Futures Resume Tumbling After Yields Spike To New 2 Year High

Futures Resume Tumbling After Yields Spike To New 2 Year High

The new week has picked up where last week left off: with futures selling off and global markets lower as yields continued their relentless treck higher, hitting fresh two year…

The new week has picked up where last week left off: with futures selling off and global markets lower as yields continued their relentless treck higher, hitting fresh two year highs (amid concerns of a faster Fed balance sheet drawdown coupled with a massive IG issuance slate forcing managers to put on rate locks in what remains an illiquid market).

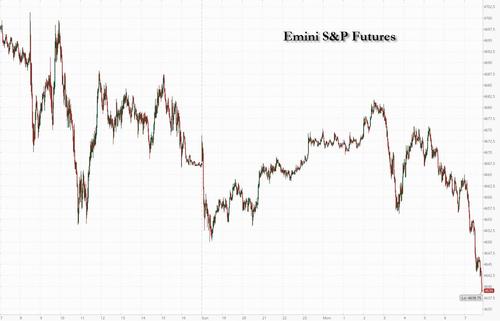

US index futures traded down to session lows as US traders sat at their desks after rising modestly earlier in the session, and were down 27 points or 0.6% at 730am...

... while Treasury yields stabilized after reversing an earlier spike rising as high as 1.8064% before dropping to 1.7656% following a global bond selloff last week as investors awaited key inflation data later in the week. Tech stocks again led the decline with Nasdaq futs down 0.63%, while Dow futures were down 0.12% or 44 points. The dollar rose, bitcoin dropped and crude oil steadied around $79 a barrel.

“Market volatility continues to grow almost everywhere,” with lingering uncertainties keeping pressure on sentiment, said Pierre Veyret, technical analyst at ActivTrades. “Traders are likely to wait for new major market drivers before pushing stock prices in new directions. All eyes will remain on monetary policy this week with a new batch of comments from major Fed speakers alongside the crucial U.S. inflation report on Wednesday.”

As Bloomberg notes, markets face increasing volatility as investors grapple with how to reprice assets as the pandemic liquidity that helped drive equities to record highs is withdrawn. The latest U.S. consumer price index data due this week will be keenly watched as the Federal Reserve prepares to subdue price pressures with faster-than-expected rate increases. HSBC strategists raised their S&P 500 year-end target to 4,900 from 4,650, but say this year will be challenging for risk assets and consensus expectations are too sanguine. Watch Adidas and Nike shares after HSBC downgraded its ratings on both to hold from buy, citing a lack of short-term catalysts. Here are some of the biggest U.S. movers today:

- BioMarin (BMRN US) shares jump 5.5% in U.S. premarket trading after the biotech firm announced positive results for its hemophilia treatment trial on Sunday.

- The bull and bear cases for Adidas (ADS GY) and Nike (NKE US) are “quite balanced from here,” according to HSBC, which downgrades its ratings on both to hold from buy, citing a lack of short-term catalysts.

- Zscaler (ZS US) has “plenty of growth levers to pull,” UBS writes in note upgrading the company to buy from neutral. The stock gains 2.5% in premarket trading.

- New Oriental’s (EDU US) Chinese ADRs rose 2.2% in U.S. premarket trading, and peer TAL Education (TAL US) gained 2.9% amid news that New Oriental dismissed 60,000 workers in 2021 after ending all K-9 tutoring services. Still, analysts foresee more regulations for the industry this year.

In Europe, the Stoxx 600 Index was slightly down, fading an initial dip through Friday’s lows. The Euro Stoxx 50 is flat, DAX off 0.1%; FTSE MIB and IBEX post small gains. Cyclical stocks in energy firms and banks tied to economic expansion were among the biggest gainers on the Stoxx Europe 600, offsetting declines in technology firms and real estate. Travel is the stand out best performer, the Stoxx 600 sector rising 2.5%, rebounding strongly after an early dip. Atos’s shares slumped as much as 19% to their lowest since June 2012, following a profit warning.

Earlier in the session, Asia’s stocks rose for a second day amid the overhang of rising interest rates, as investors awaited U.S. inflation data this week for further cues on where Treasury yields are headed. The MSCI Asia Pacific Index rallied as much as 0.4%, boosted by financial shares. Hong Kong stocks were among the best performers as technology giants including Tencent and Meituan continued to recoup some of their recent losses, while real estate shares extended a rally on state support. South Korea’s Kospi Index fell 1% to be among the region’s biggest decliners, dragged down by losses in the nation’s large chipmakers and internet stocks. Asia’s stock benchmark capped a loss of 0.5% last week. Omicron’s rapid spread in Asia is clouding the growth outlook for many economies, just as the Federal Reserve’s increasingly hawkish stance roils bond markets and hammers growth stocks including tech shares. “Some market participants may still view this pullback as another healthy correction and potentially an opportunity to buy more,” said Margaret Yang, a strategist at DailyFX, adding that the omicron variant may cause concerns about a delay in reopening among investors.

Japanese markets were closed for a holiday on Monday.

Australian stocks slipped as health-care, consumer shares hit index. The S&P/ASX 200 index fell 0.1% at 7,447.10 as of 4:15 p.m. on Monday in Sydney, after the S&P 500 capped its worst weekly start to a year since 2016. The Australian index was weighed down by consumer discretionary and health-care stocks, while shares in miners and energy firms rose. AGL Energy surged after Credit Suisse raised its recommendation on the stock to outperform from neutral. Reliance Worldwide was the biggest decliner after sliding the most in 14 months intraday. In New Zealand, the S&P/NZX 50 index fell 0.6% to 12,892.94.

In FX, the Bloomberg Dollar Spot Index was steady after earlier advancing and the greenback was mixed against its Group-of-10 peers. The Canadian and Australian dollars along with Norway’s krone were the best G-10 performers amid supportive economic data and commodity prices. Norway’s krone advanced after inflation accelerated more than estimated in December, adding pressure on the central bank to speed up interest-rate hikes. The Australian dollar reversed a drop as exporter demand and solid building data prompted leveraged funds to square short positions. The euro shed around half of Friday’s gains against the dollar and bunds mostly slipped, yet outperformed Treasuries.

In rates, treasury futures were off session lows amid gains for bunds and gilts, with cash yields across the curve still slightly cheaper on the day. Into the U.S. session, yields cheaper by up to 1.2bp across belly of the curve, spreads within 1bp of Friday session close; 10-year yields around 1.778%,lagging bunds and gilts by 1.5bp and 1bp in the sector. As we warned last night, Treasuries are hampered by expectations for another heavy IG credit issuance slate this week, but the market - dumb as always - sees today's rate locks as indication of more panicked outright selling in rates which it isn't.

We are looking at another boatload of IG issuance this week so brace for massive rate locks which will again be mistaken for panic treasury selling

— zerohedge (@zerohedge) January 9, 2022

Coupon auctions also resume this week, beginning with 3-year note sale Tuesday and including 10- and 30-year reopenings. Last week’s steep UST selloff resumed during European morning after a recommended market close during Asia session because of Japanese holiday; 10-year yields topped at 1.806% before buyers emerged

In commodities, crude futures are little changed with WTI trading either side of $79 and Brent near $82. Spot gold pushes ~$4 higher near $1,800/oz after a slow start in European hours. Base metals are in the green with LME aluminum outperforming slightly.

Market Snapshot

- S&P 500 futures down 0.6% to 4,639.25

- STOXX Europe 600 down 0.1% to 485.58

- MXAP up 0.4% to 192.99

- MXAPJ up 0.6% to 629.71

- Nikkei little changed at 28,478.56

- Topix little changed at 1,995.68

- Hang Seng Index up 1.1% to 23,746.54

- Shanghai Composite up 0.4% to 3,593.52

- Sensex up 1.1% to 60,402.57

- Australia S&P/ASX 200 little changed at 7,447.07

- Kospi down 1.0% to 2,926.72

- Brent Futures up 0.5% to $82.14/bbl

- Gold spot up 0.0% to $1,796.81

- U.S. Dollar Index up 0.17% to 95.88

- German 10Y yield little changed at -0.03%

- Euro down 0.2% to $1.1335

Top Overnight News from Bloomberg

- Bond yields are soaring globally in line with Treasuries as investors preparing for the first Federal Reserve interest-rate hike of the pandemic era set aside concern the outbreak will slow their already fragile economies

- Major emerging markets are set to report a slowdown in inflation this week, offering clues on when investors can finally shake off the burden of negative real yields

- U.K. Foreign Secretary Liz Truss said she’s prepared to unilaterally override parts of the post-Brexit agreement on Northern Ireland if talks with the EU fail

- President Vladimir Putin vowed to protect Russia and its ex-Soviet allies from what he called outside efforts to destabilize their governments with public protests, just days after Russian-led troops helped Kazakh authorities subdue nationwide demonstrations

- The Biden administration and U.S. allies are discussing possible export controls on Russia, including curbs on sensitive technology and electronics, to be imposed if President Vladimir Putin seizes more of Ukraine, a person familiar with the discussions said

- There’s growing evidence that China is encouraging state- owned property developers to take market share from stressed rivals to limit the spread of contagion from the debt-stricken industry

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac markets traded mixed and US equity futures were initially pressured after last Friday's post-NFP weakness amid higher yields despite the miss on the headline jobs data, as a wider than expected decline in the Unemployment Rate provided evidence of the US moving towards full employment and boosted odds for a rate hike at the March meeting. This resulted in underperformance in consumer discretionary and tech with the latter also not helped by the worst start to the year for the Nasdaq 100 since 2000, while ongoing Omicron woes and the absence of Japanese participants due to Coming of Aged day further added to the uninspired mood. ASX 200 (-0.1%) was subdued as consumer discretionary and tech mirrored the underperformance of their US counterparts and with Australia suffering from the ongoing surge in COVID-19 cases, although loses for the index were cushioned by strength in the commodity-related sectors and better than expected Building Approvals data. KOSPI (-1.0%) continued its descent beneath the 3,000 level as it succumbed to the tech and consumer stock woes, with participants also cautious amid mixed expectations regarding the prospects of another rate hike by the BoK later this week. Hang Seng (+1.0%) and Shanghai Comp. (+0.4%) remained afloat with Hong Kong underpinned as some property concerns eased after Shimao placed all its property projects for sale and Kaisa agreed to the Shenzhen government's request to generate a plan by end-January to repay wealth management products to investors. Furthermore, China’s Guangdong provincial government held meetings with property enterprises which was said to likely pave the way for state-owned real estate enterprises to conduct M&A with troubled property firms, although not all developers joined in on the spoils as Modern Land reversed initial double-digit gains and slumped almost 40% on resumption from a two-month trading halt with the Co. in talks on a potential debt restructuring plan, while sentiment in the mainland was also contained after China reported its first community transition of the Omicron variant in Tianjin which is a gateway city to Beijing.

Top Asian News

- Tencent Nears Deal for Smartphone Maker in Major Metaverse Push

- Fintech Startup Pine Labs Said to Seek $500 Million in U.S. IPO

- Omicron Flares in China as Variant Inches Closer to Beijing

- Shimao Group Holdings Downgraded to B- by S&P

European equities (Euro Stoxx 50 Unch; Stoxx 600 -0.1%) have erased the mild opening gains of around 0.4% as the pick-up from Friday’s losses lost steam early doors. There wasn’t much in the way of a catalyst after the cash open for the price action with not much in the way of fresh developments for the region over the weekend. The handover from the APC region was a mixed one (Japan away from markets) with the ASX (-0.1%) a touch softer amid losses on consumer discretionary and tech names, whilst Chinese bourses (Shanghai Comp. +0.4%, Hang Seng +1.1%) shrugged off COVID angst with property stocks in Hong Kong boosted after Shimao placed all its property projects for sale and Kaisa agreed to the Shenzhen government's request to generate a plan by end-January to repay wealth management products to investors. Stateside, US futures are mixed (ES Unch, NQ -0.1%, RTY +0.2%) after last week’s losses of 2.5%, 5.7% and 4.1% for the S&P 500 Nasdaq and Russell 2000 respectively. In a note published today, HSBC has raised its S&P 500 target to 4,900 from 4,650 (vs 4,677 close on Friday). The focus in the US remains on the pace of Fed tightening, on which, Goldman Sachs now anticipates a total of four hikes this year beginning in March and for the balance runoff to start in July. Elsewhere, JPMorgan recommends overweighting stocks which are positively correlated to upside in bond yields; banks, autos, mining, energy and insurance. Back to Europe, sectors are painting a relatively mixed picture, with Travel & Leisure names best in class thus far amid support from airline names, whilst Oil & Gas and Banking names are also seen higher with the latter supported by the ongoing favourable yield environment. To the downside, Real Estate names lag with softness observed in UK homebuilders (Persimmon -3.8%, Berkeley -2.8%, Barratt Developments -3.2%) as companies attempt to push back on government plans to resolve the cladding crisis which could result in them footing the bill of as much as GBP 4bln. In terms of stock specifics, Credit Suisse (+1.6%) sits at the top of the SMI following reports in Inside Paradeplatz suggesting rumours of a potential sale or merger of the Co. with UniCredit and BNP Paribas mentioned in the article. To the downside, Atos (-17%) is the standout laggard in the Stoxx 600 after issuing a further profit warning and announcing that it will present a new re-organisation to the board of directors.

Top European News

- Gold Extends Weekly Loss as U.S. Bond Yields Continue to Rise

- European Natural Gas Declines With LNG Imports at Two-Year High

- Putin Vows to Defend Ex-Soviet Allies from ‘Color Revolutions’

- Credit Suisse Sale or Merger ‘Rumored’: Inside Paradeplatz

In FX, the DXY has lost some steam after an early resurrection from Friday’s NFP-induced fall under 96.000 (to a 95.710 low), with overnight and early European gains a function of a rise in US yields and a decline in the EUR. US cash yields continue the grind higher with the 10yr eclipsing Friday’s 1.8010% peak, in part spurred (or at least influenced) by Goldman Sachs now expecting four Fed hikes this year alongside faster quantitative tightening, citing above-target inflation. This comes ahead of the CPI metrics on Wednesday - which is expected to see the headline Y/Y at 7.0% and the Core Y/Y at 5.4%; but before that, Fed Chair Powell and 2022-voters (and hawks) George and Bullard are slated for tomorrow ahead of the Fed blackout commencing on the 15th Jan. Back to this week’s inflation metrics and using last week’s PMIs (Markit and ISM) as proxies, the releases are consistent with a rise in CPI and a cooling in PPI in December. Markit noted “Input shortages, transportation delays and upticks in labor costs drove the rate of private sector input price inflation to a fresh series high in December”, whilst ISM suggested “Vendors are trying not to pass on expenses, but their margins are such that they will need to raise prices…Prices continue to be driven up, with shipping costs the largest driver due to inflated pressures on capacity and fuel costs.” From a technical standpoint, the index remains above its 50 DMA (95.838), with the 21 DMA (96.171) the closest point of resistance ahead of Friday’s 96.299 pinnacle, if 96.00 sees a convincing upside break. Ahead, the State-side calendar is light, with 2024-voter Bostic’s speech seemingly postponed.

- EUR, GBP - EUR has been offered this morning and stands as the current G10 laggard as GBP/EUR threatens an upside breach of 1.2000 (a 23-month peak), with traders noting potential stops above for GBP/EUR and below the corresponding 0.8333 mark in EUR/GBP. The weekend also saw commentary from ECB-regular Schnabel, who suggested that rising energy prices could require the ECB to act on policy but added there have not been signs so far of broader second-round effects of higher inflation. Eyes remain on the German 10yr cash yield eyeing positive territory. Nonetheless, the ECB policy divergence with the Fed and BoE keeps the single currency subdued against major peers. From a technical standpoint, EUR/USD is back under its 50 DMA (1.1345) with the 21 DMA (1.1308) the next support ahead of 1.1300. Sterling is in turn supported, with GBP/USD testing 1.3600 to the upside at the time of writing – with clean air seen until 1.3650.

- AUD, NZD, CAD, JPY - The high-beta FX are the current top performers with the Loonie leading the gains as crude prices remain firm. USD/CAD has dipped under its 100 DMA, (1.2625) for the first time since November last year. The AUD is the next best gainer with copper firm and the AUD/NZD cross topped 1.0600 once again. NZD/USD meanwhile tested but failed to breach resistance at its 21 DMA (0.6787). Conversely to the high-betas, the havens are among the straddlers with USD/JPY off its overnight highs (with Japan also observing a market holiday) and stuck within a 115.55-85 range with upside capped by the recent downside across stocks.

In commodities, WTI and Brent front-month futures have trimmed earlier gains after seeing overnight support with the inflation narrative underpinning prices at the time, although supply woes arising from Kazakhstan (1.6mln BPD) could be abating as production at its largest oilfield comes back online and the President claims the domestic unrest is now under control. In terms of some themes to be aware of: China’s COVID situation will be eyed heading into the Lunar New Year – which is marked as the largest human migration – with COVID restrictions likely to dampen the demand side of the equations. On the geopolitical front, noises out of the Iranian nuclear talks have been more sanguine but progress remains to be seen. Meanwhile, the Russian-Ukraine spat is picking up traction with punch verbal rhetoric from both sides and talks set to take place later in the week. WTI Feb has falling back under USD 79.50/bbl (vs low USD 78.36/bbl) while Brent Mar briefly topped USD 82/bbl (vs low USD 81.20/bbl). In terms of metals, spot gold remains sub-1,800/oz but topped its 100 DMA (1,792/oz) and 21 DMA (1,799/oz) with technical re-eyeing the 200 DMA (1,800/oz) and 50 DMA (1,804/oz) from a technical standpoint ahead of Wednesday’s US CPI. LME copper has been constrained to a tight range above USD 9,500/t amid the overall indecisive mood. Coal meanwhile eyes the potential resumption of Indonesian coal exports, which was paused last week amid domestic power worries. Elsewhere, Vale announced that it has partially suspended trains at the Vitoria-Minas railway amid rain in the Minas Gerais state, but maintained guidance for 2022 iron ore productions of 320-335mln tonnes.

US Event Calendar

- 10am: Nov. Wholesale Trade Sales MoM, prior 2.2%

- 10am: Nov. Wholesale Inventories MoM, est. 1.2%, prior 1.2%

DB's Jim Reid concludes the overnight wrap

Wow. What a start to the year. To be fair it’s felt to us that the Fed have been way behind the curve since the spring of last year. One can argue that a fair degree of this was deliberate due to their move to FAIT which we may look back on in the future as having arrived with very unfortunate timing. The reason we say that is that the policy mostly fights the battle of the last war and not this one where we’ve had genuine helicopter money at a time when the global banking system wasn’t in turmoil and heavily deleveraging as it was in the post-GFC years. To be fair the Fed were starting to catch up with reality late last year but Omicron meant that the market was reluctant to read their more hawkish move as entirely realistic given the risks that the variant presented. However the holiday season provided more evidence that Omicron was notably milder, especially amongst the vaccinated, and the result has been that the market has looked through this more than they were willing to before Xmas whilst at the same time the Fed have become even more hawkish by upping the ante on QT. So a perfect storm.

So in today’s EMR we wanted to start with a detailed review of the events of last week alongside commentary as to what it all might mean. Let’s start with Treasuries. 10 year yields moved +25.2bps higher (+4.1bps Friday) to 1.76%, and finally above the highs reached in 2021. The policy-driven selloff meant most of the gains were in real yields, with 5yr and 10yr real yields climbed an astonishing +32.7bps (+3.4bps Friday) and +32.6bps (+2.3bps Friday) on the week, respectively. It was the biggest weekly climb for both since the wild swings in yields we saw in March 2020. In our 2022 credit outlook we highlighted how rising real yields were much more negative for credit than rising nominal yields. The risk of real yields risking due to a Fed that would have to accelerate tightening was behind our H1 widening view (see the report from November here). We’ll see if it actually materialises though.

The fun and games started on Tuesday when a WSJ story revealed the Fed was considering starting quantitative tightening (QT) earlier in the cycle than they did last time. We didn’t need to wait long for confirmation. Minutes from the December FOMC released the next day revealed that starting QT closer to liftoff and proceeding at a faster pace than last cycle was indeed the position of the Committee. On top of that, there were strong signals that the FOMC thought that full employment and therefore liftoff were right around the corner, and Friday’s jobs numbers (recapped below) did nothing to dissuade that notion.

In turn, our US economics team have updated their Fed call. Full details here, but to recap, they’re moving their liftoff call to the March meeting and calling for four Fed rate hikes in 2022. Although not many economists have yet pencilled in a March hike, Fed Funds futures now price in an 86% chance, up from 63% at the close on New Year’s Eve, just 27% at the end of November and 0% in early October. Our economists also believe that QT will commence after two rate hikes, starting sometime in the third quarter.

The minutes forcefully argued for an aggressive QT program, noting that the Fed needed to signal a strong commitment to fighting inflation, that the balance sheet was large compared to GDP, and the imposition of the new standing repo facility should alleviate strains in money and Treasury markets that may arise from a drawdown of their portfolio. Notably, Fed presidents spanning the dove-hawk spectrum came out in support of a relatively soon start to QT in subsequent communications, with both President Daly and Bullard giving their blessing.

When QT starts, its pace, and how its decomposed between Treasury and MBS remain unknowns, but the communications had the desired effect of tightening financial conditions. After being unresponsive to the start of taper and subsequent doubling of the pace, Fed policymakers probably welcomed this tightening, although this can be a fine line to tread. All told, more than 3 hikes are priced into markets during 2022 but you would have to say that unless financial conditions notably tighten then all seven meetings from March to the end of 2022 are now potentially in play.

The increase in yields and steepening of curves reverberated through other advanced economy sovereign bond markets. 10yr gilt and bund yields increased +20.7bps (+2.2bps Friday) and +13.4bps (+1.8bps Friday) respectively. 10yr bund yields finished the week at -0.04%, approaching positive territory for the first time since spring 2019.

US equity markets took some collateral damage due to the yield selloff. The S&P 500 dropped -1.87% (-0.41% Friday), with discount exposed sectors such as large technology (FANG -2.77%, -0.60% Friday) and real estate (-4.94%, -0.55% Friday) the biggest losers. The drop in tech stocks sent the NASDAQ down -4.53% on the week (-0.96% Friday). Of course, steeper yield curves boosted financial stocks, with the S&P 500 bank index up +9.37% (+1.50% Friday). As you’ll see below, a few US financials will kickoff earnings season late this week. European equity indices proved much more resilient, with the STOXX 600 (-0.32%, -0.39% Friday), DAX (+0.40x%, -0.65% Friday), and CAC (+0.93%, -0.42% Friday) all finishing within a percent of the prior week’s close.

Oil prices climbed to start the year. OPEC+ announced they would proceed with the expected modest 400k barrel per day increase to production in February; Brent and WTI futures increased +5.10% (-0.83% Friday) and +4.91% (-1.24% Friday), respectively.

On the Covid front, a number of advanced economies registered record positive one-day case counts, including the US breaching a mind-boggling 1 million daily cases. Nevertheless, there were signs for optimism, as London, an early victim of Omicron, saw ventilator usage hit its lowest mark since mid-October coupled with a decline in positive test rates. Prime Minister Johnson remarked further lockdowns were not likely in response to Omicron, suggesting we’re moving toward an official policy of living with and adapting to Covid.

December employment data in the US showed the economy was rapidly approaching full employment. The unemployment rate sank to 3.9%, below the FOMC’s estimate of the longer-run rate of 4.0% which might be too low post covid. Headline payroll gains were below the expectations of +450k, printing at +199k, though the prior two months were revised higher. Average hourly earnings increased to +0.6%, beating expectations, while the prime-age employment-population ratio increased 0.2pps. Taken in concert, the data were consistent with an FOMC expecting the economy to reach full employment “relatively soon”, as described in the December minutes, and thus enabling the March rate hike our economists now expect. The Fed have long been way behind the curve and they are now starting to catch up with markets now finally listening.

Staying with a central bank theme, ECB board member Schnabel gave a very interesting speech over the weekend where she became the first major central bank speaker to acknowledge the risk of higher inflation with the energy transition away from carbon. Clearly this is a medium to longer-term theme but it’s been one of the reasons we’ve felt this decade will see notably higher structural inflation than the last one.

The highlight of the week ahead will clearly be US CPI on Wednesday. The Fed goes into pre-FOMC blackout at the weekend and all this week’s Fedspeak will therefore be very closely watched as the committee are moving very rapidly at the moment towards an ever tightening bias in their commentary. Even the doves are coming over to the other side. Elsewhere we start US earnings season, albeit slowly and late in the week with some important financials reporting. In terms of other data, this week sees a slew of hard US data for December with PPI (Thursday) and retail sales and industrial production on Friday alongside consumer sentiment.

There’ll also be some interest in Fed Chair Powell’s nomination hearing for a second term as Fed Chair, which is taking place before the Senate Banking Committee tomorrow. There’ll also be Governor Brainard’s nomination hearing to become Fed Vice Chair, which is taking place on Thursday. Both positions do require Senate confirmation, although last time in January 2018 Chair Powell was confirmed by a large bipartisan majority of 84-13. So a formality but there might be a fair bit of probing of their leadership

Previewing US CPI, recent months have seen consistent upside surprises as inflation has increasingly broadened out, and it’s now the case that 7 of the last 9 CPI releases have seen the monthly headline increase come in above the consensus among economists on Bloomberg, which just demonstrates how this has taken a lot of people by surprise. In terms of what to expect this time round, our US economists are projecting that year-on-year inflation will move higher once again, with an increase to +7.0%, which would be the fastest pace of inflation since 1982, back when Ronald Reagan was in his first term as president. Interestingly though, they think we could be at a turning point with December marking the peak in the year-on-year readings. For more information, take a look at our economists’ inflation outlook (link here) .

As discussed, earnings season will slowly get going this week, with a number of US financials among those reporting. The highlights include Delta Air Lines on Thursday, before we hear from Citigroup, JPMorgan Chase, Wells Fargo and BlackRock on Friday.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

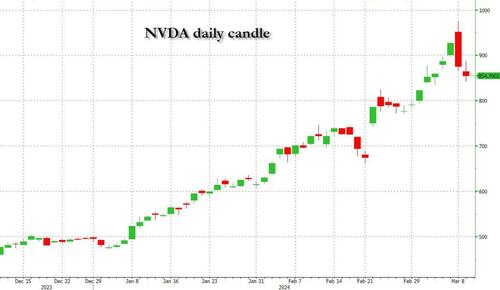

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Government

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

Spread & Containment

Trump “Clearly Hasn’t Learned From His COVID-Era Mistakes”, RFK Jr. Says

Trump "Clearly Hasn’t Learned From His COVID-Era Mistakes", RFK Jr. Says

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President…

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President Joe Biden claimed that COVID vaccines are now helping cancer patients during his State of the Union address on March 7, but it was a response on Truth Social from former President Donald Trump that drew the ire of independent presidential candidate Robert F. Kennedy Jr.

During the address, President Biden said: “The pandemic no longer controls our lives. The vaccines that saved us from COVID are now being used to help beat cancer, turning setback into comeback. That’s what America does.”

President Trump wrote: “The Pandemic no longer controls our lives. The VACCINES that saved us from COVID are now being used to help beat cancer—turning setback into comeback. YOU’RE WELCOME JOE. NINE-MONTH APPROVAL TIME VS. 12 YEARS THAT IT WOULD HAVE TAKEN YOU.”

An outspoken critic of President Trump’s COVID response, and the Operation Warp Speed program that escalated the availability of COVID vaccines, Mr. Kennedy said on X, formerly known as Twitter, that “Donald Trump clearly hasn’t learned from his COVID-era mistakes.”

“He fails to recognize how ineffective his warp speed vaccine is as the ninth shot is being recommended to seniors. Even more troubling is the documented harm being caused by the shot to so many innocent children and adults who are suffering myocarditis, pericarditis, and brain inflammation,” Mr. Kennedy remarked.

“This has been confirmed by a CDC-funded study of 99 million people. Instead of bragging about its speedy approval, we should be honestly and transparently debating the abundant evidence that this vaccine may have caused more harm than good.

“I look forward to debating both Trump and Biden on Sept. 16 in San Marcos, Texas.”

Mr. Kennedy announced in April 2023 that he would challenge President Biden for the 2024 Democratic Party presidential nomination before declaring his run as an independent last October, claiming that the Democrat National Committee was “rigging the primary.”

Since the early stages of his campaign, Mr. Kennedy has generated more support than pundits expected from conservatives, moderates, and independents resulting in speculation that he could take votes away from President Trump.

Many Republicans continue to seek a reckoning over the government-imposed pandemic lockdowns and vaccine mandates.

President Trump’s defense of Operation Warp Speed, the program he rolled out in May 2020 to spur the development and distribution of COVID-19 vaccines amid the pandemic, remains a sticking point for some of his supporters.

Operation Warp Speed featured a partnership between the government, the military, and the private sector, with the government paying for millions of vaccine doses to be produced.

President Trump released a statement in March 2021 saying: “I hope everyone remembers when they’re getting the COVID-19 Vaccine, that if I wasn’t President, you wouldn’t be getting that beautiful ‘shot’ for 5 years, at best, and probably wouldn’t be getting it at all. I hope everyone remembers!”

President Trump said about the COVID-19 vaccine in an interview on Fox News in March 2021: “It works incredibly well. Ninety-five percent, maybe even more than that. I would recommend it, and I would recommend it to a lot of people that don’t want to get it and a lot of those people voted for me, frankly.

“But again, we have our freedoms and we have to live by that and I agree with that also. But it’s a great vaccine, it’s a safe vaccine, and it’s something that works.”

On many occasions, President Trump has said that he is not in favor of vaccine mandates.

An environmental attorney, Mr. Kennedy founded Children’s Health Defense, a nonprofit that aims to end childhood health epidemics by promoting vaccine safeguards, among other initiatives.

Last year, Mr. Kennedy told podcaster Joe Rogan that ivermectin was suppressed by the FDA so that the COVID-19 vaccines could be granted emergency use authorization.

He has criticized Big Pharma, vaccine safety, and government mandates for years.

Since launching his presidential campaign, Mr. Kennedy has made his stances on the COVID-19 vaccines, and vaccines in general, a frequent talking point.

“I would argue that the science is very clear right now that they [vaccines] caused a lot more problems than they averted,” Mr. Kennedy said on Piers Morgan Uncensored last April.

“And if you look at the countries that did not vaccinate, they had the lowest death rates, they had the lowest COVID and infection rates.”

Additional data show a “direct correlation” between excess deaths and high vaccination rates in developed countries, he said.

President Trump and Mr. Kennedy have similar views on topics like protecting the U.S.-Mexico border and ending the Russia-Ukraine war.

COVID-19 is the topic where Mr. Kennedy and President Trump seem to differ the most.

Former President Donald Trump intended to “drain the swamp” when he took office in 2017, but he was “intimidated by bureaucrats” at federal agencies and did not accomplish that objective, Mr. Kennedy said on Feb. 5.

Speaking at a voter rally in Tucson, where he collected signatures to get on the Arizona ballot, the independent presidential candidate said President Trump was “earnest” when he vowed to “drain the swamp,” but it was “business as usual” during his term.

John Bolton, who President Trump appointed as a national security adviser, is “the template for a swamp creature,” Mr. Kennedy said.

Scott Gottlieb, who President Trump named to run the FDA, “was Pfizer’s business partner” and eventually returned to Pfizer, Mr. Kennedy said.

Mr. Kennedy said that President Trump had more lobbyists running federal agencies than any president in U.S. history.

“You can’t reform them when you’ve got the swamp creatures running them, and I’m not going to do that. I’m going to do something different,” Mr. Kennedy said.

During the COVID-19 pandemic, President Trump “did not ask the questions that he should have,” he believes.

President Trump “knew that lockdowns were wrong” and then “agreed to lockdowns,” Mr. Kennedy said.

He also “knew that hydroxychloroquine worked, he said it,” Mr. Kennedy explained, adding that he was eventually “rolled over” by Dr. Anthony Fauci and his advisers.

MaryJo Perry, a longtime advocate for vaccine choice and a Trump supporter, thinks votes will be at a premium come Election Day, particularly because the independent and third-party field is becoming more competitive.

Ms. Perry, president of Mississippi Parents for Vaccine Rights, believes advocates for medical freedom could determine who is ultimately president.

She believes that Mr. Kennedy is “pulling votes from Trump” because of the former president’s stance on the vaccines.

“People care about medical freedom. It’s an important issue here in Mississippi, and across the country,” Ms. Perry told The Epoch Times.

“Trump should admit he was wrong about Operation Warp Speed and that COVID vaccines have been dangerous. That would make a difference among people he has offended.”

President Trump won’t lose enough votes to Mr. Kennedy about Operation Warp Speed and COVID vaccines to have a significant impact on the election, Ohio Republican strategist Wes Farno told The Epoch Times.

President Trump won in Ohio by eight percentage points in both 2016 and 2020. The Ohio Republican Party endorsed President Trump for the nomination in 2024.

“The positives of a Trump presidency far outweigh the negatives,” Mr. Farno said. “People are more concerned about their wallet and the economy.

“They are asking themselves if they were better off during President Trump’s term compared to since President Biden took office. The answer to that question is obvious because many Americans are struggling to afford groceries, gas, mortgages, and rent payments.

“America needs President Trump.”

Multiple national polls back Mr. Farno’s view.

As of March 6, the RealClearPolitics average of polls indicates that President Trump has 41.8 percent support in a five-way race that includes President Biden (38.4 percent), Mr. Kennedy (12.7 percent), independent Cornel West (2.6 percent), and Green Party nominee Jill Stein (1.7 percent).

A Pew Research Center study conducted among 10,133 U.S. adults from Feb. 7 to Feb. 11 showed that Democrats and Democrat-leaning independents (42 percent) are more likely than Republicans and GOP-leaning independents (15 percent) to say they have received an updated COVID vaccine.

The poll also reported that just 28 percent of adults say they have received the updated COVID inoculation.

The peer-reviewed multinational study of more than 99 million vaccinated people that Mr. Kennedy referenced in his X post on March 7 was published in the Vaccine journal on Feb. 12.

It aimed to evaluate the risk of 13 adverse events of special interest (AESI) following COVID-19 vaccination. The AESIs spanned three categories—neurological, hematologic (blood), and cardiovascular.

The study reviewed data collected from more than 99 million vaccinated people from eight nations—Argentina, Australia, Canada, Denmark, Finland, France, New Zealand, and Scotland—looking at risks up to 42 days after getting the shots.

Three vaccines—Pfizer and Moderna’s mRNA vaccines as well as AstraZeneca’s viral vector jab—were examined in the study.

Researchers found higher-than-expected cases that they deemed met the threshold to be potential safety signals for multiple AESIs, including for Guillain-Barre syndrome (GBS), cerebral venous sinus thrombosis (CVST), myocarditis, and pericarditis.

A safety signal refers to information that could suggest a potential risk or harm that may be associated with a medical product.

The study identified higher incidences of neurological, cardiovascular, and blood disorder complications than what the researchers expected.

President Trump’s role in Operation Warp Speed, and his continued praise of the COVID vaccine, remains a concern for some voters, including those who still support him.

Krista Cobb is a 40-year-old mother in western Ohio. She voted for President Trump in 2020 and said she would cast her vote for him this November, but she was stunned when she saw his response to President Biden about the COVID-19 vaccine during the State of the Union address.

“I love President Trump and support his policies, but at this point, he has to know they [advisers and health officials] lied about the shot,” Ms. Cobb told The Epoch Times.

“If he continues to promote it, especially after all of the hearings they’ve had about it in Congress, the side effects, and cover-ups on Capitol Hill, at what point does he become the same as the people who have lied?” Ms. Cobb added.

“I think he should distance himself from talk about Operation Warp Speed and even admit that he was wrong—that the vaccines have not had the impact he was told they would have. If he did that, people would respect him even more.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges