Manhattan Apartment Sales Record Best Fourth Quarter In Three Decades

Manhattan Apartment Sales Record Best Fourth Quarter In Three Decades

For the last quarter of 2021, bargain hunters rushed to purchase apartments in Manhattan. Home sales in the borough reached a fourth-quarter record even though the Omicron.

For the last quarter of 2021, bargain hunters rushed to purchase apartments in Manhattan. Home sales in the borough reached a fourth-quarter record even though the Omicron variant scare has slowed the back-to-office return in the city.

Appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate released a new report Tuesday that highlighted 3,559 co-ops and condos were sold in the fourth quarter of 2021, the most sales for the quarter going back three decades. The average price for an apartment sold jumped 11% to $1.17 million compared with the same quarter a year ago.

The buying frenzy began in early 2021 as bargain hunters purchased apartments at a pandemic discount while thousands of Manhattanites in 2020 fled the metro area to suburbia because of pandemic lockdowns and violent crime.

Jonathan Miller, president of Miller Samuel, believes the buying frenzy will continue through the first half of this year.

"For the next several quarters, we're going to see above-average sales activity and that is going to go a long way to bring down inventory levels," Miller said.

"One of the things that has differentiated the Manhattan market with the rest of the country has been that it was late to the party, and the city's boom in activity really started at the beginning of 2021," he added.

Supply is down 25% from a year earlier to 6,207 apartments in the borough. This was the most significant annual reduction in seven years. Supply remains elevated, but bidding wars are starting to pick up -- the share of apartments sold above ask was 9.2%, the highest since early 2018.

A separate report on the borough's real estate market, released by Bess Freedman, chief executive officer at brokerage Brown Harris Stevens, showed tightening inventory is pushing home values higher and could suggest 2022 will be another banner year.

"The good news is that the foreign buyer has returned, Wall Street bonuses are incredible and we have a new mayor, which all bodes well," Freedman said. "Now, because pricing has ticked up a bit, it could slow things down with mortgage rates going up, but we'll have to see."

However, not all is rosy in the metro area. NYC Mayor Eric Adams has already promised to keep 1M+ students attending classes in person at the Big Apple's public schools. Wall Street megabanks - including JPM and Goldman Sachs - are delaying their employees' return to the office because of the Omicron scare.

Kastle Systems, whose electronic access systems secure thousands of office buildings across NYC, showed only 10.61% of workers were back at their desks in late December, compared with 37% on Dec. 2.

A lopsided recovery appears to be playing out. Housing could be recovering, but the overall recovery will sputter without workers in office buildings.

Government

The Virality Project’s Censorship Agenda

The Virality Project’s Censorship Agenda

Authored by Andrew Lowenthal via the Brownstone Institute,

In November 2023 Alex Gutentag and…

Authored by Andrew Lowenthal via the Brownstone Institute,

In November 2023 Alex Gutentag and I reported on the Virality Project’s internal content-flagging system, as released by the US House Committee on the Weaponization of the Federal Government.

Initiated by the Department of Homeland Security (DHS) and the Cybersecurity and Infrastructure Security Agency (CISA) and led by the Stanford Internet Observatory (SIO), the Virality Project sought to censor those who questioned government Covid-19 policies. The Virality Project primarily focused on so-called “anti-vaccine” “misinformation;” however, my Twitter Files investigations with Matt Taibbi revealed this included “true stories of vaccine side effects.”

A further review of the content flagged by the Virality Project demonstrates how they pushed social media platforms to censor such “true stories.” This was often done incompetently and without even a cursory investigation of the original sources. In one instance, the Virality Project reporters told platforms that reports of a child injured in a vaccine trial were “false” due to the timing; citing the dates of a Moderna trial when in fact the child had been in a Pfizer trial.

Trigger-happy researchers-turned-activists at the Virality Project went further, alerting their Big Tech partners (including Facebook, Twitter, Instagram, and TikTok) of protests, jokes, and general dissent.

Led by former CIA fellow Renee DiResta, the Virality Project functioned as an intermediary for government censorship. Ties between the US government and the academic research center were extremely close. DHS had “fellows” embedded at the Stanford Internet Observatory, while SIO had interns embedded at CISA, and former DHS staff contributed to the Virality Project’s final report.

The Virality Project also had contact with the White House and the Office of the Surgeon General, described the CDC as a “partner” in its design documents, and the California Department of Public Health had a login to access the Jira content flagging system, as did CISA personnel.

Kris Krebs and Alex Stamos – former directors of CISA and SIO, respectively – became business partners soon after leaving their positions.

Norwood v. Harrison established that the government “may not induce, encourage or promote private persons to accomplish what it is constitutionally forbidden to accomplish.” Stamos knew this too and put it simply; the government “lacked the legal authorisation” and so they built a consortium to “fill the gap of the things the government could not do themselves.”

Judicial precedents regarding “joint participation” and “pervasive entwinement” between public and private entities make clear that the government cannot outsource to third parties like the Virality Project actions that would be illegal for the government itself to do.

The Virality Project had several unnamed partners that appear in the content-flagging system, including billion-dollar military contractor MITRE and a communications consultancy linked to the Democratic Party, Hattaway. Founder Doug Hattaway was an “advisor and spokesperson for Secretary of State Hillary Clinton, Vice President Al Gore, and Senate Majority Leader Tom Daschle, and provided strategic counsel to the Obama White House and the Democratic leadership of the US House and Senate.” Like the Virality Project, Hattaway worked with the Rockefeller Foundation during the pandemic on issues of disinformation.

The Virality Project does not declare any relationship with MITRE or Hattaway despite providing them access to their Jira system.

The Virality Project was partly funded by the Omidyar Network, which provided $400,000 to VP partner and Pentagon consultant Graphika. Much of the Virality Project’s funding however is unknown and is also not declared on their website.

This and much more have led five plaintiffs, including Harvard and Stanford professors, to accuse the US government of violations of the First Amendment with the Virality Project as one of the key proxies. On March 18, their case will be heard by the US Supreme Court.

The Virality Project and Murthy v. Missouri

The Murthy vs Missouri plaintiffs allege that, “CISA launched a colossal mass surveillance and mass-censorship project calling itself the “Election Integrity Partnership” (and later, the “Virality Project”). The Election Integrity Project (EIP) “monitored 859 million posts on Twitter alone.”

The Virality Project used the same Jira system as EIP for flagging content and included the same core public partners: SIO, the University of Washington Center for an Informed Public, the Atlantic Council’s Digital Forensic Research Lab, and Graphika, with the addition of NYU and the congressionally chartered National Conference on Citizenship.

The Virality Project had extensive contact not only with CISA but also with the White House and the Surgeon General. White House representatives sent direct censorship requests to Twitter including, “Hey folks – Wanted to flag the below tweet and am wondering if we can get moving on the process for having it removed ASAP.” And the more threatening:

“Are you guys fucking serious? I want an answer on what happened here and I want it today.”

Flaherty also conveyed that his communications came with the backing of the very top echelons of the administration: “This is a concern that is shared at the highest (and I mean highest) levels of the WH.”

The Virality Project hosted a launch with the US Surgeon General Vivek Murthy as part of the Surgeon General’s campaign against “misinformation.” In the presentation, Renee DiResta also introduced Matt Masterson, former senior adviser at DHS, and now a “non-resident policy fellow” at SIO.

Murthy ends the presentation by telling Renee, “I just want to say thank you to you, for everything you have done, for being such a great partner.”

At that same time the White House, OSG, and others were on the warpath, claiming social media platforms were “killing people” for allowing so-called “misinformation” to circulate.

With access to the White House, the Surgeon General, CDC, DHS, and CISA, along with top-level relationships with almost every major Western social media platform, the Virality Project was a key, if not the key, coordinating node for Covid-related censorship on the Internet.

The Content-Flagging System

When the Virality Project said it considered, “true stories of vaccine side effects” to be “misinformation,” it wasn’t joking, and it flagged content to its Big Tech partners accordingly.

Perhaps the most egregious was that of Maddie de Garay. Maddie and her siblings were enrolled in the Pfizer vaccine trial at the Cincinnati Children’s Hospital. She was later unblinded and confirmed as being in the vaccine and not the placebo group.

Within 24 hours of her second shot in January 2021, Maddie developed a host of symptoms, including “severe abdominal pain, painful electric shocks on her spine and neck, swollen extremities, ice cold hands, and feet, chest pain, tachycardia, pins and needles in her feet that eventually led to the loss of feeling from her waist down.” To this day Maddie continues to suffer from a lack of feeling in her lower legs, difficulty eating, poor eyesight, and fatigue among other persisting symptoms.

Virality Project staff logged a Jira ticket titled “Maddie’s Story: False claim that 12-year-old was hospitalized due to vaccine trial” and provided extensive documentation of offending “engagement” on social media, including the micro-policing of content citing Maddie’s story with just two likes and two shares.

Much doubt has been cast on the veracity of Maddie’s injuries. Maddie’s mother, Stephanie de Garay, provided me with several doctor’s letters that confirm the link, including that of the emergency room doctor who discharged her on her initial visit. Their diagnosis was “Adverse effect of the vaccine.” Stephanie de Garay also testified under oath in front of the US Congress in November of 2023 regarding her daughter’s experience.

Most egregiously, the idea that the story was “false”rested on the claim that Maddie was in a Moderna trial. But she was in a Pfizer trial, as stated in the posts the Virality Project collected and linked to in the very same ticket.

“Dear Platform Partners,” the reporter writes as they bring the posts to the attention of Google, Facebook, Twitter, TikTok, Medium, Pinterest, and the aforementioned Hattaway Communications:

…very likely false due to issues in timing. The Moderna trial in children [began on March 16], when the participants received their first doses. However, the video claims that Maddie has an MRI scheduled for 03/16, and that these symptoms have been occurring for 1.5 months. Thus, Maddie would have had to have received the second dose of the vaccine during/before February, which is at least a month before the Moderna trials began.

“Ack – thanks for raising!” replies a platform representative.

Not only are our self-appointed censorship overlords micro-managers, they are often incompetent.

The posts were flagged “General: Anti-Vaccination” despite the de Garays volunteering their three children for the vaccine trial.

Some content flagged in the report remained up, and others were taken down. A video of Stephanie de Garay’s testimony was removed from Twitter. Whether or not this was specifically taken down due to the Virality Project report cannot be ascertained, but their intent was clear.

In another instance, the Virality Project wanted people circulating a mainstream media report censored:

“Platforms, this unconfirmed story of a healthy youth athlete who was hospitalized after being vaccinated continues to be used by anti-vaccine activists to spread misinformation about vaccines.”

“ack, thanks” responded a platform representative.

Even a report by an ABC news affiliate, one of the biggest media conglomerates in the United States, fell into the category of “General: anti-vaccination” and “Misleading Headline.”

The main link provided, to a YouTube video, was removed.

The Jira system was set up to track the actions the Big Tech partners took, as illustrated below:

The content was flagged to get platforms to take action.

“Hello Google team – sending this over as our analysts noticed that a google ad on a politico article this morning was peddling the antivax claims from the medical racism video you were monitoring. Is this against your policies?”

“Thanks for flagging – ack and sending for review.”

“Thanks for the heads up – we’re on it”

“Thanks for sharing! Our team is now tracking this.”

And follow-ups from the Virality Project team:

“Were the ads supposed to have been taken down? Just flagging for you, I just checked now and I’m still seeing another medical racism ad.”

Platforms were apologetic when they didn’t get to Virality Project’s flags quickly enough:

“With apologies for the delayed response (was in meetings) – we took action earlier in the afternoon, thanks again for the flags.”

This of course built on the Election Integrity Partnership’s more flagrant “recommendations,” which included:

“We recommend that you all flag as false, or remove the posts below.”

“Hi Facebook, Reddit, and Twitter…we recommend it be removed from your platforms.”

And many more.

The Virality Project was a strategic intermediary between the US government and major social media platforms. As Murthy v. Missouri shows, in many cases the government dispensed even with their chosen intermediary and directly demanded censorship.

With their vast resources, why did Google, Facebook, and Twitter even need an external consortium to flag “misinformation?” The answer of course is they didn’t, the government did. Much like SIO Director Alex Stamos so helpfully reminded us, First Amendment jurisprudence states that the government “may not induce, encourage or promote private persons to accomplish what it is constitutionally forbidden to accomplish.”

The First Amendment protects false speech. There is a cost to false claims, but the cost of censoring true claims is much higher. The alternative is a society where the truth is suppressed and powerful actors become even more unaccountable. The government cannot be made an arbiter of what is true.

In this inverted world, the role of academia and civil society isn’t to harness the internet to better pick up safety signals related to corporate products, it is to shield corporations from public scrutiny. In times gone by such ethical violations would see institutions shut down, but the Stanford Internet Observatory and their consortium partners continue with hardly a dent.

Dr. Aaron Kheriaty is a Murthy v. Missouri plaintiff and was the Director of the Medical Ethics Program at the University of California Irvine before he was fired for challenging the university’s vaccine mandate. Asked for his reaction to this censorship he responded:

While causation in medicine is sometimes difficult to establish, and different evaluating physicians may reach divergent conclusions about a particular case, the Virality Project’s censors (who lacked even basic medical expertise) arrogated to themselves the authority to make veracity judgments about particular medical cases–even overriding the judgments of evaluating physicians. Such censorship is completely antithetical to medical and scientific progress, which relies upon free inquiry and open, public debate.

Much of what the Virality Project flagged was plausible; however, their internet hall monitors, who likely lacked even first aid certificates, deemed themselves arbiters of the truth, and coupled their arrogance with a complimentary laziness and incompetence.

The veracity of the content was of course always irrelevant to the Virality Project, given they considered “true stories” to be “misinformation.”

All told the DHS, CISA, the White House, the Surgeon General, a DNC-aligned communications agency, military contractors, academics, NGOs, and more combined to suppress the stories of real people, including children, who were plausibly injured by the vaccine. They sought to hide it not because it might be false, but precisely because it might be true.

Republished from the author’s Substack

Andrew Lowenthal is a Brownstone Institute fellow and co-founder and former executive director of EngageMedia, an Asia-Pacific digital rights, open and secure technology, and documentary non-profit, and a former fellow of Harvard’s Berkman Klein Center for Internet and Society and MIT’s Open Documentary Lab.

International

This country became first in the world to let in tourists passport-free

Singapore has been on a larger push to speed up the flow of tourists with digital immigration clearance.

In the fall of 2023, the city-state of Singapore announced that it was working on end-to-end biometrics that would allow travelers passing through its Changi Airport to check into flights, drop off bags and even leave and exit the country without a passport.

The latter is the most technologically advanced step of them all because not all countries issue passports with the same biometrics while immigration laws leave fewer room for mistakes about who enters the country.

Related: A country just went visa-free for visitors with any passport

That said, Singapore is one step closer to instituting passport-free travel by testing it at its land border with Malaysia. The two countries have two border checkpoints, Woodlands and Tuas, and as of March 20 those entering in Singapore by car are able to show a QR code that they generate through the government’s MyICA app instead of the passport.

Here is who is now able to enter Singapore passport-free

The latter will be available to citizens of Singapore, permanent residents and tourists who have already entered the country once with their current passport. The government app pulls data from one's passport and shows the border officer the conditions of one's entry clearance already recorded in the system.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

While not truly passport-free since tourists still need to link a valid passport to an online system, the move is the first step in Singapore's larger push to get rid of physical passports.

"The QR code initiative allows travellers to enjoy a faster and more convenient experience, with estimated time savings of around 20 seconds for cars with four travellers, to approximately one minute for cars with 10 travellers," Singapore's Immigration and Checkpoints Authority wrote in a press release announcing the new feature. "Overall waiting time can be reduced by more than 30% if most car travellers use QR code for clearance."

More countries are looking at passport-free travel but it will take years to implement

The land crossings between Singapore and Malaysia can get very busy — government numbers show that a new post-pandemic record of 495,000 people crossed Woodlands and Tuas on the weekend of March 8 (the day before Singapore's holiday weekend.)

Even once Singapore implements fully digital clearance at all of its crossings, the change will in no way affect immigration rules since it's only a way of transferring the status afforded by one's nationality into a digital system (those who need a visa to enter Singapore will still need to apply for one at a consulate before the trip.) More countries are in the process of moving toward similar systems but due to the varying availability of necessary technology and the types of passports issued by different countries, the prospect of agent-free crossings is still many years away.

In the U.S., Chicago's O'Hare International Airport was chosen to take part in a pilot program in which low-risk travelers with TSA PreCheck can check into their flight and pass security on domestic flights without showing ID. The UK has also been testing similar digital crossings for British and EU citizens but no similar push for international travelers is currently being planned in the U.S.

stocks pandemic link testing singapore uk euUncategorized

Did You Spot The Gorilla In The Fed’s Meeting Room?

Did You Spot The Gorilla In The Fed’s Meeting Room?

Authored by Simon White, Bloomberg macro strategist,

Monetary policy remains exceptionally…

Authored by Simon White, Bloomberg macro strategist,

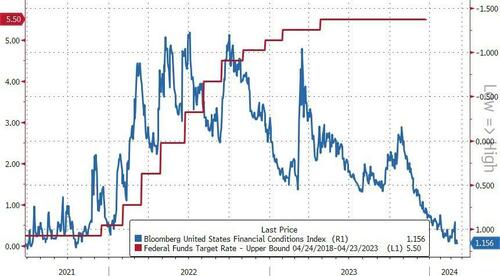

Monetary policy remains exceptionally loose given one of the fastest rate-hiking cycles seen. Pressure is likely to remain on rate expectations to move higher as the Federal Reserve reluctantly eases back on its December pivot, with the fed funds and SOFR futures curves continuing to steepen.

A famous experiment asks volunteers to watch a video of a basketball game and count the passes. Half way through, a gorilla strolls through the action. Almost no-one spots it, so focused they are on the game. As we count the dots and parse the language at this week’s Fed meeting, it’s easy miss the fact that policy overall remains very loose despite over 500 bps of rate hikes. The gorilla has gone by largely unnoticed.

The Fed held rates steady at 5.5% as expected and continued to project three rate cuts this year. But standing back and looking at the totality of monetary policy in this cycle, we can see that - far from conditions tightening - we have instead seen one of the biggest loosening of them in decades.

The chart below shows the Effective Fed Rate: the policy rate, plus its expected change over the next year, plus the one-year change in Goldman Sachs’ Financial Conditions Index, which is calibrated to convert the move in stocks, equity volatility, credit spreads and so on to an equivalent change in the Fed’s rate.

As we can see, in the three prior rate-hiking cycles the Effective Rate tightened; this time the rate has loosened, by more than it has done in at least 30 years.

It is against this backdrop the Fed’s pivot in December is even more inexplicable. By then it had become clear that a US recession was not imminent. Yet Jay Powell did not push back on the over six cuts that were priced in for 2024.

*POWELL: WE THINK FINANCIAL CONDITIONS ARE WEIGHING ON ECONOMY

— zerohedge (@zerohedge) March 20, 2024

dude, financial conditions are easier than when you started hiking

Since then inflation and growth data have come in better than expected. Still, though, the Fed may cut rates even if there is a smidge of an opening to do so. That would likely prove to be a mistake.

Typically the Effective Rate starts falling before the Fed makes its first cut and continues to fall after. This time around, the Effective Rate’s fall is already considerably steeper than normal – even before a cut is made. The Fed may end up spiking the punch bowl with more booze when the party is already quite tipsy.

The gorilla can be spotted in a number of different ways. Inflation has fallen, but it has done so largely despite the actions of the central bank, not because of them.

The San Francisco Fed splits core PCE inflation into a cyclical and an acyclical component. Cyclical inflation is made up of the PCE sub-components most sensitive to Fed interest rates, and acyclical is compiled from what’s left over, i.e. inflation that’s more influenced by non-Fed factors.

While acyclical inflation has fallen all the way back to its pre-pandemic average, cyclical PCE remains at its 40-year highs. The Wizard of the Fed has been pulling the rate-hiking levers, but they have done little to directly quell inflation.

It’s even worse if we account for borrowing costs. Mortgage costs were taken out of CPI in 1983 and car repayments in 1998. In a recent NBER paper by Larry Summers et al, the authors reconstruct CPI to take account of housing borrowing costs.

Inflation on this measure not only peaked much higher than it did in the 1970s, it is still running at 8%. Again, the question lingering in the air is: … and the Fed is considering cutting rates?

Source: NBER Working Paper 32163

(The main point of the paper is that the reason consumer sentiment indices have been depressed despite falling inflation is that they do include the impact of higher borrowing costs.)

If monetary policy was operating in the way expected, we would expect to see more slack in the economy. Yet this has signally failed to happen. The index of spare labor capacity – composed of the unemployment rate and productivity - has fallen only marginally, and remains stuck at 50-year highs.

Other measures of slack, including capacity utilization and job openings as a percentage of the unemployed are still near highs or remain historically very elevated. Under this backdrop, a Fed cut looks distinctly unwise.

Why did we not see a bigger rise in unemployment or drop in job openings despite the steep rate-hiking cycle? In short, massive government deficits allowed job hoarding.

The Kalecki-Levy equation illustrates the link between corporate profits and private and foreign-sector savings. Simply put, the more the household or government sectors dissave, i.e. spend, the higher are profit margins.

In this cycle, it has been the government’s dissaving that has allowed the corporate sector in aggregate to grow profits and - capitalizing on monopolization and on the unique economic disruption seen in the wake of the pandemic - expand profit margins.

It’s for the same reason that EPS growth has bounced back. (Buybacks also play a part here, but they too tend to happen when companies’ profits are growing, which is much easier when the government is spending like a drunken sailor.) As the chart below shows, there is a strong relationship between EPS and job openings, with EPS growth recently turning back up.

With such little movement on slack, no wonder the fall in inflation was due to factors outside of the Fed’s direct influence, most notably China’s glacial recovery. But that leaves markets in an increasingly precarious spot.

Inflation likely lulled the Fed into a false in of security when it performed its policy pirouette in December. But as was clear then and is clear now, this CPI movie isn’t over yet. Furthermore, any recession the Fed may have been wanting to circumvent continues to look off the cards for the next 3-6 months.

Yet the bank may still cut rates, on limited pretext, so confident they sounded last year that they would. That will inflame stock and other asset-bubble risks even more, at a time when we already have bitcoin making new highs and a dog “wif” a hat buying ad space on the Las Vegas Sphere.

Gorillas playing basketball is a very odd thing; the Fed cutting rates before the last quarter of this year would be even odder. Before then, though, markets are likely to try to re-impose some sobriety by reducing or eliminating the number of rate cuts priced in.

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges