International

Global X challenges EMQQ with its own EM internet & e-commerce ETF

Global X challenges EMQQ with its own EM internet & e-commerce ETF

Global X has launched its version of one of the most successful emerging market strategies in recent years.

Chelsea Rodstrom, Research Analyst at Global X ETFs.

The Global X Emerging Markets Internet & E-commerce ETF (EWEB US) has listed on Nasdaq Exchange and comes with an expense ratio of 0.65%.

The fund invests in companies from developing countries with operations linked to internet and e-commerce activities, a strategy that closely mirrors the approach of the well-established $1.3 billion EMQQ Emerging Markets Internet & Ecommerce ETF (EMQQ US).

EMQQ, which comes with a chunkier expense ratio of 0.86%, has consistently outperformed the broader emerging markets equity universe with a return of 215.7% over the past five years, as of 13 November, compared to 83.7% for the MSCI Emerging Markets Index.

This performance gap has widened during the Covid-19 pandemic environment with EMQQ up 61.9% year-to-date compared to just 6.6% for the benchmark.

The underlying investment proposition is to tap into the emerging markets growth story by targeting the converging themes of growing middle-class consumption and digitalization.

According to the IMF, when using exchange rates that are adjusted for purchasing power parity, nearly three-quarters (74%) of global growth in 2018 was attributable to emerging markets. The IMF further notes that emerging markets’ consumption has already surpassed that of developed markets and is expected to be responsible for 84% of global consumption by 2023.

These high-growth trends are supported by a burgeoning internet-connected middle class that is forming new technology-enabled consumption patterns and driving the growth of e-commerce platforms across all emerging market regions globally.

Chelsea Rodstrom, Research Analyst at Global X ETFs, commented, “There is a convergence of themes playing out in emerging markets that’s accelerating consumers’ engagement with online platforms. Education, wages, consumption, and internet connectivity are all increasing in tandem with emerging markets’ economic development.

“In many cases, this new generation of consumers is skipping physical retail experiences in favor of digital ones. Global X has a long history of providing investment solutions for both emerging markets and technology investing. With EWEB, we’re thrilled to leverage our expertise in these two areas to provide our investors access to this exceptional growth story.”

Methodology

EWEB is linked to the Nasdaq CTA Emerging Markets Internet & E-commerce Index which selects its constituents from an initial universe of emerging market stocks, including American Depository Receipts, with market capitalizations greater than $1bn and average daily trading volume above $5 million.

Eligible companies must have primary businesses that include internet retail commerce, internet-related services, internet software, or internet search engine, and must derive at least half of their revenue from internet or e-commerce related activities, as determined by the Consumer Technology Association, a US-based standards and trade organization.

The methodology selects the largest 50 eligible stocks and weights them by float-adjusted market capitalization subject to a cap of 8% on each of the top five positions and a cap of 4% on any other company. Reconstitution and rebalancing occur semi-annually.

EWEB’s methodology is essentially akin to that underpinning EMQQ bar a few slight differences. Most notably, EMQQ includes all eligible companies and uses lower market cap ($300m) and average daily turnover ($1m) thresholds, leading to a broader portfolio of over 80 names. The weighting approach is similar between the two ETFs.

EWEB’s portfolio is overweight Chinese companies which account for three-quarters (74.0%) of the total exposure compared to around 60% for EMQQ. EWEB’s next-largest country exposures are Brazil (7.0%), South Korea (6.8%), and South Africa (4.5%).

Consumer discretionary and communication services make up the bulk of EWEB’s sector exposures with weights of 53.7% and 39.4%, respectively.

There is considerable overlap in constituents with near-identical top holdings. For EWEB, this includes Pinduoduo (12.2%), Meituan (8.5%), JD.com (8.4%), Tencent Holdings (8.2%), Alibaba (6.5%), Baidu (4.2%), Naspers (4.0%), and MercadoLibre (4.0%).

The post Global X challenges EMQQ with its own EM internet & e-commerce ETF first appeared on ETF Strategy.

International

Mistakes Were Made

Mistakes Were Made

Authored by C.J.Hopkins via The Consent Factory,

Make fun of the Germans all you want, and I’ve certainly done that…

Authored by C.J.Hopkins via The Consent Factory,

Make fun of the Germans all you want, and I’ve certainly done that a bit during these past few years, but, if there’s one thing they’re exceptionally good at, it’s taking responsibility for their mistakes. Seriously, when it comes to acknowledging one’s mistakes, and not rationalizing, or minimizing, or attempting to deny them, and any discomfort they may have allegedly caused, no one does it quite like the Germans.

Take this Covid mess, for example. Just last week, the German authorities confessed that they made a few minor mistakes during their management of the “Covid pandemic.” According to Karl Lauterbach, the Minister of Health, “we were sometimes too strict with the children and probably started easing the restrictions a little too late.” Horst Seehofer, the former Interior Minister, admitted that he would no longer agree to some of the Covid restrictions today, for example, nationwide nighttime curfews. “One must be very careful with calls for compulsory vaccination,” he added. Helge Braun, Head of the Chancellery and Minister for Special Affairs under Merkel, agreed that there had been “misjudgments,” for example, “overestimating the effectiveness of the vaccines.”

This display of the German authorities’ unwavering commitment to transparency and honesty, and the principle of personal honor that guides the German authorities in all their affairs, and that is deeply ingrained in the German character, was published in a piece called “The Divisive Virus” in Der Spiegel, and immediately widely disseminated by the rest of the German state and corporate media in a totally organic manner which did not in any way resemble one enormous Goebbelsian keyboard instrument pumping out official propaganda in perfect synchronization, or anything creepy and fascistic like that.

Germany, after all, is “an extremely democratic state,” with freedom of speech and the press and all that, not some kind of totalitarian country where the masses are inundated with official propaganda and critics of the government are dragged into criminal court and prosecuted on trumped-up “hate crime” charges.

OK, sure, in a non-democratic totalitarian system, such public “admissions of mistakes” — and the synchronized dissemination thereof by the media — would just be a part of the process of whitewashing the authorities’ fascistic behavior during some particularly totalitarian phase of transforming society into whatever totalitarian dystopia they were trying to transform it into (for example, a three-year-long “state of emergency,” which they declared to keep the masses terrorized and cooperative while they stripped them of their democratic rights, i.e., the ones they hadn’t already stripped them of, and conditioned them to mindlessly follow orders, and robotically repeat nonsensical official slogans, and vent their impotent hatred and fear at the new “Untermenschen” or “counter-revolutionaries”), but that is obviously not the case here.

No, this is definitely not the German authorities staging a public “accountability” spectacle in order to memory-hole what happened during 2020-2023 and enshrine the official narrative in history. There’s going to be a formal “Inquiry Commission” — conducted by the same German authorities that managed the “crisis” — which will get to the bottom of all the regrettable but completely understandable “mistakes” that were made in the heat of the heroic battle against The Divisive Virus!

OK, calm down, all you “conspiracy theorists,” “Covid deniers,” and “anti-vaxxers.” This isn’t going to be like the Nuremberg Trials. No one is going to get taken out and hanged. It’s about identifying and acknowledging mistakes, and learning from them, so that the authorities can manage everything better during the next “pandemic,” or “climate emergency,” or “terrorist attack,” or “insurrection,” or whatever.

For example, the Inquiry Commission will want to look into how the government accidentally declared a Nationwide State of Pandemic Emergency and revised the Infection Protection Act, suspending the German constitution and granting the government the power to rule by decree, on account of a respiratory virus that clearly posed no threat to society at large, and then unleashed police goon squads on the thousands of people who gathered outside the Reichstag to protest the revocation of their constitutional rights.

Thousands gathered outside the Reichstag building in Berlin to protest the "New Normal" totalitarianism this morning, so the police declared the demonstration illegal and turned the water cannons on them ... are you satisfied yet, totalitarians? pic.twitter.com/j70CHsEWWM

— Consent Factory (@consent_factory) November 18, 2020

Once they do, I’m sure they’ll find that that “mistake” bears absolutely no resemblance to the Enabling Act of 1933, which suspended the German constitution and granted the government the power to rule by decree, after the Nazis declared a nationwide “state of emergency.”

Another thing the Commission will probably want to look into is how the German authorities accidentally banned any further demonstrations against their arbitrary decrees, and ordered the police to brutalize anyone participating in such “illegal demonstrations.”

Memories fade, and history is rewritten, so here's a 2.5 minute montage of goon squads in Germany (which, of course, bear no resemblance whatsoever to the SA, or the SS, or any other Nazi goons) enforcing compliance with official "New Normal" ideology during 2020-2022. https://t.co/GIrb4NCJcC pic.twitter.com/6BIOgLVLKx

— CJ Hopkins (@CJHopkins_Z23) March 10, 2024

And, while the Commission is inquiring into the possibly slightly inappropriate behavior of their law enforcement officials, they might want to also take a look at the behavior of their unofficial goon squads, like Antifa, which they accidentally encouraged to attack the “anti-vaxxers,” the “Covid deniers,” and anyone brandishing a copy of the German constitution.

Don't worry, Covidian Cultists ... German Antifa is mobilizing to unleash total war on "extremist neo-Nazi Corona Deniers" like the lady holding the copy of the German constitution in the lower right! pic.twitter.com/HkdXBxyaEJ

— Consent Factory (@consent_factory) December 12, 2020

Come to think of it, the Inquiry Commission might also want to look into how the German authorities, and the overwhelming majority of the state and corporate media, accidentally systematically fomented mass hatred of anyone who dared to question the government’s arbitrary and nonsensical decrees or who refused to submit to “vaccination,” and publicly demonized us as “Corona deniers,” “conspiracy theorists,” “anti-vaxxers,” “far-right anti-Semites,” etc., to the point where mainstream German celebrities like Sarah Bosetti were literally describing us as the inessential “appendix” in the body of the nation, quoting an infamous Nazi almost verbatim.

And then there’s the whole “vaccination” business. The Commission will certainly want to inquire into that. They will probably want to start their inquiry with Karl Lauterbach, and determine exactly how he accidentally lied to the public, over and over, and over again …

And whipped people up into a mass hysteria over “KILLER VARIANTS” …

And “LONG COVID BRAIN ATTACKS” …

And how “THE UNVACCINATED ARE HOLDING THE WHOLE COUNTRY HOSTAGE, SO WE NEED TO FORCIBLY VACCINATE EVERYONE!”

And so on. I could go on with this all day, but it will be much easier to just refer you, and the Commission, to this documentary film by Aya Velázquez. Non-German readers may want to skip to the second half, unless they’re interested in the German “Corona Expert Council” …

Look, the point is, everybody makes “mistakes,” especially during a “state of emergency,” or a war, or some other type of global “crisis.” At least we can always count on the Germans to step up and take responsibility for theirs, and not claim that they didn’t know what was happening, or that they were “just following orders,” or that “the science changed.”

Plus, all this Covid stuff is ancient history, and, as Olaf, an editor at Der Spiegel, reminds us, it’s time to put the “The Divisive Pandemic” behind us …

… and click heels, and heil the New Normal Democracy!

Spread & Containment

“Extreme Events”: US Cancer Deaths Spiked In 2021 And 2022 In “Large Excess Over Trend”

"Extreme Events": US Cancer Deaths Spiked In 2021 And 2022 In "Large Excess Over Trend"

Cancer deaths in the United States spiked in 2021…

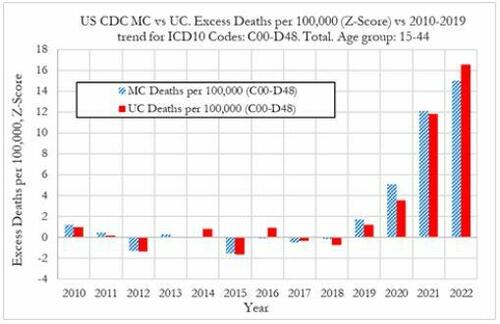

Cancer deaths in the United States spiked in 2021 and 2022 among 15-44 year-olds "in large excess over trend," marking jumps of 5.6% and 7.9% respectively vs. a rise of 1.7% in 2020, according to a new preprint study from deep-dive research firm, Phinance Technologies.

Extreme Events

The report, which relies on data from the CDC, paints a troubling picture.

"We show a rise in excess mortality from neoplasms reported as underlying cause of death, which started in 2020 (1.7%) and accelerated substantially in 2021 (5.6%) and 2022 (7.9%). The increase in excess mortality in both 2021 (Z-score of 11.8) and 2022 (Z-score of 16.5) are highly statistically significant (extreme events)," according to the authors.

That said, co-author, David Wiseman, PhD (who has 86 publications to his name), leaves the cause an open question - suggesting it could either be a "novel phenomenon," Covid-19, or the Covid-19 vaccine.

Cancer deaths in US in 2021 & 2022 in large excess over trend for 15-44 year-olds as extreme events. A novel phenomenon? C19? lockdowns? C19 vaccines? Honored to participate in this work. #CDC where are you? @DowdEdwardhttps://t.co/iUV5oQiWCW pic.twitter.com/uytzaIvvor

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 12, 2024

"The results indicate that from 2021 a novel phenomenon leading to increased neoplasm deaths appears to be present in individuals aged 15 to 44 in the US," reads the report.

The authors suggest that the cause may be the result of "an unexpected rise in the incidence of rapidly growing fatal cancers," and/or "a reduction in survival in existing cancer cases."

They also address the possibility that "access to utilization of cancer screening and treatment" may be a factor - the notion that pandemic-era lockdowns resulted in fewer visits to the doctor. Also noted is that "Cancers tend to be slowly-developing diseases with remarkably stable death rates and only small variations over time," which makes "any temporal association between a possible explanatory factor (such as COVID-19, the novel COVID-19 vaccines, or other factor(s)) difficult to establish."

That said, a ZeroHedge review of the CDC data reveals that it does not provide information on duration of illness prior to death - so while it's not mentioned in the preprint, it can't rule out so-called 'turbo cancers' - reportedly rapidly developing cancers, the existence of which has been largely anecdotal (and widely refuted by the usual suspects).

While the Phinance report is extremely careful not to draw conclusions, researcher "Ethical Skeptic" kicked the barn door open in a Thursday post on X - showing a strong correlation between "cancer incidence & mortality" coinciding with the rollout of the Covid mRNA vaccine.

The argument is over.

— Ethical Skeptic ☀ (@EthicalSkeptic) March 14, 2024

The Covid mRNA Vaxx has cause a sizeable 2021 inflection, and now novel-trend elevation in terms of both cancer incidence & mortality.

Now you know who the liars were all along.

????Incidence = 14.8% excess

????UCoD Mortality = 5.3% excess (lags Incidence) pic.twitter.com/uwN9GMrHl1

Phinance principal Ed Dowd commented on the post, noting that "Cancer is suddenly an accelerating growth industry!"

????Indeed it is…Cancer is suddenly an accelerating growth industry! @EthicalSkeptic provides a chart below showing US Cancer treatment in constant dollars with a current growth rate of 14.8% (6.3% New CAGR) versus long term trend of 1.78% CAGR or $33.8 billion in excess cancer… https://t.co/RIn4R2YZZ7

— Edward Dowd (@DowdEdward) March 14, 2024

Continued:

As a former portfolio manager of of a $14 billion Large Cap Growth Equity portfolio I can definitively say Cancer treatments and the Disabilities have become growth industries that both have inflection points coincidental to the mRNA vaccine rollouts in 2021.

— Edward Dowd (@DowdEdward) March 14, 2024

Chart 1 from… pic.twitter.com/TCt4X1plnM

Bottom line - hard data is showing alarming trends, which the CDC and other agencies have a requirement to explore and answer truthfully - and people are asking #WhereIsTheCDC.

We aren't holding our breath.

Experts are sounding the alarm on a spike in cancer diagnosis worldwide. It is still a mystery. @DowdEdward from Phinance Technologies has also been sounding the alarm for months.

— dr.ir. Carla Peeters (@CarlaPeeters3) March 15, 2024

We are facing a dramatic degradation of the human immune system https://t.co/CPnwP3Oj9G

Wiseman, meanwhile, points out that Pfizer and several other companies are making "significant investments in cancer drugs, post COVID."

Pfizer among several companies making significant investments in cancer drugs, post COVID. @DowdEdward @Kevin_McKernan @JesslovesMJK @niki_kyrylenko https://t.co/nefEZYLW1o https://t.co/r505Sbbcq4

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 15, 2024

Phinance

We've featured several of Phinance's self-funded deep dives into pandemic data that nobody else is doing. If you'd like to support them, click here.

List of our projects following disturbing tends in deaths, disabilities and absences.

— Edward Dowd (@DowdEdward) March 16, 2024

Link to projects at bottom.

✅ V-Damage Project

✅ Excess Mortality Project

✅ US Disabilities Project

✅ US BLS Absence rates Project

✅ US Cause of Death Project

✅ UK Cause of Death…

Government

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Authored by Mike Shedlock via MishTalk.com,

Young adults are more…

Authored by Mike Shedlock via MishTalk.com,

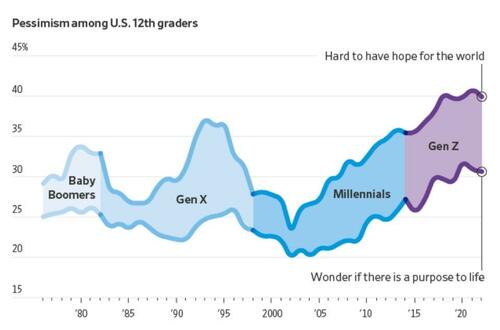

Young adults are more skeptical of government and pessimistic about the future than any living generation before them.

This is with reason, and it’s likely to decide the election.

Rough Years and the Most Pessimism Ever

The Wall Street Journal has an interesting article on The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters.

Young adults in Generation Z—those born in 1997 or after—have emerged from the pandemic feeling more disillusioned than any living generation before them, according to long-running surveys and interviews with dozens of young people around the country. They worry they’ll never make enough money to attain the security previous generations have achieved, citing their delayed launch into adulthood, an impenetrable housing market and loads of student debt.

And they’re fed up with policymakers from both parties.

Washington is moving closer to passing legislation that would ban or force the sale of TikTok, a platform beloved by millions of young people in the U.S. Several young people interviewed by The Wall Street Journal said they spend hours each day on the app and use it as their main source of news.

“It’s funny how they quickly pass this bill about this TikTok situation. What about schools that are getting shot up? We’re not going to pass a bill about that?” Gaddie asked. “No, we’re going to worry about TikTok and that just shows you where their head is…. I feel like they don’t really care about what’s going on with humanity.”

Gen Z’s widespread gloominess is manifesting in unparalleled skepticism of Washington and a feeling of despair that leaders of either party can help. Young Americans’ entire political memories are subsumed by intense partisanship and warnings about the looming end of everything from U.S. democracy to the planet. When the darkest days of the pandemic started to end, inflation reached 40-year highs. The right to an abortion was overturned. Wars in Ukraine and the Middle East raged.

Dissatisfaction is pushing some young voters to third-party candidates in this year’s presidential race and causing others to consider staying home on Election Day or leaving the top of the ticket blank. While young people typically vote at lower rates, a small number of Gen Z voters could make the difference in the election, which four years ago was decided by tens of thousands of votes in several swing states.

Roughly 41 million Gen Z Americans—ages 18 to 27—will be eligible to vote this year, according to Tufts University.

Gen Z is among the most liberal segments of the electorate, according to surveys, but recent polling shows them favoring Biden by only a slim margin. Some are unmoved by those who warn that a vote against Biden is effectively a vote for Trump, arguing that isn’t enough to earn their support.

Confidence

When asked if they had confidence in a range of public institutions, Gen Z’s faith in them was generally below that of the older cohorts at the same point in their lives.

One-third of Gen Z Americans described themselves as conservative, according to NORC’s 2022 General Social Survey. That is a larger share identifying as conservative than when millennials, Gen X and baby boomers took the survey when they were the same age, though some of the differences were small and within the survey’s margin of error.

More young people now say they find it hard to have hope for the world than at any time since at least 1976, according to a University of Michigan survey that has tracked public sentiment among 12th-graders for nearly five decades. Young people today are less optimistic than any generation in decades that they’ll get a professional job or surpass the success of their parents, the long-running survey has found. They increasingly believe the system is stacked against them and support major changes to the way the country operates.

Gen Z future Outcome

“It’s the starkest difference I’ve documented in 20 years of doing this research,” said Twenge, the author of the book “Generations.” The pandemic, she said, amplified trends among Gen Z that have existed for years: chronic isolation, a lack of social interaction and a propensity to spend large amounts of time online.

A 2020 study found past epidemics have left a lasting impression on young people around the world, creating a lack of confidence in political institutions and their leaders. The study, which analyzed decades of Gallup World polling from dozens of countries, found the decline in trust among young people typically persists for two decades.

Young people are more likely than older voters to have a pessimistic view of the economy and disapprove of Biden’s handling of inflation, according to the recent Journal poll. Among people under 30, Biden leads Trump by 3 percentage points, 35% to 32%, with 14% undecided and the remaining shares going to third-party candidates, including 10% to independent Robert F. Kennedy Jr.

Economic Reality

Gen Z may be the first generation in US history that is not better off than their parents.

Many have given up on the idea they will ever be able to afford a home.

The economy is allegedly booming (I disagree). Regardless, stress over debt is high with younger millennials and zoomers.

This has been a constant theme of mine for many months.

Credit Card and Auto Delinquencies Soar

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

For further discussion please see Credit Card and Auto Delinquencies Soar, Especially Age Group 18 to 39

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Those struggling with rent are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

On Average Everything is Great

Average it up, and things look pretty good. This is why we have seen countless stories attempting to explain why people should be happy.

Krugman Blames Partisanship

With the recent rise in consumer sentiment, time to revisit this excellent Briefing Book paper. On reflection, I'd do it a bit differently; same basic conclusion, but I think partisan asymmetry explains even more of the remaining low numbers 1/ https://t.co/4lqm7X4472

— Paul Krugman (@paulkrugman) February 17, 2024

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

This allegedly booming economy left behind the renters and everyone under the age of 40 struggling to make ends meet.

Many Are Addicted to “Buy Now, Pay Later” Plans

Buy Now Pay Later, BNPL, plans are increasingly popular. It’s another sign of consumer credit stress.

For discussion, please see Many Are Addicted to “Buy Now, Pay Later” Plans, It’s a Big Trap

The study did not break things down by home owners vs renters, but I strongly suspect most of the BNPL use is by renters.

What About Jobs?

Another seemingly strong jobs headline falls apart on closer scrutiny. The massive divergence between jobs and employment continued into February.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

Payrolls vs Employment Gains Since March 2023

-

Nonfarm Payrolls: 2,602,000

-

Employment Level: +144,000

-

Full Time Employment: -284,000

For more details of the weakening labor markets, please see Jobs Up 275,000 Employment Down 184,000

CPI Hot Again

CPI Data from the BLS, chart by Mish.

For discussion of the CPI inflation data for February, please see CPI Hot Again, Rent Up at Least 0.4 Percent for 30 Straight Months

Also note the Producer Price Index (PPI) Much Hotter Than Expected in February

Major Economic Cracks

There are economic cracks in spending, cracks in employment, and cracks in delinquencies.

But there are no cracks in the CPI. It’s coming down much slower than expected. And the PPI appears to have bottomed.

Add it up: Inflation + Recession = Stagflation.

Election Impact

In 2020, younger voters turned out in the biggest wave in history. And they voted for Biden.

Younger voters are not as likely to vote in 2024, and they are less likely to vote for Biden.

Millions of voters will not vote for either Trump or Biden. Net, this will impact Biden more. The base will not decide the election, but the Trump base is far more energized than the Biden base.

If Biden signs a TikTok ban, that alone could tip the election.

If No Labels ever gets its act together, I suspect it will siphon more votes from Biden than Trump. But many will just sit it out.

“We’re just kind of over it,” Noemi Peña, 20, a Tucson, Ariz., resident who works in a juice bar, said of her generation’s attitude toward politics. “We don’t even want to hear about it anymore.” Peña said she might not vote because she thinks it won’t change anything and “there’s just gonna be more fighting.” Biden won Arizona in 2020 by just over 10,000 votes.

The Journal noted nearly one-third of voters under 30 have an unfavorable view of both Biden and Trump, a higher number than all older voters. Sixty-three percent of young voters think neither party adequately represents them.

Young voters in 2020 were energized to vote against Trump. Now they have thrown in the towel.

And Biden telling everyone how great the economy is only rubs salt in the wound.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment4 days ago

Spread & Containment4 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex