Hot Penny Stocks to Buy For a Market Rebound? 3 to Watch

Are These Penny Stocks Good Choices For Your Watchlist Following the Market Crash?

The post Hot Penny Stocks to Buy For a Market Rebound? 3 to Watch appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

3 Penny Stocks to Watch After Today’s Bearish Drop

If you traded penny stocks or blue chips today, you likely saw the result of the stock market crash. If not, the dow dropped by almost 900 points, ending the day with the biggest drop in months. The crash today is the result of reignited fears around the pandemic and the fast-spreading Delta variant. While many thought we were out of the woods just two weeks ago, in the past few days, cases in the U.S. have risen substantially. The warning sign for this came as the U.K., which has over 70% of its population vaccinated, saw major increases in Covid case numbers in the past few weeks. [Read More]- Could Penny Stocks Skyrocket On Bezos’ Blue Origin Space Launch?

- 4 Stocks to Watch During a Market Crash

3 Penny Stocks For Your Market Rebound Watchlist

- Cinedigm Corp. (NASDAQ: CIDM)

- Senseonics Holdings Inc. (NYSE: SENS)

- Globalstar Inc. (NYSE: GSAT)

Cinedigm Corp. (NASDAQ: CIDM)

One entertainment penny stock performing well in the market right now is Cinedigm Corp. Cinedigm is a distributor of movies and television shows to various platforms. The company also holds a great deal of distribution rights and cinema assets under its belt. Some of the brands its products are distributed to include Hallmark, NFL, NHL, Scholastic, and many others. Additionally, we have discussed CIDM stock plenty of times in the past few months due to its large investor attention and the sizable intraday moves it often makes. Recently the company announced that its preliminary fourth-quarter revenue is above the consensus. The company also saw greater momentum recently after reporting its streaming channel revenue increased by 197%. The CEO of the company, Chris McGurk said, “We have now successfully completed the transition of Cinedigm from its legacy digital cinema equipment business to a high-growth, independent streaming entertainment channel and content company.” In other recent news, Cinedigm’s ad-support streaming channel revenues grew 331% year over year, and its subscription streaming channel revenues grew 117%. This has resulted in heightened interest in CIDM stock from investors of all types. With this in mind, will CIDM be on your list of penny stocks to watch?

Senseonics Holdings Inc. (NYSE: SENS)

Senseonics Holdings Inc. is another penny stock that we have talked about numerous times in the past few weeks. In addition to frequently spiking during certain trading days, SENS also has a great deal of potential with its products. For some context, Senseonics is a biotech penny stock with a focus on developing medical devices for those with diabetes. Its Eversense and Eversense XL products help diabetic individuals monitor and manage information related to their condition. [Read More] How To Make Money With Penny Stocks In a Down Market On June 28th, Senseonics announced the presentation of PROMISE data at the American Diabetes Association 81st Scientific Sessions. Other than this, there is not much company-specific information that has come from Senseonics recently. So what could be causing SENS stock to go up in the market? On July 19th, the company is up 2%, which is not extremely substantial, but considering the rest of the stock market, it is encouraging. Only a year or so ago, shares of SENS stock sat around $0.45 per share, and now, shares sit at almost $3 as of July 19th. Considering this exciting uptick, will SENS stock be on your list of penny stocks to watch?

Globalstar Inc. (NYSE: GSAT)

Globalstar Inc. is a penny stock that offers mobile satellite services and off-grid communication products. It has a variety of offerings such as voice and data products for safety, emergency, remote business, and recreational-related products. Its SPOT satellite GPS messenger is used for personal tracking and emergency location identification. Globalstar’s SPOT Trace product is in use as an anti-theft locator and an asset tracking device. As you can see, its lineup of personal safety and tracking products is expansive and offers investors a large amount of value to investors. The latest update from Globalstar Inc. came on July 1stwhen the company announced its partnership with FocusPoint International Inc. The agreement between the two will provide crisis assistance services under the Global Overwatch and Rescue Plan to Globalstar customers.“We are so pleased to extend this valuable service to Globalstar customers. Many of our users partake in extreme sports and engage in higher than average travel frequency making this offering a service that can help further improve our customers’ peace of mind. FocusPoint provides a comprehensive risk consulting service that is a great compliment to the connectivity we provide our customers.” The CEO of Globalstar, David KaganWith travel limited in the past year and a half, many people are once again getting out of the house and going on vacations. And, because off-grid locations offer a pandemic-safe way to travel, Globalstar’s products could see higher demand. While GSAT stock can be rather speculative, it is also a very popular penny stock at the moment. Noting this recent information and GSAT’s solid market performance, will this penny stock make your watchlist?

Which Penny Stocks are You Watching Right Now?

While today’s overall stock market performance was less than stellar, tomorrow is a new day. And as always, both penny stocks and blue chips see an ebb and flow that results in gains and losses. [Read More] Small-Cap Stocks To Watch After CYTK Sheds Spotlight On Biotech But, with so much going on in the world right now, it is prudent to stay as up-to-date as possible with all the events going on. And by reading the news and researching different companies, investors can be informed as to how events will impact their portfolio holdings. With all of this in mind, which penny stocks are you watching right now? The post Hot Penny Stocks to Buy For a Market Rebound? 3 to Watch appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com. economic recovery pandemic nasdaq stocks small-cap penny stocks vaccine recoveryGovernment

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

US Economic Growth Still Expected To Slow In Q1 GDP Report

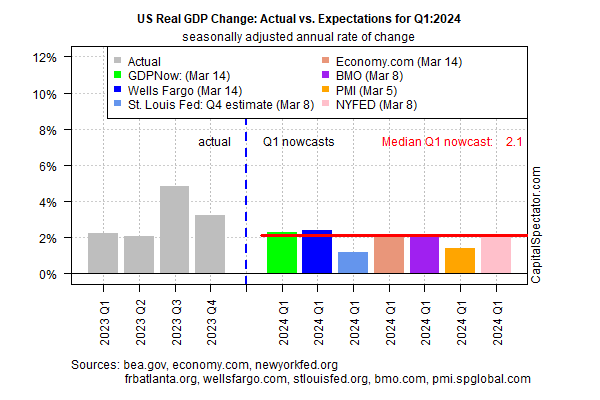

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A