Governments Face Urgent Demand for Digital Solutions and E-services; Low-Code Proves Value as Go-To Platform

Governments Face Urgent Demand for Digital Solutions and E-services; Low-Code Proves Value as Go-To Platform

PR Newswire

BOSTON, May 25, 2022

Five Ways the public sector can leverage low-code to accelerate delivery of digital government servicesRes…

Governments Face Urgent Demand for Digital Solutions and E-services; Low-Code Proves Value as Go-To Platform

PR Newswire

BOSTON, May 25, 2022

- Five Ways the public sector can leverage low-code to accelerate delivery of digital government services

- Researchers cite a perfect storm of post-pandemic demand and rising expectations for agile, responsive digital solutions by government agencies

- Majority of government agencies worldwide face urgent need to modernize critical legacy applications and incorporate next-generation tech solutions

- Low-code software development is perfectly tailored for public sector collaboration and governance across agencies and digital ecosystems

BOSTON , May 25, 2022 /PRNewswire/ -- According to Mendix, a Siemens business and global leader in modern enterprise application development, the convergence of post-pandemic trends and technological advancements are fundamentally reshaping the distribution, provision, and access to e-government and digital-first services for the public sector. Although the emergence of data-driven, tech-enabled "Smart Cities" dates back to 1974, pandemic-related mitigation measures required the public sector to reinvent secure, accessible digital channels for constituents and workforce administrators.

Recent findings by the U.S.-based National Association of State CIOs describe a seismic shift in the pace of digitalization by state and local agencies that felt like "10 years' worth of deployments in 8 months." However, the successful expansion of e-government services has raised expectations for government agility and responsiveness by administrators, constituents, policy makers, and regulators alike.

Research shows accelerating numbers of use cases — generated by increased demand for next-generation cloud-based computing, artificial intelligence, Internet of Things, 5G connectivity, and hyperautomation — for federal, state, and local agencies to digitalize their services and planning processes. Yet analysts also cite the public sector's long-established oversight, budgeting, and procurement requirements as a potential bottleneck to rapid transformation.

E-government for future needs and rising expectations

To navigate this perfect storm, a low-code software development platform with a robust ecosystem has proven invaluable for public sector agencies tasked with reinventing digital government for a new era.

"During the pandemic, Mendix public sector customers developed scalable, innovative digital solutions embraced by a range of policy makers and agencies," said Mark Smitham, head of public sector EMEA at Mendix. "Today, there is no going back. Public agencies are expected to make decisions at speed and deliver value in real time. Governments can no longer operate in a reactive mode. In our complex, volatile era, the public sector must leverage technology to collaborate across multiple jurisdictions and successfully engage with constituents."

According to Gartner, 60% of worldwide public agencies expect to triple their citizen-facing digital services by 2023. On the national level, governments are aiding the call to modernize critical legacy applications to be more responsive in this changing landscape. In the U.S. for example, a bipartisan proposal moving through congress would prioritize replacing federal legacy IT systems with modern infrastructure.

Low-code software development platforms are uniquely positioned to help the public sector maximize allocated resources while rapidly iterating and deploying innovative solutions. Here are five ways that best-in-class software development platforms will drive digital success for public sector needs.

1. Composable solutions, tailored for future needs

Research shows that government employees have the highest usage of shadow IT, turning to these workarounds when red tape and other barriers halt procurement of the technology they need to get the job done. Such ad-hoc solutions expose the organization to increased risk of cyber hacking. Plus, commercial off-the-shelf systems from single-solution vendors can prove costly later, when unexpected crises or changing conditions require customization for new use cases. A robust software development platform, on the other hand, is specifically designed for iterative collaboration. Open architecture with built-in governance and connectivity control can stabilize an agency's provision of digital services regardless of procurement cycle timing or budget allocation.

Gartner analysts recently cited the use of composable software apps (characterized as modular, adaptable, and reusable digital solutions) as the most important factor for government enterprises tasked with meeting changing regulatory, legislative, and public expectations.

2. Modernizing legacy systems for new needs

Widespread support for public sector digitalization is driving the accelerated pace of legacy modernization. Local and regional governments are charting the impact of IoT and connected devices, AI, and 5G connectivity to achieve operational efficiencies across a range of services, including traffic and transportation flows, energy use and lighting, health monitoring of waste, water, and air quality, public works and safety, emergency services, and resource planning and allocation.

Technology has always been an essential ingredient for a range of local services. The next phase, however, will come from hyperconnected public infrastructure. The ultra low latency of long-promised 5G connectivity linking massive, multiple connections of IoT sensors will be the linchpin that makes real-time decision-making at scale a reality for the public sector.

"This will be a game-changer, enabling the promise of smart cities to become a wide-spread reality," Smitham said. He cautions, however, that ease of data integration across the digital ecosystem will determine progress or delay. "An adaptable, flexible low-code platform that extends the technology stack in a malleable way will allow service providers to stay current with changing technologies, partners, and services," said Smitham. "Mendix's low-code platform can be the glue enabling communication and integration across these different protocols."

3. Security by design, embedded from the start

In today's high-threat environment, enhanced cybersecurity, data protection, and trustful interactions across e-government's digital ecosystem is top of mind for public sector managers. Even minor government transactions can potentially lead to financial and reputational exposure and loss if not adequately protected.

"What used to be an afterthought must be embedded into systems, infrastructure, and implementation standards," said Smitham. Citing the Charter of Trust and the Paris Call for Trust and Security in Cyberspace, an international framework signed by 1,200 governments, NGOs, and academic institutions, he added, "Digital security must be addressed from the very beginning. It's not something that can be added later, piecemeal."

The public sector must vet potential software development platforms for governance, control, and monitoring of activity across the application landscape. They should seek out platform providers with the highest level of third-party certifications and accreditations, such as ISO, the benchmark of global compliance for information security.

Another layer of protection is found in strategic partnerships. Microsoft operates the global, nonpartisan Defending Democracy program to protect election infrastructure, including emails and networks of voters, political parties, and staff. CloudFlare specializes in endpoint security software as a service, protecting, for example, hospital networks and infrastructure. Cloud-based hyperscalers, including Alibaba, Amazon Web Services, Google, Huawei, and Microsoft, operate at the highest level of security and oversight, employing large contingents of software engineering talent to operate safe and secure cloud platforms.

4. A key to the city that safely unlocks silos

The next challenge facing e-government? Providing an accurate, digital "proof of identity" that will unlock the full potential of e-government services, expanding access while reducing costs. There are, however, two interrelated challenges: First, the public must trust how agencies collect, store, safeguard, and control access to sensitive information, such as tax and health records, welfare payments, certifications, licensing, and more. At the same time, government services must find a way to share and validate ID credentials across agency silos, creating what researchers term "digital identity ecosystems."

Three EU countries, Belgium, Netherlands, and Estonia, have pioneered a single identity registration service that validates digital services for constituents regardless of geographic location. But for most countries, including the U.S. and the United Kingdom, hybrid systems of paper-based identification — passports, drivers licenses, social security cards, insurance cards, and biometric scans of fingerprints — are standard practice.

According to Smitham, low-code platforms have a unique advantage in building and managing digital identity ecosystems. "Connecting securely to other systems and data sets easily and readily is the fundamental driver for adopting an enterprise software development platform," he said. "It doesn't matter whether the customer is a bank, a store, or a government agency." Platforms with certified governance and control capabilities will integrate identity authentication via secure, low-code built connectors. Smitham added, "This is the future of digital public services."

5. Don't reinvent the wheel when it's possible to share

Around the world, municipal agencies provide constituents with similar services, be it tax collection, waste management, traffic and parking enforcement, emergency services, birth or marriage registration. Unlike private enterprises seeking competitive advantage, public sector organizations are free to collaborate and share digital solutions, thereby driving innovation and speeding time to value.

Furthermore, public sector activity must be transparent, responding to feedback from multiple stakeholders. When public trust evaporates, solutions can prove controversial, as evidenced by the recent IRS proposal to use facial recognition scans for U.S. taxpayers.

"Cities have begun sharing best practices on regulating public sector uses of AI," says Smitham. "Less well-known are the multitude of digital services that have been successfully delivered and adopted. Public agencies become more agile and responsive when they collaborate and share their approaches for modernizing their practices and prioritizing technology adoption."

Such collaboration also extends the public sector's digital skill set and reduces the burden on under-resourced IT departments. Smitham cited the EU's powerful "Research Online Platform" application that tracks side effects of Covid-19 vaccines. The digital tool was built on the Mendix platform in collaboration with the European Medicines Agency and the University Medical Center Utrecht in the Netherlands, and is now used in 45 countries. "The solution enables researchers to collect data internationally on a secure, scalable cloud platform with anonymized user profiles, balancing technological innovation with public needs for privacy and security," he said.

Digital solutions for the benefit of all

The new era of expanded e-government services has the potential to advance sustainability, civic engagement, and promote economic prosperity. "Low-code software development and platform integration will speed the public sector towards this goal, removing the pain points caused by monolithic processes, legacy systems, and proprietary architecture," said Johan den Haan, chief technology officer at Mendix. "Digital solutions that empower both end users and local governments while leveraging the flexibility of today's technology, tools, and services will greatly expand the public commons for every 21st century citizen."

For more information about efficient and flexible digital public services please visit Mendix for Public Sector.

Learn more about the Mendix Platform and Pricing and Availability.

Connect with Mendix

About Mendix

In a digital-first world, customers want their every need anticipated, employees want better tools to do their jobs, and enterprises know that sweeping digital transformation is the key to survival and success. Mendix, a Siemens business, is quickly becoming the engine of the enterprise digital landscape. Its industry-leading low-code platform and comprehensive ecosystem integrates the most advanced technology to support solutions that boost engagement, streamline operations, and relieve IT logjams. Built on the pillars of abstraction, automation, cloud, and collaboration, Mendix dramatically increases developer productivity and empowers a legion of not-so-technical, 'citizen' developers to create apps guided by their particular domain expertise, facilitated by Mendix's engineered-in collaborative capabilities and intuitive visual interface. Recognized as a leader and visionary by leading industry analysts, the platform is cloud-native, open, extensible, agile, and proven. From artificial intelligence and augmented reality to intelligent automation and native mobile, Mendix is the backbone of digital-first enterprises. The Mendix enterprise low-code platform has been adopted by more than 4,000 leading companies in 46 countries.

Press Inquiries

Sara Black

sara@bospar.com

(213) 618-1501

Dan Berkowitz

Senior Director Global Communications

Mendix

Dan.Berkowitz@mendix.com

(415) 518-7870

View original content to download multimedia:https://www.prnewswire.com/news-releases/governments-face-urgent-demand-for-digital-solutions-and-e-services-low-code-proves-value-as-go-to-platform-301554384.html

SOURCE Mendix

Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

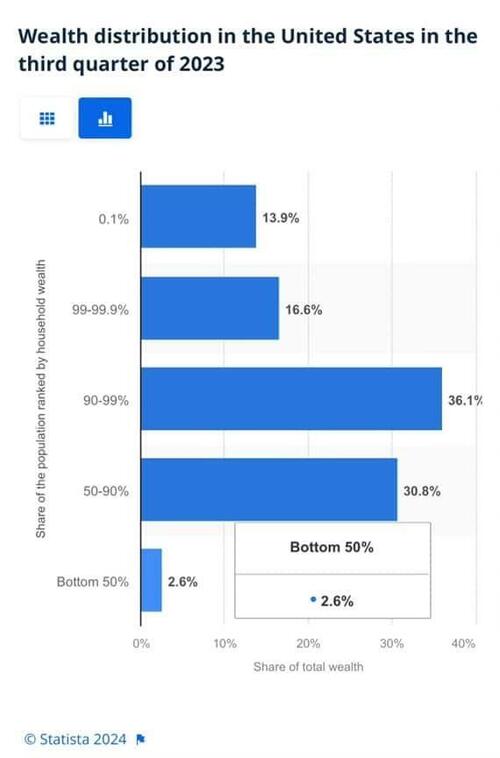

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

International

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges