Uncategorized

Nearly Half of U.S. Contractors Believe Training the Next Generation of Workers is the Industry’s Most Critical Need, According to Newly Released DEWALT® Powering the Future Survey

Nearly Half of U.S. Contractors Believe Training the Next Generation of Workers is the Industry’s Most Critical Need, According to Newly Released DEWALT® Powering the Future Survey

PR Newswire

TOWSON, Md., Oct. 24, 2022

More than half of U.S. contr…

Nearly Half of U.S. Contractors Believe Training the Next Generation of Workers is the Industry's Most Critical Need, According to Newly Released DEWALT® Powering the Future Survey

PR Newswire

TOWSON, Md., Oct. 24, 2022

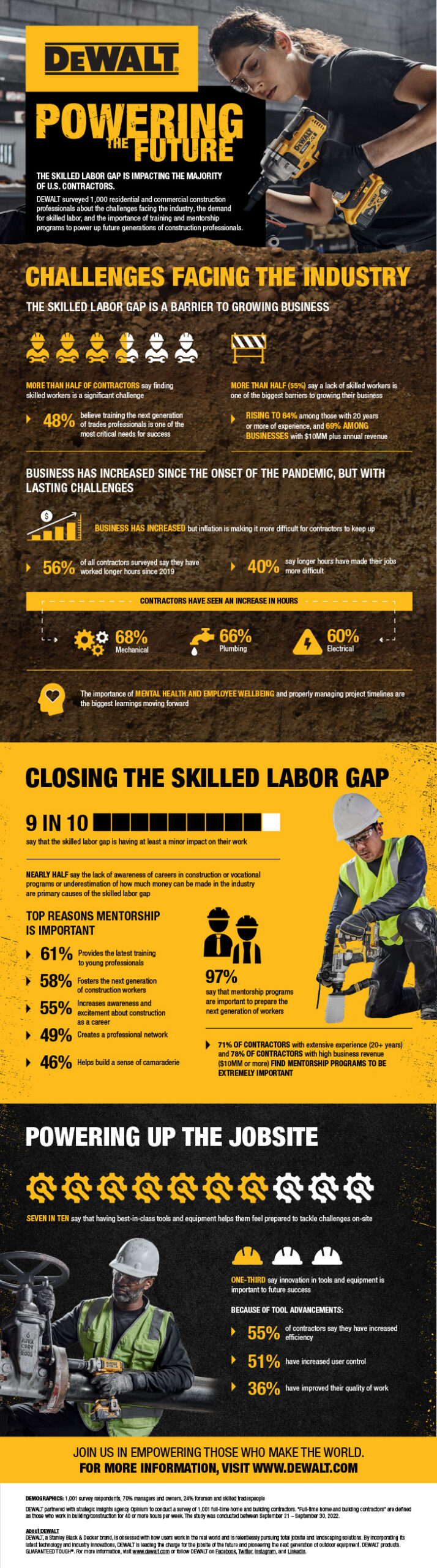

- More than half of U.S. contractors (55%) say finding enough skilled workers is one of the biggest barriers to growing their business

- Inflation (57%), insufficient labor (51%), and long hours (37%) are the three most significant challenges currently facing U.S. contractors

- After training the next generation of workers (48%), more than a third believe contingency planning/risk management (37%) and resilient supply chain solutions (37%) are critical elements for growth of the construction industry in 2023

- 67% of U.S contractors say mentorship and educational opportunities in the trades are extremely important

TOWSON, Md., Oct. 24, 2022 /PRNewswire/ -- A new survey released today from DEWALT, a Stanley Black & Decker (NYSE: SWK) brand and leader in total jobsite solutions, found more than half of U.S. contractors (55%) feel a lack of skilled workers is a barrier to growing their current business. That number rises to 69% among businesses with $10MM plus annual revenue and 64% among those with 20 years or more of experience. Looking to the future, 48% believe training the next generation of trades professionals is one of the most critical needs for the success of the construction industry in 2023.

Experience the full interactive Multichannel News Release here: https://www.multivu.com/players/English/9100752-dewalt-us-contractors-powering-the-future-survey-results/

"The DEWALT Powering the Future Survey sheds further light on the wide-reaching gap in skilled labor and its continued impact on the residential and commercial construction industries. Add to that the overwhelming demand for trades expertise during the COVID-19 pandemic and the [skilled-labor] gap is quickly becoming the most critical need that will dictate the future success of the field," said Allison Nicolaidis, President, Power Tools Group, Stanley Black & Decker. "That's why DEWALT is committed to putting a heavier spotlight on these challenges and taking a lead role in supporting our industrial and construction partners to overcome them. DEWALT will further its commitment to closing the skills deficit with the launch of the DEWALT Trade Scholarship to support trades education programs for students across the country."

Inflation, Insufficient Skilled Labor, and Long Hours are Top Challenges

Keeping up with inflation (57%), finding skilled workers/being understaffed (51%) and working long hours (37%) are the top three most significant challenges that U.S. contractors surveyed are currently facing. When it comes to the effects those challenges are having on the industry, an overwhelming majority of contractors—93%—feel the lack of skilled workers has had at least a minor impact on their existing work.

Half of those contractors who have had their work impacted by the labor shortage (50%) cite the primary causes for the gap as a lack of awareness around career paths in construction, followed by outside influences (parents, media, etc.) that guide younger people away from pursuing a career in the industry (47%), as well as an underestimation of how much money can be made in the industry (41%).

Mentorship Matters

A great deal of importance is placed on mentorship programs regardless of contractor level, tenure, or type, with 67% of all contractors labeling these programs as extremely important with an additional 24% identifying these programs as moderately important. A larger majority of contractors with extensive experience (20+ years) or high business revenue ($10MM or more) find these programs to be extremely important (71% and 78% respectively) in providing the latest training to help young professionals prepare for onsite work. In addition, more than half (53%) of contractors surveyed say mentorship increases excitement about construction as a career path.

Health and Wellbeing are Essential

Since the onset of the COVID-19 pandemic, contractors have experienced numerous changes in the industry. According to the survey, the number one takeaway (39%) from the pandemic among contractors is the importance of employee mental health and wellbeing.

Most contractors (56%) have been working more hours since 2019, with mechanical (68%), plumbing (66%) and electrical (60%) contractors more likely to have seen an increase in labor hours since the pandemic began. Nearly 40% of all contractors surveyed say longer hours have made their jobs more difficult.

2023 Forecast

Half of contractors (48%) identify training the next generation of workers as one of the most critical industry focus areas in 2023 and beyond. Seasoned contractors are particularly committed to training the next generation of workers, with 63% of those in the industry for 20 or more years indicating this is a paramount goal for the future. The second and third most critical elements for growth are contingency planning/risk management and resilient supply chain solutions (both 37%).

Also indicated as an important element of future success is the innovation of tools and equipment (33%). With tool advancements, 55% of contractors feel they have increased efficiency, half (51%) state they have increased user control, and over a third (36%) think it has improved the quality of work.

Empowering Careers in Construction and the Trades

As part of its commitment to empower the next generation of workers, DEWALT has opened the DEWALT Trades Scholarship, which will award students with a $5,000 grant in pursuance of a skilled trade educational program for the 2023-2024 academic year. Eligible candidates include high school seniors, graduates, or current undergraduate students majoring in a degree/certificate program such as trade construction, motor/power specializations, mechanics, or technology. To learn more about this opportunity and apply by February 8, visit https://scholarsapply.org.

The company continues its multi-year commitment to skilling tradespeople through the Global Impact Challenge which provides grants to nonprofits supporting skilling programs for tradespeople, including vocation skills training and retraining. Learn more here.

DEWALT is also offering several promotions on tools and equipment to power up the projects and jobsites of current and future pros. Learn more at https://www.dewalt.com/promotions.

Survey Methodology

DEWALT partnered with strategic insights agency Opinium to conduct a survey of 1,001 full-time home and building contractors. "Full-time home and building contractors" are defined as those who work in building/construction for 40 or more hours per week. The study was conducted between September 21 – September 30, 2022.

About DEWALT

DEWALT, a Stanley Black & Decker brand, is obsessed with how users work in the real world and is relentlessly pursuing total jobsite and landscaping solutions. By incorporating its latest technology and industry innovations, DEWALT is leading the charge for the jobsite of the future and pioneering the next generation of outdoor equipment. DEWALT products. GUARANTEED TOUGH®. For more information, visit www.dewalt.com or follow DEWALT on Facebook, Twitter, Instagram, and LinkedIn.

About Stanley Black & Decker

Headquartered in the USA, Stanley Black & Decker (NYSE: SWK) is the world's largest tool company operating manufacturing facilities worldwide. Guided by its purpose – for those who make the world – the company's approximately 60,000 diverse and high-performing employees produce innovative, award-winning power tools, hand tools, storage, digital tool solutions, lifestyle products, outdoor products, engineered fasteners and other industrial equipment to support the world's makers, creators, tradespeople and builders. The company's iconic brands include DEWALT®, BLACK+DECKER®, CRAFTSMAN®, STANLEY®, CUB CADET®, HUSTLER® and TROY-BILT®. Recognized for its leadership in environmental, social and governance (ESG), Stanley Black & Decker strives to be a force for good in support of its communities, employees, customers and other stakeholders. To learn more visit: www.stanleyblackanddecker.com.

SOURCE DEWALT

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges