Uncategorized

Futures Rise As Regional Banks Squeezed Higher

Futures Rise As Regional Banks Squeezed Higher

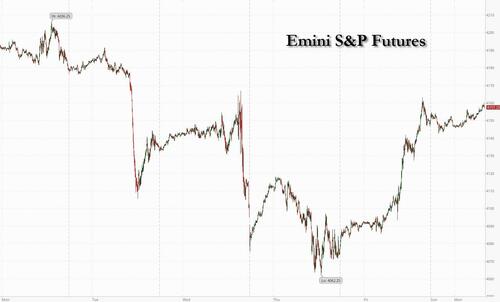

US stock futures reversed losses and traded near session highs as the squeeze in regional…

US stock futures reversed losses and traded near session highs as the squeeze in regional banks pushed stock prices higher despite another huge (unadjusted) deposit drop last week as investors assessed the outlook for the banking crisis while awaiting inflation figures due later this week for clues about the path of Federal Reserve policy. Contracts on the S&P 500 and Nasdaq 100 rose 0.2% at 735am ET. The underlying benchmarks had rallied 1.8% and 2.1% on Friday, respectively. Oil edged higher to start the week, while European markets rose and Chinese bank stocks soared. Japanese stocks fell as traders came back online after a holiday. Elsewhere, Janet Yellen warned the debt-limit impasse may trigger a constitutional crisis. And Warren Buffett says good times are coming to an end.

In premarket trading, Occidental Petroleum dropped after Warren Buffett said Berkshire Hathaway won’t make an offer for full control of the energy group. Meanwhile, PacWest Bancorp soared as much as 32%, extending Friday’s brisk rebound and leading gains in US regional banks as short were squeezed, after it slashed its quarterly dividend and said business remains “sound” even though clearly deposit outflow will continue as long as the Fed's QT continues. Tyson shares plunged as much as 10% in premarket trading Monday after cutting its sales guidance for the full year. The updated guidance also missed the average analyst estimate for the period. Cryptocurrency-exposed stocks slump as Binance restarted withdrawals of Bitcoin after citing congestion on the token’s blockchain for two halts in less than 12 hours. Marathon Digital (MARA US) -6.9%, Riot Platforms (RIOT US) -6.7%.

US stocks have tracked sideways since the beginning of April as as better-than-feared corporate earnings offset concerns around an economic slowdown and the health of regional banks. Unexpectedly strong jobs data Friday supported bets the Federal Reserve will hold rates high for longer, straining consumer spending, corporate profits and bank balance sheets. Despite Friday’s stock rebound, investors still have much to worry about. The rout in US bank shares has the S&P 500 financials index on the verge of falling back below its 2007 peak.

Meanwhile, Treasury Secretary Janet Yellen sees “simply no good options” for solving the debt limit stalemate in Washington without Congress raising the cap. She even cautioned that resorting to the 14th Amendment would provoke a constitutional crisis.

“We see a chance that Treasury’s cash amount is enough to sustain till mid-June and probably slightly beyond that,” Oversea-Chinese Banking Corp. strategists Frances Cheung and Christopher Wong wrote in a note. However, “the irregular nature of fiscal receipts and outlays shall render investors staying cautious,” they said.

Investors are monitoring turmoil in regional banks and the impact on the wider sector, with the S&P 500 financials index on the verge of falling back below its 2007 peak. Meanwhile, investors are looking forward to consumer-price data due on Wednesday to assess whether the Fed’s fight against inflation has been paying off.

“None of the underlying fundamentals in US banks give us any reason to be deeply frightened, it’s really more investors confidence and managements ability to rein in investor confidence fast enough that’s been the primary issue,” said Alexander Morris, chief investment officer and president of F/M Acceleration said on Bloomberg Television. There could be another small Fed hike and rate cuts will likely be reserved until 2024, he added.

Rates on swap contracts linked to Fed meetings — which on Thursday briefly priced in a cut in July — moved higher, to levels consistent with a stable policy rate until September, followed by at least two quarter-point cuts by year-end. Consumer-inflation data Wednesday may provide further clues on the rates path.

“Unless we see a sharp turnaround in the inflation numbers, the Fed ought to be quite comfortable with where policy rates are right now,” Tai Hui, chief Asia market strategist at JPMorgan Asset Management, said on Bloomberg Television.

In Europe, the Stoxx Europe 600 index edged 0.2% higher, with energy stocks outperforming as crude oil gained. With UK markets closed for a a holiday in honor of King Charles III, trading volumes were relatively modest. The German 10-yield climbed 4 basis points. Here are the biggest European movers:

- PostNL gains as much as 11.3% after the Dutch delivery company reported first-quarter revenue that beat estimates, with analysts noting that parcel volumes were better than anticipated

- Novo Nordisk gains as much as 4.8%, with Citi flagging continued “stellar” growth of the Danish pharmaceutical group’s GLP-1 diabetes and obesity portfolio across the past rolling four weeks

- Banca Monte dei Paschi climbs as much as 4.4% after Reuters reported that Italy is open to selling down its stake in the lender if terms or buyers are right, citing three people with knowledge

- Danske Bank gains as much as 3.9% after Danish newspaper Jyllands-Posten reported that the lender’s number of customers in Denmark has risen by a net 14,061 since the start of 2022, citing a poll

- Raiffeisen Bank gains as much as 2.3% after the Austrian lender was raised to neutral from sell at Citi following “very strong” first-quarter results and upgraded outlook

- Assa Abloy shares fall 1.8% despite its announcement that it has reached a settlement with the US Department of Justice over its planned $4.3b acquisition of the HII division of Spectrum Brands

- SBB shares fall as much as 9.7% after the Swedish landlord saw its credit rating cut one step to junk by Standard & Poor’s with the rating agency signaling it may downgrade further

Earlier in the session, Asian stocks gained as easing banking concerns helped revive risk appetite, while Chinese financial shares saw frenzied trading amid a hunt for the next market catalyst. The MSCI Asia Pacific Index rose as much as 0.5% on Monday, led by energy and finance shares. China and South Korea were among the best performers, while Japanese stocks retreated as trading resumed after the Golden Week holidays. Asian shares started the week on a strong note as sentiment stabilized following a rebound in US regional bank shares. An unexpected pickup in US hiring and wages tempered worries about a recession, with inflation data due this week expected to provide clues on the Federal Reserve’s next move.

Chinese banking shares surged to a one-year high after more lenders cut deposit rates and further progress on state-owned enterprise reform boosted sentiment. In contrast, shares of Japanese lenders — which are seen as the most vulnerable in Asia to the turmoil gripping the US banking sector — underperformed the broader market, with a sub-gauge of bank shares falling 1.3%. Asian stocks have held up relatively well amid the recent volatility in global markets, with the regional stock benchmark capping a 1% increase last week. “Thanks to a buoyant China, we expect emerging markets to maintain their economic growth advantage over developed peers,” said Luca Paolini, chief strategist at Pictet Asset Management.“The positive gap will lead to superior corporate earnings growth across the developing world, and therefore higher returns for emerging stocks.”

Japanese stocks declined in post-holiday trade as a surprisingly strong US jobs data undermined the case for a Federal Reserve rate cut. The Topix Index fell 0.2% to end at 2,071.21, while the Nikkei declined 0.7% to 28,949.88. Sony Group Corp. contributed the most to the Topix Index’s drop, decreasing 1.9%. Out of 2,160 stocks in the index, 1,332 rose and 733 fell, while 95 were unchanged. “The FOMC meeting result was expected, but the market was partly optimistic with many who thought that there would be a rate cut,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management. “There was a gap between the two which weighed down Japan stocks.”

The S&P/ASX 200 index rose 0.8% to close at 7,276.50, the biggest jump in a month, boosted by mining and bank stocks amid relative calm and positive sentiment across regional financial markets. Investors await Australia’s federal budget due Tuesday after market close. In New Zealand, the S&P/NZX 50 index rose 0.4% to 11,942.49

In FX, the Bloomberg Dollar Spot Index fell 0.2% in its fifth day of declines amid continuing concern that ongoing turmoil among US regional banks could fuel a tightening in lending. Traders are betting the toll from that could be so great that the Fed will start easing monetary policy as soon as July to stimulate the economy. The Norwegian krone is the best performer among the G-10’s, rising 0.7% versus the greenback. The Japanese yen is the weakest. Leveraged funds had bought USD/JPY heading into release of the Bank of Japan’s meeting minutes, according to Asia-based FX traders, as investors sought to meet net dollar demand over the Tokyo fix, which came in at around 135.15.

In rates, treasuries were cheaper across the curve with stock futures steady near top of Friday session range. Treasury yields cheaper by 2bp to 4bp across the curve with front-end-led losses flattening 2s10s spread by ~1.5bp on the day; 10-year yields around 3.48%, cheaper by 5bps vs Friday close with bunds lagging by ~2bp in the sector. IG issuance slate is expected to be packed as companies front-load ahead of Wednesday’s CPI data; yields spiked higher after news that Apple announced a 5-part bond offering to fund buybacks, sending the 10Y yield to session highs. German government bonds are in the red with two-year yields rising 4bps and back to levels seen before last week’s ECB decision.

In commodities, crude futures advance with WTI rising 1.6% to trade near $72.50. Spot gold gains 0.3% to around $2,023.

Bitcoin dropped 4% after Binance temporarily halted BTC withdrawals as the Bitcoin network experienced a congestion issue but then resumed withdrawals, according to CoinDesk. Binance later closed BTC withdrawals again due to the large volume of pending transactions, while it also announced it was replacing BTC withdrawal transactions with a higher fee so that they can get picked up by mining pools.

US session highlights include wholesale inventory and sales data, while at 2pm ET we get the closely-watched release of the Fed’s Senior Loan Officer survey during afternoon which is expected to show a dramatic tightening in loan standards

Market Snapshot

S&P 500 futures little changed at 4,151.50

Brent Futures up 1.5% to $76.42/bbl

Gold spot up 0.3% to $2,022.38

U.S. Dollar Index down 0.1% to 101.08

Top Overnight News

Western companies warn of hit from China’s slow recovery. US and European groups say they overestimated how quickly the country would bounce back from Covid-19 lockdowns. FT

Brussels has proposed sanctions on Chinese companies for supporting Russia’s war machine for the first time since the war in Ukraine began, a development that is likely to increase tensions with Beijing. FT

German industrial production fell more than expected in March, partly due to a weak performance by the automotive sector, spurring again recession fears in Europe's largest economy. Production decreased by 3.4% on the previous month following a slightly revised increase of 2.1% in February, the federal statistical office said on Monday. In a Reuters poll, analysts had pointed to a 1.3% fall. RTRS

Ukraine’s upcoming offensive could help pave the way for negotiations between it and Russia by the end of the year, with China potentially playing a key role in bringing Moscow to the table. WSJ

Top Democrats and Republicans are racing to try to find a politically acceptable way to raise the nation’s borrowing limit in the coming weeks, diving into talks that President Biden has avoided during months of impasse. WSJ

The White House is downplaying the need to curb short-selling of banks even as it insists President Joe Biden hasn’t ruled out any options to ensure the stability of the banking system. BBG

More than 60% of Americans think Biden does not have the mental or physical stamina to serve effectively as president (only 1/3 of the country feels Biden is in physical shape for the presidency vs. 64% who feel that way about Trump). WaPo

Biden polls behind Trump (44-38%) and DeSantis (42-37%) in head-to-head matchups, although there are large numbers of undecided voters. WaPo

Janet Yellen said Congress has "no good options" other than to lift the debt ceiling to prevent an economic and constitutional crisis, a day after 43 GOP senators reiterated opposition to doing so without budget cuts. Yellen told ABC she doesn't want to consider emergency options, such as Joe Biden taking unilateral action. The president meets with congressional leaders tomorrow. BBG

Although mega-cap tech’s sales growth gap relative to the index narrowed between 2021 and 2022, analysts expect this gap will widen. Mega-cap tech generated average annual sales growth of 15% from 2013 to 2019 vs. just 4% for the S&P 500. However, between 2021 and 2022 the gap narrowed from 11 pp to just 2 pp (17% vs. 15%) as S&P 500 sales growth reaccelerated. Looking forward, although mega-cap tech’s 2023-25 annualized sales growth is projected to decelerate, the gap vs. the index is expected to widen to 5 pp (9% vs. 4%).

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly gained as the region took impetus from Friday's rally on Wall St and strong US jobs data. ASX 200 was led higher by the commodity-related sectors and with sentiment underpinned after Australian Treasurer Chalmers confirmed an energy rebate of up to AUD 500 for millions of Australians in Tuesday’s budget. Nikkei 225 declined beneath the 29,000 level on return from Golden Week with banking shares suffering after the recent headwinds for their regional US counterparts. Hang Seng and Shanghai Comp. were positive as gains in energy and auto stocks offset the losses in the property industry, while China pledged to prioritise the real economy, adhere to the principle of seeking progress while maintaining stability, as well as strengthen the breakthrough of core technology and boost support of strategic resources.

Top Asian News

- China’s forex reserves USD 3.205tln at end-April vs prev. USD 3.184tln at end-March, while China’s gold reserves rose to 132.35bln at end-April vs prev. USD 131.665bln at end-March.

- China held security and trade talks with the Taliban as Beijing looks to boost its investment in Afghanistan and bring it into the Belt and Road project, according to FT.

- Western companies have reportedly warned of a hit from China’s slow recovery with US and European groups saying they overestimated how quickly China would bounce back from COVID-19 lockdowns, according to FT.

- US sanctions are reportedly driving Chinese firms to advance AI without the latest chips, according to WSJ.

- BoJ March meeting minutes stated that several members said they must be vigilant to the risk that inflation may accelerate more than expected and members agreed there was very high uncertainty surrounding Japan's economy. The minutes also stated that a few members said there were some positive signs towards achieving the BoJ's price target, while several members said cost-push price pressure might last longer than expected if global commodity prices rise more than projected.

- Japanese PM Kishida said dialogue between Japan and South Korea is progressing in various areas including finance and culture, while Japan’s government is currently taking steps to reinclude South Korea in the export white list. Furthermore, Kishida expressed support to host South Korea for restarting trilateral talks with China and believes it is his responsibility to cooperate with South Korea, according to Reuters.

- South Korean President Yoon said he agreed with Japanese PM Kishida to develop bilateral ties to a higher level and both leaders welcome efforts to normalise ties on security, as well as strengthen cooperation on semiconductor and other key materials sectors. Furthermore, they agreed that North Korea’s missile programme is a severe threat to world peace and stability, agreed on the strategic importance of the Indo-Pacific region and to boost coordination on Indo-Pacific strategies, while Yoon said South Korea is open to Japan joining the South Korea-US military nuclear planning in the future, according to Reuters.

European bourses are firmer across the board, Euro Stoxx 50 +0.1%, though trade has been very contained/steady with the UK away. Stateside, the narrative is much the same with US futures essentially flat ahead of numerous Fed survey's and FOMC speak; weekend newsflow was limited and focused on BRK.B and the debt ceiling. Back to Europe, sectors are mixed and lacking in breadth with outperformance in Energy given broader benchmark action while individual movers are sparse. Berkshire Hathaway (BRK.B) - Q1 earnings were USD 8.065bln (+12.6% Y/Y). Insurance underwriting profit was USD 911mln (vs 167mln Y/Y), investment income from insurance +68% to USD 1.969bln. Berkshire increased its stock buybacks by USD 4.4bln. It is reducing its investments in stocks such as Chevron (CVX). Buffett said he expects earnings to decrease this year at most of Berkshire's businesses due to an economic downturn. +1.3% in the pre-market.

Top European News

- UK PM Sunak agreed with Canadian PM Trudeau to use momentum from the Trans-Pacific Partnership to further bilateral trade talks and they discussed how their countries could deepen collaboration on defence and security technology including cyber security, according to Reuters.

- Chinese President Xi sent a congratulatory message to King Charles and said that China and the UK should jointly promote cooperation, while he added that China is willing to expand cooperation and cultural exchanges with the UK.

- ECB’s Knot said that they are starting to see that policy is working but more will be needed to contain inflation and it is still not certain how high European rates will have to go, according to Reuters.

- Fitch affirmed the European Stability Mechanism at AAA; Outlook Stable and affirmed Switzerland at AAA; Outlook Stable, while it affirmed Slovenia at A; Outlook Stable.

FX

- DXY dangles above 101.000 awaiting more US debt ceiling developments, employment trends and Fed surveys; in 101.04-101.33 bounds.

- Aussie and Kiwi outperform as AUD/USD probes 100 DMA at 0.6789 and NZD/USD rebounds firmly through 0.6300.

- Franc claws back post-Swiss CPI losses and reclaims 0.8900+ status, Euro firm on 1.1000 handle irrespective of bleak EZ Sentix index and Pound retains strength around 1.2650 in UK Coronation holiday trade.

- PBoC set USD/CNY mid-point at 6.9158 vs exp. 6.9159 (prev. 6.9114)

Fixed Income

- Bunds hit Fib resistance and retreat sharply between 136.21-135.46 parameters, regardless of weaker than expected German industrial output and Eurozone Sentix index.

- BTPs top out after opening mark-up and uptick within a 115-19-114.48 range and take note of Italian Treasury announcement of new 4 year retail supply for early June.

- T-note hugs base of 115-16+/115-27 + band ahead of US employment Trends, Fed Senior Loan Office Survey and NY Fed Consumer Expectations.

- Italian Treasury to sell a 4yr BTP bond as part of a new "bond type group" which will be for retail investors only, to be offered across 5th-9th June and have step-up coupons and a loyalty premium.

Commodities

- Crude benchmarks are firmer on the session, in a continuation of the attempted recovery which began towards the latter half of last week and despite the broader tentative tone; crude benchmarks are posting gains of over USD 1/bbl at USD 72.70/bbl and USD 76.50/bbl for WTI Jun and May Jul respectively.

- Spot gold is essentially unchanged on the session with sub-10/oz parameters and still comfortably above the USD 2k/oz mark while base metals are modestly firmer on the session as the USD pulls back towards a 101.00 base in thin trade owing to the absence of LME participants given the UK Bank Holiday.

- More broadly, the Barrick Gold CEO Bristow in an FT interview said the Co. expects gold and copper prices to increase, to the benefit of mining stocks.

- Iraq set June Basrah medium crude OSP to Asia at minus USD 0.15/bbl vs Oman/Dubai and OSP to Europe at minus USD 4.60/bbl vs dated Brent, while it set OSP to North and South America at a discount of USD 1.00/bbl vs ASCI.

Geopolitics

- Russia began evacuating hundreds of civilians from occupied areas in south-eastern Ukraine including families with children from a town housing workers for the Zaporizhzhia nuclear power plant which has raised fresh concerns about its safety, according to FT. In relevant news, a Twitter source noted air defence activity in Dnipropetrovsk and Zaporizhzhia oblast, while missiles were launched from bombers flying over the Black Sea towards Odesa oblast, while Ukraine media confirmed a missile attack on Odesa and Kyiv's Mayor said drone wreckage hit Kyiv's Sviatoshyn district.

- Russian President Putin has not yet responded to the proposals by UN Secretary-General Guterres on the Black Sea grain deal, according to a Kremlin spokesman cited by TASS.

- Russia’s Wagner Group Chief Prigozhin said he was promised as much ammunition and weapons needed to continue fighting in the Ukrainian city of Bakhmut, according to Reuters.

- Russian Foreign Ministry accused the US and the West of supporting terrorism carried out by Ukraine after a car bomb attack which injured a Russian nationalist writer and killed his driver, according to Reuters.

- Brussels is planning sanctions on Chinese companies aiding Russia's war machine, according to FT.

- Chinese Foreign Minister Qin met with the US ambassador to Beijing and said it is imperative to stabilise Sino-US relations, avoid a downward spiral and prevent accidents between China and the US. Qin added the US side should correct its understanding of China and return to rationality and the US must especially correctly handle the Taiwan issue, as well as stop continuing to hollow out the One-China principle, according to state media.

- US State Department spokesperson said the US does not believe Syria merits readmission into the Arab League at this point in time and the US is sceptical of Syrian President Assad’s willingness to solve the crisis but is aligned with Arab partners on ultimate goals, while the US understands partners intend to use direct engagement with Syria's Assad to further push a solution to the Syrian crisis.

- Qatar Foreign Ministry spokesman said Qatar’s position over normalising relations with the Syrian regime has not changed and it hopes that the Syrian regime would be motivated to fix the roots of the crisis that led to a boycott, according to Reuters.

- Armenia and Azerbaijan are to resume peace talks in Brussels, according to FT.

US Event Calendar

- 10:00: March Wholesale Trade Sales MoM, est. 0.4%, prior 0.4%

- 10:00: March Wholesale Inventories MoM, est. 0.1%, prior 0.1%

- 14:00: Fed Releases Senior Loan Officer Opinion Survey

- 16:00: Fed Releases May 2023 Financial Stability Report

- 16:45: Fed’s Kashkari Moderates Panel Discussion on Minimum Wages

Uncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International23 hours ago

International23 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges