Donovan wrote. “People who use AI to disrupt elections are likely to do what they can to hide their tracks, which is why it’s necessary for the public to remain skeptical about claims that do not come from verified sources, such as local TV news or social media accounts of reputable news organizations.”

4. A new kind of political machine

AI-powered disinformation campaigns are also difficult to counter because they can include bots – automated social media accounts that pose as real people – and can include online interactions tailored to individuals, potentially over the course of an election and potentially with millions of people.

Harvard political scientist Archon Fung and legal scholar Lawrence Lessig described these capabilities and laid out a hypothetical scenario of national political campaigns wielding these powerful tools.

Attempts to block these machines could run afoul of the free speech protections of the First Amendment, according to Fung and Lessig. “One constitutionally safer, if smaller, step, already adopted in part by European internet regulators and in California, is to prohibit bots from passing themselves off as people,” they wrote. “For example, regulation might require that campaign messages come with disclaimers when the content they contain is generated by machines rather than humans.”

Read more: How AI could take over elections – and undermine democracy

This story is a roundup of articles from The Conversation’s archives.

This article is part of Disinformation 2024: a series examining the science, technology and politics of deception in elections.

You may also be interested in:

Misinformation, disinformation and hoaxes: What’s the difference?

trump pandemic testing iran european russia china

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex