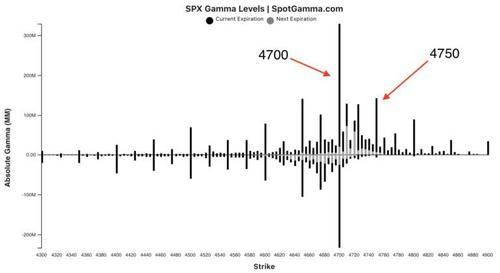

Futures Rise To 4,700 “Max Gamma” As Oil Slide Accelerates

Futures Rise To 4,700 "Max Gamma" As Oil Slide Accelerates

U.S. index futures rose again, trading on top of the massive 4700 "max gamma" level despite downbeat data out of Chinese tech names, as investors awaited the latest batch of unemploym

U.S. index futures rose again, trading on top of the massive 4700 "max gamma" level despite downbeat data out of Chinese tech names, as investors awaited the latest batch of unemployment data and taking comfort from signals that central banks will stay far behind the curve and keep pledges to overlook faster inflation rather than rush into rate hikes.

European stocks were steady and Asian equities fell as Chinese tech stocks tumbled after poor results from Baidu and Bilibili. Treasury yields edged higher, the dollar was little changed and gold declined. Bitcoin retreated for a fifth straight day. Oil prices skidded to a six-week low on concern about a supply overhang and the prospect of China, Japan and the United States dipping in to their fuel reserves, with Brent futures last at $79.77, more than 8% off last month's three-year high. Nasdaq futures rose 86.25 points or 0.53% outperforming S&P 500 futs which were up 11.50 points or 0.25% to 4697.75, after chip giant Nvidia jumped 7% after a sales forecast by the world’s largest chipmaker.

Elsewhere in premarket trading, Cisco dropped 6.6% after the computer networking equipment group’s growth and earnings forecast fell short of expectations while Alibaba slid after reporting sales that missed analyst estimates for a second straight quarter. Some other notable premarket movers:

- EV makers are mixed in U.S. premarket trading, with Rivian Automotive (RIVN US), Lucid (LCID US) and Canoo (GOEV US) all declining and newly-listed Sono (SEV US) extending its bounce

- Nvidia (NVDA US) shares gain 7% in U.S. premarket trading, with analysts saying the chipmaker delivered a strong enough quarter to justify its punchy valuation

- Amtech (ASYS US) fell 22% in post-market trading after reporting fourth quarter revenue that missed estimates from two analysts. The semiconductor stock has risen 139% this year through Wednesday’s trading.

- Kraft Heinz (KHC US) fell 1.6% in postmarket trading on Wednesday after announcing one of its top holders was selling a portion of its stake.

- Victoria’s Secret (VSCO US) shares gain 13% in U.S. premarket trading as analysts highlight “better-than- feared” 3Q results for the lingerie retailer.

- JD.com (JD US) shares advanced 2.2% premarket after it reported net revenue for the third quarter that beat the average analyst estimate.

“While companies are managing to report solid third-quarter numbers, the ability to do so is being tempered by concerns about slimmer margins,” said Michael Hewson, chief market analyst at CMC Markets in London. “One positive thing, aside from the concern over rising inflation, has been the resilience of labor markets, on both sides of the Atlantic.”

The Stoxx Europe 600 Index was little changed with most cash indexes giving back early gains or losses to trade flat as travel and consumer companies gained while the energy and minings industries retreated. FTSE 100 underperformed slightly. Oil & gas was the weakest sector followed by mining stocks. European metals and mining stocks fall 0.8%, the second worst performing sub-index on the benchmark Stoxx 600, amid sinking iron ore futures and copper prices. Iron ore retreated as investors weighed a top producer’s forecasts of a balanced market next year and the impact on miners amid a price collapse in recent months. Diversified miners drop, Glencore -0.8%, Anglo American -1%, BHP -0.7%, Rio Tinto -1.1%; the four stocks account for more than 60% of the SXPP.

Earlier in the session, Asian stocks fell, on track for a second day of losses, as Baidu helped lead a slump in Chinese technology giants. The MSCI Asia Pacific Index dropped as much as 0.4%, extending its two-day slide to about 0.9%. The Hang Seng Tech Index lost about 3%, as search engine giant Baidu tumbled on worries over the advertising outlook and video-streaming firm Bilibili dropped after posting a larger-than-expected loss. Hong Kong’s Hang Seng Index and China’s CSI 300 benchmark were the worst performing national benchmarks Thursday, while Taiwan’s Taiex managed a small gain. Alibaba also fell, ahead of its highly awaited earnings report later today that may show the impact of Beijing’s regulatory curbs. Japan's Nikkei was down 0.6% in early trade.

"We do seem to have stalled somewhat as we head into the year end," said Jun Bei Liu, a portfolio manager at Tribeca Investment Partners in Sydney. "Investors perhaps are just taking a bit of pause," she said, in the wake of a strong U.S. results season, but as inflation and China's slowdown loom as macroeconomic headwinds.

“With a bout of earnings having been released and put behind the market, we’re in an environment where investors are inclined to take profits,” said Takashi Ito, an equity market strategist at Nomura Securities in Tokyo. “Investors are likely to cherry pick stocks that have high earnings and ROE and have strong momentum for growth.” The region’s equities are now poised for a weekly drop after wiping out gains from earlier this week. Anxiety over global inflation has weighed on sentiment as investors search for clues on when central banks will start raising interest rates. Indonesia and the Philippines kept borrowing costs unchanged, as expected, to aid two economies that bore the brunt of Covid-19 outbreaks in Southeast Asia this year.

In rates, treasuries were slightly cheaper across long-end of the curve after S&P 500 and Nasdaq 100 futures breached Wednesday’s highs. Yields are higher by ~1bp in 30-year sector, with 2s10s steeper by ~1bp, 5s30s by ~0.5bp; 10-year is ~1.60%, trailing bunds by ~2bp as traders push back on ECB rate-hike pricing. Focal points Thursday include several Fed speakers and a potentially historic 10-year TIPS auction at 1pm ET - at $14BN, the 10Y TIPS reopening is poised to draw a record low yield near -1.14%; breakeven inflation rate at ~2.71% is within 7bp of Monday’s YTD high. Elsewhere, Gilts outperformed richening ~2.5bps across the curve. Peripheral spreads tighten, semi-core widens marginally.

In FX, the U.S. dollar erased an earlier modest loss and was flat, with majors mostly range-bound. Treasury yields stabilized from overnight declines; the greenback traded mixed versus its Group-of-10 peers, though most were confined to tight ranges, New Zealand’s dollar led G-10 gains after two-year ahead inflation expectations rose to 2.96% in the fourth quarter from 2.27% in the third, according to survey of businesses published by the Reserve Bank of New Zealand. Support in euro- Swiss franc at 1.0500 holds for now and consolidation for risk reversals this week suggests that a breach of the key level may not see a big follow through. The pound inched up and is on its longest winning streak in nearly seven months after this week’s jobs and inflation data fueled confidence that the Bank of England will hike rates.

The Turkish lira plunged to a new all time low, with the USDTRY rising to 10.93 after the central bank cut rates by 100bps.

Currency traders are also assessing a sharp downdraft in the Aussie/yen cross, often a barometer of market sentiment. It fell through its 200-day moving average on Tuesday and has lost almost 4% in a dozen sessions .

"You've got the perfect storm there for bears," said Matt Simpson, senior analyst at brokerage City Index. "Fundamentally and technically Aussie/yen looks pretty good with lower oil prices."

In commodities, crude futures remained in the red but bounce off worst levels as the potential for SPR releases remains center stage. WTI finds support near $77, recovering toward $78; Brent regains a $80-handle. Spot gold gives back Asia’s small gains, dropping ~$7 to trade near $1,860/oz. Base metals trade poorly, LME zinc and lead underperform.

Looking at the day ahead now, and data releases from the US include the weekly initial jobless claims, the Philadelphia Fed’s business outlook for November, the Kansas City Fed’s manufacturing index for November, and the Conference Board’s leading index for October. Central bank speakers include PBoC Governor Yi Gang, the ECB’s Centeno, Panetta and Lane, and the Fed’s Bostic, Williams, Evans and Daly. There’ll also be a number of decisions from EM central banks, including Bank Indonesia, the Central Bank of Turkey and the South African Reserve Bank. Finally, earnings releases include Intuit, Applied Materials and TJX.

Market Snapshot

- S&P 500 futures up 0.4% to 4,703.25

- STOXX Europe 600 up 0.1% to 490.50

- MXAP down 0.3% to 199.31

- MXAPJ down 0.6% to 650.79

- Nikkei down 0.3% to 29,598.66

- Topix down 0.1% to 2,035.52

- Hang Seng Index down 1.3% to 25,319.72

- Shanghai Composite down 0.5% to 3,520.71

- Sensex down 0.4% to 59,755.91

- Australia S&P/ASX 200 up 0.1% to 7,379.20

- Kospi down 0.5% to 2,947.38

- Brent Futures down 0.1% to $80.18/bbl

- Gold spot down 0.2% to $1,863.45

- U.S. Dollar Index little changed at 95.75

- German 10Y yield little changed at -0.26%

- Euro little changed at $1.1327

Top Overnight News from Bloomberg

- More Wall Street banks are wagering that the Federal Reserve will hike rates at a faster-than-expected pace, with Citigroup Inc. joining Morgan Stanley in backing trades that will profit if the central bank does just that

- China is releasing some oil from its strategic reserves days after the U.S. invited it to participate in a joint sale, suggesting the world’s two biggest oil consumers are willing to work together to keep a lid on energy costs

- European countries are increasingly forcing reluctant companies to let employees work from home in an effort to break the rapidly spreading fourth wave of the coronavirus pandemic

A more in depth look at global markets courtesy of Newsqauwk

Asia-Pac stocks traded mostly negative with sentiment in the region subdued amid a lack of significant macro drivers and following the uninspired lead from the US - where the major indices finished a choppy session in the red and the DJIA gave up the 36k status. Nonetheless, the ASX 200 (+0.1%) remained afloat with notable strength in gold miners, as well as some consumer stocks, although advances in the index were limited by losses in the financial and energy sectors after similar underperformance stateside amid a decline in yields and oil prices. The Nikkei 225 (-0.3%) was initially dragged lower by unfavourable currency inflows which overshadowed reports that Japan wants to enhance tax breaks for corporations that raise wages, while shares in Eisai were hit after EU regulators placed doubts regarding the approval of Co. and Biogen’s co-developed Alzheimer’s drug and SoftBank also declined after the US regulator raised concerns regarding Nvidia’s acquisition of Arm. However, the index then briefly returned flat in late trade on reports that the Japanese stimulus package is to require JPY 55.7tln of fiscal spending which is higher than the previously speculated of around JPY 40tln. The Hang Seng (-1.3%) and Shanghai Comp. (-0.5%) weakened after another liquidity drain by the PBoC and with the declines in Hong Kong exacerbated by tech selling, while the losses in the mainland were to a lesser extent with China said to be mulling additional industrial policies aimed to support growth and SGH Macro sources suggested the US and China agreed there would be some substantial progress on trade such as the removal of some punitive tariffs by the US and increased purchases of US products by China, although the report highlighted that it was unclear if this would be from a high-profile announcement or a discrete relaxing of tariffs. Finally, 10yr JGBs were initially flat as prices failed to benefit from the subdued risk appetite in Japan and rebound in global peers, while firmer metrics at the 20yr JGB bond auction provided a mild tailwind in late trade although the support was only brief and prices were then pressured on news of the potentially larger than anticipated fiscal spending in PM Kishida's stimulus package.

Top Asian News

- China Property Stocks Sink, $4.2 Billion Rush: Evergrande Update

- Japan’s Kishida Eyes Record Fiscal Firepower to Boost Recovery

- China Property Firm Shinsun’s Shares and Bonds Slump

- JD.com Sales Beat Estimates as Investments Start to Pay Off

Major bourses in Europe are choppy, although sentiment picked up following a subdued APAC session but despite a distinct lack of fresh catalysts. US equity futures have also been grinding higher in early European hours, with the NQ (+0.6%) outpacing the ES (+0.3%), RTY (+0.2%) and YM (+0.2%). Back to European cash – broad-based gains are seen across the Euro bourses – which lifted the CAC, DAX and SMI to notch record intraday highs, whilst upside in the UK's FTSE 100 (-0.2%) has been hampered by hefty losses in today's lagging sectors– the Energy and Basic Resources - amid price action in the respective markets. Tech names also see a strong performance thus far as chip names cheer NVIDIA (+6% pre-market) earnings yesterday. Overall, sectors have maintained a similarly mixed picture vs the cash open, with no overarching theme. In terms of individual movers, Swatch (+2.8%) and Richemont (+0.6) piggyback on the increase in Swiss Watch Exports vs 2020 and 2019. Metro Bank (-20%) plumbed the depths after terminating takeover talks with Carlyle.

Top European News

- Royal Mail Hands Investors $540 Million Amid Parcel Surge

- German Coalition Plans Stricter Rent Increase Regulation: Bild

- HSBC Sees ECB Sticking With Easy Stance Despite Record Inflation

- Astra Covid Antibody Data Shows Long-Lasting Protection

In FX, the Kiwi has extended its recovery on heightened RBNZ tightening expectations prompted by significant increases in Q4 inflation projections, with some pundits now assigning a greater probability to the OCR rising 50 bp compared to the 25 bp more generally forecast and factored in. Nzd/Usd is eyeing 0.7050 and the 50 DMA just above (at 0.7054 today) having breached the 100 DMA (0.7026), while the Aud/Nzd cross is probing further below 1.0350 even though the Aussie has found some support into 0.7250 against its US rival and will be encouraged by news that COVID-19 restrictions in the state of Victoria are on the verge of being completely lifted.

- GBP/EUR/DXY - Notwithstanding Kiwi outperformance, the Dollar has lost a bit more of its bullish momentum to the benefit of most rivals, and several of those that compose the basket. Indeed, Cable has popped above 1.3500, while the Euro is looking more comfortable on the 1.1300 handle as the index retreats further from Wednesday’s new y-t-d peak and away from the psychological 96.000 level into a 95.840-642 range. Ahead, IJC and Philly Fed are due amidst another decent slate of Fed speakers, while Eur/Usd will also be eyeing the latest ECB orators for some direction and Eur/Gbp is back around 0.8400 where decent option expiry interest resides (1.1 bn), but perhaps more focused on latest talks between the UK and EU on the NI dispute.

- CHF/CAD/JPY - The Franc has pared more declines vs the Buck from sub-0.9300 and remains firm against the Euro near 1.0500 in wake of Swiss trade data showing a wider surplus and pick-up in key watch exports, but the Loonie looks a bit hampered by a more pronounced fall in the price of oil as the US calls on other countries for a concerted SPR tap and China is said to be working on the release of some crude stocks. Usd/Cad is tethered to 1.2600 and highly unlikely to threaten 1.1 bn option expiries at the 1.2500 strike in contrast to the Yen that stalled above 114.00 and could be restrained by 1.4 bn between 113.90 and the round number or 1.3 bn from 114.20-25, if not reports that Japan’s stimulus package may require Jpy 55.7 tn of fiscal spending compared to Jpy 40 tn previously speculated.

In commodities, WTI and Brent front-month futures are off worst levels but still under pressure amid the prospect of looming crude reserves releases, with reports suggesting China is gearing up for its own release. There were also prior source reports that the US was said to have asked other countries to coordinate a release of strategic oil reserves and raised the oil reserve release request with Japan and China. Furthermore, the US tapping of the SPR could be either in the form of a sale and/or loan from the reserve, and the release from the reserve needs to be more than 20mln-30mln bbls to get the message to OPEC, while a source added that the US asked India, South Korea and large oil-consuming countries, but not European countries, to consider oil reserve releases after pleas to OPEC failed. This concoction of headlines guided Brent and WTI futures under USD 80/bbl and USD 78/bbl respectively with early selling also experienced as European players entered the fray. On the geopolitical front, US National security adviser Jake Sullivan raised with his Israeli counterpart the idea of an interim agreement with Iran to buy more time for nuclear negotiations, according to sources. However, two American sources familiar with the call said the officials were just "brainstorming" and that Sullivan passed along an idea put forward by a European ally. Next, participants should continue to expect jawboning from the larger economies that advocated OPEC+ to release more oil. OPEC+ is unlikely to react to prices ahead of next month's meeting (barring any shocks). Elsewhere, spot gold and silver have been choppy within a tight range. Spot gold trades under USD 1,875/oz - with technicians flagging a Fib around USD 1,876/oz. Spot silver trades on either side of USD 25/oz. Base metals are on a softer footing amid the broader performance across industrial commodities – LME copper remains subdued under the USD 9,500/t level, whilst some reports suggest companies are attempting to arbitrage the copper spread between Shanghai and London.

US Event Calendar

- 8:30am: Nov. Initial Jobless Claims, est. 260,000, prior 267,000; Continuing Claims, est. 2.12m, prior 2.16m

- 8:30am: Nov. Philadelphia Fed Business Outl, est. 24.0, prior 23.8

- 9:45am: Nov. Langer Consumer Comfort, prior 50.3, revised 50.3

- 10am: Oct. Leading Index, est. 0.8%, prior 0.2%

- 11am: Nov. Kansas City Fed Manf. Activity, est. 28, prior 31

Central banks

- 8am: Fed’s Bostic Discusses Regional Outlook

- 9:30am: Fed’s Williams speaks on Transatlantic responses to pandemic

- 2pm: Fed’s Evans Takes Part in Moderated Q&A

- 3:30pm: Fed’s Daly takes part in Fed Listens event

DB's Jim Reid concludes the overnight wrap

After 9 weeks since surgery, yesterday I got the green light to play golf again from my consultant. Yippee. However he said that he’ll likely see me in 3-5 years to do a procedure called distal femoral osteotomy where he’ll break my femur and realign the leg over the good part of the knee. Basically I have a knee that is very good on the inside half and very bad on the outer lateral side. He’s patched the bad side up but it’s unlikely to last more than a few years before the arthritis becomes too painful. This operation would be aimed at delaying knee replacement for as long as possible! Sounds painful and a bit crazy! Meanwhile I also have a painful slipped disc in my back at the moment that I’m going to have an injection for to hopefully avoid surgery after years of managing it. As you might imagine from reading my posts last week I don’t get much sympathy at home at the moment for my various ailments. In terms of operations and golf I’m turning into a very very poor man’s Tiger Woods!

Markets have been limping a bit over the last 24 hours too as the inflation realities seemed to be a bit more in focus. Those worries were given additional fuel from the UK CPI release for October, which followed the US and the Euro Area in delivering another upside surprise, just as a number of key agricultural prices continued to show significant strength. Oil was down notably though as we’ll discuss below. To add to the mix, the latest global Covid-19 wave has shown no sign of abating yet, even if some countries are better equipped for it than others.

Starting with inflation, one of the main pieces of news arrived yesterday morning, when the UK reported that CPI came in at +4.2% year-on-year in October. That was above every economist’s estimate on Bloomberg, surpassing the +3.9% consensus expectation that was also the BoE’s staff projection in their November Monetary Policy Report. That’s the fastest UK inflation since 2011, and core inflation also surprised on the upside with a +3.4% reading (vs. +3.1% expected). In response to this, our UK economist (link here) is now expecting that CPI will peak at +5.4% in April, with the 2022 annual average CPI still at +4.2%, which is more than double the BoE’s 2% target. The release was also seen as strengthening the case for a December rate hike by the BoE, and sterling was the second best performing G10 currency after being top the day before in response, strengthening +0.45% against the US dollar.

Even as inflation risks mounted however, the major equity indices demonstrated an impressive resilience, with the STOXX 600 (+0.14%) rising for the 17th time in the last 19 sessions. This is the best such streak since June this year, when the index managed to increase 18 of 20 days. We’ll see if that mark is matched today That was a better performance than the S&P 500 (-0.26%). 342 stocks were in the red today, the most in three weeks. Energy (-1.74%) and financials (-1.11%) each declined more than a percent, on lower oil prices and yields, respectively. Real estate (+0.65%) and consumer discretionary (+0.59%) led the way, driven by a +3.25% increase in Tesla. In line with the broad-based retreat, small-caps continued to put in a much weaker performance, with the Russell 2000 shedding -1.16% as it underperformed the S&P for a 4th consecutive session.

Sovereign bonds also managed to advance yesterday, with yields on 10yr Treasuries (-4.5bps) posting their biggest decline in over a week, taking them to 1.59%. Declining inflation expectations drove that move, with the 10yr breakeven down -3.2bps to 2.71%, which was its biggest decline in over two weeks. For Europe it was a different story however, with yields on 10yr bunds only down -0.3bps, just as those on 10yr OATs (+0.1bps) and BTPs (+0.5bps) both moved higher. Most of the Treasury rally was after Europe closed though.

Those moves came against the backdrop of a fairly divergent performance among commodities. On the one hand oil prices fell back, with WTI (-2.97%) closing beneath $80/bbl for only the second time in the last month as speculation continued that the US would tap its strategic reserves. On the other hand, there was no sign of any relenting in European natural gas prices, which rose a further +0.79% yesterday to bring their gains over the last 7 days to +31.57%. That follows the German regulator’s decision to temporarily suspend certification for Nord Stream 2, which has added to fears that Europe will face major supply issues over the winter. And while we’re discussing the factors fuelling inflation, there were some fresh moves higher in agricultural prices as well yesterday, with wheat futures (+1.48%) hitting an 8-year high, and coffee futures (+4.75%) climbing to their highest level in almost a decade.

Central banks will be watching these trends closely. There’s still no word on who’s going to lead the Fed over the next 4 years, but yesterday’s news was that President Biden will make his pick by Thanksgiving. For those keeping track at home, on Tuesday the guidance was within the next four days. So, while it appears momentum toward an announcement is growing, take signaling of any particular day with a grain of salt. On the topic of the Fed, our US economists released their updated Fed outlook yesterday (link here) in which they brought forward their view of the expected liftoff to July 2022, with another rate increase following in Q4 2022. And although it’s not their base case, they acknowledge that incoming data could even push the Fed to speed up their taper and raise rates before June. They don’t see the choice of the next Fed Chair as having much impact on the broad policy trajectory, since inflation next year is likely to still be at high levels that makes most officials uncomfortable, plus the annual rotation of regional Fed presidents with an FOMC vote leans more hawkish next year. So that will constrain the extent to which a new chair could shift matters in a dovish direction, even if they wanted to.

Overnight in Asia stocks are trading mostly in the red outside of a flat KOSPI (+0.01%). The Shanghai Composite (-0.13%), CSI (-0.64%), Nikkei (-0.77%) and Hang Seng (-1.35%) are being dragged down by tech after a bout of Chinese IT companies missed earnings continuing a theme of this earnings season. Elsewhere in Japan, the Nikkei reported that the new economic stimulus package could be around YEN 78.9 tn ($691 bn). Prime Minister Fumio Kishida will announce the package on Friday. Elsewhere S&P 500 (+0.08%) and DAX futures (+0.01%) both fairly flat.

The House of Representatives is slated to begin debate on the Biden social and climate spending ‘build back better’ bill. Word from Congress suggested it could be tabled for a vote as soon as today, though the House has been as profligate missing self-imposed deadlines to vote on the bill as President Biden has been with the announcement of Fed Chair. In addition to the Build Back Better package, there’ll still be plenty of action in Congress over the next month, with another government shutdown looming on December 3, and then a debt ceiling deadline estimated on December 15. The House Budget Chair echoed Treasury Secretary Yellen’s exhortation, and urged Congress to raise the debt ceiling to avoid a government default. Treasury bills are pricing increasing debt ceiling uncertainty during December; yields on bills maturing from mid- to late-December are around double the yields of bills maturing in November and January.

Turning to the pandemic, cases have continued to rise at the global level over recent days, as alarm grows in a number of countries about the potential extent of the winter wave. In Germany, Chancellor Merkel and Vice Chancellor Scholz are taking part in a video conference with state leaders today on the pandemic amidst a major surge in cases. And Sweden’s government said that they planned to bring in a requirement for vaccine passports at indoor events with more than 100 people. In better news however, the UK’s 7-day average of reported cases moved lower for the first time in a week yesterday. Moderna also joined Pfizer in seeking emergency use authorization from the FDA for booster jabs of its Covid vaccines for all adults.

Looking at yesterday’s other data, US housing starts fell in October to an annualised rate of 1.520m (vs. 1.579m expected), whilst the previous months’ reading was also revised lower. Building permits rose by more than expected however, up to an annualised rate of 1.650m (vs. 1.630m expected). Finally, Canada’s CPI inflation reading rose to +4.7% in October as expected, marking the largest annual rise since February 2003.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, the Philadelphia Fed’s business outlook for November, the Kansas City Fed’s manufacturing index for November, and the Conference Board’s leading index for October. Central bank speakers include PBoC Governor Yi Gang, the ECB’s Centeno, Panetta and Lane, and the Fed’s Bostic, Williams, Evans and Daly. There’ll also be a number of decisions from EM central banks, including Bank Indonesia, the Central Bank of Turkey and the South African Reserve Bank. Finally, earnings releases include Intuit, Applied Materials and TJX.

Government

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Government

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While “Waiting” For Deporation, Asylum

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While "Waiting" For Deporation, Asylum

Over the past several…

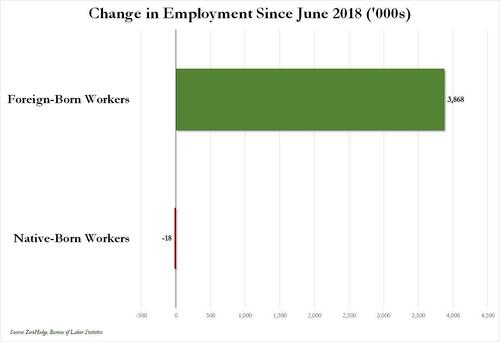

Over the past several months we've pointed out that there has been zero job creation for native-born workers since the summer of 2018...

... and that since Joe Biden was sworn into office, most of the post-pandemic job gains the administration continuously brags about have gone foreign-born (read immigrants, mostly illegal ones) workers.

And while the left might find this data almost as verboten as FBI crime statistics - as it directly supports the so-called "great replacement theory" we're not supposed to discuss - it also coincides with record numbers of illegal crossings into the United States under Biden.

In short, the Biden administration opened the floodgates, 10 million illegal immigrants poured into the country, and most of the post-pandemic "jobs recovery" went to foreign-born workers, of which illegal immigrants represent the largest chunk.

'But Tyler, illegal immigrants can't possibly work in the United States whilst awaiting their asylum hearings,' one might hear from the peanut gallery. On the contrary: ever since Biden reversed a key aspect of Trump's labor policies, all illegal immigrants - even those awaiting deportation proceedings - have been given carte blanche to work while awaiting said proceedings for up to five years...

... something which even Elon Musk was shocked to learn.

Wow, learn something new every day https://t.co/8MDtEEZGam

— Elon Musk (@elonmusk) March 10, 2024

Which leads us to another question: recall that the primary concern for the Biden admin for much of 2022 and 2023 was soaring prices, i.e., relentless inflation in general, and rising wages in particular, which in turn prompted even Goldman to admit two years ago that the diabolical wage-price spiral had been unleashed in the US (diabolical, because nothing absent a major economic shock, read recession or depression, can short-circuit it once it is in place).

Well, there is one other thing that can break the wage-price spiral loop: a flood of ultra-cheap illegal immigrant workers. But don't take our word for it: here is Fed Chair Jerome Powell himself during his February 60 Minutes interview:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants work hard, and Americans are lazy. But much more importantly, since illegal immigrants will work for any pay, and since Biden's Department of Homeland Security, via its Citizenship and Immigration Services Agency, has made it so illegal immigrants can work in the US perfectly legally for up to 5 years (if not more), one can argue that the flood of illegals through the southern border has been the primary reason why inflation - or rather mostly wage inflation, that all too critical component of the wage-price spiral - has moderated in in the past year, when the US labor market suddenly found itself flooded with millions of perfectly eligible workers, who just also happen to be illegal immigrants and thus have zero wage bargaining options.

None of this is to suggest that the relentless flood of immigrants into the US is not also driven by voting and census concerns - something Elon Musk has been pounding the table on in recent weeks, and has gone so far to call it "the biggest corruption of American democracy in the 21st century", but in retrospect, one can also argue that the only modest success the Biden admin has had in the past year - namely bringing inflation down from a torrid 9% annual rate to "only" 3% - has also been due to the millions of illegals he's imported into the country.

We would be remiss if we didn't also note that this so often carries catastrophic short-term consequences for the social fabric of the country (the Laken Riley fiasco being only the latest example), not to mention the far more dire long-term consequences for the future of the US - chief among them the trillions of dollars in debt the US will need to incur to pay for all those new illegal immigrants Democrat voters and low-paid workers. This is on top of the labor revolution that will kick in once AI leads to mass layoffs among high-paying, white-collar jobs, after which all those newly laid off native-born workers hoping to trade down to lower paying (if available) jobs will discover that hardened criminals from Honduras or Guatemala have already taken them, all thanks to Joe Biden.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex