International

Futures Soar On Stimulus Hopes, Fed Bond Buying, Ignore Geopolitical Clashes

Futures Soar On Stimulus Hopes, Fed Bond Buying, Ignore Geopolitical Clashes

After Monday's dramatic intraday reversal which saw the S&P500 surge more than 100 points from session lows and closing above its 200-day moving average, ES futures continued their levitation overnight and were trading at 3,110 last, propelled both by Monday's Fed announcement it would start to buy corporate bonds on Tuesday, and a late Bloomberg report that Trump was seeking a $1 trillion infrastructure proposal to stimulate the economy which would focus on 5G and rural broadband, although reports added it would still under discussion and would need the backing of Congress.

As Bloomberg notes, government stimulus has been a key feature of the global equities rally, despite soaring unemployment and signs that a second wave of the virus has started to emerge. Now there are signals that more economic support is on the way. "The size and the pace of Fed balance sheet expansion is something that will put a floor under global equity markets,” Stephen Gallo, BMO Capital Markets head of European FX strategy, said on Bloomberg TV.

At the same time, investors mostly ignored news of a sharp escalation in Korean tensions, as well as a deadly clash between Indian and Chinese border troops, while expecting a record rebound in May retail sales. Investors will be keeping a close watch on a live telecast of Fed Chair Jerome Powell’s two-day testimony before the Congress which is expected to begin at 10 a.m. ET. Powell’s remarks follow the grim outlook from the U.S. central bank last week that brought back volatility into stock markets after bets of a swift economic rebound helped the Nasdaq confirm a bull market.

As a result of more stimulus hopes, S&P futures rose 1.2% overnight, lifting the S&P 500 index to 9% below its record high hit four months earlier after coming within 5% of that level early last week. U.S. stocks ended a volatile session higher on Monday with the S&P 500 closing above its 200-day moving average, a key technical indicator of long-term momentum.

Travel-related stocks, also known as the "Robinhood darlings", jumped with Delta Air Lines, United Airlines, Carnival Corp, Norwegian Cruise Lines and Royal Caribbean jumping between 8% and 10% in premarket trading.

In Europe, the Stoxx 600 Index rallied the most in a month lef by construction stocks following a Bloomberg report that the Trump administration is weighing a $1t infrastructure program as part of plans to boost the economy. Stoxx 600 Construction & Materials index gains as much as 4.2%, the most since May 18, led by gains for CRH, HeidelbergCement and LafargeHolcim

Ashtead jumps as much as 19%, touching a record high, boosted by the U.S. plans and 4Q results that Jefferies said were slightly ahead of guidance. Ground engineering specialist Keller up as much as 15% after update.

Asian stocks gained, led by materials and industrials, after falling in the last session. All markets in the region were up, with South Korea's Kospi Index gaining 5.3% and Japan's Topix Index rising 4.1%. The Topix gained 4.1%, with TEMONA and Furukawa Battery rising the most. The Shanghai Composite Index rose 1.4%, with Nanjing Iron & Steel and Shanghai Yimin Commerce Group posting the biggest advances.

In geopolitical news, there was a sharp escalation out of North Korea which said it was mulling plan to enter demilitarized zones and its army is preparing to implement government orders. Subsequently, North Korea demolished the inter-Korean joint liaison office. South Korea's Blue House said Seoul will "strongly respond" if North Korea further worsens the situation, with traders now looking at a US response.

Separately, an Indian Army Colonel and 2 Army soldiers were killed in action during a clash with Chinese troops at one of the standoff points in the Galwan Valley, Ladakh, India Today Senior Editor Aroor; after reports of fresh tensions at standoff points in Easter Ladakh at Pangong Tso/Galwan, according to The Hindu's Peri. Some reports note that Indian soldiers attacked Chinese soldiers at the border. Thereafter, the Global Times reported that the Chinese Foreign Ministry said that China and India have agreed to resolve bilateral issues through dialogue to ease the border situation and maintain peace and tranquillity in border areas. More recently, the Chinese Global Times editor tweeted “China also suffered casualties in the Galwan Valley in the physical clashes with Indian soldiers, China doesn’t want to have a clash with India, but we don’t fear it”.

In rates, ttreasuries were off the lowest levels of the day although yields remain cheaper by up to 5bp at long end of the curve in a bear-steepening move. Plans for more U.S. stimulus via a $1 trillion infrastructure proposal lifted stocks, weighed on Treasuries as it implied far more issuance to come. Yields cheaper by 0.5bp to 5bp across the curve with front-end out to 7-year sector outperforming, steepening 2s10s by 1.7bp, 5s30s by ~5bp; 30-year yields topped at 1.542%, highest since June 10

In FX, the dollar fell versus most of its Group-of-10 peers following the U.S. infrastructure proposal to revive the virus-hit economy. "Dollar de-basement risks are mounting again and Treasury yields going much higher because of the expected infrastructure spending,” said Mizuho head of strategy Vishnu Varathan. "Markets are anticipating a lot more money flooding into the market with this spending and that the U.S. will have to sell a lot more bonds." The pound led G-10 gains after talks between U.K. Prime Minister Boris Johnson and the EU’s top officials. Bunds slipped while Italian bonds led outperformance by euro peripheral debt.

Elsewhere, WTI climbed toward $38 a barrel in New York, with Brent trading at $40.58 last amid signs of improving demand and declining production.

Looking at the day ahead, there are a number of data highlights from the US, including May’s retail sales, industrial production and capacity utilization, and finally June’s NAHB housing market index. Elsewhere, Fed Chair Powell will be speaking before the Senate Banking Committee, while we’ll also hear from Fed Vice Chair Clarida, the ECB’s Visco and Bank of Canada Governor Macklem. Oracle is reporting earnings.

Market Snapshot

- S&P 500 futures up 1.2% to 3,102.50

- STOXX Europe 600 up 2% to 360.21

- MXAP up 3.2% to 158.26

- MXAPJ up 2.6% to 507.74

- Nikkei up 4.9% to 22,582.21

- Topix up 4.1% to 1,593.45

- Hang Seng Index up 2.4% to 24,344.09

- Shanghai Composite up 1.4% to 2,931.75

- Sensex up 0.6% to 33,412.76

- Australia S&P/ASX 200 up 3.9% to 5,942.30

- Kospi up 5.3% to 2,138.05

- German 10Y yield rose 1.7 bps to -0.429%

- Euro up 0.09% to $1.1333

- Brent Futures up 1.6% to $40.36/bbl

- Italian 10Y yield rose 1.2 bps to 1.33%

- Spanish 10Y yield fell 3.2 bps to 0.529%

- Brent futures up 2% to $40.50/bbl

- Gold spot up 0.2% to $1,729.35

- U.S. Dollar Index down 0.1% to 96.60

Top Overnight News

- The Federal Reserve said Monday that it will begin buying individual corporate bonds under its Secondary Market Corporate Credit Facility, an emergency lending program that to date has purchased only exchange-traded funds

- Stocks rose globally alongside U.S. equity futures after news about American monetary and fiscal stimulus plans bucked up investor sentiment in face of worries over a second virus wave

- The U.K. and European Union moved a step closer to reaching a deal over their future relationship, with the bloc’s top officials confident Boris Johnson is willing to compromise and the prime minister saying the prospects for an accord are “very good”

- U.K. jobless claims more than doubled to almost 3 million during the virus lockdown, adding urgency to Bank of England and government efforts to cushion the blow

- The Bank of Japan increased its lending support aimed at struggling companies while leaving its main monetary policy settings untouched as it continues to monitor the economic fallout from the coronavirus pandemic

- Japanese fund managers sold the most U.S. agency bonds in six years in April after buying an unprecedented amount the previous month, according to data from the Treasury Department

Asia-Pac bourses notched considerable gains as the region took impetus from Wall Street's recovery after the pace of infections slowed in key US states and the Fed announced its Secondary Market Corporate Credit Facility will begin purchasing corporate bonds. ASX 200 (+3.9%) and Nikkei 225 (+4.9%) surged from the open with energy and tech leading the firms gains in Australia and Viva Energy the biggest gaining stock following its guidance, while stocks in Tokyo also rallied as they coat-tailed on the recent favourable currency moves and with focus on the BoJ announcement in which the central bank kept policy settings unchanged as expected but noted the size of market operations and lending facilities to address the pandemic is likely to increase to around JPY 110tln from the current JPY 75tln. Hang Seng (+2.4%) and Shanghai Comp. (+1.4%) were also positive amid some moderation in the US-China related headlines with the US to permit Chinese carriers to continue to operate 4 flights from China per week and with the US to also allow companies to work with Huawei to develop 5G standards despite its blacklisting, although gains for the mainland were relatively reserved compared to its peers after the PBoC’s net liquidity drain. Finally, 10yr JGBs were lower in which they briefly fell below the 152.00 level amid spill over selling from USTs and as stock markets surged, while the losses in bonds also followed the BoJ decision to maintain its monetary policy settings as expected.

Top Asia News

- Rupee Declines With Stocks on India-China Border Face-Off

European equities drift lower as trade is underway, but the region remains in firm positive territory [Euro Stoxx 50 +2.4%] despite the slew of geopolitical developments in early EU hours including further souring in inter-Korean relations alongside clashes between nuclear powers India and China. Some participants point yesterday’s recovery to the recent Fed decision to directly purchase corporate bonds, but scepticism remains regarding the stock market “shrugging off” stacking negative fundamentals and rising uncertainty – with the latest BofA June Fund Manager survey also noting that a record 98% of investors say the stock market is the most overvalued since 1998. Nonetheless, broad-based gains are seen across Europe of some 2%, whilst sectors also point to risk appetite in the market as cyclicals outpace defensives. In sectoral breakdown mimics the “risk-on” sentiment as Material, Banks and Travel & Leisure stand as the top performers, whilst Health, Retail and Media lag. In terms of individual movers, the strong performance in the Travel sector sees Carnival (+8.8%), easyJet (+7.3%), IAG (+7.7%) and Tui (+6.7%) leading the gains – with the latter also noting that the easing of travel restrictions allows the group to partially restart its summer 2020 programme. Ashtead (+7.0%) trimmed earlier gains but holds a spot among the leaders following its trading update. Commerzbank (+2.5%) is unfazed by the spat with its second largest shareholder Cerberus, who recently stated the German bank has not executed or embraced any actions put forward by Cerberus.

Top European News

- U.K. and EU See Brexit Deal a Step Closer After Johnson Call

- U.K. Jobless Claims Double to Almost 3 Million Amid Lockdown

- European Construction Stocks Bounce on U.S. Infrastructure Plan

In FX, the DXY is trying to form a base around 96.500 following its late reversal through the 97.000 level on Monday when flagging risk sentiment due to heighted 2nd wave coronavirus fears was given a double boost by the Fed announcing individual corporate bond buying under the SMCCF program and US President Trump’s admin working on a draft proposal for a Usd 1tn infrastructure bill. However, subsequent flare ups on the Korean border, between China and India, Saudi Arabia and the Houthis, Iran and the US, have sapped momentum from riskier assets like stocks and the Dollar has reclaimed some of its losses as a result along with similar rebounds in fellow safe havens. Ahead, US retail sales and ip data before Fed chair Powell’s Senate testimony.

- GBP - Aside from the broader upturn in risk appetite, Sterling has received an independent boost via latest Brexit news as the Times reports that the EU may be ready to back down on fishing rights rather than somewhat inconclusive UK labour and earnings data. Indeed, Cable is holding relatively firmly above 1.2600 and Eur/Gbp is back down below 0.9000, albeit the former off best levels close to 1.2690 and the 200 DMA (1.2692) and the latter rebounding from a dip under 0.8950.

- EUR/AUD/CHF/CAD - All moderately firmer against the Greenback, with the Euro reclaiming 1.1300+ status and eclipsing a couple of HMAs (100 and 200) on the way up to around 1.1350, and maintaining gains after an encouraging ZEW survey, while the Aussie has retained a grip on the 0.6900 handle in wake of RBA minutes reaffirming an on hold stance with a bias to do more if needed. Elsewhere, the Franc remains above 0.9500, but flattish vs the Euro either side of 1.0750 following a modest Swiss Government GDP forecast upgrade, though still predicting a deep 2020 contraction and the trough in Q2, while the Loonie is meandering between 1.3510-1.3600 parameters amidst consolidation in oil prices off recent lows as the IEA raises its global demand estimate by nearly 500k bpd for this year.

- JPY/NZD/SEK - Marginal G10 underperformers with the Yen pivoting 107.50 vs the Buck after the BoJ left key policy metrics unchanged as expected, but increased COVID-19 lending by Jpy 35 tln, the Kiwi relinquishing 0.6500 ahead of NZ Q1 current account balances and the Swedish Crown ruffled by the Swedish Labour Board lifting its 2020 jobless forecast appreciably and the Riksbank reporting a deterioration in bond market functioning to leave Eur/Sek elevated above 10.5000.

- EM - No surprise to see pressure on the Krw beyond 1210 vs the Usd in light of North Korea destroying the Inter-Korean joint liaison office, according to South Korea’s Ministry of Unification, but regional currencies in general are jittery, bar the Zar and Mxn that have reversed some of Monday’s declines to revisit resistance ahead of psychological/round number levels at 17.0000 and 22.0000 respectively.

- RBA Minutes from June 2nd Meeting affirmed the target for 3yr yields would be maintained and the central bank will also not increase the cash rate until progress was made on its employment and inflation targets. The minutes stated that members recognized the global economy was in a severe downturn and that the Australian economy was experiencing its largest contraction since the 1930s, while it is prepared to scale up bond purchases if needed but also noted it had only purchased government bonds only on one occasion since the prior meeting. Furthermore, members noted yields on bonds with 1-2 years to maturity had risen to be a few basis points higher than the yields on 3-year bonds and if this should continue, they would consider purchasing bonds in the secondary market to ensure that these short-term yields are consistent with the target for three-year yields. (Newswires)

In commodities, WTI and Brent front month futures continue to grind higher since the European cash open as participants digest a string of geopolitical headlines alongside the IEA monthly oil market report. Firstly, tensions ramped up in the Korean Peninsula after North Korea destroyed the inter-Korean liaison office, as well as a standoff between nuclear powers India and China in which a number of soldiers lost their lives in the clash – which China blames India for instigating. Meanwhile, the IEA raised its 2020 global oil demand growth forecast by 500k BPD amid demand from China and India. 2021 oil demand is forecast to rise by 5.7mln BPD, which remains below 2019 levels. Furthermore, the agency does not expect demand to return to pre-crisis levels until at least 2022. This is in stark contrast to the EIA STEO report last week which downgraded its respective 2020 global demand forecast by 120k BPD. The two reports, however, synchronise on the view that US crude is set to fall this year: the IEA expects a decline of 900k BPD and the EIA a fall of 670k BPD. WTI July gains a firmer footing above USD 37/bbl (vs. 36.38/bbl low) whilst its Brent Aug prices extends above USD 40/bbl (vs. 38.95/bbl low). Next up in terms of scheduled events, traders will be eyeing the weekly Private Inventory data for a glimpse at crude stocks over the last week. Further head, the JTC will be convening tomorrow ahead of the JMMC meeting on Thursday. Spot gold meanwhile retains an underlying bid above USD 1730/oz amid the aforementioned developments in the geopolitical sphere ahead of Fed Chair Powell’s testimony, albeit the statement is unlikely to divert much from the FOMC script, but the Q&A section of the event will garner attention. Copper prices meanwhile track stocks higher but found resistance at USD 2.625/lb as the red metal remains within Friday’s range.

US Event Calendar

- 8:30am: Retail Sales Advance MoM, est. 8.35%, prior -16.4%

- 8:30am: Retail Sales Ex Auto MoM, est. 5.5%, prior -17.2%

- 8:30am: Retail Sales Control Group, est. 5.2%, prior -15.3%

- 9:15am: Industrial Production MoM, est. 3.0%, prior -11.2%; Manufacturing (SIC) Production, est. 5.0%, prior -13.7%

- 10am: Business Inventories, est. -1.0%, prior -0.2%

- 10am: NAHB Housing Market Index, est. 45, prior 37

DB's Jim Reid concludes the overnight wrap

Sorry to go back to last week’s meanderings, but Chill Acoustic - the radio station I’ve very happily listened to while working from home for the last three months - is still stuck on the same track it was 6 days ago. This has ruined my flow and is starting to hit my productivity as I have to keep going back to check if it’s been fixed. So if anyone knows how on earth I can get them to fix this I’m all ears. I’m not sure if anyone actually controls this radio station. It has 19 twitter followers, hasn’t posted a tweet or a Facebook post for a couple of years and has a seemingly unmanned email address. I suspect I was the only global listener for most of the last three months. It was great while it lasted.

Unlike “Chill Acoustic”, the mood music for markets at the end of yesterday was very different to that at the start. Indeed, a day that started with fears of a second wave ended with waves of liquidity completely reversing the session from the London open. At roughly 7am London time, S&P futures were down -3.29% from Friday’s close but rallied around +4.7% from these lows as the day progressed. The actual S&P 500 closed +0.83% with tech outperforming (NASDAQ +1.43%). The market was slowly recovering from the lows prior to the US open but in the second half of the session a pair of headlines saw the index push higher into the close. First was a report that the US may allow domestic companies to work with China’s Huawei to develop new 5G standards, which could be seen as ameliorating some of the recent tension. The S&P rose around 0.6% on this, but then the real move came in the early afternoon when headlines flashed through that the Federal Reserve would start purchasing a broad portfolio of US corporate bonds. The index rose over 1.3% on that news even if it was hard to find something new in that announcement. Overall it was a remarkable turnaround, given where futures had been earlier in the day. News overnight suggesting that the White House is considering $1tn in infrastructure spending has propelled futures further too (more on that shortly).

As another way to look at the switch in sentiment, at around noon (NY time), 80% of S&P 500 stocks were down on the day, and all sectors except Consumer Staples were in the red, however by the end of the day 77.6% of the index was higher and every sector was up. Furthermore, when S&P futures hit their overnight low, the VIX volatility index hit its highest intraday level (44.37) since April 22, before actually closing down -1.7pts at 34.4pts. While in Europe the STOXX 600 also recovered from its opening lows to close down only -0.27%, but the index missed the real late surge in risk.

Asian markets have made strong headway this morning also. The Nikkei (+3.93%), Hang Seng (+2.95%), Kospi (+4.34%) and Asx (+3.64%) have all posted big gains, while the Shanghai Comp has advanced a more modest +0.87%. As mentioned above, news that the White House is considering a $1tn infrastructure proposal has seemingly also given risk assets a boost. The prospect of further stimulus was already known however the size and timing was more up in the air. According to a Bloomberg story, the preliminary version of the proposal would see funding reserved for traditional infrastructure work like roads and bridges as well as 5G wireless infrastructure and rural broadband. The current infrastructure funding law is due for renewal by the end of September and the House Democrats have already proposed their own $500bn proposal over five years. For now there is no detail on how long the administration’s draft would authorize spending. Nevertheless, long-end Treasuries are up 6bps post the news, while the short-end is little changed.

In other news, the BoJ left rates and asset purchases unchanged this morning while revising up the estimated size of its virus-response measures and pledged to do more to help the economy if needed. The central bank now estimates the size of its overall package of virus measures at JPY 110tn ($1tn), up from JPY 75tn as the government had expanded its aid for businesses in measures linked to one of the BoJ’s lending programs. Elsewhere, North Korea’s state media is reporting that the regime is reviewing a plan to send its army into some areas of the demilitarized zone separating the country from South Korea.

Moving on. As mentioned above, a big part of the late day rally yesterday was the expected news that the Fed was about to start buying corporate debt. This should not be seen as new as this was already lined up as part of the Secondary Market Corporate Credit Facility (SMCCF). Up to this point the central bank has been just purchasing ETFs, but they are now making it official that they'll start buying individual securities this week. What was new information, is that the Fed will be essentially creating its own index against which it will manage its SMCCF bond portfolio. To remind readers the criteria of the bonds that are purchasable remain the same – less than 5yrs to maturity, a US company, IG rated or a fallen angel as of March 22 or later.

The other main story bubbling in the background are the rise in cases across various US states. Cases in the US are slowing overall, but the hot spots we have highlighted in recent days continue to remain the main focus – namely Florida, Texas, Arizona and California. Florida cases were up 2.3% yesterday, compared with a 7-day average of 2.4%, while Texan cases rose 1.9% for the second day in a row. Texas also set a record with most daily hospitalizations for a fourth day in a row with over 2300 people admitted. The governor of California came out yesterday to say that the rate of positive tests continues to fall, and that they would continue to stay ahead of new problem areas. See the full run down in the full report today where we show the usual case and fatality tables including the four current in-focus US states. Elsewhere, India continues to see case growth at just under 4% per day, even as the country gets ready to reopen. India and South America remain the big risks outside the US while China reported 40 new cases on Monday and locked down more residential compounds around the area close to a market where a case had been found.

Back to markets yesterday and sovereign bond yields tracked equity prices yesterday, recovering from overnight lows throughout both the European and US sessions. By the close, yields on 10yr US Treasuries had risen +1.8bps and bunds finished down -0.7bps.There was a slight narrowing in peripheral spreads in Europe, with yields on 10yr Spanish (-2.6bps), Portuguese (-1.8bps) and Greek (-5.7bps) debt all falling over bunds. BTPs were the exception though, with 10yr yields up +1.8bps.

Onto Brexit, and there were a few headlines following the high-level meeting that took place yesterday between UK Prime Minister Johnson and the Presidents of the European Commission, Council and Parliament. Most notably, Prime Minister Johnson said afterwards to Sky News that “What we all really said today is the faster we can do this the better, we see no reason why you shouldn’t get that done in July”, and that “I don’t want to see it going on until the autumn, winter, as perhaps in Brussels they would like.” So a clear aim to conclude matters in the next few weeks, during which intensified negotiations are due to take place, with talks each week between the two sides from the week commencing 29 June to the week commencing 27 July. The press are generally reporting the fact that Mr Johnson was upbeat and keen to accelerate talks as a positive even if lots of areas of disagreements need to be sorted.

In terms of yesterday’s data, the Empire State manufacturing survey from the US beat expectations, with a -0.2 reading in June for the general business conditions indicator (vs. -29.6 expected). Although much better than expected, it’s worth bearing in mind (as with the PMIs) that this is a diffusion index, so a negative reading still means that slightly more respondents said that conditions had worsened in June compared with the previous month, rather than improved. So we shouldn’t get too carried away by the outperformance relative to expectations. It was a similar story for the new orders component, which rose to -0.6 from -42.4 the previous month.

To the day ahead now, and there are a number of data highlights from the US, including May’s retail sales, industrial production and capacity utilisation. Meanwhile there’s also June’s NAHB housing market index, along with UK unemployment data for April and the ZEW survey for June from Germany. Elsewhere, Fed Chair Powell will be speaking before the Senate Banking Committee, while we’ll also hear from Fed Vice Chair Clarida, the ECB’s Visco and Bank of Canada Governor Macklem.

International

Four Years Ago This Week, Freedom Was Torched

Four Years Ago This Week, Freedom Was Torched

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare…

Authored by Jeffrey Tucker via The Brownstone Institute,

"Beware the Ides of March,” Shakespeare quotes the soothsayer’s warning Julius Caesar about what turned out to be an impending assassination on March 15. The death of American liberty happened around the same time four years ago, when the orders went out from all levels of government to close all indoor and outdoor venues where people gather.

It was not quite a law and it was never voted on by anyone. Seemingly out of nowhere, people who the public had largely ignored, the public health bureaucrats, all united to tell the executives in charge – mayors, governors, and the president – that the only way to deal with a respiratory virus was to scrap freedom and the Bill of Rights.

And they did, not only in the US but all over the world.

The forced closures in the US began on March 6 when the mayor of Austin, Texas, announced the shutdown of the technology and arts festival South by Southwest. Hundreds of thousands of contracts, of attendees and vendors, were instantly scrapped. The mayor said he was acting on the advice of his health experts and they in turn pointed to the CDC, which in turn pointed to the World Health Organization, which in turn pointed to member states and so on.

There was no record of Covid in Austin, Texas, that day but they were sure they were doing their part to stop the spread. It was the first deployment of the “Zero Covid” strategy that became, for a time, official US policy, just as in China.

It was never clear precisely who to blame or who would take responsibility, legal or otherwise.

This Friday evening press conference in Austin was just the beginning. By the next Thursday evening, the lockdown mania reached a full crescendo. Donald Trump went on nationwide television to announce that everything was under control but that he was stopping all travel in and out of US borders, from Europe, the UK, Australia, and New Zealand. American citizens would need to return by Monday or be stuck.

Americans abroad panicked while spending on tickets home and crowded into international airports with waits up to 8 hours standing shoulder to shoulder. It was the first clear sign: there would be no consistency in the deployment of these edicts.

There is no historical record of any American president ever issuing global travel restrictions like this without a declaration of war. Until then, and since the age of travel began, every American had taken it for granted that he could buy a ticket and board a plane. That was no longer possible. Very quickly it became even difficult to travel state to state, as most states eventually implemented a two-week quarantine rule.

The next day, Friday March 13, Broadway closed and New York City began to empty out as any residents who could went to summer homes or out of state.

On that day, the Trump administration declared the national emergency by invoking the Stafford Act which triggers new powers and resources to the Federal Emergency Management Administration.

In addition, the Department of Health and Human Services issued a classified document, only to be released to the public months later. The document initiated the lockdowns. It still does not exist on any government website.

The White House Coronavirus Response Task Force, led by the Vice President, will coordinate a whole-of-government approach, including governors, state and local officials, and members of Congress, to develop the best options for the safety, well-being, and health of the American people. HHS is the LFA [Lead Federal Agency] for coordinating the federal response to COVID-19.

Closures were guaranteed:

Recommend significantly limiting public gatherings and cancellation of almost all sporting events, performances, and public and private meetings that cannot be convened by phone. Consider school closures. Issue widespread ‘stay at home’ directives for public and private organizations, with nearly 100% telework for some, although critical public services and infrastructure may need to retain skeleton crews. Law enforcement could shift to focus more on crime prevention, as routine monitoring of storefronts could be important.

In this vision of turnkey totalitarian control of society, the vaccine was pre-approved: “Partner with pharmaceutical industry to produce anti-virals and vaccine.”

The National Security Council was put in charge of policy making. The CDC was just the marketing operation. That’s why it felt like martial law. Without using those words, that’s what was being declared. It even urged information management, with censorship strongly implied.

The timing here is fascinating. This document came out on a Friday. But according to every autobiographical account – from Mike Pence and Scott Gottlieb to Deborah Birx and Jared Kushner – the gathered team did not meet with Trump himself until the weekend of the 14th and 15th, Saturday and Sunday.

According to their account, this was his first real encounter with the urge that he lock down the whole country. He reluctantly agreed to 15 days to flatten the curve. He announced this on Monday the 16th with the famous line: “All public and private venues where people gather should be closed.”

This makes no sense. The decision had already been made and all enabling documents were already in circulation.

There are only two possibilities.

One: the Department of Homeland Security issued this March 13 HHS document without Trump’s knowledge or authority. That seems unlikely.

Two: Kushner, Birx, Pence, and Gottlieb are lying. They decided on a story and they are sticking to it.

Trump himself has never explained the timeline or precisely when he decided to greenlight the lockdowns. To this day, he avoids the issue beyond his constant claim that he doesn’t get enough credit for his handling of the pandemic.

With Nixon, the famous question was always what did he know and when did he know it? When it comes to Trump and insofar as concerns Covid lockdowns – unlike the fake allegations of collusion with Russia – we have no investigations. To this day, no one in the corporate media seems even slightly interested in why, how, or when human rights got abolished by bureaucratic edict.

As part of the lockdowns, the Cybersecurity and Infrastructure Security Agency, which was and is part of the Department of Homeland Security, as set up in 2018, broke the entire American labor force into essential and nonessential.

They also set up and enforced censorship protocols, which is why it seemed like so few objected. In addition, CISA was tasked with overseeing mail-in ballots.

Only 8 days into the 15, Trump announced that he wanted to open the country by Easter, which was on April 12. His announcement on March 24 was treated as outrageous and irresponsible by the national press but keep in mind: Easter would already take us beyond the initial two-week lockdown. What seemed to be an opening was an extension of closing.

This announcement by Trump encouraged Birx and Fauci to ask for an additional 30 days of lockdown, which Trump granted. Even on April 23, Trump told Georgia and Florida, which had made noises about reopening, that “It’s too soon.” He publicly fought with the governor of Georgia, who was first to open his state.

Before the 15 days was over, Congress passed and the president signed the 880-page CARES Act, which authorized the distribution of $2 trillion to states, businesses, and individuals, thus guaranteeing that lockdowns would continue for the duration.

There was never a stated exit plan beyond Birx’s public statements that she wanted zero cases of Covid in the country. That was never going to happen. It is very likely that the virus had already been circulating in the US and Canada from October 2019. A famous seroprevalence study by Jay Bhattacharya came out in May 2020 discerning that infections and immunity were already widespread in the California county they examined.

What that implied was two crucial points: there was zero hope for the Zero Covid mission and this pandemic would end as they all did, through endemicity via exposure, not from a vaccine as such. That was certainly not the message that was being broadcast from Washington. The growing sense at the time was that we all had to sit tight and just wait for the inoculation on which pharmaceutical companies were working.

By summer 2020, you recall what happened. A restless generation of kids fed up with this stay-at-home nonsense seized on the opportunity to protest racial injustice in the killing of George Floyd. Public health officials approved of these gatherings – unlike protests against lockdowns – on grounds that racism was a virus even more serious than Covid. Some of these protests got out of hand and became violent and destructive.

Meanwhile, substance abuse rage – the liquor and weed stores never closed – and immune systems were being degraded by lack of normal exposure, exactly as the Bakersfield doctors had predicted. Millions of small businesses had closed. The learning losses from school closures were mounting, as it turned out that Zoom school was near worthless.

It was about this time that Trump seemed to figure out – thanks to the wise council of Dr. Scott Atlas – that he had been played and started urging states to reopen. But it was strange: he seemed to be less in the position of being a president in charge and more of a public pundit, Tweeting out his wishes until his account was banned. He was unable to put the worms back in the can that he had approved opening.

By that time, and by all accounts, Trump was convinced that the whole effort was a mistake, that he had been trolled into wrecking the country he promised to make great. It was too late. Mail-in ballots had been widely approved, the country was in shambles, the media and public health bureaucrats were ruling the airwaves, and his final months of the campaign failed even to come to grips with the reality on the ground.

At the time, many people had predicted that once Biden took office and the vaccine was released, Covid would be declared to have been beaten. But that didn’t happen and mainly for one reason: resistance to the vaccine was more intense than anyone had predicted. The Biden administration attempted to impose mandates on the entire US workforce. Thanks to a Supreme Court ruling, that effort was thwarted but not before HR departments around the country had already implemented them.

As the months rolled on – and four major cities closed all public accommodations to the unvaccinated, who were being demonized for prolonging the pandemic – it became clear that the vaccine could not and would not stop infection or transmission, which means that this shot could not be classified as a public health benefit. Even as a private benefit, the evidence was mixed. Any protection it provided was short-lived and reports of vaccine injury began to mount. Even now, we cannot gain full clarity on the scale of the problem because essential data and documentation remains classified.

After four years, we find ourselves in a strange position. We still do not know precisely what unfolded in mid-March 2020: who made what decisions, when, and why. There has been no serious attempt at any high level to provide a clear accounting much less assign blame.

Not even Tucker Carlson, who reportedly played a crucial role in getting Trump to panic over the virus, will tell us the source of his own information or what his source told him. There have been a series of valuable hearings in the House and Senate but they have received little to no press attention, and none have focus on the lockdown orders themselves.

The prevailing attitude in public life is just to forget the whole thing. And yet we live now in a country very different from the one we inhabited five years ago. Our media is captured. Social media is widely censored in violation of the First Amendment, a problem being taken up by the Supreme Court this month with no certainty of the outcome. The administrative state that seized control has not given up power. Crime has been normalized. Art and music institutions are on the rocks. Public trust in all official institutions is at rock bottom. We don’t even know if we can trust the elections anymore.

In the early days of lockdown, Henry Kissinger warned that if the mitigation plan does not go well, the world will find itself set “on fire.” He died in 2023. Meanwhile, the world is indeed on fire. The essential struggle in every country on earth today concerns the battle between the authority and power of permanent administration apparatus of the state – the very one that took total control in lockdowns – and the enlightenment ideal of a government that is responsible to the will of the people and the moral demand for freedom and rights.

How this struggle turns out is the essential story of our times.

CODA: I’m embedding a copy of PanCAP Adapted, as annotated by Debbie Lerman. You might need to download the whole thing to see the annotations. If you can help with research, please do.

* * *

Jeffrey Tucker is the author of the excellent new book 'Life After Lock-Down'

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

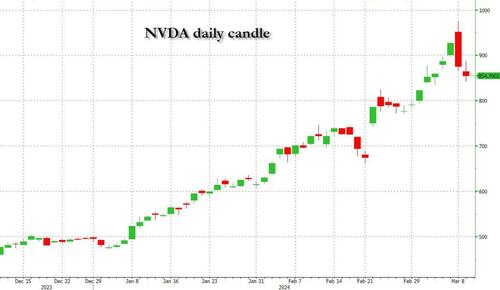

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Government

Trump “Clearly Hasn’t Learned From His COVID-Era Mistakes”, RFK Jr. Says

Trump "Clearly Hasn’t Learned From His COVID-Era Mistakes", RFK Jr. Says

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President…

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President Joe Biden claimed that COVID vaccines are now helping cancer patients during his State of the Union address on March 7, but it was a response on Truth Social from former President Donald Trump that drew the ire of independent presidential candidate Robert F. Kennedy Jr.

During the address, President Biden said: “The pandemic no longer controls our lives. The vaccines that saved us from COVID are now being used to help beat cancer, turning setback into comeback. That’s what America does.”

President Trump wrote: “The Pandemic no longer controls our lives. The VACCINES that saved us from COVID are now being used to help beat cancer—turning setback into comeback. YOU’RE WELCOME JOE. NINE-MONTH APPROVAL TIME VS. 12 YEARS THAT IT WOULD HAVE TAKEN YOU.”

An outspoken critic of President Trump’s COVID response, and the Operation Warp Speed program that escalated the availability of COVID vaccines, Mr. Kennedy said on X, formerly known as Twitter, that “Donald Trump clearly hasn’t learned from his COVID-era mistakes.”

“He fails to recognize how ineffective his warp speed vaccine is as the ninth shot is being recommended to seniors. Even more troubling is the documented harm being caused by the shot to so many innocent children and adults who are suffering myocarditis, pericarditis, and brain inflammation,” Mr. Kennedy remarked.

“This has been confirmed by a CDC-funded study of 99 million people. Instead of bragging about its speedy approval, we should be honestly and transparently debating the abundant evidence that this vaccine may have caused more harm than good.

“I look forward to debating both Trump and Biden on Sept. 16 in San Marcos, Texas.”

Mr. Kennedy announced in April 2023 that he would challenge President Biden for the 2024 Democratic Party presidential nomination before declaring his run as an independent last October, claiming that the Democrat National Committee was “rigging the primary.”

Since the early stages of his campaign, Mr. Kennedy has generated more support than pundits expected from conservatives, moderates, and independents resulting in speculation that he could take votes away from President Trump.

Many Republicans continue to seek a reckoning over the government-imposed pandemic lockdowns and vaccine mandates.

President Trump’s defense of Operation Warp Speed, the program he rolled out in May 2020 to spur the development and distribution of COVID-19 vaccines amid the pandemic, remains a sticking point for some of his supporters.

Operation Warp Speed featured a partnership between the government, the military, and the private sector, with the government paying for millions of vaccine doses to be produced.

President Trump released a statement in March 2021 saying: “I hope everyone remembers when they’re getting the COVID-19 Vaccine, that if I wasn’t President, you wouldn’t be getting that beautiful ‘shot’ for 5 years, at best, and probably wouldn’t be getting it at all. I hope everyone remembers!”

President Trump said about the COVID-19 vaccine in an interview on Fox News in March 2021: “It works incredibly well. Ninety-five percent, maybe even more than that. I would recommend it, and I would recommend it to a lot of people that don’t want to get it and a lot of those people voted for me, frankly.

“But again, we have our freedoms and we have to live by that and I agree with that also. But it’s a great vaccine, it’s a safe vaccine, and it’s something that works.”

On many occasions, President Trump has said that he is not in favor of vaccine mandates.

An environmental attorney, Mr. Kennedy founded Children’s Health Defense, a nonprofit that aims to end childhood health epidemics by promoting vaccine safeguards, among other initiatives.

Last year, Mr. Kennedy told podcaster Joe Rogan that ivermectin was suppressed by the FDA so that the COVID-19 vaccines could be granted emergency use authorization.

He has criticized Big Pharma, vaccine safety, and government mandates for years.

Since launching his presidential campaign, Mr. Kennedy has made his stances on the COVID-19 vaccines, and vaccines in general, a frequent talking point.

“I would argue that the science is very clear right now that they [vaccines] caused a lot more problems than they averted,” Mr. Kennedy said on Piers Morgan Uncensored last April.

“And if you look at the countries that did not vaccinate, they had the lowest death rates, they had the lowest COVID and infection rates.”

Additional data show a “direct correlation” between excess deaths and high vaccination rates in developed countries, he said.

President Trump and Mr. Kennedy have similar views on topics like protecting the U.S.-Mexico border and ending the Russia-Ukraine war.

COVID-19 is the topic where Mr. Kennedy and President Trump seem to differ the most.

Former President Donald Trump intended to “drain the swamp” when he took office in 2017, but he was “intimidated by bureaucrats” at federal agencies and did not accomplish that objective, Mr. Kennedy said on Feb. 5.

Speaking at a voter rally in Tucson, where he collected signatures to get on the Arizona ballot, the independent presidential candidate said President Trump was “earnest” when he vowed to “drain the swamp,” but it was “business as usual” during his term.

John Bolton, who President Trump appointed as a national security adviser, is “the template for a swamp creature,” Mr. Kennedy said.

Scott Gottlieb, who President Trump named to run the FDA, “was Pfizer’s business partner” and eventually returned to Pfizer, Mr. Kennedy said.

Mr. Kennedy said that President Trump had more lobbyists running federal agencies than any president in U.S. history.

“You can’t reform them when you’ve got the swamp creatures running them, and I’m not going to do that. I’m going to do something different,” Mr. Kennedy said.

During the COVID-19 pandemic, President Trump “did not ask the questions that he should have,” he believes.

President Trump “knew that lockdowns were wrong” and then “agreed to lockdowns,” Mr. Kennedy said.

He also “knew that hydroxychloroquine worked, he said it,” Mr. Kennedy explained, adding that he was eventually “rolled over” by Dr. Anthony Fauci and his advisers.

MaryJo Perry, a longtime advocate for vaccine choice and a Trump supporter, thinks votes will be at a premium come Election Day, particularly because the independent and third-party field is becoming more competitive.

Ms. Perry, president of Mississippi Parents for Vaccine Rights, believes advocates for medical freedom could determine who is ultimately president.

She believes that Mr. Kennedy is “pulling votes from Trump” because of the former president’s stance on the vaccines.

“People care about medical freedom. It’s an important issue here in Mississippi, and across the country,” Ms. Perry told The Epoch Times.

“Trump should admit he was wrong about Operation Warp Speed and that COVID vaccines have been dangerous. That would make a difference among people he has offended.”

President Trump won’t lose enough votes to Mr. Kennedy about Operation Warp Speed and COVID vaccines to have a significant impact on the election, Ohio Republican strategist Wes Farno told The Epoch Times.

President Trump won in Ohio by eight percentage points in both 2016 and 2020. The Ohio Republican Party endorsed President Trump for the nomination in 2024.

“The positives of a Trump presidency far outweigh the negatives,” Mr. Farno said. “People are more concerned about their wallet and the economy.

“They are asking themselves if they were better off during President Trump’s term compared to since President Biden took office. The answer to that question is obvious because many Americans are struggling to afford groceries, gas, mortgages, and rent payments.

“America needs President Trump.”

Multiple national polls back Mr. Farno’s view.

As of March 6, the RealClearPolitics average of polls indicates that President Trump has 41.8 percent support in a five-way race that includes President Biden (38.4 percent), Mr. Kennedy (12.7 percent), independent Cornel West (2.6 percent), and Green Party nominee Jill Stein (1.7 percent).

A Pew Research Center study conducted among 10,133 U.S. adults from Feb. 7 to Feb. 11 showed that Democrats and Democrat-leaning independents (42 percent) are more likely than Republicans and GOP-leaning independents (15 percent) to say they have received an updated COVID vaccine.

The poll also reported that just 28 percent of adults say they have received the updated COVID inoculation.

The peer-reviewed multinational study of more than 99 million vaccinated people that Mr. Kennedy referenced in his X post on March 7 was published in the Vaccine journal on Feb. 12.

It aimed to evaluate the risk of 13 adverse events of special interest (AESI) following COVID-19 vaccination. The AESIs spanned three categories—neurological, hematologic (blood), and cardiovascular.

The study reviewed data collected from more than 99 million vaccinated people from eight nations—Argentina, Australia, Canada, Denmark, Finland, France, New Zealand, and Scotland—looking at risks up to 42 days after getting the shots.

Three vaccines—Pfizer and Moderna’s mRNA vaccines as well as AstraZeneca’s viral vector jab—were examined in the study.

Researchers found higher-than-expected cases that they deemed met the threshold to be potential safety signals for multiple AESIs, including for Guillain-Barre syndrome (GBS), cerebral venous sinus thrombosis (CVST), myocarditis, and pericarditis.

A safety signal refers to information that could suggest a potential risk or harm that may be associated with a medical product.

The study identified higher incidences of neurological, cardiovascular, and blood disorder complications than what the researchers expected.

President Trump’s role in Operation Warp Speed, and his continued praise of the COVID vaccine, remains a concern for some voters, including those who still support him.

Krista Cobb is a 40-year-old mother in western Ohio. She voted for President Trump in 2020 and said she would cast her vote for him this November, but she was stunned when she saw his response to President Biden about the COVID-19 vaccine during the State of the Union address.

“I love President Trump and support his policies, but at this point, he has to know they [advisers and health officials] lied about the shot,” Ms. Cobb told The Epoch Times.

“If he continues to promote it, especially after all of the hearings they’ve had about it in Congress, the side effects, and cover-ups on Capitol Hill, at what point does he become the same as the people who have lied?” Ms. Cobb added.

“I think he should distance himself from talk about Operation Warp Speed and even admit that he was wrong—that the vaccines have not had the impact he was told they would have. If he did that, people would respect him even more.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 days ago

International4 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges