The surface of B cells is covered with antigen receptors with which they recognize invading pathogens such as bacteria and viruses. When a B cell receptor binds to an antigen, that is, to a foreign structure, the B cell is activated and triggers the production of antibodies. Antibodies are essential for our survival and protect us against severe diseases from infections with pathogens such as COVID-19. Vaccinations have a protective effect as they activate antigen receptors, thereby triggering an immune response. An international team of researchers from the Cluster of Excellence CIBSS of the University of Freiburg and Harvard Medical School, USA, has now published the exact molecular structure of an IgM-type B cell receptor. Their findings indicate that the receptor on the surface of the B cell interacts with further receptors, thus controlling its signal transduction. The study was published in the renowned journal Nature.

Connection of Signaling Subunits with the Immunoglobulin

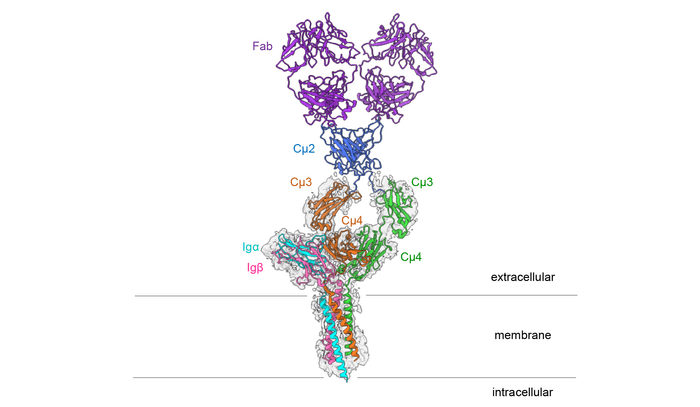

The B cell antigen receptor consists of an antibody bound to the cell membrane and two smaller proteins, Ig alpha and Ig beta. These smaller subunits pass on signals to the inside of the cell as soon as the B cell receptor identifies a pathogen. “Exactly how these signaling subunits are connected with the immunoglobulin was previously unknown,” says Prof. Dr. Michael Reth from the University of Freiburg’s Faculty of Biology, who has been conducting research on the receptor for over 30 years and originally discovered its signaling subunits. He is a member of the Cluster of Excellence CIBSS – Centre for Integrative Biological Signalling Studies and co-director of the Cluster of Excellence BIOSS. “For a long time, we did not have the technical possibilities to study the exact structure of membrane proteins. Now, cryo-electron microscopy has enabled us to create a high-resolution image of the B cell receptor,” says Reth.

With cryo-electron microscopy, the sample to be studied is cooled very rapidly to minus 183 °C. This reduces the natural movement of the molecules and prevents the formation of tiny ice crystals that otherwise would destroy the protein structure. In this way, it is possible to achieve resolutions that are many times higher than with other electron microscopic methods. In their current study, the researchers achieved a resolution of 3.3 ångströms, which corresponds to the width of just a few atoms. To do so, they combined hundreds of thousands of images of the entire receptor with those of a truncated version that lacked two flexible regions. They then used these data to calculate the complete three-dimensional structure of the B cell receptor on the computer.

Symmetrical membrane-bound antibody binds only on one side

The striking thing about the three-dimensional structure is that the symmetrical membrane-bound antibody only binds to Ig alpha and Ig beta on one side, thus forming an asymmetrical complex. This asymmetry resembles that of the T cell receptor, another important immune receptor whose structure was first elucidated in 2019. “It is astounding that both types of antigen receptor form asymmetrical complexes,” explains Reth. “This leads us to conclude that the structure now elucidated is part of a larger receptor complex and that it interacts with still other molecules on the B cell surface.”

Such larger structures, which are held together through less powerful forces, cannot yet be studied with techniques like cryo-electron microscopy. However, the newly published molecular structure provides further evidence in favor of such an interaction with other molecules: It shows that the outside of the B cell receptor contains conserved amino acids. Amino acids are described as conserved if they hardly change in the course of evolution and are therefore identical in the antigen receptors of different organisms. “The presence of conserved amino acids that are directed outward suggests that the IgM B cell receptor has further binding partners,” says Reth. “In other words, we only know part of the machine so far – and now we want to identify the other building blocks and determine how they influence the signaling effect of the receptor.”

These other building blocks could explain how the receptor is normally kept quiescent and is activated only when it binds to an antigen. “That will be one of the next important tasks in the study of adaptive immunity,” summarizes Reth. “A better understanding of B cell activation could also help us to further improve the development of vaccines or to understand the formation of lymphoma in which the B cell receptor is activated in an uncontrolled manner.”

About the Cluster of Excellence CIBSS

The Cluster of Excellence CIBSS – Centre for Integrative Biological Signalling Studies has the goal of gaining a comprehensive understanding of biological signaling processes across scales – from interactions between individual molecules and cells to processes in organs and entire organisms. Researchers use the knowledge thus gained to develop strategies for controlling signals in a targeted manner. These technologies enable them not only to gain insights in research but also to develop innovations in medicine and plant sciences.

Fact sheet:

- Original publication: Dong, Y. Pi,X. Bartels-Burgahn, F. Saltukoglu, D. Liang, Z. Yang, J. Alt, F.W., Reth, M. Wu, H. (2022). Structural principles of B-cell antigen receptor assembly. In: Nature. Doi: https://doi.org/10.1038/s41586-022-05412-7

- Michael Reth is a senior professor for molecular immunology at the University of Freiburg’s Faculty of Biology, a member of the Cluster of Excellence CIBSS – Centre for Integrative Biological Signalling Studies, and co-director of the signaling research center BIOSS – Centre for Biological Signalling Studies. His research focuses on the function and activation of the B cell receptor.

- Hao Wu is a professor for structural biology as well as biochemistry and molecular biology at Harvard Medical School, Boston, USA.

- The study was funded by the National Institutes of Health (NIH) and the German Research Foundation (DFG).

Contact:

Michal Rössler

CIBSS – Centre for Integrative Biological

University of Freiburg

Tel.: +49 761/203-97120

E-Mail: michal.roessler@cibss.uni-freiburg.de

Annette Kollefrath-Persch

University and Science Communiation

University of Freiburg

Tel.: +49 761/203-8909

E-Mail: annette.persch@zv.uni-freiburg.de

Journal

Nature

DOI

10.1038/s41586-022-05412-7

Subject of Research

Cells

Article Title

Structural principles of B-cell antigen receptor assembly