Uncategorized

Futures Rise Ahead Of Critical CPI Print

Futures Rise Ahead Of Critical CPI Print

After yesterday’s cryptoquake shook all capital markets, sending global stocks tumbling, on Thursday…

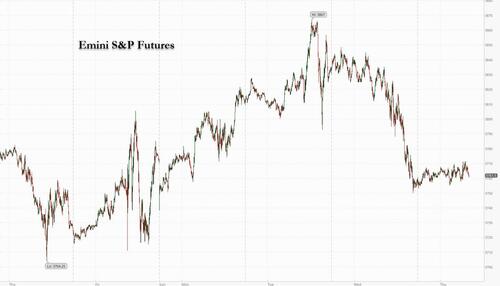

After yesterday's cryptoquake shook all capital markets, sending global stocks tumbling, on Thursday morning US equity futures are steady as traders brace for an inflation print which will determine not only the December Fed rate hike but set the pace for Fed tightening over the next quarter. Nasdaq 100 and S&P 500 futures both edged modestly higher, rising 0.2% at 7:30 a.m. ET after underlying indexes plunged on Wednesday as the sweeping Republican Congressional victories that Wall Street traders bet on failed to materialize. Treasuries fell, with yield curves bear-flattening. The dollar advanced, while oil extended its slide to a fourth day.

In premarket trading, Coinbase led cryptocurrency-exposed stocks higher as Bitcoin rallied following Wednesday’s rout fueled by the withdrawal of Binance’s offer to buy FTX.com. Gen Digital Inc. jumped as its earnings matched estimates. Here are the other notable premarket movers:

- Rivian shares gained 6.7% in US premarket trading after the electric-vehicle maker confirmed its guidance and a plan to build 25,000 EVs this year, even in the face of supply- chain issues weighing on its manufacturing operations. Analysts welcomed its third-quarter results as positive.

- Coupang shares jump as much as 14% in US premarket trading after the South Korean e-commerce firm reported earnings that exceeded expectations, with Morgan Stanley calling it a “breakthrough” quarter.

- Altria Group drops 1.9% in premarket trading as UBS downgrades it to a sell from neutral, saying in a note that the market appears to be pricing in too favorable an outlook for the company as consumers go for cheaper products.

- Coinbase shares gain ~2% in premarket trading as Bitcoin rose following Wednesday’s rout fueled by the withdrawal of Binance’s offer to buy FTX.com.

- Digital Turbine shares surged as much as 24% in US premarket trading, putting the stock on track for its biggest gain since August 2020, after the mobile phone software maker posted 2Q profit and adjusted Ebitda that beat estimates.

- RingCentral’s guidance on improving margins addresses a key investor concern and will be welcomed, analysts say. Shares in the cloud communications software firm rose 13% in extended trading.

- Bumble’s quarterly results and guidance are disappointing and will leave investors with concerns over its underlying performance and execution, analysts say. The stock fell 15% in after-hours trading after the report.

As we previewed earlier, the CPI for October is expected to have climbed 7.9% from a year ago, only a slight slowing from the 8.2% recorded in September. Investors will be closely assessing whether the Fed’s interest-rate increases are reining in prices and what a potential miss or beat would mean for the US central bank’s policy. A preview by a Goldman trader shared the following trading framework:

- >8.2% S&P loses 3+%

- 8 – 8.2% S&P loses 1-2%

- 7.8 – 7.9% S&P gains 0 - 1%

Meanwhile, according to a scenario analysis by JPMorgan, the S&P 500 could rally more than 5% if the reading falls to 7.6% or below, but a higher-than-estimated figure would spark a 6% slump.

“The consumer price index is the center of attention,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “An upside surprise could be temporarily painful given the current risk-off momentum. Investors are still incredibly jittery due to the crypto train wreck, US election bets that failed to materialize, and the seemingly never-ending Covid malaise in China.”

"We expect the Fed will continue to increase interest rates and we see peak rates in March 2023, reaching 5.25%," Frederique Carrier, head of investment strategy at RBC Wealth Management, said on Bloomberg TV. “The Fed seems to be standing out from other central banks in terms of its hawkishness. Having said that, the labor market is starting to show some cracks and we think that while the Fed is being quite hawkish now, it might reverse path quite quickly.”

Among midterm updates, Republicans are inching toward control of the House. Still, Democrats delivered a better-than-expected performance in the elections, defying predictions of a conservative red wave sweeping the nation. Wall Street was looking forward to a period of divided government, promising to prevent any major policy changes that could worsen inflation or just make the economic or corporate outlook more uncertain. It will still get it but in a more modest version.

European stocks pared losses with risk sentiment recovering slightly ahead of key US inflation data later. Euro Stoxx 50 falls 0.2%. FTSE MIB outperforms peers, adding 0.2%, CAC 40 lags, dropping 0.6%. Real estate, retail and miners lag while utilities and healthcare outperform. Here are some of the biggest movers in Europe:

- AstraZeneca shares rise as much as 2.5% as the pharmaceuticals firm raises guidance after a 3Q beat helped by strong performance for key drugs such as Calquence and Imfinzi.

- Allianz gains as much as 2.6% after 3Q earnings showed a stronger-than- expected capital position, modestly uplifted earnings guidance and the German insurer announced a EU1b buyback, according to Jefferies.

- Engie rises as much as 6.1%, hitting the highest since February, with analysts saying the French energy group’s new guidance is comfortably ahead of expectations.

- Delivery Hero jumps as much as 12% after the food delivery firm increased its Ebitda margin target, despite guiding gross merchandise value for the year to the lower end of its outlook range. The results offer “more to cheer than fear,” according to Jefferies.

- Teleperformance tumbles as much as 38% as Colombia’s Ministry of Labor started an investigation into the French call center operator. The probe is related to “alleged union-busting, traumatic working conditions and low pay,” according to a Time Magazine report on Wednesday.

- B&M drops as much as 7.8% after the UK discount retailer reported 1H adjusted Ebitda fell 18% from a year earlier. RBC expects FY24 consensus estimates to be cut, given that margins are likely to come under more pressure from the stronger dollar and more discounting.

- ALK-Abello falls as much as 13% after slowing sales for the Danish allergy drugmaker’s key tablet products cast doubt on the company’s growth going ahead, analysts say.

- Luxury stocks including Italian brand Moncler, Danish jeweler Pandora and Cartier-owner Richemont slip after China stepped up Covid-related restrictions across some of its biggest cities, including Beijing.

Earlier in the session, Asian equities dropped for a second day, as the turmoil in the crypto market and China’s Covid restrictions prompted a selloff ahead of key US Inflation data. The MSCI Asia Pacific Index fell more than 1%, with gauges in Hong Kong among the biggest decliners in the region. Consumer discretionary and tech shares fell the most. Shares linked to the crypto industry fell after Binance dropped its bid for FTX.com, while China’s heavyweights face dwindling Singles Day sales. Risk-off sentiment prevailed in Asia trading on Thursday as investors awaited data on price increases in the US to gauge the Fed’s next policy move. Chinese stocks dropped as the nation strengthened Covid restrictions to curb an outbreak in a key manufacturing hub, dampening hopes of a reopening that triggered a rally this month.

“I believe weak sentiment from the US and crypto is spilling over into Asia today with broad regional declines,” said Marvin Chen, a Bloomberg Intelligence strategist. “We expect volatility to continue until we get a catalyst on policy direction, which may be coming as attention turns to 2023.” Vietnam stocks tumbled as leveraged traders exited positions on concerns about liquidity shortages spreading in the property sector. The Asia benchmark is still poised for back-to-back weekly gains as traders piled into beaten-down Chinese shares on Monday. But with optimism over a potential China reopening losing momentum and the jury out on US inflation, investors remain on edge

Japanese stocks declined for a second day following US peers lower, as risk appetite decreased. A deepening slump in cryptocurrencies hurt sentiment, as investors also parsed US midterm election results ahead of key inflation data due later Thursday. The Topix fell 0.7% to close at 1,936.66, while the Nikkei declined 1% to 27,446.10. Toyota Motor Corp. contributed the most to the Topix decline, decreasing 2.9%. Out of 2,165 stocks in the index, 708 rose and 1,347 fell, while 110 were unchanged. “If the CPI numbers come out higher than estimates, the Fed will likely tighten further,” said Tomo Kinoshita, a global market strategist at Invesco Asset Management. “This is a risk factor that might cause Japanese stocks to decline further.”

Australian stocks halted a four-day winning streak, weighed by declines in mining and financial shares. The S&P/ASX 200 index fell 0.5% to close at 6,964.00 with Origin Energy the top performer, surging 35% after it received a takeover offer from a group led by Canadian private equity giant Brookfield. Xero was among the worst decliners after the enterprise software firm’s EBITDA result missed analyst estimates, according to Jefferies. In New Zealand, the S&P/NZX 50 index fell 0.5% to 11,091.93

In FX, the Bloomberg Dollar Spot Index advanced 0.3%, adding to the 0.6% advance on Wednesday, and the greenback strengthened against most of its Group-of-10 peers. The euro was among the worst performers and fell to a low of $0.9937. Treasuries bear- flattened, with yields rising by 1-4bps. Bunds fell in line with Treasuries while Italian bonds underperformed. The pound was the best G-10 performer, after dropping 1.6% against the dollar on Wednesday. Options have been bearish the euro ever since the US warned in early February that Russia could take offensive military action or attempt to spark a conflict inside Ukraine. A soft US CPI print could be the stimulus for a new era in its volatility skew. Gilts slipped, sending yields up by around 4bps across the curve. The yen was steady within recent narrow ranges against the greenback while implied volatility rose across the curve, led by shorter-term tenors, as investors geared up for upcoming US inflation data.

In rates, Treasuries were narrowly mixed across the curve into early US session with front-end and belly yields higher, flattening 2s10s, 5s30s spreads from Wednesday’s highs. Yields were cheaper by ~2bp across front-end of the curve with 2s10s, 5s30s spreads flatter by ~3bp and ~1bp on the day; 10- year yields around 4.095% are little changed vs Wednesday’s close with gilts outperforming by ~2bp in the sector. Price action muted ahead of October CPI data, 30-year bond auction and several Fed speakers. Fed speaker slate follows early comments from Minneapolis Fed’s Kashkari, who said that any talk of a Fed pivot is “entirely premature”; Harker, Logan, Daly, Mester and George are scheduled to speak during the US session. US auction cycle concludes with $21b 30- year bond sale at 1pm; Wednesday’s 10-year tailed by 3.4bp. WI 30- year yield at 4.23% is above auction stops since 2011 and ~30bp cheaper than October’s, which tailed by 1bp. Bunds 10-year yields rise about 1.5bps, each within Wednesday’s range; gilts underperform, with the 10-year yield adding 5bps to above 3.5%.

WTI drifts 0.5% lower to trade around $85 intraday as the mood remains cautious and the Dollar picks up. Base metals are also lower across the board amid the cautious risk tone and firmer Dollar, with 3M LME copper back under USD 8,000/t (vs high USD 8,100/t). Spot gold has adopted a mild downside bias as the Dollar gained in recent trade, with the 100 DMA at USD 1,714.55/oz and yesterday’s low at USD 1,701.20/oz.

Bitcoin extended gains, advancing about 6% after earlier hitting a fresh low for the year at $15,574.

FTX's downfall was rooted in poorly performing investments made during the crypto rout and the FTX owner used customer deposits to partially finance his trading firm earlier this year, according to Reuters sources. It was also separately reported that FTX is seeking emergency funding to meet withdrawal requests and without funding would result in bankruptcy, according to Bloomberg.

To the day ahead now, and the main highlight will be the US CPI release for October. Other data releases include the US weekly initial jobless claims and Italian industrial production for September. From central banks, speakers include the Fed’s Waller, Harker, Daly, Mester and George, as well as the ECB’s Schnabel, Kazimir, Vasle and de Cos, along with the BoE’s Ramsden.

Market Snapshot

- S&P 500 futures up 0.3% to 3,766.25

- STOXX Europe 600 down 0.1% to 419.75

- MXAP down 1.2% to 141.77

- MXAPJ down 1.4% to 455.83

- Nikkei down 1.0% to 27,446.10

- Topix down 0.7% to 1,936.66

- Hang Seng Index down 1.7% to 16,081.04

- Shanghai Composite down 0.4% to 3,036.13

- Sensex down 0.7% to 60,593.48

- Australia S&P/ASX 200 down 0.5% to 6,964.02

- Kospi down 0.9% to 2,402.23

- German 10Y yield up 0.6% at 2.19%

- Euro down 0.5% to $0.9966

- Brent Futures down 0.2% at $92.45/bbl

- Gold spot up 0.1% to $1,707.72

- U.S. Dollar Index little changed at 110.63

Top Overnight News from Bloomberg

- While an expected fall in US CPI will likely be welcomed by investors, Friday’s University of Michigan 5-10 year inflation expectations will resonate with Federal Reserve officials fearful of price rises becoming entrenched

- Federal Reserve Bank of Minneapolis President Neel Kashkari said policymakers were trying hard to achieve a soft landing for the US economy but will not flinch from curbing high inflation

- The ECB has increased the amount of securities that central banks in the euro area can lend out against cash collateral, a bid to satisfy demand for high-quality liquid assets around year-end

- Norway’s inflation unexpectedly accelerated to 7.5% in October, the fastest pace since 1987, while economists in a Bloomberg survey had expected an increase to 7.1%. Price growth in Denmark rose to 10.1% in September -- a 40-year high

- Japan is enjoying some success in its battle with speculators targeting the enfeebled yen and the central bank’s stubborn grip on yields, but more tests lie ahead

A more detailed look at global markets courtesy of newsquawk

APAC stocks traded negatively as the region followed suit to the losses stateside where the major indices were pressured amid a firmer dollar and contagion from further crypto turmoil as Binance pulled out of the FTX buyout deal. ASX 200 was subdued by underperformance in the tech and commodity-related sectors although losses in the index were cushioned by M&A-related news with Origin Energy shares up by more than 30% following a buyout offer from a Brookfield consortium and with Perpetual underpinned after it rejected a revised non-binding indicative proposal. Nikkei 225 declined as participants digested a slew of earnings releases and with Honda amongst the worst performers after its H1 net fell and cut its vehicle sales forecast due to the chip shortage. Hang Seng and Shanghai Comp retreated amid ongoing COVID woes in China after Guangzhou locked down another district on Wednesday, while two districts in Chongqing also raised COVID restrictions and halted schools.

Top Asian News

- US President Biden said he is not willing to make any fundamental concessions when he meets with Chinese President Xi and he wants them to lay out what each of their red lines are when they meet. Biden added that they will discuss Taiwan and will discuss fair trade with Xi, as well as relationships with other countries, according to Reuters.

- China Politburo Standing Committee hosted its first meeting; top leadership was urged to stick with COVID zero policy, state media reports; urges more precise COVID control, stressed the need to minimise impacts on economy.

- Two districts in China's Chongqing were said to have raised COVID restrictions and halted schools.

- BoJ Governor Kuroda said they are not at the stage where they can debate an exit and that raising interest rates now would hurt the economy still in the midst of recovering from the pandemic's impact, so is undesirable. BoJ Governor Kuroda said they will maintain easy monetary policy to sustainably and stably achieve 2% inflation accompanied by wage growth, while he also stated that deepening the negative rate is among the policy options if needed, according to Reuters.

- RBA Deputy Governor Bullock said they are seeing more broad-based CPI pressure in the economy and need to raise interest rates to influence demand, although she separately commented that they are getting closer to the point where they might be able to pause and take a look, while she is hoping demand in the economy is slowing but needs more evidence, according to Reuters.

- BoJ Governor Kuroda said he told PM Kishida that the BoJ will continue with monetary easing to achieve the price target in tandem with wage growth, via Reuters.

- Japanese government has asked residents to stay at home in the event that localities request stronger measures during a future COVID wave, according to NHK.

Major bourses mostly hold a downward bias following weak handovers from Wall Street and then APAC in the run-up to US CPI later today. Sectors in Europe are mostly in the red, although to a lesser extent than at the cash open, with no overarching theme aside from earnings. US equity futures are trading sideways with modest gains and relatively broad-based performance thus far.

Top European News

- UK Chancellor Hunt is reportedly looking to cut the surcharge on UK bank profits to 3% from 8% which would effectively shield UK banks from the bulk of a corporate tax rise, according to Bloomberg.

- What to Expect in UK Chancellor’s Plan to Fix Fiscal Hole

- UK Has Frozen Over £18 Billion in Russian Assets On Sanctions

- Paris, London Commuters Hit by Strike Chaos on Thursday

- Teleperformance Slumps 38% on Report of Colombian Labor Probe

- Inflation Jump in Norway, Denmark Adds Woes for Nordic Economies

- Credit Agricole ‘Very Confident’ on Banco BPM Talks

FX

- DXY managed to fend off further downside pressure and form a base just above 110.000 before rebounding towards 111.00.

- AUD, NZD, CHF, and EUR are the major laggards as the Buck bounced and sentiment soured.

- GBP stands as the g10 outperformer as Cable held around 1.1350 and above the 50 DMA.

Fixed Income

- Bonds appear to have hit the buffers for little apparent reason other than corrective price action and positioning for US CPI.

- US Treasuries touched 110-25+ overnight compared to its 109-14 w-t-d trough.

- Gilts peaked at 103.70 on Liffe yesterday vs 99.92 the day before.

- Bunds reached 138.74 earlier having been down at 135.76 at one stage on Tuesday.

Commodities

- WTI and Brent futures trade with mild losses intraday as the mood remains cautious and the Dollar picks up.

- Spot gold has adopted a mild downside bias as the Dollar gained in recent trade, with the 100 DMA at USD 1,714.55/oz and yesterday’s low at USD 1,701.20/oz.

- Base metals are also lower across the board amid the cautious risk tone and firmer Dollar, with 3M LME copper back under USD 8,000/t (vs high USD 8,100/t).

Geopolitics

- US President Biden said Russia's evacuation of Kherson shows that they have real problems and he hopes that Russian President Putin will discuss more seriously a prisoner exchange for Brittney Griner.

- US will not give advanced drones to Ukraine to avoid escalation with Russia, according to WSJ.

- Top US general sees a relatively static front line in Ukraine during the winter and said opportunities to negotiate must be seized, according to Reuters.

- Indonesian government confirmed that Russian President Putin will not attend the G20 summit in Bali but said he is scheduled to participate in one session at the G20 summit virtually, while Russia is to send Foreign Minister Lavrov instead, according to Reuters.

- Russia's Kremlin said Foreign Minister Sergei Lavrov will represent Russia at the G20 summit in Indonesia, according to Al Jazeera.

US Event Calendar

- 08:30: Oct. CPI MoM, est. 0.6%, prior 0.4%

- CPI YoY, est. 7.9%, prior 8.2%

- CPI Ex Food and Energy YoY, est. 6.5%, prior 6.6%

- CPI Ex Food and Energy MoM, est. 0.5%, prior 0.6%

- Real Avg Hourly Earning YoY, prior -3.0%

- 08:30: Nov. Initial Jobless Claims, est. 220,000, prior 217,000

- Continuing Claims, est. 1.49m, prior 1.49m

- 08:30: Oct. Real Avg Weekly Earnings YoY, prior -3.8%

- 14:00: Oct. Monthly Budget Statement, est. -$90b, prior -$165.1b

Central bank speakers

- 09:00: Fed’s Harker Discusses The Economic Outlook

- 09:35: Fed’s Logan Speaks at Energy and the Economy Conference

- 11:00: Fed’s Daly Speaks with European Economics & Financial Center

- 12:30: Fed’s Mester Discusses the Economic Outlook

- 13:30: Fed’s George Speaks at Energy and the Economy Conference

DB's Jim Reid concludes the overnight wrap

As we wake up two days after the midterm elections, we still don’t have much more certainty to offer you this morning on which party has won either chamber of Congress. Based on the results we have so far, the most likely outcome appears to be that the Republicans will retake the House with a narrow majority, and the Democrats will maintain control of the Senate narrowly as well. But we should caveat that there’s still a margin of error around both those outcomes, with a non-zero chance that the Republicans could still end up with a majority in the Senate, or that the Democrats end up just about maintaining their control of the House.

Ultimately, the outcome is going to hinge on a small handful of tight races, which could take days or even weeks to resolve. That’s particularly the case in the Senate, where the CNN count now stands at 49 seats for the Republicans and 48 for the Democrats, with 3 races still outstanding. Both sides need to pick up 2 of those 3 to win the chamber, since in the event of a 50-50 split, it would go to the Democrats with Vice President Harris’ tie-breaking vote. One of those 3 outstanding races is in Georgia, which is heading to a runoff election on December 6, as no candidate received the 50% necessary to win under state law. That means that if the other two races in Nevada and Arizona aren’t won by the same party, control of the entire Senate will hinge on that runoff result next month, just as happened two years ago.

When it comes to the House of Representatives, CNN’s count is now at 209 for the Republicans and 191 for the Democrats, with 218 needed for the majority. So far, the Republicans have gained a net 12 seats from the Democrats, which is above the net gain of 5 they require to retake the House. There are still some outstanding races, but as it stands the Republicans are ahead in the vote count in enough seats to just about give them a majority, albeit a very narrow one.

Whilst the range of outcomes is still open, the results we have make clear it was a much better outcome for the Democrats than generally expected beforehand. Indeed, whereas the Republicans lost -42 House seats in 2018 at President Trump’s first midterm election, and the Democrats lost -63 House seats in 2010 at President Obama’s first midterm election, today’s vote count suggests that the Democrat’s House losses could be in the single-digits, if you look at who’s ahead in each district as it stands. One Republican who did perform strongly however was Florida’s Governor Ron DeSantis, who won re-election by nearly 20 points and strengthened his position as a potential challenger for the Republican presidential nomination in 2024.

US equities have historically done very well in the year following the midterm elections, but day one got off to a bad start yesterday, with the S&P 500 (-2.08%) ending its run of three consecutive gains with a sharp move lower. That was driven by losses among the more cyclical sectors, with tech stocks in particular suffering losses, which left the NASDAQ (-2.48%) and the FANG+ Index (-3.44%) noticeably lower on the day. Weak earnings didn’t help matters either, with Disney (-13.16%) ending up as the worst performer in the entire S&P after falling short of analysts’ estimates.

That decline in risk appetite comes ahead of the latest US CPI data for October, which is out at 13:30 London time. This is one of the most important variables for the Fed as they consider whether to slow down their pace of rate hikes next month, although it’s worth bearing in mind that there’s still another CPI report after this one before their next meeting. In terms of what to expect, our US economists see energy boosting the monthly headline CPI print to +0.62%, which would be the fastest pace since June. However, they see core CPI stepping down a bit to +0.46%, and think that should draw the most focus, especially given the upside surprise in that measure last month. In turn, those monthly numbers should see the year-on-year CPI tick down to +8.0%, whilst year-on-year core CPI should also see a modest fall to +6.5%.

Ahead of the CPI release, investors moved to take out some of the monetary tightening they’d been expecting over the months ahead, with the futures-implied rate for December 2023 down -7.5bps to 4.70%. In turn, that helped Treasuries at the front-end of the curve to rally, with the 2yr yield coming down -7.1bps to 4.58%, while 10yr yields fell -3.1bps to 4.09%. That downward trend in yields has continued in overnight trading, with 10yr yields (-3.0 bps) trading at 4.06% as we go to print.

Whilst US assets struggled, European ones put in a relatively better performance yesterday, aided by the news that Russia had ordered its troops to leave the city of Kherson in Ukraine. To date, markets have generally taken news of Russian losses as a positive, as it’s seen as raising the chances of them negotiating, even if recent months haven’t exactly borne out that thesis. Nevertheless, sovereign bonds in Europe rallied on the back of the news, with yields on 10yr bunds (-11.2bps), OATs (-10.9bps) and gilts (-9.7bps) all ending the day lower. When it came to equities, the major indices did decline, although significantly less than their US counterparts, with the STOXX 600 down -0.30%.

Those losses for US equities have been echoed in Asia this morning, with indices including the Hang Seng (-1.77%), Nikkei (-0.96%), the CSI (-1.09%), the Shanghai Composite (-0.59%) and the KOSPI (-0.61%) all trading in negative territory. In the meantime, there’ve also been sharp losses in crypto markets, with Bitcoin slumping -15.87% yesterday to $15,731, which is its lowest closing level in nearly two years, although this morning it’s since rebounded +5.80% to $16,644. That came as Binance walked away from plans to acquire the FTX.com exchange. Bloomberg reported that FTX’s CEO told investors yesterday that the company would need to file for bankruptcy without a cash injection. Looking forward however, US equity futures are pointing to a modest rebound today, with those on the S&P 500 (+0.23%) and the NASDAQ 100 (+0.43%) moving higher.

To the day ahead now, and the main highlight will be the US CPI release for October. Other data releases include the US weekly initial jobless claims and Italian industrial production for September. From central banks, speakers include the Fed’s Waller, Harker, Daly, Mester and George, as well as the ECB’s Schnabel, Kazimir, Vasle and de Cos, along with the BoE’s Ramsden.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex