Futures Rise Ahead Of Biggest Fed Rate Hike Since The Dot Com Bubble Burst

Futures Rise Ahead Of Biggest Fed Rate Hike Since The Dot Com Bubble Burst

May the 4th is here, and US futures are up slightly ahead of a…

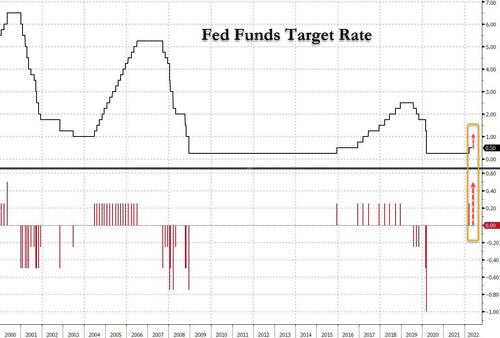

May the 4th is here, and US futures are up slightly ahead of a key Federal Reserve meeting in which the Fed is widely expected to raise rates by 50bps, the biggest hike since the dot com bubble burst in May 2000, and to release plans for balance-sheet normalization; Chair Powell’s post-meeting press conference will provide guidance on potential for bigger rate hikes at subsequent meetings and policy makers’ assessment of the neutral rate. As DB's Jim Reid puts it, "if you're under 43, did 3 years at university and then joined financial markets then you won't have worked in an era of 50bps Fed rate hikes. This will very likely change tonight as the Fed are a near certainty to raise rates by 50bps. In fact it'll be the first time the Fed have hiked at consecutive meetings since 2006. So we enter a new era that won't be familiar to many."

In any case, investors have already priced in the Fed’s largest hike since 2000 - in fact, OIS contracts currently price in around 160bp of additional hikes over the next three policy meetings - and they will scrutinize Chair Jerome Powell’s speech for clues on the pace of future rate increases and balance-sheet reduction. Some traders are betting on an even larger 75 basis-point hike in June. As such, even though global financial conditions are already the tightest they have ever been (according to Goldman), S&P and Nasdaq futures are both up 0.5%, while 10-year yields drifts lower, having stalled again near 3% at the European open.

"Powell’s words about how aggressively the Fed will tame inflation are likely to shape market sentiment for the next couple of weeks at least," said technical analyst Pierre Veyret at ActivTrades in London. Lyft tumbled 26% in premarket trading after the ride-hailing company’s second-quarter outlook disappointed Wall Street.

Global bonds have slumped under a wave of monetary tightening, with German 10-year yields around 1% and the U.K.’s near 2%, while US 10Y yields are circling 3%. Adding to the tightening outlook, European Central Bank Executive Board Member Isabel Schnabel said it’s time for policy makers to take action to tame inflation, and that an interest-rate hike might come as early as July. Meanwhile, Iceland’s central bank delivered its biggest hike since the 2008 financial crisis and India’s raised its key interest rate in a surprise move Wednesday.

“There is a difficult set up in general for risk assets” as valuations remain stretched despite a drop in equities, Kathryn Koch, chief investment officer for public markets equity at Goldman Sachs & Co., said on Bloomberg Television. She added that “some people think stagflation is a real risk.”

In premarket trading, Didi Global was 6% lower and Chinese technology shares slumped as the U.S. Securities and Exchange Commission is investigating the ride-hailing giant’s chaotic 2021 debut in New York. Advanced Micro Devices jumped 5.7% in premarket trading after the chipmaker gave a strong sales forecast for the current quarter. Starbucks gained 6.6% after the coffee chain reported higher-than-expected U.S. sales, outweighing the negative impact of high inflation and Chinese lockdowns. Here are some of the biggest U.S. movers today:

- Lyft (LYFT) shares slump 27% premarket after the ride-hailing company’s second-quarter outlook disappointed Wall Street, highlighting investors’ willingness to dump growth stocks at the first hint of trouble

- Uber (UBER) slipped as Lyft’s results hit the more diversified peer. Uber said it rescheduled the release of its 1Q financial results and its quarterly conference to Wednesday morning from the afternoon, after rival Lyft gave a weaker-than-expected outlook

- Airbnb (ABNB) jumps 4.5% premarket after its second-quarter revenue forecast beat estimates, with the company seeing “substantial demand” after more than two years of Covid-19 restrictions

- Livent (LHTM) shares surge 23% premarket, with KeyBanc highlighting an increase in the lithium product maker’s 2022 Ebitda guidance

- Match Group (MTCH) slips 6.7% premarket as analysts say the miss in the dating-app company’s guidance takes some of the shine off its revenue beat

- Didi Global (DIDI) led a drop in U.S.-listed Chinese internet stocks after news of an SEC investigation into the ride-hailing company’s 2021 debut in New York added to investor concerns around the sector

- Skyworks Solutions (SKWS) shares drop 2.5% premarket after the semiconductor device company gave a forecast that was below the average analyst estimate

- Herbalife (HLF) sinks 17% premarket after slashing its full-year forecast and setting second-quarter adjusted earnings per share outlook below the average analyst estimate

- Advanced Micro Devices (AMD) rises as much as 7.5% in premarket trading, with analysts positive on the demand the chipmaker is seeing from data centers

- Akamai (AKAM) falls as much as 14% after analysts noted that a slowdown in internet traffic and the loss of revenue due to the war in Ukraine hit the company’s first-quarter results and full-year guidance

JPMorgan CEO Jamie Dimon said in an interview Wednesday that the Fed should have moved quicker to raise rates as inflation hits the world economy. He said there was a 33% chance of the Federal Reserve’s actions leading to a soft landing for the U.S. economy and a third chance of a mild recession.

“The Fed remains very focused on bringing inflation down, however, any further hawkish pivots will likely be tempered to some extent by the desire to achieve a soft landing,” Blerina Uruci, U.S. economist at T. Rowe Price Group Inc., wrote in a note.

In Europe, declines for retailers and most other industry groups outweighed gains for energy, media and travel and leisure companies, pulling the Stoxx 600 Europe Index down 0.6%. The DAX outperforms, dropping 0.4%, Stoxx 600 lags, dropping 0.5%. Retailers, financial services and construction are the worst performing sectors. Here are the biggest European movers:

- Flutter Entertainment rises more than 6.9% its 1Q update matched broker expectations. Jefferies says a strong U.S. performance fuels confidence that a profitability “tipping point” is nearing.

- Kindred shares advance after its second-biggest shareholder, Corvex Management LP, said it believes Kindred’s board should evaluate strategic alternatives including a sale or merger.

- Fresenius SE shares rise as much as 4.2% on beating 1Q expectations. The beat was driven by the Kabi pharmaceutical division, which benefited from a positive FX impact, according to Jefferies.

- Siemens Healthineers rises after the German health care firm upgraded its earnings guidance. The beat was driven by a “strong performance” in its diagnostics division, Jefferies says.

- Stillfront shares rise as much as 10% after the Swedish video gaming group presented its latest earnings. Handelsbanken says the report provides good news, justifying some relief in the shares.

- Yara and K+S climb after the EU’s proposal to sanction the largest Belarus potash companies. Yara may see higher input prices but its market share may rise in wake of a ban, analysts note.

- Skanska falls as much as 12% after the construction group presented its latest earnings. The report was overall in-line, but construction margins were a weakness, Kepler Cheuvreux says.

Earlier in the session, Asian stocks declined for a third straight day, with the Federal Reserve’s upcoming policy decision and a U.S. regulatory probe into Didi Global weighing on sentiment. The MSCI Asia Pacific Index fell by as much as 0.5%, with Chinese internet giants Tencent and Alibaba the biggest drags. The sector declined on news that the U.S. regulators are investigating Didi’s 2021 trading debut in New York. India’s stock measures fell the most in the region as the domestic central bank hiked a key policy rate in an unscheduled decision. Benchmarks in Hong Kong and Vietnam also fell as some markets returned from holidays, while Japan and China remained closed. All eyes are now on the Fed’s interest-rate decision on Wednesday, with policy makers expected to hike by 50 basis points, the biggest increase since 2000.

“We have two forces of gravity working on Asian equities -the rising interest rates and the lockdowns and weaker growth in China,” Herald van der Linde, head of Asia Pacific equity strategy at HSBC, told Bloomberg Television. The MSCI Asia gauge has dropped more than 13% this year as rising borrowing costs, China’s Covid-19 lockdowns and rising inflation hurt prospects for corporate profits. Shanghai’s exit from a five-week lockdown that has snarled global supply chains is being delayed by infections persistently appearing in the community. “The most important decision Asian equity investors have to make throughout this year may be duration, how to position themselves if inflation is going to peak,” van der Linde added.

In rates, treasuries advanced, outperforming bunds and rising with stock futures, although price action remains subdued ahead of 2pm ET Fed policy decision. Intermediate sectors lead the advance, with yields richer by ~2bp in 5- to 10-year sectors, before Treasury’s quarterly refunding announcement at 8:30am. Yields little changed across 2-year sector, flattening 2s10s by ~1.5bp; 10-year at ~2.96% outperforms bunds and gilts by ~3.5bp. Dollar issuance slate empty so far; two borrowers priced $3.7b Tuesday taking weekly total past $8b as new-issue activity remains light; at least two borrowers stood down from announcing deals. Bund and gilt curves bear flatten. Euribor futures drop 7-8 ticks in red and green packs following comments from ECB’s Schnabel late Tuesday.

In FX, the Bloomberg Dollar Spot Index was little changed and the dollar was steady to slightly weaker against most of its Group- of-10 peers. Treasuries were steady, with the 10-year yield nudging 3%. The euro hovered around $1.0520 and European bonds fell. The pound rose past the key $1.25 level and gilts fell in line with euro-area peers, as traders braced for the FOMC rate decision later Wednesday and eyed Thursday’s Bank of England meeting. Data from the British Retail Consortium showed shop price inflation accelerated to 2.7% from a year ago in April, the most since 2011. Australia’s dollar advanced against all its Group-of-10 peers and the nation’s sovereign bonds extended losses as retail sales rising to a record high boosted bets for central bank tightening. Retail sales surged 1.6% in March to A$33.6b, more than triple economists’ forecast for a 0.5% increase.

Bitcoin is bid this morning, in contrast to the recent contained sessions, posting upside in excess of 3.0% on the session; albeit, yet to mount a test of the USD 40k mark.

In commodities, oil rallies after the European Union proposed to ban Russian crude oil over the next six months; however, sources indicate that Hungary and Slovakia will receive an extend phase-our period in order to appease their known opposition. WTI drifts 3.2% higher with gains capped near $105 so far. Spot gold steady at $1,868/Oz. Most base metals trade in the green

Looking at the day ahead, the main highlight will be the aforementioned Fed decision, along with Chair Powell’s subsequent press conference. On the data side, we’ll also get the final services and composite PMIs from around the world, UK mortgage approvals and Euro Area retail sales for March, and US data for the March trade balance, the ISM services index for April, and the ADP’s report of private payrolls for April. Finally, earnings releases include CVS Health, Booking Holdings, Regeneron, Uber, Marriott International and Moderna.

Market Snapshot

- S&P 500 futures up 0.3% to 4,180.00

- STOXX Europe 600 down 0.4% to 444.21

- MXAP down 0.3% to 167.37

- MXAPJ down 0.4% to 553.87

- Nikkei down 0.1% to 26,818.53

- Topix little changed at 1,898.35

- Hang Seng Index down 1.1% to 20,869.52

- Shanghai Composite up 2.4% to 3,047.06

- Sensex down 1.2% to 56,318.69

- Australia S&P/ASX 200 down 0.2% to 7,304.68

- Kospi down 0.1% to 2,677.57

- German 10Y yield little changed at 1.00%

- Euro little changed at $1.0527

- Brent Futures up 3.6% to $108.77/bbl

- Gold spot up 0.1% to $1,870.11

- U.S. Dollar Index little changed at 103.40

Top Overnight News from Bloomberg

- A lot is riding on how Federal Reserve Chairman Jerome Powell parries a question he’ll surely be asked after Wednesday’s monetary policy decision: is a 75-basis-point rate hike in the cards at some stage?

- The negative-yielding bond is nearing extinction: there’s only 100 left in the world. That’s down from over 4,500 such securities last year in the Bloomberg Global Aggregate Negative Yielding Debt index, following a surge in yields as investors bet on imminent interest-rate hikes.

- The EU plans to ban Russian crude oil over the next six months and refined fuels by the end of the year as part of a sixth round of sanctions to increase pressure on Vladimir Putin over his invasion of Ukraine

- The ECB should consider raising interest rates as soon as July as inflation accelerates, ERR reported, citing Governing Council member Madis Muller

- North Korea launched what appeared to be a medium-range ballistic missile Wednesday, as Kim Jong Un ramps up his nuclear program ahead of U.S. President Joe Biden’s first visit to Seoul

- Iceland’s central bank delivered its biggest hike since the 2008 financial crisis to try to curb inflation and rein in Europe’s fastest house-price rally. The Monetary Policy Committee in Reykjavik lifted the seven-day term deposit rate by 100 basis points to 3.75%, accelerating tightening with its largest move yet since the pandemic. The increase was within the range of outcomes indicated by recent surveys of market participants

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were cautious amid holiday closures and as markets braced for the incoming FOMC. ASX 200 was rangebound as strength in financials was offset by tech and consumer sector losses. Hang Seng underperformed amid a tech rout and after a wider than expected contraction in Hong Kong’s advanced Q1 GDP, while China’s COVID-19 woes persisted with Beijing tightening its restrictions.

Top Asian News

- Hong Kong Plots Different Covid Path to Xi’s Zero Tolerance

- Beijing Shuts Metro Stations and Suspends Bus Routes

- Didi Leads Slump in U.S.-Listed Chinese Shares Amid SEC Probe

- Record India IPO Opens to Retail Amid Fickle Markets: ECM Watch

European bourses, Euro Stoxx 50 -0.3%, are modestly softer after another subdued but limited APAC handover amid ongoing regional closures. US futures remain in tight pre-FOMC ranges, with participants also awaiting ISM Services and ADP. In Europe, sectors are mostly lower with the exception. US President Biden's administration is reportedly moving towards the imposition of human-rights related sanctions on Hikvision, according to FT sources; final decision has not been taken.

Top European News

- Hungary Voices Objection to EU Sanctions Plan on Russian Oil

- U.K. Mortgage Approvals Fall to 70.7k in March Vs. Est. 70k

- European Energy Prices Jump as EU Proposes Banning Russian Oil

- Boohoo Plunges as Online Clothing Retailer’s Growth Wilts

FX

- DXY anchored around 103.500 awaiting FOMC and Fed chair Powell for further guidance.

- Aussie gets retail therapy and hawkish RBA rate calls to consolidate gains made in wake of 25 bp hike; AUD/USD pivots 0.7100 and AUD/NZD 1.1050.

- Kiwi elevated following NZ labour data showing record low unemployment and strength in wages, NZD/USD tightens grip of 0.6400 handle and closer to half round number above.

- Loonie on a firmer footing ahead of Canadian trade as oil prices bounce, USD/CAD towards base of a broad 1.2850-00 range.

- Indian Rupee rallies after RBI lifts benchmark rate and reserve ratio at off-cycle policy meeting, former up 40 bp to 4.40% and latter +50 bp to 4.50%.

- Euro, Yen and Franc remain in close proximity of round and psychological numbers, circa 1.0500, 130.00 and 0.9800 respectively.

- RBI raises its key repo rate by 40bps to 4.4% in an off-cycle meeting; Also raises the cash reserve ratio by 50bps to 4.5%. Will retain accommodative policy stands but will remain focused on the withdrawal of accommodation.

Fixed Income

- Bonds attempt to nurse some losses before FOMC and a busy agenda in the run up, including ADP, Quarterly Refunding details and the services ISM.

- Bunds back from a 152.44 low to 153.00+, Gilts edging towards 118.00 from 117.55 and 10 year T-note fractionally above par within a 118-17+/06 range.

- German Green issuance well received as cover climbs from prior sale and retention dips, albeit with the average yield sharply higher.

Commodities

- WTI and Brent are bolstered amid the EU unveiling the sixth round of Russian sanctions, seeing a complete import ban on all Russian oil, benchmarks firmer by circa. USD 3.5/bbl

- However, sources indicate that Hungary and Slovakia will receive an extend phase-our period in order to appease their known opposition.

- US Energy Inventory Data (bbls): Crude -3.5mln (exp. -0.8mln), Gasoline -4.5mln (exp. -0.6mln), Distillate -4.5mln (exp. -1.3mln), Cushing +1.0mln.

- India is looking for Russian oil at under USD 70/bbl on a delivered basis in order to compensate for additional components incl. securing financing, via Bloomberg sources; adding, that India has purchased over 40mln/bbl of Russian crude since late-Feb.

- OPEC+ sees the 2022 surplus at 1.9mln, +600k BPD from the prior forecasts, according to the JTC report.

- Several OPEC+ officials expected the current oil pact to continue, according to Argus Media.

US Event Calendar

- 07:00: April MBA Mortgage Applications, prior -8.3%

- 08:15: April ADP Employment Change, est. 382,000, prior 455,000

- 08:30: March Trade Balance, est. -$107.1b, prior -$89.2b

- 09:45: April S&P Global US Services PMI, est. 54.7, prior 54.7

- 09:45: April S&P Global US Composite PMI, est. 55.1, prior 55.1

- 10:00: April ISM Services Index, est. 58.5, prior 58.3

- 14:00: May Interest on Reserve Balances R, est. 0.90%, prior 0.40%

- 14:00: May FOMC Rate Decision; est. 0.75%, prior 0.25%

DB's Jim Reid concludes the overnight wrap

I feel like I aged 20 years after the first half of the Champions League semi-final last night. Luckily the second half was less stressful and Liverpool are through to the final. I don't think I got those 20 years back though.

Talking of age, if you're under 43, did 3 years at university and then joined financial markets then you won't have worked in an era of 50bps Fed rate hikes. This will very likely change tonight as the Fed are a near certainty to raise rates by 50bps. In fact it'll be the first time the Fed have hiked at consecutive meetings since 2006. So we enter a new era that won't be familiar to many.

In terms of what to expect later, our US economists are also calling for a 50bps hike in their preview (link here), which follows the comment from Chair Powell before the blackout period that “50 basis points will be on the table” at this meeting. Looking forward, they further see Powell affirming market pricing that further 50bp hikes are ahead, and our US economists believe this will be the first of 3 consecutive 50bp moves, which will eventually take the Fed funds to a peak of 3.6% in mid-2023. We’re also expecting an announcement that balance sheet rundown will begin in June, with terminal cap sizes of $60bn for Treasuries and $35bn for MBS, with both to be phased in over 3 months. See Tim’s preview on QT (link here) for more info on that as well.

While the Fed might have already begun their hiking cycle 7 weeks ago now, the sense that they’re behind the curve has only grown over that time. For example, the latest inflation data from March showed CPI hitting a 40-year high of +8.5%, meaning that the Fed Funds rate was beneath -8% in real terms that month, which is lower than at any point during the 1970s. Meanwhile the labour market has continued to tighten as well, with unemployment at a post-pandemic low of 3.6% in March, and data out yesterday showed that the number of job openings hit a record high of 11.55m (vs. 11.2m expected) as well. That means the number of vacancies per unemployed worker stood at a record high of 1.94 in March, which speaks to the labour shortages present across numerous sectors at the minute.

Ahead of the decision later on, the S&P 500 surrendered an intraday gain of more than +1% to finish the day +0.48% higher, in another New York afternoon turnaround. Energy (+2.87%) and financials (+1.26%) did most of the work keeping the index afloat after dipping its toes in the red late in the day, while only two sectors ultimately finished lower, staples (-0.24%) and discretionary (-0.29%). A sizable 35 S&P 500 companies reported earnings before the close, but there weren’t any standout results to drive an index-wide response. Indeed, the mega-cap FANG+ index only slightly underperformed the broader index at +0.11%. In Europe the STOXX 600 was up +0.53%, closing before the New York reversal. In line with the turnaround, overall volatility remained elevated, with the VIX index (-3.09pts) closing just below the 30 mark.

Ahead of today’s FOMC decision US Treasuries continued their recent back-and-forth price action. The 10yr yield ended ever so slightly lower at -0.1bps. That masks continued rates volatility, however, with the 10yr as much as -8bps lower intraday after having moved above 3% in the previous session for the first time since 2018. The back-and-forth was matched by real yields, as 10yr real yields were as many as -11bps lower before closing down just -0.1bps, comfortably in positive territory for only the second day since March 2020 at 0.14%. The curve flattened as short-end rates moved higher, with 2yr yields gaining +5.1bps, after most tenors were lower earlier in the session.

In Europe, yields on 10yr bunds moved above 1% in trading for the first time since 2015 shortly after the open. Yields did then swing lower, but subsequently recovered to be down just -0.2bps at 0.961%. However, bunds were one of the stronger-performing European sovereigns yesterday, and the spread of both Italian (+2.2bps) and Spanish (+1.1bps) 10yr yields over bunds widened to fresh post-Covid highs in both cases, at 191bps and 106bps respectively.

Asian equity markets are mixed in a holiday thinned session ahead of the Fed’s key rate decision later. The Hang Seng (-0.90%) is trading in negative territory as a decline in Chinese listed tech stocks is weighing on sentiment. Elsewhere, the Kospi (-0.15%) and S&P/ASX 200 (-0.08%) are fractionally lower. Meanwhile, markets in Japan and mainland China are closed today for holidays. Oil prices are slightly higher amid rising prospects of an EU embargo of Russian crude oil. As I type, Brent and WTI futures are c.+1% up to trade at $106.09/bbl and $103.53/bbl respectively.

Early morning data showed that Australia’s retail sales rose for the third consecutive month, advancing +1.6% m/m in March and going past market estimates for a + 0.5% gain. It followed a +1.8% rise in February.

Looking at yesterday’s other data releases, US factory orders grew by a stronger-than-expected +2.2% in March (vs. +1.2% expected). And over in Europe, German unemployment fell be -13k in April (vs. -15k expected), whilst the Euro Area unemployment rate in March fell to 6.8%, which is the lowest since the single currency’s formation. Finally, Euro Area PPI in March soared to 36.8% (vs. 36.3% expected), which is also a record since the single currency’s formation.

To the day ahead now, and the main highlight will be the aforementioned Fed decision, along with Chair Powell’s subsequent press conference. On the data side, we’ll also get the final services and composite PMIs from around the world, UK mortgage approvals and Euro Area retail sales for March, and US data for the March trade balance, the ISM services index for April, and the ADP’s report of private payrolls for April. Finally, earnings releases include CVS Health, Booking Holdings, Regeneron, Uber, Marriott International and Moderna.

Uncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

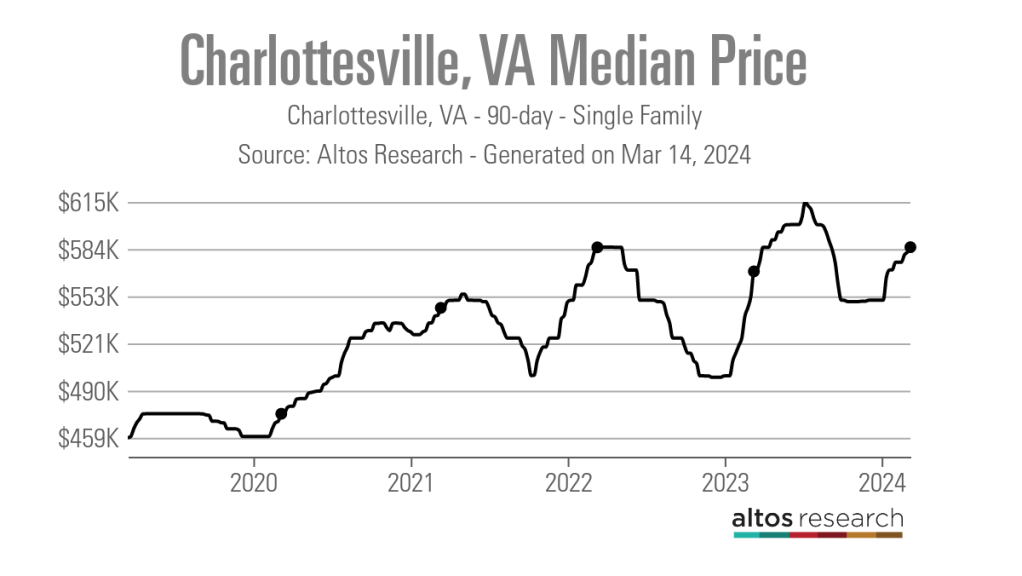

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest ratesInternational

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

As the global pandemic unfolded, government-funded…

As the global pandemic unfolded, government-funded experimental vaccines were hastily developed for a virus which primarily killed the old and fat (and those with other obvious comorbidities), and an aggressive, global campaign to coerce billions into injecting them ensued.

Then there were the lockdowns - with some countries (New Zealand, for example) building internment camps for those who tested positive for Covid-19, and others such as China welding entire apartment buildings shut to trap people inside.

It was an egregious and unnecessary response to a virus that, while highly virulent, was survivable by the vast majority of the general population.

Oh, and the vaccines, which governments are still pushing, didn't work as advertised to the point where health officials changed the definition of "vaccine" multiple times.

Tucker Carlson recently sat down with Dr. Pierre Kory, a critical care specialist and vocal critic of vaccines. The two had a wide-ranging discussion, which included vaccine safety and efficacy, excess mortality, demographic impacts of the virus, big pharma, and the professional price Kory has paid for speaking out.

Keep reading below, or if you have roughly 50 minutes, watch it in its entirety for free on X:

Ep. 81 They’re still claiming the Covid vax is safe and effective. Yet somehow Dr. Pierre Kory treats hundreds of patients who’ve been badly injured by it. Why is no one in the public health establishment paying attention? pic.twitter.com/IekW4Brhoy

— Tucker Carlson (@TuckerCarlson) March 13, 2024

"Do we have any real sense of what the cost, the physical cost to the country and world has been of those vaccines?" Carlson asked, kicking off the interview.

"I do think we have some understanding of the cost. I mean, I think, you know, you're aware of the work of of Ed Dowd, who's put together a team and looked, analytically at a lot of the epidemiologic data," Kory replied. "I mean, time with that vaccination rollout is when all of the numbers started going sideways, the excess mortality started to skyrocket."

When asked "what kind of death toll are we looking at?", Kory responded "...in 2023 alone, in the first nine months, we had what's called an excess mortality of 158,000 Americans," adding "But this is in 2023. I mean, we've had Omicron now for two years, which is a mild variant. Not that many go to the hospital."

'Safe and Effective'

Tucker also asked Kory why the people who claimed the vaccine were "safe and effective" aren't being held criminally liable for abetting the "killing of all these Americans," to which Kory replied: "It’s my kind of belief, looking back, that [safe and effective] was a predetermined conclusion. There was no data to support that, but it was agreed upon that it would be presented as safe and effective."

Tucker Carlson Asks the Forbidden Question

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

He wants to know why the people who made the claim “safe and effective” aren’t being held to criminal liability for abetting the “killing of all these Americans.”

DR. PIERRE KORY: “It’s my kind of belief, looking back, that [safe and… pic.twitter.com/Icnge18Rtz

Carlson and Kory then discussed the different segments of the population that experienced vaccine side effects, with Kory noting an "explosion in dying in the youngest and healthiest sectors of society," adding "And why did the employed fare far worse than those that weren't? And this particularly white collar, white collar, more than gray collar, more than blue collar."

Kory also said that Big Pharma is 'terrified' of Vitamin D because it "threatens the disease model." As journalist The Vigilant Fox notes on X, "Vitamin D showed about a 60% effectiveness against the incidence of COVID-19 in randomized control trials," and "showed about 40-50% effectiveness in reducing the incidence of COVID-19 in observational studies."

Dr. Pierre Kory: Big Pharma is ‘TERRIFIED’ of Vitamin D

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

Why?

Because “It threatens the DISEASE MODEL.”

A new meta-analysis out of Italy, published in the journal, Nutrients, has unearthed some shocking data about Vitamin D.

Looking at data from 16 different studies and 1.26… pic.twitter.com/q5CsMqgVju

Professional costs

Kory - while risking professional suicide by speaking out, has undoubtedly helped save countless lives by advocating for alternate treatments such as Ivermectin.

Kory shared his own experiences of job loss and censorship, highlighting the challenges of advocating for a more nuanced understanding of vaccine safety in an environment often resistant to dissenting voices.

"I wrote a book called The War on Ivermectin and the the genesis of that book," he said, adding "Not only is my expertise on Ivermectin and my vast clinical experience, but and I tell the story before, but I got an email, during this journey from a guy named William B Grant, who's a professor out in California, and he wrote to me this email just one day, my life was going totally sideways because our protocols focused on Ivermectin. I was using a lot in my practice, as were tens of thousands of doctors around the world, to really good benefits. And I was getting attacked, hit jobs in the media, and he wrote me this email on and he said, Dear Dr. Kory, what they're doing to Ivermectin, they've been doing to vitamin D for decades..."

"And it's got five tactics. And these are the five tactics that all industries employ when science emerges, that's inconvenient to their interests. And so I'm just going to give you an example. Ivermectin science was extremely inconvenient to the interests of the pharmaceutical industrial complex. I mean, it threatened the vaccine campaign. It threatened vaccine hesitancy, which was public enemy number one. We know that, that everything, all the propaganda censorship was literally going after something called vaccine hesitancy."

Money makes the world go 'round

Carlson then hit on perhaps the most devious aspect of the relationship between drug companies and the medical establishment, and how special interests completely taint science to the point where public distrust of institutions has spiked in recent years.

"I think all of it starts at the level the medical journals," said Kory. "Because once you have something established in the medical journals as a, let's say, a proven fact or a generally accepted consensus, consensus comes out of the journals."

"I have dozens of rejection letters from investigators around the world who did good trials on ivermectin, tried to publish it. No thank you, no thank you, no thank you. And then the ones that do get in all purportedly prove that ivermectin didn't work," Kory continued.

"So and then when you look at the ones that actually got in and this is where like probably my biggest estrangement and why I don't recognize science and don't trust it anymore, is the trials that flew to publication in the top journals in the world were so brazenly manipulated and corrupted in the design and conduct in, many of us wrote about it. But they flew to publication, and then every time they were published, you saw these huge PR campaigns in the media. New York Times, Boston Globe, L.A. times, ivermectin doesn't work. Latest high quality, rigorous study says. I'm sitting here in my office watching these lies just ripple throughout the media sphere based on fraudulent studies published in the top journals. And that's that's that has changed. Now that's why I say I'm estranged and I don't know what to trust anymore."

Vaccine Injuries

Carlson asked Kory about his clinical experience with vaccine injuries.

"So how this is how I divide, this is just kind of my perception of vaccine injury is that when I use the term vaccine injury, I'm usually referring to what I call a single organ problem, like pericarditis, myocarditis, stroke, something like that. An autoimmune disease," he replied.

"What I specialize in my practice, is I treat patients with what we call a long Covid long vaxx. It's the same disease, just different triggers, right? One is triggered by Covid, the other one is triggered by the spike protein from the vaccine. Much more common is long vax. The only real differences between the two conditions is that the vaccinated are, on average, sicker and more disabled than the long Covids, with some pretty prominent exceptions to that."

Watch the entire interview above, and you can support Tucker Carlson's endeavors by joining the Tucker Carlson Network here...

Uncategorized

These Cities Have The Highest (And Lowest) Share Of Unaffordable Neighborhoods In 2024

These Cities Have The Highest (And Lowest) Share Of Unaffordable Neighborhoods In 2024

Authored by Sam Bourgi via CreditNews.com,

Homeownership…

Authored by Sam Bourgi via CreditNews.com,

Homeownership is one of the key pillars of the American dream. But for many families, the idyllic fantasy of a picket fence and backyard barbecues remains just that—a fantasy.

Thanks to elevated mortgage rates, sky-high house prices, and scarce inventory, millions of American families have been locked out of the opportunity to buy a home in many cities.

To shed light on America’s housing affordability crisis, Creditnews Research ranked the 50 most populous cities by the percentage of neighborhoods within reach for the typical married-couple household to buy a home in.

The study reveals a stark reality, with many cities completely out of reach for the most affluent household type. Not only that, the unaffordability has radically worsened in recent years.

Comparing how affordability has changed since Covid, Creditnews Research discovered an alarming pattern—indicating consistently more unaffordable housing in all but three cities.

Fortunately, there’s still hope for households seeking to put down roots in more affordable cities—especially for those looking beyond Los Angeles, New York, Boston, San Jone, and Miami.

The typical American family has a hard time putting down roots in many parts of the country. In 11 of the top 50 cities, at least 50% of neighborhoods are out of reach for the average married-couple household. The affordability gap has widened significantly since Covid; in fact, no major city has reported an improvement in affordability post-pandemic.

Sam Bourgi, Senior Analyst at Creditnews

Key findings

-

The most unaffordable cities are Los Angeles, Boston, St. Louis, and San Jose; in each city, 100% of neighborhoods are out of reach for for married-couple households earning a median income;

-

The most affordable cities are Cleveland, Hartford, and Memphis—in these cities, the typical family can afford all neighborhoods;

-

None of the top 50 cities by population saw an improvement in affordable neighborhoods post-pandemic;

-

California recorded the biggest spike in unaffordable neighborhoods since pre-Covid;

-

The share of unaffordable neighborhoods has increased the most since pre-Covid in San Jose (70 percentage points), San Diego (from 57.8 percentage points), and Riverside-San Bernardino (51.9 percentage points);

-

Only three cities have seen no change in housing affordability since pre-Covid: Cleveland, Memphis, and Hartford. They’re also the only cities that had 0% of unaffordable neighborhoods before Covid.

Cities with the highest share of unaffordable neighborhoods

With few exceptions, the most unaffordable cities for married-couple households tend to be located in some of the nation’s most expensive housing markets.

Four cities in the ranking have an unaffordability percentage of 100%—indicating that the median married-couple household couldn’t qualify for an average home in any neighborhood.

The following are the cities ranked from the least affordable to the most:

-

Los Angeles, CA: Housing affordability in Los Angeles has deteriorated over the last five years, as average incomes have failed to keep pace with rising property values and elevated mortgage rates. The median household income of married-couple families in LA is $117,056, but even at that rate, 100% of the city’s neighborhoods are unaffordable.

-

St. Louis, MO: It may be surprising to see St. Louis ranking among the most unaffordable housing markets for married-couple households. But a closer look reveals that the Mound City was unaffordable even before Covid. In 2019, 98% of the city’s neighborhoods were unaffordable—way worse than Los Angeles, Boston, or San Jose.

-

Boston, MA: Boston’s housing affordability challenges began long before Covid but accelerated after the pandemic. Before Covid, married couples earning a median income were priced out of 90.7% of Boston’s neighborhoods. But that figure has since jumped to 100%, despite a comfortable median household income of $172,223.

-

San Jose, CA: Nestled in Silicon Valley, San Jose has long been one of the most expensive cities for housing in America. But things have gotten far worse since Covid, as 100% of its neighborhoods are now out of reach for the average family. Perhaps the most shocking part is that the median household income for married-couple families is $188,403—much higher than the national average.

-

San Diego, CA: Another California city, San Diego, is among the most unaffordable places in the country. Despite boasting a median married-couple household income of $136,297, 95.6% of the city’s neighborhoods are unaffordable.

-

San Francisco, CA: San Francisco is another California city with a high married-couple median income ($211,585) but low affordability. The percentage of unaffordable neighborhoods for these homebuyers stands at 89.2%.

-

New York, NY: As one of the most expensive cities in America, New York is a difficult housing market for married couples with dual income. New York City’s share of unaffordable neighborhoods is 85.9%, marking a 33.4% rise from pre-Covid times.

-

Miami, FL: Partly due to a population boom post-Covid, Miami is now one of the most unaffordable cities for homebuyers. Roughly four out of five (79.4%) of Miami’s neighborhoods are out of reach price-wise for married-couple families. That’s a 34.7% increase from 2019.

-

Nashville, TN: With Nashville’s population growth rebounding to pre-pandemic levels, the city has also seen greater affordability challenges. In the Music City, 73.7% of neighborhoods are considered unaffordable for married-couple households—an increase of 11.9% from pre-Covid levels.

-

Richmond, VA: Rounding out the bottom 10 is Richmond, where 55.9% of the city’s 161 neighborhoods are unaffordable for married-couple households. That’s an 11.9% increase from pre-Covid levels.

Cities with the lowest share of unaffordable neighborhoods

All the cities in our top-10 ranking have less than 10% unaffordable neighborhoods—meaning the average family can qualify for a home in at least 90% of the city.

Interestingly, these cities are also outside the top 15 cities by population, and eight are in the bottom half.

The following are the cities ranked from the most affordable to the least:

-

Hartford, CT: Hartford ranks first with the percentage of unaffordable neighborhoods at 0%, unchanged since pre-Covid times. Married couples earning a median income of $135,612 can afford to live in any of the city’s 16 neighborhoods. Interestingly, Hartford is the smallest city to rank in the top 10.

-

Memphis, TN: Like Hartford, Memphis has 0% unaffordable neighborhoods, meaning any married couple earning a median income of $101,734 can afford an average homes in any of the city’s 12 neighborhoods. The percentage of unaffordable neighborhoods also stood at 0% before Covid.

-

Cleveland, OH: The Midwestern city of Cleveland is also tied for first, with the percentage of unaffordable neighborhoods at 0%. That means households with a median-couple income of $89,066 can qualify for an average home in all of the city’s neighborhoods. Cleveland is also among the three cities that have seen no change in unaffordability compared to 2019.

-

Minneapolis, MN: The largest city in the top 10, Minneapolis’ share of unaffordable neighborhoods stood at 2.41%, up slightly from 2019. Married couples earning the median income ($149,214) have access to the vast majority of the city’s 83 neighborhoods.

-

Baltimore, MD: Married-couple households in Baltimore earn a median income of $141,634. At that rate, they can afford to live in 97.3% of the city’s 222 neighborhoods, making only 2.7% of neighborhoods unaffordable. That’s up from 0% pre-Covid.

-

Louisville, KY: Louisville is a highly competitive market for married households. For married-couple households earning a median wage, only 3.6% of neighborhoods are unaffordable, up 11.9% from pre-Covid times.

-

Cincinnati, OH: The second Ohio city in the top 10 ranks close to Cleveland in population but has a much higher median married-couple household income of $129,324. Only 3.6% of the city’s neighborhoods are unaffordable, up slightly from pre-pandemic levels.

-

Indianapolis, IN: Another competitive Midwestern market, only 4.4% of Indianapolis is unaffordable, making the vast majority of the city’s 92 neighborhoods accessible to the average married couple. Still, the percentage of unaffordable neighborhoods before Covid was less than 1%.

-

Oklahoma City, OK: Before Covid, Oklahoma City had 0% neighborhoods unaffordable for married-couple households earning the median wage. It has since increased to 4.69%, which is still tiny compared to the national average.

-

Kansas City, MO: Kansas City has one of the largest numbers of neighborhoods in the top 50 cities. Its married-couple residents can afford to live in nearly 95% of them, making only 5.6% of neighborhoods out of reach. Like Indiana, Kansas City’s share of unaffordable neighborhoods was less than 1% before Covid.

The biggest COVID losers

What's particularly astonishing about the current housing market is just how quickly affordability has declined since Covid.

Even factoring in the market correction after the 2022 peak, the price of existing homes is still nearly one-third higher than before Covid. Mortgage rates have also more than doubled since early 2022.

Combined, the rising home prices and interest rates led to the worst mortgage affordability in more than 40 years.

Against this backdrop, it’s hardly surprising that unaffordability increased in 47 of the 50 cities studied and remained flat in the other three. No city reported improved affordability in 2024 compared to 2019.

The biggest increases are led by San Jose (70 percentage points), San Diego (57.8 percentage points), Riverside-San Bernardino (51.9 percentage points), Sacramento (43 percentage points), Orlando (37.4 percentage points), Miami (34.7 percentage points), and New York City (33.4 percentage points).

The following cities in our study are ranked by the largest percentage point change in unaffordable neighborhoods since pre-Covid:

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges