Government

Key Events In THe Coming Holiday-Shortened Week

Key Events In THe Coming Holiday-Shortened Week

As the mid-summer sun rises, we see a shortened trading week with Friday a US holiday in lieu of Independence Day on Saturday, and as DB's Jim Reid predicts, Thursday will likely see activity wind down early and rapidly ahead of the weekend.

That said, the last major act of the week will be the all-important payrolls report brought forward to Thursday, where DB's economists are looking for a further +2m gain in non-farm payrolls, following last month’s unexpected +2.509m increase, along with a further reduction in the unemployment rate to 12.6% (unclear if this assume the BLS will continue making the same admitted mistake it has been doing for the past two months). This improved labor market performance chimes with what we’ve seen in other indicators, such as the weekly initial jobless claims that have fallen for 12 consecutive weeks now. That said, it’s worth remembering that given the US shed over 22m jobs in March and April, even another +2m reading would still mean that payrolls have recovered less than a quarter of their total losses, suggesting there’s still a long way to go before the labor market returns to normality again.

The other main data highlight will be the final June PMI releases from around the world. The manufacturing numbers are out on Wednesday before the services and composite PMIs come out on Friday for the most part (ex US), while there’ll also be the ISM manufacturing index too from the US (on Wednesday). For the countries where we already have a flash PMI reading, they generally surprised to the upside, even as many remained below the 50-mark. It’ll also be worth keeping an eye on the numbers for China, given they’re some way ahead in the reopening process relative to the US and Europe.

In politics, a key highlight this week will be a meeting between Chancellor Merkel and President Macron taking place today, where both the EU budget and the recovery fund will be on the agenda. That comes ahead of another summit of EU leaders scheduled for the 17-18th July, where the 27 leaders will meet in person in Brussels for further discussions on the recovery fund. Meanwhile, the start of July on Wednesday formally sees Germany take over the rotating EU presidency, which they’ll hold for the next six months.

Staying with politics, Reid points out that Brexit negotiations between the UK and the EU on their future relationship will return once again. This will be the first set of intensified talks that are taking place every week over the next five weeks, as the two sides look to come to an agreement following fairly slow progress in the talks thus far. Since the last round of negotiations, a high-level meeting took place between Prime Minister Johnson and the Presidents of the European Commission, Council and Parliament, where the two sides agreed in their statement that “new momentum was required” in the discussions. There does seem a bit more positivity now than there was a month ago but much work still needs to be done.

Elsewhere we have the release of the FOMC minutes for the June meeting on Wednesday, along with an appearance by Fed Chair Powell and Treasury Secretary Mnuchin tomorrow before the House Financial Services Committee. Otherwise, speakers next week include the BoE’s Governor Bailey and Deputy Governor Cunliffe, along with the ECB’s Schnabel and New York Fed President Williams.

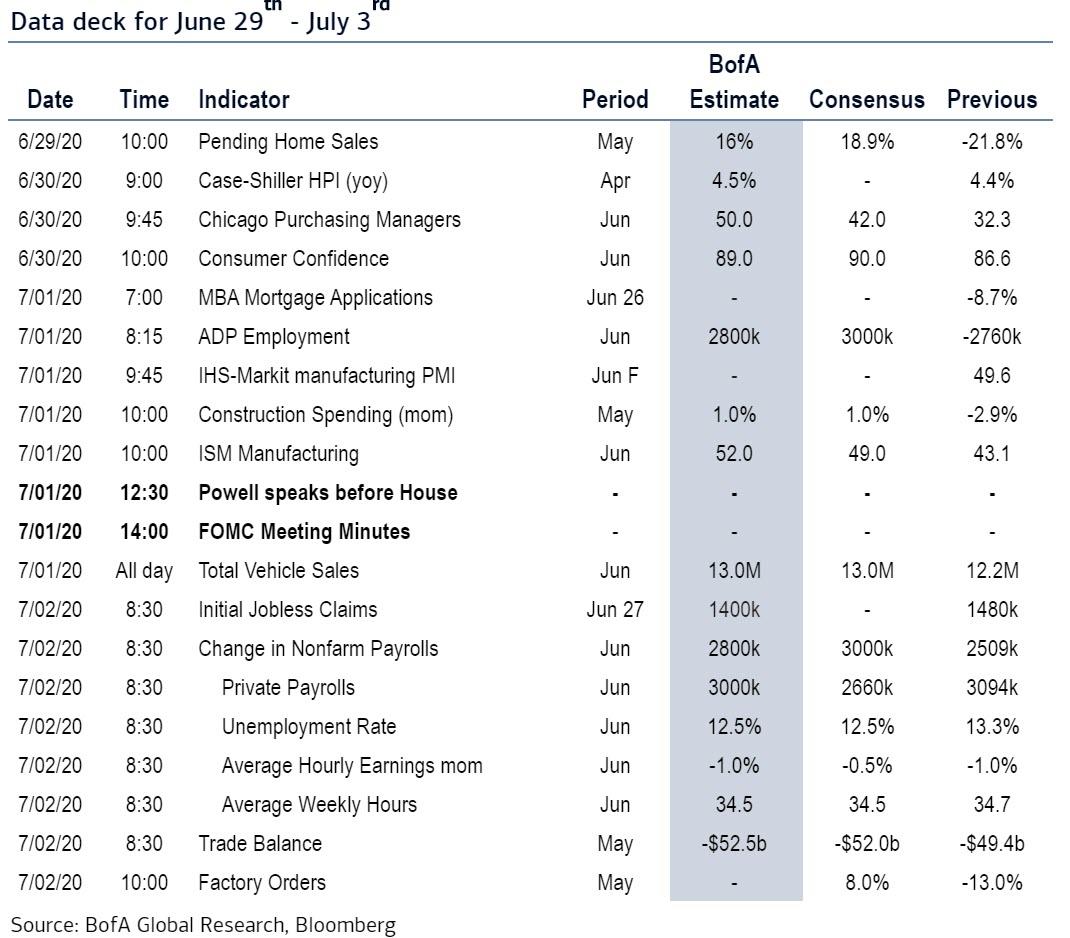

Courtesy of Deutsche Bank, here is a day-by-day calendar of events:

Monday

- Data: Japan May retail sales; Spain preliminary June CPI; UK May consumer credit, mortgage approvals, M4 money supply; Euro area June economic, industrial, services and consumer confidence; Germany preliminary June CPI; US May pending home sales and June Dallas Fed manufacturing activity index.

- Central Banks: BoE's Bailey, Breeden and Vlieghe speeches; Fed's Daly and Williams speeches; IMF's Georgieva speech.

- Politics: German and French leaders meet to discuss clinching a deal on the EU recovery fund.

- Others: EU Brexit chief negotiator Michel Barnier meets UK counterpart David Frost for further talks on a trade deal.

Tuesday

- Data: Japan preliminary May industrial production; China June official PMIs; UK final June GfK consumer confidence, June Lloyds business barometer, final 1Q GDP, private consumption, government spending, gross fixed capital formation, exports, business investments, current account balance, imports; France preliminary June CPI, May PPI and consumer spending; Spain final 1Q GDP; Italy preliminary June CPI and May PPI; Euro area preliminary June CPI and Core CPI; US April S&P CoreLogic house price index, June Chicago Fed PMI, Conference board consumer confidence, expectations and present situation index.

- Central Banks: ECB Schnabel speech; BoE Cunliffe and Haldane speeches; Fed Williams speech; Colombia rate decision.

- Others: Fed's Powell and US Treasury Secretary Mnuchin testify before the House Finance Panel.

- Politics: European Council President Charles Michel and European Commission President Ursula von der Leyen meet with South Korean President Moon Jae-in in a virtual summit, NATO Secretary General Jens Stoltenberg speaks on the geopolitical implications of Covid-19.

Wednesday

- Data: Japan 2Q Tankan survey results, June consumer confidence and final June manufacturing PMI; China June Caixin manufacturing PMI; Spain June manufacturing PMI; Italy June manufacturing PMI; France final June manufacturing PMI; Germany final June manufacturing PMI, June unemployment claims rate and unemployment change; Euro area final June manufacturing PMI; UK final June manufacturing PMI; US latest weekly MBA mortgage applications, June Challenger job cuts and ADP employment change, final June manufacturing PMI, May construction spending, June ISM manufacturing, new orders, prices paid and employment, June FOMC meeting minutes, June Wards total vehicles sales.

- Central Banks: Sweden rate decision, BoE Haskel speech; Fed Evans speech.

- Politics: Russia holds the final day of voting on changes to the nation’s constitution.

- Others: The head of Germany’s BaFin financial regulator testifies before the German parliament on the accounting scandal at payment-processing firm Wirecard AG; the U.S.-Mexico-Canada Agreement is due to take effect.

Thursday

- Data: Euro area May PPI and unemployment rate; US May trade balance, June nonfarm payrolls, unemployment rate and average hourly earnings, latest weekly initial and continuing claims, May factory orders, final May durable goods and capital goods orders.

- Others: SIFMA has recommended an early close (14:00 EDT) for the fixed-income market before the U.S. Independence Day holiday

Friday

- Data: Final June services and composite PMIs for Japan, China (Caixin), Spain, Italy, France, Germany, Euro area and UK; France May YtD budget balance; UK June official reserve changes.

- Central Banks: ECB Knot speech.

- Others: US Independence Day holiday

* * *

Finally, courtesy of Goldman, here is a preview of events in the US, where as Jan Hatzius notes, key events this week are the ISM manufacturing index on Wednesday and the employment report on Thursday. The minutes of the June FOMC meeting will be released on Wednesday.

Monday, June 29

- 10:00 AM Pending home sales, May (GS +33.0%, consensus +18.0%, last -21.8%): We estimate that pending home sales rebounded by 33.0% in May based on regional home sales data, following a 21.8% drop in April. We have found pending home sales to be a useful leading indicator of existing home sales with a one-to-two-month lag.

- 10:30 AM Dallas Fed manufacturing index, June (consensus -22.0, last -49.2)

- 11:00 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will speak on a panel discussion on higher education. Prepared text is not expected. Audience and media Q&A are expected.

- 3:00 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will moderate a discussion with IMF Managing Director Georgieva.

Tuesday, June 30

- 09:00 AM S&P/Case-Shiller 20-city home price index, April (GS +0.7%, consensus +0.5%, last +0.47%); We estimate the S&P/Case-Shiller 20-city home price index increased by 0.7% in April, following a 0.47% increase in March.

- 09:45 AM Chicago PMI, June (GS 46.0, consensus 44.0, last 32.3); We estimate that the Chicago PMI rebounded by 13.7pt to 46.0 in June—following a 3.1pt decline in May—reflecting improved June readings for other manufacturing surveys.

- 10:00 AM Conference Board consumer confidence, June (GS 94.0, consensus 90.5, last 86.6): We estimate that the Conference Board consumer confidence index increased to 94.0 in June from 86.6 in May.

- 11:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give a speech via webinar on central banking during the pandemic. Prepared text and moderator Q&A are expected.

- 12:30 PM Fed Chair Powell (FOMC voter) speaks: Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin will testify before the House Financial Services Committee. Prepared text is TBD and questions from Members are expected.

- 02:00 PM: Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a virtual panel discussion on race and social justice in economics. Prepared text is not expected. Audience Q&A is expected.

Wednesday, July 1

- 08:15 AM ADP employment report, June (GS +2,500k, consensus +2,950k, last -2,760k); We expect a 2,500k gain in ADP payroll employment, reflecting a boost from falling jobless claims and higher oil prices. We expect the “active” employment input to understate actual job gains in the ADP model.

- 10:00 AM ISM manufacturing index, June (GS 49.0, consensus 49.5, last 43.1); We expect the ISM manufacturing index to increase by 5.9pt to 49.0 in June, after rebounding by 1.6pt in May. While we expect the key components – new orders, production, and employment – to improve; faster delivery times will likely weigh on the degree of recovery in the composite index.

- 10:00 AM Construction spending, May (GS +0.8%, consensus +0.9%, last -2.9%): We estimate a 0.8% increase in construction spending in May, with a faster recovery in non-residential than residential construction.

- 10:00 AM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will host a forum on the future of the city of Chicago. Prepared text is not expected, nor is discussion of monetary policy. Audience Q&A is expected.

- 02:00 PM Minutes from the June 9-10 FOMC meeting: At its June meeting, the FOMC left the target range for the policy rate unchanged at 0-0.25%; and in the Summary of Economic Projections, participants expected high unemployment, low inflation, and a flat funds rate through 2022. In the minutes, we will look for further discussion of the economic outlook and the Fed’s toolkit, including the Committee’s discussion of yield curve control.

- 05:00 PM Lightweight motor vehicle sales, May (GS 13.1m, consensus 13.0m, last 12.2m)

Thursday, July 2

- 08:30 AM Nonfarm payroll employment, June (GS +4,250k, consensus +3,000k, last +2,509k); Private payroll employment, June (GS +4000k, consensus +2,519k, last +3,094k); Average hourly earnings (mom), June (GS -1.0%, consensus -0.8%, last -1.0%); Average hourly earnings (yoy), June (GS +5.3%, consensus +5.3%, last +6.7%); Unemployment rate, June (GS 12.7%, consensus 12.4%, last 13.3%): We estimate nonfarm payroll growth accelerated from the +2.5mn record gain in May to +4.25mn in June. With much of the economy reopening, our forecast reflects a rapid albeit partial reversal of temporary layoffs. While jobless claims remain elevated, alternative data suggest unprecedented increases in the number of workers at work sites. We also expect a seasonal bias in education categories to boost job growth by roughly 0.5mn.

- We expect that about half of the 4.9mn excess workers that were employed but not at work for “other reasons” in May will be reclassified as unemployed in the June household survey, applying upward pressure on the unemployment rate. Additionally, we expect the labor force participation rate increased as business reopenings encouraged job searches. Taken altogether, we estimate the unemployment rate as reported will fall by 0.6pp to 12.7% in Thursday’s report. Correcting for misclassification of unemployed workers, we estimate the “true” unemployment rate declined more significantly, but to an even higher level (-2.4pp to 14.0% in June from 16.4% in May).

- We estimate average hourly earnings declined 1.0% month-over-month and 5.3% year-over-year as lower-paid workers are rehired and the associated composition shift unwinds.

- 08:30 AM Trade balance, May (GS -$54.0bn, consensus -$53.0bn, last -$49.4bn): We estimate the trade deficit increased by $4.1bn in May, reflecting a rise in the goods trade deficit.

- 08:30 AM Initial jobless claims, week ended June 27 (GS 1,375k, consensus 1,336k, last 1,480k): Continuing jobless claims, week ended June 20 (consensus 18,904k, last 19,522k); We estimate initial jobless claims declined but remained elevated at 1,375k in the week ended June 27.

- 10:00 AM Factory orders, May (GS +11.1%, consensus +7.9%, last -13.0%); Durable goods orders, May final (last +15.8%); Durable goods orders ex-transportation, May final (last +4.0%); Core capital goods orders, May final (last +2.3%); Core capital goods shipments, May final (last +1.8%)

Friday, July 3

- US Independence Day holiday observed. US equity and bond markets are closed.

Source: DB, BofA

Government

Moderna turns the spotlight on long Covid with new initiatives

Moderna’s latest Covid effort addresses the often-overlooked chronic condition of long Covid — and encourages vaccination to reduce risks. A digital…

Moderna’s latest Covid effort addresses the often-overlooked chronic condition of long Covid — and encourages vaccination to reduce risks. A digital campaign debuted Friday along with a co-sponsored event in Detroit offering free CT scans, which will also be used in ongoing long Covid research.

In a new video, a young woman describes her three-year battle with long Covid, which includes losing her job, coping with multiple debilitating symptoms and dealing with the negative effects on her family. She ends by saying, “The only way to prevent long Covid is to not get Covid” along with an on-screen message about where to find Covid-19 vaccines through the vaccines.gov website.

“Last season we saw people would get a flu shot, but they didn’t always get a Covid shot,” said Moderna’s Chief Brand Officer Kate Cronin. “People should get their flu shot, but they should also get their Covid shot. There’s no risk of long flu, but there is the risk of long-term effects of Covid.”

It’s Moderna’s “first effort to really sound the alarm,” she said, and the debut coincides with the second annual Long Covid Awareness Day.

An estimated 17.6 million Americans are living with long Covid, according to the latest CDC data. About four million of them are out of work because of the condition, resulting in an estimated $170 billion in lost wages.

While HHS anted up $45 million in grants last year to expand long Covid support initiatives along with public health campaigns, the condition is still often ignored and underfunded.

“It’s not just about the initial infection of Covid, but also if you get it multiple times, your risks goes up significantly,” Cronin said. “It’s important that people understand that.”

grants covid-19 cdc hhsGovernment

Consequences Minus Truth

Consequences Minus Truth

Authored by James Howard Kunstler via Kunstler.com,

“People crave trust in others, because God is found there.”

-…

Authored by James Howard Kunstler via Kunstler.com,

“People crave trust in others, because God is found there.”

- Dom de Bailleul

The rewards of civilization have come to seem rather trashy in these bleak days of late empire; so, why even bother pretending to be civilized? This appears to be the ethos driving our politics and culture now. But driving us where? Why, to a spectacular sort of crack-up, and at warp speed, compared to the more leisurely breakdown of past societies that arrived at a similar inflection point where Murphy’s Law replaced the rule of law.

The US Military Academy at West point decided to “upgrade” its mission statement this week by deleting the phrase Duty, Honor, Country that summarized its essential moral orientation. They replaced it with an oblique reference to “Army Values,” without spelling out what these values are, exactly, which could range from “embrace the suck” to “charlie foxtrot” to “FUBAR” — all neatly applicable to our country’s current state of perplexity and dread.

Are you feeling more confident that the US military can competently defend our country? Probably more like the opposite, because the manipulation of language is being used deliberately to turn our country inside-out and upside-down. At this point we probably could not successfully pacify a Caribbean island if we had to, and you’ve got to wonder what might happen if we have to contend with countless hostile subversive cadres who have slipped across the border with the estimated nine-million others ushered in by the government’s welcome wagon.

Momentous events await. This Monday, the Supreme Court will entertain oral arguments on the case Missouri, et al. v. Joseph R. Biden, Jr., et al. The integrity of the First Amendment hinges on the decision. Do we have freedom of speech as set forth in the Constitution? Or is it conditional on how government officials feel about some set of circumstances? At issue specifically is the government’s conduct in coercing social media companies to censor opinion in order to suppress so-called “vaccine hesitancy” and to manipulate public debate in the 2020 election. Government lawyers have argued that they were merely “communicating” with Twitter, Facebook, Google, and others about “public health disinformation and election conspiracies.”

You can reasonably suppose that this was our government’s effort to disable the truth, especially as it conflicted with its own policy and activities — from supporting BLM riots to enabling election fraud to mandating dubious vaccines. Former employees of the FBI and the CIA were directly implanted in social media companies to oversee the carrying-out of censorship orders from their old headquarters. The former general counsel (top lawyer) for the FBI, James Baker, slid unnoticed into the general counsel seat at Twitter until Elon Musk bought the company late in 2022 and flushed him out. The so-called Twitter Files uncovered by indy reporters Matt Taibbi, Michael Shellenberger, and others, produced reams of emails from FBI officials nagging Twitter execs to de-platform people and bury their dissent. You can be sure these were threats, not mere suggestions.

One of the plaintiffs joined to Missouri v. Biden is Dr. Martin Kulldorff, a biostatistician and professor at the Harvard Medical School, who opposed Covid-19 lockdowns and vaccine mandates. He was one of the authors of the open letter called The Great Barrington Declaration (October, 2020) that articulated informed medical dissent for a bamboozled public. He was fired from his job at Harvard just this past week for continuing his refusal to take the vaccine. Harvard remains among a handful of institutions that still require it, despite massive evidence that it is ineffective and hazardous. Like West Point, maybe Harvard should ditch its motto, Veritas, Latin for “truth.”

A society hostile to truth can’t possibly remain civilized, because it will also be hostile to reality. That appears to be the disposition of the people running things in the USA these days. The problem, of course, is that this is not a reality-optional world, despite the wishes of many Americans (and other peoples of Western Civ) who wish it would be.

Next up for us will be “Joe Biden’s” attempt to complete the bankruptcy of our country with $7.3-trillion proposed budget, 20 percent over the previous years spending, based on a $5-billion tax increase. Good luck making that work. New York City alone is faced with paying $387 a day for food and shelter for each of an estimated 64,800 illegal immigrants, which amounts to $9.15-billion a year. The money doesn’t exist, of course. New York can thank “Joe Biden’s” executive agencies for sticking them with this unbearable burden. It will be the end of New York City. There will be no money left for public services or cultural institutions. That’s the reality and that’s the truth.

A financial crack-up is probably the only thing short of all-out war that will get the public’s attention at this point. I wouldn’t be at all surprised if it happened next week. Historians of the future, stir-frying crickets and fiddleheads over their campfires will marvel at America’s terminal act of gluttony: managing to eat itself alive.

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

International

The millions of people not looking for work in the UK may be prioritising education, health and freedom

Economic inactivity is not always the worst option.

Around one in five British people of working age (16-64) are now outside the labour market. Neither in work nor looking for work, they are officially labelled as “economically inactive”.

Some of those 9.2 million people are in education, with many students not active in the labour market because they are studying full-time. Others are older workers who have chosen to take early retirement.

But that still leaves a large number who are not part of the labour market because they are unable to work. And one key driver of economic inactivity in recent years has been illness.

This increase in economic inactivity – which has grown since before the pandemic – is not just harming the economy, but also indicative of a deeper health crisis.

For those suffering ill health, there are real constraints on access to work. People with health-limiting conditions cannot just slot into jobs that are available. They need help to address the illnesses they have, and to re-engage with work through organisations offering supportive and healthy work environments.

And for other groups, such as stay-at-home parents, businesses need to offer flexible work arrangements and subsidised childcare to support the transition from economic inactivity into work.

The government has a role to play too. Most obviously, it could increase investment in the NHS. Rising levels of poor health are linked to years of under-investment in the health sector and economic inactivity will not be tackled without more funding.

Carrots and sticks

For the time being though, the UK government appears to prefer an approach which mixes carrots and sticks. In the March 2024 budget, for example, the chancellor cut national insurance by 2p as a way of “making work pay”.

But it is unclear whether small tax changes like this will have any effect on attracting the economically inactive back into work.

Jeremy Hunt also extended free childcare. But again, questions remain over whether this is sufficient to remove barriers to work for those with parental responsibilities. The high cost and lack of availability of childcare remain key weaknesses in the UK economy.

The benefit system meanwhile has been designed to push people into work. Benefits in the UK remain relatively ungenerous and hard to access compared with other rich countries. But labour shortages won’t be solved by simply forcing the economically inactive into work, because not all of them are ready or able to comply.

It is also worth noting that work itself may be a cause of bad health. The notion of “bad work” – work that does not pay enough and is unrewarding in other ways – can lead to economic inactivity.

There is also evidence that as work has become more intensive over recent decades, for some people, work itself has become a health risk.

The pandemic showed us how certain groups of workers (including so-called “essential workers”) suffered more ill health due to their greater exposure to COVID. But there are broader trends towards lower quality work that predate the pandemic, and these trends suggest improving job quality is an important step towards tackling the underlying causes of economic inactivity.

Freedom

Another big section of the economically active population who cannot be ignored are those who have retired early and deliberately left the labour market behind. These are people who want and value – and crucially, can afford – a life without work.

Here, the effects of the pandemic can be seen again. During those years of lockdowns, furlough and remote working, many of us reassessed our relationship with our jobs. Changed attitudes towards work among some (mostly older) workers can explain why they are no longer in the labour market and why they may be unresponsive to job offers of any kind.

And maybe it is from this viewpoint that we should ultimately be looking at economic inactivity – that it is actually a sign of progress. That it represents a move towards freedom from the drudgery of work and the ability of some people to live as they wish.

There are utopian visions of the future, for example, which suggest that individual and collective freedom could be dramatically increased by paying people a universal basic income.

In the meantime, for plenty of working age people, economic inactivity is a direct result of ill health and sickness. So it may be that the levels of economic inactivity right now merely show how far we are from being a society which actually supports its citizens’ wellbeing.

David Spencer has received funding from the ESRC.

uk pandemic-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex