Gift Guide: TechCrunch’s Favorite Things of 2021

We made it, friends. Another year in the books. Was it the very normal year we all wanted? No. But, for many, it was at least a step in that direction. Or maybe two steps in that direction, and one step back. Yeah, it was still a weird one. No matter…

We made it, friends. Another year in the books.

Was it the very normal year we all wanted? No. But, for many, it was at least a step in that direction. Or maybe two steps in that direction, and one step back. Yeah, it was still a weird one.

No matter the year, we here at TechCrunch like to cap it off with a list of our favorite things from the last 365-or-so days. As always, “things” here is defined… very loosely. “Things” here can be books. Or podcasts. Or concepts. Or people! Or games, or songs, or… it doesn’t matter really. If it made that person’s 2021 a little brighter — and regardless of whether or not those things were new to 2021 — it can go on the list.

Why? Because we like to do it, and because people tell us they like reading it. And because it’s a fun little glimpse into the head spaces of the people who make this little piece of the Internet exist. Plus if you’re still looking for some last minute gift, maybe you’ll find some sort of inspiration. Here we go!

— Greg

Greg Kumparak

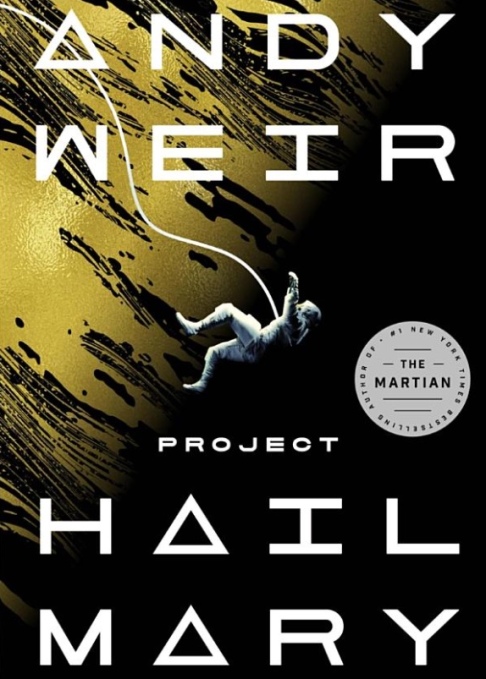

Project Hail Mary

I waited a while to read this book because while I loved Andy Weir’s The Martian, his next book Artemis — while still very good! — didn’t hook me the same way. Once I finally sat down to read Project Hail Mary, I couldn’t stop.

Exploding with intrigue from page one, all I can say without spoiling anything is: a man wakes up on a spaceship without any idea how or why he’s there. As he explores the ship, he slowly re-learns who he is … and why he left Earth in the first place. Read it.

Robin Robin (Netflix Christmas short)

Image Credits: Netflix

This Christmas-y stop-motion short from the studio behind Wallace and Gromit is only a few weeks old, but it’s an instant classic. The animation is beautiful, the songs are adorable, and every little piece of it is perfectly honed. My three year old has been requesting it on a loop since it came out, and I don’t mind a bit.

The Attraction, an escape room in SF

Image Credits: Palace of Fine Arts

I’ve done so many escape rooms that they’ve started to sort of blend together in my brain. The ever growing collection of rooms at San Francisco’s Palace of Fine Arts, however, stand alone in my mind. The production values, stagecraft, and storytelling are just on a different level. Their latest, “The Attraction“, isn’t my favorite Palace room (that’d be their Edison room) — but it’s still an absolute masterpiece. If you’ve got a clever crew that has proven themselves in other escape rooms, you have to see these ones.

Jordan Crook

NYC’s Bond Vet

Image Credits: Bond Vet

As a new puppy mom (yes, I have a pandemic pet), figuring out how to care for my little guy has both been a joy and a massive source of stress. Bond Vet has loads of locations in New York City, handles urgent care inquiries, and has people available to chat on the phone for just about any question. It comes with a nifty app for downloading my puppy’s medical records or scheduling an appointment, and they have a pharmacy in-house so anything prescribed is given to you during the appointment or can be mailed to you after a telehealth visit. Good service. Great prices. Big fan.

PlayStation 5

Image Credits: Phil Barker/Future Publishing via Getty Images via Getty Images

I got the PS5 recently and it is a vastly improved experience over the PS4. As an avid gamer, it truly is the worst when the system itself is moving slow. The PS5 is lightning quick, has amazing graphics, and games look and feel great on it. The only caveat: you probably need to expand its storage somehow if you like to flip between a bunch of different games. Still worth upgrading!

Netflix’s Formula 1: Drive to Survive / Formula 1 in general

Image Credits: Ian Cuming / Getty Images

I watch all the TV that exists in the world and the show that changed my life the most has been Formula 1: Drive to Survive. Countless articles have been written about how the Netflix Effect has made an impact on Formula 1 as a sport, so I won’t do that here. All I’ll say is that Formula 1 is an intricate, complex, fascinating sport and the best bridge to understanding it is to learn about the drivers and team principals on a more personal level, which this series does very well. Also, it’s worth saying that 2021 has been the most interesting and competitive season of Formula 1 in a long, long time and I can’t wait to see how the behind-the-scenes narrative unfolds on the next seasons of Drive to Survive.

Natasha Mascarenhas

Wired headphones

Image Credits: Martin Barraud (opens in a new window) / Getty Images

Airpods feel super 2018, and that’s not just because I got my pair that year. With the rise of audio rooms on Clubhouse and Twitter, I’ve resorted back to my old wired headphones for clearer voice quality. It’s simply icing on the cake that I never have to charge them.

Farmer’s market tomatoes

Image Credits: JNix (opens in a new window) / Shutterstock (opens in a new window)

As someone who price compares everything – and walks an extra mile just to pay 50 cents less on almond milk – I’ve always been pretty neutral on splurging at farmer’s markets. Over this past year, though, my partner and I have begun ending our long runs at a San Francisco farmer’s market to indulge in farm fresh tomatoes. Unlike, say, bell peppers, fresh tomatoes taste truly different and, coming from your frugal friend, are always worth the few extra bucks. Plus, the guy who offers free samples always makes my day.

Griefbacon

Are there some writers whose words inspire you to write more? For me that person is Helena Fitzgerald, the author of Griefbacon (aka, the only Substack I currently pay money to read). Her “long, weird essays” make me feel heard in ways I didn’t even know I craved, capturing the true definition of holidays and the importance of rooms.

Devin Coldewey

Backpacking

Image Credits: Wanphen Chawarung (opens in a new window)

I’ve gone car-camping for years and loved it, and only recently decided to try out a bit of real backpacking. Hiking ten miles somewhere beautiful and wild with a couple good friends and everything you need on your back is unlike anything else. Plus I love to obsess over gear and I live like half a mile from REI. I’m amazed it took me this long.

Emahoy Tsegué-Maryam Guèbrou

I came across this remarkable pianist in a list of must-listen jazz recordings. The first girl to be sent abroad from Ethiopia for her education (among other firsts for women there,) she returned only to become a prisoner of war in the ’30s and afterwards proceeded to hide her musical light under a bushel for several decades. Guèbrou’s compositions, only recently recorded, are somewhere between blues and Chopin, unique and strange but virtuosic and incredibly compelling.

Genshin Impact

Image Credits: Genshin Impact

OK OK, nerd alert. This free to play game draws a lot of fire for its gambling mechanics and anime waifus and husbandos. But I’ve passed many a very pleasant hour just rambling around its enormous map, collecting treasure, solving puzzles, and fighting monsters… because those things are fun and games are supposed to be fun. It’s been a real balm during stressful times.

Alex Wilhelm

Naps

I turn 33 next year. I actually forgot how old I was yesterday. My spouse noted that we were 31 during a conversation, but I am 32. Her birthday is 5 months after mine, which means for half the year she gets to call me old. But I forgot that I was 32. I just nodded, yes, we are 31. Anyway, naps. Naps are good for my aging body as I wake up, pour coffee into my ears, and slump to the desk. This means that my spine has become an ampersand, and my brain overcooked noodle mash. I combat both issues by taking 20 minute naps at times. This clears my head, and unfogs my eyes. Don’t tell TechCrunch though.

Grand Strategy Video Games

Image Credits: Paradox

One of the best parts of being married is that being Not Cool loses some of its sting. I can now lean fully into the more dweeby elements of my personality and not worry about it.

Enter Grand Strategy Games. Imagine a game that is insanely complex, while also being unpredictable, frustrating, and slow-moving. Sound good? Hell yeah it sounds good. I have spent more time playing Crusader Kings III in the last year than I want to admit. If we throw in a few other titles it’s even more embarrassing.

But don’t worry, I’ve got a lot back from the effort. For example, I once conquered all the Christian holy sites of the Old World, created a new Christian faith that was female-dominated instead of male-led, and then converted the world en masse to a gender-flipped history of religion. More often I get murdered by rude subjects, but hey.

Airheads

Image Credits: Airheads

Playing complex video games, however, can be tiring. So you have to keep your energy up. Enter sugar. Namely condensed, artificially-flavored sugar in the form of Airheads. Anyway, I’m off to floss again.

Kirsten Korosec

Yoga

Image Credits: Hero Images

Nothing has been quite as effective at removing me from my COVID slump – figuratively and literally – as yoga. It was nothing short of a savior even on days when the news cycle and the day-to-day drag of the pandemic threatened to push me over the edge.

Lofi Air Traffic Control

Image Credits: Lofi ATC

What happens when you combine communication from air traffic controllers and lo-fi tunes? The most weirdly calming music stream ever. Hardware editor Brian Heater turned me onto this and at first I laughed. But really, it’s great. You can even pick what airport to hear chat from and if you go to the settings you can determine the balance of music to communication.

Community Supported Agriculture

Image Credits: Valeriya Tikhonova (opens in a new window) / Getty Images

I spend a lot of time in front of a computer and not enough in the garden. Luckily, I support my local CSA, which means every week I am able to pick up fresh, seasonal veggies and even some fruit from local farmers. We took a break on the CSA for a bit, but I’m glad we’re back, even on the weeks that are heavy on turnips.

Rebecca Bellan

Brain.fm

Image Credits: brain.fm

Back in journalism school, I once wrote an article called ‘This is your brain on music’ that explained how music stimulates the reward centers in our brains which can help us focus. For a long time I was a regular on YouTube channels for lo-fi tunes, but then I found Brain.fm, which plays specially designed LYRIC-LESS music to help you focus, or relax or meditate. The company holds patents on its tech that is meant to elicit strong neural phase locking, which they say allows “populations of neurons to engage in various kinds of coordinated activity.”

Whether it’s placebo or real science, all I know is that I don’t truly start writing until I have my headphones on and this beautiful, human/AI-generated music playing in my brain.

Gardening

Image Credits: Witthaya Prasongsin (opens in a new window) / Getty Images under a Witthaya Prasongsin on Getty license.

I recently moved to Auckland, New Zealand, into a house that had some semblance of a garden. It was a mess, but it was also clear that someone, at some point, loved this garden.

Beneath the overgrown weeds, I found patches of parsley, arugula, fennel. Over the last several months, I’ve cleared away the weeds and set to work giving the beds some love with fresh compost that my house collects. There is something so energizing and calming about getting your hands in the dirt everyday, even if it’s just to pull some weeds out of the ground.

Amanda Silberling

Libby

Image Credits: Overdrive

As a famous cartoon aardvark once said, having fun isn’t hard when you’ve got a library card. But Libby makes it even easier.

Libby, owned by Overdrive, is a phone app that lets you borrow ebooks and audiobooks from your local library on the go. It’s completely free. The quality of your Libby experience probably depends on how good a catalog your local library has — but even if it only has a few of the books on your wishlist, you’re still saving some cash. For times when the library’s catalog lets me down, I pay for a subscription to Libro.fm, an Audible competitor that supports independent bookstores rather than Jeff Bezos. Sometimes, believe it or not, I even buy physical books. But I love libraries, I love the Libby app, and I love audiobooks.

Darrell Etherington

Analogue Pocket

Image Credits: Analogue

This is the greatest game console there is, bar none. I thought I was a pretty heavy Game Boy player back in the day, but using Analogue’s new retro console to play GB, GBC and GBA cartridges I scrounge from various local retro gaming shops has been a true delight and also a revelation that there’s a lot out there that I missed during the OG Game Boy heyday that more than holds up today.

Traeger Ironwood 885 Pellet Grill

Image Credits: Traeger

I don’t remember exactly how or why I got interested in low and slow smoking and grilling, but the pandemic really kicked it up a notch in terms of how into it I am. That’s why I was thrilled to get my hands on the Traeger Ironwood 885, a pellet smoker with all the bells and whistles you could ever ask for, including remote control and monitoring via the excellent Traeger app. The Ironwood series adds seriously useful features like an insulated cooking barrel for all-weather smoking, and a built-in pellet sensor that lets you know when you need to top up for those truly all-day cooks.

Canon EOS R5 + RF 50mm F1.2 L lens

Image Credits: Canon

Canon may have gotten off to a slow start in the full-frame mirrorless world, but it’s hitting its stride with its most recent cameras. The R5, while originally released in 2020, is still an amazing camera offering fantastic ergonomics and handling, as well as amazing image quality. As a longtime Canon fan before switching over to Sony in recent years, it’s amazing to be getting that fantastic Canon color science in a camera that feels like it’s finally caught up.

Brian Heater

L’Rain – Fatigue

Image Credits: L’Rain

I can’t really overstate the degree to which music has gotten me through these past two years. And, thankfully, in spite of everything else being entirely miserable there continues to be a lot of great stuff, consistently reminding us of how much we undervalue artists as a society. L’Rain flew completely under my radar with her debut. A musician I recently interviewed namechecked Fatigue, and I was blown away.

As a piece of music, it’s wonderfully impossible to categorize, a small army of musicians creating songs that are intentionally difficult to define, peppered with found sound. It alternately soothes and subverts – music that’s challenging but not difficult. Encompassing on first listen and rewarding with subsequent spins.

(I didn’t have nearly as much time to work on this list as I’d like, so I’m going to cheat and toss in a link to a Spotify playlist I made of my favorite music of the year, including my top track from Fatigue. I hope Greg doesn’t get mad.)

Natasha Lomas

Yak Tack

Image Credits: Yak Tack

Since I discovered it back in April, Yak Tack has managed to do what few apps can: Stick around on my phone and actually get used!

As a word nerd it is indubitably my kind of app. It’s both pocket dictionary (for quick & easy look-ups) but also — and here comes the automagic! — aide memoire for making newly encountered vocab stick. It applies a system of adaptive space repetition to help hack the brain’s memory banks (in the nicest possible way). And if you fail to confirm you revisited a word on schedule it’ll email you the gentlest lil’ reminder: “Don’t forget about your words!”

Yak Tack is a passion project for its developer creator, Jeremy Thomas. He also made a purely email-based ‘no frills’ version (without the app’s light social features). So here’s a big thanks — for a great side hustle and to surviving 2021 one (new) word at a time!

@mattgreencomedy

Talking of survival, coping with another year of UK politics has been an increasingly perilous pastime since ~2016. But 2021 has really tested the limits of what a sane populace will accept from its ‘elected representatives’. Still, Boris Johnson’s grifting Conservative government of none-of-the-talents has had one upside: It’s been pure comedy gold (‘if you don’t laugh you’ll cry’ etc etc). All the mixed messaging, daylight grifting, dubious denials and damaging delays around Covid policy; all the rule-breaking scandals, excruciating leaked videos, perpetual internecine Tory warefare by WhatsApp Group and the cringing parade of leaked ‘it wasn’t a party’ party photos (mostly you’re just glad you weren’t there) have provided rich pickings for British satirist, Matt Green, who’s been a bright light in Twitter’s dark places this year.

Continuous Glucose Monitoring

Image Credits: Ultrahuman

For a few weeks this year I’ve been testing a “metabolic fitness” service (Ultrahuman’s ‘Cyborg’) — full review to come! — which involves the use of a continuous glucose monitor (CGM) to provide real-time feedback on your blood glucose levels via an app. Many factors can affect blood sugar (diet, exercise, stress etc) and there are a lot of questions over how to best interpret this kind of data but — overall — it’s been a fascinating glimpse of where quantified health is headed and an addictive taster of biohacking. I think I’m hooked!

Anna Heim

Puzzling

Image Credits: Wentworth Puzzles

It all started with Wallace and Gromit: I am a huge fan, so when I heard that Aardman had partnered with a British puzzle manufacturer for a Christmas special, I knew I had to get one. Because of high demand, my puzzle arrived in early January, and it ended up shaping my 2021: I loved it so much that puzzles became my hobby all throughout the year, and hopefully for the rest of my life. It’s doing wonders for my anxiety levels, and it’s also very fun – especially jigsaws with tons of little details, like drawings by Guillermo Mordillo or Sempé, or wooden ones with cutely shaped pieces, known as whimsies.

eos link pandemic goldInternational

Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

The struggling chain has given up the fight and will close hundreds of stores around the world.

It has been a brutal period for several popular retailers. The fallout from the covid pandemic and a challenging economic environment have pushed numerous chains into bankruptcy with Tuesday Morning, Christmas Tree Shops, and Bed Bath & Beyond all moving from Chapter 11 to Chapter 7 bankruptcy liquidation.

In all three of those cases, the companies faced clear financial pressures that led to inventory problems and vendors demanding faster, or even upfront payment. That creates a sort of inevitability.

Related: Beloved retailer finds life after bankruptcy, new famous owner

When a retailer faces financial pressure it sets off a cycle where vendors become wary of selling them items. That leads to barren shelves and no ability for the chain to sell its way out of its financial problems.

Once that happens bankruptcy generally becomes the only option. Sometimes that means a Chapter 11 filing which gives the company a chance to negotiate with its creditors. In some cases, deals can be worked out where vendors extend longer terms or even forgive some debts, and banks offer an extension of loan terms.

In other cases, new funding can be secured which assuages vendor concerns or the company might be taken over by its vendors. Sometimes, as was the case with David's Bridal, a new owner steps in, adds new money, and makes deals with creditors in order to give the company a new lease on life.

It's rare that a retailer moves directly into Chapter 7 bankruptcy and decides to liquidate without trying to find a new source of funding.

Image source: Getty Images

The Body Shop has bad news for customers

The Body Shop has been in a very public fight for survival. Fears began when the company closed half of its locations in the United Kingdom. That was followed by a bankruptcy-style filing in Canada and an abrupt closure of its U.S. stores on March 4.

"The Canadian subsidiary of the global beauty and cosmetics brand announced it has started restructuring proceedings by filing a Notice of Intention (NOI) to Make a Proposal pursuant to the Bankruptcy and Insolvency Act (Canada). In the same release, the company said that, as of March 1, 2024, The Body Shop US Limited has ceased operations," Chain Store Age reported.

A message on the company's U.S. website shared a simple message that does not appear to be the entire story.

"We're currently undergoing planned maintenance, but don't worry we're due to be back online soon."

That same message is still on the company's website, but a new filing makes it clear that the site is not down for maintenance, it's down for good.

The Body Shop files for Chapter 7 bankruptcy

While the future appeared bleak for The Body Shop, fans of the brand held out hope that a savior would step in. That's not going to be the case.

The Body Shop filed for Chapter 7 bankruptcy in the United States.

"The US arm of the ethical cosmetics group has ceased trading at its 50 outlets. On Saturday (March 9), it filed for Chapter 7 insolvency, under which assets are sold off to clear debts, putting about 400 jobs at risk including those in a distribution center that still holds millions of dollars worth of stock," The Guardian reported.

After its closure in the United States, the survival of the brand remains very much in doubt. About half of the chain's stores in the United Kingdom remain open along with its Australian stores.

The future of those stores remains very much in doubt and the chain has shared that it needs new funding in order for them to continue operating.

The Body Shop did not respond to a request for comment from TheStreet.

bankruptcy pandemic canadaGovernment

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex