Larry Fink: Spending Will Increase Inflation, Debase US Dollar

Larry Fink: Spending Will Increase Inflation, Debase US Dollar

CNBC Transcript: BlackRock CEO Larry Fink Speaks with CNBC’s “Squawk Box” today on earnings, reopening the economy and more.

Q1 2020 hedge fund letters, conferences and more

WHERE: CNBC’s “Squawk Box”

Full interview with BlackRock CEO Larry Fink on earnings, reopening the economy and more

All references must be sourced to CNBC.

BECKY QUICK: Alright, Andrew, thank you. BlackRock just out with its earnings. Beating on top and bottom lines for the quarter. Joining us right now is Larry Fink, BlackRock’s Chairman and CEO. Larry, it’s great to see you. It’s great to have you here. And looking through these numbers, you beat expectations by a long shot. $6.60 versus that the $6.36 the street was expecting. Revenue also beating, and, in fact, revenue year-over-year, up by 11%, because of an increase in higher base fees and then, growth in technology services revenue, too. I think what surprised me the most, though, is that you saw $35 billion in quarterly net inflows that came in during this awful quarter for the markets. Tell us a little bit about what’s happening and what you are seeing.

LARRY FINK: Well, first of all, welcome. It is nice to talk to you from home. This is my first time talking to all of you from home. It is a little different for me. So, let me just start off and say, Becky, that it has been hard for everybody, obviously. BlackRock’s 16,000 employees really brought everything together. And if I were to reflect on the quarter beyond our inflows and outflows, a few of our major components of our business really performed really well. There had been so much talk over the years about ETFs. And on the show when I’m there, I’m always asked about ETFs and do they represent risk? Well, let me say first and foremost, the ETF markets perform incredibly well, even in the most stressful weeks. Those who are looking for liquidity, those who are looking to move their beta exposures up or down, they were able to do that. All of the fixed ETFs performed quite well. There was never a period of time where the imbalance between the underlying assets and the ETFs were really skewed. And most importantly, what we saw was, we saw many first-time users of ETFs, whether it was to sell them to reduce their exposure or to buy them to get exposure. That is first and foremost. Two, in our quarter, the allotted revenues were up 34% from a year ago. But most importantly, we have 250 clients, including all of BlackRock. The Aladdin system worked fantastically. We did not design Aladdin to be – to having 90% of employees working remoting. And then our clients worldwide to be working remotely. And it performed really well. And I probably received more compliments about the Aladdin system in the first quarter than any time and probably the cumulative time – Aladdin. And yes, you are right, the whole firm came together with $35 billion of inflows. Let me describe that, as you described, our revenues were up 11% from last year, operating income was up 3%, and our margins didn’t really move all that much, down only 20 basis points. But let me really give you the underlying transformation of the quarter. Something that was fabulous but something that was really core. And I want to use a benchmark of February 21st to give you an idea of what we saw. We saw, cumulatively, from the beginning of the year to February 21, we had about $82 billion of long-term inflows. We had actually outflows in cash in the first part of the quarter. And then from February 21 to the end of the quarter, we actually had $100 billion of outflows, mostly in index product, where people are going buying in and out, getting their exposures, whether it was index product or ETFs. And so, it was a big reversal of market sentiment, obviously. We actually were beginning one of the best first quarters in our history with $82 billion in inflows by mid-February and then obviously, ended up where we were. So, we saw big outflows in index products in the last six weeks of the year. Huge inflows in cash. And then since the quarter end, we are seeing more inflows. Probably one of the other highlights of our quarter, unlike the industry that had over $100 billion of active equity outflows, we actually had active equity inflows of $4 billion. So, I think what the quarter shows me, the area where we emphasized iShares, illiquid alternatives where we had $7 billion of inflows, we emphasized cash for the last few years with over $50-odd-billion of inflows. So, between iShares, between our Aladdin platform, up 39%, the components worked. And then I would also say, I think one of the biggest reasons why it worked, we have spoken to over 50,000 of our clients since the pandemic really become a top priority. Between myself and a few other executives, we’ve had over 100 different individual virtual meetings with other CEOs, other CIOs and governmental officials. So, I think the presence of BlackRock worldwide has given us an opportunity to be working with our clients, helping our clients. And then this quarter, working with clients meant helping them reduce exposures. But overall, as I’ve been saying to you for many quarters, we are winning more share of mind with our clients.

BECKY QUICK: Hey Larry, let me ask you, just based on the number of clients and based on the number of government leaders and others you’ve spoken to in this whole thing, would you say we’ve seen the worst of it or would you say there is there more bad news to come?

LARRY FINK: Well, I’m not a scientist so it is hard for me to answer that question. If the disease curve in the developed world continues to decline, at the same time, we see the curve of governmental support for monetary policy and fiscal policy worldwide increases, we could have seen the bottom. On the other hand, I think what the market is still under-appreciating, it has been mostly the developed world that has experienced the virus. As we start entering summertime, the southern hemisphere is beginning to have their winter. Are we going to see an acceleration of the disease in other parts of the world? And does that mean we close our borders for a longer period of time? We may be opening up some businesses, we may be experimenting how we reboot our economies and our businesses. But I don’t believe we have any real information about how the disease, how COVID-19 is going to spread in the world. We have learned like in Indonesia, burials are up 40 percent from a year ago. And yet no one talks about COVID-19 in Indonesia. Because there is no testing, there’s not an ability or a platform really to monitor that. And that’s one of the big issues we are going to have. The IMF and World Bank are talking about this right now where we are seeing obviously mostly a supply of masks and gloves are being held in the developed world. The developing world that does not have the ability to secure the mask and does not have the necessary health care systems, much more crowding, larger cities. So, we are still going to see elements of the disease increasing in other parts of the world. And until we have adequate testing, rapid testing, it is hard for me to see how we are going to reboot in the next 30 days. Every business is going to be very cautious. They want to be protective of their employees. They want employees to feel good about coming back to the office. Let’s be clear, anxiety is still very high. And we hope we have the ability to reboot. But in doing so, I know many leaders told the president yesterday, we need to have adequate testing to make sure we have a secured environment. And the one thing that’s very clear--

BECKY QUICK: What’s --

LARRY FINK: I’m sorry. Go ahead, Becky.

BECKY QUICK: Go ahead.

LARRY FINK: No-no.

BECKY QUICK: Well, I just -- what’s adequate testing, Larry? What--how do you measure that?

LARRY FINK: I think it is different for different organizations and different situations. In a factory where everybody is coming to work in a defined location, that is an easier – that’s a closed environment. In a closed environment, you are going to have the ability to do either weekly testing and through that process, you could probably reboot. In the service side of the world like restaurants, like airplanes, that represents a different issue because you have an open system. The question is how do you reboot that? To me, it is all about testing and making sure that we can assure safety, we can assure that people could eat at a restaurant, fly on an airplane with the security that every other person in the restaurant or flying on the plane is disease-free. Until we have that testing --

BECKY QUICK: Well, we just spoke -- we just spoke with Eunice Yoon in Beijing. She told us about some of the testing there. She has to have a card with a bar code on it that checks her to get into her get into her apartment and checks her to get into restaurants. And part of what they can see is her health status but they can also where she has been in the last 14 days, to know she hasn’t left Beijing. She said, you give up a lot of privacy. But, on the other hand, you feel more secure when you are out at some of these places to know when you’re in a restaurant, everybody has passed that same check to get in. I don’t know if that’s the type of thing that would fly in a democratic state like the U.S. though.

LARRY FINK: This is why China has been able to reboot faster. In my conversations with Chinese leadership, they are still very worried about service side of the economy. Restaurants are not even close to full, maybe 30% full, even with that testing. People are not flying. In China, you are seeing the manufacturing side rebooting. You’re not seeing the service side rebooting as fast. It is far from normalized. And you are right, democracy is where privacy is a very strong foundation of who and what we are. Obviously, if people agree to that, that’s a whole different story. But it is going to be hard for me to see people giving up those rights.

BECKY QUICK: And then you carry out the idea that we are such a services-based economy, that starts to make you wonder about what happens from here. We can declare things open, but if there is no demand, if they don’t want to go back to restaurants, they don’t want to go back to spas, they don’t want to go back to gyms, what happens?

LARRY FINK: Well, it’s -- our economy. You know, I don’t believe we’ll have a V-shaped economy. I think we are going to have something closer to a J that ultimately turns into a U. If we have adequate testing--if the testing that Abbott labs has been testing, if that works and we have adequate testing, maybe we can have in airports prior to you going into a terminal, you go through a process of being tested. And maybe it requires you getting to the airport an hour, hour and a half early, before you go through the airport itself, you are tested. And fifteen minutes later, it’s determined if you are disease-free and then everybody in the terminal on airplanes, everyone can feel secure. So, it is about testing. It is about knowledge. But at the same time, it is about creating anti-viral cocktails that reduce the severity of the disease. If everybody felt much more comfortable that, Okay, I could get COVID-19 and I have a very modest risk of being placed into an ICU, more like an influenza, maybe we could get on to our life. Originally, when people were talking about COVID-19, early months, they were talking about, well, look at the influenza, we have around 22,000 Americans dying every year with the influenza. Many people get the influenza every year. We live our lives with that disease. We need to get to that point where we are going to live our life with COVID-19, too, whether that’s going to be through a vaccination or through therapies and a cocktail of different drugs to reduce the severity. And I feel very confident over the next four to five months we’ll determine different protocols to save lives, different protocols to minimize the severity. And through that process, I do believe we’ll be able to reboot. I do believe we’ll be able to have a better, more normalized environment. But it may not be in June or July, it may be in August. And so, the economy will be slow to really reboot. As you said, because we are such a heavy service-side economy. The most important thing, we need to have all Americans feeling comfortable, feeling safe. And at this time, I don’t believe that many people feel secure and safe.

BECKY QUICK: That gives us a lot to think about. Larry, will you bear with us for just a moment? We are going to slip in a quick break.

ANDREW ROSS SORKIN: We want to get back to our very special guest this morning, Larry Fink, the CEO of BlackRock, the world’s largest asset manager. Larry, it is great to see you, and I want to go rapid fire with you. Because we have so many different topics we want to get through with you. But I do want to just pick up on one very quick thing you just said to Becky before. The idea that you don’t expect a V-shaped recovery. you talked about it maybe being like a U or even a J. Give me your 30-second version of your thought there, given the risk on the market today.

LARRY FINK: Well, hi, Andrew. The risk for the market for today is that the disease will take longer. The risk for today is that we don’t have Americans and Europeans feeling very comfortable with their environment. And so, that will be taking time. What I’m saying is I just don’t see a rapid rebound. I see a rebound that will take time as we develop the testing and as we develop the anti-virals, before we develop a vaccination. And so, I just think it’s going to take a longer period of time.

ANDREW ROSS SORKIN: But you also suggested we might be at -- you also suggested we might have hit a bottom and so what I think what we’re all trying to figure out is, is the market fairly priced?

LARRY FINK: Well, there are two curves. There’s the curve of the disease and then the curve of government response. We’ve seen -- we’ve seen historic governmental response. The Federal Reserve has said they -- you know, they could purchase a couple trillion dollars of assets in addition to the monetary stimulus from the different Central Banks, like the ECB, the dramatic fiscal response by the American government and other governments. So, we’re doing quite a bit to stabilize the economy, to stabilize markets, to allow corporations to access capital. And so, these are two different curves. And right now, the response by governments is quite large and I do believe --

ANDREW ROSS SORKIN: What’s the long-term impact of all of the responses by the government? Talk about the long-term impact. Because one of the questions out there is if we’re printing money, if every government is printing money, is it going to effectively nullify everybody? Are dollars going to become so, less valuable and therefore assets are more valuable? Maybe we do have inflation?

LARRY FINK: We are triaging a sick economy. We’re doing everything we can to stabilize this economy, to make it healthy again. And so, in doing so, we are accumulating large amounts of debt. It’s like being in an operating room, you are doing everything you can to keep the patient strong. I think that’s what our government is doing. And I applaud the government for all of the actions it’s doing. I would hope Europe, specifically, Germany, does more. I think Europe needs to do more. I am very worried about the actions of Europe because they’re not as significant as they should be. And so, you know, we’re going to have to see how this plays out between the length of time people feel comfortable related to their lives and their safety and then the other curve of governmental support. I do believe in the United States we are going to have to have another fiscal stimulus to help small and medium-sized business, to help the independent contractors.

ANDREW ROSS SORKIN: How big? How big do you think that’s going to have to be?

LARRY FINK: If it adds up another trillion dollars, it adds up another trillion dollars. And so now, going forward, if you ask me the question, what does that mean? It probably does mean, in three or four years, we are going to be looking at more inflation. We are going to look at potentially more basing or devaluation of the American dollar. The American dollar is almost at a record high right now. So, a little devaluation of the dollar right now would really improve our competitiveness worldwide. So, I don’t look at that as a bad thing. I actually look at that as a good thing. And as to kind of reframe the question, Andrew, I do believe some inflation would be good at this time.

ANDREW ROSS SORKIN: Let me flip the whole conversation around. One of the things we’ve talked about for years is ESG. You’ve been one of the biggest advocates for ESG. The idea of environmental government sustainability being such an important thing for companies to be focused on. And yet, in a world where we are socializing losses and privatizing gains and the government is effectively creating a PUT for every company in America, and you can even argue perverting the very idea of free market capitalism, where does ESG land in the middle of that? Does it have any importance anymore? More importance, less importance?

LARRY FINK: I think it has much more importance. First of all, in the first quarter, we had $10 billion of ESG ETF. So, we saw from clients more than ever demand for products that are -- that have an ESG focus. And for the fifth quarter in a row, those products outperformed regular indexes. I actually believe when you focus on safety and people’s fear of the pandemic, it also enlarges people’s feelings about our environment. And so, in my conversations, even with the pandemic, even the closing of all of these small and medium businesses, even with all of the stress, I’m still having a remarkable amount of conversations about how should ESG play in a portfolio. And I think the conclusion will be when we’re over the worst part of the virus and we have this upswing in the economy, I truly believe more and more people are going to say, I’m still worried about our world, beyond just a health crisis, but also environmental crisis. And so, there’s no question today in our dialogues, the economy the disease curves are more prominent in conversation, but the conversation about ESG is just as prominent, maybe secondary to those primary conversations. But let’s be clear, in our flows in the first quarter, $10 billion in ESG strategy, that says it all.

ANDREW ROSS SORKIN: Well, what do you think about the government effectively privatizing -- or, rather, socializing the corporate losses that are taking place and privatizing the gains? Because that’s what’s happened here. We’ve now done it twice effectively in the last 12 years.

LARRY FINK: And I do believe it’s going to lead to questions of the role of stock pre-purchases. We may see rising corporate taxes to pay for these deficits. We’re going to have to – when we’re over -- you’re asking questions that are not in my mind as important at the moment but will be very important once we believe the disease curve is behind us and we have more safety and soundness. Your questions are legitimately important, but I don’t believe they’re primary at this moment. And we all have to be worried about how we are triaging and fixing the health of the global economy. We are doing what you just said. We’re not weeding out the underperformers as fast as we should be. Generally, during recessions, the cleaning out of companies is a natural process. So, you’re absolutely right on this. But I -- but I don’t know how today, especially with such governmental support, how do you -- is this time, Andrew, to pick winners and losers? And I have a hard time making that judgment call now. If you’re picking a loser, are you willing to say that 120,000 employees are going to lose their job?

ANDREW ROSS SORKIN: Larry, it’s a longer conversation. I absolutely agree with you. Today is not the time to legislate that. But it is a conversation that is going to have a huge impact on our country, and I imagine on the markets in the future and I hope we can continue that conversation. Stay healthy and safe, Larry. We appreciate spending time with you this morning.

LARRY FINK: Thanks.

The post Larry Fink: Spending Will Increase Inflation, Debase US Dollar appeared first on ValueWalk.

Government

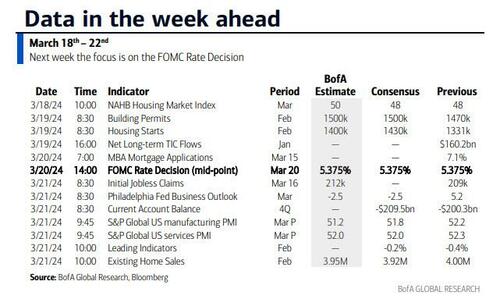

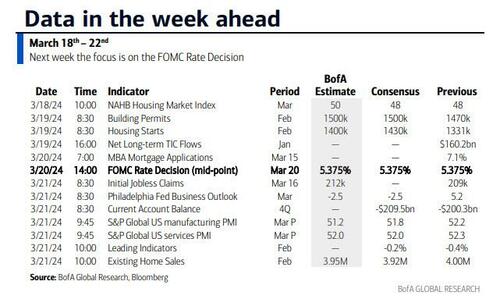

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

Spread & Containment

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The…

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The U.S. Supreme Court will soon hear oral arguments in a case that concerns what two lower courts found to be a “coordinated campaign” by top Biden administration officials to suppress disfavored views on key public issues such as COVID-19 vaccine side effects and pandemic lockdowns.

The Supreme Court has scheduled a hearing on March 18 in Murthy v. Missouri, which started when the attorneys general of two states, Missouri and Louisiana, filed suit alleging that social media companies such as Facebook were blocking access to their platforms or suppressing posts on controversial subjects.

The initial lawsuit, later modified by an appeals court, accused Biden administration officials of engaging in what amounts to government-led censorship-by-proxy by pressuring social media companies to take down posts or suspend accounts.

Some of the topics that were targeted for downgrade and other censorious actions were voter fraud in the 2020 presidential election, the COVID-19 lab leak theory, vaccine side effects, the social harm of pandemic lockdowns, and the Hunter Biden laptop story.

The plaintiffs argued that high-level federal government officials were the ones pulling the strings of social media censorship by coercing, threatening, and pressuring social media companies to suppress Americans’ free speech.

‘Unrelenting Pressure’

In a landmark ruling, Judge Terry Doughty of the U.S. District Court for the Western District of Louisiana granted a temporary injunction blocking various Biden administration officials and government agencies such as the Department of Justice and FBI from collaborating with big tech firms to censor posts on social media.

Later, the Court of Appeals for the Fifth Circuit agreed with the district court’s ruling, saying it was “correct in its assessment—‘unrelenting pressure’ from certain government officials likely ‘had the intended result of suppressing millions of protected free speech postings by American citizens.’”

The judges wrote, “We see no error or abuse of discretion in that finding.”

The ruling was appealed to the Supreme Court, and on Oct. 20, 2023, the high court agreed to hear the case while also issuing a stay that indefinitely blocked the lower court order restricting the Biden administration’s efforts to censor disfavored social media posts.

Supreme Court Justices Samuel Alito, Neil Gorsuch, and Clarence Thomas would have denied the Biden administration’s application for a stay.

“At this time in the history of our country, what the Court has done, I fear, will be seen by some as giving the Government a green light to use heavy-handed tactics to skew the presentation of views on the medium that increasingly dominates the dissemination of news,” Justice Alito wrote in a dissenting opinion.

“That is most unfortunate.”

The Supreme Court has other social media cases on its docket, including a challenge to Republican-passed laws in Florida and Texas that prohibit large social media companies from removing posts because of the views they express.

Oral arguments were heard on Feb. 26 in the Florida and Texas cases, with debate focusing on the validity of laws that deem social media companies “common carriers,” a status that could allow states to impose utility-style regulations on them and forbid them from discriminating against users based on their political viewpoints.

The tech companies have argued that the laws violate their First Amendment rights.

The Supreme Court is expected to issue a decision in the Florida and Texas cases by June 2024.

‘Far Beyond’ Constitutional

Some of the controversy in Murthy v. Missouri centers on whether the district court’s injunction blocking Biden administration officials and federal agencies from colluding with social media companies to censor posts was overly broad.

In particular, arguments have been raised that the injunction would prevent innocent or borderline government “jawboning,” such as talking to newspapers about the dangers of sharing information that might aid terrorists.

But that argument doesn’t fly, according to Philip Hamburger, CEO of the New Civil Liberties Alliance, which represents most of the individual plaintiffs in Murthy v. Missouri.

In a series of recent statements on the subject, Mr. Hamburger explained why he believes that the Biden administration’s censorship was “far beyond anything that could be constitutional” and that concern about “innocent or borderline” cases is unfounded.

For one, he said that the censorship that is highlighted in Murthy v. Missouri relates to the suppression of speech that was not criminal or unlawful in any way.

Mr. Hamburger also argued that “the government went after lawful speech not in an isolated instance, but repeatedly and systematically as a matter of policy,” which led to the suppression of entire narratives rather than specific instances of expression.

“The government set itself up as the nation’s arbiter of truth—as if it were competent to judge what is misinformation and what is true information,” he wrote.

“In retrospect, it turns out to have suppressed much that was true and promoted much that was false.”

The suppression of reports on the Hunter Biden laptop just before the 2020 presidential election on the premise that it was Russian disinformation, for instance, was later shown to be unfounded.

Some polls show that if voters had been aware of the report, they would have voted differently.

Government

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex