Government

Is A Volatility Storm Coming?

Is A Volatility Storm Coming?

Authored by Patrick Hill via RealInvestmentAdvice.com,

“Volatility often refers to the amount of uncertainty or risk related to the size of changes in a security’s value. A higher volatility means that…

Authored by Patrick Hill via RealInvestmentAdvice.com,

“Volatility often refers to the amount of uncertainty or risk related to the size of changes in a security’s value. A higher volatility means that a security’s value can potentially be spread out over a larger range of values. This means that the price of the security can change dramatically over a short time period in either direction.” – Investopedia

Federal Reserve Bond Tapering & Interest Rate Hikes Reduce Liquidity

Federal Reserve liquidity injections have bailed out the economy and equity markets for the last 18 months. And as a result, the bailout created a relatively low volatility environment for equity and bond markets. Will the announced withdrawal of Fed injections of $120B per month set up the monetary system for higher volatility? We see major economic forces combining in the intermediate future to create a possible ‘volatility storm’ driving valuations down. These economic forces include:

-

Fed tapering

-

Interest rate hikes

-

Inflation

-

Labor wage increases.

One of these macro factors is a challenge for monetary policymakers to mitigate damage to the financial system. But, a combination of these factors already building may overwhelm the monetary system. Further, markets are at historic high valuations today. But, market weaknesses and structure, along with valuations may create optimal conditions for a volatility storm.

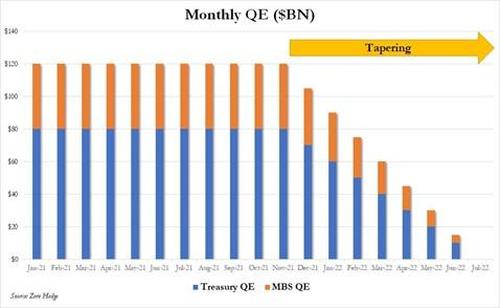

Taper Is Coming

In September, the minutes of the September Federal Open Market Committee meeting noted that most participants agreed that tapering of treasury and mortgage bond purchases should begin in December, but analysts expect a formal announcement at the November Fed meeting. Accordingly, here is a forecast of how the projected tapering may occur into mid – June 2022.

Sources: Zero Hedge, Real Investment Advice – 10/15/21

The financial markets enjoyed about $2.16T in liquidity injections resulting in a low volatility monetary environment for the S&P 500 to bull market from a March 2020 low of 2191 to 4471. The impact of tapering is both real and psychological. However, some analysts argue that the real reduction in bond purchases will have a minimal effect on bond markets. Others note that while the actual withdrawal of treasury bond purchases in the $21.9T treasury market is small, the psychological aspects of tapering are significant. Investors will feel the Federal Reserve is not ‘covering their downside risk’ anymore.

Some economists see an increase in volatility due to the end of bond purchases and increasing interest rates. On Fox News, October 17th, Mohammed El-Erian, Chief Economic Advisor at Allianz SE, said he sees increased volatility in the future.

“I worry…that this wonderful world we’ve been living in of low volatility, everything going up, may come to a stop with higher volatility. If I were an investor, I would recognize that I’m riding a huge liquidity wave thanks to the Fed, but I would remember that waves tend to break at some point, so I would be very attentive.”

Inflation Surges to Decade Highs

The Consumer Price Index, CPI has moved above 5% on a year-over-year basis and it continues to rise. Housing rent prices are up by 17.9%, according to the Case – Shiller housing September index. Rent increases lead owner equivalent rent housing costs by five months based on a model by Macrobond and Nordea. This means that the 14% jump in existing home prices YoY is likely to extend into next year. Below is a chart of the CPI since 2017 and major components such as housing and gasoline.

Sources: Bloomberg, Bureau of Labor Statistics – 10/13/21

The record prices of key commodities continue to drive the price of manufactured goods higher. Oil prices settled at $85 per barrel, a three-year high on October 15th. Aluminum prices have increased by 40% in the last year. The metal price hit a 13 year high on the London Metal Exchange on October 15th as well. Copper prices surged by12% in the last week to the highest price since May 12th with a 74 year low in inventories. Demand for primary metals has soared due to power generation demand and the shift to green power infrastructure systems. If passed, the $1T Bipartisan Infrastructure Bill agreed upon in Congress will likely keep commodities prices high for a couple of years.

China Boosting Demand

Plus, China continues to make considerable investments in manufacturing and power generation projects keeping global demand high for commodities. Container shipping of commodities adds to their price. Container shipping rates from Shanghai to Los Angeles have increased by ten times in the last year. Computer chip shortages continue with the highest delays on record in chip shipments for September and auto manufacturers have reduced production on some models by 10 – 20% reducing car inventories at dealers and supporting high new and used car prices. Mitigating the surge in inflation would be declining consumer sentiment and buying, plus a possible slowdown in the global economy. Yet, wages may continue to climb, causing businesses to respond with price increases.

Increased Wages Drive Demand Inflation

Increases in wages will possibly sustain demand. Weekly earnings have soared to almost 10%. This chart shows weekly earnings back to 1983, the last time earnings increased at this high level.

Source: Bloomberg – 10/12/21

Worker earnings increases continue to be driven by a labor shortage. There are 4.3M jobs left to fill since the labor force participation rate high of February 2020. Critical factors in many jobs not being filled include: 3.6M retirees not returning to the labor force, lower-wage hospitality workers into higher-paying warehouse and delivery jobs, and 2.5M workers staying at home to care for Covid-19 relatives. The Wall Street Journal reports on October 14th the labor participation rate is at 61.6% versus 63.3% in February 2020. As a result, the labor force participation rate continues to be below pre-pandemic levels.

Sources: Labor Department, The Wall Street Journal – 10/14/21

Labor Shortages Aren’t Helping

The National Federation of Independent Businesses recently reported that their Hard Jobs to Fill indicator shows that wages are likely to continue to soar. The following chart shows how the labor shortage is fueling a rise in wages.

Sources: NFIB, The Daily Shot 10/12/21

In many industries, the labor shortage is forcing employers to hire key employees away from competitors. Accordingly, employers report in tight markets such as software programming offering 20% hire-on bonuses. The restaurant industry’s average wage now stands above $15 per hour to attract workers in this 400% yearly worker churn sector. Further, recruiters report that some workers seeing a tight labor market are evaluating work-life balance choices. Also, drop-out workers in some cases are taking vacations, pursuing hobbies, or just taking a break. Remote work-from-home options will continue to create tighter labor conditions for the foreseeable future. A September Wall Street Journal survey of 52 economists showed that 42% expect the economy to not recover to pre-pandemic workforce levels for years to come.

Next, let’s look at how weaknesses in the market can provide clues on a gathering volatility storm.

Monthly, Weekly Time Frames Show Bearish Market Direction

Brett Freeze, principal at Global Technical Analysis (GTA), uses a unique set of time frames matched with trend models to identify support and resistance levels. Markets behave in different ways based on different time periods and participants. For example, institutional investors tend to make long-term investments quarterly. GTA analysis reports on quarterly, monthly, weekly, and daily trends. The following chart shows ES futures contract prices are below Monthly and Weekly Trends. The model notes a one period or two-period move as below trend. When ES future prices make three consecutive period moves, a trend is indicated for that timeframe.

Source: Brett Freeze, Global Technical Analysis – 10/15/21

Note: PQH = Previous Quarter High, PQL = Previous Quarter Low, PMH = Previous Month High, PML = Previous Month Low, PWH = Previous Weekly High, PML = Previous Weekly Low, PDH = Previous Daily High, PDL = Previous Daily Low

Realized Volatility Is Relatively Low, Yet Implied Volatility Is Rising

Realized volatility is the change in price between the daily closes of a stock, ETF, or financial instrument. The following chart from Lance Roberts and CNBC shows how price changes in the S&P 500 have been above average but are still within a 2% daily range since the March 2020 SPX lows.

Source: Real Investment Advice – 10/6/21

Realized volatility shows how market participants are actually driving market price swings by direct trading. The limited movement of realized volatility obscures the impact of implied volatility of markets.

Implied Volatility

Implied volatility is the range of prices based on speculation of where a price may be for underlying security or index at a specific date. Overall implied volatility has been climbing the past few years. The Volatility Index (VIX) is an indicator of implied volatility. The Chicago Board Options Exchange developed the VIX as a real-time index representing market expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). It is calculated based on the ratio of puts (an option to sell underlying security) to calls (an option to buy underlying security) for near-term (30 days or less) options contracts.

VIX – Bullish or Bearish?

The lower the VIX index and the more calls to puts is considered bullish. Conversely, the more puts to calls driving and higher VIX is deemed to be bearish. The VIX uses put and call options set at specific strike price levels that traders speculate the SPX maybe, not the actual SPX index value. The VIX is one gauge of market sentiment on the direction of prices for the SPX. Over the past several years, the baseline VIX has been climbing as the SPX has rallied. Higher lows indicate growing anxiety about high valuations. The following monthly chart shows the VIX levels since 2014 with higher lows (red arrow) as it spikes at market lows like March 2020.

Source: Patrick Hill – 10/16/21

The VIX reached a low of 9.51 in 2017 and today stands at 16.30 on October 15th as a rally continues. The VIX reached a high of 53.54 at the SPX March 2020 decline. It would seem with higher lows that a higher spike is possible. Daily options market volume as of September is higher than the volume of underlying stocks. This means that speculation on where the SPX level will be is overtaking market flows.

Options Levels Point to A Volatility Storm Zone – Below 4400

Options analysts note last week’s bounce in S&P 500 Index is likely due to traders selling put options at monthly expiration, which crushed implied volatility. The VIX indicator fell to 16.80 from 20. Dealers began setting up ‘short volatility positions and buying calls supporting the rise in market prices. SPX levels of open interest in puts and calls identify where there may be support or resistance to prices.

The following chart shows a gamma pivot point at 4400. Gamma is the rate of change of the delta or sensitivity of the option price to a $1 change in the underlying stock price. It measures the rate at which dealers must adjust their hedged positions. Positive gamma is above 4400, where there are more calls than puts and traders are net-long options. As a stock price goes up, the dealer sells the stock and buys it as it goes down. Dealers dampen price changes in a positive gamma environment.

Conversely, when a dealer is net short options, they must hedge by selling the stock as it goes down and buying the stock as price rises triggering increased volatility. Today, 4400 is the pivot point between positive and negative gamma. Below 4300, we added a Volatility Zone where a volatility storm may build. The chart shows total open interest with puts below the zero line and calls above, with current expiration darkly shaded.

Sources: SpotGamma.com and Patrick Hill – 10/15/21

Watch out Below 4400

Brent Kochuba, a co-founder of SpotGamma, notes likely increased volatility below 4400,

” We currently see fairly light put positions below 4400. This implies that traders may need to purchase put options on a break of 4400, which could in turn force options dealers to short futures. This could lead to dealers shorting into a down market, which increases volatility.”

We have located where the volatility storm may develop. But, what factors might trigger a storm?

Factors Triggering a Volatility Storm

The critical triggering events will be Federal Reserve tapering and interest rate increases planned for 2022. The financial markets depend on high levels of liquidity, so any reduction in liquidity could act as a catalyst for a volatility storm. Other factors that may magnify a liquidity crunch include:

-

The debt ceiling not being raised in December

-

Options hedgers overreach and can’t cover margin positions, triggering forced selling

-

Inflation roaring further ahead beyond the Fed’s ability to control it, so the market loses confidence in the Fed

-

The Fed raises interest rates higher and faster than the market expects

-

Consumers quit spending, causing retail sales to drop, corporations sales fall, and stock buybacks end that were sustaining high market valuations

-

The economy goes into a recession as GDP drops, employment falls, and corporate valuations fall

-

Any black swan event like the pandemic

Any volatility storm as markets decline is likely to force analysts to shift from valuing stocks based on market speculation to actual GAAP earnings (not stock buyback inflated EPS), fundamentals, and related unused valuation tools. The TINA – ‘there is no alternative’ trading phenomenon would be over. Investors will need to be mindful of the extreme volatility posed by a volatility storm. Accordingly, wild rallies and steep falls will require portfolio managers to sharpen their hedging and volatility strategies to maintain portfolio value.

Government

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire