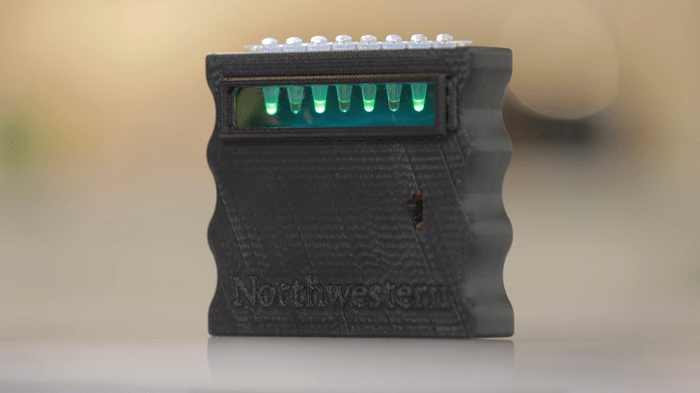

Northwestern University synthetic biologists have developed a low-cost, easy-to-use, hand-held device that can let users know — within mere minutes — if their water is safe to drink.

The new device works by using powerful and programmable genetic networks, which mimic electronic circuits, to perform a range of logic functions.

Among the DNA-based circuits, for example, the researchers engineered cell-free molecules into an analog-to-digital converter (ADC), a ubiquitous circuit type found in nearly all electronic devices. In the water-quality device, the ADC circuit processes an analog input (contaminants) and generates a digital output (a visual signal to inform the user).

The research will be published on Feb. 17 in the journal Nature Chemical Biology.

Equipped with a series of eight small test tubes, the device glows green when it detects a contaminant. The number of tubes that glow depend upon how much contamination is present. If only one tube glows, then the water sample has a trace level of contamination. But if all eight tubes glow, then the water is severely contaminated. In other words, the higher concentration of contamination leads to a higher signal.

“We programmed each tube to have a different threshold for contaminations,” said Northwestern’s Julius B. Lucks, who led the research. “The tube with the lowest threshold will light up all the time. If all the tubes light up, then there is a big problem. Building circuits and programmable DNA computing opens up many possibilities for other types of smart diagnostics.”

Lucks is a professor of chemical and biological engineering in Northwestern’s McCormick School of Engineering and a member of the Center for Synthetic Biology. The paper’s co-authors include Jaeyoung Jung, Chloé Archuleta and Khalid Alam — all from Northwestern.

Meet ROSALIND

The new system builds off work that Lucks and his team published in Nature Biotechnology in July 2020. In that work, the team introduced ROSALIND (named after famed chemist Rosalind Franklin and short for “RNA output sensors activated by ligand induction”), which could sense 17 different contaminants in a single drop of water. When the test detected a contaminant exceeding the U.S Environmental Protection Agency’s standards, it either glowed green or not to give a simple, easy-to-read positive or negative result.

To develop ROSALIND, Lucks and his team employed cell-free synthetic biology. With synthetic biology, researchers take molecular machinery — including DNA, RNA and proteins — out of cells, and then reprogram that machinery to perform new tasks. At the time, Lucks likened ROSALIND’s inner workings to “molecular taste buds.”

“We found out how bacteria naturally taste things in their water,” he said. “They do so with little molecular-level ‘taste buds.’ Cell-free synthetic biology allows us to take those little molecular taste buds out and put them into a test tube. We can then ‘re-wire’ them to produce a visual signal. It glows to let the user quickly and easily see if there’s a contaminant in the water.”

Molecular brainpower

Now, in the new version — dubbed ROSALIND 2.0 — Lucks and his team have added a “molecular brain.”

“The initial platform was a bio-sensor, which acted like a taste bud,” Lucks said. “Now we have added a genetic network that works like a brain. The bio-sensor detects contamination, but then the output of the bio-sensor feeds into the genetic network, or circuit, which works like a brain to perform logic.”

Researchers freeze-dried the reprogrammed “molecular brains” to become shelf-stable and put them into test tubes. Adding a drop of water to each tube sets off a network of reactions and interactions, ultimately causing the freeze-dried pellet to glow in the presence of a contaminant.

To test the new system, Lucks and his team demonstrated that it could successfully detect concentration levels of zinc, an antibiotic and an industrial metabolite. Giving the level of contamination — rather than a simple positive or negative result — is important for informing mitigation strategies, Lucks said.

“After we introduced ROSALIND, people said they wanted a platform that could also give concentration amounts,” he said. “Different contaminants at different levels require different strategies. If you have a low level of lead in your water, for example, then you might be able to tolerate it by flushing your water lines ahead of using them. But if you have high levels, then you need to stop drinking your water immediately and replace your water line.”

Empowering individuals

Ultimately, Lucks and his team hope to empower individuals to test their own water on a regular basis. With inexpensive, hand-held devices like ROSALIND, that may soon become a reality.

“It’s clear that we need to enable people with information to make important, sometimes lifesaving decisions,” Lucks said. “We’re seeing that with at-home tests for COVID-19. People need at-home tests because they need that information quickly and regularly. It’s similar with water. There are many cases where water quality needs to be measured routinely. It’s not a one-time thing because contamination levels can change over time.”

The study, “Programming cell-free biosensors with DNA strand displacement circuits,” was supported by the U.S. Department of Defense, the National Science Foundation, the Crown Family Center for Jewish and Israel Studies and the Searle Funds at The Chicago Community Trust.

Journal

Nature Chemical Biology

DOI

10.1038/s41589-021-00962-9

Method of Research

Experimental study

Subject of Research

Not applicable

Article Title

Programming cell-free biosensors with DNA strand displacement circuits

Article Publication Date

17-Feb-2022