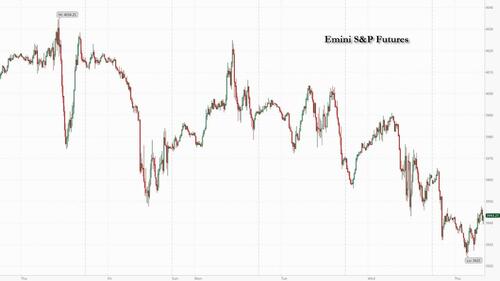

US futures dropped for a third consecutive day on Thursday, as 10Y yields traded near session highs at 4.04% mirroring moves in the euro-area, and even 30Y yields topping 4.0% for the first time since November, amid worries how the Federal Reserve will tackle hotter-than-expected economic data. Futures on the S&P 500 were 0.6% lower and contracts on the Nasdaq 100 fell by 0.8% by 5:28 a.m. in New York. The yield on the benchmark 10-year US Treasuries climbed above 4% to the highest level since November, damping appetite for equities. The Bloomberg Dollar Spot Index traded at session highs, pressuring all G10 currencies. Oil climbed, while gold and Bitcoin fell

Among the most notable US premarket movers, Salesforce soared 15% in premarket after the company gave a surprisingly upbeat forecast for the coming year and said it planned to step up stock buybacks, potentially easing the pressure it faces from a cadre of activist investors. On the other side, Tesla fell as much as 5.7% in US premarket trading today after Elon Musk’s much-hyped third Master Plan for the company fell flat with investors after failing to offer any firm detail on the company’s long-awaited next generation of electric cars. Another big loser in premarket trading was Silvergate Capital which plunged over 30%, after the cryptocurrency-friendly bank said Wednesday it needs more time to assess the extent of damage to its finances stemming from last year’s crypto rout, including whether it can remain viable. Cano Health, a health provider that serves US seniors in the Medicare program, tumbled 15% in premarket after providing a 2023 revenue forecast that fell short of estimates. Here are all the notable premarket movers:

- American Eagle Outfitters gains 4% after the apparel retailer reported 4Q net revenue and adjusted EPS that beat the average analyst estimates.

- Amneal Pharma gains 7.2% after reporting 4Q profit that beat. The company also said the FDA accepted for review an abbreviated new drug application filing for the generic version of Narcan.

- Bright Health gains 13% in the wake of a 42% drop Wednesday that marked the stock’s sharpest rout since its 2021 debut.

- Best Buy Co. (BBY) slips 2.8% after the company predicted that sales will fall a second straight year.

- Funko tumbles 24% after the toymaker’s revenue and earnings-per-share projections for the current quarter fell short of analysts’ expectations.

- Hayward Holdings declines 7.7% in as funds affiliated with CCMP Capital Advisors and Alberta Investment Management offer 16 million shares for sale via Goldman.

- Macy’s Inc. climbs 9% after the retailer reported 4Q earnings that exceeded expectations, thanks in part to sales growth at the Bloomingdale’s and Bluemercury brands.

- Okta rises 16% after the software company gave a forecast that is much stronger than expected.

- Pure Storage falls 11% after the cloud storage firm provided a revenue outlook for fiscal 2024 that fell short of estimates.

- Salesforce jumps 15% as analysts hiked their price targets on the software company after the company’s results and full-year forecast were both better than expected.

- Snowflake shares slip 7% after the company provided a worse-then-expected sales outlook as many corporations scrutinize their cloud spending.

- Wolfspeed slips 11% and ON Semiconductor (ON) falls 7% after Tesla said that it found a way to use less silicon carbide wafer without compromising the efficiency of its cars.

After a powerful rally at the start of the year, US equities dropped in February and have started March on the back foot as buoyant economic indicators and sticky inflation spurred concerns about a hawkish response from the Federal Reserve trying to keep price growth in check. Stocks tumbled yesterday after a gauge of US manufacturing improved for the first time in six months and Federal Reserve Bank of Atlanta President Raphael Bostic called for continued interest-rate hikes to above 5%. The market for wagers on the Fed’s policy rate is pricing in a higher peak of 5.5% in September.

“Markets were in denial about inflation between October and January and now the pressure on yields is here to stay and certainly at higher levels than today, that’s my intuition,” Pierre-Yves Gauthier, head of research and founder of AlphaValue said by phone.

“In the US, there are doubts on the profit generating capacity of tech, these doubts are here to stay and I do not think a rebound is likely before the end of the year,” Gauthier added, noting that the situation was different in Europe where earnings provided a positive surprise for investors.

The focus now is on how much higher interest rates might go in the US and eurozone, with swaps markets now pricing a peak Fed policy rate of 5.5% in September, and some even betting on 6%. US 10-year yields, the main reference rate for the global cost of capital, rose 40 basis points in February and are consolidating their rise past 4%. Thursday data showed euro-area inflation slowed by less than anticipated and underlying price pressures surged to a new record, heaping pressure on the European Central Bank to drive up rates further. ECB interest rates are now seen rising above 4% and German benchmark bond yields traded above 2.7%.

“We have upgraded our terminal Fed forecast to 5.75% which is above what markets are pricing — we do think the US economy is proving highly resilient because of excess savings and a strong labor market,” Thomas Hempell, head of macro and market research at Generali Investments, said in an interview. “Data has poured cold water on the disinflation process and markets are highly alert to anything that alters the inflation outlook.”

That’s damping appetite for risk taking in markets around the world, with some even expressing concern that China’s post-Covid economic recovery could exacerbate global price pressures. China’s reopening is a much-needed bright spot for investors, but in terms of inflation “adds cyclical upside pressure because of the sheer amount of demand” that it brings, especially in commodities, Charu Chanana, senior markets strategist at Saxo Capital Markets, said on Bloomberg Television. The hawkish Fed rate bets supported the US dollar against its Group-of-10 counterparts, with the greenback looking set to extend February’s 2.6% gain.

European stocks also fell for a third day while yields continue their rapid accent as investors contemplate the prospect of ongoing monetary tightening. The Stoxx 600 is down 0.3% with tech, travel and banks the worst performing sectors. Here are the biggest European movers:

- AB InBev shares drop as much as 4.5%, the most since July, after the world’s largest brewer reported its first volume decline since the early days of the pandemic

- Haleon shares declined as much as 4.5% after posting mixed results, with analysts saying a solid sales performance for the consumer health group is offset by weaker margins

- Schroders shares slip as much as 4.6%, the most since December, with analyst saying the UK investment manager’s results showed small misses across a number of key areas

- Merck KGaA falls as much as 3.9% after the German life science and pharma group posted a fourth-quarter earnings miss for 2022, along with guidance that analysts say would disappoint

- ITV shares decline as much as 4.3% after the UK broadcaster offered a bleak advertising revenue outlook for the first four months of the year

- Beazley drops as much as 9.1%, the most since September 2020, after the insurer reported results which Morgan Stanley says were a miss on the company’s topline growth

- Flutter shares drop 6.6% in Dublin as the betting company’s full-year earnings missed consensus estimates, though analysts say the outlook for 2023 remains positive

- CRH jumps as much as 12%, to a record high, after reporting results that beat expectations and recommending transitioning to a US primary listing in 2023

- National Express shares surge as much as 15%, the most since March, with RBC saying the underlying performance for the UK transport operator is encouraging

- Subsea 7 shares rise as much as 6.7% with analysts saying the oil services company’s earnings are a significant beat and its commentary on the outlook is encouraging

- M&G shares rise as much as 4.8% after Sky News reported that Macquarie is weighing a takeover of the UK fund manager

- Ambu rises as much as 7.1% following an upgrade to buy from hold by DNB, which says the Danish medical technology firm may be closing in on an inflection point

As BBG's Heather Burke notes, European stocks have faced pressure from rising bond yields, exacerbated by muted cyclical outlooks and a cost-of-living crisis weighing on consumer staples. While European companies are posting healthy earnings, cyclical sectors like industrials, materials and consumer discretionary showing weak EPS trends, Morgan Stanley noted. Covestro warned 2023 profits will be sharply lower because of high energy costs. The chemical and materials firm isn’t paying a 2022 dividend after earnings halved due to soaring input costs. While Clariant sees raw material costs falling as some supply issues ease, the chemicals company is still one of today’s biggest decliners, with analysts noting a deteriorating EBITDA margin. Puma sank on Wednesday after forecasting slower profit growth. There’s also concern in markets that pinched consumers are getting tired of paying higher prices for branded goods and that’s feeding through into earnings. AB InBev reported its first volume decline since the early days of the pandemic.

Earlier in the session, Asian stocks fell, with a rally in Chinese shares losing steam as traders lowered expectations for further stimulus on signs the nation’s economy is improving. The MSCI Asia Pacific Index dropped as much as 0.6%, driven by declines in major Chinese internet companies. Hong Kong led losses around the region, while onshore China shares edged lower after gains Wednesday on strong manufacturing data. South Korean stocks climbed after a holiday. A faster-than-expected recovery in the Chinese economy is seen suggesting that the government may be restrained in rolling out new stimulus measures this year. That’s tempering expectations for more supportive policies from a meeting of the nation’s top political leaders starting this weekend. “This year will see what we call the ‘holding bottom’ policies” in China, said Yifan Hu, regional chief investment officer and head of APAC macroeconomics at UBS Global Wealth Management, in a Bloomberg TV interview. “Maybe we won’t have a strong stimulus package coming out at once, but we think that this year if the economy is down, the government will continue pumping up supportive policy.” The MSCI Asian benchmark fell nearly 6% in February, pushing it below its 50-day moving average.

Asian stocks have been hit by concerns of rising US interest rates as well as uncertainty over China’s economy. Investors have stayed positive on Asian stocks despite recent weakness, and February’s declines are best viewed as post-rally corrections, according to Goldman Sachs Group Inc. Investors apart from hedge funds are still conservatively positioned, implying potential demand to propel markets higher, strategists including Timothy Moe wrote in a note

Japanese equities dropped, erasing earlier gains, as investors assessed the potential for reduced China stimulus after strong economic data as well as hot US inflation that could prompt further Fed rate hikes. The Topix fell 0.2% to close at 1,994.57, while the Nikkei declined 0.1% to 27,498.87. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix decline, decreasing 1%. Out of 2,160 stocks in the index, 881 rose and 1,161 fell, while 118 were unchanged. “While the conversation around China’s recovery has been positive for Japanese stocks, concerns around further monetary tightening in the US and Europe have created some risk-off sentiment,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management. “Japanese equities are stuck in between.”

Australian stocks were little changed with the S&P/ASX 200 index closing at 7,255.40, as gains in mining and energy shares were offset by losses in all other sectors. Approvals to build new homes in Australia fell by the most on record in January, with permits for private houses tumbling, suggesting weak residential property investment will continue to drag on the economy. A gauge of real estate shares closed 0.5% lower to its lowest level since Jan. 11. In New Zealand, the S&P/NZX 50 index rose 0.2% to 11,900.86.

Stocks in India resumed their slide with the benchmark index posting its ninth decline in 10 sessions as rising rates and slowing economic growth roil global equities. The S&P BSE Sensex fell 0.8% to 58,909.35 in Mumbai, while the NSE Nifty 50 Index declined 0.7% on Thursday. Fourteen of BSE Ltd.’s 20 sector sub-gauges ended lower, led by an index of telecom, media and technology companies. Software services exporters and banks, which constitute half the weight in key gauges, were also among the worst performers. Infosys declined 1.6%, contributing most to Sensex’s decline. For every gainer in the 30-stock Sensex, four declined

The Dollar Index is up 0.3%, rising against all its G-10 counterparts. The Norwegian krone and New Zealand dollar are the weakest. Crude futures advance with WTI rising roughly 0.6% to trade near $78.15. Spot gold falls around 0.2% to trade near $1,832.

In rates, treasuries were mostly cheaper across the curve led by the long-end, fading portion of prior two-day flattening move. Treasury yields cheaper by as much as 2bp-3bp across 30-year sector with 2s10s, 5s30s spreads steeper by 2bp and 1.6bp on the day; 10-year yields trade just above 4% after rising as high as 4.046%, trailing bunds by 2bp, gilts by 3bp in the sector.

In commodities, crude futures advance with WTI rising roughly 0.6% to trade near $78.15. Spot gold falls around 0.2% to trade near $1,832.

Looking to the day ahead at 8:30 a.m., we’ll get initial jobless claims data. Federal Reserve Governor Chris Waller speaks at 2 p.m., while Minneapolis Fed President Neel Kashkari will deliver remarks at a separate event at 6 p.m. The US will sell $75 billion of four-week and $40 billion of eight-week bills at 11:30 a.m. Finally, earnings releases include Costco.

Market Snapshot

- S&P 500 futures down 0.5% to 3,936.25

- MXAP down 0.3% to 159.63

- MXAPJ down 0.3% to 519.53

- Nikkei little changed at 27,498.87

- Topix down 0.2% to 1,994.57

- Hang Seng Index down 0.9% to 20,429.46

- Shanghai Composite little changed at 3,310.65

- Sensex down 0.8% to 58,923.29

- Australia S&P/ASX 200 little changed at 7,255.36

- Kospi up 0.6% to 2,427.85

- STOXX Europe 600 down 0.2% to 456.70

- German 10Y yield little changed at 2.75%

- Euro down 0.3% to $1.0632

- Brent Futures up 0.6% to $84.78/bbl

- Gold spot down 0.2% to $1,833.03

- U.S. Dollar Index up 0.20% to 104.70

Top Overnight News from Bloomberg

- ECB President Christine Lagarde said interest-rate increases may need to persist beyond a planned half-point move in two weeks’ time

- UK Chancellor of the Exchequer Jeremy Hunt will offer voters a dollop of optimism alongside well-flagged spending restraint in his spring Budget as he tries to curb inflation, one of his junior ministers said

- The BOJ is leaning toward monitoring the impact of recent tweaks to its stimulus program rather than making another adjustment at Governor Haruhiko Kuroda’s final policy meeting next week, according to people familiar with the matter

- BOJ Board Member Hajime Takata says that the bank needs to continue with monetary easing persistently while considering its impacts on the functioning of the financial market

- China’s economy is recovering faster than top officials had expected with its Covid outbreak on reopening passing rapidly, according to a person familiar with the matter, suggesting the government will be restrained in rolling out new stimulus measures this year

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were choppy and mostly traded rangebound after the uninspiring handover from Wall Street where risk appetite was hampered by the latest ISM data and hawkish Fed rhetoric. ASX 200 was indecisive as weakness in the financial, tech and consumer sectors offset the resilience in commodity-related industries, with sentiment not helped by a slump in building approvals. Nikkei 225 failed to sustain early advances with the index stuck around the 27,500 level after data showed Japanese recurring profits declined Y/Y for the first time in eight quarters. Hang Seng and Shanghai Comp. were mixed with underperformance in Hong Kong as investors booked profits from yesterday’s tech-led rally, while sentiment in the mainland was clouded by several weak earnings and ongoing frictions as the US was reportedly lobbying allies on possible China sanctions should Beijing provide Russia with military aid in Ukraine.

Top Asian News

- China may aim for a higher 2023 GDP growth target than the 4.5%-5.5% proposed in November, while its target could range between 5.0%-5.5% and be as high as 6.0%, according to sources involved in policy discussions cited by Reuters.

- China's Human Resources Minister said China's employment will continue to improve this year and remains stable overall, while the minister added China's employment is better than expected for January-February, according to Reuters.

- US State Department approved the potential sale of F-16 munitions and related equipment to Taiwan for an estimated cost of USD 619mln, according to the Pentagon.

- China and Australian trade officials are set to continue their "productive dialogue" with negotiations expected to pave the way for an eventual visit to Beijing by Australia's Farrell, via SCMP sources; however, there was reportedly a "snag" in talks.

- China is reportedly pledging USD 1.9bln toward the country's top memory chipmaker Yangtze Memory Technologies, according to Bloomberg sources.

- BoJ is said to prefer watching how the impact of earlier policy tweaks works out for now, according to Bloomberg sources. Note, this echoes earlier commentary from BoJ's Takata who said he does not see a need now to take additional steps to improve market function, will need some time to gauge impact of the December measures.

European bourses are softer across the board, Euro Stoxx 50 -0.5%, though off lows with limited reaction to EZ HICP ahead of minutes/Schnabel. Sectors are mixed with Construction names outperforming post-CRH while Real Estate is recouping from recent pressure after Taylor Wimpey's FY update. Stateside, futures are under similar pressure, ES -0.5%, though the NQ -0.7% lags as yields continue to rise.

Top European News

- G-20 Latest: Consensus Emerging on Wording on Russia’s War

- LSE Announces £750 Million Buyback From Refinitiv Investors

- Ukraine Latest: Missile Strike, Scholz Cautions China on Arms

- Scholz Warns China Not to Supply Russia With Weapons

- Flutter Shares Fall After Fans’ Winning Bets Undermine Profit

FX

- Higher yields help Dollar recover from midweek malaise, DXY firmer within 104.830-330 range.

- Yuan hands back some post-Chinese PMI upside, as USD/CNY and USD/CNH rebound through 6.9000 and retest 200 DMAs.

- Kiwi loses momentum irrespective of a surprise rise in NZ terms of trade and Aussie undermined by much weaker than forecast building approvals.

- Euro and Pound retreat vs bouncing Buck as former shrugs off hot EZ inflation data and latter heeds softer DMP CPI expectations and DUP doubts over NI trade pact

- PBoC set USD/CNY mid-point at 6.8808 vs exp. 6.8809 (prev. 6.9400)

Fixed Income

- Core benchmarks remain softer on the session despite a pause for breath before and ultimately after the EZ HICP metrics, Bunds currently lower to the tune of just 15 ticks.

- On the data, EGBs came under pressure given the hawkish numbers; though, Bunds ultimately held above their earlier 131.31 low and the associated 10yr yield has eased from a 2.77% peak.

- Gilts are directionally in-fitting with EZ peers with Gilts little changed ahead of commentary from BoE's Pill and Tenreyro after the DMP was broadly in-fitting with recent data/Bailey.

- USTs are similarly softer with yields steeper across the curve though action is more pronounced at the long-end thus far with Fed's Waller and Kashkari due.

Commodities

- Crude benchmarks are firmer intraday after a stronger settlement on Wednesday, action comes after APAC consolidation and with attention on increasing geopolitical risk amid reports of Ukrainian DRG activity within Russia.

- Currently, WTI Apr and Brent May are at the top-end of circa. USD 1/bbl parameters.

- Saudi Aramco CEO sees very strong oil demand from China and excellent demand in US and Europe.

- Oman's energy ministry is to offer new oil and gas concessions, to be announced in the end of Q1 2023; to offer offshore oil and gas concessions in Q2 2023.

- Dutch TTF and Henry Hub are diverging very modestly, with TTF slipping further below EUR 50/MWh this morning.

- Spot gold is a touch softer as the USD continues to benefit from markedly elevated yields and risk sentiment, with the yellow metal seemingly unable to glean any support from the tone thus far.

Geopolitics

- US is reportedly lobbying allies on possible China sanctions if Beijing gives Russia military aid in Ukraine, according to Reuters citing sources.

- "Reports that a Ukrainian DRG group has entered Bryansk oblast, Russia...reports that Ukrainian soldiers have captured inhabitants in the village of Sushany.", according to Faytuks News. Subsequently, Military administration in Odessa says "No Ukrainian forces infiltrated into Russian Bryansk, and perhaps Wagner took the hostages", according to Al Jazeera.

- In the wake of this, Russian Lawmakers say President Putin is to chair an emergency meeting of the Russian Security Council, following the Bryansk events.. The Kremlin subsequently pushed back on this and clarified that Russian President Putin will chair a security council meeting on Friday.

- Israel's Minister for Strategic Affairs and National Security Adviser are expected to visit Washington early next week for meetings with senior Biden administration officials that will focus on Iran, according to Axios citing officials.

US Event Calendar

- 08:30: Feb. Continuing Claims, est. 1.67m, prior 1.65m

- 08:30: 4Q Unit Labor Costs, est. 1.6%, prior 1.1%

- 08:30: 4Q Nonfarm Productivity, est. 2.5%, prior 3.0%

- 08:30: Feb. Initial Jobless Claims, est. 195,000, prior 192,000

Central Bank Speakers

- 14:00: Fed’s Waller Discusses the Economic Outlook

- 18:00: Fed’s Kashkari Discusses Race, Justice and the Economy

DB's Jim Reid concludes the overnight wrap

Markets got the month off to a rough start yesterday, with the S&P 500 (-0.47%) down to its lowest level in nearly six weeks, whilst the 10yr Treasury yield moved above 4% intraday for the first time since November. That was thanks to several data releases pointing to further inflationary pressures, coupled with a series of hawkish remarks from central bankers. In turn, that led to the familiar pattern of investors pricing in a more aggressive path of rate hikes, with expectations for the Fed’s terminal rate hitting a new high for this cycle of 5.47%.

In terms of the specifics, the bond selloff began from the open after the regional German inflation prints showed an acceleration in price growth. Later in the session, that was then confirmed by the national figures, with German CPI unexpectedly rising to +9.3% in February on the EU-harmonised measure (vs. +9.0% expected). That also comes on the back of upside surprises in the French and Spanish numbers the previous day, so it’s clear that this is broader than just one country.

Then in the US, we had the ISM manufacturing print for February. The headline indicator was much as expected at 47.7 (vs. 48.0 expected), marking a fourth consecutive month in contractionary territory. However, the prices paid component rose to 51.3 (vs. 46.5 expected), which is the first time since September that it’s been above the 50-mark that indicates an increase.

With all that in mind, there was another significant bond selloff over the last 24 hours, following on the heels of one of the worst February performances in decades. For instance, the 10yr Treasury yield rose +7.3bps to 3.99%, having surpassed the 4% mark at one point in trading for the first time since November. And overnight it’s risen another +2.6bps to 4.02%. There were also some new records at the front-end, with the 2yr yield up +6.1bps to a new post-2007 high of 4.876%. The main driver behind this was rising inflation expectations rather than real rates, with the 2yr breakeven up another +6.7bps to 3.248%, which is its highest level since July, and speaks to growing concern about the US inflation outlook over the next couple of years.

This backdrop of growing concerns about inflation meant that Fed funds futures priced their most aggressive path of interest rate hikes to date, with the terminal rate up to a new high for the cycle of 5.471% yesterday, which has been followed up by another rise overnight to 5.483%. We also saw pricing for the next meeting on March 22 reach a new high, with +31.2bps worth of hikes now priced in, which implies nearly a 25% probability of a 50bp move at that meeting. Speaking of that hike, we heard from Minneapolis Fed President Kashkari yesterday, who said that “I’m open-minded, at this point, about whether it’s 25 or 50 basis points”, and that the more important question was the signal in the dot plot, rather than the size of the next hike. Separately, Atlanta Fed President Bostic said in an online essay that “I think we will need to raise the federal funds rate to between 5 and 5.25 percent and leave it there until well into 2024”. That’s actually a lower terminal rate than markets are now pricing. But he made the more hawkish comment that “history teaches that if we ease up on inflation before it is thoroughly subdued, it can flare anew. That happened with disastrous results in the 1970s.”

As all that was happening, we had a fresh round of signals that higher rates were filtering through to the real economy, since the MBA’s index of mortgage applications for home purchases fell to its lowest level since 1995. That covered the week ending February 24, which also saw the contract rate on a 30yr mortgage hit its highest level since mid-November, at 6.71%.

Back in Europe, all eyes today are on the Euro Area CPI print, which is out at 10am London time. But concerns have already been growing ahead of that thanks to the higher-than-expected country releases from Germany, France and Spain. In fact, yesterday saw the 10yr bund yield (+6.0bps) close above 2.7% for the first time since 2011, alongside similar moves for 10yr OATs (+6.9bps) and 10yr BTPs (+8.7bps). Those moves were also supported by some hawkish remarks from Bundesbank President Nagel, who said on QT that he was “in favour of taking a steeper path of reduction starting in July”. On the question of rate hikes, he said that the hike “announced for March will not be the last. Further significant interest-rate steps might even be necessary afterwards, too.” So implying that the ECB could maintain their 50bps pace beyond just the next meeting two weeks from now.

This selloff on the rates side proved a tough backdrop for equities, with the S&P 500 posting a -0.47% decline by the close. Energy (+1.9%) and Materials (+0.7%) outperformed on the back of higher commodity prices, while bond proxies followed the selloff in rates with Utilities (-1.7%) and Real Estate (-1.5%) among the worst-performing industries. Over in Europe there were even larger moves, with the STOXX 600 down -0.74% to hit a 3-week low of its own. There were only two Stoxx 600 sectors up on the day as Basic Resources (+2.2%) and Autos (+0.9%) gained.

The aforementioned commodity rally saw WTI and Brent Crude prices increase +0.83% and 0.63% to $77.69/bbl and $84.42/bbl. Metals also rallied with copper up 1.72% and gold gaining 0.54%. Overall the Bloomberg commodity index rose +1.07%, to gain for a third consecutive session.

After the US close, the US Senate voted to block a Biden administration rule that sought to have retirement plans consider ESG issues in their investment decisions. The House voted 216-204 and the Senate voted 50-46 to block the federal agency rule. However, the White House has already signalled that President Biden would veto the override, arguing that fiduciaries should “have the fullest set of available tools to protect their life savings and pensions. “

Overnight in Asia, equity markets are struggling to gain traction this morning as concerns over higher interest rates persist. The Hang Seng (-0.61%) is trading in negative territory, whilst the Nikkei (+0.02%), the CSI 300 (-0.09%) and the Shanghai Comp (+0.06%) are all roughly flat. The KOSPI is outperforming however, with a +0.67% advance. Looking forward, futures are indicating that negative tone will continue, with those on the S&P 500 down -0.44% overnight. And we’ve seen further losses for bonds too, with the 2yr Treasury yield up another +4.2bps overnight to a post-2007 high of 4.92%.

Here in the UK, gilts were a relative outperformer yesterday, with the 10yr yield only up by +1.2bps, albeit still to their highest level since Liz Truss was PM. That followed comments from BoE Governor Bailey, who said in a speech that “I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more”. This was interpreted in a dovish light by investors, with the amount of further hikes priced by year-end falling to +75.6bps, down by -9.5bps on the day. Separately, data also showed that UK mortgage approvals had fallen to 39.6k in January (vs. 38.5k expected), which is their lowest level since May 2020 at the height of the Covid-19 pandemic. Indeed, apart from April and May 2020, it hasn’t been that low since January 2009 during the GFC.

To the day ahead now, and data releases include the Euro Area flash CPI release for February, along with the US weekly initial jobless claims. From central banks, we’ll get the ECB’s account of their February meeting, as well as remarks from the Fed’s Waller and Kashkari, the ECB’s Schnabel and the BoE’s Pill. Finally, earnings releases include Costco.