MyHealthTeam and Discovery Health Partner to Launch myCOVIDteam, a Secure Social Network for People Who Have COVID-19 or Long COVID

MyHealthTeam and Discovery Health Partner to Launch myCOVIDteam, a Secure Social Network for People Who Have COVID-19 or Long COVID

PR Newswire

SAN FRANCISCO, March 1, 2022

SAN FRANCISCO, March 1, 2022 /PRNewswire/ — MyHealthTeam, creator of the l…

MyHealthTeam and Discovery Health Partner to Launch myCOVIDteam, a Secure Social Network for People Who Have COVID-19 or Long COVID

PR Newswire

SAN FRANCISCO, March 1, 2022

SAN FRANCISCO, March 1, 2022 /PRNewswire/ -- MyHealthTeam, creator of the largest and fastest-growing social networks for people facing chronic health conditions, today announced its partnership with South Africa's largest private health insurance administrator, Discovery Health, to launch myCOVIDteam, a social network - also known as an online patient community - for people facing acute or long-haul symptoms of COVID-19 (known as 'long COVID').

MyHealthTeam's patient communities are patient-led, online groups where patients, caregivers, doctors, researchers, and others come together with a focus on a particular disease. They share stories, offer support and information, and even develop solutions where needed.

"COVID-19 will have a wide-ranging impact on individuals and communities around the world for years to come," said Eric Peacock, cofounder and CEO of MyHealthTeam. "The myCOVIDteam network is key to empowering community members on multiple levels. Visitors to myCOVIDteam have access to medically reviewed information and trusted resources to help them talk with their doctors more effectively and better manage their recovery."

myCOVIDteam provides community members with access to:

- Foundational information about COVID-19 - including risk factors, symptoms, treatment options and more;

- Interviews with medical experts addressing various aspects of COVID-19 - including conversations with renowned specialists in cardiology, nephrology, pulmonology, neurology, and psychology;

- Guidance for navigating daily life with the disease - including addressing physical, mental, social, and practical impacts;

- Research insights and new information - including accessible summaries of studies from around the world that explain what people can expect and what they can do when facing COVID-19 and its long-term effects; and

- Member stories from the myCOVIDteam community - through which real people have a chance to share their personal experiences, providing validation and support to others within the community.

"Long COVID is an emerging illness causing distress for a surprisingly high percentage of previously healthy individuals, following a COVID-19 infection," said Dr Ryan Noach, CEO of Discovery Health. "Our data demonstrates an unequivocal increase in healthcare burden in a cohort of previously COVID-positive members who are living with ongoing symptoms. This poses significant individual concern and discomfort, population health risk and a health economic challenge."

"Throughout the pandemic we have supported members of schemes administered by Discovery Health with up-to-date and factual clinical information regarding COVID-19. We believe our partnership with MyHealthTeam to launch myCOVIDteam is an extension of this very important work. We consider it critical to facilitate interaction between affected patients through secure communities which encourage information sharing, learning and support."

"A strong, medically-sound, social network is key in helping people navigate the challenges of long COVID, feel supported, less isolated, and truly informed about a disease which the world's scientific community continues to learn about. We believe that myCOVIDteam will provide much needed empathy and practical know-how to people facing both acute and long-haul COVID-19 symptoms."

People in 13 countries – United States of America, South Africa, United Kingdom, Canada, Australia, New Zealand, the Netherlands, Ireland, Sweden, Denmark, Norway, Iceland, and Finland - can now connect with others facing the challenges of COVID-19 illness at www.mycovidteam.com. Once signed up (at no cost), members can share their firsthand experience of the disease and connect with others facing similar symptoms or challenges in a secure, private environment.

Partnership extends to chronic illness patient communities

In addition to collaborating on the launch of myCOVIDteam, the partnership between MyHealthTeam and Discovery Health includes integration of Discovery Health as the exclusive sponsor of MyHeartDiseaseTeam and DiabetesTeam in South Africa, for a period of two years.

Discovery Health will soon open access to these online patient communities to its members, helping them take a proactive approach to managing their health while living with these common chronic conditions.

About MyHealthTeam

MyHealthTeam believes that if you are diagnosed with a chronic condition, it should be easy to find and connect with others like you. MyHealthTeam creates social networks that provide support and information for people living with a chronic health condition. Millions of people have joined one of the company's 42 highly engaged communities focusing on the following conditions: Alzheimer's, amyloidosis, asthma, autism, breast cancer, COPD, chronic pain, COVID-19, Crohn's and ulcerative colitis, depression, diabetes (type 2), eczema, endometriosis, epilepsy, fibromyalgia, food allergies, heart disease, hemophilia, hidradenitis suppurativa, HIV, hyperhidrosis, irritable bowel syndrome, leukemia, lung cancer, lupus, lymphoma, migraines, multiple sclerosis, myeloma, myeloproliferative neoplasms, narcolepsy, obesity, osteoporosis, ovarian cancer, Parkinson's, PCOS, psoriasis, pulmonary hypertension, rheumatoid arthritis, spinal muscular atrophy, spondylitis, and vitiligo. MyHealthTeam social networks are available in 13 countries.

About Discovery Health

Discovery Health (DH) is South Africa's largest private health insurance administrator, providing comprehensive healthcare insurance to more than 3.7 million people in South Africa. Discovery, through its proprietary wellness programme, Vitality, partners with leading global insurers in Asia-Pacific, Europe, North America and South America servicing more than 20 million clients globally, and enabling them to live healthier, longer lives. Due to its scale and prominence in the private healthcare environment Discovery Health has unparalleled access to a unique data set in South Africa encompassing full electronic health records, wellness data, and vaccination data for these insured lives. Discovery Group is the holding company of Vitality Group in the USA and of Vitality UK.

About Long Covid

According to the US Centers for Disease Control & Prevention (CDC), some people experience a range of new or ongoing symptoms that can last weeks or months after first being infected with the virus that causes COVID-19. Unlike other types of post-COVID conditions that tend only to occur in people who have had severe illness, these symptoms can present in anyone who has had COVID-19, even if the illness was mild, or if they had no initial symptoms. A list of common post-acute symptoms can be found here.

A study published in medical journal The Lancet found that 68% of people still had at least one symptom six months after contracting COVID-19, and half did one year after. Additionally, nearly one-third of patients reported experiencing continuing pain and discomfort following their recovery from acute Covid.

View original content to download multimedia:https://www.prnewswire.com/news-releases/myhealthteam-and-discovery-health-partner-to-launch-mycovidteam-a-secure-social-network-for-people-who-have-covid-19-or-long-covid-301492364.html

SOURCE MyHealthTeam

International

The Grand Realpolitik Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

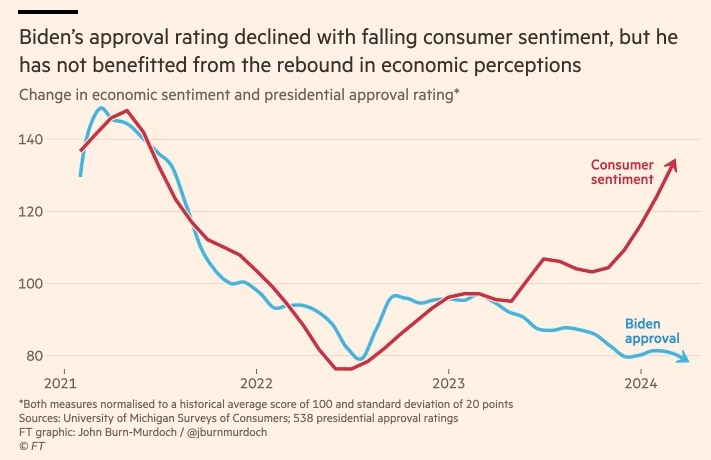

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “it’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments, impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19International

Wake-Up Call

Wake-Up Call

Authored by James Howard Kunstler via Kunstler.com,

“Those who organized the disaster will take advantage of the inevitable…

Authored by James Howard Kunstler via Kunstler.com,

“Those who organized the disaster will take advantage of the inevitable discontent arising from efforts to overcome it, for if there is one thing that they are skilled in, it is demagoguery.”

- Theodore Dalrymple

Can you feel it? The tension rising to the red-line? It runs clear through all of Western Civ. We are ruled by governments of fiends. But now, the sun rides higher in the sky. The sap is rising in the northern forests. The earth heaves. The buds swell and blush. Something is in the air. The animals are waking from their long winter sleep. The natives are restless.

The two traditional political divisions, liberal and conservative died with Covid. Now there are simply the sane versus the insane. The sane have had enough of being pushed around by the insane. The insane don’t register much of what reality tries to tell them. They have a body of insane ideas to comfort and protect them from the reality’s rigors. To call that body of ideas an “ideology” is way too polite.That the insane call themselves “progressive,” is a signature of their insanity.

Progress toward what better state of things? Toward a supremacy of fiends, sadists, degenerates, and morons seizing riches and power by every dishonest means possible outside the rule of law and common decency? It’s not even suitable to call them “communists.” They lack the necessary idealism for that.

They don’t expect to put their shoulders to the wheel with their fellow man. They just want to grab your stuff and then kill you so they don’t have to hear any complaints.

The insane do not believe any of the theoretical bullshit they want to force you to swallow. They don’t care about climate change. It’s just a cudgel they use to beat everyone over the head so they can steal your stuff. They don’t care about “democracy.” It’s just a line of bullshit to cover up their election-stealing. Do you suppose that sane people would keep using electronic vote-tabulating machines that were demonstrably connected to the Internet, and thus hackable, if they cared about election integrity? Of course not. They would arrange p.d.q. to junk them and use paper ballots, and only in person at polling places, with “absentee” exceptions only for people out of the country.

The insane do not care about public health. Everything that is known about the Covid-19 vaccinations tells you that they are unsafe and don’t prevent infection or transmission of a flu-like illness that might not even be what it was officially labeled as. Our public health officials in the FDA, the CDC, and in other corners of the Department of health and Human Services, lie about everything they’re responsible for. This week, the CDC (under Director Mandy Cohen) released a 148-page study on myocarditis reactions to mRNA shots. Every word on every page of the document was redacted. The CDC printed countless copies of the report with 148 utterly blank pages, and then proffered them to the news media. How is that not insane?

The insane do not care about the rule of law. The conduct of “Lawfare” is the subversion of the law by dishonest means. It is a species of racketeering. And that is why Lawfare rogues such Marc Elias, Norm Eisen, Andrew Weissmann, Mary McCord, Lisa Monaco, Matthew Graves, and Merrick Garland, should be charged under the federal RICO statutes for conspiring to deprive sane citizens of their rights and property in the many cases related to the 1/6/21 riot at the US Capitol.

It is, so far, an abiding mystery of contemporary history as to how New York Attorney General Letitia James managed to get away with prosecuting a real estate case against Donald Trump that was no more than victimless business-as-usual between a borrower and his lenders. Ms. James ran for that elected office promising to “get” Mr. Trump on something, anything. That is not how the rule of law works. Under the rule of law, first you determine that there is a crime and then look for who did the crime.

Letitia James must be insane and/or pretty stupid. The short-term gain of stealing Mr. Trump’s property under a false color-of-law and creating impediments to his election campaign, will, sooner or later, blow back at her as a matter of malicious prosecution and, plausibly, racketeering as well. (With whom did she conspire to bring this case? We shall find out.) She will eventually be disgraced publicly as her teammate Fani Willis has already been disgraced in Fulton County, Georgia. I’ll tell you something that all sane people now know but won’t talk about for fear of being crushed by the levers of Lawfare: this looks like a concerted effort by people-of-color to railroad people of non-color. If you think that is a good thing for race relations in our country, then you are insane.

Here are a bunch of other things that are insane: Re-litigating the first amendment is insane. It means what it says, and states it plainly. The open border is insane. No credible sovereign polity would allow it. It would be opposed with force, if necessary. Turning children into transsexuals on a wholesale basis is insane, and fiendishly so. Everybody knows that it is not good for the children or for our society as a whole. But fiends got to fiend, and if you try to deprive them of being fiends then you are guilty of “hate.”

The war in Ukraine is insane. We certainly didn’t ignite it in the service of “democracy.” Our pawn there, Mr. Zelensky, canceled the national elections last year. The war was arguably an effort by our CIA to deprive Russia of its market for natgas in Europe, and thus deprive Russia of a great deal of money, that is, of prosperity. The project failed. Russia overcame NATO’s proxy army and found other markets for its gas. Blowing up the Nord Stream pipelines only served to impoverish and weaken our NATO allies, who no longer have affordable gas to run their industries. The leaders of those allies were too insane to recognize that the Nord Stream op was an act-of-war against them. They were also busy destroying themselves, like the USA, with open borders. They will end up in a new medievalism, ruled by savages. You’d have to be insane to arrange that for yourself.

What’s most obviously insane in our country is that the insane party is pretending to nominate the mentally unfit White House place-keeper, “Joe Biden,” for reelection. You would think that if this party wanted to retain power, they would run a candidate who, though insane, was not also visibly senile. But the rank and file of this party are too insane to see that this dodge is not working. They are pretending with all their might that this is okay, that the growing faction of the sane don’t notice.

Sensing the growing impatience with insanity among the voters, the insane party has reached its point of terminal desperation. What will they try next? Murder? Why not? Nothing else seemed to work. They are too far gone in their insanity to understand that winter is over. We’ve entered the season of rebirth and renewal, starting with a renewed appreciation for being sane and for that indispensable ingredient that makes liberty in a free society possible: good faith. Really, the only question left is: how rough do they intend to play to prevent the return of sanity and good faith?

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

Uncategorized

Rising insurance costs, ample inventory create a unique market in Southwest Florida

Despite a slower housing market, agents are optimistic about what the spring and summer will bring

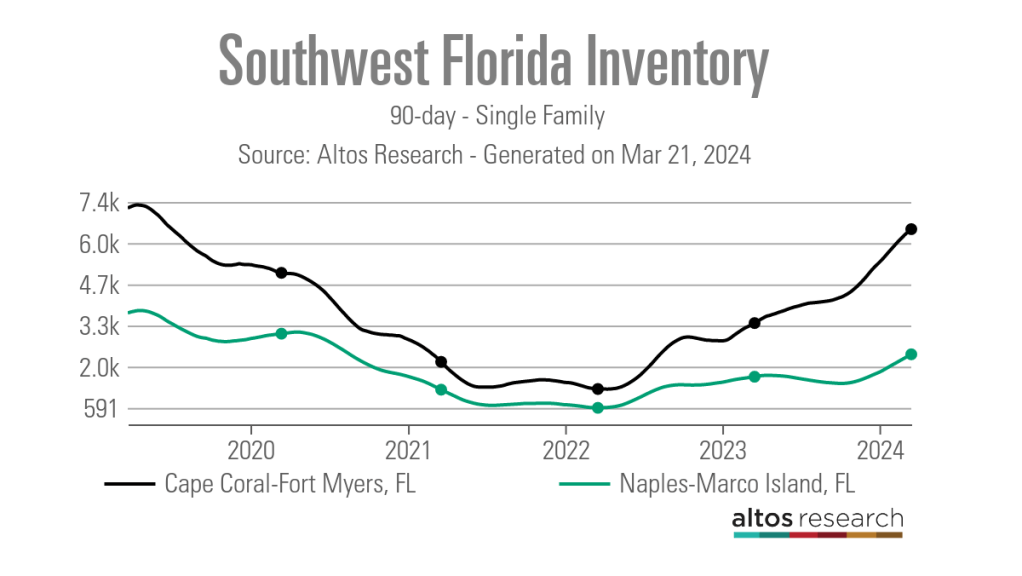

Unlike many other metropolitan areas across the country, the housing market in Southwest Florida is comparably flush with for-sale inventory.

“I think one of the major trends we are seeing is that our overall inventory is up 60% year over year compared to 2023,” said PJ Smith, president of the Naples Area Board of Realtors and the broker-owner of Naples Golf to Gulf Real Estate. “We are seeing a healthy increase in inventory, which we really needed.”

According to data from Altos Research as of March 15, the 90-day average number of single-family active listings in the Naples-Marco Island metro area was 2,362, up from 1,605 one year earlier but down from the 3,760 listings recorded in late March 2019 prior to the COVID-19 pandemic.

In the nearby metro area of Cape Coral-Fort Myers, active single-family inventory over the previous 90 days averaged 6,500 listings as of March 15, above its March 2020 level of 5,044 listings and approaching its March 2019 level of 7,243 listings.

Smith attributes the uptick in inventory to a bump in new listings. The 90-day average number of new listings as of mid-March 2024 was 170 in Naples-Marco Island, and 432 in Cape Coral-Fort Myers). There is also some pent-up desire to sell being released by a steadier interest rate environment and an overall slower market.

“Last year we were still adjusting from the effects of the pandemic market, but now the trends seem to be getting back to our baseline, which is more like our 2019 market,” Smith said. “Days on market is also trending back to what is more normal for our market as well.”

Data from Altos Research shows that the 90-day average median number of days on market in the Naples-Marco Island metro area was 70 days as of mid-March, up from a record low of 21 days in mid-May 2022.

While some properties are sitting on the market longer, Smith noted that those in good condition, priced well and in a desirable location are still selling quickly.

“I just sold a property after two days on the market,” Smith said. “We are still seeing properties go pending quickly and some with multiple offers.”

Local real estate professionals attribute the slower market to a variety of factors including higher home prices, which have remained steady despite the slowdown, higher interest rates, and rising costs for homeowners and flood insurance.

“Florida, like many places, is seeing the insurance piece of the component impacting people’s payments in a way that is making it hard to them to navigate the market,” said Cyndee Haydon, a Seminole-based agent for Future Home Realty agent.

According to an analysis by S&P Global, between 2018 and 2023, homeowners insurance rates in Florida have jumped by 43.2%. From 2022 to 2023 alone, rates rose 15%. And data from the Insurance Information Institute shows that Floridian homeowners are paying an average of nearly $6,000 a year in insurance, which is nearly three times what they paid in 2019. In comparison, the average U.S. homeowners insurance policy was roughly $1,700 in 2023.

Compounding the rising insurance costs is the fact that many insurers and reinsurers have made the decision to leave the state. These companies have cited the recent uptick in the number and severity of hurricanes and other weather-related disasters impacting the Sunshine State.

“Florida is seeing notably more hurricanes, so continuous years of poor experience, meaning losses for the insurance carriers, they have no choice but to increase those premiums,” said Sean Kent, the senior vice president of insurance at FirstService Financial.

“Additionally, there are just a few carriers that are willing to participate and insure some of those units, so accessibility to coverage has been reduced significantly.”

These rising costs are understandably impacting the ability or willingness of some buyers to purchase specific properties.

“Insurance is an expense that is expected — but nothing as substantial as we are seeing today,” said Sheryl Houck, a Tampa-based eXp Realty agent. “We are seeing contracts fall through during the due-diligence period because of the sticker shock on insurance costs, so that is definitely a problem.”

Due to this, real estate professionals are bringing insurance partners into their transactions much earlier than before.

“It is definitely a significant concern and issue,” Smith said. “What we recommend is that before you put a property under contract, you consult and get a quote so that you know what your potential insurance costs will be.”

In addition to navigating rising insurance costs with buyers, agents said they have also had to field questions from past clients about the rising premiums, who often need help in finding ways to lower their costs.

“We have instances where clients reach out and ask why they are seeing a 62% jump in their insurance, but we have been able to help them, whether that’s raising their deductible or putting them in touch with some of our other insurance contacts,” Houck said.

Despite rising insurance costs that make homeownership in these markets more costly, local real estate professionals don’t feel that this is behind the recent uptick in new listings.

“We’ve seen a lot of people move out of state to more affordable markets,” Houck said, ”but it is all relative because we are also seeing a lot of people moving in, because our market is more affordable than New York or California.”

Still, if premiums continue to rise, agents feel like this could become a bigger issue, especially for the area’s large population of retirees.

“When we look at people that are getting closer to retirement or have a fixed income, it becomes more and more of a concern,” Haydon said. “People are really being pinched with affordability.”

But while rising insurance costs are certainly a challenge for owners and buyers in Southwest Florida, Haydon said the slower housing market is good news for a lot of buyers.

“I have negotiated some of the most incredible deals for my buyers that are in the market right now that I have seen since the 2008 housing market crash,” Haydon said. “I had a buyer last month and the property was listed as $475,000, but with the necessary repairs, its value was $410,000 and we were able to negotiate an offer for $410,000.

“Normally, I would tell buyers that if they are 10% off the list price, they are dealing in different realities than the seller.”

Haydon said she has also recently had offers accepted with sale contingencies, closing cost coverages and a variety of other seller concessions.

Although things have slowed from the height of the frenzied post-pandemic market, local agents are optimistic about where the market is headed this spring and summer.

“It is very busy. Literally since Jan. 1, the spigot has turned on,” said Dyan Pithers, co-founder of The Pithers Group, a Tampa-based and Coldwell Banker Realty-brokered firm. “There are a lot of buyers in the market, and we are really focusing on showing value to sellers to get those listings out there so there are homes for buyers to purchase. It is going to be a really strong spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges