Futures Slide Amid Renewed Recession Fears After China Doubles Down On “Covid Zero”

Futures Slide Amid Renewed Recession Fears After China Doubles Down On "Covid Zero"

One day after futures ramped overnight (if only to crater…

One day after futures ramped overnight (if only to crater during the regular session) on hopes China was easing its highly politicized Zero Covid policy after it cut the time of quarantine lockdowns, this morning futures slumped early on after China's President Xi Jinping made clear that Covid Zero isn't going anywhere and remains the most “economic and effective” policy for China during a symbolic visit to the virus ground zero in Wuhan, in which he cast the strategy as proof of the superiority of the country’s political system. That coupled with renewed recession worries (market is again pricing in a rate cut in Q1 2023) even as monetary policy tightens in much of the world to fight supply-side inflation, sent US futures and global markets lower. S&P futures dropped 0.2% and Nasdaq 100 futures were down 0.4% after the underlying index slumped on 3.1% on Tuesday. The dollar was steady after rising the most in over a week while WTI crude climbed above $112 a barrel, set for a fourth session of gains. In cryptocurrencies, Bitcoin dipped below the closely watched $20,000 level on news crypto hedge fund 3 Arrows Capital was ordered to liquidate.

The Nasdaq's Tuesday’s slump added to what was already one of the worst years in terms of big daily selloffs in US stocks. The S&P 500 Index has fallen 2% or more on 14 occasions, putting 2022 in the top 10 list, according to Bloomberg data.

Not helping the tech sector, on Wednesday morning JPMorgan cut its earnings estimates across the sector, especially for companies exposed to online advertising, citing macroeconomic pressures, forex and company-specific dynamics.

One of the chief drivers for overnight weakness, China's Xi said during a trip Tuesday to Wuhan where the virus first emerged in late 2019 that relaxing Covid controls would risk too many lives in the world’s most populous country. China would rather endure some temporary impact on economic development than let the virus hurt people’s safety and health, he said, in remarks reported Wednesday by state media. As a result, China’s CSI 300 Index extended loss to 1.4% after the headline, while the yuan drops as much as 0.2% to trade 6.7132 against the dollar in the offshore market.

Among key premarket movers, Tesla slipped in US premarket trading. The electric-vehicle maker laid off hundreds of workers on its Autopilot team as it shuttered a California facility, according to people familiar with the matter. Carnival slumped as Morgan Stanley analysts warned that the London and New York-listed cruise vacation company’s shares could lose all their value in the event of another demand shock. Pinterest gained 3.7% as the company’s co- founder and CEO Ben Silbermann quit and handed the reins to Google and PayPal veteran Bill Ready in a sign the social-media company will focus more on e-commerce. Also, despite the pervasive weakness, the Energy Select Sector SPDR Fund ETF (XLE) rebounded off key support (50% Fibonacci) relative to the SPDR S&P 500 ETF (SPY). That said, energy was alone and most other notable movers were down in the premarket:

- Carnival (CCL US) shares fall 8% premarket as Morgan Stanley analysts warned that the cruise vacation firm’s shares could lose all their value in the event of another demand shock.

- Nio (NIO US) shares drop 8.2% after short-seller Grizzly Research published a report on Tuesday alleging that the electric carmaker used battery sales to a related party to inflate revenue and boost net income margins. The company rejected the claims.

- Upstart Holdings (UPST US) shares slump about 9% after Morgan Stanley downgraded the consumer finance company to underweight from equal-weight amid rising cyclical headwinds.

- Ormat Technologies (ORA US) rallies as much as 5% after the renewable energy company is set to be included in the S&P Midcap 400 Index.

- 2U (TWOU US) shares rise 16% premarket. Indian online-education provider Byju’s has offered to buy the company in a cash deal that values the US-listed edtech firm at more than $1 billion, a person familiar with the matter said.

- Watch Amazon (AMZN US) shares as Redburn initiated coverage of the stock with a buy recommendation and set a Street-high price target, saying “there is a clear path toward a $3 trillion value for AWS alone.”

- Shares in data center REITs could be active later in the trading session after short-seller Jim Chanos said in an FT interview that he’s betting against “legacy” data centers. Watch Digital Realty (DLR US) and Equinix (EQIX US), as well as data center operators Cyxtera Technologies (CYXT US) and Iron Mountain (IRM US)

Investors are growing increasingly skeptical that the Fed can avoid a bruising economic downturn amid sharp interest-rate hikes. Evaporating consumer confidence is feeding into concerns that the US might tip into a recession. Naturally, Fed officials sought to play down recession risk. New York Fed President John Williams and San Francisco’s Mary Daly both acknowledged they had to cool inflation, but insisted that a soft landing was still possible.

“It seems the market is in this tug of war between on the one hand the hope that we are close to the peak in inflation and rates, and on the other hand the challenge of a slowing economy and potential recession,” Emmanuel Cau, head of European equity strategy at Barclays Bank Plc, said in an interview with Bloomberg TV. “Central banks are walking a very tight line and to a certain extent dictate the mood in the markets.”

European equities snapped three days of gains, trading poorly but off worst levels with sentiment also hurt by China remaining committed to its zero-Covid approach. Spanish inflation unexpectedly surged to a record, dashing hopes that inflation in the euro zone’s fourth-biggest economy had peaked, and emboldening European Central Bank policy makers pushing for big increases in interest rates. The ECB should consider raising interest rates by twice the planned amount next month if the inflation outlook deteriorates, according to Governing Council member Gediminas Simkus, as calls not to exclude an outsized initial move grow. German benchmark bonds rose, while 10-year Treasury yields slipped to 3.16%. DAX lags, dropping as much as 1.8%. Real estate, autos and miners are the worst performing sectors.

In notable moves in European stocks, Hennes & Mauritz (H&M) gained after the Swedish low-cost retailer’s earnings beat analyst estimates. Just Eat Takeaway.com NV tumbled to a record low after Berenberg analysts rated the stock sell, saying the food delivery firm’s UK business will remain under pressure. Here are some of the biggest European movers today:

- Just Eat Takeaway shares plunge as much as 21% after Berenberg initiated coverage with a sell rating, saying the firm’s UK business will remain under pressure and a sale of its Grubhub unit is unlikely to satisfy the bulls.

- Carnival stocks slumped over 12% in London as Morgan Stanley analysts warned that the cruise vacation firm’s shares could lose all their value in the event of another demand shock.

- Pearson drops as much as 6.1% after the education company was cut to sell at UBS, which reduced forecasts to reflect a weak outlook for 2022 college enrollments.

- Grifols shares plunge as much as 13% on a media report the Spanish plasma firm is weighing a capital raise of as much as EU2b to cut its debt.

- Diageo shares fall after downgrades for the spirits group from Deutsche Bank and Kepler Cheuvreux, while Pernod Ricard also dips on a rating cut from the latter.

- Diageo declines as much as 4.2%, Pernod Ricard -3.7%

- Fluidra shares fall as much as 8.4% after Santander cut its rating on the Spanish swimming pools company. The bank’s analyst Alejandro Conde cut the recommendation to neutral from outperform.

- H&M shares rise as much as 6.8% after the Swedish apparel retailer reported 2Q earnings that beat estimates. Jefferies said the margin beat in particular was reassuring, while Morgan Stanley said it was a “positive surprise” overall.

- Ipsen shares rise as much as 3.1% after UBS analyst Michael Leuchten said that accepting palovarotene refiling priority review should be a net present value and confidence boost.

Asian stocks fell, halting a four-day gain, as renewed angst over the outlook for global economic growth and inflation help drive a selloff across most of the region’s equity markets. The MSCI Asia Pacific Index dropped as much as 1.5%, led by consumer discretionary and information sectors. Chinese equities in particular took a hit, as the CSI 300 Index fell 1.5% Wednesday after Xi Jinping reiterated his firm stance on Covid zero. Tech-heavy indexes in markets such as South Korea and Taiwan took the brunt of Wednesday’s drop amid lingering concerns that monetary tightening in much of the world to fight inflation will cause an economic slowdown. While Federal Reserve members have played down the risk of a US recession, gloomy data such as US consumer confidence have damped investor sentiment.

“Volatility is going to be the enduring feature of the market, I suspect, for the next couple of quarters at least until we get a firm sense that peak inflation has passed,” John Woods, Credit Suisse Group AG’s Asia-Pacific chief investment officer, said in an interview with Bloomberg TV. “Markets, I think, have aggressively priced in quite a serious or steep recession.” China’s four-day winning streak came to a halt, putting its advance toward a bull market on hold. “We will continue to see a risk of targeted lockdowns, and that spoils the initial euphoria seen in the markets from the announcement on relaxation of quarantine requirements,” said Charu Chanana, market strategist at Saxo Capital Markets. “Still, economic growth will likely be prioritized as this is a politically important year for China.”

Japanese equities decline as investors digested data that showed a drop in US consumer confidence over inflation worries and increased concerns of an economic downturn. The Topix Index fell 0.7% to 1,893.57 in Tokyo on Wednesday, while the Nikkei declined 0.9% to 26,804.60. Toyota Motor Corp. contributed the most to the Topix’s decline, decreasing 1.8%. Out of 2,170 shares in the index, 1,114 fell, 984 rose and 72 were unchanged. “There are concerns about stagflation,” said Hideyuki Suzuki a general manager at SBI Securities. “The consumer sentiment from the University of Michigan, which provides one of the fastest data points, has already shown poor figures.”

Stocks in India tracked their Asian peers lower as brent rose to the highest level in two weeks, while high inflation and slowing global growth continued to dampen risk-appetite for global equities. The S&P BSE Sensex fell 0.3% to 53,026.97 in Mumbai, while the NSE Nifty 50 Index declined by an equal measure. Both gauges have lost more than 4% in June and are set for their third consecutive month of declines. The main indexes have dropped for all but one month this year. Twelve of the 19 sub-sector gauges compiled by BSE Ltd. eased, led by banking companies while power producers were the top performers. Investors will also be watching the expiry of monthly derivative contracts on Thursday, which may lead to some volatility in the markets. Hindustan Unilever was the biggest contributor to the Sensex’s decline, decreasing 3.5%. Out of 30 shares in the Sensex, 10 rose and 20 fell.

The Bloomberg Dollar Spot Index inched up modestly as the greenback traded mixed against its Group-of-10 peers; the Swiss franc led gains while Antipodean currencies were the worst performers and the euro traded in a narrow range around $1.05. The relative cost to own optionality in the euro heading into the July meetings of the ECB and the Federal Reserve was too low for investors to ignore and has become less and less underpriced. The yen strengthened and US and Japanese bond yields fell.

In rates, fixed income has a choppy start. Bund futures initially surged just shy of 200 ticks on a soft regional German CPI print before fading the entire move over the course of the morning as Spanish data hit the tape, delivering a surprise record 10% reading for June and more hawkish ECB comments crossed the wires. Treasuries and gilts followed with curves eventually fading a bull-steepening move. Long-end gilts underperform, cheapening ~4bps near 2.75%. Peripheral spreads are tighter to core.

Treasuries are slightly higher as US trading day begins, off the session lows reached as bund futures jumped after the first monthly drop since November in a German regional CPI gauge. Yields are lower across the curve, by 1bp-2bp for tenors out to the 10-year with long-end yields little changed; 10-year declined as much as 5.3bp vs as much as 8.2bp for German 10- year, which remains lower by ~3bp. Focal points for the US session include a final revision of 1Q GDP, comments by Fed Chair Powell, and anticipation of quarter-end flows favoring bonds. Quarter-end is anticipated to cause rebalancing flows into bonds; Wells Fargo estimated that $5b will be added to bonds, with most of the flows occurring Wednesday and Thursday.

In commodities, crude futures advance. WTI drifts 0.3% higher to trade near $112.13. Base metals are mixed; LME tin falls 5.6% while LME zinc gains 0.4%. Spot gold falls roughly $5 to trade near $1,815/oz

Looking ahead, the highlight will be the panel at the ECB Forum that includes Fed Chair Powell, ECB President Lagarde and BoE Governor Bailey. We’ll also be hearing from ECB Vice President de Guindos, the ECB’s Schnabel, the Fed’s Mester and Bullard, and the BoE’s Dhingra. On the data side, releases include German CPI for June, Euro Area money supply for May, and the final Euro Area consumer confidence reading for June. From the US, we’ll also get the third reading of Q1 GDP.

Market Snapshot

- S&P 500 futures little changed at 3,829.00

- STOXX Europe 600 down 0.8% to 412.69

- MXAP down 1.3% to 159.96

- MXAPJ down 1.6% to 531.04

- Nikkei down 0.9% to 26,804.60

- Topix down 0.7% to 1,893.57

- Hang Seng Index down 1.9% to 21,996.89

- Shanghai Composite down 1.4% to 3,361.52

- Sensex little changed at 53,204.17

- Australia S&P/ASX 200 down 0.9% to 6,700.23

- Kospi down 1.8% to 2,377.99

- German 10Y yield little changed at 1.59%

- Euro little changed at $1.0510

- Brent Futures down 0.4% to $117.46/bbl

- Gold spot down 0.2% to $1,816.09

- U.S. Dollar Index little changed at 104.55

Top Overnight News from Bloomberg

- The Fed’s Loretta Mester said she wants to see the benchmark lending rate reach 3% to 3.5% this year and “a little bit above 4% next year” to rein in price pressures even if that tips the economy into a recession

- The ECB should consider raising interest rates by twice the planned amount next month if the inflation outlook deteriorates, according to Governing Council member Gediminas Simkus, as calls not to exclude an outsized initial move grow

- ECB has “ample room” to hike in 25bps-50bps steps to “whatever rate we think, we consider reasonable,” Governing Council member Robert Holzmann said in interview with CNBC

- Swedish consumers are gloomier than they have been since the mid-1990s, as prices surge on everything from fuel to food and furniture

- China’s President Xi Jinping declared Covid Zero the most “economic and effective” policy for the nation, during a symbolic visit to Wuhan in which he cast the strategy as proof of the superiority of the country’s political system

- NATO moved one step closer to bolstering its eastern front with Russia after Turkey dropped its opposition to Swedish and Finnish bids to join the military alliance

A more detailed look at markets courtesy of Newsquawk

Asia-Pac stocks were pressured amid headwinds from the US where disappointing Consumer Confidence data added to the growth concerns. ASX 200 failed to benefit from better than expected Retail Sales and was dragged lower by weakness in miners and tech. Nikkei 225 fell beneath the 27,000 level as industries remained pressured by the ongoing power crunch. Hang Seng and Shanghai Comp. conformed to the negative picture in the region although losses in the mainland were initially stemmed after China cut its quarantine requirements which the National Health Commission caveated was not a relaxation but an optimization to make it more scientific and precise.

Top Asian News

- Chinese President Xi said China's COVID prevention control and strategy is correct and effective and must stick with it, via state media. Shanghai will gradually reopen museums and scenic sports from July 1st, state media reports.

- US Deputy Commerce Secretary Graves said the US will take a balanced approach on Chinese tariffs and that a clear response on China tariffs is coming soon, according to Bloomberg.

- China State Council's Taiwan Affairs Office said it firmly opposes the US signing any agreement that has sovereign connotations with Taiwan, according to Global Times.

- BoJ Governor Kuroda said Japanese Core CPI reached 2.1% in April and May which is almost fully due to international energy prices and Japan's economy has not been affected much by the global inflationary trend so monetary policy will stay accommodative, according to Reuters.

- Japanese govt to issue power supply shortage warning for a fourth consecutive day on Thursday, according to a statement.

European bourses are on the backfoot as the region plays catch-up to the losses on Wall Street yesterday. Sectors are mostly lower (ex-Energy) with a defensive tilt as Healthcare, Consumer Products, Food & Beverages, and Utilities are more cushioned than their cyclical peers. Stateside, US equity futures trade on either side of the unchanged mark with no stand-out performers thus far, with the contracts awaiting the next catalyst.

Top European News

- UK expects defence spending to reach 2.3% of GDP and said PM Johnson will announce new military commitments to NATO, according to Reuters.

- UK Weighs Capping Maximum Stake in Online Casinos at £5

- Europe Is the Only Region Where Earnings Estimates Are Rising

- European Gas Prices Rise as Supply Risks Add to Storage Concerns

- Gold Steady as Traders Weigh Fed Comments on US Recession Risks

- Choppy Start for Euro-Area Bonds on Mixed Inflation

FX

- Dollar mostly bid otherwise as rebalancing demand underpins - DXY pivots 104.500 within 104.700-350 confines.

- Franc outperforms on rate and risk considerations - Usd/Chf breaches 0.9550 and Eur/Chf approaches parity.

- Euro erratic in line with conflicting inflation data - Eur/Usd rotates around 1.0500.

- Aussie and Kiwi undermined by downturn in sentiment - Aud/Usd loses 0.6900+ status, Nzd/Usd wanes from just over 0.6250.

- Yen rangy following firmer than forecast Japanese retail sales and BoJ Governor Kuroda reaffirming intent to remain accommodative - Usd/Jpy straddles 136.00.

- Nokkie welcomes oil worker wage agreement with unions to avert strike action, but Sekkie hampered by softer Swedish macro releases pre-Riksbank policy call tomorrow - Eur/Nok probes 10.3000, Eur/Sek hovers around 10.6800.

- Rand rattled by decline in Gold and ongoing SA power supply problems, but Rouble rallies irrespective of CBR and Russian Economy Ministry divergence over deflation.

Central Banks

- ECB's Lane said there are two-way inflation risks: "on the one side, there could be forces that keep inflation higher than expected for longer. On the other side, we do have the risk of a slowdown in the economy, which would reduce inflationary pressure", via ECB.

- ECB's Holzmann said "We will have to make an assessment where the economic development is going and where inflation stands and afterwards there’s ample room to hike in 0.25 and 0.5 levels to whatever rate we think, we consider reasonable" via CNBC.

- ECB's Simkus said if data worsens, then he wants a 50bps July hike as an option, 50bps hike is very likely in September; ECB's fragmentation tool should serve as a deterrent, via Bloomberg.

- ECB's Herodotou said EZ inflation will peak this year, via CNBC.

- ECB's Wunsch said government aid may spell more rate hikes, via Bloomberg; 150bps of hikes by March 2023 is reasonable

- ECB is said to be weighting whether or not they should announce the size and duration of their upcoming bond-buying scheme, according to Reuters sources.

- Fed's Mester (2022, 2024 voter) said on a path towards restrictive interest rates; July debate between 50bps and 75bps hike, via CNBC. Mester said if inflation expectations become unanchored, monetary policy would have to act more forcefully; current inflation situation is a very challenging one, via Reuters.

- SARB Governor said a 50bps hike is "not off the table", Via Bloomberg

- CBR Governor said she does not see risks of deflation; sees room to cut rates; sticking to policy of floating RUB exchange rate.

- PBoC will step up implementation of prudent monetary policy, will keep liquidity reasonably ample.

Fixed Income

- Bunds unwind all and a bit more of their hefty post-NRW CPI gains as other German states show smaller inflation slowdowns and Spanish HICP soars.

- Gilts suffer more pronounced fall from grace in relative terms and US Treasuries slip from overnight peaks in sympathy.

- UK debt and STIRs also await testimony from MPC member elect to see if newbie leans dovish, hawkish or middle of the road

- 10 year benchmarks settle off worst levels within 147.37-145.14, 112.66-11.85 and 117-12+/116-27 respective ranges awaiting comments from ECB, Fed and BoE heads at Sintra Forum.

Commodities

- WTI and Brent front-month futures traded with no firm direction in early European hours before picking up modestly in recent trade.

- US Private Inventory (bbls): Crude -3.8mln (exp. -0.6mln), Cushing -0.7mln, Distillate +2.6mln (exp. -0.2mln) and Gasoline +2.9mln (exp. -0.1mln).

- Norway's Industri Energi and SAFE labour unions agreed a wage deal for oil drilling workers and will not go on strike, according to Reuters.

- OPEC to start today at 12:00BST/07:00EDT; JMMC on Thursday at 12:00BST/07:00EDT followed by OPEC+ at 12:30BST/07:30EDT, via EnergyIntel.

- Libya's NOC suspends oil exports from Es Sider port.

- Spot gold is under some mild pressure as the Buck and Bond yields picked up, with the yellow metal back to near-two-week lows

- Base metals are mixed but off best levels after President Xi reaffirmed China's COVID stance – LME copper fell back under USD 8,500/t

US Event Calendar

- 07:00: June MBA Mortgage Applications, prior 4.2%

- 08:30: 1Q PCE Core QoQ, est. 5.1%, prior 5.1%

- 08:30: 1Q GDP Price Index, est. 8.1%, prior 8.1%

- 08:30: 1Q Personal Consumption, est. 3.1%, prior 3.1%

- 08:30: 1Q GDP Annualized QoQ, est. -1.5%, prior -1.5%

Central Banks

- 09:00: Powell Takes Part in Panel Discussion at ECB Forum in Sintra

- 09:00: Lagarde, Powell, Bailey, Carstens Speak in Sintra

- 11:30: Fed’s Mester Speaks on Panel at ECB Forum in Sintra

- 13:05: Fed’s Bullard Makes Introductory Remarks

DB's Jim Reid concludes the overnight wrap

I'm finishing this off in a taxi on the way to the Eurostar this morning and I made the mistake of telling the driver I was slightly pressed for time. He seems to be taking the racing line everywhere and my motion sickness is kicking in.

A little like this car journey, it's been another volatile 24 hours in markets, with a succession of weak data releases raising further questions about how close the US and Europe might be to a recession. That saw equities give up their initial gains to post a decent decline on the day, whilst there was little respite from central bankers either, with sovereign bonds selling off further as multiple speakers doubled down on their hawkish rhetoric. That comes ahead of another eventful day ahead on the calendar, with investors primarily focused on a panel featuring Fed Chair Powell, ECB President Lagarde and BoE Governor Bailey, as well as the flash German CPI print for June, who are the first G7 economy to release their inflation print for the month, which will provide some further clues on how fast central banks will need to move on rate hikes. Just as we go to print the NRW region of Germany has seen CPI print at 7.5% YoY, way below last month's 8.1%. This region is around a quarter of GDP so it could imply the national numbers will be notably softer when we get them later. The energy tax cuts were always going to come through in June so some respite was always possible but at first glance this seems materially below what might have been expected.

This comes after a significant sovereign bond selloff in Europe once again yesterday as President Lagarde reiterated the central bank’s determination to bring down inflation, and described inflation pressures that were “broadening and intensifying”. And although Lagarde stuck to the existing script about the ECB raising rates by 25bps at the next meeting, we also heard from Latvia’s Kazaks who said that “front-loading the increase would be a reasonable choice” in the event that the situation with inflation or inflation expectations deteriorates. Lagarde did nod to this in part, saying that if the ECB was “to see higher inflation threatening to de-anchor inflation expectations, or signs of a more permanent loss of economic potential that limits resources availability, we would need to withdraw accommodation more promptly to stamp out the risk of a self-fulfilling spiral.” Separately on fragmentation, Lagarde said that they could “use flexibility in reinvesting redemptions” from PEPP starting July 1 in order to deal with the issue.

For now, overnight index swaps are only pricing in a +31.3bps move in July from the ECB, so still closer to 25 than 50 for the time being. Meanwhile the rate priced in by year-end rose also by +7.9bps as investors interpreted the comments in a hawkish light. That supported a further rise in yields, with those on 10yr bunds up another +8.1bps yesterday, following on from their +10.7bps move in the previous session. That’s now almost reversed the -21.9ps move over the previous week, which itself was the third-largest weekly decline in bund yields for a decade, and brought the 10yr yield back up to 1.63%, so not far off its multi-year high of 1.77% seen last week. A similar pattern was seen elsewhere, with 10yr yields on 10yr OATs (+9.6bps), BTPs (+4.2bps) and gilts (+7.2bps) all moving higher too.

Things turned near the European close with some poor US data releases piling on to some lacklustre confidence figures in Europe. Earlier in the day the GfK consumer confidence reading from Germany fell to -27.4 (vs. -27.3 expected), taking it to another record low. Separately in France, consumer confidence fell to 82 on the INSEE’s measure (vs. 84 expected), which we haven’t seen since 2013. Then in the US, the Conference Board’s measure fell to 98.7 (vs. 100.0 expected), which is the lowest since February 2021. The Conference Board’s one-year ahead inflation expectations hit a record high of 8.0%, surpassing the June 2008 record of 7.7%, adding to the pessimism. Along with waning confidence, the Richmond Fed’s Manufacturing Index registered a -19, its lowest since the peak onset of the pandemic, versus expectations of -7 and a prior of -9, showing that production data has weakened as well. This put a serious damper on risk sentiment which drove Treasury yields and equities lower intraday during the New York session.

10yr Treasury yields ended down -2.8bps after trading as much as +5.5bps higher during the European session. They are down another -4bps this morning. Concerningly as well, there was a fresh flattening in the Fed’s preferred yield curve indicator (which is 18m3m – 3m), which came down another -9.1bps to 165bps, which is the flattest its been since early March.

With that succession of bad news helping to dampen risk appetite, US equities gave up their opening gains to leave the S&P 500 down -2.01% on the day. Tech stocks saw the worst losses, with the NASDAQ (-2.98%) and the FANG+ (-3.74%) seeing even larger declines. And whilst there was a stronger performance in Europe, the STOXX 600 ended the day up just +0.27%, having been as high as +0.95% in the couple of hours before the close.

We didn’t hear so much from the Fed ahead of Chair Powell’s appearance today, although New York Fed President Williams said that at the upcoming July meeting “I think 50 to 75 is clearly going to be the debate”. Markets are continuing to price something in between the two, although since the last Fed meeting futures have been consistently closer to 75 than 50, with 69.0 bps right now.

Those sharp losses in US equities are echoing across Asia this morning. The Hang Seng (-1.86%) is leading the losses followed by the Kospi (-1.82%), the Nikkei (-1.07%) and the ASX 200 (-1.06%). Over in mainland China, the Shanghai Composite (-0.77%) and the CSI (-0.80%) are slightly out-performing after yesterday’s surprise move by China to slash the quarantine period for inbound travellers (more on this below). Looking ahead, US stock index futures point to a positive opening with contracts on the S&P 500 (+0.18%) and NASDAQ 100 (+0.19%) mildly higher.

Earlier today, data released showed that Japan’s retail sales advanced for the third consecutive month in May (+3.6% y/y) but lower than the consensus of +4.0%, but with the previous month's data revised up to +3.1% (vs +2.9% preliminary). Meanwhile, South Korea’s consumer sentiment index (CSI) fell sharply to 96.4 in June (vs 102.6 in May), sliding below the long-term average of 100 for the first time since Feb 2021. Separately, Australia’s retail sales put in another strong performance as it climbed +0.9% m/m in May, surpassing analyst estimates of a +0.4% increase.

Oil has fallen back slightly overnight after three sessions of gains with Brent futures down -0.84% at $116.99 and WTI futures (-0.64%) at $111.04/bbl as I type.

Just after we went to press yesterday, it was also announced that China would be shortening the required quarantine period for inbound travellers to one week from two. So although China is still very-much committed to a Covid-zero strategy for the time being, this step towards loosening rather than tightening restrictions is an interesting development that helped support Chinese equities in yesterday’s session towards the close which filtered through into early northern hemisphere risk performance.

In terms of other data yesterday, there were signs that US house price growth might finally be slowing somewhat, with the S&P CoreLogic Case-Shiller index up by +20.4% in April, which is down slightly from the +20.6% gain in March. So still a long way from an absolute decline, but that marks a reversal in the trend after the previous 4 months of rises in the year-on-year measure.

To the day ahead now, and the highlight will likely be the panel at the ECB Forum that includes Fed Chair Powell, ECB President Lagarde and BoE Governor Bailey. We’ll also be hearing from ECB Vice President de Guindos, the ECB’s Schnabel, the Fed’s Mester and Bullard, and the BoE’s Dhingra. On the data side, releases include German CPI for June, Euro Area money supply for May, and the final Euro Area consumer confidence reading for June. From the US, we’ll also get the third reading of Q1 GDP.

Government

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

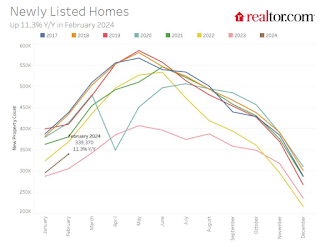

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges