Government

It’s Time To Drop The Hysteria And Learn To Live With COVID

It’s Time To Drop The Hysteria And Learn To Live With COVID

Authored by Bruce Pardy via The Epoch Times,

For most people, Omicron is a highly contagious cold. Lots will catch it, and most will get sniffles and a sore throat. Yes, even…

Authored by Bruce Pardy via The Epoch Times,

For most people, Omicron is a highly contagious cold. Lots will catch it, and most will get sniffles and a sore throat. Yes, even with Omicron, as with the flu, some people will get seriously ill, and a few will die. Masking, social distancing, capacity limits, lockdowns, curfews, and “vaccines” are not stopping the spread. People who dodge Omicron this time will face the next variant, or the one after that. Like other respiratory viruses in circulation, COVID-19 is here to stay.

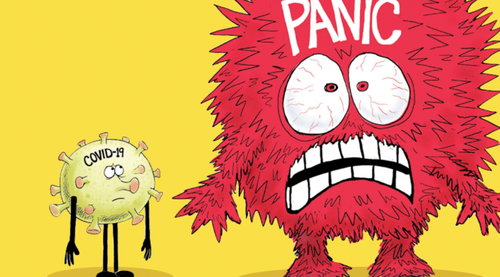

Therefore, COVID is done. Either mild Omicron is the end of COVID madness, or there is no off-ramp.

The panic-demic must finish or we will be doing this forever.

For the past 23 months, the real pandemic has not been COVID but anxiety. According to Mattias Desmet, professor of clinical psychology at Ghent University in Belgium, the COVID crisis is a product of “mass formation,” a collective psychosis that can occur when a significant portion of the population develops an irrational fixation on an external cause. Mass formation is most likely to occur, Desmet says, when a critical mass of people suffers from a lack of social bonds, a lack of meaning in their lives, free-floating anxiety that has no specific source or cause, and free-floating frustration and aggression not directed at a particular target.

The virus may have made people anxious, but it was more the other way around. Those already afraid, disconnected, and adrift in their lives were more susceptible to media messaging that portrayed COVID as a bigger threat than it really was. The virus offered an external phenomenon on which to focus their distress. It gave purpose to fear. Masks, lockdowns, social distancing, and vaccine mandates provided the illusion of control and a justification for imposing the burden of their anxiety on others. For some, hiding behind masks, staying home, working online, and being isolated gave respite from social interactions that they found uncomfortable anyway.

COVID is a righteous platform from which to rage against non-conformists. COVID cranks cheer when small businesses are shut, workers dismissed, university students ousted, and schools closed, all to assuage their anxiety. The country was never “in this together.” As Aldous Huxley wrote, “The surest way to work up a crusade in favor of some good cause is to promise people they will have a chance of maltreating someone. To be able to destroy with good conscience, to be able to behave badly and call your bad behavior ‘righteous indignation’ — this is the height of psychological luxury, the most delicious of moral treats.”

COVIDians who feel threatened by the end of the cause for which they have lived these past two years will clamour for more and harsher restrictions. In Canada, the game is still on. Quebec imposed new curfews. Ontario throttled down on widespread testing but then lurched back into partial lockdown and closed its schools again. Booster campaigns are in full swing and “the pandemic of the unvaccinated” rhetoric continues. Prime Minister Justin Trudeau even suggested during last fall’s election campaign that the unvaxxed are racists and misogynists who should not be tolerated.

And yet, signs of the Great Backtrack are slowly emerging.

In the United States, the CDC has put the kybosh on PCR tests, while the Biden administration has admitted that there is no federal solution to COVID. In some states, stadiums are still full, and there are no masking requirements or vaccine mandates. Perceptive pundits, formerly in solidarity with the COVID regime, are delicately heading for the exit, trying not to be the last one in the room when the music stops.

In some jurisdictions such as Ontario, the vaccinated have been catching Omicron at a higher rate per capita than the unvaxxed. For those who judge themselves to be at low risk from the virus, why expose yourself to disputed side effects from a therapy not yet fully tested? People should have the right to make their own medical choices. After being suspended, dismissed, ousted, banished, and demonized, the unvaccinated have defended that right the hard way. They are not likely to give it up now.

COVID rules, say some apostles, protect the right to be kept safe from respiratory viruses. But no such right exists. If it did, lockdowns would be the established practice against colds, flu, and the many other respiratory viruses in circulation.

Society would have come to a screeching halt long before now. Viruses are part of human existence. If you’re sick, stay home. Remember when we used to just say that? People who are susceptible to COVID, even to Omicron, should keep themselves safe as best they can. The rest of humanity must get on with their lives.

As a health crisis, COVID is over. The hysteria, however, will be more stubborn.

International

Copper Soars, Iron Ore Tumbles As Goldman Says “Copper’s Time Is Now”

Copper Soars, Iron Ore Tumbles As Goldman Says "Copper’s Time Is Now"

After languishing for the past two years in a tight range despite recurring…

After languishing for the past two years in a tight range despite recurring speculation about declining global supply, copper has finally broken out, surging to the highest price in the past year, just shy of $9,000 a ton as supply cuts hit the market; At the same time the price of the world's "other" most important mined commodity has diverged, as iron ore has tumbled amid growing demand headwinds out of China's comatose housing sector where not even ghost cities are being built any more.

Copper surged almost 5% this week, ending a months-long spell of inertia, as investors focused on risks to supply at various global mines and smelters. As Bloomberg adds, traders also warmed to the idea that the worst of a global downturn is in the past, particularly for metals like copper that are increasingly used in electric vehicles and renewables.

Yet the commodity crash of recent years is hardly over, as signs of the headwinds in traditional industrial sectors are still all too obvious in the iron ore market, where futures fell below $100 a ton for the first time in seven months on Friday as investors bet that China’s years-long property crisis will run through 2024, keeping a lid on demand.

Indeed, while the mood surrounding copper has turned almost euphoric, sentiment on iron ore has soured since the conclusion of the latest National People’s Congress in Beijing, where the CCP set a 5% goal for economic growth, but offered few new measures that would boost infrastructure or other construction-intensive sectors.

As a result, the main steelmaking ingredient has shed more than 30% since early January as hopes of a meaningful revival in construction activity faded. Loss-making steel mills are buying less ore, and stockpiles are piling up at Chinese ports. The latest drop will embolden those who believe that the effects of President Xi Jinping’s property crackdown still have significant room to run, and that last year’s rally in iron ore may have been a false dawn.

Meanwhile, as Bloomberg notes, on Friday there were fresh signs that weakness in China’s industrial economy is hitting the copper market too, with stockpiles tracked by the Shanghai Futures Exchange surging to the highest level since the early days of the pandemic. The hope is that headwinds in traditional industrial areas will be offset by an ongoing surge in usage in electric vehicles and renewables.

And while industrial conditions in Europe and the US also look soft, there’s growing optimism about copper usage in India, where rising investment has helped fuel blowout growth rates of more than 8% — making it the fastest-growing major economy.

In any case, with the demand side of the equation still questionable, the main catalyst behind copper’s powerful rally is an unexpected tightening in global mine supplies, driven mainly by last year’s closure of a giant mine in Panama (discussed here), but there are also growing worries about output in Zambia, which is facing an El Niño-induced power crisis.

On Wednesday, copper prices jumped on huge volumes after smelters in China held a crisis meeting on how to cope with a sharp drop in processing fees following disruptions to supplies of mined ore. The group stopped short of coordinated production cuts, but pledged to re-arrange maintenance work, reduce runs and delay the startup of new projects. In the coming weeks investors will be watching Shanghai exchange inventories closely to gauge both the strength of demand and the extent of any capacity curtailments.

“The increase in SHFE stockpiles has been bigger than we’d anticipated, but we expect to see them coming down over the next few weeks,” Colin Hamilton, managing director for commodities research at BMO Capital Markets, said by phone. “If the pace of the inventory builds doesn’t start to slow, investors will start to question whether smelters are actually cutting and whether the impact of weak construction activity is starting to weigh more heavily on the market.”

* * *

Few have been as happy with the recent surge in copper prices as Goldman's commodity team, where copper has long been a preferred trade (even if it may have cost the former team head Jeff Currie his job due to his unbridled enthusiasm for copper in the past two years which saw many hedge fund clients suffer major losses).

As Goldman's Nicholas Snowdon writes in a note titled "Copper's time is now" (available to pro subscribers in the usual place)...

... there has been a "turn in the industrial cycle." Specifically according to the Goldman analyst, after a prolonged downturn, "incremental evidence now points to a bottoming out in the industrial cycle, with the global manufacturing PMI in expansion for the first time since September 2022." As a result, Goldman now expects copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25.’

Here are the details:

Previous inflexions in global manufacturing cycles have been associated with subsequent sustained industrial metals upside, with copper and aluminium rising on average 25% and 9% over the next 12 months. Whilst seasonal surpluses have so far limited a tightening alignment at a micro level, we expect deficit inflexions to play out from quarter end, particularly for metals with severe supply binds. Supplemented by the influence of anticipated Fed easing ahead in a non-recessionary growth setting, another historically positive performance factor for metals, this should support further upside ahead with copper the headline act in this regard.

Goldman then turns to what it calls China's "green policy put":

Much of the recent focus on the “Two Sessions” event centred on the lack of significant broad stimulus, and in particular the limited property support. In our view it would be wrong – just as in 2022 and 2023 – to assume that this will result in weak onshore metals demand. Beijing’s emphasis on rapid growth in the metals intensive green economy, as an offset to property declines, continues to act as a policy put for green metals demand. After last year’s strong trends, evidence year-to-date is again supportive with aluminium and copper apparent demand rising 17% and 12% y/y respectively. Moreover, the potential for a ‘cash for clunkers’ initiative could provide meaningful right tail risk to that healthy demand base case. Yet there are also clear metal losers in this divergent policy setting, with ongoing pressure on property related steel demand generating recent sharp iron ore downside.

Meanwhile, Snowdon believes that the driver behind Goldman's long-running bullish view on copper - a global supply shock - continues:

Copper’s supply shock progresses. The metal with most significant upside potential is copper, in our view. The supply shock which began with aggressive concentrate destocking and then sharp mine supply downgrades last year, has now advanced to an increasing bind on metal production, as reflected in this week's China smelter supply rationing signal. With continued positive momentum in China's copper demand, a healthy refined import trend should generate a substantial ex-China refined deficit this year. With LME stocks having halved from Q4 peak, China’s imminent seasonal demand inflection should accelerate a path into extreme tightness by H2. Structural supply underinvestment, best reflected in peak mine supply we expect next year, implies that demand destruction will need to be the persistent solver on scarcity, an effect requiring substantially higher pricing than current, in our view. In this context, we maintain our view that the copper price will surge into next year (GSe 2025 $15,000/t average), expecting copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25’

Another reason why Goldman is doubling down on its bullish copper outlook: gold.

The sharp rally in gold price since the beginning of March has ended the period of consolidation that had been present since late December. Whilst the initial catalyst for the break higher came from a (gold) supportive turn in US data and real rates, the move has been significantly amplified by short term systematic buying, which suggests less sticky upside. In this context, we expect gold to consolidate for now, with our economists near term view on rates and the dollar suggesting limited near-term catalysts for further upside momentum. Yet, a substantive retracement lower will also likely be limited by resilience in physical buying channels. Nonetheless, in the midterm we continue to hold a constructive view on gold underpinned by persistent strength in EM demand as well as eventual Fed easing, which should crucially reactivate the largely for now dormant ETF buying channel. In this context, we increase our average gold price forecast for 2024 from $2,090/toz to $2,180/toz, targeting a move to $2,300/toz by year-end.

Much more in the full Goldman note available to pro subs.

Government

Moderna turns the spotlight on long Covid with new initiatives

Moderna’s latest Covid effort addresses the often-overlooked chronic condition of long Covid — and encourages vaccination to reduce risks. A digital…

Moderna’s latest Covid effort addresses the often-overlooked chronic condition of long Covid — and encourages vaccination to reduce risks. A digital campaign debuted Friday along with a co-sponsored event in Detroit offering free CT scans, which will also be used in ongoing long Covid research.

In a new video, a young woman describes her three-year battle with long Covid, which includes losing her job, coping with multiple debilitating symptoms and dealing with the negative effects on her family. She ends by saying, “The only way to prevent long Covid is to not get Covid” along with an on-screen message about where to find Covid-19 vaccines through the vaccines.gov website.

“Last season we saw people would get a flu shot, but they didn’t always get a Covid shot,” said Moderna’s Chief Brand Officer Kate Cronin. “People should get their flu shot, but they should also get their Covid shot. There’s no risk of long flu, but there is the risk of long-term effects of Covid.”

It’s Moderna’s “first effort to really sound the alarm,” she said, and the debut coincides with the second annual Long Covid Awareness Day.

An estimated 17.6 million Americans are living with long Covid, according to the latest CDC data. About four million of them are out of work because of the condition, resulting in an estimated $170 billion in lost wages.

While HHS anted up $45 million in grants last year to expand long Covid support initiatives along with public health campaigns, the condition is still often ignored and underfunded.

“It’s not just about the initial infection of Covid, but also if you get it multiple times, your risks goes up significantly,” Cronin said. “It’s important that people understand that.”

grants covid-19 cdc hhsGovernment

Consequences Minus Truth

Consequences Minus Truth

Authored by James Howard Kunstler via Kunstler.com,

“People crave trust in others, because God is found there.”

-…

Authored by James Howard Kunstler via Kunstler.com,

“People crave trust in others, because God is found there.”

- Dom de Bailleul

The rewards of civilization have come to seem rather trashy in these bleak days of late empire; so, why even bother pretending to be civilized? This appears to be the ethos driving our politics and culture now. But driving us where? Why, to a spectacular sort of crack-up, and at warp speed, compared to the more leisurely breakdown of past societies that arrived at a similar inflection point where Murphy’s Law replaced the rule of law.

The US Military Academy at West point decided to “upgrade” its mission statement this week by deleting the phrase Duty, Honor, Country that summarized its essential moral orientation. They replaced it with an oblique reference to “Army Values,” without spelling out what these values are, exactly, which could range from “embrace the suck” to “charlie foxtrot” to “FUBAR” — all neatly applicable to our country’s current state of perplexity and dread.

Are you feeling more confident that the US military can competently defend our country? Probably more like the opposite, because the manipulation of language is being used deliberately to turn our country inside-out and upside-down. At this point we probably could not successfully pacify a Caribbean island if we had to, and you’ve got to wonder what might happen if we have to contend with countless hostile subversive cadres who have slipped across the border with the estimated nine-million others ushered in by the government’s welcome wagon.

Momentous events await. This Monday, the Supreme Court will entertain oral arguments on the case Missouri, et al. v. Joseph R. Biden, Jr., et al. The integrity of the First Amendment hinges on the decision. Do we have freedom of speech as set forth in the Constitution? Or is it conditional on how government officials feel about some set of circumstances? At issue specifically is the government’s conduct in coercing social media companies to censor opinion in order to suppress so-called “vaccine hesitancy” and to manipulate public debate in the 2020 election. Government lawyers have argued that they were merely “communicating” with Twitter, Facebook, Google, and others about “public health disinformation and election conspiracies.”

You can reasonably suppose that this was our government’s effort to disable the truth, especially as it conflicted with its own policy and activities — from supporting BLM riots to enabling election fraud to mandating dubious vaccines. Former employees of the FBI and the CIA were directly implanted in social media companies to oversee the carrying-out of censorship orders from their old headquarters. The former general counsel (top lawyer) for the FBI, James Baker, slid unnoticed into the general counsel seat at Twitter until Elon Musk bought the company late in 2022 and flushed him out. The so-called Twitter Files uncovered by indy reporters Matt Taibbi, Michael Shellenberger, and others, produced reams of emails from FBI officials nagging Twitter execs to de-platform people and bury their dissent. You can be sure these were threats, not mere suggestions.

One of the plaintiffs joined to Missouri v. Biden is Dr. Martin Kulldorff, a biostatistician and professor at the Harvard Medical School, who opposed Covid-19 lockdowns and vaccine mandates. He was one of the authors of the open letter called The Great Barrington Declaration (October, 2020) that articulated informed medical dissent for a bamboozled public. He was fired from his job at Harvard just this past week for continuing his refusal to take the vaccine. Harvard remains among a handful of institutions that still require it, despite massive evidence that it is ineffective and hazardous. Like West Point, maybe Harvard should ditch its motto, Veritas, Latin for “truth.”

A society hostile to truth can’t possibly remain civilized, because it will also be hostile to reality. That appears to be the disposition of the people running things in the USA these days. The problem, of course, is that this is not a reality-optional world, despite the wishes of many Americans (and other peoples of Western Civ) who wish it would be.

Next up for us will be “Joe Biden’s” attempt to complete the bankruptcy of our country with $7.3-trillion proposed budget, 20 percent over the previous years spending, based on a $5-billion tax increase. Good luck making that work. New York City alone is faced with paying $387 a day for food and shelter for each of an estimated 64,800 illegal immigrants, which amounts to $9.15-billion a year. The money doesn’t exist, of course. New York can thank “Joe Biden’s” executive agencies for sticking them with this unbearable burden. It will be the end of New York City. There will be no money left for public services or cultural institutions. That’s the reality and that’s the truth.

A financial crack-up is probably the only thing short of all-out war that will get the public’s attention at this point. I wouldn’t be at all surprised if it happened next week. Historians of the future, stir-frying crickets and fiddleheads over their campfires will marvel at America’s terminal act of gluttony: managing to eat itself alive.

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex