Uncategorized

JPM CEO Says “System Is Very, Very Sound” After Second Largest US Bank Failure In History

JPM CEO Says "System Is Very, Very Sound" After Second Largest US Bank Failure In History

Update (0835ET): After another massive bank failure…

Update (0835ET): After another massive bank failure - and taxpayer-funded bailout - JPMorgan CEO Jamie Dimon told listeners on an investor call this morning that "The system is very, very sound."

Doesn't seem like it Jamie, old chap?

But hey, whatever you say now as the CEO of a bank that holds over 10% of America's deposits.

"We need large, successful banks in the largest economy," Dimon continued, proclaiming that "this is nothing like '08 or '09."

Well he is right, in so much as this is far larger... and we really don't know where the CRE holes on bank balance sheets are (even as Charlie Munger warns they are everywhere).

The good news, Dimon declares regarding bank failures, "this is getting near the end of it." Thought how he would know that is hard to comprehend?

Finally, the too-biggest-to-fail bank CEO warned, "we are clearly gong to see some reduction in bank lending," implying JPMorgan will be doing "God's work" for The Fed by contracting credit without the need for rate-hikes.

For now, it's clear what the market thinks of JPM's state-sponsored buyout of FRC assets...

* * *

Heading into the weekend, US regulators were facing a dilemma over the fate of First Republic Bank: either let the insolvent California bank fail and bail-in some (or all) of the $30 billion in uninsured rescue deposits given to the bank by a consortium of banks including JPMorgan, BofA, Goldman and others so as not to appear like the Biden admin is bailing-out big, bad banks again a la 2008, but in the process restarting the bank run panic as an impairment of all bank depositors would reverse Janet Yellen's vow not to do just that in the aftermath of the SVB collapse, or bail out FRC including all of its depositors, both retail and institutional, insured and uninsured, and spark a fresh political crisis where republicans accuse democrats of rescuing Jamie Dimon and his banker pals.

In the end, early on Monday morning, the US unveiled a hybrid solution - after all other attempts at a private rescue effort failed - one where the FDIC would seize the insolvent First Republic, the 14th largest US bank by assets, making it the second biggest bank failure in US history, and immediately sell the bulk of its assets and all of its deposits to JPMorgan after a sham but "highly competitive bidding process" had taken place over the weekend (one in which virtually nobody wanted to participate as nobody would buy FRC without explicit government backstops, which in the end is precisely what they ended up getting on FRC's IO and CRE loan portfolio) while keeping FRC's toxic Interest-only mortgages to Hamptons' billionaires.

According to the FDIC announcement, JPMorgan would assume all of First Republic’s $92 billion in deposits — insured and uninsured, including the $5 billion in deposits gived by JPM to First Republic on March 16. It is also buying most of the bank’s assets, including about $173 billion in loans and $30 billion in securities.

As part of the agreement, the Federal Deposit Insurance Corp. will share losses with JPMorgan on First Republic’s loans. The agency estimated that its insurance fund would take a hit of $13 billion in the deal, which is precisely the hole that prevented a private sector solution from being reached. JPMorgan also said it would receive $50 billion in financing from the FDIC to consummate the deal.

More importantly, the FDIC and JPMorgan also entered into a "loss-share transaction on single family, residential and commercial loans it purchased of the former First Republic Bank." As part of this transaction, the FDIC as receiver and JPMorgan will share in the losses and potential recoveries on the loans covered by the loss-share agreement.

The loss-share transaction, the FDIC said, is projected to maximize recoveries on the assets by keeping them in the private sector, and "is also expected to minimize disruptions for loan customers. In addition, JPMorgan Chase Bank, National Association, will assume all Qualified Financial Contracts."

The second largest US bank failure in history become a fact after the San Francisco-based First Republic lost $100 billion in deposits in a March run following the collapse of fellow Bay Area lender Silicon Valley Bank, a testament to the catastrophic supervision of the Mary Daly-led San Fran Fed, which was more worried about rainbow flags and DEI than making sure banks in its regions were, you know, solvent. It limped along for weeks after a group of America’s biggest banks came to its rescue with a $30 billion deposit. Those deposits will be repaid after the deal closes, JPMorgan said.

And with the collapse of FRC, three of the four largest-ever U.S. bank failures have occurred in the past two months. First Republic, with some $233 billion in assets at the end of the first quarter, ranks just behind the 2008 collapse of Washington Mutual. Rounding out the top four are Silicon Valley Bank and Signature Bank, a New York-based lender that also failed in March.

Meanwhile, just as we said a month ago when we joked that the regional bank crisis is meant to make JPM even bigger and more systematically important than ever, as it pays just 0.01% on its deposits as it remains the only truly "safe" bank for US depositors, in effect collecting a $90 billion annual subsidy courtesy of its TBTF status...

JPM's "Too Biggest To Never Fail" subsidy: if it paid 4% on its $2.3 trillion in deposits, it would pay out $90BN per year. Instead it pays nothing to fund its assets thanks to 0.01% deposit rates pic.twitter.com/w7D4oCZ2HN

— zerohedge (@zerohedge) April 25, 2023

... both First Republic and Washington Mutual are now substantially owned by JPMorgan. The nation’s largest bank, it has been known to step in during banking crises. Chief Executive Officer Jamie Dimon was pivotal in earlier efforts to rescue First Republic.

“Our government invited us and others to step up, and we did,” Dimon said Monday.

Following the transaction, First Republic’s 84 branches will reopen as part of JPMorgan Monday during normal business hours, and customers will have full access to their deposits, the FDIC said.

As the WSJ notes, First Republic’s failure seems unlikely to spur another crisis of confidence in the Main Street lenders that serve a large chunk of America’s businesses and consumers. Regional lenders uniformly lost deposits during the first quarter, but the declines were modest compared with First Republic’s $100 billion outflow.

“This is the last stages of that initial panic. First Republic’s problems started as a result of SVB and Signature,” said Steven Kelly, a senior researcher at the Yale Program on Financial Stability. “This isn’t the story of 2008, where one bank went down and investors focused on the next biggest bank, which would wobble.”

Actually, it is, because only now does the solvency crisis courtesy of trillions in commercial real estate on bank books start to manifest itself, as we also warned it will. But it will take a while for that to trickle down to the rest of the population.

As for the immediate cause of First Republic’s collapse, just like in the case of Silicon Valley Bank, was a smartphone-enabled exodus of panicked depositors with big uninsured balances, but the bank’s problems were rooted in a wrong-way bet on interest rates. A focus on America’s coastal elite helped First Republic become one of the most valuable U.S. banking franchises. Big deposits from customers with lots of cash funded low-rate jumbo mortgages to wealthy home buyers in both California and New York. Ultralow interest rates and a pandemic savings boom supercharged the bank’s growth.

When the Fed began raising interest rates last year to cool inflation, customers began demanding higher yields to keep their money at First Republic. Rising rates also dented the value of loans the bank made when rates were near zero.

The chronic problem turned into an acute one in March, when the collapse of Silicon Valley Bank sparked fears about the overlooked risks lurking in the banking system. Investors and customers were especially worried about banks, such as First Republic, that relied heavily on uninsured deposits and had large unrealized losses in their loan and securities portfolios due to rising rates.

“It was a run on the business model,” Kelly said.

First Republic’s badly damaged balance sheet left it with few good options. In a dismal quarterly-earnings report last week, the bank disclosed the extent of the deposit run and said it had filled the hole on its balance sheet with expensive loans from the Federal Reserve and Federal Home Loan Bank. An untenable future, in which it earned less on its loans than it paid on liabilities, appeared all but certain. The earnings report sent the bank’s stock down nearly 50% in one day. First Republic shares ended the week at $3.51. They closed at $115 on March 8, the day before SVB’s disastrous run. They traded around $1.9 in the premarket following news of the FDIC seizure which effectively wipes out the equity.

As the WSJ notes, while some employees started jumping ship after SVB’s collapse, many stayed and watched the bank’s stock crater last week and frantically texted friends about how they feared the bank would go under soon. Some said they wished management had provided clearer communication about where the bank was headed.

Business had grown quieter since the banking turmoil started, current and former employees said. First Republic bankers who previously focused on luring in deposits found there was little they could do to reverse the tide when customers started pulling cash. Pay took a hit too: Bankers were compensated in part by how much in customer deposits they brought to the bank.

In a pair of emails late Friday and Saturday morning, CEO Michael Roffler and Executive Chairman Jim Herbert thanked First Republic employees for staying focused during the turmoil.

“Throughout our history and in these past weeks, we have done what we always do—serve our clients, support our communities, and take care of one another,” Roffler wrote. “When we come in next week, we will continue to do the same.”

Hoping that the bank crisis is over now that First Republic has been tucked away, the US Treasury issued a statement on Monday morning after the deal was announced, saying that the US banking system remains sound, resilient, and with the ability “to fulfill its essential function of providing credit to businesses and families."

The good news is that we will very soon test just how resilient the banking system is after the full extent of the CRE crisis become evident over the coming year.

As for the biggest winner from the FRC bank failure and the regional banking crisis in general, it should be quite clear to all who that is by now.

In a presentation published by JPMorgan laying out the transaction details, the bank explained just how it would clean up the various odds and ends from the failed March rescue: it will repay $25B of deposits from large U.S. banks and eliminate a $5B deposit from JPMorgan Chase on consolidation. It will also make a $10.6 billion payment to the FDIC, while the FDIC will provide a new $50B five-year fixed-rate term financing which will take the place of FRC's existing deposits.

Additionally, as noted above, the FDIC will provide loss share agreements with respect to most acquired loans: Single family residential mortgages: 80% loss coverage for seven years; Commercial loans, including CRE: 80% loss coverage for five years.

JPM also disclosed that it would take a one-time gain of $2.6B post-tax at closing, not including expected restructuring costs of $2.0B over the course of 2023 and 2024; and perhaps more importantly the fair value marks on acquired loans is ~$22B, with an average loan mark of 87%, while the FDIC's loss sharing deal reduces risk weighting on covered loans, with an average risk weighting of ~25%.

As for the deal rationale, well... JPM didn't have to include this slide - after all the rationale was all about taxpayers getting stuck with FRC's toxic sludge while JPM getting all the good assets at pennies on the dollar - but it did anyway, so here you are: 20% IRR courtesy of taxpayers.

Finally, all of FRC's high net worth clients in California and New York now belong to JPM.

For those wondering, this is the reason why one month ago we changed JPMorgan's name to JPMega.

The full JPM First Republic integration slideshow is below (pdf link).

Uncategorized

One city held a mass passport-getting event

A New Orleans congressman organized a way for people to apply for their passports en masse.

While the number of Americans who do not have a passport has dropped steadily from more than 80% in 1990 to just over 50% now, a lack of knowledge around passport requirements still keeps a significant portion of the population away from international travel.

Over the four years that passed since the start of covid-19, passport offices have also been dealing with significant backlog due to the high numbers of people who were looking to get a passport post-pandemic.

Related: Here is why it is (still) taking forever to get a passport

To deal with these concurrent issues, the U.S. State Department recently held a mass passport-getting event in the city of New Orleans. Called the "Passport Acceptance Event," the gathering was held at a local auditorium and invited residents of Louisiana’s 2nd Congressional District to complete a passport application on-site with the help of staff and government workers.

'Come apply for your passport, no appointment is required'

"Hey #LA02," Rep. Troy A. Carter Sr. (D-LA), whose office co-hosted the event alongside the city of New Orleans, wrote to his followers on Instagram (META) . "My office is providing passport services at our #PassportAcceptance event. Come apply for your passport, no appointment is required."

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The event was held on March 14 from 10 a.m. to 1 p.m. While it was designed for those who are already eligible for U.S. citizenship rather than as a way to help non-citizens with immigration questions, it helped those completing the application for the first time fill out forms and make sure they have the photographs and identity documents they need. The passport offices in New Orleans where one would normally have to bring already-completed forms have also been dealing with lines and would require one to book spots weeks in advance.

These are the countries with the highest-ranking passports in 2024

According to Carter Sr.'s communications team, those who submitted their passport application at the event also received expedited processing of two to three weeks (according to the State Department's website, times for regular processing are currently six to eight weeks).

While Carter Sr.'s office has not released the numbers of people who applied for a passport on March 14, photos from the event show that many took advantage of the opportunity to apply for a passport in a group setting and get expedited processing.

Every couple of months, a new ranking agency puts together a list of the most and least powerful passports in the world based on factors such as visa-free travel and opportunities for cross-border business.

In January, global citizenship and financial advisory firm Arton Capital identified United Arab Emirates as having the most powerful passport in 2024. While the United States topped the list of one such ranking in 2014, worsening relations with a number of countries as well as stricter immigration rules even as other countries have taken strides to create opportunities for investors and digital nomads caused the American passport to slip in recent years.

A UAE passport grants holders visa-free or visa-on-arrival access to 180 of the world’s 198 countries (this calculation includes disputed territories such as Kosovo and Western Sahara) while Americans currently have the same access to 151 countries.

stocks pandemic covid-19 grantsUncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

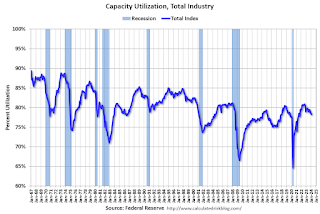

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex