Liberty Mutual Insurance Reports First Quarter 2022 Results

Liberty Mutual Insurance Reports First Quarter 2022 Results

PR Newswire

BOSTON, May 5, 2022

BOSTON, May 5, 2022 /PRNewswire/ — Liberty Mutual Holding Company Inc. and its subsidiaries (collectively “LMHC” or the “Company”) reported net income attr…

Liberty Mutual Insurance Reports First Quarter 2022 Results

PR Newswire

BOSTON, May 5, 2022

BOSTON, May 5, 2022 /PRNewswire/ -- Liberty Mutual Holding Company Inc. and its subsidiaries (collectively "LMHC" or the "Company") reported net income attributable to LMHC of $498 million for the three months ended March 31, 2022, a decrease of $358 million from the same period in 2021.

"Net income attributable to LMHC in the quarter was $498 million, down from $856 million in the prior year quarter," said David H. Long, Liberty Mutual Chairman and Chief Executive Officer. "Earnings in the first quarter reflect more moderate returns in our limited partnership portfolio compared to the exceptional returns we experienced last year and $144 million of net realized losses resulting from recent market volatility. Pre-tax catastrophe losses in the quarter were $656 million, down from $1.0 billion in the prior year quarter which partially offset the weaker investment results.

"We are navigating the market uncertainties brought on by macroeconomic and geopolitical headwinds and continue to make progress on strategic priorities. On March 1st, we completed the acquisition of State Auto Group, further strengthening our leading market positions in U.S. personal and small commercial lines. With this transaction, Liberty Mutual becomes the second-largest carrier in the independent agent channel."

The tables below outline highlights of LMHC's consolidated financial results for the three months ended March 31, 2022.

Net Written Premium ("NWP") by Business:

Three Months Ended March 31, | |||

$ in Millions | 2022 | 2021 | Change |

Global Retail Markets | $7,690 | $6,845 | 12.3% |

Global Risk Solutions | 3,954 | 3,560 | 11.1 |

Corporate and Other | (77) | (4) | NM |

Total NWP | $11,567 | $10,401 | 11.2% |

Foreign exchange effect on growth | (0.8) | ||

NWP growth excluding foreign exchange1 | 12.0% | ||

1 | Determined by assuming constant foreign exchange rates between periods. |

NM = Not Meaningful |

Consolidated Results of Operations:

Three Months Ended March 31, | |||

$ in Millions | 2022 | 2021 | Change |

Revenues | $11,874 | $11,815 | 0.5% |

Underlying PTOI before limited partnerships income1 | $1,066 | $1,077 | (1.0%) |

Catastrophes2 | (656) | (1,040) | (36.9) |

Net incurred losses attributable to prior years: | |||

- Asbestos and environmental3 | - | - | - |

- All other4 | (11) | 39 | NM |

Pre-tax operating income before limited partnerships income | 399 | 76 | NM |

Limited partnerships income | 365 | 838 | (56.4) |

Pre-tax operating income | 764 | 914 | (16.4) |

Net realized (losses) gains | (144) | 254 | NM |

Unit linked life insurance | 47 | (56) | NM |

Acquisition & integration costs | (9) | (4) | 125.0 |

Restructuring costs | (2) | (1) | 100.0 |

Pre-tax income | 656 | 1,107 | (40.7) |

Income tax expense | 158 | 250 | (36.8) |

Consolidated net income | 498 | 857 | (41.9) |

Less: Net income attributable to non-controlling interest | - | 1 | (100.0) |

Net income attributable to LMHC | 498 | 856 | (41.8) |

Net income attributable to LMHC excluding unrealized impact5 | 509 | 793 | (35.8) |

Cash flow provided by continuing operations | $786 | $1,046 | (24.9%) |

1 | Limited partnerships income includes LP, LLC and other equity method income within net investment income in the accompanying Consolidated Statements of Income and revenue and expenses from direct investments in natural resources. |

2 | Catastrophes are defined as a natural catastrophe, civil unrest, terror event, war or conflict exceeding $25 million in estimated ultimate losses, net of reinsurance, and before taxes. Catastrophe losses, where applicable, include the impact of accelerated earned catastrophe premiums and earned reinstatement premiums. |

3 | Asbestos and environmental is gross of the related adverse development reinsurance (the "NICO Reinsurance Transaction", which is described further in Reinsurance). |

4 | Net of earned premium and reinstatement premium attributable to prior years of $8 million for the three months ended March 31, 2022, and $36 million for the same period in 2021. |

5 | Excludes unrealized gains on equity securities, unit linked life insurance, and the corresponding tax impact. |

NM = Not Meaningful |

Combined Ratio:

Three Months Ended March 31, | |||

CONSOLIDATED | 2022 | 2021 | Change (Points) |

Underlying combined ratio | |||

Claims and claim adjustment expense ratio | 64.1% | 62.1% | 2.0 |

Underwriting expense ratio | 28.7 | 29.5 | (0.8) |

Subtotal | 92.8 | 91.6 | 1.2 |

Catastrophes | 6.0 | 10.4 | (4.4) |

Net incurred losses attributable to prior years: | |||

- Asbestos and environmental | - | - | - |

- All other1 | 0.1 | (0.5) | 0.6 |

Total combined ratio2 | 98.9% | 101.5% | (2.6) |

1 | Net of earned premium and reinstatement premium attributable to prior years. |

2 | The combined ratio, expressed as a percentage, is a measure of underwriting profitability. This measure should only be used in conjunction with, and not in lieu of, underwriting income and may not be comparable to other performance measures used by the Company's competitors. The combined ratio is computed as the sum of the following property and casualty ratios: the ratio of claims and claim adjustment expense less managed care income to earned premium; the ratio of insurance operating costs plus amortization of deferred policy acquisition costs less third-party administration income and fee income (primarily related to the Company's involuntary market servicing carrier operations) and installment charges to earned premium; and the ratio of policyholder dividends to earned premium. Provisions for uncollectible premium and reinsurance are not included in the combined ratio unless related to an asbestos and environmental commutation and certain other run off. Restructuring and acquisition and integration costs are not included in the combined ratio. |

Equity:

As of | As of | ||

$ in Millions |

2022 |

2021 | Change |

Unassigned equity | $29,906 | $28,776 | 3.9% |

Accumulated other comprehensive (loss) income | (3,606) | (960) | NM |

Non-controlling interest | 32 | 32 | - |

Total equity | $26,332 | $27,848 | (5.4%) |

NM = Not Meaningful |

Subsequent Events

Management has assessed material subsequent events through May 4, 2022, the date the financial statements were available to be issued.

Financial Information

The Company's financial results, management's discussion and analysis of operating results and financial condition, accompanying financial statements and other supplemental financial information for the three months ended March 31, 2022 are available on the Company's Investor Relations website at www.libertymutualgroup.com/investors.

About Liberty Mutual Insurance

At Liberty Mutual, we believe progress happens when people feel secure. By providing protection for the unexpected and delivering it with care, we help people embrace today and confidently pursue tomorrow.

In business since 1912, and headquartered in Boston, today we are the sixth largest global property and casualty insurer based on 2021 gross written premium. We also rank 71st on the Fortune 100 list of largest corporations in the U.S. based on 2020 revenue. As of December 31, 2021, we had $48.2 billion in annual consolidated revenue.

We employ over 50,000 people in 29 countries and economies around the world. We offer a wide range of insurance products and services, including personal automobile, homeowners, specialty lines, reinsurance, commercial multiple-peril, workers compensation, commercial automobile, general liability, surety, and commercial property.

For more information, visit www.libertymutualinsurance.com.

Risks and Uncertainties

The extent to which the coronavirus impacts our future results will depend on developments which are highly uncertain and cannot be predicted, including litigation developments, legislative or regulatory actions and intervention, the length and severity of the coronavirus (including of second waves), the level of acceptance of the vaccines, and the actions of government actors to contain the coronavirus or treat its impact, among others. Possible effects on our business and operations include:

- disruptions to business operations resulting from working from home or from closures of our corporate or sales offices and the offices of our agents and brokers and quarantines of employees, customers, agents, brokers and suppliers in areas affected by the outbreak;

- disruptions to business operations resulting from travel restrictions and reduced consumer spending on new homes or new automobiles which could reduce demand for insurance;

- disruptions to business operations resulting from our customers having lower payrolls and revenues which could have an impact on insurance revenue;

- increased claims related to trade credit, general liability, workers compensation, and event cancellation coverage, among others;

- executive or legislative mandates or court decisions expanding property insurance policy coverage to cover business interruptions resulting from COVID-19 notwithstanding any exclusions set forth in such policies or conditions precedent generally required for liability under such policies; and

- disruption of the financial markets resulting in reductions in the value of our investment portfolio.

A significant rise in the number of COVID-19 infections, infections in a wide range of countries and regions, or a prolongation of the outbreak, could create an adverse economic effect on the Company.

Cautionary Statement Regarding Forward Looking Statements

This report contains forward looking statements that are intended to enhance the reader's ability to assess the future financial and business performance of the Company. Forward looking statements include, but are not limited to, statements that represent the Company's beliefs concerning future operations, strategies, financial results, investment market fluctuations, or other developments, and contain words and phrases such as "may," "expects," "should," "believes," "anticipates," "estimates," "intends" or similar expressions. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond the Company's control or are subject to change, actual results could be materially different.

Contact: | Investor Relations | Media Relations |

Nik Vasilakos | Rich Angevine | |

857-224-6655 | 617-833-0926 |

View original content to download multimedia:https://www.prnewswire.com/news-releases/liberty-mutual-insurance-reports-first-quarter-2022-results-301540747.html

SOURCE Liberty Mutual Insurance

Government

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

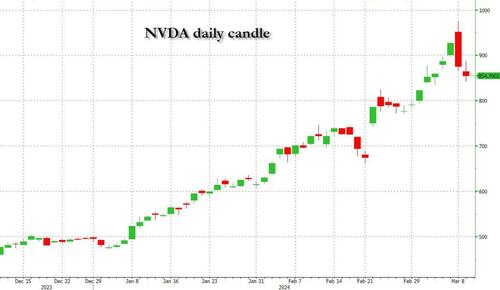

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Government

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges