Spread & Containment

Niantic tries its hand at sports with NBA All-World

Niantic, the company behind the mega-hit Pokémon GO, has reached an inflection point. Whether because of pandemic fatigue or frustration over the limitations…

Niantic, the company behind the mega-hit Pokémon GO, has reached an inflection point.

Whether because of pandemic fatigue or frustration over the limitations of today’s AR tech, the Google-spawned startup has struggled mightily to replicate the success of GO, which became one of the fastest-growing games in history shortly after it launched in July 2016. Niantic shut down Harry Potter: Wizards Unite, its first high-profile title after GO, just two years post-debut, while another tentpole project — Pikmin Bloom — has generated only a fraction of the downloads that GO attained over the same time frame.

Last June, Niantic laid off 8% of its staff — about 85 to 90 people — and canceled four of its projects, including a Transformers game that had already entered beta testing.

Needless to say, there’s a lot riding on NBA All-World, Niantic’s latest attempt to again achieve iOS and Android virality. Revealed last summer in a joint announcement with the NBA and National Basketball Players Association, All-World — which is visually quite similar to GO — is chock full of merchandise, nods to basketball culture, minigames and opportunities to meet avatars of real-world NBA players like Jordan Poole, Karl-Anthony Towns and Andrew Wiggins.

I’ll be the first to admit that I’m not All-World’s core demographic. The only team I’ve ever followed is the Cleveland Cavaliers, and that’s simply because I grew up near Cleveland (and, well, LeBron’s stardom didn’t hurt). Being that I’m not much of a sports person — my preferred type of game involves controllers and screens — I hadn’t given All-World much thought until Darrell Etherington, TechCrunch’s managing editor, assigned me to write a first impressions piece.

So I went in blind to my All-World demo, which took place on a gray and gloomy, rainy afternoon at the Compound near Red Hook in Brooklyn. The Compound, I was informed by the PR folks who arranged the affair, was founded by hip-hop DJ Set Free Richardson of AND1 fame. Neat. In any case, the loft-like space was nicely appointed, with checkerboard-patterned rugs, Picasso-esque prints and a pool table racked and ready for play.

Image Credits: Kyle Wiggers / TechCrunch

But I wasn’t there for pool. After arriving and pouring myself a cup of coffee, I plopped down on a thick leather couch next to Glenn Chin, head of global marketing at Niantic, and Marcus Matthews, a senior producer for All-World, to walk through All-World a day ahead of its release on the Play Store and App Store.

I started with the obvious question: why basketball, now, for Niantic? Why’d the studio choose this sport for its next AR venture? Answering candidly, Chin pointed out that licensing deals are far easier to strike with an international organization like the NBA as opposed to, say, disparate soccer confederations. But he and Matthews — who grew up playing basketball in Downtown Jacksonville, Florida — repeatedly emphasized basketball’s communal aspect, too, particularly in cities with public courts where kids and teens gather (so I’m told) to casually shoot some hoops.

In emphasizing social, the dev team behind All-World followed in the footsteps of GO, which — beyond Pokémon sheer brand strength — resonated because of the compelling mix of shared and competitive experiences it delivered. (Think gym battles with strangers and mad dashes for rare Pokémon.) It’s the fine-tuning of a familiar formula, albeit with a few twists and adaptations to meet the expectations of today’s game-playing audience.

Image Credits: Niantic

As with GO, All-World players can explore their own neighborhoods for collectibles, power-ups and other items of varying intruige. Exploring requires physically walking to a place — this is a Niantic game, after all — and navigating menus by tap- and swipe-based gestures. In-app, you’re represented by an avatar.

All-World is built on Niantic’s Lightship platform, which leverages the Unity game engine to power graphics and gameplay. Orlando-based HypGames co-developed the experience with Niantic; HypGames CEO Mike Taramykin served as VP and GM over EA’s Tiger Woods franchise until 2013.

On top of a real-world map of a player’s surroundings, All-World layers things like power-ups, challenges, gear, boosts and in-game currency. There wasn’t much near the Compound when Matthews demoed the game to me, but he managed to pick up some moolah that could be put toward apparel for his NBA player avatars.

A central mechanic in All-World is recruiting those players, who can then be “leveled up” to become the “rulers” of local basketball courts. (The game has over 100,000 courts at present.) Players can challenge each other to three-point shootouts and other timing-based minigames in recreations of real-world courts, which not only increase the level of a player’s recruits but also their overall team level.

The team level serves as a merit-based stand-in for real-world salary caps — the higher the level, the stronger the NBA players an All-World player can recruit.

Image Credits: Kyle Wiggers / TechCrunch

Adjacent to this, All-World has a robust merchandising component. Players can search for “drops” of jerseys and more (a la Supreme) from brands such as Adidas and Nike that mirror real-world SKUs. Their in-game team members don this merch, some of which improves their game stats. Chin says that the plan is to work with additional brands to create and recreate accessories, balls, clothing and sneakers and even time drops with real-world product launches.

The merch mechanic was built to reflect — and respect — the basketball fan frenzy around collectibles, Chin and Matthews say. I don’t doubt that fact. But there’s an obvious profit motive, too. All-World might be free-to-play, but it certainly isn’t a charity.

As another case in point, Niantic also plans to make money by selling “boosts” for player stats like offense and defense, which improve performance in the minigames. Chin and Matthews don’t deny players who shell out can advance through certain aspects of All-World faster. But Matthews stressed that players don’t need to fork over cash if they play relatively often.

Image Credits: Niantic

That remains to be seen. I was only treated to glimpses of the game — which, unfortunately, experienced some freezing issues during the demo. (Matthews blamed the Compound building’s poor reception, which isn’t unlikely — it wasn’t good.) The bigger-picture question is whether All-World has staying power — and indeed, whether it can make enough noise to stand out in the ultra-crowded mobile market.

With All-World, Niantic is placing bets both on the strength of the NBA brand and the appeal of AR. As a sports ignoramus, I can’t speak on the former point. But on the latter, I wouldn’t write a eulogy for AR just yet. The tech’s just getting started, I’d argue — especially if rumors of an Apple headset someday come to pass.

If Niantic can keep All-World fresh and interesting with compelling AR-focused gameplay, it might just have a fighting chance. (My impression is that it’s a bit light on content at the moment, but to be fair, it’s early.) On the other hand, if All-World devolves into a pay-to-win collect-a-thon down the line, I can’t see it topping the download charts for very long — if ever.

As for what All-World’s success or failure might spell for Niantic, it wouldn’t tank or make the company necessarily. Niantic sells its Lightship platform to developers as a paid service. And GO is still going (pun intended) strong, with revenue estimated to be north of $1 billion. Besides, Niantic raised $300 million at a $9 billion valuation in November 2021 — more than doubling its valuation from 2018.

But after years in development, it’d no doubt be a disappointment for the studio — and for the NBA head honchos who evidently have faith in Niantic’s ability to spin viral magic.

Niantic tries its hand at sports with NBA All-World by Kyle Wiggers originally published on TechCrunch

testing pandemicInternational

AI can help predict whether a patient will respond to specific tuberculosis treatments, paving way for personalized care

People have been battling tuberculosis for thousands of years, and drug-resistant strains are on the rise. Analyzing large datasets with AI can help humanity…

Tuberculosis is the world’s deadliest bacterial infection. It afflicted over 10 million people and took 1.3 million lives in 2022. These numbers are predicted to increase dramatically because of the spread of multidrug-resistant TB.

Why does one TB patient recover from the infection while another succumbs? And why does one drug work in one patient but not another, even if they have the same disease?

People have been battling TB for millennia. For example, researchers have found Egyptian mummies from 2400 BCE that show signs of TB. While TB infections occur worldwide, the countries with the highest number of multidrug-resistant TB cases are Ukraine, Moldova, Belarus and Russia.

Researchers predict that the ongoing war in Ukraine will result in an increase in multidrug-resistant TB cases because of health care disruptions. Additionally, the COVID-19 pandemic reduced access to TB diagnosis and treatment, reversing decades of progress worldwide.

Rapidly and holistically analyzing available medical data can help optimize treatments for each patient and reduce drug resistance. In our recently published research, my team and I describe a new AI tool we developed that uses worldwide patient data to guide more personalized and effective treatment of TB.

Predicting success or failure

My team and I wanted to identify what variables can predict how a patient responds to TB treatment. So we analyzed more than 200 types of clinical test results, medical imaging and drug prescriptions from over 5,000 TB patients in 10 countries. We examined demographic information such as age and gender, prior treatment history and whether patients had other conditions. Finally, we also analyzed data on various TB strains, such as what drugs the pathogen is resistant to and what genetic mutations the pathogen had.

Looking at enormous datasets like these can be overwhelming. Even most existing AI tools have had difficulty analyzing large datasets. Prior studies using AI have focused on a single data type – such as imaging or age alone – and had limited success predicting TB treatment outcomes.

We used an approach to AI that allowed us to analyze a large and diverse number of variables simultaneously and identify their relationship to TB outcomes. Our AI model was transparent, meaning we can see through its inner workings to identify the most meaningful clinical features. It was also multimodal, meaning it could interpret different types of data at the same time.

Once we trained our AI model on the dataset, we found that it could predict treatment prognosis with 83% accuracy on newer, unseen patient data and outperform existing AI models. In other words, we could feed a new patient’s information into the model and the AI would determine whether a specific type of treatment will either succeed or fail.

We observed that clinical features related to nutrition, particularly lower BMI, are associated with treatment failure. This supports the use of interventions to improve nourishment, as TB is typically more prevalent in undernourished populations.

We also found that certain drug combinations worked better in patients with certain types of drug-resistant infections but not others, leading to treatment failure. Combining drugs that are synergistic, meaning they enhance each other’s potency in the lab, could result in better outcomes. Given the complex environment in the body compared with conditions in the lab, it has so far been unclear whether synergistic relationships between drugs in the lab hold up in the clinic. Our results suggest that using AI to weed out antagonistic drugs, or drugs that inhibit or counteract each other, early in the drug discovery process can avoid treatment failures down the line.

Ending TB with the help of AI

Our findings may help researchers and clinicians meet the World Health Organization’s goal to end TB by 2035, by highlighting the relative importance of different types of clinical data. This can help prioritize public health efforts to mitigate TB.

While the performance of our AI tool is promising, it isn’t perfect in every case, and more training is needed before it can be used in the clinic. Demographic diversity can be high within a country and may even vary between hospitals. We are working to make this tool more generalizable across regions.

Our goal is to eventually tailor our AI model to identify drug regimens suitable for individuals with certain conditions. Instead of a one-size-fits-all treatment approach, we hope that studying multiple types of data can help physicians personalize treatments for each patient to provide the best outcomes.

Sriram Chandrasekaran receives funding from the US National Institutes of Health.

treatment genetic pandemic covid-19 spread russia ukraine world health organizationGovernment

Young People Aren’t Nearly Angry Enough About Government Debt

Young People Aren’t Nearly Angry Enough About Government Debt

Authored by The American Institute for Economic Research,

Young people sometimes…

Authored by The American Institute for Economic Research,

Young people sometimes seem to wake up in the morning in search of something to be outraged about. We are among the wealthiest and most educated humans in history. But we’re increasingly convinced that we’re worse off than our parents were, that the planet is in crisis, and that it’s probably not worth having kids.

I’ll generalize here about my own cohort (people born after 1981 but before 2010), commonly referred to as Millennials and Gen Z, as that shorthand corresponds to survey and demographic data. Millennials and Gen Z have valid economic complaints, and the conditions of our young adulthood perceptibly weakened traditional bridges to economic independence. We graduated with record amounts of student debt after President Obama nationalized that lending. Housing prices doubled during our household formation years due to zoning impediments and chronic underbuilding. Young Americans say economic issues are important to us, and candidates are courting our votes by promising student debt relief and cheaper housing (which they will never be able to deliver).

Young people, in our idealism and our rational ignorance of the actual appropriations process, typically support more government intervention, more spending programs, and more of every other burden that has landed us in such untenable economic circumstances to begin with. Perhaps not coincidentally, young people who’ve spent the most years in the increasingly partisan bubble of higher education are also the most likely to favor expanded government programs as a “solution” to those complaints.

It’s Your Debt, Boomer

What most young people don’t yet understand is that we are sacrificing our young adulthood and our financial security to pay for debts run up by Baby Boomers. Part of every Millennial and Gen-Z paycheck is payable to people the same age as the members of Congress currently milking this system and miring us further in debt.

Our government spends more than it can extract from taxpayers. Social Security, which represents 20 percent of government spending, has run an annual deficit for 15 years. Last year Social Security alone overspent by $22.1 billion. To keep sending out checks to retirees, Social Security goes begging to the Treasury Department, and the Treasury borrows from the public by issuing bonds. Bonds allow investors (who are often also taxpayers) to pay for some retirees’ benefits now, and be paid back later. But investors only volunteer to lend Social Security the money it needs to cover its bills because the (younger) taxpayers will eventually repay the debt — with interest.

In other words, both Social Security and Medicare, along with various smaller federal entitlement programs, together comprising almost half of the federal budget, have been operating for a decade on the principle of “give us the money now, and stick the next generation with the check.” We saddle future generations with debt for present-day consumption.

The second largest item in the budget after Social Security is interest on the national debt — largely on Social Security and other entitlements that have already been spent. These mandatory benefits now consume three quarters of the federal budget: even Congress is not answerable for these programs. We never had the chance for our votes to impact that spending (not that older generations were much better represented) and it’s unclear if we ever will.

Young Americans probably don’t think much about the budget deficit (each year’s overspending) or the national debt (many years’ deficits put together, plus interest) much at all. And why should we? For our entire political memory, the federal government, as well as most of our state governments, have been steadily piling “public” debt upon our individual and collective heads. That’s just how it is. We are the frogs trying to make our way in the watery world as the temperature ticks imperceptibly higher. We have been swimming in debt forever, unaware that we’re being economically boiled alive.

Millennials have somewhat modest non-mortgage debt of around $27,000 (some self-reports say twice that much), including car notes, student loans, and credit cards. But we each owe more than $100,000 as a share of the national debt. And we don’t even know it.

When Millennials finally do have babies (and we are!) that infant born in 2024 will enter the world with a newly minted Social Security Number and $78,089 credit card bill for Granddad’s heart surgery and the interest on a benefit check that was mailed when her parents were in middle school.

Headlines and comments sections love to sneer at “snowflakes” who’ve just hit the “real world,” and can’t figure out how to make ends meet, but the kids are onto something. A full 15 percent of our earnings are confiscated to pay into retirement and healthcare programs that will be insolvent by the time we’re old enough to enjoy them. The Federal Reserve and government debt are eating the economy. The same interest rates that are pushing mortgages out of reach are driving up the cost of interest to maintain the debt going forward. As we learn to save and invest, our dollars are slowly devalued. We’re right to feel trapped.

Sure, if we’re alive and own a smartphone, we’re among the one percent of the wealthiest humans who’ve ever lived. Older generations could argue (persuasively!) that we have no idea what “poverty” is anymore. But with the state of government spending and debt…we are likely to find out.

Despite being richer than Rockefeller, Millennials are right to say that the previous ways of building income security have been pushed out of reach. Our earning years are subsidizing not our own economic coming-of-age, but bank bailouts, wars abroad, and retirement and medical benefits for people who navigated a less-challenging wealth-building landscape.

Redistribution goes both ways. Boomers are expected to pass on tens of trillions in unprecedented wealth to their children (if it isn’t eaten up by medical costs, despite heavy federal subsidies) and older generations’ financial support of the younger has had palpable lifting effects. Half of college costs are paid by families, and the trope of young people moving back home is only possible if mom and dad have the spare room and groceries to make that feasible.

Government “help” during COVID-19 resulted in the worst inflation in 40 years, as the federal government spent $42,000 per citizen on “stimulus” efforts, right around a Millennial’s average salary at that time. An absurd amount of fraud was perpetrated in the stimulus to save an economy from the lockdown that nearly ruined it. Trillions in earmarked goodies were rubber stamped, carelessly added to young people’s growing bill. Government lenders deliberately removed fraud controls, fearing they couldn’t hand out $800 billion in young people’s future wages away fast enough. Important lessons were taught by those programs. The importance of self-sufficiency and the dignity of hard work weren’t top of the list.

Boomer Benefits are Stagnating Hiring, Wages, and Investment for Young People

Even if our workplace engagement suffered under government distortions, Millennials continue to work more hours than other generations and invest in side hustles and self employment at higher rates. Working hard and winning higher wages almost doesn’t matter, though, when our purchasing power is eaten from the other side. Buying power has dropped 20 percent in just five years. Life is $11,400/year more expensive than it was two years ago and deficit spending is the reason why.

We’re having trouble getting hired for what we’re worth, because it costs employers 30 percent more than just our wages to employ us. The federal tax code both requires and incentivizes our employers to transfer a bunch of what we earned directly to insurance companies and those same Boomer-busted federal benefits, via tax-deductible benefits and payroll taxes. And the regulatory compliance costs of ravenous bureaucratic state. The price paid by each employer to keep each employee continues to rise — but Congress says your boss has to give most of the increase to someone other than you.

Federal spending programs that many people consider good government, including Social Security, Medicare, Medicaid, and health insurance for children (CHIP) aren’t a small amount of the federal budget. Government spends on these programs because people support and demand them, and because cutting those benefits would be a re-election death sentence. That’s why they call cutting Social Security the “third rail of politics.” If you touch those benefits, you die. Congress is held hostage by Baby Boomers who are running up the bill with no sign of slowing down.

Young people generally support Social Security and the public health insurance programs, even though a 2021 poll by Nationwide Financial found 47 percent of Millennials agree with the statement “I will not get a dime of the Social Security benefits I have earned.”

In the same survey, Millennials were the most likely of any generation to believe that Social Security benefits should be enough to live on as a sole income, and guessed the retirement age was 52 (it’s 67 for anyone born after 1959 — and that’s likely to rise). Young people are the most likely to see government guarantees as a valid way to live — even though we seem to understand that those promises aren’t guarantees at all.

Healthcare costs tied to an aging population and wonderful-but-expensive growth in medical technologies and medications will balloon over the next few years, and so will the deficits in Boomer benefit programs. Newly developed obesity drugs alone are expected to add $13.6 billion to Medicare spending. By 2030, every single Baby Boomer will be 65, eligible for publicly funded healthcare.

The first Millennial will be eligible to claim Medicare (assuming the program exists and the qualifying age is still 65, both of which are improbable) in 2046. As it happens, that’s also the year that the Boomer benefits programs (which will then be bloated with Gen Xers) and the interest payments we’re incurring to provide those benefits now, are projected to consume 100 percent of federal tax revenue.

Government spending is being transferred to bureaucrats and then to the beneficiaries of government spending who are, in some sense, your diabetic grandma who needs a Medicare-paid dialysis treatment, but in a much more immediate sense, are the insurance companies, pharma giants, and hospital corporations who wrote the healthcare legislation. Some percentage of every college graduate’s paycheck buys bullets that get fired at nothing and inflating the private investment portfolios of government contractors, with dubious, wasteful outcomes from the prison-industrial complex to the perpetual war machine.

No bank or nation in the world can lend the kind of money the American government needs to borrow to fulfill its obligations to citizens. Someone will have to bite the bullet. Even some of the co-authors of the current disaster are wrestling with the truth.

Forget avocado toast and streaming subscriptions. We’re already sensing it, but we haven’t yet seen it. Young people are not well-informed, and often actively misled, about what’s rotten in this economic system. But we are seeing the consequences on store shelves and mortgage contracts and we can sense disaster is coming. We’re about to get stuck with the bill.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

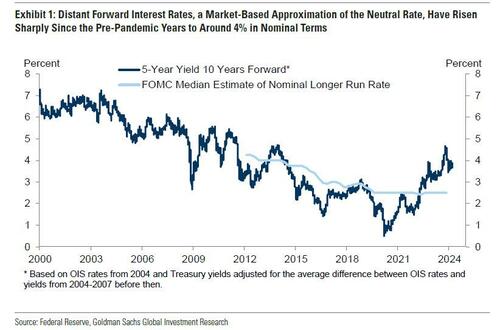

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex