Government

Nicki Minaj’s COVID-19 vaccine tweet about swollen testicles signals the dangers of celebrity misinformation and fandom

Nicki Minaj’s international anti-vaccine fiasco reveals the life-and-death stakes at the heart of normalizing a culture of fandom tribalism.

Rapper and pop singer Nicki Minaj made headlines after her Sept. 13 tweet about her as-of-yet unidentified cousin’s friend in Trinidad, who was dumped at the altar by his wife-to-be because “the vaccine” — presumably for COVID-19 — allegedly made his testicles swell. Trinidad and Tobago’s health minister said two days later the claim was debunked after being investigated.

MSNBC political commentator Joy Reid expressed concern for Minaj’s 22 million Twitter followers, arguing Minaj used her platform “to put people in the position of dying from a disease they don’t have to die from.”

Speaking directly to Minaj, Reid added: “As somebody who is your fan, I am so sad you did that.”

Minaj’s international anti-vaccine fiasco does more than reveal the troubling intersection of entertainment and politics. It reveals the life-and-death stakes at the heart of normalizing a culture of political tribalism.

Debunked claims

Minaj also tweeted on Sept. 13: “They want you to get vaccinated for the Met. (I)f I get vaccinated it won’t for the Met. It’ll be once I feel I’ve done enough research.” Vogue editor-in-chief Anna Wintour’s event, which Minaj did not attend, required vaccination.

But what began as a tweet soon dominated headlines as mainstream media pushed back against Minaj’s unverified storytelling. Minaj, (with her fans, “The Barbz”), pushed back.

While Minaj did tweet that she would eventually get the vaccine to go on tour, her recommendation that others get the vaccine in order to work because a “lot of countries won’t let [people] work w/o the vaccine” reflects the anti-vaxx criticisms against vaccine mandates created to save lives.

What the fiasco has made clear is the troubling intersection of entertainment and political tribalism, highlighting a culture where cults of personality reign and critical thinking is discouraged.

Sticky emotions in a neoliberal age

Unpacking political tribalism and its spillover into entertainment means understanding how communities have come to be shaped under pressures of uncertainty in a neoliberal era of globalization. British environmentalist and activist George Monbiot highlights how neoliberalism has contributed to a culture of competition by redefining “citizens as consumers whose democratic choices are best exercised by buying and selling.”

As argued by feminist author and scholar Sara Ahmed, emotions play a part in building community spaces and their boundaries. Ahmed asks: What happens when one doesn’t believe in the same set of emotional and cultural ideas that would make one a “legitimate citizen” of a given community?

For example, marginalized individuals are expected to carry the same beliefs and feelings as dominant society. As such, “happiness” and “belonging” act as forms of emotional coercion. To be happy is to follow the script. To follow the script is to belong. Those who can’t or won’t follow the script can be seen as strangers or even as threats to the community.

Economic anxiety, inequality, bigotry

Today, growing economic anxiety, inequality and bigotry has led to a right-wing populist movement. People have become bound together and aligned through bitter, negative emotions and anti-democratic desires. An anti-vaccination stance has become characteristic of the alt-right, even at the cost of lives.

Trumpism has led to the consolidation of a tribe of politically and culturally affiliated people.

What we’ve seen until recently among Trump followers is people who almost unquestioningly worship their leader, believe his words no matter how untrue and view those who question him as the enemy.

When Trump himself sheepishly suggested at a recent Alabama rally that taking the vaccine wasn’t so bad, he was booed. What author Stephen Hassan called the cult of Trump has taken on such a life of its own that the man himself may be disposable should he shy away from the policies and ideas that solidified his community.

Echo chamber

From Fox News anchors like Tucker Carlson to Republican politicians like Florida Gov. Ron DeSantis, many who empathize with Trumpian politics have added to the anti-vaccination echo chamber.

To belong to the fold means to align with the fold. And the competitive neoliberal culture that has divided humans into winners and losers, outsiders and insiders underlies entertainment “fandoms” also.

Anti-democratic territory

In today’s era where disinformation campaigns and socio-political polarization have normalized an attack on truth and facts, what seems like “regular competition” between fandoms leads us into anti-democratic territory.

As cultural studies researcher Sascha Buchanan writes: “Fans will defend their favourite entertainers adamantly, as well as against other readings, as a way to authenticate their status within the fan base and to mutually recognize each other’s shared passion.”

This means no form of criticism against “the fave” is permitted regardless of how logical that criticism may be. Just as Minaj fans can terrorize Toronto journalist Wanna Thompson for critiquing the singer’s music, many stand with her against those criticizing her anti-vaccination tweets regardless of the danger they pose.

Disrespect for Black women, self-policing

Now the very same right-wingers who would have looked down on a Black women in hip hop are dishonestly upholding Minaj as one of their fold.

And as Minaj is aligning herself with people like Carlson, who has demonstrated disrespect for Black women’s lives, she has also degraded Joy Reid when suggesting Reid is an Uncle Tom and using other racialized slurs — all because in a world where you must be either for or against, Reid stood against. Minaj’s weaponization of anti-Black racism against a fellow Black woman suggests the grim reality of her willingness to align herself with the same systems of oppression that would just as easily dispose of her should she fall “out of line.”

The “neoliberal turn” in fandom has seen the cultivation of a fan culture of policing one’s self and others. Fans ensure those in the fan community adhere to fan orthodoxies. That Minaj fan flags have been recently shown flying at anti-vaccination rallies seems to clarify how this debacle aligns with today’s political climate.

‘Hatred for outsiders’

The right-wing attack on COVID-19 vaccinations, which is costing lives, and the conservative distrust of facts is backed up by powerful economic actors and institutional forces.

These attempt to erase the importance of history, context and evidence — while manipulating their followers by using their hatred for outsiders.

Politics professor Lilliana Mason argues in Uncivil Agreement: How Politics Became Our Identity that it doesn’t take much to bring out a sense of group identity in the average person, nor does it take much to get them to hate those they consider outsiders.

Politics is emotional. But so is fandom. And emotions can be manipulated.

Sarah R. Olutola does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

trump covid-19 vaccineInternational

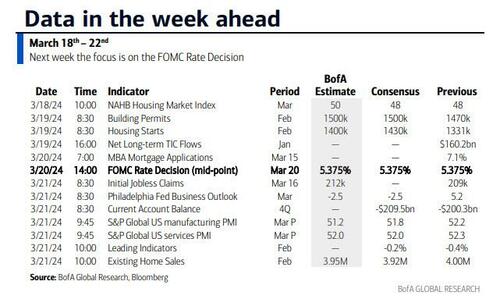

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

International

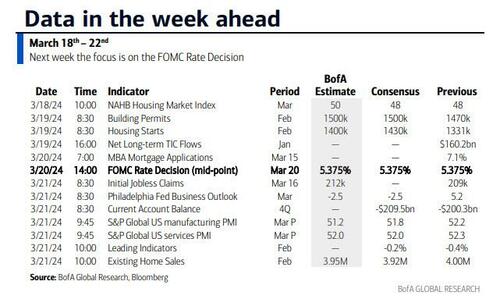

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

International

AI vs. elections: 4 essential reads about the threat of high-tech deception in politics

Using disinformation to sway elections is nothing new. Powerful new AI tools, however, threaten to give the deceptions unprecedented reach.

It’s official. Joe Biden and Donald Trump have secured the necessary delegates to be their parties’ nominees for president in the 2024 election. Barring unforeseen events, the two will be formally nominated at the party conventions this summer and face off at the ballot box on Nov. 5.

It’s a safe bet that, as in recent elections, this one will play out largely online and feature a potent blend of news and disinformation delivered over social media. New this year are powerful generative artificial intelligence tools such as ChatGPT and Sora that make it easier to “flood the zone” with propaganda and disinformation and produce convincing deepfakes: words coming from the mouths of politicians that they did not actually say and events replaying before our eyes that did not actually happen.

The result is an increased likelihood of voters being deceived and, perhaps as worrisome, a growing sense that you can’t trust anything you see online. Trump is already taking advantage of the so-called liar’s dividend, the opportunity to discount your actual words and deeds as deepfakes. Trump implied on his Truth Social platform on March 12, 2024, that real videos of him shown by Democratic House members were produced or altered using artificial intelligence.

The Conversation has been covering the latest developments in artificial intelligence that have the potential to undermine democracy. The following is a roundup of some of those articles from our archive.

1. Fake events

The ability to use AI to make convincing fakes is particularly troublesome for producing false evidence of events that never happened. Rochester Institute of Technology computer security researcher Christopher Schwartz has dubbed these situation deepfakes.

“The basic idea and technology of a situation deepfake are the same as with any other deepfake, but with a bolder ambition: to manipulate a real event or invent one from thin air,” he wrote.

Situation deepfakes could be used to boost or undermine a candidate or suppress voter turnout. If you encounter reports on social media of events that are surprising or extraordinary, try to learn more about them from reliable sources, such as fact-checked news reports, peer-reviewed academic articles or interviews with credentialed experts, Schwartz said. Also, recognize that deepfakes can take advantage of what you are inclined to believe.

2. Russia, China and Iran take aim

From the question of what AI-generated disinformation can do follows the question of who has been wielding it. Today’s AI tools put the capacity to produce disinformation in reach for most people, but of particular concern are nations that are adversaries of the United States and other democracies. In particular, Russia, China and Iran have extensive experience with disinformation campaigns and technology.

“There’s a lot more to running a disinformation campaign than generating content,” wrote security expert and Harvard Kennedy School lecturer Bruce Schneier. “The hard part is distribution. A propagandist needs a series of fake accounts on which to post, and others to boost it into the mainstream where it can go viral.”

Russia and China have a history of testing disinformation campaigns on smaller countries, according to Schneier. “Countering new disinformation campaigns requires being able to recognize them, and recognizing them requires looking for and cataloging them now,” he wrote.

3. Healthy skepticism

But it doesn’t require the resources of shadowy intelligence services in powerful nations to make headlines, as the New Hampshire fake Biden robocall produced and disseminated by two individuals and aimed at dissuading some voters illustrates. That episode prompted the Federal Communications Commission to ban robocalls that use voices generated by artificial intelligence.

AI-powered disinformation campaigns are difficult to counter because they can be delivered over different channels, including robocalls, social media, email, text message and websites, which complicates the digital forensics of tracking down the sources of the disinformation, wrote Joan Donovan, a media and disinformation scholar at Boston University.

“In many ways, AI-enhanced disinformation such as the New Hampshire robocall poses the same problems as every other form of disinformation,” Donovan wrote. “People who use AI to disrupt elections are likely to do what they can to hide their tracks, which is why it’s necessary for the public to remain skeptical about claims that do not come from verified sources, such as local TV news or social media accounts of reputable news organizations.”

4. A new kind of political machine

AI-powered disinformation campaigns are also difficult to counter because they can include bots – automated social media accounts that pose as real people – and can include online interactions tailored to individuals, potentially over the course of an election and potentially with millions of people.

Harvard political scientist Archon Fung and legal scholar Lawrence Lessig described these capabilities and laid out a hypothetical scenario of national political campaigns wielding these powerful tools.

Attempts to block these machines could run afoul of the free speech protections of the First Amendment, according to Fung and Lessig. “One constitutionally safer, if smaller, step, already adopted in part by European internet regulators and in California, is to prohibit bots from passing themselves off as people,” they wrote. “For example, regulation might require that campaign messages come with disclaimers when the content they contain is generated by machines rather than humans.”

Read more: How AI could take over elections – and undermine democracy

This story is a roundup of articles from The Conversation’s archives.

This article is part of Disinformation 2024: a series examining the science, technology and politics of deception in elections.

You may also be interested in:

Misinformation, disinformation and hoaxes: What’s the difference?

trump pandemic testing iran european russia china

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex