Uncategorized

Futures Rise As China Reopening Hopes Return

Futures Rise As China Reopening Hopes Return

And just like that, sentiment has turned on a dime… or rather a yuan.

One day after global…

And just like that, sentiment has turned on a dime... or rather a yuan.

One day after global stocks and commodities tanked following a weekend of violent protests swept across China, Beijing appears to have learned its lesson and overnight Chinese government health experts made an unscheduled overnight announcement in which they not only vowed to speed up Covid shots for the elderly - a move regarded as crucial to the reopening - but to avoid excessive restrictions, fueling a new round of bets that Beijing is bending to the pressure of an economic reopening. A spokesman for the National Health Commission also said local officials must avoid excessive restrictions.

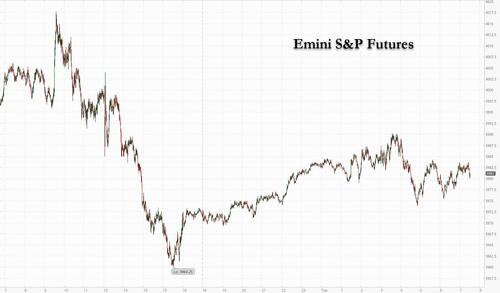

As a result, contracts on the Nasdaq 100 were up 0.4% at 7:30 a.m. in New York, while S&P 500 futures rose 0.2%, erasing earlier gains which pushed spoos as high as 3990. Both underlying indexes tumbled about 1.5% on Monday amid fears that protests in China about Covid restrictions would affect the pace of the reopening.

In premarket trading, Chinese stocks listed in the US rallied, including internet stocks Alibaba and JD.com, while the exchange-traded KraneShares CSI China Internet Fund rose more than 6%, following on from Asian markets’ sharp bounce earlier in the day. Apple rose along with tech stocks, lifted by the general positive sentiment on China. Roku dropped after a broker downgrade. Here are all notable premarket movers:

- 23andMe is initiated with a buy recommendation at Berenberg, which sees the genomics firm as well-positioned to become a “leader in a redefined individualized healthcare ecosystem.” The broker also sets a Street-high price target for the stock. Shares gain 2.7%.

- AZEK fell 6.2% after the outdoor living products manufacturer reported fourth-quarter revenue that was ahead of consensus, though the company’s first- quarter net sales forecast fell short of expectations. For the analysts, the guide was disappointing, with some highlighting the impact that inventory headwinds would have in the first quarter.

- BigCommerce shares are up 2.9% in premarket trading, after the e-commerce software company said its merchant gross merchandise value rose 31% on Black Friday, a growth rate that analysts see as strong.

- Cryptocurrency-exposed stocks rise in US premarket trading following Monday’s losses, as Bitcoin gained amid the return of risk appetite on China reopening bets, though worries lingered over the fallout from FTX’s collapse. Coinbase shares gained 1.6%.

- Chinese stocks listed in the US rally as officials vowed to speed up Covid shots for the elderly and to avoid excessive restrictions, fueling a new round of bets that Beijing is bending to pressure for a reopening. Alibaba shares gain 5.3%, JD.com shares rise 7.2%, Baidu shares advance 5.9%

- Generac shares fall 2.6% in premarket trading after Jefferies downgraded the backup generator manufacturer to underperform from hold, noting the risk bidirectional charging for electric vehicles poses to home standby penetration over the long-term.

- Lordstown Motors rose as much as 6% in premarket trading upon reaching the conditions to start consumer sales.

- Hibbett Inc reported earnings per share for the third quarter that missed the average analyst estimate. Shares decline 5.8%.

- Microsoft shares advance 0.2% in US premarket trading, as Morgan Stanley says that it has confidence in the software firm’s commercial businesses, which are sending a strong and durable demand signal.

- Mirum Pharmaceuticals fell as much as 9.8% premarket upon deciding to discontinue the OHANA study of volixibat in intrahepatic cholestasis of pregnancy due to enrollment feasibility.

- Novocure is upgraded to overweight at Wells Fargo ahead of results from the company’s LUNAR non-small cell lung cancer trial, expected early next year. Shares decline 1.2%.

- Roku (ROKU) shares decline 3% after the stock was downgraded to sector weight from overweight at KeyBanc, which says consensus for 2023 and 2024 looks “too optimistic.

- United Parcel Service (UPS) shares are up 1.4% in premarket trading, after Deutsche Bank upgraded the package shipping company to buy from hold.

- US-listed shares of Bilibili (BILI) are up 10.4% in premarket trading, after the China-based video game company reported third-quarter results that beat expectations, though it also gave a fourth-quarter revenue forecast that was below the average analyst estimate.

“My guess is China has reached some kind of tipping point on Covid restrictions,” said Christophe Barraud, chief strategists at the Market Securities brokerage in Paris. “Even before the recent unrest, officials were preparing to implement more targeted measures, but the unrest will only accelerate the process.”

Another tailwind for stocks is the likelihood that the Federal Reserve will move to a slower rate-hiking pace, with Fed Chair Jerome Powell seen cementing those bets when he speaks on Wednesday. That view, alongside the easing in China tensions, and expectations for further slowing in payroll gains on Friday, pushed the dollar lower against a basket of peers, following two days of gains.

US stocks have rallied in the past two months on growing optimism that the Federal Reserve would slow the pace of rate hikes as inflation showed signs of cooling and as the US inevitably slides into recession. But policy makers have stressed they will continue to raise borrowing costs further until they see a meaningful dip in prices, and market strategists have warned the rally may fizzle out over the coming weeks amid recession worries.

“Investors don’t want to hear what the Fed says; it says it will hike slower but higher, investors hear that the Fed will hike slower, and so we have rallies that get interrupted by frequent rectification from the Fed officials,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “Even soft growth, soft jobs and soft inflation should not lead to a sustained recovery as they would hint at recession.”

That hawkish drumbeat from central bankers has seen global bonds signal a recession, as a gauge measuring the worldwide yield curve inverted for the first time in at least two decades.

Meanwhile UBS Wealth Management Chief Investment Officer Mark Haefele agreed and warned that investors should remain cautious over the revival in risk appetite that has occurred over the past few months. “The path back toward the Fed’s 2% inflation target could be bumpy, sparking renewed concerns about how high rates will have to rise,” he wrote in a note on Tuesday. On the other hand, Deutsche Bank strategists said they expect the rally to continue as both rate and equity volatility falls, while systematic strategies raise equity exposure from extremely low levels, propelling the S&P to 4,500 before it all comes crashing down in Q3 2023 when stocks plunge to 3,250 only to rebound the next quarter.

In Europe, the Stoxx 50 rose 0.3% on speculation that unrest in China over Covid restrictions would force authorities to move faster in loosening curbs. FTSE 100 outperformed peers, adding 0.8%. Here are the most notable European movers:

- Union Financière de France shares rise as much as 53% after majority owner Abeille Assurances lodged a EU21/share buyout offer for the 25% of capital it doesn’t already own.

- Shares in Danish pharma giant Novo Nordisk gained as much as 4% after the FDA cleared forms at Catalent’s Wegovy manufacturing sites in the US and Brussels.

- ASM International shares jump as much as 8% after the Dutch chip-tool maker forecast a less severe sales impact from the US chip export restrictions and raised its fourth-quarter guidance.

- Boozt rises as much as 14%, the most since August, after the Swedish online retailer said it expects to reach the high end of its full-year guidance. The Stoxx 600 Retail subindex is among the best performing in Tuesday trading, with Zalando +3.7%, JD Sports +2.1% and H&M +1.3%

- Mining and energy are the best-performing sectors in Europe on Tuesday amid a rebound in commodity markets as China refined its approach for dealing with Covid-19 and investors looked ahead to an OPEC+ meeting on output policy.

- The Stoxx 600 Basic Resources subindex rises as much as 2.5% to the highest since mid-June, led by heavyweights like Rio Tinto and Anglo American

- Capita shares fall as much as 5.8% in London trading, the steepest intraday decline since Sept. 30.

- Shares in Orlen gain as much as 4.2% as Poland’s biggest refiner boosted Ebitda in 3Q following acquisition of Lotos.

- Greencore Group falls 4.9% after saying that it remains cautious about the potential impact of the recessionary environment and cost-of-living factors on consumer spending through the year ahead.

- Nestle shares drop as much as 1.1%, underperforming the Stoxx 600’s food, beverage and tobacco subgroup, after the Swiss food giant set financial targets and said it’s considering options for Palforzia, just two years after buying the peanut-allergy treatment in a $2.6 billion deal.

Earlier in the session, Asian equities rose as latest official commentary in China bolstered reopening trades, with a weaker dollar adding to tailwinds for the region. The MSCI Asia Pacific Index extended its advance to as much as 1.7% in afternoon trading, with gauges in Hong Kong jumping more than 5% to lead gains in the region. In a briefing, Chinese officials urged elderly vaccination and avoidance of excessive restrictions, which added to reopening optimism. Beijing’s additional support for developers also buoyed stocks. A decline in the dollar boosted benchmarks in South Korea, Taiwan and India, although measures in Japan fell. Consumer discretionary and telecom shares were the biggest sectoral advancers in the region. “It’s been a tough year for most funds, so if they miss out on big moves in China” going into the end of the year, that “would hurt performance,” said Sat Duhra, portfolio manager at Janus Henderson Investors. “From a tactical point of view, that’s the reason China is so volatile.” Asia’s stock gauge has gained 14% in November, on track for its best month since 1998, with beaten-down markets in North Asia showing signs of recovery boosted by month-end positioning. Still, traders will closely monitor a host of US economic data due this week as well as commentary by Federal Reserve officials to gauge global inflation and growth prospects next year.

Japanese equities dropped after Fed policymakers stressed that there will be further monetary-policy tightening ahead to curb inflation. The Topix Index fell 0.6% to 1,992.97 as of market close in Tokyo, while the Nikkei 225 declined 0.5% to 28,027.84. Toyota Motor Corp. contributed the most to the Topix’s decline, as the automaker fell 1.4%. Among 2,164 stocks in the index, 1,478 fell and 586 rose, while 100 were unchanged. “Though Fed officials have been commenting, even in that case, monetary tightening will go in the direction of easing,” said Hideyuki Suzuki, general manager at SBI Securities. “What the market needs to be concerned about is whether the global economy will do okay.”

In rates, Treasuries were moderately higher across the curve, holding gains amassed during the European session as German inflation data unleashed a bull-steepening rally in bunds. Intermediates outperformed slightly on the curve. Home price and consumer confidence data are focal points of US session, along with potential for month-end flows to support long-end. Yields richer by 1bp to 3bp across the curve with belly-led gains tightening the 2s5s30s fly by ~2.5bp; 10-year TSYs around 3.66%, down 2bps on the day and trailing bunds in the sector by 7.5bp. German curve aggressively bull-steepens as ECB hike premium is pared; 2-year German yields richer by 13bp on the day in early US session. Bunds bull steepened, with yields dropping 6-11bps, and money markets aggressively pared ECB tightening wagers. Inflation in German states as well as in Spain pointed toward a faster deceleration than economists forecast for the national figure later today, and sure enough, German CPI came in at -0.5%, well below the -0.2% expected, and a sharp drop from 0.9% last month. Peripheral spreads are mixed to Germany; Italy tightens, Spain widens and Portugal tightens.

In FX, the Bloomberg dollar spot index fell 0.6%, extending losses as the greenback weakened against all of its Group-of-10 peers apart from the Swiss franc. Australian and New Zealand dollars led gains amid optimism after China’s briefing on the implementation of virus prevention and control measures.

- The euro pared most of yesterday’s decline but stopped short of breaching the $1.04 handle as money markets aggressively pared ECB tightening wagers. Inflation in German states as well as in Spain pointed toward a faster deceleration than economists forecast for the national figure later today.

- The pound advanced to trade around 1.20 per dollar. Gilts gained but underperformed bunds. The BOE starts its first “demand-led” sale of long-end bonds and linkers bought after September’s mini-budget

- Sweden’s krona underperformed other risk-sensitive G-10 currencies; GDP expanded by less than forecast in the third quarter while separate data showed retail sales plunged most on record last month

Elsewhere, oil extended a rebound from the lowest level in almost a year, on speculation that the Organization of Petroleum Exporting Countries and its allies will deepen supply cuts to respond to weakening global demand. Crude futures advanced, Brent rises 2.9% near $85.62. Spot gold rises roughly $14 to trade near $1,756/oz

To the day ahead now, and data releases include German CPI for November, UK mortgage approvals for October, Canada’s Q3 GDP, the US Conference Board’s consumer confidence for November, and the FHFA house price index for September. Central bank speakers include BoE Governor Bailey and the BoE’s Mann, ECB Vice President de Guindos and the ECB’s de Cos.

Market Snapshot

- S&P 500 futures up 0.3% to 3,980.75

- STOXX Europe 600 down 0.1% to 437.53

- MXAP up 1.6% to 155.12

- MXAPJ up 2.4% to 499.98

- Nikkei down 0.5% to 28,027.84

- Topix down 0.6% to 1,992.97

- Hang Seng Index up 5.2% to 18,204.68

- Shanghai Composite up 2.3% to 3,149.75

- Sensex up 0.4% to 62,750.28

- Australia S&P/ASX 200 up 0.3% to 7,253.31

- Kospi up 1.0% to 2,433.39

- German 10Y yield down 4.5% to 1.90%

- Euro up 0.3% to $1.0370

- Brent Futures up 2.2% to $84.98/bbl

- Gold spot up 0.8% to $1,755.58

- U.S. Dollar Index down 0.37% to 106.28

Top Overnight News from Bloomberg

- Chinese health authorities struck a conciliatory tone a day after protests against stringent Covid curbs were stymied by a heavy police presence, social media censorship and quiet pandemic concessions

- China’s worsening economic slump and a likely disruptive rollback of Covid restrictions will keep the central bank on its easing path, economists said, with calls growing for more interest rate cuts

- The ECB must continue monitoring underlying inflation as it determines what dose of monetary-policy tightening is needed to tame record price gains, according to Vice President Luis de Guindos

- The minutes of the UK DMO’s meeting with gilt-edged market makers (GEMMs) and investors on Nov. 28 showed a preference for either a new 30- or 40-year bond syndication in the final quarter of this financial year

- OPEC and its allies are expected to consider deeper supply curbs when they meet this weekend against the backdrop of a faltering global oil market

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive with the improvement in risk appetite spurred after China protests were clamped down on by police and after the country also announced support measures for developers, while there was also speculation of a potential easing of COVID controls ahead of a press briefing by China’s State Council. ASX 200 pared its early losses after rebounding from a floor around the 7,200 level although gains were contained amid the lack of pertinent domestic catalysts. Nikkei 225 was subdued after Unemployment Rate and Retail Sales data disappointed expectations and with automakers Toyota and Honda adjusting or suspending factories in China due to the COVID situation, while Eisai was the worst performer after a second death was linked to the Co. and Biogen's Lecanemab Alzheimer's drug. Hang Seng and Shanghai Comp were lifted with outperformance in developers after China resumed approving listed developers' mergers and is also to ease rules on developer bond state guarantees, while hopes of a relaxation of COVID restrictions added to the tailwinds.

Top Asian News

- China is aiming to increase the pace of COVID vaccination for those 80 and above, according to the Health Authority, to allow elderly to take a booster three months after vaccine. CDC Official says they will promptly and effectively solve difficult problems reported by the masses; when asked if protests will prompt them to reconsider zero-COVID policy, says they will continue to fine tune policy to reduce the impact on the economy and society.

- Beijing City reports 2,126 (prev. 2,086) COVID infections on November 29th as of 3pm, according to a health official.

- UK PM Sunak called for Britain to evolve its foreign policy approach to China, while he also said the golden era of UK-China relations is over and criticised China's crackdown, according to SCMP and The Mirror.

European bourses trade mixed after the initial China-led optimism petered out in early European hours, Euro Stoxx 50 +0.2%. Sectors are mostly firmer following choppiness in the European morning, but base metals remain the marked outperformer. US equity futures meanwhile remain modestly firmer across the board but off best levels as participants look ahead to Fed Chair Powell tomorrow, followed by US PCE on Thursday and NFP on Friday, ES +0.3%.

Top European News

- UK government is abandoning controversial powers from the Online Safety Bill that would have forced internet companies to take down legal but harmful content following backlash from the tech industry and free speech advocates, according to FT.

- UK Oct. Mortgage Approvals Fall to 28-Month Low of 59k

- UK Rewrites Online Safety Bill After Free Speech Backlash

- Goldman Moves Some London Traders to Milan in Fresh Brexit Shift

- EasyJet Targets Full Capacity as Discounters Thrive in Slump

- Ørsted Offers to Buy Certain Sub Capital Securities

FX

- Antipodean Dollars revived alongside Yuan as Chinese Covid cases dip to provide some respite, AUD/USD and NZD/USD firmly back above 0.6700 and 0.6200, while Usd/Cnh retreats from just shy of 7.2500.

- Buck off Monday's recovery highs, but DXY underpinned between 106.050-750 parameters on hawkish Fed rhetoric.

- Yen rebounds through 138.00 vs Greenback as bond yields recede to offset disappointing Japanese data.

- Euro and Pound bounce against the Dollar towards 1.0400 and over 1.2050 at one stage.

- Loonie pares declines in tandem with WTI as Usd/Cad recoils within a 1.3497-09 range ahead of Canadian GDP metrics.

- PBoC set USD/CNY mid-point at 7.1989 vs exp. 7.2077 (prev. 7.1617)

Fixed Income

- Another firm recovery in debt futures, with EGBs encouraged by slowdowns in German state and Spanish national CPI readings.

- Bunds reach 141.74 from 140.08 at worst and Bonos 130.20 vs 129.46.

- BTPs outperform either side of solid month end Italian auctions as the 10 year benchmark tops out at 120.67 for a 169 tick gain on the day.

- Gilts cautious around 106.00 ahead of BoE commentary, but T-note firm on 113-00 handle awaiting US consumer confidence.

Commodities

- WTI and Brent Jan futures have been trending higher since the APAC session on speculation China could that China could ease its COVID restrictions, although the Chinese health officials instead boosted the vaccination drive for the elderly and stressed they must keep avoiding excessive COVID curbs.

- Spot gold trades in tandem with the Dollar and remains within recent ranges on either side of USD 1,750/oz ahead of key risk events later this week.

- Base metals are lifted by the overnight China COVID optimism alongside support measures announced for China’s property sector, in turn boosting demand for raw materials, with 3M LME copper back on a USD 8,000/t level and extending on gains.

- China's President Xi says China is ready to boost Russian energy cooperation, via CCTV.

- Russian Deputy PM Novak says they are discussing with Kazakhstan and Uzbekistan a gas union for shipments, which would include shipments to China, via Ifx.

- CNOOC is planning a 50-day overhaul at their 240k BPD Huizhou site from March, via Reuters citing sources.

- Euronext has informed clients that due to a technical incident, a failover has occurred on the commodities segment at 09:46GMT; Order Entry on all commodities contracts will be enabled at 10:45 GMT. These contracts will move into continuous tradable phase at 11:00 GMT.

Geopolitics

- US official said Washington will announce significant financial assistance to Ukraine today and the new aid aims to mitigate damage caused by Russian bombing of Ukraine's energy grid, while the official said the Biden administration has allocated over USD 1bln to support the energy sector in Ukraine and Moldova, according to Sky News Arabia.

- China's military said a US cruiser illegally intruded into waters near the Spratly Islands in the South China Sea, while it added that it followed the US cruiser and said the US move infringes China's sovereignty, according to Reuters.

- China's ambassador to Britain has been summoned to the Foreign Office following the police "beating" of a BBC journalist in Shanghai, according to the Evening Standard.

- South Korean President Yoon said China can and should influence North Korea's behaviour to stop weapons development and he warned that any new North Korean nuclear test will be met with a joint response not seen in the past. Yoon also stated he is firmly opposed to any attempt to change the status quo unilaterally regarding Taiwan and said that in the event of a Taiwan conflict, South Korean troops' imminent concern would be any North Korean military action, according to Reuters.

US Event Calendar

- 09:00: Sept. S&P CS Composite-20 YoY, est. 10.50%, prior 13.08%

- S&P/CS 20 City MoM SA, est. -1.20%, prior -1.32%

- FHFA House Price Index MoM, est. -1.2%, prior -0.7%

- 10:00: Nov. Conf. Board Consumer Confidence, est. 100.0, prior 102.5

- Expectations, prior 78.1

- Present Situation, prior 138.9

DB's Jim Reid concludes the overnight wrap

I've been writing the EMR for nearly 16 years and before yesterday I can remember only one previous day where we couldn't distribute it for technical reasons. So apologies for the non-appearance yesterday in your email boxes. Given the size of the distribution list we use an external vendor to publish and our respective systems had a bit of a fight yesterday. The EMR was the loser. We think they have sat down and reconciled their differences now so fingers crossed this reaches you before you retire.

Moving on, over the next 25 hours we'll perhaps have a few more clues as to whether the ECB will hike 50bps or 75bps two weeks on Thursday. I say next 25 hours but if the EMR is 6 hours late today then you'll already know the German CPI numbers out today. The NRW region, which has the highest weighting in the national number, should be out around the time we hit inboxes with other regions at 9am London time and the country-wide number at 1pm. Our German economists previewed the release last night (link here) suggesting the YoY for the country will likely only ease a tenth to 10.3% and might only dip below 10% from March when the government's "energy price breaks" kick in. We also see the Spanish print today and then the French equivalent at 7.45am London time tomorrow (hence the 25 hours). As a reminder, our economists expect the Eurozone November print to tick up a further tenth to 10.7% tomorrow (10am), which would be another record since the single currency’s formation.

Ahead of these we had several hawkish developments yesterday, with the Netherlands’ central bank governor Knot describing inflation risks as “entirely tilted to the upside”, and describing talk of over-tightening was “a bit of a joke”. Furthermore, Knot made the point that the declining downside risks to growth over recent weeks had hawkish implications for the ECB.

In this context, global markets got the week off to a rough start yesterday, with the S&P 500 (-1.54%) and other risk assets losing ground as investors sought to understand the consequences of the ongoing Covid situation in China. Understandably, the initial reaction has been pretty negative, since rising cases have generally led to a greater chance of restrictions in every country as the pandemic got underway, particularly as policymakers sought to avoid healthcare services becoming overwhelmed. And just as Chinese markets had surged in recent weeks on speculation about an earlier reopening in China, the last 24 hours have seen that process go into reverse as the prospect of further lockdowns come into view.

However, much as the initial reaction has been pretty negative, in some ways the read-across from the current situation to markets is more difficult. On the one hand, it’s plausible that the months ahead see fresh lockdowns as we saw in Shanghai in Q2. But it’s also possible that the protests lead to a quicker move away from the zero Covid strategy, which based on past performance would prove fairly supportive. Indeed, sentiment was very positive 2-3 weeks ago after it was announced that the quarantine time for close contacts and inbound travellers was being cut from 10 days to 8, since it was seen as signalling a move away from the restrictive approach that had previously been adopted. And as the US session got underway there were signs of that dynamic taking place. For instance, the NASDAQ Golden Dragon China index surged by +2.83% yesterday, which is an index of US-listed stocks for whom most of their business is done in China. In the meantime, futures on the Hang Seng were more than +1% higher during the US session, indicating that there could be some sort of bounceback following the initial slump.

This more positive momentum has carried into Asia helped by an absence of any further escalations in the protests against Covid-19 restrictions in China. Across the region, the Hang Seng Tech index is leading gains rising past +6.0% with the Hang Seng +4.31% higher alongside the CSI (+3.26%) and the Shanghai Composite (+2.35%) ahead of a newly arranged State Council Covid briefing today (3pm local time. 7am London) to discuss prevention and control measures. It's not clear whether any new polices will be implemented. The country reported 38,421 new local cases on Monday down from a record high of 40,052 reported for Sunday with no deaths reported for two consecutive days. This was the first decline in cases for more than a week.

Elsewhere, the KOSPI (+1.02%) is trading higher in early trade while the Nikkei (-0.53%) is bucking the regional trend. In overnight trading, US stock futures are indicating a more positive start with contracts on the S&P 500 (+0.32%) and the NASDAQ 100 (+0.44%) moving higher.

Early morning data showed that Japan’s jobless rate for October remained steady from the prior month’s reading of +2.6% (v/s +2.5% expected). At the same time, the jobs-to-applicant ratio climbed to 1.35, in-line with market expectations and compared to a level of 1.34 in September highlighting that the nation’s labour market remains tight. A separate report showed that retail sales (+0.2% m/m) rose less than expected in October following an upwardly revised increase of +1.5% in September as household spending was squeezed by inflation running at its fastest pace in 40 years.

The China whipsaw over the last 24 hours seems to have had most impact on oil, where prices fell to their lowest intraday levels in months on the back of the weekend developments. For instance, WTI hit an intraday low of $73.60/bbl during the European morning, which briefly put it in negative territory on a YTD basis, before recovering sharply into the US session to actually gain ground on the day and close at $77.24/bbl and up another +1.8% to $78.65 in Asia.

It was a similar story for Brent crude, which hit its lowest intraday level since January at $80.61/bbl, before recovering into the close to end just a hair lower at $83.45/bbl. It's at $84.75 in Asia. The recent fall in oil has fed through to consumer prices as well, with the US AAA’s data on the average national pump price down at $3.546 on Sunday, marking its lowest level since Russia’s invasion of Ukraine began.

Incidentally, we had another positive development in Europe yesterday as the immediate threat of a further Russian gas cutoff was avoided. This stemmed from Gazprom’s threat last week that they would curb gas shipments to Moldova via Ukraine from November 28, but shipments continued yesterday, which is important more broadly since the route is also used for further transport to Europe. In the meantime, ECB President Lagarde said that there was “too much uncertainty” to assume that inflation had peaked, particularly in terms of how wholesale energy costs were passed through to the retail level, and said “it would surprise me” if it had peaked in October.

As investors dwelled on the prospects of a more hawkish ECB, yields on 10yr government debt rose across the continent, with yields on 10yr bunds (+1.1bps), OATs (+2.5bps) and BTPs (+5.6bps) all moving higher on the day. Treasury yields were a bit more subdued after back-and-forth price action through the day, with yields on 10yr Treasuries finally rising a marginal +0.4bps to 3.68% before climbing 2.5bps in Asia. For yesterday, the China story growth fears netted out with hawkish Fed officials to leave yields roughly flat across the curve. On the Fed, St. Louis Fed President Bullard noted that markets were underestimating the chances of a more aggressive stance from the Fed next year. New York Fed President and FOMC Vice Chair Williams emphasised that the Fed still needed to impart further tightening, and that unemployment would be climbing next year. He noted that recession was not a part of his baseline forecast but that there were downside looks to the outlook. So the Fed continues to get closer to our Street-leading recession forecast. Before the talk of tighter policy, 10yr Treasuries did sink as low as 3.62% after the China news hit trading. Earlier in the day, the 2s10s curve had also hit a new intraday low for the current cycle, falling as far as -81bps at one point, before recovering into the close to hit -76.3bps.

Equities struggled against this backdrop, with the S&P 500 (-1.54%) losing ground for a second day running. The decline was a fairly broad-based one, with just 37 companies in the index rising on the day, and other indices including the NASDAQ (-1.58%) and the Dow Jones (-1.45%) saw similar declines. Over in Europe, the STOXX 600 also shed -0.65%, with declines for the DAX (-1.09%) and the CAC 40 (-0.70%) as well.

To the day ahead now, and data releases include German CPI for November, UK mortgage approvals for October, Canada’s Q3 GDP, the US Conference Board’s consumer confidence for November, and the FHFA house price index for September. Central bank speakers include BoE Governor Bailey and the BoE’s Mann, ECB Vice President de Guindos and the ECB’s de Cos.

Uncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest ratesUncategorized

These Cities Have The Highest (And Lowest) Share Of Unaffordable Neighborhoods In 2024

These Cities Have The Highest (And Lowest) Share Of Unaffordable Neighborhoods In 2024

Authored by Sam Bourgi via CreditNews.com,

Homeownership…

Authored by Sam Bourgi via CreditNews.com,

Homeownership is one of the key pillars of the American dream. But for many families, the idyllic fantasy of a picket fence and backyard barbecues remains just that—a fantasy.

Thanks to elevated mortgage rates, sky-high house prices, and scarce inventory, millions of American families have been locked out of the opportunity to buy a home in many cities.

To shed light on America’s housing affordability crisis, Creditnews Research ranked the 50 most populous cities by the percentage of neighborhoods within reach for the typical married-couple household to buy a home in.

The study reveals a stark reality, with many cities completely out of reach for the most affluent household type. Not only that, the unaffordability has radically worsened in recent years.

Comparing how affordability has changed since Covid, Creditnews Research discovered an alarming pattern—indicating consistently more unaffordable housing in all but three cities.

Fortunately, there’s still hope for households seeking to put down roots in more affordable cities—especially for those looking beyond Los Angeles, New York, Boston, San Jone, and Miami.

The typical American family has a hard time putting down roots in many parts of the country. In 11 of the top 50 cities, at least 50% of neighborhoods are out of reach for the average married-couple household. The affordability gap has widened significantly since Covid; in fact, no major city has reported an improvement in affordability post-pandemic.

Sam Bourgi, Senior Analyst at Creditnews

Key findings

-

The most unaffordable cities are Los Angeles, Boston, St. Louis, and San Jose; in each city, 100% of neighborhoods are out of reach for for married-couple households earning a median income;

-

The most affordable cities are Cleveland, Hartford, and Memphis—in these cities, the typical family can afford all neighborhoods;

-

None of the top 50 cities by population saw an improvement in affordable neighborhoods post-pandemic;

-

California recorded the biggest spike in unaffordable neighborhoods since pre-Covid;

-

The share of unaffordable neighborhoods has increased the most since pre-Covid in San Jose (70 percentage points), San Diego (from 57.8 percentage points), and Riverside-San Bernardino (51.9 percentage points);

-

Only three cities have seen no change in housing affordability since pre-Covid: Cleveland, Memphis, and Hartford. They’re also the only cities that had 0% of unaffordable neighborhoods before Covid.

Cities with the highest share of unaffordable neighborhoods

With few exceptions, the most unaffordable cities for married-couple households tend to be located in some of the nation’s most expensive housing markets.

Four cities in the ranking have an unaffordability percentage of 100%—indicating that the median married-couple household couldn’t qualify for an average home in any neighborhood.

The following are the cities ranked from the least affordable to the most:

-

Los Angeles, CA: Housing affordability in Los Angeles has deteriorated over the last five years, as average incomes have failed to keep pace with rising property values and elevated mortgage rates. The median household income of married-couple families in LA is $117,056, but even at that rate, 100% of the city’s neighborhoods are unaffordable.

-

St. Louis, MO: It may be surprising to see St. Louis ranking among the most unaffordable housing markets for married-couple households. But a closer look reveals that the Mound City was unaffordable even before Covid. In 2019, 98% of the city’s neighborhoods were unaffordable—way worse than Los Angeles, Boston, or San Jose.

-

Boston, MA: Boston’s housing affordability challenges began long before Covid but accelerated after the pandemic. Before Covid, married couples earning a median income were priced out of 90.7% of Boston’s neighborhoods. But that figure has since jumped to 100%, despite a comfortable median household income of $172,223.

-

San Jose, CA: Nestled in Silicon Valley, San Jose has long been one of the most expensive cities for housing in America. But things have gotten far worse since Covid, as 100% of its neighborhoods are now out of reach for the average family. Perhaps the most shocking part is that the median household income for married-couple families is $188,403—much higher than the national average.

-

San Diego, CA: Another California city, San Diego, is among the most unaffordable places in the country. Despite boasting a median married-couple household income of $136,297, 95.6% of the city’s neighborhoods are unaffordable.

-

San Francisco, CA: San Francisco is another California city with a high married-couple median income ($211,585) but low affordability. The percentage of unaffordable neighborhoods for these homebuyers stands at 89.2%.

-

New York, NY: As one of the most expensive cities in America, New York is a difficult housing market for married couples with dual income. New York City’s share of unaffordable neighborhoods is 85.9%, marking a 33.4% rise from pre-Covid times.

-

Miami, FL: Partly due to a population boom post-Covid, Miami is now one of the most unaffordable cities for homebuyers. Roughly four out of five (79.4%) of Miami’s neighborhoods are out of reach price-wise for married-couple families. That’s a 34.7% increase from 2019.

-

Nashville, TN: With Nashville’s population growth rebounding to pre-pandemic levels, the city has also seen greater affordability challenges. In the Music City, 73.7% of neighborhoods are considered unaffordable for married-couple households—an increase of 11.9% from pre-Covid levels.

-

Richmond, VA: Rounding out the bottom 10 is Richmond, where 55.9% of the city’s 161 neighborhoods are unaffordable for married-couple households. That’s an 11.9% increase from pre-Covid levels.

Cities with the lowest share of unaffordable neighborhoods

All the cities in our top-10 ranking have less than 10% unaffordable neighborhoods—meaning the average family can qualify for a home in at least 90% of the city.

Interestingly, these cities are also outside the top 15 cities by population, and eight are in the bottom half.

The following are the cities ranked from the most affordable to the least:

-

Hartford, CT: Hartford ranks first with the percentage of unaffordable neighborhoods at 0%, unchanged since pre-Covid times. Married couples earning a median income of $135,612 can afford to live in any of the city’s 16 neighborhoods. Interestingly, Hartford is the smallest city to rank in the top 10.

-

Memphis, TN: Like Hartford, Memphis has 0% unaffordable neighborhoods, meaning any married couple earning a median income of $101,734 can afford an average homes in any of the city’s 12 neighborhoods. The percentage of unaffordable neighborhoods also stood at 0% before Covid.

-

Cleveland, OH: The Midwestern city of Cleveland is also tied for first, with the percentage of unaffordable neighborhoods at 0%. That means households with a median-couple income of $89,066 can qualify for an average home in all of the city’s neighborhoods. Cleveland is also among the three cities that have seen no change in unaffordability compared to 2019.

-

Minneapolis, MN: The largest city in the top 10, Minneapolis’ share of unaffordable neighborhoods stood at 2.41%, up slightly from 2019. Married couples earning the median income ($149,214) have access to the vast majority of the city’s 83 neighborhoods.

-

Baltimore, MD: Married-couple households in Baltimore earn a median income of $141,634. At that rate, they can afford to live in 97.3% of the city’s 222 neighborhoods, making only 2.7% of neighborhoods unaffordable. That’s up from 0% pre-Covid.

-

Louisville, KY: Louisville is a highly competitive market for married households. For married-couple households earning a median wage, only 3.6% of neighborhoods are unaffordable, up 11.9% from pre-Covid times.

-

Cincinnati, OH: The second Ohio city in the top 10 ranks close to Cleveland in population but has a much higher median married-couple household income of $129,324. Only 3.6% of the city’s neighborhoods are unaffordable, up slightly from pre-pandemic levels.

-

Indianapolis, IN: Another competitive Midwestern market, only 4.4% of Indianapolis is unaffordable, making the vast majority of the city’s 92 neighborhoods accessible to the average married couple. Still, the percentage of unaffordable neighborhoods before Covid was less than 1%.

-

Oklahoma City, OK: Before Covid, Oklahoma City had 0% neighborhoods unaffordable for married-couple households earning the median wage. It has since increased to 4.69%, which is still tiny compared to the national average.

-

Kansas City, MO: Kansas City has one of the largest numbers of neighborhoods in the top 50 cities. Its married-couple residents can afford to live in nearly 95% of them, making only 5.6% of neighborhoods out of reach. Like Indiana, Kansas City’s share of unaffordable neighborhoods was less than 1% before Covid.

The biggest COVID losers

What's particularly astonishing about the current housing market is just how quickly affordability has declined since Covid.

Even factoring in the market correction after the 2022 peak, the price of existing homes is still nearly one-third higher than before Covid. Mortgage rates have also more than doubled since early 2022.

Combined, the rising home prices and interest rates led to the worst mortgage affordability in more than 40 years.

Against this backdrop, it’s hardly surprising that unaffordability increased in 47 of the 50 cities studied and remained flat in the other three. No city reported improved affordability in 2024 compared to 2019.

The biggest increases are led by San Jose (70 percentage points), San Diego (57.8 percentage points), Riverside-San Bernardino (51.9 percentage points), Sacramento (43 percentage points), Orlando (37.4 percentage points), Miami (34.7 percentage points), and New York City (33.4 percentage points).

The following cities in our study are ranked by the largest percentage point change in unaffordable neighborhoods since pre-Covid:

Uncategorized

Your financial plan may be riskier without bitcoin

It might actually be riskier to not have bitcoin in your portfolio than it is to have a small allocation.

This article originally appeared in the Sound Advisory blog. Sound Advisory provide financial advisory services and are specialize in educating and guiding clients to thrive financially in a bitcoin-powered world. Click here to learn more.

“Belief is a wise wager. Granted that faith cannot be proved, what harm will come to you if you gamble on its truth and it proves false? If you gain, you gain all; if you lose, you lose nothing. Wager, then, without hesitation, that He exists.”

- Blaise Pascal

Blaise Pascal only lived to age 39 but became world-famous for many contributions in the fields of mathematics, physics, and theology. The above quote encapsulates Pascal’s wager—a philosophical argument for the Christian belief in the existence of God.

The argument's conclusion states that a rational person should live as though God exists. Even if the probability is low, the reward is worth the risk.

Pascal’s wager as a justification for bitcoin? Yes, I’m aware of the fallacies: false dichotomy, appeal to emotion, begging the question, etc. That is not the point. The point is that binary outcomes instigate extreme results, and the game theory of money suggests that it’s a winner-take-all game.

The Pascalian investor: A rational approach to bitcoin

Humanity’s adoption of “the best money over time” mimics a series of binary outcomes—A/B tests.

Throughout history, inferior forms of money have faded as better alternatives emerged (see India’s failed transition to a gold standard). And if bitcoin is trying to be the premier money of the future, it will either succeed or it won’t.

“If you ain’t first, you’re last.” -Ricky Bobby, Talladega Nights, on which monies succeed over time.

So, we can look at bitcoin success similarly to Pascal’s wager—let’s call it Satoshi’s wager. The translated points would go something like this:

- If you own bitcoin early and it becomes a globally valuable money, you gain immensely. ????

- If you own bitcoin and it fails, you’ve lost that value. ????

- If you don’t own bitcoin and it goes to zero, no pain and no gain. ????

- If you don’t own bitcoin and it succeeds, you will have missed out on the significant financial revolution of our lifetimes and fall comparatively behind. ????

If bitcoin is successful, it will be worth far more than it is today and have a massive impact on your financial future. If it fails, the losses are only limited to your exposure. The most that you could lose is the money that you invested.

It is hypothetically possible that bitcoin could be worth 100x more than it is today, but it can only possibly lose 1x its value as it goes to zero. The concept we’re discussing here is asymmetric upside - significant gains with relatively limited downside. In other words, the potential rewards of the investment outweigh the potential risks.

Bitcoin offers an asymmetric upside that makes it a wise investment for most portfolios. Even a small allocation provides potential protection against extreme currency debasement.

Salt, gasoline, and insurance

“Don’t over salt your steak, pour too much gas on the fire, or buy too much insurance.”

A little bit goes a long way, and you can easily overdo it. The same applies when looking at bitcoin in the context of a financial plan.

Bitcoin’s asymmetric upside gives it “insurance-like” qualities, and that insurance pays off very well in times of money printing. This was exemplified in 2020 when bitcoin's value increased over 300% in response to pandemic money printing, far outpacing stocks, gold, and bonds.

Bitcoin offers a similar asymmetric upside today. Bitcoin's supply is capped at 21 million coins, making it resistant to inflationary debasement. In contrast, the dollar's purchasing power consistently declines through unrestrained money printing. History has shown that societies prefer money that is hard to inflate.

If recent rampant inflation is uncontainable and the dollar system falters, bitcoin is well-positioned as a successor. This global monetary A/B test is still early, but given their respective sizes, a little bitcoin can go a long way. If it succeeds, early adopters will benefit enormously compared to latecomers. Of course, there are no guarantees, but the potential reward justifies reasonable exposure despite the risks.

Let’s imagine Nervous Nancy, an extremely conservative investor. She wants to invest but also take the least risk possible. She invests 100% of her money in short-term cash equivalents (short-term treasuries, money markets, CDs, maybe some cash in the coffee can). With this investment allocation, she’s nearly certain to get her initial investment back and receive a modest amount of interest as a gain. However, she has no guarantees that the investment returned to her will purchase the same amount as it used to. Inflation and money printing cause each dollar to be able to purchase less and less over time. Depending on the severity of the inflation, it might not buy anything at all. In other words, she didn’t lose any dollars, but the dollar lost purchasing power.

Now, let’s salt her portfolio with bitcoin.

99% short-term treasuries. 1% bitcoin.

With a 1% allocation, if bitcoin goes to zero overnight, she’ll have only lost a penny on the dollar, and her treasury interest will quickly fill the gap. Not at all catastrophic to her financial future.

However, if the hypothetical hyperinflationary scenario from above plays out and bitcoin grows 100x in purchasing power, she’s saved everything. Metaphorically, her entire dollar house burned down, and “bitcoin insurance” made her whole. Powerful. A little bitcoin salt goes a long way.

(When protecting against the existing system, it’s important to remember that you need to get your bitcoin out of the system. Keeping bitcoin on an exchange or with a counterparty will do you no good if that entity fails. If you view bitcoin as insurance, it’s essential to keep your bitcoin in cold storage and hold your keys. Otherwise, it’s someone else’s insurance.)

When all you have a hammer, everything looks like a…

A construction joke:

There are only three rules to construction: 1.) Always use the right tool for the job! 2.) A hammer is always the right tool! 3.) Anything can be a hammer!

Yeah. That’s what I thought, too. Slightly funny and mostly useless.

But if you spend enough time swinging a hammer, you’ll eventually realize it can be more than it first appears. Not everything is a nail. A hammer can tear down walls, break concrete, tap objects into place, and wiggle other things out. A hammer can create and destroy; it builds tall towers and humbles novice fingers. The use cases expand with the skill of the carpenter.

Like hammers, bitcoin is a monetary tool. And a 1-5% allocator to the asset typically sees a “speculative insurance” use case - valid. Bitcoin is speculative insurance, but it is not only speculative insurance. People invest and save in bitcoin for many different reasons.

I’ve seen people use bitcoin to pursue all of the following use cases:

- Hedging against a financial collapse (speculative insurance)

- Saving for family and future (long-term general savings and safety net)

- Growing a downpayment for a house (medium-term specific savings)

- Shooting for the moon in a manner equivalent to winning the lottery (gambling)

- Opting out of government-run, bank-controlled financial systems (financial optionality)

- Making a quick buck (short-term trading)

- Escaping a hostile country (wealth evacuation)

- Locking away wealth that can’t be confiscated (wealth preservation)

- As a means to influence opinions and gain followers (social status)

- Fix the money and fix the world (mission and purpose)

Keep this in mind when taking other people’s financial advice. They are often playing a different game than you. They have different goals, upbringings, worldviews, family dynamics, and circumstances. Even though they might use the same hammer as you, it could be for a completely different job.

Wrapping Up

A massive allocation to bitcoin may seem crazy to some people, yet perfectly reasonable to others. The same goes for having a 1% allocation.

But, given today’s macroeconomic environment and bitcoin’s trajectory, I find very few use cases where 0% bitcoin makes sense. By not owning bitcoin, you implicitly say that you are 100% certain it will fail and go to zero. Given its 14-year history so far, I’d recommend reducing your confidence. Nobody is 100% right forever. A little salt goes a long way. Your financial plan may be riskier without bitcoin. Diversify accordingly.

“We must learn our limits. We are all something, but none of us are everything.” - Blaise Pascal.

bonds pandemic stocks bitcoin link goldContact

Office: (208)-254-0142

Ste. 205

Eagle, ID 83616

Check the background of your financial professional on FINRA's BrokerCheck.The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Copyright 2024 FMG Suite.

Sound Advisory, LLC (“SA”) is a registered investment advisor offering advisory services in the State of Idaho and in other jurisdictions where exempt. Registration does not imply a certain level of skill or training. The information on this site is not intended as tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This information should not be relied upon as the sole factor in an investment-making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal any performance noted on this site.

The information on this site is provided “AS IS” and without warranties of any kind, either express or implied. To the fullest extent permissible pursuant to applicable laws, Sound Advisory LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

SA does not warrant that the information on this site will be free from error. Your use of the information is at your sole risk. Under no circumstances shall SA be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if SA or an SA authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges