Futures Slip As Traders Read Between Powell’s Lines

Futures Slip As Traders Read Between Powell’s Lines

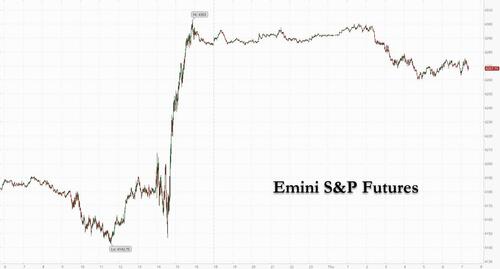

After yesterday’s torrid, Powell-inspired meltup which saw the S&P soar the most since…

After yesterday's torrid, Powell-inspired meltup which saw the S&P soar the most since May 2020 (just days after its biggest drop since June 2020)...

In the past week, S&P 500 has had both its best day since May 2020 and its worst day since June 2020

— Liz Ann Sonders (@LizAnnSonders) May 5, 2022

[Past performance is no guarantee of future results] pic.twitter.com/BA9p6MDzWZ

... U.S. futures paused their surge after Jerome Powell eased fears that the Federal Reserve will unleash an even more aggressive tightening path and took a 75bps rate hike off the table. As of 745am EDT, S&P 500 futures dropped 0.6%, while Nasdaq 100 contracts fell 0.8%, as investors digested Powell’s vow to curb inflation, while acknowledging it could inflict some “pain” to the economy. In fact, an example of just what the Fed is fearing came earlier today when the BOE hiked 25bps as expected, but warned a stagflationary recession is be imminent as the central bank now expects GDP to contract while inflation rises double digits in the coming months, which is precisely what happens when central banks are far behind the curve.

In other assets, the dollar jumped to session highs as cable tumbled to July 2020 lows, 10Y yields were flat around 2.95 while bitcoin traded off yesterday's highs between 39K and 40K.

“Alongside tightening monetary policy, a number of risks - persistently high inflation, indications that consumer demand is softening, and the economic consequences of the Russian invasion of Ukraine - have raised investors’ concerns about the strength of future economic growth,” said Richard Flynn, U.K. managing director at Charles Schwab. “In this context, market volatility is likely to continue.”

For those who missed yesterday's white knuckle session, the US central bank raised the benchmark rate by a half percentage point on Wednesday, the steepest increment since 2000, in order to keep inflation under control. By ruling out a more aggressive hike, the central bank gave a boost to equity markets, with the S&P 500 posting its biggest daily advance since 2020. The Nasdaq 100 closed 3.4% higher, but is still down 17% this year.

“We are puzzled why the market thinks that Fed hikes are going to stop inflation,” said Nancy Davis, founder of Quadratic Capital Management. “We see inflation as driven by massive government spending, supply chain disruptions and, more recently, by Russia’s invasion of Ukraine.”

Sure, the Fed is powerless to do anything against inflation, but it has to do something. Policy makers are trying to juggle the need to quell the fastest inflation in four decades against hard-won economic growth. In Europe, German factory orders plummeted, highlighting the toll from the war. The soaring price of commodities further complicates efforts to subdue price pressures.

“The combination of high inflation and a weakening global economic outlook has fueled concerns about how far central banks will be able to raise interest rates without overburdening the economy,” Fraser Lundie, head of public fixed income markets at Federated Hermes, wrote in a note to clients.

In premarket trading, EBay plunged 6.9% as analysts said macro headwinds, including the war in Ukraine, inflation and consumer confidence, will pressure results in the near term. The e-commerce firm gave a lackluster sales and profit outlook for the second quarter, as a pandemic-driven sales bump fades. U.S.-listed Chinese stocks dropped again as investors mulled an expanding list of firms that face potential security delistings and the Federal Reserve’s rate decision. JD.com (JD US) shares trade down 2.8%, Pinduoduo (PDD US) -3.5% and Bilibili (BILI US) -5% in premarket. Some other notable premarket movers:

- Albemarle (ALB US) shares jump 14% in premarket trading after the company boosted its profit and sales guidance for the full year, citing continued strength in pricing in the Lithium and Bromine businesses. .

- Hycroft Mining (HYMC US) shares surge as much as 36% in U.S. premarket trading after the precious metals producer gave an update for the first quarter, with the firm saying that its strengthened balance sheet allows it to cut debt, complete technical studies and launch an exploration program.

- Qorvo (QRVO US) analysts said that guidance from the radio frequency solutions fell short of expectations amid weakness in China and high inventory, prompting price target cuts among brokers. Qorvo shares fell 4.9% in postmarket trading on Wednesday after forecasting adjusted earnings per share for the first quarter that missed the average analyst estimate.

- Booking Holdings (BKNG US) impressed analysts with April bookings topping 2019 levels and positive comments on summer travel. The shares rose 7.7% in postmarket trading after the company’s first-quarter revenue and gross bookings both beat the average analyst estimate.

- Twilio (TWLO US) analysts highlighted the gross margin performance and reiteration of guidance as encouraging points in the communication-software provider’s results, though some were left wanting more from the firm’s revenue beat. The shares rose 3.8% in after-hours trading Wednesday after adjusted earnings per share for the first quarter beat the average analyst estimate.

- Fortinet (FTNT US) analysts lauded the infrastructure software company’s solid quarter in light of continued supply chain pressures. The company’s shares rose 7% in extended trading on Wednesday after it reported first-quarter results and raised its full-year forecast.

- Etsy (ETSY US) analysts were overall positive on the e-commerce firm’s results, though noted that challenges relating to the macroeonomic backdrop and the reopening of economies weighed on the company’s outlook. Etsy shares fell 10% in postmarket trading Wednesday after its forecast for second-quarter revenue fell short of the average analyst estimate.

In Europe, the Stoxx 600 was up 1% after rising as much as 1.8%. FTSE 100 up 1.1%, and DAX +1.4%, with most indexes well off session highs. Tech, real estate and industrials were the strongest performing sectors, autos and insurance underperform as gains are faded. Positive results from large caps including Airbus SE, Shell Plc, UniCredit SpA and ArcelorMittal SA also helped brighten the mood. Some notable European movers:

- Airbus jumps as much as 8.5% on a “solid” 1Q, with adjusted Ebit “significantly” above consensus, Bernstein says, with Jefferies noting key highlight is plan to ramp up A320 production.

- Shell shares rise as much as 3.6% after company reports record profit for the quarter. Jefferies said the results signaled “strong” second-half buyback acceleration.

- UniCredit jumps as much as 7.6%, the most intraday since March 29, after reporting revenue for the first quarter that beat estimates. Analysts note “solid” earnings ex-Russia.

- S4 Capital shares soared as much as 20% on Thursday after Martin Sorrell’s media company said it will publish its results for last year tomorrow, following a lengthy delay.

- Outokumpu shares rise as much as 9.3% after the Finnish steel maker presented its latest earnings, which included several beats to consensus estimates, including on adjusted Ebitda.

- Argenx shares rise as much as 6.7% after the Belgian immunology firm posted its latest earnings, which included a large beat on sales for its key drug Vyvgart (efgartigimod).

- Netcompany shares rise as much as 6.1%, the most intraday in a month, after the software developer reported 1Q earnings that are broadly in line with estimates.

- Verbund dropped the most in two months after the Austrian Chancellor said he’s asked the finance and economy ministries to develop new rules to administer windfall profits at state-controlled companies.

- Virgin Money shares slide as much as 6.7% after the lender reported first-half results. Goodbody linked the share price drop to several factors, including the bank not announcing a buyback.

- Hikma Pharmaceuticals fell as much as 11%, the most since April 2020, after the company reduced guidance for its generics division. Peel Hunt calls update “obviously disappointing.”

Earlier in the session, Asia’s stock benchmark rose, poised to snap a three-day decline, as the Federal Reserve’s policy announcement calmed fears about super-sized hikes. The MSCI Asia Pacific Index climbed as much as 1.2% before paring gains to around 0.4%. Tech and materials were the biggest boosts to the Asia gauge as most sectors rose, with TSMC and Infosys hauling up the measure. Bucking the trend, China’s stock gauge closed lower after a three-day holiday in a sign that Beijing’s vow to boost growth has failed to alleviate concerns over the outlook. The Fed delivered a 50-basis-point increase that was in line with expectations on Wednesday, and said a bigger hike was not being actively considered. Benchmarks in the Philippines and Vietnam were among the top gainers in the region. Japan and South Korea markets were closed for holidays. Tech stocks will likely “see a further rally until the next U.S. consumer price inflation reading next week,” said Jessica Amir, a market strategist at Saxo Capital Markets Australia. “The rate hikes weren’t as much as feared,” bond yields have pared and volatility is subsiding, she added. The rally marked a reprieve for Asia’s beaten-down shares, which remain mired in a bear market. The regional benchmark is underperforming U.S. and European peers this year, hurt by the impact of China’s strict Covid-19 restrictions and rising inflation around the region.

In FX, the Bloomberg Dollar Spot Index jumped as cable tumbled on the BOE's recession warning, clawing back some of its post-FOMC losses when Powell ruled out a more aggressive pace of monetary tightening. The greenback traded higher against all of its Group-of-10 peers and the Treasury yield curve bear-flattened, trimming some of Wednesday’s aggressive bull steepening which followed the FOMC outcome. The euro fell back below $1.06 and yields on short-dated European bonds fell as ECB hike bets were pared. German factory orders plummeted, highlighting the toll from the war. The pound plunged after the Bank of England warned of a stagflationary recession even as it hiked another 25bps. Norway’s krone held a loss after the central bank kept its key policy unchanged, as widely expected among analysts, and confirmed its plan to deliver a fourth increase in borrowing costs next month. Australia’s dollar pared yesterday’s gains; weaker-than- expected Chinese economic data raised concerns over demand for the nation’s commodity exports and weighed on the Australia’s sovereign bond yields.

China’s yuan dropped as weak economic data hit sentiment. The USD/CNH rose 0.4% to 6.6489; USD/CNY gains 0.2% to 6.6194 after China’s services activity slumped to its weakest level in more than two years in April as Covid outbreaks and lockdowns continued to pummel consumer spending and threaten economic growth. The Caixin China Services purchasing managers’ index crashed to 36.2 in April, the lowest since February 2020, as Covid outbreaks and lockdowns continued to pummel consumer spending, threatening economic growth.

In rates, the Treasury front-end briefly extends losses, following move in gilts after Bank of England hiked 25bp with three voters looking for a bigger 50bp move. U.S. 10-year yields traded around 2.95%, little changed after retreating from day’s high; gilts outperform. Yields cheapened as much as 6bp across front-end of the curve before retreating; U.K. 2-year yields erased the 3bp increase that followed the Bank of England policy announcement; front-end led losses flatten 2s10s, 5s30s spreads by ~2bp and ~4bp on the day. Bear-flattening move has 5s30s spread near session lows into early U.S. session, unwinding portion of Wednesday’s post-Fed bull-steepening. Fed speakers resume Friday with six events slated.

In the aftermath of Wednesday’s policy announcement, overnight swaps are now pricing in close to 50bp rate hikes at the next three policy meetings. Dollar issuance slate empty so far; session has potential to be busy given a number of expected issuers have so far stood down this week. Three-month dollar Libor dropped -3.54bp at 1.37071%, its first decline since April 5.

Looking at today's calendar, we get the BoE policy decision (a hike of 25bps as noted earlier, but accompanied by a very dovish warning of recession in late 2022) and UK local elections. Otherwise from central banks, we’ll hear from the ECB’s Lane, Holzmann and Centeno. Data releases include the weekly initial jobless claims from the US and nonfarm productivity. Finally, earnings releases today include Shell.

Market Snapshot

- S&P 500 futures down 0.7% to 4,267.00

- MXAP up 0.4% to 167.94

- MXAPJ up 0.4% to 556.06

- Nikkei down 0.1% to 26,818.53

- Topix little changed at 1,898.35

- Hang Seng Index down 0.4% to 20,793.40

- Shanghai Composite up 0.7% to 3,067.76

- Sensex up 0.3% to 55,834.32

- Australia S&P/ASX 200 up 0.8% to 7,364.65

- Kospi down 0.1% to 2,677.57

- STOXX Europe 600 up 1.2% to 446.50

- Brent Futures up 0.4% to $110.56/bbl

- Gold spot up 0.5% to $1,890.84

- U.S. Dollar Index up 0.34% to 102.94

- German 10Y yield little changed at 1.01%

- Euro down 0.3% to $1.0587

Top Overnight NEws from Bloomberg

- ECB Executive Board member Fabio Panetta said economic expansion has almost ground to a halt in the euro area and faces further “high costs” as policy makers battle record inflation

- On the eve of the 25th anniversary of its independence, the U.K. central bank is widely expected to hike interest rates to 1% -- the highest since the financial crisis -- and lay out how it intends to take uncharted steps toward unwinding more than a decade of bond purchases

- U.K. Prime Minister Boris Johnson will meet his Japanese counterpart Fumio Kishida in London where they are expected to discuss a plan to support Asian nations in diversifying away from Russian oil and gas

- Boris Johnson has been engulfed by scandal for months and came close to being ousted by members of his Conservative Party. On Thursday, voters across the U.K. are likely to give him their own kicking. Local election results typically deliver losses for ruling parties, especially if they’ve been in power for 12 years as the Tories have

- The Reserve Bank of New Zealand’s Monetary Policy Committee will return to a full complement of seven for the first time this year when it meets later this month. Assistant Governor Karen Silk joins the RBNZ on May 16 and will be an internal member of the committee from that date

- The dollar fell Wednesday by the most in nearly a month on a trade-weighted basis following the latest Federal Reserve policy decision yet pairs some of those losses as the move was more down to short-term positioning

A more detailed breakdown of global markets courtesy of Newsquawk

Asia-Pac stocks traded positively as the region reacted to the FOMC meeting where the Fed hiked rates by 50bps as expected and announced to begin reducing the balance sheet from next month, while Fed Chair Powell dispelled concerns of a more aggressive 75bps rate hike. ASX 200 was firmer with gold miners buoyed by higher prices and as the energy sector benefitted from the proposed Russian oil embargo. Hang Seng and Shanghai Comp were higher following the mainland’s return from the Labour Day holidays but with advances initially contained by several headwinds including an extension of COVID restrictions in Beijing, the deterioration in Caixin Services and Composite PMIs, while the US SEC added over 80 companies to its list for possible delisting and HKMA also hiked its base rate by 50bps in lockstep with the Fed.

Top Asian News

- Concerns Mount Over Asset Sales; Stocks Fall: Evergrande Update

- S&P 500 Remains Expensive Despite Yield-Driven Drop: Macro View

- North Korea Lifts Sweeping Lockdown After One Day, Yonhap Says

- India’s Surprise Rate Hike Spurs Aggressive Tightening Bets

European bourses are firmer across the board, Euro Stoxx 50 +1.3%, benefitting from the perceived less-hawkish Fed and associated Wall St./APAC performance. Stateside, futures are softer across the board though the likes of the ES remain in relative proximity to overnight best levels, ES -0.5%. Back to Europe, sectors are mostly positive with Real Estate and Tech the outperformers while defensive-biased names are lagging.

Top European News

- UniCredit Takes $2 Billion Hit on Russia to Cover Potential Exit

- U.K. April Composite PMI 58.2 vs Flash Reading 57.6

- BMW Profit Beats Estimates on Strong Demand for Top-End Cars

- Norway Rate Hike Locked and Loaded for June to Quell Inflation

FX:

- Dollar finds its feet after FOMC fall out on less hawkish than factored in policy guidance from Fed chair Powell, DXY back within reach of 103.000 vs 102.340 low.

- Aussie* undermined by much weaker than forecast building approvals, mixed trade, technical and psychological resistance; AUD/USD closer to 0.7200 than 0.7250 and AUD/NZD fades just shy of 1.1100.

- Sterling weak on super BoE Thursday on prospects that MPC may be more circumspect after latest 25 bp hike; Cable down around 1.2550 vs 1.2635 peak and EUR/GBP firm on 0.8400 handle.

- Euro underpinned by rebound in EGB yields and option expiries as 1.8 bn rolls off 1.0600.

- Loonie cushioned by crude alongside Norwegian Crown after no change in rates by Norges Bank that is sticking to schedule for next quarter point hike in June; USD/CAD mostly sub-1.2750 and EUR/NOK capped below 9.9000.

- Turkish Lira deflated as CPI soars even further beyond target and PPI over 100%.

- Polish Zloty awaits 100 bp hike from NBP and Czech Koruna 50 bp courtesy of CNB.

- Brazil's Central Bank raised the Selic rate by 100bps to 12.75%, as expected, while it left the door open to further monetary tightening at a slower pace and considered it appropriate to advance the process of monetary tightening significantly into even more restrictive territory. BCB also stated that inflationary pressures arising from the pandemic period have intensified due to problems related to the new COVID-19 wave in China and the Ukraine war, according to Reuters.

- Norges Bank: Key Policy Rate 0.75% (exp. 0.75%, prev. 0.75%). Reiterates that the next hike will “most likely” occur in June. Adds, the Krone has recently depreciated and is now weaker than projected.

Fixed Income

- Very volatile moves in bonds between the FOMC, BoE and NFP, with Treasuries flipping from bull-to-bear steepening.

- 10 year note soft within wide 119-09+/118-19+ range, Bunds flat between 153.79-152.74 parameters and Gilts firm in catch-up trade either side of 118.00.

- Bonos and Oats off best levels after digesting Spanish and French multi-tranche debt issuance

Commodities

- WTI and Brent have been pivoting relatively narrow ranges ahead of today's JMMC/OPEC+ gatherings, currently posting gains of USD 0.30/bbl.

- OPEC+ is expected to maintain its policy of increase the output quota by 432k BPD in June, lifted from the 400k BPD in May as part of the pacts terms; newsquawk preview here.

- Spot gold is bid but lost the USD 1900/oz mark in early-European trade, a figure it has spent the morning modestly below.

- Norway's labour unions said initial wage talks with oil firms broke down and they will proceed with mediation, according to Reuters.

Crypto

- Bitcoin is subdued and returned to existing session lows of USD 39.4k amid coverage of the below WSJ story; more broadly, Bitcoin has been steady at the lower-end of the morning's ranges.

- US Senators Warren and Smith have sent a letter to Fidelity over its Bitcoin 401(k) plan which would allow investors to allocate as much as 20% of their portfolios into Bitcoin, according to WSJ; senators suggest that Bitcoin could be too risky for savers.

US Event Calendar

- 08:30: 1Q Unit Labor Costs, est. 10.0%, prior 0.9%

- 08:30: 1Q Nonfarm Productivity, est. -5.3%, prior 6.6%

- 08:30: April Continuing Claims, est. 1.4m, prior 1.41m

- 08:30: April Initial Jobless Claims, est. 180,000, prior 180,000

DB's Jim Reid concludes the overnight wrap

I'm normally asleep at around 945pm each evening but tense football games often disturb that equilibrium and last night was the ultimate sleep disrupter. I was just about to close down my iPad in bed and fall asleep as Man City we're two goals ahead in injury time in the Champions League semi. I stayed the extra minute and in that minute Real Madrid scored twice, took the game into extra time and ultimately won a stunning tie. I finally turned my iPad off 10 minutes before the end but couldn't sleep so turned it on again after they won. Liverpool vs Real Madrid will be an epic final! So all in all a hectic evening trying to watch the Fed while my wife and I watched Ozark (stressful in its own right) and then the football. I'm worn out this morning.

So after all that, the Fed intentionally or unintentionally decided that the market has had enough stress for now and clamped down on the more hawkish potential near-term paths for policy. As a result equities soared, yields fell (especially at the front-end), credit tightened, the dollar slumped and oil built on its earlier rally.

Let's very briefly get the boring bit out of the way in a line or two. Basically the FOMC rose rates by +50bps and signalled they would begin to reduce the size of their balance sheet in June, both in line with our expectations (Our full US econ review is here).

However the most pressing question for markets was how willing the Committee was to consider future rate increases of +75bps. Market participants didn't have to wait long for an answer, as Chair Powell quickly noted that +75bp hikes were not actively being considered, while +50bp hikes were on the table for the "next couple" of meetings. In line, market pricing for the next two meetings ended the day at +100bps, having stripped out any of the small, but recently growing, premium priced in for +75bps over the June and July meetings. The firm rebuke led to a rally in Treasury yields, led by the short-end, as 2yr yields fell -14.0bps, while 10yr yields were a relatively benign -3.7bps by comparison. The move in nominal 10yrs again masked divergence in the decomposition driven by the market’s dovish interpretation, with breakevens widening +4.9bps to 2.88%, while real yields fell -8.6bps, still managing to finish the day in positive territory at 0.05% though.

Elsewhere in the presser, the Chair made multiple mentions of the Committee’s intention to “expeditiously” get policy towards more neutral levels given the monumental inflation-fighting task at hand. He demurred when asked if policy would ultimately need to reach a restrictive rather than just neutral stance, but did not rule it out. He still maintained hope that the Fed could engineer a soft landing after this hiking cycle, but to be fair, it is hard to imagine him saying anything else. He cited strong household and consumer balance sheets as reasons for why the economy could withstand the hiking cycle, when indeed, that very strength when inflation is at multi-decade highs is why policy will probably need to reach restrictive levels not currently appreciated by market pricing. In my opinion the Fed can control the near-term market expectations but beyond that it is all about the inflation data. If it doesn't improve then 50bps will be live at every meeting and not just the "next couple", and 75bps risks will be back on the table. This is all for another day though.

When all was said and done, the market took -11.7bps out of policy tightening during 2022, with futures implying fed funds hitting 2.77% after the December meeting. Futures are still implying that the Fed will hit its terminal rates sometime in the third quarter next year, but that rate was around -18bps lower following the meeting at 3.24%.

Indeed the breathing space given by the removal of the price hike premiums sent US equities on a tear. Little changed heading into the meeting, the S&P 500 ended the day +2.99% higher, its largest one-day gain since May 2020. Every sector ended in the green, with a full 477 companies posting gains, the most since February. The gains were broad-based, with every sector but real estate (+1.09%) gaining at least 2%, though energy (+4.12%), communications (+3.68%) and tech (+3.51%) were the standouts. In line, the NASDAQ (+3.19%) and FANG+ index (+3.40%) outperformed, on the drop in discount rates.

In Asia, mainland Chinese stocks returned following a few days of holidays and are in positive territory with the Shanghai Composite (+0.95%) and CSI (+0.28%) higher. Meanwhile, the Hang Seng (+0.76%) is trading up, but paring its early morning gains. Elsewhere, the S&P/ASX 200 (+0.67%) is climbing while the Japanese and Korean markets are closed for public holidays. Outside of Asia, contracts on the S&P 500 (-0.08%) and NASDAQ 100 (-0.07%) are fractionally lower. Stoxx 50 futures are +2.4% due to a post Fed catch-up effect.

Early morning data showed that China’s services sector activity contracted further in April as the Caixin services PMI tumbled to 36.2, its lowest level since the initial onset of the pandemic in February 2020 and compared to March’s reading of 42.

Back now to life pre the Fed. Earlier we had seen sovereign bonds sell off in Europe, with yields on 10yr bunds marginally up +0.7bps to 0.97%, having regularly traded above the 1% mark during the session. Those moves were echoed across the continent and there was a further widening in peripheral spreads, with the gap between Italian 10yr yields over bunds widening by +6.7bps to 198bps. That’s their 11th consecutive move wider, and takes the spread to its highest closing level in almost two years. We’ve also seen a similar move with the Spanish spread, which is at its highest in nearly two years as well, at 109bps. It is likely we'll get a decent reversal this morning though.

That selloff in sovereign bonds came as oil prices reversed their declines so far this week, with Brent Crude up +4.93% to $110.14/bbl after EU President Von der Leyen proposed a ban on Russian oil in the latest sanctions package. Von der Leyen said this would be done “in an orderly fashion”, with the proposal seeing Russian crude oil phased out within 6 months, and refined products by year-end. Nevertheless, Hungary’s foreign minister said that “In its current form the Brussels sanctions package cannot be supported”, which risks holding up the package since it has to have unanimous agreement among the 27 member states. Bloomberg reported people familiar with the matter saying that Hungary and Slovakia would be granted a longer period until the end of 2023 to enforce the sanctions. Although energy stocks benefited from the rise in prices yesterday, they were mostly the exception in Europe, where the broader STOXX 600 underwent a larger -1.08% decline. This morning, Brent crude (+0.43%) is extending its gains.

Looking forward now, central banks will remain on the agenda today as well, with the Bank of England decision at mid-day where the consensus and market pricing are expecting a 25bps hike, which would take Bank Rate up to its highest level since the GFC, at 1%. In his preview (link here), our UK economist is in line with this, and expects the core message from the MPC to remain similar to March, highlighting the uncomfortable and intensifying trade-off between growth and inflation. He’s also expecting that the MPC will confirm its intension to start selling gilts, but doesn’t think we’ll get the details until August, with sales commencing early September.

Staying on the UK, we’ve got local elections taking place today as well that’ll be an important mid-term milestone for both the government and opposition, and our UK economists have put together a preview (link here). Last year the Conservatives had a very good set of results as the economy reopened amidst the vaccine rollout. But whereas they were 9 points ahead of Labour in the polls a year ago, they’re now 6 points behind them according to Politico’s average, so it’s a very different context. However, given most of the seats up for grabs today were last fought in 2018 when the Conservatives and Labour were roughly level in the polls during Theresa May’s premiership, the scale of Conservative losses may not be as big as the polling swing over the last 12 months would otherwise imply. One important contest to watch out for will be the Assembly elections in Northern Ireland, where the Irish nationalist Sinn Féin party are leading in the polls, and could become the largest party for the first time since Irish partition in the 1920s. Politico’s poll of polls puts Sinn Féin on 26%, ahead of the unionist DUP on 19%.

On the data side yesterday, we saw the ADP’s report of private payrolls for April, which showed weaker-than-expected growth of 247k in April (vs. 383k expected). That comes ahead of tomorrow’s US jobs report, where our economists are expecting that nonfarm payrolls will have risen by +465k in April. Then there was the ISM services index for April, where the headline felt to 57.1 (vs. 58.5), but the prices paid index rose to a record 84.6. Over in Europe meanwhile, the final composite PMI for the Euro Area in April was in line with the flash reading at 55.8, and March’s retail sales fell by -0.4% (vs. -0.3% expected).

To the day ahead now, and the highlights will include the aforementioned BoE policy decision and UK local elections. Otherwise from central banks, we’ll hear from the ECB’s Lane, Holzmann and Centeno. Data releases include German factory orders and French industrial production for March, the final UK services and composite PMIs for April, and the weekly initial jobless claims from the US. Finally, earnings releases today include Shell.

Government

Young People Aren’t Nearly Angry Enough About Government Debt

Young People Aren’t Nearly Angry Enough About Government Debt

Authored by The American Institute for Economic Research,

Young people sometimes…

Authored by The American Institute for Economic Research,

Young people sometimes seem to wake up in the morning in search of something to be outraged about. We are among the wealthiest and most educated humans in history. But we’re increasingly convinced that we’re worse off than our parents were, that the planet is in crisis, and that it’s probably not worth having kids.

I’ll generalize here about my own cohort (people born after 1981 but before 2010), commonly referred to as Millennials and Gen Z, as that shorthand corresponds to survey and demographic data. Millennials and Gen Z have valid economic complaints, and the conditions of our young adulthood perceptibly weakened traditional bridges to economic independence. We graduated with record amounts of student debt after President Obama nationalized that lending. Housing prices doubled during our household formation years due to zoning impediments and chronic underbuilding. Young Americans say economic issues are important to us, and candidates are courting our votes by promising student debt relief and cheaper housing (which they will never be able to deliver).

Young people, in our idealism and our rational ignorance of the actual appropriations process, typically support more government intervention, more spending programs, and more of every other burden that has landed us in such untenable economic circumstances to begin with. Perhaps not coincidentally, young people who’ve spent the most years in the increasingly partisan bubble of higher education are also the most likely to favor expanded government programs as a “solution” to those complaints.

It’s Your Debt, Boomer

What most young people don’t yet understand is that we are sacrificing our young adulthood and our financial security to pay for debts run up by Baby Boomers. Part of every Millennial and Gen-Z paycheck is payable to people the same age as the members of Congress currently milking this system and miring us further in debt.

Our government spends more than it can extract from taxpayers. Social Security, which represents 20 percent of government spending, has run an annual deficit for 15 years. Last year Social Security alone overspent by $22.1 billion. To keep sending out checks to retirees, Social Security goes begging to the Treasury Department, and the Treasury borrows from the public by issuing bonds. Bonds allow investors (who are often also taxpayers) to pay for some retirees’ benefits now, and be paid back later. But investors only volunteer to lend Social Security the money it needs to cover its bills because the (younger) taxpayers will eventually repay the debt — with interest.

In other words, both Social Security and Medicare, along with various smaller federal entitlement programs, together comprising almost half of the federal budget, have been operating for a decade on the principle of “give us the money now, and stick the next generation with the check.” We saddle future generations with debt for present-day consumption.

The second largest item in the budget after Social Security is interest on the national debt — largely on Social Security and other entitlements that have already been spent. These mandatory benefits now consume three quarters of the federal budget: even Congress is not answerable for these programs. We never had the chance for our votes to impact that spending (not that older generations were much better represented) and it’s unclear if we ever will.

Young Americans probably don’t think much about the budget deficit (each year’s overspending) or the national debt (many years’ deficits put together, plus interest) much at all. And why should we? For our entire political memory, the federal government, as well as most of our state governments, have been steadily piling “public” debt upon our individual and collective heads. That’s just how it is. We are the frogs trying to make our way in the watery world as the temperature ticks imperceptibly higher. We have been swimming in debt forever, unaware that we’re being economically boiled alive.

Millennials have somewhat modest non-mortgage debt of around $27,000 (some self-reports say twice that much), including car notes, student loans, and credit cards. But we each owe more than $100,000 as a share of the national debt. And we don’t even know it.

When Millennials finally do have babies (and we are!) that infant born in 2024 will enter the world with a newly minted Social Security Number and $78,089 credit card bill for Granddad’s heart surgery and the interest on a benefit check that was mailed when her parents were in middle school.

Headlines and comments sections love to sneer at “snowflakes” who’ve just hit the “real world,” and can’t figure out how to make ends meet, but the kids are onto something. A full 15 percent of our earnings are confiscated to pay into retirement and healthcare programs that will be insolvent by the time we’re old enough to enjoy them. The Federal Reserve and government debt are eating the economy. The same interest rates that are pushing mortgages out of reach are driving up the cost of interest to maintain the debt going forward. As we learn to save and invest, our dollars are slowly devalued. We’re right to feel trapped.

Sure, if we’re alive and own a smartphone, we’re among the one percent of the wealthiest humans who’ve ever lived. Older generations could argue (persuasively!) that we have no idea what “poverty” is anymore. But with the state of government spending and debt…we are likely to find out.

Despite being richer than Rockefeller, Millennials are right to say that the previous ways of building income security have been pushed out of reach. Our earning years are subsidizing not our own economic coming-of-age, but bank bailouts, wars abroad, and retirement and medical benefits for people who navigated a less-challenging wealth-building landscape.

Redistribution goes both ways. Boomers are expected to pass on tens of trillions in unprecedented wealth to their children (if it isn’t eaten up by medical costs, despite heavy federal subsidies) and older generations’ financial support of the younger has had palpable lifting effects. Half of college costs are paid by families, and the trope of young people moving back home is only possible if mom and dad have the spare room and groceries to make that feasible.

Government “help” during COVID-19 resulted in the worst inflation in 40 years, as the federal government spent $42,000 per citizen on “stimulus” efforts, right around a Millennial’s average salary at that time. An absurd amount of fraud was perpetrated in the stimulus to save an economy from the lockdown that nearly ruined it. Trillions in earmarked goodies were rubber stamped, carelessly added to young people’s growing bill. Government lenders deliberately removed fraud controls, fearing they couldn’t hand out $800 billion in young people’s future wages away fast enough. Important lessons were taught by those programs. The importance of self-sufficiency and the dignity of hard work weren’t top of the list.

Boomer Benefits are Stagnating Hiring, Wages, and Investment for Young People

Even if our workplace engagement suffered under government distortions, Millennials continue to work more hours than other generations and invest in side hustles and self employment at higher rates. Working hard and winning higher wages almost doesn’t matter, though, when our purchasing power is eaten from the other side. Buying power has dropped 20 percent in just five years. Life is $11,400/year more expensive than it was two years ago and deficit spending is the reason why.

We’re having trouble getting hired for what we’re worth, because it costs employers 30 percent more than just our wages to employ us. The federal tax code both requires and incentivizes our employers to transfer a bunch of what we earned directly to insurance companies and those same Boomer-busted federal benefits, via tax-deductible benefits and payroll taxes. And the regulatory compliance costs of ravenous bureaucratic state. The price paid by each employer to keep each employee continues to rise — but Congress says your boss has to give most of the increase to someone other than you.

Federal spending programs that many people consider good government, including Social Security, Medicare, Medicaid, and health insurance for children (CHIP) aren’t a small amount of the federal budget. Government spends on these programs because people support and demand them, and because cutting those benefits would be a re-election death sentence. That’s why they call cutting Social Security the “third rail of politics.” If you touch those benefits, you die. Congress is held hostage by Baby Boomers who are running up the bill with no sign of slowing down.

Young people generally support Social Security and the public health insurance programs, even though a 2021 poll by Nationwide Financial found 47 percent of Millennials agree with the statement “I will not get a dime of the Social Security benefits I have earned.”

In the same survey, Millennials were the most likely of any generation to believe that Social Security benefits should be enough to live on as a sole income, and guessed the retirement age was 52 (it’s 67 for anyone born after 1959 — and that’s likely to rise). Young people are the most likely to see government guarantees as a valid way to live — even though we seem to understand that those promises aren’t guarantees at all.

Healthcare costs tied to an aging population and wonderful-but-expensive growth in medical technologies and medications will balloon over the next few years, and so will the deficits in Boomer benefit programs. Newly developed obesity drugs alone are expected to add $13.6 billion to Medicare spending. By 2030, every single Baby Boomer will be 65, eligible for publicly funded healthcare.

The first Millennial will be eligible to claim Medicare (assuming the program exists and the qualifying age is still 65, both of which are improbable) in 2046. As it happens, that’s also the year that the Boomer benefits programs (which will then be bloated with Gen Xers) and the interest payments we’re incurring to provide those benefits now, are projected to consume 100 percent of federal tax revenue.

Government spending is being transferred to bureaucrats and then to the beneficiaries of government spending who are, in some sense, your diabetic grandma who needs a Medicare-paid dialysis treatment, but in a much more immediate sense, are the insurance companies, pharma giants, and hospital corporations who wrote the healthcare legislation. Some percentage of every college graduate’s paycheck buys bullets that get fired at nothing and inflating the private investment portfolios of government contractors, with dubious, wasteful outcomes from the prison-industrial complex to the perpetual war machine.

No bank or nation in the world can lend the kind of money the American government needs to borrow to fulfill its obligations to citizens. Someone will have to bite the bullet. Even some of the co-authors of the current disaster are wrestling with the truth.

Forget avocado toast and streaming subscriptions. We’re already sensing it, but we haven’t yet seen it. Young people are not well-informed, and often actively misled, about what’s rotten in this economic system. But we are seeing the consequences on store shelves and mortgage contracts and we can sense disaster is coming. We’re about to get stuck with the bill.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

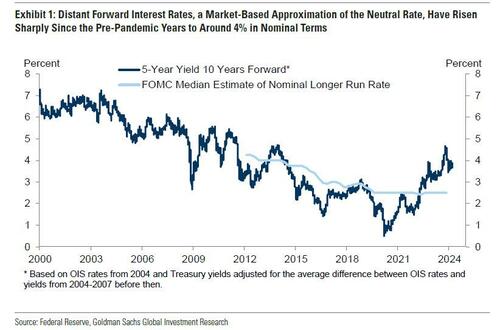

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

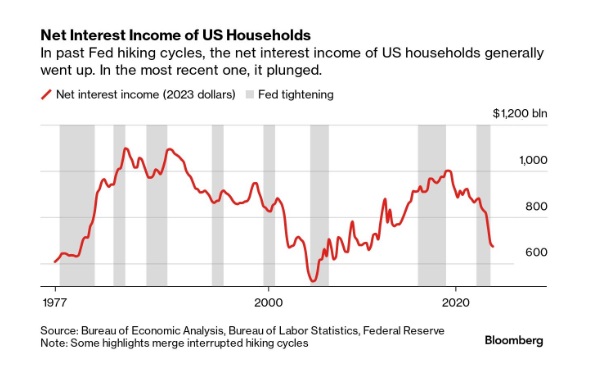

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex