International

Micro-influencers with a major platform: Are they the next big thing in pharma marketing?

Damian Washington didn’t want to be “the MS guy.”

He was a lifelong performer — he booked his first commercial at 15 promoting Captain Crunch cereal — and a funny guy with a YouTube channel full of clever videos. The only problem? He wasn’t…

Damian Washington didn’t want to be “the MS guy.”

He was a lifelong performer — he booked his first commercial at 15 promoting Captain Crunch cereal — and a funny guy with a YouTube channel full of clever videos. The only problem? He wasn’t getting a lot of views.

Until one day in May 2017. That’s when he filmed his experience at an infusion center getting Genentech’s then-new multiple sclerosis treatment Ocrevus. Suddenly, the self-proclaimed nerd with a degree from Middlebury College was getting hits.

Today he’s what marketing teams and tech-savvy teens call an influencer — the semi-famous rulers of social media who are slowly replacing celebrities in pharma digital ad campaigns.

Thousands of users watched Washington’s first infusion video, which wasn’t sponsored. In the intro, he talks about his experiences taking Copaxone and Rebif. The former didn’t give him the desired effect and the latter came with side effects that he described as a hangover-like feeling minus the night of drinking.

“We kind of want to nip this disease progression in the bud,” he says in the video, explaining why he switched to Ocrevus. Then he brings a camera to West Hills Hospital & Medical Center in Los Angeles where he explains each step of the infusion process as it’s happening, live while getting his IV drip.

“Done deal-y, for really,” he says at the end. “First injection, so far so good, quick and painless … Thanks Ocrevus.”

Comments flooded in from other MS patients. To his surprise, Washington had inadvertently created a community forum for patients who were eager to share their own stories.

“Great video! I’m moving from Tysabri to Ocrevus right now. It was good to see the process,” one commenter posted.

“90 seconds got you a new subscriber bro. Great video, looking forward to checking out your others. I have to stop Tysabri and am considering Ocrevus,” another said.

After that, Washington started cranking out MS videos. The viewers wanted more — and so did Ocrevus’ maker Genentech. After seeing his videos, the pharma company began signing him on for promotional work. Not all of his videos are sponsored, but his most recent gig was performing a rap at the company’s #MSVisibility Virtual Concert emceed by Broadway performer David Osmond.

“The aim is to shift the algorithm on YouTube in my favor as far as relevant content and information for people with multiple sclerosis,” Washington said, adding that it’s also “another way to put myself in front of people and to be the answer to questions that people have.”

In the direct-to-consumer space, this type of marketing — algorithm-driven social media marketing — is moving to eclipse TV advertising by pharma marketers in terms of reach, Kathryn Aikin, senior social science analyst and research team lead in the FDA’s Office of Prescription Drug Promotion, said at a recent Duke University event. On TV, pharma ads feature familiar faces like Queen Latifah, Serena Williams and Annie Murphy, but many influencers on social media are just regular people — with a lot of followers.

Across the board, influencer marketing was worth around $9.7 billion in 2020, according to Influencer Marketing Hub, which estimated the market would grow to $13.8 billion in 2021. At the same time, overall digital ad spend in the pharma space skyrocketed 242% year over year from January to February in 2020 and 2021, MediaRadar reported.

Health Union, which acquired WEGO Health in June, pairs pharma companies with patient influencers as one of its services. It also owns 38 — and counting — online health communities, such as multiplesclerosis.net. While Washington is now proud to be “the MS guy,” Health Union has a combined network of more than 100,000 influencers in virtually every condition.

Early figures suggest the strategy is working: In one case study, an Instagram campaign by Health Union for a “niche oncology brand” featuring patient and caregiver influencers saw 114% higher traffic rates compared to the brand’s benchmarks on other digital media.

As pharma advertising shifts to social channels like Instagram and TikTok, a number of questions arise: Who are influencers, who’s regulating this kind of marketing, and will it stick — or is it just another fad?

For some, the word “influencer” conjures images of stilettoed Kardashians hawking the latest fads — and that wouldn’t be completely off-base. The Canadian biotech Duchesnay did, after all, receive an FDA warning letter back in 2015 after Kim Kardashian endorsed its morning sickness pill Diclegis on Instagram without detailing the drug’s risks. The reality TV star ultimately issued another post with the hashtag #CorrectiveAd, in which she outlined the risks.

And her sister Khloe Kardashian is currently one of the celebrity migraine sufferers fronting Biohaven’s Nurtec ODT digital-first advertising campaign.

But to Jack Barrette, former CEO of WEGO Health and current chief innovation officer of Health Union, the definition of an influencer in the pharma space is much different.

“An influencer is, especially in the area of serious illness and chronic illness as we define it at Health Union, someone who has a following of other folks that they converse with and bring together and provide advice to,” he said.

Jack Barrette (Credit: Christine Hochkeppel, Salty Broad Studios)

Jack Barrette (Credit: Christine Hochkeppel, Salty Broad Studios)When he co-founded WEGO more than 14 years ago, Barrette would have called them “health activists” or “patient leaders.” If he had to guess, the name “influencer” began to stick roughly three to five years ago when it became clear that social media communities were forming around these patients.

Why would a company choose to work with regular people when they could be working with celebrities like Kardashian? In the age of social media, it’s all about establishing a relationship, Barrette said. It may seem intuitive, but someone with 1,000 dedicated followers has a more personal connection with consumers than someone with hundreds of thousands. The smaller audience influencers often personally respond to comments and answer questions. The bonus for pharma companies is outreach to a much more targeted audience.

“What pharmaceutical companies really gain is a chance to be a part of that social health conversation, where people are actually knowing each other and providing information, in a trusted and authentic way,” he said.

Then there are the influencers who lean more on the side of celebrity. Take Derek Theler, for instance, a handsome TV sitcom supporting actor who markets for Dexcom’s glucose monitoring system on Instagram. A recent image he posted wearing Dexcom’s system on his torso — tagged “paid partnership with Dexcom” — as he stands by a waterfall got more than 6,000 likes. The comments were flooded with fire and heart-eye emojis, along with some feedback from patients.

“It’s so strange seeing the Dexcom on an adult’s body! My son is 6 years old and it takes up much more real estate! (Less than when he was 2, though). All the best, thanks for being a positive T1 ambassador for people like my boy to look up to,” one commenter wrote.

One of the reasons Dexcom’s campaign has been so successful, according to Hyosun Kim, an assistant professor of communication at Indiana State University, is that it brings in a lot of user-generated content.

Hyosun Kim

Hyosun Kim“A lot of people … posted on their social media, ‘I [am] a Type 1 diabetes patient and I used Dexcom and it’s a magical game-changer,’ or something like that,” and that can be really meaningful to fellow patients, she said.

Barrette sees Health Union as a sort of liaison between pharma companies and patient influencers, although it’s not always about selling a drug. A lot of the work Health Union does is unbranded, meaning the influencers are hired by a pharma company to do educational work or raise awareness for a disease, without mentioning any product names.

The end result is something like an ad, yet doesn’t look or sound like one.

“If you’re just scrolling on your phone, and you see a guy being like, ‘Look, if you got MS man, listen: Let me tell you about this other thing, right here,’ that is a bit more engaging, and speaks more to the viewer,” Washington said.

What could go wrong? It depends on who you ask. While Kim sees the benefits of this type of marketing, she’s also been closely studying the FDA’s concerns, and has picked up on a few key themes.

Being from South Korea, Kim had never seen pharmaceutical ads until she came to the US for graduate school work and was shocked by a Viagra commercial on TV. She ended up writing a paper on prescription drug advertising for her media law class, and since then, she’s been on a mission to learn everything she can. Recently, she spoke at the virtual Duke University event along with Aikin that was called, “Informing and Refining the Prescription Drug Promotion Research Agenda.”

For the most part, Kim likes the idea of direct-to-consumer advertising. It puts some of the power into patients’ hands and allows them to have better discussions with their doctors. But looking at warning letters sent by the FDA, she identified three of the agency’s main concerns with social media advertising: the use of first-person narratives, the promotion of non-approved drugs or products, and misleading ad techniques such as having to hover over a post to see the risks.

“Marketers are fascinated by influencer marketing because these influencers are relatable, touchable, approachable, kind of, you know, personalities,” Kim said. “People see them as someone like me, like fellow consumers or fellow patients.”

But in reality, influencers working with pharmaceutical companies are not totally like you — because they have an incentive to post. Some critics argue influencers are selling not only products, but a certain lifestyle. Theler has diabetes, but with his Dexcom system, he also swims with his dog and paddleboards in Sequoia National Park, one Instagram post suggests.

“[Consumers] are more likely to develop a strong relationship with this person,” Kim said. “And then they see this ad as less promotional and more like information,” she said, adding that while that can be good news for the marketers, it may be concerning for viewers.

One caveat to consider, of course, is that patients cannot access prescription drugs without consulting with a physician.

“It is a totally different ballgame,” Washington said. For one, he was taking Ocrevus before Genentech began sponsoring him. And when he’s doing a video, he’ll often make a disclaimer similar to: “This is not medical advice. Speak to your doctor,” he said.

Still, critics have poked holes in this type of marketing approach. For example, how do you know if an influencer has taken the drug they’re promoting? Or if and how they’re being paid?

The Federal Trade Commission can reprimand and fine influencers who are promoting without disclosing the fact that they’re being paid for the content. The regulatory agency requires influencers to disclose any “material connections” they have with a brand they are endorsing.

In October, the FTC announced it sent out penalty notices to more than 700 companies putting them on notice that they could face civil fines up to $43,792 per violation for improper endorsements. Among the companies on the list were more than a dozen pharma companies including AbbVie, Bayer, Bristol Myers Squibb, Eli Lilly, Merck, Pfizer and Takeda.

Still, the rules and regulations can get ambiguous when a patient is raising awareness about a condition, rather than promoting a drug.

While Barrette said there’s “room for interpretation,” Health Union always discloses sponsorships. Washington has never directly promoted a drug for a pharmaceutical company, but when companies hire him to make videos raising awareness for MS, they’ll have him verbally disclose if a video is sponsored or include it in the caption. Back in 2020, the FDA proposed a study with several types of endorsers (including influencers) to find out whether disclosing payment status would affect patient reactions.

As for disclosing whether an influencer has actually taken the drug they’re sponsoring, Barrette isn’t aware of any specific FDA requirement to do so.

However, Health Union and WEGO have taken what he calls a “proactive stance,” and in almost all cases the promotional content will reference the influencer’s personal connection with the drug. For example, an influencer may say, “While I have not taken this medication myself, many in my patient community are discussing it.”

Is this the dawn of a new era in pharma marketing? Barrette said the social health movement, as he calls it, is exploding. The pandemic has encouraged people to connect in “a very real and therapeutic way” through digital means, and there’s no turning back. In addition, pharma digital and social spending has only continued to grow over the last couple years.

“This idea that digital online connections are valuable — maybe it’s not in real life, but they have tremendous benefit to folks with especially chronic disease and serious illness to become healthier because they participated in the social health movement,” Barrette said. “So I see a continuing growth … I think we saved five or 10 years in adoption of social health because of the pandemic.”

And the feedback, so far, has been positive. Health Union grew the number of pharma companies it worked with by about 30% from 2020 to 2021, according to Barrette.

When Washington was diagnosed with MS about five years ago, the digital community wasn’t as established. He turned to blogs like Ardra Shephard’s Tripping on Air. But it wasn’t the same as picking up a smartphone and watching a full trip to an infusion center.

“I would say that it’s never a good time to get MS. However, this is a fabulous time to get MS,” he said. “Me being able to talk to someone in London about their disease, their condition, my ups and my downs and their ups and their downs … it’s really, really remarkable what we have going now.”

For Washington, it’s not about marketing trends or even the sponsorship payments. When asked to predict what’s next in social media, he said he’s just going to keep doing what he’s doing.

He said, “I make videos every week so that people with multiple sclerosis feel less alone. Period.”

real estate pandemic treatment fda medication south koreaInternational

A popular vacation destination is about to get much more expensive

The entry fee to this destination known for its fauna has been unchanged since 1998.

When visiting certain islands and other remote parts of the world, travelers need to be prepared to pay more than just the plane ticket and accommodation costs.

Particularly for smaller places grappling with overtourism, local governments will often introduce "tourist taxes" to go toward things like reversing ecological degradation and keeping popular attractions clean and safe.

Related: A popular European city is introducing the highest 'tourist tax' yet

Located 900 kilometers off the coast of Ecuador and often associated with the many species of giant turtles who call it home, the Galápagos Islands are not easy to get to (visitors from the U.S. often pass through Quito and then get on a charter flight to the islands) but are often a dream destination for those interested in seeing rare animal species in an unspoiled environment.

Shutterstock

This is how much you'll have to pay to visit the Galápagos Islands

While local authorities have been charging a $100 USD entry fee for all visitors to the islands since 1998, Ecuador's Ministry of Tourism announced that this number would rise to $200 for adults starting from August 1, 2024.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to the local tourism board, the increase has been prompted by the fact that record numbers of visitors since the pandemic have started taking a toll on the local environment. The islands are home to just 30,000 people but have been seeing nearly 300,000 visitors each year.

"It is our collective responsibility to protect and preserve this unparalleled ecosystem for future generations," Ecuador's Minister of Tourism Niels Olsen said in a statement. "The adjustment in the entry fee, the first in 26 years, is a necessary measure to ensure that tourism in the Galápagos remains sustainable and mutually beneficial to both the environment and our local communities."

These are the other countries which are raising (or adding) their tourist taxes

While the $200 applies to most international adult arrivals, there are some exceptions that can make one eligible for a lower rate. Adult citizens of the countries that make up the South American treaty bloc Mercosur will pay a $100 fee while children from any country will also get a discounted rate that is currently set at $50. Children under the age of two will continue to get free access.

In recent years, multiple countries and destinations have either raised or introduced new taxes for visitors. Thailand recently started charging all international visitors between 150 and 300 baht (up to $9 USD) that are put toward a sustainability budget while the Italian city of Venice is running a test in which it charges those coming into the city during the most popular summer weekends five euros.

Places such as Bali, the Maldives and New Zealand have been charging international arrivals a fee for years while Iceland's Prime Minister Katrín Jakobsdóttir hinted at plans to introduce something similar at the United Nations Climate Ambition Summit in 2023.

"Tourism has really grown exponentially in Iceland in the last decade and that obviously is not just creating effects on the climate," Jakobsdóttir told a Bloomberg reporter. "Most of our guests visit our unspoiled nature and obviously that creates a pressure."

stocks pandemic europeanInternational

Merck’s six-year deal strategy could deliver a blockbuster if hypertension drug is OK’d this month

With an FDA decision expected next week for its blood pressure drug sotatercept, Merck is hoping that its bundle of acquisitions in recent years will lead…

With an FDA decision expected next week for its blood pressure drug sotatercept, Merck is hoping that its bundle of acquisitions in recent years will lead to multiple approvals and late-stage clinical wins.

The regulator is set to decide whether to approve the pulmonary arterial hypertension drug known as sotatercept by March 26. If approved, the drug could generate $1.9 billion in sales in 2025, according to Leerink Partners analyst Daina Graybosch.

The subcutaneous treatment came to Merck by way of its $11.5 billion acquisition of Acceleron in 2021.

“We viewed [Acceleron] as a great Merck-type company to own, especially with their legacy of R&D,” Sunil Patel, Merck’s head of corporate development and business development & licensing, said in an interview.

For the past few years, the pharma giant has been amassing help from external biotechs to broaden its pipeline and prepare for the looming patent deadline for Keytruda, the cancer immunotherapy that had $25 billion in sales last year. It’s Merck’s most notable treatment to come from external innovation; Organon made the drug, known then as pembrolizumab, and was bought by Schering-Plough, which merged with Merck in 2009.

Now, Merck is once again hoping a drug that it bet billions of dollars on will lead a spate of approvals out of its promising late-stage pipeline. The company has put at least $50 billion toward business development since 2018. Aside from Covid-19 treatment Lagevrio, which was authorized in late 2021 and developed with Ridgeback Biotherapeutics, Merck’s dealmaking over the past few years has not produced another blockbuster medicine.

In three months, Merck could have another approval in patritumab deruxtecan, an antibody-drug conjugate it’s developing with Daiichi Sankyo, in certain forms of non-small cell lung cancer. The FDA set a decision date of June 26. As part of the $4 billion upfront deal, Merck is co-developing and co-commercializing three antibody-drug conjugates with the ADC powerhouse.

Merck also expects a late-stage race with Roche in the inflammatory market, stemming from its $10.8 billion acquisition of Prometheus Biosciences last year. It began a Phase III of Prometheus’ lead drug, now called tulisokibart or MK-7240, in ulcerative colitis last fall. Meanwhile, the company also bagged a Phase I/II cancer drug via its more relatively modest $680 million acquisition of Harpoon Therapeutics earlier this year.

The acquisitions are likely to keep coming. Merck CEO Rob Davis said earlier this year the pharma is willing to spend as much as $15 billion on M&A.

It’s made more than 20 biotech acquisitions in the past 10 years, and that has led to at least 17 compounds that have been approved or are in mid- and late-stage development, Patel said.

“This current management team is deeply rooted in the legacy of this company. They understand the importance of building a long-term sustainable future, and they’re just not afraid to make the bold scientific bets,” he said.

Last year, Merck adjusted the way it calculates R&D spending to factor in M&A and licensing costs, and doing so catapulted the company to the top of Endpoints News’ 2023 pharma R&D expenditure list.

But not all deals have been smooth. Merck discontinued a Covid-19 treatment candidate from its 2020 acquisition of OncoImmune. And a chronic cough drug that it gained through its 2016 acquisition of Afferent Pharmaceuticals has twice been rejected by the FDA. The drug has been approved in Europe, Switzerland and Japan.

All told, Merck inks about 80 to 100 business development transactions per year, Patel said. That includes licensing pacts and early-stage collaborations, like a $1 billion biobuck-loaded deal for new biologics with Pearl Bio that it announced last week.

“Once we get through the science, we act decisively and very rapidly to bring the right type of BD structure,” said Patel, who’s been at Merck Research Laboratories for 25 years.

Dean Li

Dean LiAbout 80 employees search and evaluate potential transactions, which are then presented to a committee led by Dean Li, president of Merck Research Laboratories. Li joined Merck in 2017 from the University of Utah Health, where he co-founded biotechs such as Recursion and Hydra Biosciences.

“It’s seamless between Merck Research Labs and the BD unit. We’re just one simple group that operates with the one pipeline mentality,” Patel said.

About 60% of the Acceleron team remains at Merck.

“That’s a testament to how we can integrate these teams and how we embrace the science that we’re acquiring,” he said.

treatment fda covid-19 japan europeInternational

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

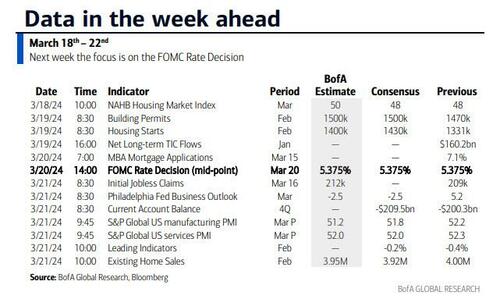

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex