International

How family and science moved Exelixis’ new CMO to work on oncology blockbusters; While John Maraganore racks up the prizes, his old crew at Alnylam selects president

Vicki Goodman

After 18 years at the FDA and climbing the corporate ladder in biopharma, Vicki Goodman is now in the biotech C-suite for the first time. The new CMO and executive VP of product development for Exelixis started on Dec. 4, flying out to the..

After 18 years at the FDA and climbing the corporate ladder in biopharma, Vicki Goodman is now in the biotech C-suite for the first time. The new CMO and executive VP of product development for Exelixis started on Dec. 4, flying out to the biotech’s headquarters just outside sunny San Francisco before returning home and flying all the way back to Philly, where she is based.

Goodman got her passion for medicine as a young child — it didn’t surprise anyone that she majored in biochemistry before going through medical school and residency, finishing up in the early 2000s with an emphasis in internal medicine, medical oncology and hematology. But for her, there was an underlying desire to use science to help people and work on problems that impact people’s health.

Part of that desire came from personal tragedy: Goodman lost her mother to breast cancer right as Goodman finished medical school. She decided to focus her career in oncology.

It was a a pivotal time in the field. Science was changing — particularly doctors’ understanding of biology and cancer.

“It was becoming very clear that our understanding of human biology — and increasing understanding of some of the molecular genetic underpinnings of cancer — could really have the potential to revolutionize treatment of patients with cancer,” Goodman told Endpoints News.

She noted Novartis’ tyrosine kinase inhibitor Gleevec for chronic myeloid leukeima was approved in 2001, near the end of her residency. The first-of-its-kind target therapy fundamentally transformed treatment of that type of cancer, and pushed her towards drug development.

“We really watched how that treatment — which was molecularly targeted — transformed the treatment of that disease from one that inexorably progressed,” Goodman said. “We didn’t have drugs that really affected the underlying disease. And ultimately, you know, patients would have a blast crisis and die of the disease. You were seeing with treatment with Gleevec, the tumors, cancer cells just melted away, the leukemic cells just disappeared.”

And going into drug development she did. After spending some time at the FDA, got hired at GlaxoSmithKline, where she spent 8 years working in clinical and medicine development before going over to Bristol Myers Squibb in 2015. While at Bristol Myers, Goodman worked as a VP, development lead before moving into the oncology senior leadership team there, ultimately working on blockbuster PD-(L)1 inhibitor Opdivo.

That’s when Goodman first got acquainted with Exelixis — she helped lead the partnership between BMS and Exelixis on the Checkmate -9ER trial, which combined Opdivo with Exelixis’ lead candidate, the now-approved drug Cabometyx for renal cell carcinoma.

After leaving BMS in 2020, she went to Merck, where she worked on PD-(L)1 blockbuster Keytruda and other Merck candidates in indications such as thoracic malignancies, head and neck cancers, breast and gynecologic cancers, and hematology.

Which brought her back to Exelixis. Goodman heard that the CMO position was open, and when they reached out to her, she didn’t want to let go of an opportunity, so she went for it.

So what’s next for Goodman and Exelixis? In Goodman’s own words, “There’s a lot to do,” especially on the data side of things. There’s expected readouts for Cabometyx for this year — some of them in Phase III trials for even more indications for the drug. There’s also pipeline expansion and setting up a registrational trial this year for XL092, the company’s new TKI inhibitor, and down the road for XL102, their new CDK7 inhibitor.

“The other key focus for me is really on the people and teams and making sure that we have the right capabilities in place,” Goodman said.

And it plays right into one of the things on her leadership to-do list: start building a development team out on the East Coast — which in Goodman’s view, is a crucial step for future success.

— Paul Schloesser

Happy 2022, Peer Review readers! The new year has started with an unparalleled deluge of appointments, so buckle up:

Akshay Vaishnaw

Akshay Vaishnaw→ A new era at Alnylam begins now with Yvonne Greenstreet as CEO, a new siRNA deal with Novartis, and a promotion: Akshay Vaishnaw has been elevated to president after nearly four years as president of R&D with the RNAi pioneer. Vaishnaw has been an Alnylam exec since 2006, leaving Biogen to take a job as VP of clinical research, and he’s been steadily rising in the company ever since.

As for Alnylam’s former CEO, the beat goes on with John Maraganore’s mission to “be a granddad” for other companies — Peer Review may as well institute a Maraganore Meter to track all the gigs he accumulates. What’s on tap for him now? First, he became an executive partner at RTW, as detailed by our Paul Schloesser; Atlas Venture tweeted this week that Maraganore will lend his expertise as a venture advisor; next, Maraganore has been named chairman of the board at Hemab, a Danish blood disorder biotech helmed by former Codiak exec Benny Sorensen; SQZ Biotechnologies also came calling this week, tapping Maraganore as a strategic advisor; and finally, he will be chair of the advisory council at Stanley Crooke’s non-profit n-Lorem Foundation.

Kate Haviland

Kate Haviland→ Last year, Blueprint Medicines earned its fourth approval by crossing the goal line with Ayvakit for advanced systemic mastocytosis, and joined the M&A party by purchasing Lengo Therapeutics for $250 million upfront. On April 4, Blueprint will have a change at the top as CEO Jeff Albers passes the baton to Kate Haviland, who was hired as CBO in 2016 and has been COO since 2019. Haviland ventured off to Blueprint after her tenure as VP, rare diseases and oncology program leadership at Idera; she’s also led commercial development Sarepta and PTC Therapeutics. Albers will be executive chairman until the end of the year, at which time he will continue as chairman.

Another piece of Blueprint news: Also effective April 4, Christina Rossi, the company’s chief commercial officer since 2018, will replace Haviland as COO.

Javier Szwarcberg

Javier Szwarcberg→ Mike Grey’s days are up as interim CEO of Spruce Biosciences after pinch-hitting for the retired Richard King, now entrusting the company to Javier Szwarcberg. Following a short stay as VP of R&D and business development at Horizon, Szwarcberg pivoted to Ultragenyx, becoming SVP, head of program and portfolio management. Since February 2020, Szwarcberg had been group VP and head of program and portfolio development for JJ Bienaimé at BioMarin. Another Spruce note: Samir Gharib has been elevated to president and will retain his duties as CFO.

Kenneth Galbraith

Kenneth Galbraith→ There will be a new sheriff in town at cancer bispecifics biotech Zymeworks as Kenneth Galbraith replaces CEO Ali Tehrani “on or before” Feb. 1. Tehrani spent 18+ years at the helm and he’ll stick around as an advisor during the transition period. Galbraith has familiarity with the company already as a former board member from 2009-13, and the ex-CEO of Liminal BioSciences and Fairhaven Pharmaceuticals has been an entrepreneur-in-residence with Syncona since last April. There’s one more bit of C-suite activity to sort out — CFO and 15-year Zymeworks vet Neil Klompas has tacked on the role of COO with immediate effect.

Hubert Chen

Hubert Chen→ While we were on a break (apologies to Ross from “Friends”), Hubert Chen resigned as CMO of Metacrine effective New Year’s Eve, leaving CEO Preston Klassen to fill the vacancy. Chen found another CMO gig at ADARx Pharmaceuticals, an RNA editing startup that raised the curtain on a $75 million Series B co-led by OrbiMed and SR One in September 2021. Chen joined Metacrine in August 2018 after four years with Pfenex — first as CMO, then as chief scientific and medical officer — and has previously been VP of clinical development at Aileron Therapeutics. Like many companies, Metacrine ran into a brick wall with NASH, throwing in the towel with its program in October and instead concentrating on a Phase II for inflammatory bowel disease with MET642.

Joshua Grass

Joshua Grass→ The Grass is always greener: Joshua Grass has succeeded the retiring Alain Baron as CEO of San Diego-based upstart Escient Pharmaceuticals, with Baron staying on as a strategic advisor through Q1. After 15 years at BioMarin, where he was SVP, business and corporate development, Grass launched the rare disease play Modis Therapeutics in 2018 while he was an entrepreneur-in-residence at F-Prime Capital. The next year, Zogenix scooped up Modis for $250 million upfront.

→ Peer Review received a statement on behalf of Spark that Joseph La Barge has stepped down “to begin focusing on his next chapter in biotech.” La Barge jumped on board at Spark in 2013 as chief legal officer and had served as CBO for almost two years, playing a pivotal role in the acquisition by Roche.

Simon Allen

Simon Allen→ Simon Allen will be CEO of Anebulo Pharmaceuticals, which seeks to turn the tables on cannabinoid overdose and substance abuse. He will replace Daniel Schneeberger, who announced his resignation effective Feb. 1. Allen returned for a second tour of duty as CBO for Ambrx in March 2019 after holding the same position at the California biotech from 2010-15. Austin-based Anebulo, whose lead candidate ANEB-001 is in a Phase II proof-of-concept study for acute cannabinoid intoxication, has also brought in Scott Anderson as head of investor relations and public relations.

Julien Miara

Julien Miara→ At Paris-based biotech Onxeo, Julien Miara has replaced CEO Judith Greciet on an interim basis starting this week. A member of Onxeo’s board since September 2020, Miara’s run at Invus began more than a decade ago, earning a promotion in 2018 to lead its European team. Greciet was named CEO of Onxeo in 2011, back when the company was known as BioAlliance Pharma until it merged with Topotarget and was rebranded. The DNA damage response biotech is now chaired by Epizyme chief medical and development officer Shefali Agarwal.

Eric Hobbs

Eric Hobbs→ Eric Hobbs will be reassigned from CEO “to president of the Antibody Therapeutics business line” at digital cell biology player Berkeley Lights when his replacement is found. Hobbs first came to Berkeley Lights in 2013 as senior director of R&D and was promoted to CEO in March 2017. Berkeley Lights struck while the IPO iron was hot in the summer of 2020, blowing by the standard $100 million they initially penciled in with a $205 million upsized offering.

Francis Sarena

Francis Sarena→ Francis Sarena has signed on to be COO of Apexigen, whose CD40 agonist sotigalimab is in Phase II studies in a number of cancer indications, namely melanoma. From 2011-21, Sarena was an exec with Five Prime, serving as chief strategy officer from 2016 until Amgen padded its oncology pipeline by purchasing the company for $2 billion. This is Apexigen’s second major executive appointment in the last several months after bringing in CMO Frank Hsu from Oncternal Therapeutics.

→ Michael Skynner has pedaled into a new post this week at Bicycle Therapeutics, shifting from COO to chief technology officer for CEO Kevin Lee’s squad while VP, human resources and communications Alistair Milnes steps into the COO slot. Skynner, Bicycle’s COO since 2018, first arrived in 2016 as VP, operations and discovery after his days as head of external alliances, rare disease research unit with Pfizer. Bicycle put a little air in Ionis’ tires in July 2021 with an oligonucleotide deal that saw Ionis fork over $45 million upfront.

Joseph McIntosh

Joseph McIntosh→ Stephen Squinto’s nucleic acid gene therapy biotech Gennao Bio has pegged Joseph McIntosh as CMO and Anuj Goswami as general counsel. McIntosh was in this space a mere eight months ago when he took the CMO job at Jaguar Gene Therapy, spending the previous year as the medical chief of Aruvant. This is Goswami’s first foray into biotech after a 21-year career in private practice with Philadephia-based Ballard Spahr.

Esther Rajavelu

Esther Rajavelu→ Rare disease player Fulcrum Therapeutics has found a new CFO in Esther Rajavelu, who most recently served as a senior equities research analyst at UBS. Rajavelu’s experience also includes stints at Deutsche Bank and Oppenheimer & Co. Fulcrum’s stock price went through the roof last summer on the strength of data for its sickle cell drug FTX-6058.

→ New York’s Indaptus Therapeutics has tapped Boyan Litchev as CMO, the latest move in a whirlwind of stops the last five years. Let’s break it all down: Litchev had only led global clinical development at Shoreline Biosciences since the summer of 2021, and as we told you then, he spent his previous 16 months as head of clinical development, oncology at Poseida. Litchev was briefly the executive medical director, head of clinical development, oncology at Halozyme after two years with Akcea, and he joins Indaptus in time to push its lead cancer candidate Decoy20 into Phase I sometime this year.

Stephanie Oestreich

Stephanie Oestreich→ Danish biotech Galecto, part of the 2020 IPO frenzy, has waved in Stephanie Oestreich as CBO. After 12 years with Novartis, Oestreich was the international business leader for Avastin at Roche, then jumped over to Evotec, where she was head of academic partnerships and investments, North America & Asia. She just finished an abbreviated run as VP of operations and head of alliance management with Mnemo Therapeutics. Galecto’s lead product, GB0139, is an inhaled galectin-3 inhibitor in a Phase IIb trial for idiopathic pulmonary fibrosis.

David McIntyre

David McIntyre→ David McIntyre has been named CFO of cardiovascular disease player Anthos Therapeutics, launched nearly three years ago by Blackstone and Novartis. An ex-partner at Apple Tree Partners, McIntyre just had a year-long stint as finance chief at Tessa Therapeutics. Anthos’ lead candidate, the monoclonal antibody abelacimab, is being developed as an anticoagulant to prevent or treat venous thromboembolism.

Sarah Liu

Sarah Liu→ GI disease player 9 Meters Biopharma out of Raleigh, NC has named Sarah Liu chief commercial officer and Al Medwar head of investor relations. Liu spearheaded global commercial strategy for the spinal muscular atrophy drug Zolgensma while she was VP and head of worldwide new product planning and VP, global marketing at Novartis Gene Therapies. The Takeda and Abbott vet has also been VP of commercial operations and strategic planning at Melinta Therapeutics. Medwar swings into 9 Meters from Aruna Bio, where he was EVP of corporate & commercial development.

→ Kevin Lynch is making his way over to Notable Labs as CBO. Lynch comes aboard after careers as CBO of Recursion and VP of business development at Vir Biotechnology. Not only that, but earlier in his career, Lynch ran a 20-year stint over at Abbott/AbbVie as VP, search and evaluation.

Marie-Louise Fjällskog

Marie-Louise Fjällskog→ Marie-Louise Fjällskog has left Sensei Biotherapeutics to become CMO at Finnish immunotherapy biotech Faron Pharmaceuticals. While Fjällskog was CMO at Sensei, the company rolled to a $152 million IPO in early 2021. In addition to her new role at Faron, Fjällskog also serves as associate professor of oncology at Uppsala University in Sweden.

Christopher Horan

Christopher Horan→ Christopher Horan has answered the bell as chief technical operations officer at Artiva Biotherapeutics, Merck’s CAR-NK partner that doubled the fun in 2021 with a $120 million raise and a Nasdaq debut. After 13 years at Merck and another 14 with Genentech where he rose to head of product and global supply chain management, Horan served as chief technical operations officer at Dermira and, most recently, SanBio.

→ UK-based 4D pharma made the SPAC-tacular move of reverse merging with blank check company Longevity Acquisition Corporation and has now recruited John Doyle as CFO. Doyle had a quick cup of coffee as Chiasma’s finance chief last year after three years at Verastem, where he was promoted to VP, finance and investor relations.

Erik Vahtola

Erik Vahtola→ Giving the Teva reject laquinimod another go for patients with non-infectious non-anterior uveitis, Sweden’s Active Biotech has named Big Pharma vet Erik Vahtola as CMO. Vahtola was based in Finland when he worked for Roche from 2013-16, and since 2019 he had been head of medical affairs, oncology at Bayer. Elsewhere at Active Biotech, CSO Helena Eriksson’s 23 years with the company have come to a close, but she’ll stay active, so to speak, in a consulting role.

Jula Inrig

Jula Inrig→ Travere Therapeutics, the company formerly known as Retrophin which was operating under “Pharma Bro” Martin Shkreli, has tacked on Jula Inrig as CMO. Inrig joins the company from IQVIA, where she served as global head of the renal center of excellence, right as they try once again to push for the accelerated approval of sparsentan.

Kirsten Gruis

Kirsten Gruis→ DiaMedica, focused on developing treatments for neurological disorders and kidney diseases, has named Kirsten Gruis as CMO. Gruis brings with her a wealth of experience from her former stints at Edgewise Therapeutics (CMO), Roche (neuromuscular franchise head), Agilis Biotherapeutics, Wave Life Sciences, Idera, Alnylam and Pfizer.

→ Salt Lake City-based Elevar Therapeutics changed CEOs in 2021 when Kate McKinley took over for Alex Kim. As we ring in 2022, Elevar has selected Bristol Myers vet Jenny Gizzi as chief people officer. Gizzi was the VP of human resources for Arena Pharmaceuticals, Pfizer’s M&A jewel to close out last year, after a year with Mirati as head of human resources and site operations. Among the drug candidates in Elevar’s pipeline is rivoceranib, developed by Hengrui and approved in China for gastric cancer and second-line advanced hepatocellular carcinoma.

→ Eye drop developer Oculis has turned its eyes on Webb Ding as its next COO and general manager, China. Ding makes his way to Oculis from Fresenius Kabi, where he served as country president for China. Prior to that, Ding was with Novartis in China for a decade and notably served as general manager of Novartis Vaccines Greater China and Tianyuan Bio-Pharma. Earlier in his career, Ding also served in roles at Bristol Myers Squibb and Xi’an Janssen.

→ Biosion has welcomed Anthony Yeh as chief strategy officer and head of China business development. Yeh hails from CStone Pharmaceuticals, where he served as VP, head of corporate strategy, investor relations and capital market.

Diana Chung

Diana Chung→ Terns Pharmaceuticals is giving it the old college try with NASH and brings two appointments to this week’s Peer Review: Jeffrey Jasper as SVP, head of research and Diana Chung as chief development officer. Most recently, Jasper was VP, drug discovery at Rubedo Life Sciences, and he also served as executive director, research science at Merck Research Laboratories. Chung has been at Terns since September 2019, where she started as VP, clinical development and operations before moving to SVP in November 2020.

Judith Robertson

Judith Robertson→ Australian eye disease biotech Opthea has appointed Judith Robertson as chief commercial officer. Robertson is no stranger to Opthea, where she has served on the board of directors (chaired by Ovid chief Jeremy Levin) since June 2021. Robertson has held the position of CCO at both Eleusis and Aerie Pharmaceuticals, and at J&J‘s Janssen, she was global commercial VP, immunology and ophthalmology.

→ Cancer-focused Curis has locked in three new execs: Felix Geissler (VP of medical affairs) just held the same post at Horizon, which plunked down $25 million upfront in a deal with Alpine Immune Sciences last month; Kimberly Steinmann (VP of clinical development) is a Boehringer Ingelheim vet who had been a consultant for Takeda’s oncology development program and was executive medical director for orphan diseases with Grifols; and Dora Ferrari (VP of clinical operations), who had a 10-year career at ArQule, comes to Curis from Aileron Therapeutics, where she was VP, clinical development and program management. Curis’ IRAK4 kinase inhibitor CA-4948 is in a Phase I/II study for acute myeloid leukemia or high-risk myelodysplastic syndromes, both as a monotherapy and in combination with azacitidine or venetoclax.

→ Everything’s coming up Chemomab in Peer Review, whether it’s Dale Pfost hitting the scene as CEO and later becoming chairman or naming David Weiner as interim CMO. This time the Israeli fibrotic and inflammatory disease biotech has installed Jack Lawler as VP of global clinical development operations. Lawler hails from Goldfinch Bio, where he was VP, clinical operations and data management, and he was director of clinical development operations at ViroPharma before Shire’s $4.2 billion acquisition.

Rimma Steinhertz

Rimma Steinhertz→ Putting mutations of the MAPK and mTOR pathways under the proverbial microscope, Immuneering has picked up Eisai and Merck alum Rimma Steinhertz as VP, project and alliance management. Steinhertz had spent the last two years as executive director, global program leader, portfolio & program management, oncology at Glenmark sub Ichnos Sciences, and she was the group director, external collaborations, oncology during her time at Merck.

→ Repare Therapeutics has brought on Philip Herman as its EVP of commercial and new product development. Herman most recently served as CCO at Y-mAbs Therapeutics, where he oversaw the launch of the neuroblastoma drug Danyelza. Herman has also served as head of marketing at Dyax and director of marketing at Vanda Pharmaceuticals.

Matthew Vincent

Matthew Vincent→ Peter Kolchinsky orchestrated Point Biopharma’s Nasdaq debut through a SPAC deal in March 2021, and this week the radiopharmaceutical player has welcomed Matthew Vincent as SVP, business development. Vincent had held the same title at Avacta Life Sciences since 2017. A month ago, Point promoted Justyna Kelly to COO and bid farewell to chief commercial officer Michael Gottlieb, who left “to pursue other opportunities.”

→ Announced on Christmas Eve, Danielle Campbell has returned to aTyr Pharma, this time as VP of human resources after working in HR there for a brief period in 2015-16. Campbell just closed out her five years with Poseida as senior director, facilities operations after starting out in HR for Eric Ostertag’s crew. San Diego-based aTyr is seeking redemption with lead candidate ATYR1923 for patients with pulmonary sarcoidosis after stumbling with Project ORCA in 2018, triggering a 30% reduction in its staff.

→ Philly-based Context Therapeutics has named Christopher Beck as SVP of operations and Mark Fletcher as VP of R&D. Additionally, the company will be parting ways with its current head of CMC Bill Rencher as he plans for retirement. Beck joins the women’s oncology-focused company from Galera Therapeutics, where he served as VP of program management. Prior to that, Beck spent nearly a decade with Shire and had stints at Merck and AstraZeneca. Meanwhile, Fletcher comes aboard with experience from his time at Pharmaceutical Associates, Hikma Pharmaceutical US Operations, Douglas Pharmaceuticals, Endo Health Solutions and Ligand Pharmaceuticals.

Joanna Auch

Joanna Auch→ South San Francisco heart disease biotech Tenaya Therapeutics, which hit Nasdaq last summer not long after a $106 million crossover round, has enlisted Joanna Auch — formerly the head of HR North America for Santen — as SVP of people and culture. Tenaya has also named Ultragenyx chief legal officer and EVP Karah Parschauer to the board of directors, which also includes Eli Casdin and June Lee. The ex-associate general counsel at Allergan is on the boards of Evolus and Anebulo Pharmaceuticals.

→ The pandemic crushed Esperion’s hopes of making its cholesterol therapy Nexletol into a blockbuster, prompting Tim Mayleben to throw the CEO keys to Sheldon Koenig and put someone with commercial bona fides into the top spot. After drastic cutbacks in October, Esperion has turned to Benjamin Looker to be general counsel. Looker comes from Trillium, where he was general counsel for a biotech that Pfizer purchased for more than $2 billion. At MorphoSys from 2017-19, Looker — an EMD Serono alum — was VP, head of US legal and global business operations.

Ronald Krasnow

Ronald Krasnow→ T-knife needed just a year to pull together a $110 million Series B in August 2021 after its initial financing round, and the biotech focused on T cell receptor (TCR) engineered T cell therapies has enlisted Ronald Krasnow as general counsel. Krasnow had a 10-year run as Relypsa before moving on to Menlo Therapeutics as general counsel, secretary and chief compliance officer and his most recent stop as the COO of Arch Oncology.

→ Jared Cohen has moved into the role of general counsel at Boston-based Entrada Therapeutics, now targeting neuromuscular diseases like Duchenne with oligonucleotide therapies and nabbing $116 million in funding last March to do so. Since April 2020, Cohen had served as Entrada’s VP, head of IP and legal affairs. Prior to that, he served as VP of legal affairs at Repertoire Immune Medicines.

Rahul Khara

Rahul Khara→ Rahul Khara has taken on the role of general counsel at Disc Medicine, which plucked bitopertin out of mothballs from Roche and recently raked in a $90 million Series B. Before Merck backed up the Brinks truck, Khara spent three years at Acceleron as VP, legal and chief compliance officer. In another Acceleron connection, its former R&D chief and one-time Celgene CMO Jay Backstrom has joined Disc Medicine’s board of directors.

Mira Chaurushiya

Mira Chaurushiya→ Westlake Village BioPartners is welcoming Mira Chaurushiya to the fray as a senior partner. Chaurushiya hops aboard after a six-year stint at 5AM Ventures. During her time to 5AM, Chaurushiya invested in and served as director or observer on the boards of multiple organizations, including Precision Nanosystems (acquired by Danaher), Ideaya Biosciences, Enliven Therapeutics, Escient Pharmaceuticals, Magnetic Insight, Novome Biotechnologies, Purigen Biosystems, and TMRW.

→ Legend‘s CEO Ying Huang is now taking a seat on its board of directors as a Class I director. Huang has served in the position of CEO since September 2020 after his predecessor Frank Zhang was placed under house arrest as part of a customs investigation involving GenScript. Prior to his role at the helm of the company, Huang started as Legend’s CFO after stints at BofA Securities, Wells Fargo, Credit Suisse and Schering-Plough.

Yuan Xu

Yuan Xu→ Speaking of Legend, ex-CEO Yuan Xu is the latest addition to the board of directors at Xilio Therapeutics — chaired by Dan Lynch — after Sara Bonstein and the aforementioned Christina Rossi became board members last year. Xilio made the Nasdaq leap in October 2021 with a nearly $118 million IPO.

→ Led by first-year CEO and former Ovid president and CMO Amit Rakhit, Houston portfolio company Sporos Bioventures has given ex-Black Diamond CMO Rachel Humphrey a seat on the board of directors. Humphrey, who also is on the board at Xilio, is the CEO of an unnamed “biotech startup focused on immunotherapies.”

John Orloff

John Orloff→ Lonnie Moulder’s US/China startup Zenas BioPharma has made John Orloff a member of the board of directors. Orloff, the former R&D chief at AstraZeneca sub Alexion, has changed course as a venture partner for Agent Capital.

→ Ex-Five Prime CFO David Smith has claimed another board seat, this time with Sonny Hsiao’s antibody-cell conjugation outfit Acepodia, which has another $109 million to work with from last month’s Series C round. Smith is also a board member with Codexis and Neurelis. Acepodia has also supplemented its scientific advisory board with Elizabeth Smith and Richard Lopez.

John Shiver

John Shiver→ Taking its VLP “soccer ball” technology to Nasdaq with a nine-figure IPO last summer, Seattle’s Icosavax has made space available for John Shiver on its board of directors. After 22 years at Merck and seven more at Sanofi, Shiver is IGM’s chief strategy officer for infectious diseases.

→ Crinetics, which spun out its radiopharmaceutical pipeline into a new company called Radionetics Oncology last fall, has named Rogério Vivaldi to the board of directors. Since August 2018, Vivaldi has been president and CEO of Flagship’s Sigilon.

→ Laurence Reid, the CEO of Decibel Therapeutics, is taking a seat on the board of directors of Cambridge, MA-based Garuda Therapeutics. Prior to taking the helm of Decibel, Reid was an entrepreneur-in-residence at Third Rock Ventures and formerly CEO of Warp Drive Bio. Additionally, Reid served as CBO and SVP of Alnylam.

Tunde Otulana

Tunde Otulana→ Down in New Orleans, Revolo Biotherapeutics — once known as Immune Regulation — has appointed ex-Mallinckrodt CMO Tunde Otulana to the board of directors. Otulana, the current CMO at Veloxis Pharmaceuticals, was SVP, clinical development & medical affairs during his time at Boehringer Ingelheim.

→ Sebastian Guth has been appointed to the board of directors at New York oncology player Phosplatin Therapeutics. Guth currently serves as president of Bayer Pharmaceuticals Americas, and sits on the boards of the Pharmaceutical Research and Manufacturers of America, BIO and Children’s Aid.

Jennifer Lew

Jennifer Lew→ RA Capital-backed Boundless Bio, a San Diego cancer biotech that raked in $105 million in a Series B last April, has appointed Jennifer Lew to its board of directors. Lew, who currently serves as EVP and CFO of Annexon Biosciences, will also act as chairperson of Boundless Bio’s audit committee.

→ At the same time as paying $1,452,724 in amounts owed to Numus Financial as part of a debt settlement, Sona Nanotech has brought on Neil Fraser and Walter Strapps to its board of directors. Fraser is president of Medtronic Canada, while Strapps most recently served as CSO of Gemini Therapeutics and previously led discovery at Intellia Therapeutics.

→ John Varian has been added to the board of directors at Acorda, which sang a familiar tune by slicing what’s left of its workforce by 15% in September. Varian, the ex-CEO of XOMA, is a board member at AmMax Bio and Sellas Life Sciences.

Aniz Girach

Aniz Girach→ Paris-based Pharnext has welcomed Elisabeth Svanberg as chairman of its board of directors, succeeding Michel de Rosen who will continue to serve the company as non-executive director. Svanberg brings with her experience from her time at Serono, BMS and Janssen.

→ French hearing loss outfit Sensorion has tapped Aniz Girach on the shoulder as successor to Jean-François Morin on its board of directors. Girach currently serves as CMO of ProQR Therapeutics and formerly served in the same role at Nightstar Therapeutics and Oxurion.

→ Ideaya Biosciences, the company that picked up a $50 million IPO back in 2019 to fuel the clinical drive on synthetic lethality, has picked up former Onyx Pharmaceuticals founder and CSO Frank McCormick as chair for its scientific advisory board.

Derek Graf also contributed to this edition.

nasdaq equities pandemic yuan treatment fda genetic therapy rna dna canada european uk sweden chinaInternational

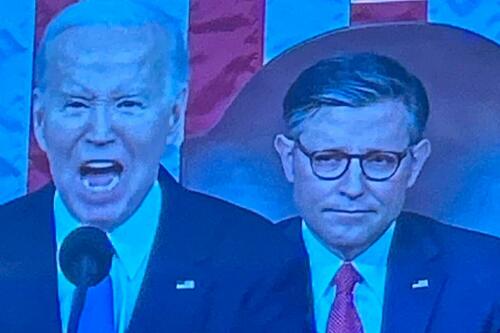

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexico-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International10 hours ago

International10 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges