Uncategorized

Futures Tumble, Briefly Drop Below 3,600, Despite Latest Panic Pivot By Bank of England

Futures Tumble, Briefly Drop Below 3,600, Despite Latest Panic Pivot By Bank of England

Another day, another rout, only this time there was…

Another day, another rout, only this time there was an even more ominous twist. It's shaping up as another risk off day on Wall Street, and around the world, as stocks fell... again... as usual... pressured by the relentless rout in the chip sector (following Friday's decision by the Biden administration to put fresh curbs on China’s access to US semiconductor technology) which sent chip giant Taiwan Semi conductor plunging 8.3%, its biggest drop on record, and wiped out $240 billion in market cap from the global semiconductor sector, while US futures extended their Monday slump amid general amid fears of persistently high inflation two days ahead of the CPI report, and signs that company earnings were set to disappoint. A gauge of the dollar climbed to the highest this month before reversing.

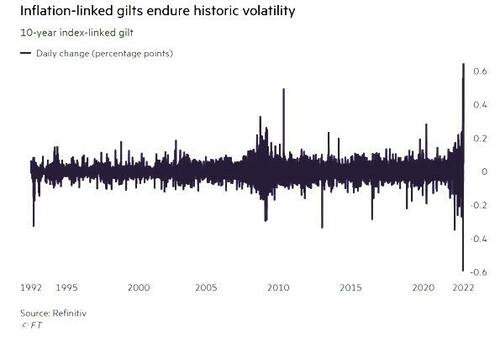

But the ominous twist today is that for the second time in two weeks, the BOE stepped in the market, this time boosting its "temporary" QE to add linker bonds to its usual array of gilt purchases to tackle what it called “fire-sale dynamics.” While this helped lift gilts and cable (if only briefly), its effect on futures was truly transitory, with the Emini dumping as much as 1% to a low of 3584, falling below the key level of 3,600, before stabilizing uneasily just above 3,600. It was down 0.6% at last check, while Nasdaq future were 0.5% lower as of 7:45am ET.

In US premarket trading, Meta Platforms slipped after it was cut to neutral from overweight by Atlantic Equities, which sees the social media giant’s growth outlook increasingly challenged by the strengthening macro headwinds and growing competition for advertising dollars; it was also added by Russia to a list of terrorist and extremist organizations. Here are some other notable premarket movers:

- Zoom shares decline 3% in premarket trading as Morgan Stanley cut the recommendation on the stock to equal-weight from overweight, saying the company’s online business needs to normalize post Covid for the firm to unlock the “tremendous value” in its enterprise platform.

- Roblox falls as much as 3.8% in premarket trading after Barclays initiates coverage with an underweight rating, saying the gaming platform’s daily users are “fairly saturated” and growth is decelerating post Covid.

- Amgen shares rise 1.7% in premarket trading after being upgraded to overweight from equal-weight by Morgan Stanley, which highlighted the “unappreciated upside” in the biopharma’s mid-term pipeline.

- Lululemon shares rise 1.3% in premarket trading after Piper Sandler upgraded the athletic apparel brand to overweight from neutral, noting the company’s momentum in the broker’s Spring 2022 Taking Stock With Teens survey.

- Elastic drops 2.4% in US premarket trading as Wells Fargo initiates at underweight, giving the application software company its only negative analyst rating.

- Leggett & Platt shares fell 8.6% in postmarket trading on Monday after the company lowered sales guidance for the full-year. Piper Sandler reduced the price target to a Street low, noting that the company’s speciality foam business is not only losing share but has been “disproportionately impacted” by weakness in the bed-in-a-box part of the market.

The mood remains extremely fragile ahead of Thursday’s US inflation data, with the case for another 75 basis-point rate hike likely to be strong if the reading comes in higher than than forecast. Fed officials until now show little sign they are in a mood to pause the rate-hiking cycle despite the potential hit to economic growth.

“We have not seen the impact of tightening,” Michael Kelly, head of the multi-asset team at PineBridge Investments told Bloomberg TV. “That lies ahead and when we see that, it’s another leg down for risk assets.”

Meanwhile, Russian President Vladimir Putin threatened further missile attacks on Ukraine after hitting Kyiv and other cities in the most intense barrage of strikes since the first days of its invasion. “It’s little wonder investors enter the week in a dreary mood, especially with headlines from Ukraine signaling a further escalation in geopolitical tensions,” said Christopher Smart, chief global strategist at Barings.

European stocks also declined with the Euro Stoxx 50 falling 0.9%. Energy, chemicals and miners are the worst performing sectors. IBEX outperforms peers, dropping 0.7%, FTSE MIB lags, dropping 1.4%. Here are the biggest premarket movers:

- Qiagen shares rise as much as 7.2%, the most intraday since November 2021, after a Dow Jones report that Bio-Rad Laboratories is in talks to combine with the German diagnostics firm.

- Airbus shares rise as much as 1.3% after September deliveries of 55 aircraft seen as “an encouraging data point,” compatible with the jetmaker reaching its target of 700 deliveries this year, Deutsche Bank analysts write in a note.

- Dustin shares rise as much as 10%, the most since January, after the Swedish computer and technology retail company reported 4Q results which Handelsbanken said included “solid” organic growth helped by its corporate and public sector unit.

- Boozt rises as much as 9%, the most since August, after Danske Bank upgraded the Swedish online fashion retailer to buy from hold, seeing an attractive share after recent weak performance despite a “more resilient business model than before.”

- Mining and energy stocks decline more than the broader European market on Tuesday as metals and crude slide amid concerns over weaker demand due to global economy slowdown and strengthening dollar. BP dropped as much as 3.4%, and Shell -2.4%

- European semiconductor stocks fall for a third day, following a rout in shares of Asian chip powerhouses including Samsung and TSMC. ASML declined as much as -2.8%

- Givaudan shares are down as much as 8.3%, reaching the lowest value since March 2020, after the company reported weaker-than-expected 3Q sales. Analysts are worried about soft growth in North America and a miss by the taste and wellbeing division amid a weakening consumer backdrop.

- Ferrexpo shares decline as much as 11% in early trading on Tuesday, most in three weeks, after the iron- ore maker said production has been temporarily suspended at group’s operations in Ukraine due to limited power supply.

Asian equities headed for a third day of declines amid a continued selloff in semiconductor shares, with markets in Taiwan, South Korea and Japan declining as trading resumed after holidays. The MSCI Asia Pacific Index dropped as much as 2.2%, with a technology sub-gauge falling more than 4%. Chip-related stocks in the region declined in the wake of fresh curbs on China’s access to US technology. The Hang Seng Tech Index also fell more than 3% amid the geopolitical tensions. Read: Chipmaker Rout Engulfs TSMC, Samsung With $240 Billion Wiped Out Hong Kong’s benchmark gauge slipped after a state-owned newspaper endorsed China’s Covid-Zero policy for the second day in a row, quashing investors’ hopes for a relaxation around the upcoming Communist Party congress. Chinese shares edged higher. Rising geopolitical risks are also weighing on sentiment, after Russia bombarded Kyiv and other Ukrainian cities. Meanwhile, investors remain on edge amid the prospect of more aggressive monetary tightening ahead of the release of US consumer-inflation data on Thursday.

“Thin volumes, high volatility and uncertainty, and a bearish sentiment globally means investors will overreact on the downside to any negative news,” Olivier d’Assier, head of APAC applied research at Qontigo, wrote in a note. Several data releases this week, as well as a further escalation in the war in Ukraine, may trigger further selling, he added. The MSCI’s Asian stock benchmark is once again approaching the lowest level since April 2020, having fallen more than 4% over a three-day period.

Japanese stocks fell, dragged by losses in technology shares amid concerns on earnings and the impact of new US curbs on chip-related exports to China. The Topix fell 1.9% to close at 1,871.24, while the Nikkei declined 2.6% to 26,401.25. Out of 2,168 stocks in the Topix, 285 rose and 1,833 fell, while 50 were unchanged. The market was closed for a holiday Monday. Tokyo Electron slid more than 5% after the Biden administration put fresh curbs on Chinese access to US chip technology. Tech sentiment was also hurt by a forecast cut at Yaskawa Electric, while Fast Retailing dropped more than 3% ahead of its earnings report this week. “With around 30% of Japanese tool makers’ orders coming from China, we think we are now likely to see cancelations hurting backlogs just when the chip market is facing a major oversupply,” said Amir Anvarzadeh, a strategist at Asymmetric Advisors Ltd., adding that Tokyo Electron would be among the hardest hit.

In FX, the Bloomberg Dollar Spot Index rose for fifth day as commodity currencies fell versus the greenback. Aussie and loonie were the worst G-10 performers as global growth concerns prompted traders to seek haven in the dollar; China signaled it may retain its strict Covid Zero policy, hitting stocks and commodities including iron ore

- The euro halted a four-day decline. German bonds advanced while Italy’s yield premium over Germany rose, paring some of Monday’s sharp drop amid doubts about Germany’s support for joint EU debt issuance.

- UK bonds edged higher in a bull-steepening move after the Bank of England expanded its financial stability operations, adding inflation-linked debt to its purchases, while pausing the sale of corporate bonds. The focus is on the result of the BOE’s daily bond-buying operation, a sale of 2051 linkers by the government and Governor Andrew Bailey’s comments later. The pound traded weaker versus the euro and was little changed against the dollar. Options traders are adding downside exposure in the pound again as cable retreats toward the $1.10 handle.

- The yen traded in a narrow range amid caution the authorities will step in to prevent further currency losses. Government bonds fell in tandem with overseas peers.

In rates, Treasuries pared a decline and the curve bear steepened after the panicking BOE expanded its QE operation. The 10-year yields pated Monday’s gilt-led losses led by gains in UK bond market, after earlier touching 4%, while the 30-year yield hit its highest level since 2014; yields on two-year Treasuries rose to the highest since 2007. US cash market, closed Monday’s for bank holiday, remains cheaper vs Friday’s close by as much as 6bp at long end. US 10-year yield is higher by ~4bp at 3.92%, steepening 2s10s by ~5bp vs Friday’s close, with 5s30s also ~5bp wider on the day; gilts bull-steepen with UK 2-year yields richer by 11bp on the day. As reported earlier, Monday’s record slide in gilts was arrested after BOE said inflation-linked notes will be included in this week’s remaining buybacks. US auctions resume at 1pm New York time with $40b 3-year note sale, followed by 10- and 30-year sales Wednesday and Thursday

In commodities, WTI drifts 2.6% lower to trade near $88.74. Spot gold falls roughly $3 to trade near $1,665/oz. Most base metals are in the red.

Bitcoin hovers around the USD 19,000 mark whilst Ethereum remains under 1,300.

Looking to the day ahead now, it's another quiet event calendar with just the NFIB’s small business optimism index from the US for September out today (92.1, above 91.6 expected). From central banks, we’ll hear from BoE Governor Bailey and Deputy Governor Cunliffe, the ECB’s Lane and Villeroy, as well the Fed’s Mester. Finally, the IMF will be publishing their latest World Economic Outlook.

Market Snapshot

- S&P 500 futures down 0.7% to 3,599.25

- STOXX Europe 600 down 0.9% to 386.58

- MXAP down 2.0% to 137.94

- MXAPJ down 2.1% to 445.19

- Nikkei down 2.6% to 26,401.25

- Topix down 1.9% to 1,871.24

- Hang Seng Index down 2.2% to 16,832.36

- Shanghai Composite up 0.2% to 2,979.79

- Sensex down 0.7% to 57,610.70

- Australia S&P/ASX 200 down 0.3% to 6,644.99

- Kospi down 1.8% to 2,192.07

- Brent Futures down 1.5% to $94.71/bbl

- Gold spot down 0.1% to $1,667.26

- U.S. Dollar Index little changed at 113.21

- German 10Y yield little changed at 2.30%

- Euro little changed at $0.9708

Top Overnight News from Bloomberg

- Record inflation and the danger of winter energy shortages are sinking confidence in the euro-zone economy. As the hard data gradually worsen, the hawks who currently steer ECB policy have only a limited opportunity to deliver more big hikes

- UK unemployment fell unexpectedly to the lowest since 1974 as people dropped out of the workforce at a record rate. The government said 3.5% of adults were looking for work in the three months through August, down from 3.6% the month before. Economists had expected no change

- From Japanese pensions and life insurers to foreign governments and US commercial banks, where once they were lining up to get their hands on US government debt, most have now stepped away. And then there’s the Federal Reserve, which a few weeks ago upped the pace that it plans to offload Treasuries from its balance sheet to $60 billion a month

- Credit Suisse Group AG is the last of 16 banks to face a US class-action lawsuit accusing it of conspiring with others to rig the foreign exchange market

A more detailed breakdown courtesy of RanSquawk

APAC stocks traded with a negative bias as several markets returned from the long weekend and reacted to the recent bearish themes with tech stocks hit due to the US’s chip tech curbs on China and with global sentiment not helped by the heightened geopolitical concerns after Russia’s missile assault on Ukrainian cities. ASX 200 was indecisive after mixed data and with the index subdued by underperformance in tech and energy. Nikkei 225 declined with the reopening of Japan’s borders overshadowed by tech sector woes which also saw heavy selling pressure on South Korean and Taiwanese chipmakers. Hang Seng and Shanghai Comp. were mixed with notable losses in tech and casino stocks in which the latter suffered after domestic trips in China during the National Day Golden Week holiday fell by 18% Y/Y, while sentiment was also dampened by increased lockdown concerns as China tightened COVID controls ahead of the Communist Party congress including the rollout of mandatory biweekly mass testing in Shanghai.

Top Asian News

- China Securities Daily suggested that China may cut RRR in Q4.

- People's Daily said China must stick to zero-COVID policy which is sustainable and key to stabilising the economy.

- China's Xi'an announced on Tuesday to suspend onsite classes for some students amid the COVID-19 flare-ups, other areas including culture venues, tourist attractions and cinemas also suspended services on Tuesday, according to Global Times.

- PBoC set USD/CNY mid-point at 7.1075 vs exp. 7.1038 (prev. 7.0992)

- Japanese PM Kishida said the BoJ needed to maintain policy until wages increase, while he urged companies that increase prices to raise pay also and said the government will prepare measures to help companies raise salaries, according to FT.

- Japanese Finance Minister Suzuki said they are closely watching FX moves with a strong sense of urgency and will respond to excess FX moves, according to Reuters.

- Japan's MOF top currency official Kanda said they are always ready to take necessary steps against FX volatility and said he can make a decision on FX intervention anywhere even from an aeroplane, according to TBS.

- Japanese Chief Cabinet Secretary Matsuno said they are closely watching FX moves with a high sense of urgency; to take appropriate steps on excess FX moves, via Reuters.

- Japan is to draw up economic measures before the end of October, according to NHK.

- RBI likely sold USD in spot and received forwards via state-run banks, according to traders cited by Reuters.

- RBNZ Governor Orr said in the Annual Report that there is more work to do and increasing the OCR is the most effective way we can reduce inflation and support maximum sustainable employment over the coming years, consistent with our monetary policy remit.

European bourses are once again underwater as the selling pressure from yesterday has bled through into today’s session. Sectors in Europe are mostly softer but Retail is the standout outperformer. Stateside, US futures are also on the backfoot with the e-mini S&P Dec contract dipping below 3600 in a continuation of yesterday’s losses.

Top European News

- Barclaycard UK consumer spending rose 1.8% Y/Y in September which was the slowest pace since February 2021.

- Germany's government rejected the report about Chancellor Scholz backing joint EU debt for loans to ease the energy crisis and said "such plans are not known in the government", according to a source cited by Reuters.

- German Chancellor Scholz said Germany will discuss inflation reduction act with the US; there must be no customs war, via Reuters.

- EU trade commissioner said it is working on a new temporary state aid framework which will allow countries to support firms hit by high energy bills; adds that decoupling from China is not an option for EU companies, via Reuters.

- UK Chancellor Kwarteng will need to plug a GBP 60bln hole in the public finances with either spending reductions or a tax raid, according to the IFS via the Telegraph.

- BoE said it intends to purchase index-linked Gilts, effective from Oct 11-14, and announced a temporary pause to corporate bond sales. Linker purchases will act as a backstop to restore order; purchases are time limited.

- Many pension funds feel that the BoE intervention in gilts market should be extended to October 31st "and possibly beyond", according to the Pension Fund Trade Body cited by Reuters.

- Brookfield, DigitalBridge Said to Weigh Vantage Stake Bid

- European Gas Rises on Supply Risks as Russia Escalates War

- Apollo Makes Quick Gains on CLOs Dumped by UK Pension Funds

- Credit Suisse Is Final Holdout in FX Rigging Case Going to Trial

- Discounted Fuel, Grains Make Taliban Boost Trade With Russia

FX

- DXY is firmer on the day with a current intraday high of 113.50 (vs a 112.95 low)

- G10s are mixed vs the USD with the CAD and AUD the laggards, in-fitting with losses across oil and base metals respectively.

- USD/JPY held within a 145.86-50 range (vs YTD high of 145.90) following more jawboning from Japanese Chief Cabinet Secretary Matsuno.

Fixed Income

- Schatz and Bund futures both retreated to new intraday lows and the latter is just under Monday’s 135.83 session base, at 135.81.

- The 10yr UK debt future also recoiled to a deeper Liffe low (92.06) before bouncing and thereby remaining ‘comfortably’ off yesterday’s 91.46 trough.

- US Treasuries are narrowly mixed and side-lined awaiting the return of cash traders, more Fed speakers and USD 40bln 3 year issuance.

Commodities

- WTI and Brent front-month futures are weaker intraday amid several factors including technicals, a firmer Dollar, alongside further bearish COVID-related headlines emanating from China.

- Spot gold is relatively flat despite the firmer Dollar, but remains under its 21 DMA (1,674/oz) as the clock ticks down to US CPI on Thursday.

- LME metals meanwhile are mostly lower with 3M copper softer on the day amid the stronger Buck, sullied risk tone, and with the Chinese COVID restrictions an ongoing tail risk with the metal moving on either side of USD 7,500/t.

- Iranian State News Agency denied reports of worker strikes at Abadan refinery, according to Reuters.

Geopolitics

- US President Biden and G7 leaders will hold a virtual meeting today to discuss their commitment to support Ukraine, according to the White House.

- US Democrat Senator Menendez threatened to block US cooperation with Saudi amid its deepening ties with Russia, while he ripped into the decision to cut oil output and effectively accused Saudi of fuelling Russia's war machine, according to Business Insider.

- Russian Deputy Foreign Minister Ryabkov said direct conflict with the US and NATO is not in Moscow's interests but noted that Russia will take adequate countermeasures in response to the West's growing involvement in the Ukraine conflict, according to RIA.

- Russian Deputy Foreign Minister said Russia does not threaten anyone with the use of nuclear weapons, via Al Jazeera

US Event Calendar

- 06:00: Sept. SMALL BUSINESS OPTIMISM, 92.1, est. 91.5, prior 91.8

Central Banks

- 12:00: Fed’s Mester Speaks to Economics Club of New York

DB's Jim Reid concludes the overnight wrap

It's been another rough 24 hours for markets, with a major European bond selloff after Bloomberg reported that German Chancellor Scholz would support issuing joint EU debt to deal with the energy crisis. At this stage it’s just a report without formal confirmation and we’ll have to see how it might be executed, so we shouldn’t get ahead of ourselves. However, the details from the story suggested that Scholz had signalled an openness to common borrowing at last week’s EU summit in Prague, so long as the money was distributed in the form of loans rather than grants. So perhaps the common borrowing announced during the pandemic will prove to have been the first of many rather than a one-off. If the last decade was all about how Europe/Germany could get away with as little fiscal spending as they could, this decade seems to be all about spending. This continues to change the macro dynamics of the continent completely from where it was, especially with regards bond yields and the depo rate.

We should note however, that after Europe closed, Reuters suggested that a German government source rejected the story that Berlin backed such joint EU debt for this purpose. So we'll see if there is any retracement in yields this morning as the initial market reaction was substantial.

Yields on 10yr bunds surged +14.3bps on the day (+11bps after the story hit) to close at 2.33%, thus leaving them at their highest closing level since 2011. There were similar moves across the continent, with yields on 10yr OATs up +11.5bps to a post-2012 high of 2.91%. However, the big outperformer were Italian BTPs where yields actually fell on the day following the news, with the spread between 10yr BTPs over bunds down by -21.3bps to 230bps. That was a big change from earlier in the session, when the Italian spread had been on track to close at its widest level since April 2020 as nerves built ahead of Italian draft budget proposals.

However it was a case of anything Europe could do, the UK could do worse, as the 10yr Gilt yield soared by +23.6bps on the day to 4.46% after the BoE announced fresh measures (see below) which seemed to scare investors of what might be out there rather than reassured them. The moves were eerily reminiscent of the late-September turmoil after the mini-budget, with rises in yields taking place across all maturities, with the 30yr yield up by an even-larger +28.8bps. It’s clear that LDI trades are still creating some tension in the market. If nominal yield moves weren’t enough for you, the movements in real yields were even more astonishing, with the 10yr real yield up by +64.1bps on the day to close at 1.23%, which is its highest closing level since 2009. In the meantime, sterling (-0.28%) lost ground against the US Dollar for a 4th consecutive session, closing at $1.1055, and implied sterling-dollar volatility over the next month has also been creeping back up to near its levels shortly after the mini-budget.

Those movements for gilts came in spite of numerous announcements from UK policymakers yesterday as they sought to deal with the mini-budget’s legacy. First, the Bank of England said that as part of their ongoing intervention to purchase long-dated government gilts, they would increase the maximum auction sizes for this week, which comes ahead of the planned end to the operation on Friday. In addition, they announced the launch of a “Temporary Expanded Collateral Repo Facility”, which is designed to help ease pressures on liability driven investment funds. Second, we heard that the government were bringing forward the Medium-Term Fiscal Plan to October 31 from November 23, which will be published alongside a forecast from the independent OBR. And finally, it was confirmed that James Bowler would be the new Permanent Secretary to the Treasury (the most senior civil servant in the department). Bowler is currently Permanent Secretary at the Department for International Trade but has over 20 years’ experience working in the Treasury, and the appointment was widely reported as a U-turn by PM Truss to reassure markets. That’s because Truss had pledged when running for PM that she would combat the “Treasury orthodoxy”, but has instead opted for someone with lengthy experience in the department.

Over in the US, Treasury markets weren’t actually open given the Columbus Day holiday, but Fed funds futures showed that investors were continuing to price out the pivot speculation from early last week, with the rate priced in by December 2023 up by a further +6bps to 4.46% over the last 24 hours and up from 4% at the pivot lows a week ago. In Asia, yields on the 30-year UST (+10.38 bps) rose to 3.95%, the highest since 2014, whereas the 10yr yield (+11bps) has broken through the 4.0% threshold as we go to press.

This all follows a fresh set of comments from Fed officials, including Chicago Fed President Evans, who said that “I see the nominal funds rate rising to a bit above 4.5% early next year and then remaining at this level for some time while we assess how our policy adjustments are affecting the economy”. Vice Chair Brainard spoke late in the session but didn't really move the needle too much but her comment that the Fed should be cautious seemed to lean a little dovish even though she covered both sides of the argument. Henry in my team wrote about the five "Fed pivot" trades that markets have tried to encourage in the last few months in his weekly "Mapping Markets" yesterday. See here for more.

Whilst bonds were having another bad day, there wasn’t much respite for equities either, with the S&P 500 (-0.75%) moving lower for a 4th consecutive session, which leaves it less than 1% away from its closing low for the year at end-September. The 6% rally in the first 2 and a bit days of the quarter seems a lifetime away rather than 3 business days ago. The more interest-sensitive tech stocks bore the brunt of the declines, with the NASDAQ down -1.04% to close at its lowest level since July 2020, whilst the FANG+ index (-1.17%) of megacap tech stocks has now shed around -43% since its all-time peak back in November 2021. Backin Europe the tone was also a fairly negative one, with the STOXX 600 (-0.40%) losing ground for a 4th day in a row as well.

Asian equity markets are mostly trading lower this morning as concerns continue about the Fed’s tightening cycle alongside Washington’s semiconductor export controls on China. As I type, the Nikkei (-2.34%) and the Kospi (-2.29%) are sharply lower after resuming trading following a holiday with the Hang Seng (-1.43%) also sliding. Bucking the trend are Chinese equities with the Shanghai Composite (+0.40%) and the CSI (+0.49%) both moving higher. However, concerns over rising Covid-19 cases in China are still hovering in the background. In overnight trading, US stock futures point to further losses with contracts tied to the S&P 500 (-0.45%) and NASDAQ 100 (-0.40%) both trading in negative territory.

Early morning data showed that Japan’s current account surplus (+58.9 billion yen) shrank to its smallest amount on record for the month of August as import prices surged compared to July’s surplus of +229.0 billion yen.

In geopolitical news, the G-7 nations have called for an emergency meeting (videoconference) today to discuss the escalating war in Ukraine in the wake of Russia's revenge attacks over the last 24 hours. In addition to this, the G7 will also discuss energy issues in an attempt to bring down gas prices by creating a buyer’s alliance.

To the day ahead now, and data releases include UK labour market data for August and September, Italy’s industrial production for August, as well as the NFIB’s small business optimism index from the US for September. From central banks, we’ll hear from BoE Governor Bailey and Deputy Governor Cunliffe, the ECB’s Lane and Villeroy, as well the Fed’s Mester. Finally, the IMF will be publishing their latest World Economic Outlook.

Uncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex