Get ready for even more incompetence at the IRS in 2023

The IRS is hiring 87,000 agents, thanks to President Joe Biden’s 2021 infrastructure package, but they won’t be fully trained for three years.

…

The IRS is hiring 87,000 agents, thanks to President Joe Biden’s 2021 infrastructure package, but they won’t be fully trained for three years.

The Internal Revenue Service is hiring 87,000 new agents, but taxpayers will not feel the pain for another two to three years. That’s how long it will take the agency to hire and train agents. Few have discussed the extent of this pain. Still, it’s something to think about when you consider the majority of coming audits will be conducted by new agents, many of whom will have been hastily hired and operating with minimal supervision.

Playing the audit lottery will not be smart in future tax years. Taxpayers should protect themselves now, especially when profiting from statutory gray areas — such as cryptocurrency staking, investing through decentralized autonomous organizations (DAOs) and other decentralized finance (DeFi) products.

When I started my career in the mid-2000s, business audits were standard, and the new agents were always the worst with which to deal. You had to explain everything in detail to them like little children, and they still would write up non-factual summaries or incorrect legal opinions. That required escalating cases for a manager to review or file an appeal. New agents were also often uber-aggressive, fighting over small changes to build a reputation for always having major tax increases in the audits they took on.

Don’t get me wrong. The IRS needs to hire agents. The situation for the last few years has been nothing short of a nightmare. Good luck reaching an agent to resolve a tax issue! In 2021, the IRS received 282 million telephone calls. Customer service representatives only answered 32 million, or 11 percent, of those calls. The IRS certainly needs to hire more staff to answer phones and resolve issues within a reasonable time.

Related: Biden is hiring 87,000 new IRS agents — and they’re coming for you

The trouble at the IRS dates back to 2011, when major budgetary cuts led to a hiring freeze across the board. The total number of workers at the IRS has fallen massively, from 94,711 agents in 2010 to 78,661 full-time equivalent employees in 2021. This means that adding 87,000 revenue agents will more than double the size of the current IRS!

Add to this the roughly 20,000 agents eligible to retire at the IRS right now, and the IRS will need to hire more than 107,000 agents in the next few years. Thus, two out of three IRS employees will be total newbies in three years. In a perfect world, this could lead to a startup-like culture at the IRS, with innovations and a culture of making a difference. Yeah, right. This is the government. They won’t run things efficiently. And these agents who are tracked on their performance will go for the low-hanging fruit with taxpayers they can bully into big changes on examination, meaning a big increase in small business and individual audits.

However, we won’t see much of an increase in audits for a couple of years. It will take a while for the IRS to find enough hires though to fill all those seats. The hiring freeze was lifted in 2019, but because of the pandemic, actual net hiring has not yet occurred. In 2021, the IRS lost 14,500 employees due to retirement or separation but gained only 12,500 external hires.

This failure in hiring wasn’t from a lack of trying. In 2021, I was inundated with Facebook ads and recruiter messages, but they still couldn’t even hire enough agents to fill the seats of those who were retiring. So one certainly has to ask, how will they find over 100,000 new agents? And will their hiring standards drop substantially to get enough warm bodies in chairs?

Then it will take even more time before we see these agents in the field. Once a revenue agent is hired, there is another one to two years of training before they are unleashed on the public.

The most likely agent you will meet, a “Small Business/Self-Employed Revenue Agent in Field Examination,” requires 1,888 hours of training. At 40 hours per week, this amounts to 47.2 weeks, which is almost a year after vacation and personal time. A “Special Agent for Criminal Investigations” requires 3,904 hours of training, or closer to two years, to get up to speed. Even a “Customer Service Representative” needs 1,500 hours of training, or more than nine months — to answer the phone lines!

While the IRS has been dwindling in size and struggling to replace retiring agents, the tax laws and technology-based financial transactions have become increasingly complex. The Tax Cuts and Jobs Act (TCJA) in 2017 was the first major overhaul of the tax system since the Tax Reform Act of 1986. Five years after passing the TCJA, not all the provisions have been implemented yet. Who knows what strange memos might start coming out in these not-yet-interpreted areas? Then there are all the gray areas created by different types of cryptocurrency transactions, staking, DAOs and DeFi, with many unique fact patterns for which the relevant laws have yet to be interpreted by the tax courts.

The antiquated IRS computer system further adds to the challenges faced. The IRS still runs on a mainframe computer system from the 1960s that is coded in Cobol. Few current programmers know Cobol, and the IRS has struggled to modify its systems. During the pandemic, a revenue agent admitted to me on a call that the IRS did not have the code to pause the system that mails out automated delinquency notices to taxpayers.

For the last 20 years, the U.S. Treasury has been spending billions a year to develop a new tax computer system, but there never seems to be a clear timeline of when this system will be released. It always seems about five years out with the ever-floating deadline. Because of this lack of decent computer systems, a lot of tasks at the IRS are still performed manually. The IRS has about 60 case management systems that are not interconnected; each function’s employees must transcribe or import information from other electronic systems and mail or fax it to other departments.

Related: Tips to claim tax losses with the US Internal Revenue Service

Despite all these challenges, the IRS is already signaling that they intend to start doing substantial business audits in future years. It has been years since the Coinbase John Doe summons, and the IRS still has not done the expected bulk audits, so with staffing increases, these will probably start increasing.

Since the pandemic, transfer pricing audits have ground to a halt but will surely pick up again soon — and I expect many crypto businesses to be the target of these audits as well, especially those in DeFi with cross-border lending transactions. And then for R&D, the IRS has issued two memos in the last year requiring full due diligence and documentation to be done before preparing the tax return, but the R&D credit mills predatorily targeting startups have yet to change their business practices, so I expect to see audits of R&D credits en masse once enough agents are ready.

Most of the tax accountants I worked with early in my career have long since retired. The new generation of so-called “experts” didn’t get this business audit experience in their early careers and are utterly unprepared for what is on the horizon at the IRS. Because of this, there is a lot of incorrect information floating around in the tax world. Many advisors who have been playing the audit lottery for years successfully are in line to get both themselves and their clients burned in the coming audit storm.

When should taxpayers be afraid? Considering the two- to three-year timeline to get staffed and the three-year statute of limitations for auditing most tax returns, the tax years that will be most at risk for audit are 2021 and onwards. Per 2019 IRS statistics, individuals with taxable income between $25,000 and $500,000 only have a roughly 0.2% chance of being audited each year, with those reporting $0 income or a net loss for the year at 1.1%.

Back in 2010, mid-range incomes were only at a 0.7% risk. If $0 or less of income was reported, there was a 20.6% chance of an audit — meaning those playing it conservatively will likely still be OK. However, those taking aggressive positions were at far greater risk, likely running that 1-in-5 risk of audit.

Because of this, I recommend choosing your advisors carefully. Aggressive tax positions should be avoided right now unless the benefit outweighs the risk regarding the cost of litigation. The biggest fallacies I hear in consult calls every week tend to come from Reddit threads, and trust me, Reddit is not a credible source. Be sure to look up your advisors and make sure they are licensed and experienced, as this, at least, will give some grounds to have penalties waived if an aggressive tax position is questioned.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

cryptocurrency crypto pandemic cryptoUncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

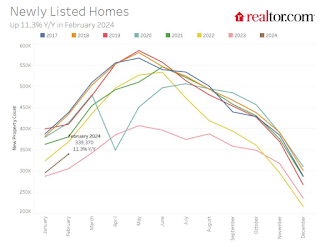

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Government

RFK Jr. Reveals Vice President Contenders

RFK Jr. Reveals Vice President Contenders

Authored by Jeff Louderback via The Epoch Times,

New York Jets quarterback Aaron Rodgers and former…

Authored by Jeff Louderback via The Epoch Times,

New York Jets quarterback Aaron Rodgers and former Minnesota governor and professional wrestler Jesse Ventura are among the potential running mates for independent presidential candidate Robert F. Kennedy Jr., the New York Times reported on March 12.

Citing “two people familiar with the discussions,” the New York Times wrote that Mr. Kennedy “recently approached” Mr. Rodgers and Mr. Ventura about the vice president’s role, “and both have welcomed the overtures.”

Mr. Kennedy has talked to Mr. Rodgers “pretty continuously” over the last month, according to the story. The candidate has kept in touch with Mr. Ventura since the former governor introduced him at a February voter rally in Tucson, Arizona.

Stefanie Spear, who is the campaign press secretary, told The Epoch Times on March 12 that “Mr. Kennedy did share with the New York Times that he’s considering Aaron Rodgers and Jesse Ventura as running mates along with others on a short list.”

Ms. Spear added that Mr. Kennedy will name his running mate in the upcoming weeks.

Former Democrat presidential candidates Andrew Yang and Tulsi Gabbard declined the opportunity to join Mr. Kennedy’s ticket, according to the New York Times.

Mr. Kennedy has also reportedly talked to Sen. Rand Paul (R-Ky.) about becoming his running mate.

Last week, Mr. Kennedy endorsed Mr. Paul to replace Sen. Mitch McConnell (R-Ky.) as the Senate Minority Leader after Mr. McConnell announced he would step down from the post at the end of the year.

CNN reported early on March 13 that Mr. Kennedy’s shortlist also includes motivational speaker Tony Robbins, Discovery Channel Host Mike Rowe, and civil rights attorney Tricia Lindsay. The Washington Post included the aforementioned names plus former Republican Massachusetts senator and U.S. Ambassador to New Zealand and Samoa, Scott Brown.

In April 2023, Mr. Kennedy entered the Democrat presidential primary to challenge President Joe Biden for the party’s 2024 nomination. Claiming that the Democrat National Committee was “rigging the primary” to stop candidates from opposing President Biden, Mr. Kennedy said last October that he would run as an independent.

This year, Mr. Kennedy’s campaign has shifted its focus to ballot access. He currently has qualified for the ballot as an independent in New Hampshire, Utah, and Nevada.

Mr. Kennedy also qualified for the ballot in Hawaii under the “We the People” party.

In January, Mr. Kennedy’s campaign said it had filed paperwork in six states to create a political party. The move was made to get his name on the ballots with fewer voter signatures than those states require for candidates not affiliated with a party.

The “We the People” party was established in five states: California, Delaware, Hawaii, Mississippi, and North Carolina. The “Texas Independent Party” was also formed.

A statement by Mr. Kennedy’s campaign reported that filing for political party status in the six states reduced the number of signatures required for him to gain ballot access by about 330,000.

Ballot access guidelines have created a sense of urgency to name a running mate. More than 20 states require independent and third-party candidates to have a vice presidential pick before collecting and submitting signatures.

Like Mr. Kennedy, Mr. Ventura is an outspoken critic of COVID-19 vaccine mandates and safety.

Mr. Ventura, 72, gained acclaim in the 1970s and 1980s as a professional wrestler known as Jesse “the Body” Ventura. He appeared in movies and television shows before entering the Minnesota gubernatorial race as a Reform Party headliner. He was a longshot candidate but prevailed and served one term.

Former pro wrestler Jesse Ventura in Washington on Oct. 4, 2013. (Brendan Smialowski/AFP via Getty Images)

In an interview on a YouTube podcast last December, Mr. Ventura was asked if he would accept an offer to run on Mr. Kennedy’s ticket.

“I would give it serious consideration. I won’t tell you yes or no. It will depend on my personal life. Would I want to commit myself at 72 for one year of hell (campaigning) and then four years (in office)?” Mr. Ventura said with a grin.

Mr. Rodgers, who spent his entire career as a quarterback for the Green Bay Packers before joining the New York Jets last season, remains under contract with the Jets. He has not publicly commented about joining Mr. Kennedy’s ticket, but the four-time NFL MVP endorsed him earlier this year and has stumped for him on podcasts.

The 40-year-old Rodgers is still under contract with the Jets after tearing his Achilles tendon in the 2023 season opener and being sidelined the rest of the year. The Jets are owned by Woody Johnson, a prominent donor to former President Donald Trump who served as U.S. Ambassador to Britain under President Trump.

Since the COVID-19 vaccine was introduced, Mr. Rodgers has been outspoken about health issues that can result from taking the shot. He told podcaster Joe Rogan that he has lost friends and sponsorship deals because of his decision not to get vaccinated.

Quarterback Aaron Rodgers of the New York Jets talks to reporters after training camp at Atlantic Health Jets Training Center in Florham Park, N.J., on July 26, 2023. (Rich Schultz/Getty Images)

Earlier this year, Mr. Rodgers challenged Kansas City Chiefs tight end Travis Kelce and Dr. Anthony Fauci to a debate.

Mr. Rodgers referred to Mr. Kelce, who signed an endorsement deal with vaccine manufacturer Pfizer, as “Mr. Pfizer.”

Dr. Fauci served as director of the National Institute of Allergy and Infectious Diseases from 1984 to 2022 and was chief medical adviser to the president from 2021 to 2022.

When Mr. Kennedy announces his running mate, it will mark another challenge met to help gain ballot access.

“In some states, the signature gathering window is not open. New York is one of those and is one of the most difficult with ballot access requirements,” Ms. Spear told The Epoch Times.

“We need our VP pick and our electors, and we have to gather 45,000 valid signatures. That means we will collect 72,000 since we have a 60 percent buffer in every state,” she added.

The window for gathering signatures in New York opens on April 16 and closes on May 28, Ms. Spear noted.

“Mississippi, North Carolina, and Oklahoma are the next three states we will most likely check off our list,” Ms. Spear added. “We are confident that Mr. Kennedy will be on the ballot in all 50 states and the District of Columbia. We have a strategist, petitioners, attorneys, and the overall momentum of the campaign.”

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges