Hidden Bankruptcy: The Reality Behind Uncle Sam’s Inflated Bar Tab

Hidden Bankruptcy: The Reality Behind Uncle Sam’s Inflated Bar Tab

Authored by Matthew Piepenburg via GoldSwitzerland.com,

Below, we look at The hidden bankruptcy of the US in the wake of even more inflationary forces confirmed by cost-of-li

Authored by Matthew Piepenburg via GoldSwitzerland.com,

Below, we look at The hidden bankruptcy of the US in the wake of even more inflationary forces confirmed by cost-of-living-adjustments, Uncle Sam’s interest expenses, objectively unloved Treasuries and a roaring as well as convenient COVID narrative.

Math vs. Double-Speak

Given the fact that just about everything coming out of the mouths of debt-cornered policy makers requires a lie-detector and “double-speak” translator, we’ve been arguing since the moment the Fed began peddling the “transitory inflation” meme/myth to think differently.

In short: It’s our view that inflation is a snowball growing, not melting.

Toward this end, we’ve written and spoken at length as often as we can as to the many converging forces pointing toward rising inflation—from increased governmental guarantees (controls) over commercial bank loans, commodity super cycles to just plain economic realism, as inflation (and hence currency debasement) is the only tool left (beyond bankruptcy, taxation and “growth”) to service otherwise unsustainable debt levels: A hidden bankruptcy.

But let us not stop there, as other inflationary storm clouds are on the horizon yet ignored (not surprisingly) by an increasingly clueless financial media.

Another Glaringly-Ignored Inflation Indicator—COLA 2.2022

In particular, we are thinking about the U.S. Cost of Living Adjustment (“COLA”) for 2022 which could easily reach 6%, the highest of its kind since 1982.

It would seem that the U.S. Social Security Administration, unlike Powell, is aware of inflation, and therefore preparing (i.e., “adjusting”) for the same.

As the price for entitlement obligations rises, so too will the level of money printing to pay for the same, a veritable vicious circle for rising inflation.

Then there’s simple math.

We’ve talked about the Realpolitik of negative real rates as the final and desperate way for debt-soaked sovereigns to service their debt.

The signs of this are literally everywhere.

If we take, for example, a 1.4% Treasury Yield and subtract a potential 6% COLA increase for Social Security, we get -4.6% real rates, which will be a boon for alternative stores of value like gold and silver or “currencies” like BTC (as well as farmland and high-end real estate, which is continuing to enjoy a debt-jubilee of negative 3% real (i.e., “free” mortgages).

The necessary evil of negative real rates also speaks to the ongoing taper debate…

Giving Clarity to the Taper Debate

As tweets by twits pour across the electronic universe, it’s often important to notice what is not being “tweeted,” such as the interest expense on Uncle Sam’s national bar tab.

As the financial world hangs on the edge of its seat to see if the Fed will taper its QE (i.e., money printing) program and send bonds (and stocks) to the floor and rates toward the sky, they’ve ignored some basic math and a key chart.

Specifically, we are referring to the chart below representing the true interest expense on the debt bar-tab of a now fully debt-intoxicated Uncle Sam:

With central-bank “accommodated” asset bubbles (from stocks to real estate to art) now at historically unprecedented levels, tax receipts flowing into the U.S. coffers from the ever-growing millionaire-to-billionaire class have been rising.

This may seem good for that punch-drunk Uncle Sam, but what no one is talking about is that despite even those “capital gain” receipts, the interest expense (i.e., “bar tab”) in D.C. is now an astronomical 111% of those same tax receipts.

In other words, U.S. tax income doesn’t come close to even paying interest (let alone that archaic concept known as “principal”) on growing U.S. debt obligations.

Can anyone say, “Uh-oh?”

Given the stark but ignored reality of unpayable U.S. debt, the implications going forward are fairly clear.

First, the Fed will not be able to “taper,” as less QE will mean an even higher interest rate, and thus higher interest expense on debt it still can’t pay at today’s artificially low rates.

Stated otherwise, a “taper” would only add helicopters of gasoline to a debt fire that is already burning the Divided States of America.

Given the dangers of such a taper, it likely won’t happen because it can’t happen, and this means more money printing and hence more negative real rates creating a hidden bankruptcy ahead, a weaker USD and rising precious metal prices, among others.

But What If the Fed Tapers?

Alternatively, should the Fed somehow turn hawkish and taper its QE support in the face of a debt forest fire, Treasuries will sell off dramatically, rates will rise, markets will tank, and the USD will surge—not good for Gold, BTC or just about anything else.

Does it Matter?

But as we’ve also tried to make crystal clear, there is no way the Fed will taper QE liquidity before it sets up a back-channel for even more liquidity from the Standing Repo Facility, Reverse Repo Facility and FIMA swap lines, which are all just “QE” by other names.

In simple speak, therefore, the “taper debate” is no debate, as the Fed has many liquidity tricks up its greasy sleeves.

In addition to liquidity tricks, the Fed has some ugly bonds to buy.

Embarrassing Treasuries

As we’ve said so many times, the biggest issue today is unsustainable and embarrassing debt levels requiring inflation (hidden bankruptcy), compliments of policy makers rather than a viral pandemic narrative out of all proportion to its confused scientific truths.

COVID has been an all-too timely and convenient pretext for blaming global debt ($300T) or U.S. public debt ($28.5T) on a flu rather than a sordid history of grotesque mismanagement from politico’s and bankers that was in play long before the first headlines out of Wuhan.

Furthermore, COVID monetary and fiscal policy measures effectively became a (hidden) pretext for a second market bailout greater in scope (yet better in optics) than the post-Lehman bailout of those otherwise Too Big to Fail banks.

In short, the façade (and branding) of a humanitarian crisis allowed a market-saving liquidity rescue (Bailout 2.0) to an otherwise Dead-on-Arrival bond market in late 2019.

In case this sounds too controversial to consider, please follow the Treasury market rather than our bemused nouns and adjectives, not to mention our total lack of scientific/medical credentials.

Bad IOUs

Just like friends don’t accept IOUs from drug addicts, global investors heading into 2020 stopped buying Uncle Sam’s Treasuries.

In simple-speak, Uncle Sam just seemed too debt-drunk to trust.

As a result, his Treasury bonds, once seen as “safe havens,” were finally seen as “bad jokes”—akin to the paper coming out of equally discredited zip codes like Greece, Italy or Spain.

For this reason, foreigners in a nervous 2020 (unlike a broken 2009) had not only stopped buying U.S. Treasuries, they were selling them.

Yep.

Months ago, smart voices from the Street, including Stan Druckenmiller, were warning about the implications of such a shift in financial consciousness/trust.

Druckenmiller’s Astonishment

Specifically, Druckenmiller spoke of something he’d never seen in over 40 years as a market veteran.

That is, as stocks were tanking in the spring of 2020, he also saw the bond market lose 18 points in one day.

This correlated fall in stocks and bonds was not, as everyone “tweeted,” a reaction to the fiscal profligacy of the CARES Act, but more sadly a very new trend by foreigners to get rid of increasingly discredited U.S. IOUs.

Folks, this is a critical shift.

For over two decades (including during the Great Financial Crisis of 2009), U.S. Treasuries (and the USD) were once seen as “safe” landing places for foreign money rather than a risky bet.

Now, instead of seeing an annual average $500B inflow into U.S. bonds, we are seeing annual outflows of $500B…

When you tack on a $700B current account deficit in D.C. to a net loss of $1 trillion in Treasury support, whose left to “fill the gap” and buy those unwanted IOU’s?

You guessed it: The Fed.

And how will they come up the money to cover these purchases?

You guessed it again: They’ll mouse-click that “money” out of thin air to create a stealthy, hidden bankruptcy.

Needless to say, such realism (i.e., objective math) puts a lot of pressure on the U.S. Dollar as the Fed is forced to create even more money at a record pace to buy otherwise unwanted Treasuries.

But what kept the USD from falling in favor by end of 2020, if no one was buying our bonds but the Fed?

Well, the short answer is that all that foreign money (from sovereign wealth funds and foreign central banks) once ear-marked for our once-credible U.S. Treasury bonds went instead into those massive U.S. digital transformation companies who benefited most from a locked-down new mad world, namely GOOG, ZOOM and MSFT etc.

And how did Druckenmiller describe this shift?

Simple. He called it a “raging new mania.”

From Mania to Desperate

Foreign money once reserved for “safe haven” bonds was (and is) pouring into an already over-sized equity bubble.

By July, the USD had peaked, but after a peak comes, well…a fall for the Greenback—all very good for commodities, real estate, growth tech stocks and, of course, precious metals.

Back to the “What If” of a Naked Taper

But (and this is a very big “but”), what if the Fed were insane enough to taper QE without any back-door liquidity from foreign swap lines and the repo programs?

Again, ugly Treasuries would get even uglier, tank in price, sending rates and the USD higher and gold lower, along with a sharp sell-off in risk assets—i.e., corporate stocks and bonds.

But again, we don’t think this will happen, because as desperate as central bankers are, they are equally predictable.

Predictable Behavior?

That is, they know that such a naked taper (i.e., a taper without a back door repo or swap-induced liquidity) would cause rates to spike, and hence Uncle Sam’s bar-tab to default.

As the Fed’s Vice Chair intimated last year, US Treasuries (Uncle Sam’s bar tab) are simply too big to fail.

This means we can expect more liquidity (QE or repo/swap) and hence more, not less inflation.

The Fed is stuck in a self-inflicted dilemma–between letting inflation rip (to partially service America’s bar tab and “declaring” a hidden bankruptcy) or watching markets sink to the bottom of time.

For now, which choice do you think these banking, pro-market cabal thinkers will make?

The Realpolitik of COVID

Meanwhile, and regardless of one’s views on the vaccine mandates, case fatality rates vs. infection rates, or mask wearing vs. mask annoyance, no one needs our amateur medical advice.

But looking at COVID as a policy tool rather than as controversial health issue, it’s also fairly clear that the powers that be will be milking this fear-porn-to-policy trick for all its worth for as long as its worth.

Why?

Again, COVID is a wonderful narrative to justify more debt and more instant liquidity (i.e., fiat monetary expansion) and hence more inflation to inflate away the debt of debt-drunk nations already fatally in debt pre-COVID.

Rightly or wrongly, there are already scientists out of the UK (namely Oxford vaccine creator Sarah Gilbert) with more IQ-power and credibility than Fauci or Fergusson (admittedly not a high bar), who are already signaling that COVID will resemble little more than a common cold by next year.

This, if true (and no one really knows anyway), would be good for the world—but would the policy makers like this?

A post-COVID normal would be a boon to commerce and economic activity, and hence a boon to the velocity of money, which would kick inflation into ultra-high-gear.

High inflation will mean higher rates, which scare debt-soaked politicians and central bankers, unless inflation rises higher than those rates and negative real yields become the norm, which, again, we think is the realistic (i.e., only option) for these financial magicians running our governments, lives and central banks.

In such a scenario, gold will smile upon the inflation to come.

In short, and however we look at it, inflation is the new norm, and negative real rates are no less so, regardless of how the taper or COVID debate plays out.

As the future unfolds, gold, whose price is waiting for confirmation of such inflation, will only grow stronger as the “transitory” meme gets weaker by the day.

Uncategorized

Apartment permits are back to recession lows. Will mortgage rates follow?

If housing leads us into a recession in the near future, that means mortgage rates have stayed too high for too long.

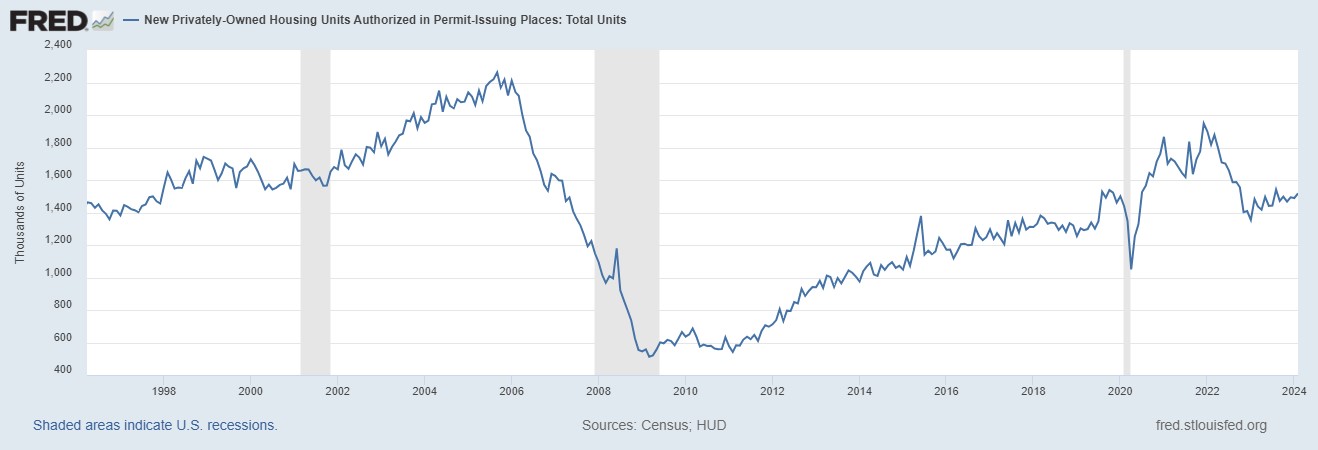

In Tuesday’s report, the 5-unit housing permits data hit the same levels we saw in the COVID-19 recession. Once the backlog of apartments is finished, those jobs will be at risk, which traditionally means mortgage rates would fall soon after, as they have in previous economic cycles.

However, this is happening while single-family permits are still rising as the rate of builder buy-downs and the backlog of single-family homes push single-family permits and starts higher. It is a tale of two markets — something I brought up on CNBC earlier this year to explain why this trend matters with housing starts data because the two marketplaces are heading in opposite directions.

The question is: Will the uptick in single-family permits keep mortgage rates higher than usual? As long as jobless claims stay low, the falling 5-unit apartment permit data might not lead to lower mortgage rates as it has in previous cycles.

From Census: Building Permits: Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,518,000. This is 1.9 percent above the revised January rate of 1,489,000 and 2.4 percent above the February 2023 rate of 1,482,000.

When people say housing leads us in and out of a recession, it is a valid premise and that is why people carefully track housing permits. However, this housing cycle has been unique. Unfortunately, many people who have tracked this housing cycle are still stuck on 2008, believing that what happened during COVID-19 was rampant demand speculation that would lead to a massive supply of homes once home sales crashed. This would mean the builders couldn’t sell more new homes or have housing permits rise.

Housing permits, starts and new home sales were falling for a while, and in 2022, the data looked recessionary. However, new home sales were never near the 2005 peak, and the builders found a workable bottom in sales by paying down mortgage rates to boost demand. The first level of job loss recessionary data has been averted for now. Below is the chart of the building permits.

On the other hand, the apartment boom and bust has already happened. Permits are already back to the levels of the COVID-19 recession and have legs to move lower. Traditionally, when this data line gets this negative, a recession isn’t far off. But, as you can see in the chart below, there’s a big gap between the housing permit data for single-family and five units. Looking at this chart, the recession would only happen after single-family and 5-unit permits fall together, not when we have a gap like we see today.

From Census: Housing completions: Privately‐owned housing completions in February were at a seasonally adjusted annual rate of 1,729,000.

As we can see in the chart below, we had a solid month of housing completions. This was driven by 5-unit completions, which have been in the works for a while now. Also, this month’s report show a weather impact as progress in building was held up due to bad weather. However, the good news is that more supply of rental units will mean the fight against rent inflation will be positive as more supply is the best way to deal with inflation. In time, that is also good news for mortgage rates.

Housing Starts: Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,521,000. This is 10.7 percent (±14.2 percent)* above the revised January estimate of 1,374,000 and is 5.9 percent (±10.0 percent)* above the February 2023 rate of 1,436,000.

Housing starts data beat to the upside, but the real story is that the marketplace has diverged into two different directions. The apartment boom is over and permits are heading below the COVID-19 recession, but as long as the builders can keep rates low enough to sell more new homes, single-family permits and starts can slowly move forward.

If we lose the single-family marketplace, expect the chart below to look like it always does before a recession — meaning residential construction workers lose their jobs. For now, the apartment construction workers are at the most risk once they finish the backlog of apartments under construction.

Overall, the housing starts beat to the upside. Still, the report’s internals show a marketplace with early recessionary data lines, which traditionally mean mortgage rates should go lower soon. If housing leads us into a recession in the near future, that means mortgage rates have stayed too high for too long and restrictive policy by the Fed created a recession as we have seen in previous economic cycles.

The builders have been paying down rates to keep construction workers employed, but if rates go higher, it will get more and more challenging to do this because not all builders have the capacity to buy down rates. Last year, we saw what 8% mortgage rates did to new home sales; they dropped before rates fell. So, this is something to keep track of, especially with a critical Federal Reserve meeting this week.

recession covid-19 fed federal reserve home sales mortgage rates recessionGovernment

Young People Aren’t Nearly Angry Enough About Government Debt

Young People Aren’t Nearly Angry Enough About Government Debt

Authored by The American Institute for Economic Research,

Young people sometimes…

Authored by The American Institute for Economic Research,

Young people sometimes seem to wake up in the morning in search of something to be outraged about. We are among the wealthiest and most educated humans in history. But we’re increasingly convinced that we’re worse off than our parents were, that the planet is in crisis, and that it’s probably not worth having kids.

I’ll generalize here about my own cohort (people born after 1981 but before 2010), commonly referred to as Millennials and Gen Z, as that shorthand corresponds to survey and demographic data. Millennials and Gen Z have valid economic complaints, and the conditions of our young adulthood perceptibly weakened traditional bridges to economic independence. We graduated with record amounts of student debt after President Obama nationalized that lending. Housing prices doubled during our household formation years due to zoning impediments and chronic underbuilding. Young Americans say economic issues are important to us, and candidates are courting our votes by promising student debt relief and cheaper housing (which they will never be able to deliver).

Young people, in our idealism and our rational ignorance of the actual appropriations process, typically support more government intervention, more spending programs, and more of every other burden that has landed us in such untenable economic circumstances to begin with. Perhaps not coincidentally, young people who’ve spent the most years in the increasingly partisan bubble of higher education are also the most likely to favor expanded government programs as a “solution” to those complaints.

It’s Your Debt, Boomer

What most young people don’t yet understand is that we are sacrificing our young adulthood and our financial security to pay for debts run up by Baby Boomers. Part of every Millennial and Gen-Z paycheck is payable to people the same age as the members of Congress currently milking this system and miring us further in debt.

Our government spends more than it can extract from taxpayers. Social Security, which represents 20 percent of government spending, has run an annual deficit for 15 years. Last year Social Security alone overspent by $22.1 billion. To keep sending out checks to retirees, Social Security goes begging to the Treasury Department, and the Treasury borrows from the public by issuing bonds. Bonds allow investors (who are often also taxpayers) to pay for some retirees’ benefits now, and be paid back later. But investors only volunteer to lend Social Security the money it needs to cover its bills because the (younger) taxpayers will eventually repay the debt — with interest.

In other words, both Social Security and Medicare, along with various smaller federal entitlement programs, together comprising almost half of the federal budget, have been operating for a decade on the principle of “give us the money now, and stick the next generation with the check.” We saddle future generations with debt for present-day consumption.

The second largest item in the budget after Social Security is interest on the national debt — largely on Social Security and other entitlements that have already been spent. These mandatory benefits now consume three quarters of the federal budget: even Congress is not answerable for these programs. We never had the chance for our votes to impact that spending (not that older generations were much better represented) and it’s unclear if we ever will.

Young Americans probably don’t think much about the budget deficit (each year’s overspending) or the national debt (many years’ deficits put together, plus interest) much at all. And why should we? For our entire political memory, the federal government, as well as most of our state governments, have been steadily piling “public” debt upon our individual and collective heads. That’s just how it is. We are the frogs trying to make our way in the watery world as the temperature ticks imperceptibly higher. We have been swimming in debt forever, unaware that we’re being economically boiled alive.

Millennials have somewhat modest non-mortgage debt of around $27,000 (some self-reports say twice that much), including car notes, student loans, and credit cards. But we each owe more than $100,000 as a share of the national debt. And we don’t even know it.

When Millennials finally do have babies (and we are!) that infant born in 2024 will enter the world with a newly minted Social Security Number and $78,089 credit card bill for Granddad’s heart surgery and the interest on a benefit check that was mailed when her parents were in middle school.

Headlines and comments sections love to sneer at “snowflakes” who’ve just hit the “real world,” and can’t figure out how to make ends meet, but the kids are onto something. A full 15 percent of our earnings are confiscated to pay into retirement and healthcare programs that will be insolvent by the time we’re old enough to enjoy them. The Federal Reserve and government debt are eating the economy. The same interest rates that are pushing mortgages out of reach are driving up the cost of interest to maintain the debt going forward. As we learn to save and invest, our dollars are slowly devalued. We’re right to feel trapped.

Sure, if we’re alive and own a smartphone, we’re among the one percent of the wealthiest humans who’ve ever lived. Older generations could argue (persuasively!) that we have no idea what “poverty” is anymore. But with the state of government spending and debt…we are likely to find out.

Despite being richer than Rockefeller, Millennials are right to say that the previous ways of building income security have been pushed out of reach. Our earning years are subsidizing not our own economic coming-of-age, but bank bailouts, wars abroad, and retirement and medical benefits for people who navigated a less-challenging wealth-building landscape.

Redistribution goes both ways. Boomers are expected to pass on tens of trillions in unprecedented wealth to their children (if it isn’t eaten up by medical costs, despite heavy federal subsidies) and older generations’ financial support of the younger has had palpable lifting effects. Half of college costs are paid by families, and the trope of young people moving back home is only possible if mom and dad have the spare room and groceries to make that feasible.

Government “help” during COVID-19 resulted in the worst inflation in 40 years, as the federal government spent $42,000 per citizen on “stimulus” efforts, right around a Millennial’s average salary at that time. An absurd amount of fraud was perpetrated in the stimulus to save an economy from the lockdown that nearly ruined it. Trillions in earmarked goodies were rubber stamped, carelessly added to young people’s growing bill. Government lenders deliberately removed fraud controls, fearing they couldn’t hand out $800 billion in young people’s future wages away fast enough. Important lessons were taught by those programs. The importance of self-sufficiency and the dignity of hard work weren’t top of the list.

Boomer Benefits are Stagnating Hiring, Wages, and Investment for Young People

Even if our workplace engagement suffered under government distortions, Millennials continue to work more hours than other generations and invest in side hustles and self employment at higher rates. Working hard and winning higher wages almost doesn’t matter, though, when our purchasing power is eaten from the other side. Buying power has dropped 20 percent in just five years. Life is $11,400/year more expensive than it was two years ago and deficit spending is the reason why.

We’re having trouble getting hired for what we’re worth, because it costs employers 30 percent more than just our wages to employ us. The federal tax code both requires and incentivizes our employers to transfer a bunch of what we earned directly to insurance companies and those same Boomer-busted federal benefits, via tax-deductible benefits and payroll taxes. And the regulatory compliance costs of ravenous bureaucratic state. The price paid by each employer to keep each employee continues to rise — but Congress says your boss has to give most of the increase to someone other than you.

Federal spending programs that many people consider good government, including Social Security, Medicare, Medicaid, and health insurance for children (CHIP) aren’t a small amount of the federal budget. Government spends on these programs because people support and demand them, and because cutting those benefits would be a re-election death sentence. That’s why they call cutting Social Security the “third rail of politics.” If you touch those benefits, you die. Congress is held hostage by Baby Boomers who are running up the bill with no sign of slowing down.

Young people generally support Social Security and the public health insurance programs, even though a 2021 poll by Nationwide Financial found 47 percent of Millennials agree with the statement “I will not get a dime of the Social Security benefits I have earned.”

In the same survey, Millennials were the most likely of any generation to believe that Social Security benefits should be enough to live on as a sole income, and guessed the retirement age was 52 (it’s 67 for anyone born after 1959 — and that’s likely to rise). Young people are the most likely to see government guarantees as a valid way to live — even though we seem to understand that those promises aren’t guarantees at all.

Healthcare costs tied to an aging population and wonderful-but-expensive growth in medical technologies and medications will balloon over the next few years, and so will the deficits in Boomer benefit programs. Newly developed obesity drugs alone are expected to add $13.6 billion to Medicare spending. By 2030, every single Baby Boomer will be 65, eligible for publicly funded healthcare.

The first Millennial will be eligible to claim Medicare (assuming the program exists and the qualifying age is still 65, both of which are improbable) in 2046. As it happens, that’s also the year that the Boomer benefits programs (which will then be bloated with Gen Xers) and the interest payments we’re incurring to provide those benefits now, are projected to consume 100 percent of federal tax revenue.

Government spending is being transferred to bureaucrats and then to the beneficiaries of government spending who are, in some sense, your diabetic grandma who needs a Medicare-paid dialysis treatment, but in a much more immediate sense, are the insurance companies, pharma giants, and hospital corporations who wrote the healthcare legislation. Some percentage of every college graduate’s paycheck buys bullets that get fired at nothing and inflating the private investment portfolios of government contractors, with dubious, wasteful outcomes from the prison-industrial complex to the perpetual war machine.

No bank or nation in the world can lend the kind of money the American government needs to borrow to fulfill its obligations to citizens. Someone will have to bite the bullet. Even some of the co-authors of the current disaster are wrestling with the truth.

Forget avocado toast and streaming subscriptions. We’re already sensing it, but we haven’t yet seen it. Young people are not well-informed, and often actively misled, about what’s rotten in this economic system. But we are seeing the consequences on store shelves and mortgage contracts and we can sense disaster is coming. We’re about to get stuck with the bill.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

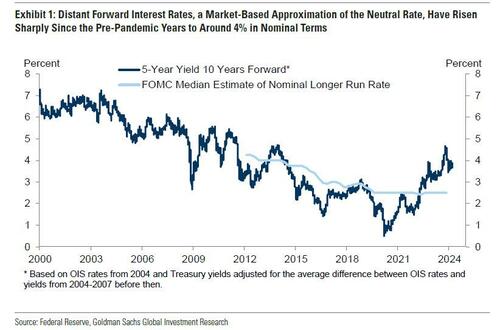

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex