International

It’s time to rethink the physician-pharma relationship

The traditional sales channel for the pharmaceutical industry has centered on face-to-face interaction with its core target audience

The post It’s time to rethink the physician-pharma relationship appeared first on .

The traditional sales channel for the pharmaceutical industry has centered on face-to-face interaction with its core target audience – prescribing physicians. What happens when suddenly that form of interaction is taken away? Michael Brandreth, group vice president at WebMD Global, tells us how the events of the last 18 months make it more important than ever for pharma to reimagine how to reach its base in a new, more holistic way.

Physicians’ time has become a valuable commodity due to the pandemic. Brandreth says some, but not all, pharma marketers recognise there’s been a shift in how its audience wants to engage with the industry.

“Physicians are incredibly time poor because they have such a challenging work environment. When they do engage with the pharmaceutical industry, they increasingly want to do it on their own terms,” says Brandreth.

Indeed, the number of physicians seeking clinical information from independent websites is growing. According to a recent Medscape survey of over 5,500 physicians in the EU found 86% had increased their consumption of medical content online during the pandemic.

• Read the full article in pharmaphorum’s Deep Dive digital magazine

The post It’s time to rethink the physician-pharma relationship appeared first on .

eu pandemicInternational

Disney remote jobs: the most magical WFH careers on earth?

Disney employs hundreds of thousands of employees at its theme parks and elsewhere, but the entertainment giant also offers opportunities for remote w…

The Walt Disney Co. (DIS) is a major entertainment and media company that operates amusement parks, produces movies and television shows, airs news and sports programs, and sells Mickey Mouse and Star Wars merchandise at its retail stores across the U.S.

While most of the jobs at the multinational entertainment conglomerate require working with people — such as at its theme parks, film-production facilities, cruise ships, or corporate offices — there are also opportunities for remote work at Disney. And while remote typically means working from home, with Disney, it could also mean working in a non-corporate office and being able to move from one location to another and conduct business outside normal working hours.

Related: Target remote jobs: What type of work and how much does it pay?

What remote jobs are available at Disney?

Many companies, including Disney, have called employees to return to the office for work in the wake of the COVID-19 pandemic, and the bulk of the company’s positions are forward-facing, meaning they involve meeting with clients and customers on a regular basis.

Still, there are some jobs at the “most magical company on earth” that are listed as remote and don’t require frequent in-person interaction with people, including opportunities in data entry and sales.

On Disney’s career website, there are limited positions available where the work is completely remote. One listing, for example, is for a “graphics interface coordinator covering sporting events.” This role involves working on nights, weekends, and holidays — times when corporate offices tend to be closed — and it may make sense for the company to hire people who can work from home or to travel and work in a location separate from the game venue.

Some of the senior roles that are shown on the website involve managers who can oversee remote teams, whether that be in sales or data. Sometimes, a supervisor overseeing staff who work outside corporate offices may be responsible for hiring freelancers who work remotely.

On the employment website Indeed, there are limited positions listed. A job listing for a manager in enterprise underwriting for a federal credit union indicates weekend duty, working outside of an 8 a.m. to 5 p.m. schedule, and being able to work in different locations. The listed annual salary range of $84,960 to $132,000, though, is well above the national annual average of around $50,000.

Internationally, Disney offers remote work in India, largely in the field of software development for its India-based streaming platform, Disney+ Hotstar.

The company also offers some hybrid schemes, which involve a mixture of in-office and remote work. For a mid-level animator position based in San Francisco, the role would involve being in the office and working from home occasionally.

How much do remote jobs at Disney pay?

Pay for remote jobs at Disney varies significantly based on location. A salary for a freelance artist in New York City, for example, may be higher than for the same job in Orlando, Florida.

Disney lists actual salary ranges in some of its job postings. For example, the yearly pay for a California-based compensation manager who works with clients is $129,000 to $165,000.

In an online search for “remote jobs at Disney,” results range from $30 to $39 an hour, for data entry, or $28.50 to $38 an hour for social media customer support.

How can I apply for remote jobs at Disney?

You can look for remote jobs on Disney's career site, and type “remote” in the search field. Listings may also appear on career-data websites, including Indeed and Glassdoor.

How many employees does Disney have?

In 2023, Disney employed about 225,000 people globally, of which around 77% were full-time, 16% part-time, and 7% seasonal. The majority of the workers, around 167,000, were in the U.S.

Disney says that a significant number of its employees, including many of those who work at its theme parks, along with most writers, directors, actors, and production personnel, belong to unions. It’s not immediately known how many remote workers at the company, if any, are union members.

india pandemic covid-19International

The Digest #194

Poor Charlie’s Almanack, Ben Graham, GAAP accounting, John Templeton, AI dystopia, Inflation, Bloomstran on Berkshire, Intuitive Surgical, The lessons…

Poor Charlie’s Almanack

Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger was first published in 2005 as a “coffee table” style book. It was beautifully presented but came with a high price tag. It was also heavy, somewhat unwieldy to read, and not very portable. The book’s format and price probably limited its reach.

Stripe Press published a new edition of the book shortly after Mr. Munger died last year at the age of ninety-nine. Amazon and other vendors instantly sold all available inventory. After waiting for three months, I finally received my copy last week.

Peter Kaufman is the editor of all editions of the book and I suspect that his main goal two decades ago was to honor Charlie Munger’s wisdom in a format that was not expected to “go viral.” In 2005, Charlie Munger was well known in the Berkshire Hathaway shareholder community and in the value investing world, but he was not as prominent as he became during his final decade. The clear purpose of the new edition is to disseminate his ideas as widely as possible.

The new edition is abridged to reduce repetitive content and I will withhold judgment about the wisdom of this abridgment until I finish reading the book. Since the heart of the book is comprised of speeches given by Charlie Munger, there are definitely cases where the same ideas are presented again and again.

Great books can be read many times while remaining highly relevant. I found this to be the case when I reread Charlie Munger’s Harvard School commencement address delivered in June 1986 when his youngest son was among the graduates. In the speech, Mr. Munger “inverts” the typical advice delivered in such speeches by explaining how the graduates should go about guaranteeing a life of failure and misery through time-tested strategies such as ingesting drugs and indulging in envy and resentment.

I am not sure how many graduates were convinced by Charlie Munger on that early summer day, but I suspect that most of them remember the speech because it was so unconventional. In contrast, I have no recollection of the commencement addresses when I graduated from high school or college, or even who the speaker was.

Articles

A Memorial for Charlie Munger by John Harvey Taylor, March 12, 2024. This is a brief account of a recent memorial service for Charlie Munger at Harvard-Westlake School. “We learned Sunday that someone once asked if he knew how to play the piano. ‘I don’t know,’ he said. ‘I’ve never tried.’ Yet he tried and finished so much in his century. Imagine what he is making of eternity.” (Episcopal Diocese of Los Angeles)

Benjamin Graham: Big Moments on the Way to Big Earnings, March 2024. Ben Graham’s granddaughter reflects on the challenges Graham experienced when he applied for college. “Most graduating seniors make their college plans in advance, but Ben Graham had no money for tuition. All through the long days of arduous farm labor, my grandfather dreamed of winning a Pulitzer Scholarship.” (Beyond Ben Graham)

Graham’s “Unpopular Large Caps” Part 2: Thoughts on Diversification by John Huber, March 19, 2024. “I would segment these ideas into two groups: core operating investments and bargain assets. In the former, you want to be very selective in picking a relatively small number of companies you intend to own for the long term. In the latter, you’d want to think like the insurance underwriter, buying as many as you can to ensure that the law of large numbers is on your side.” (Base Hit Investing)

Warren Buffett Minds the GAAP by Donald E. Graham, March 13, 2024. “I have a challenge for the FASB and the SEC: If you believe today’s accounting rules present a clearer picture of Berkshire’s results, put it to a test. Ask Berkshire’s shareholders if they prefer the present method of reporting earnings over the status quo ante. I don’t believe a single informed shareholder would say so. The rule is confusing and uninformative.” (WSJ)

- Berkshire Hathaway’s Distorted Quarterly Results, August 7, 2022. “Berkshire’s net income figure has been totally useless for analytical purposes since 2018. This is true on an annual basis and even more true on a quarterly basis.” (The Rational Walk)

Sir John Templeton: The Gentleman Bargain Hunter by Kingswell, March 12, 2024. “Templeton, who passed away in 2008, arrived on the investing scene with a series of uber-profitable contrarian bets in the early days of World War II — and continued to outwit Mr. Market with maddening consistency for the next several decades.” (Kingswell)

They Praised AI at SXSW—and the Audience Started Booing by Ted Gioia, March 19, 2024. Many recent innovations seem to have a dystopian aura. Apparently, this sentiment is not restricted to the usual luddites (old men shouting at clouds) but is shared by some of the attendees of SXSW. What seems cool to tech bros in Silicon Valley might not seem so cool to those outside tech culture. (The Honest Broker)

We Still Don’t Believe How Much Things Cost by Rachel Wolfe and Rachel Louise Ensign, March 12, 2024. People tend to focus on the aggregate amount of inflation over the past few years and interpreted transitory to mean that price spikes would reverse. Of course, politicians and economists only meant that the rate of inflation would decrease, not that prices would ever return to pre-pandemic levels. (WSJ)

My 2023 Apple Report Card by John Gruber, March 18, 2024. A solid report card overall from a widely read technology blog. (Daring Fireball)

Podcasts

Christopher Bloomstran on Buffett, Berkshire, Munger, and China, March 19, 2024. 1 hour, 1 minute. Video. Also be sure to check out the latest Semper Augustus client letter which has a lengthy section on Berkshire Hathaway. (Value After Hours)

Renaissance Technologies, March 18, 2024. 3 hours, 10 minutes. Notes. “Renaissance Technologies is the best performing investment firm of all time. And yet no one at RenTec would consider themselves an ‘investor’, at least in any traditional sense of the word. It’d rather be more accurate to call them scientists — scientists who’ve discovered a system of math, computers and artificial intelligence that has evolved into the greatest money making machine the world has ever seen.” (Acquired)

- Review of The Man Who Solved the Market, December 28, 2019 (Rational Walk)

Intuitive Surgical: Robotic Precision, March 20, 2024. 1 hour, 6 minutes. Transcript. “Intuitive creates robotic products to assist minimally invasive surgeries. Its Da Vinci system is a pioneer in this area as it increases the efficiency & accuracy of surgery and reduces the burden on the surgeons themselves.” (Business Breakdowns)

The Lessons of History (Will & Ariel Durant), March 18, 2023. 53 minutes. Notes. “In every age men have been dishonest and governments have been corrupt.” (Founders)

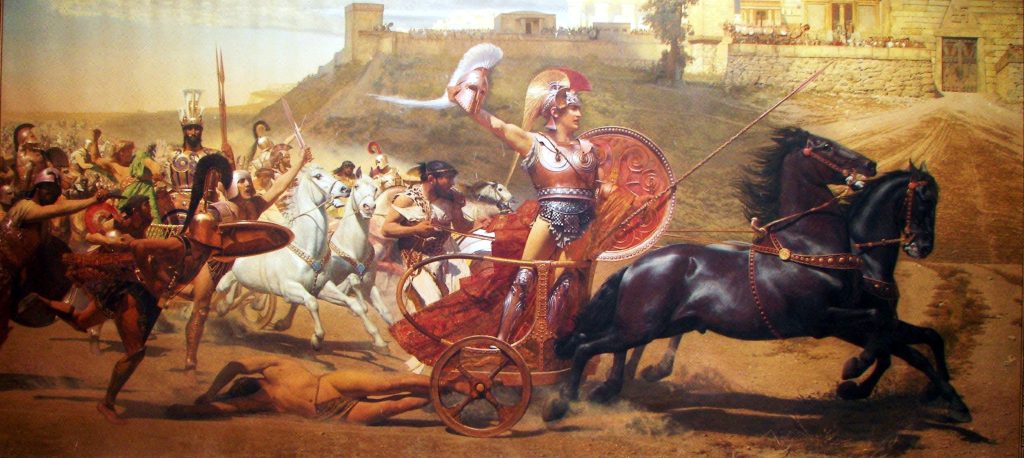

A Classicist Believes that Homer Directly Dictated the Iliad, and Was Also an Excellent Horseman, March 14, 2024. 53 minutes. “The Iliad is the world’s greatest epic poem—heroic battle and divine fate set against the Trojan War. Its beauty and profound bleakness are intensely moving, but great questions remain: Where, how, and when was it composed and why does it endure?” (History Unplugged)

Triumph of Achilles

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

china pandemicInternational

Major airline learns its Chapter 11 bankruptcy fate

The airline industry has suffered since the covid pandemic changed how and when people travel.

The covid pandemic dealt multiple blows to the airline industry. The first hit was simply that air travel largely went away for over a year, and international travel was hit even harder.

Airlines were barely flying and the planes that did take off had very few passengers. That did not mean that expenses stopped. Airlines still had to pay their employees and keep their fleet in working order.

Popular clothing retailer shuts down all its stores unexpectedly

Related: Popular clothing retailer shuts down all its stores unexpectedly

Basically, it was a period where a lot of money went out, but very little came in. That led to many airlines increasing their debt load at high interest rates while they put off every possible expense.

The second hit came when the impact of the pandemic gradually receded. People had learned that some travel that once seemed essential maybe wasn't.

A lot of companies cut back on business travel while international routes were slower to come back in any way. Losing business travelers who often paid for seats in Business or First Class robbed airlines — companies that desperately needed cash — of some of their best customers.

It's not that people no longer fly, but some in-person trips have become Zoom meetings, and many companies have cut back on trade shows, in-person meetings, and other events.

That situation has hit some airlines harder than others. It pushed one leading global airline into bankruptcy and the company has just learned whether U.S. courts have successfully approved its Chapter 11 filing.

Image source: Shutterstock

SAS shared its Chapter 11 bankruptcy process

While many Americans don't know Scandinavian Airline SAS, it's a major global carrier. The company shared its mission on its website.

"Aviation is a vital part of Scandinavian infrastructure. We maintain the highest frequency of departures to and from Scandinavia and connect smaller regional airports with larger hubs. As part of Star Alliance, we fly our customers to 1300 destinations worldwide."

SAS does fly to a number of U.S. destinations, and its Chapter 11 bankruptcy was filed in an American court.

"The chapter 11 process is a legal process conducted under the supervision of the U.S. federal court system, which many large international airlines based outside of the U.S. have successfully used over the years to reduce their costs and complete financial restructurings," the company shared on its website.

It has been a long bankruptcy process as SAS first filed in July of 2022. The company has tried to reassure passengers and potential passengers that it had the money needed to keep operating.

"SAS’ operations and flight schedule are unaffected by the chapter 11 filing, and SAS will continue to serve its customers as normal. Importantly, we expect to have sufficient liquidity to support our business and meet our obligations going forward. SAS has obtained $700 million in Debtor-in-Possession (DIP) financing which provides SAS with a strong financial position to fund our operations throughout our restructuring process in the U.S.," the airline added.

SAS gets a Chapter 11 answer

SAS has received approval from U.S. Bankruptcy Judge Michael Wiles of the New York Bankruptcy Court to move forward with a plan that gives it $1.2 billion in new funding from a group that included the Danish government.

"The winning bidder consortium consists of Castlelake, L.P., onbehalf of certain funds or affiliates, Air France-KLM S.A., and Lind Invest ApS, together with the Danish state," the airline shared on its website.

Junior creditors will receive a mix of credit and equity, totaling $350 million. SAS did not share how much of what the company originally owed was not repaid.

“The investment agreement that was approved by the court today is a key milestone in our SAS Forward plan, and it shows that our new investors believe in SAS and our potential to remain at the forefront of the airline industry for years to come" CEO Anko van der Werff shared.

"The restructuring will result in the cancellation of SAS equity, with no payments to existing shareholders," Reuters reported.

bankruptcy pandemic interest rates france-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex