Futures Rebound From Post-CPI Rout As China Property Stocks Soar

Futures Rebound From Post-CPI Rout As China Property Stocks Soar

US futures rose and European bourses once again rebounded from overnight lows, this time after concerns that scorching US and Chinese CPI and PPI prints will prompt central…

US futures rose and European bourses once again rebounded from overnight lows, this time after concerns that scorching US and Chinese CPI and PPI prints will prompt central banks to tighten much sooner than expected. The bounce was aided by a surge in Chinese property developers which booked their best two-day gain in six years, joined by a jump in technology stocks, as investors speculated Beijing may soften regulatory crackdowns on the two industries. At 730am S&P futures were up 16.75 ot 0.36 to 4,658.50, Dow Jones futs were up 40 points or 0.11% and Nasdaq futures were up 97.50 or 0.61%. The dollar index rose and cash Treasurys are closed today for Veterans day.

Wednesday’s stronger-than-forecast data on U.S. consumer prices finally crushed the argument that inflation is transitory and weighed on the tech sector in particular as Treasury yields spiked. Tesla shares rose 5% in premarket trading following filings that showed Chief Executive Officer Elon Musk sold $5 billion in stock in the electric-vehicle maker a few days after the shares hit a record high. Disney dropped 4.8% in premarket trading to lead declines among Dow components after reporting the smallest rise in Disney+ subscriptions since the service's launch and posted downbeat profit at its theme park division. SoFi rose as much as 16% in premarket after Jefferies said the fintech’s third-quarter results were a “strong” beat. Amazon-backed electric-vehicle maker Rivian Automotive jumped 4.9%, adding to the nearly 30% gain on its blockbuster trading debut. Chinese tech stocks got some comfort from a report that ride-hailing company Didi Global Inc. is getting ready to relaunch its apps in China by the end of the year as an investigation wraps up. Here are some of the biggest U.S. movers today:

- Beyond Meat (BYND US) shares plunged 20% in premarket after the maker of plant-based meats released a disappointing sales projection for 4Q.

- Fossil (FOSL US) jumped 33% premarket after the accessory maker boosted its net sales forecast for the full year.

- Bumble (BMBL US) the dating app that lets women make the first move, reported earnings in the third quarter that missed analysts’ estimates. The shares fell 7% premarket.

- Disney (DIS US) shares fall as much as 5.3% in premarket, with analysts flagging softness in its Disney+ subscribers and net income in its fiscal fourth quarter.

- Rivian (RIVN US) jumps 8% in premarket after the electric truck maker soared in its trading debut on Wednesday.

- Didi (DIDI US) gains 4% in premarket after Reuters reported that the company is preparing to reintroduce its apps in China by the end of the year as regulators wrap up their investigations into the ride- hailing giant.

- Marqeta (MQ US) gains 17% premarket, with analysts saying the payments platform delivered a strong beat-and-raise report for 3Q.

- SoFi Technologies (SOFI US) rises 15% premarket with Jefferies saying the fintech’s 3Q results are a “strong” beat.

- Figs (FIGS US) shares sank 14% in postmarket trading on Wednesday, after the seller of scrubs for health-care workers reported a third-quarter profit in line with analysts’ estimates.

- Oscar Health (OSCR US) fell 10% postmarket Wednesday after the upstart health insurer projected a deeper adjusted Ebitda loss for the full year.

- Payoneer Global (PAYO US), the payment solutions company, gained 8% premarket after its full- year revenue forecast beat the average analyst estimate.

- Wish (WISH US) fell 2% after the e-commerce services company posted an Ebitda loss for the fourth quarter

Despite today's mini relief rally, investors are bracing for tighter monetary policy sooner rather than later, after Wednesday’s stronger-than-forecast data on U.S. consumer prices dealt a blow to the argument that inflation is transitory. Meanwhile, Bloomberg reported that the European Central Bank could stop buying bonds as early as next September if inflation looks to have sustainably returned to the official target, Governing Council member Robert Holzmann said.

“This is the perfect time to gravitate toward defensive plays, to take profit and to be in the sectors that are strategically positioned toward this volatile market that presents a lot of challenges,” Katerina Simonetti, senior vice president at Morgan Stanley Private Wealth Management, said on Bloomberg Television.

Market participants were also watching developments around the nomination of the Federal Reserve Chair, with President Joe Biden still weighing whether to keep Jerome Powell for a second term or elevate Fed Governor Lael Brainard to the post

In Europe, equities pushed into the green after a muted start, with the Stoxx 600 Index up 0.1% while the Euro Stoxx 50 is little changed as France's CAC outperformed and the U.K.’s exporter-heavy FTSE 100 Index rose as the pound held near an 11-month low after better-than-expected economic growth data. Basic resources, construction and banking names are the strongest sectors; travel and oil & gas the notable laggards.

The Stoxx Europe 600 basic resources sub-index rose as much as 2.9%, the most in about a month, as iron ore rebounds and other metals rise. Anglo American, Rio Tinto, BHP, Glencore and Norsk Hydro among those leading gains by index points.ArcelorMittal also rallied after 3Q results. Miners are outperforming gains on the Stoxx Europe 600, which is up 0.2%. Iron ore’s rout halted as expectations build for an easing of the real-estate turmoil in China that’s battered demand, while aluminum jumped as supplies of the metal tighten. And speaking of Europe, ECB-dated OIS rates now price ~20bps of hikes by end-2022 as STIRs globally wrestle with the latest hot inflation prints. Here are some of the biggest European movers this morning:

- Auto Trader jumped as much as 15% to a record high, with Jefferies saying its new guidance should drive mid-single-digit upgrades to consensus estimates for the online car listings platform.

- Sika shares surge as much as 12% following the acquisition of construction chemicals peer MBCC, with Baader, Vontobel and Morgan Stanley all positive on the deal.

- ArcelorMittal shares rise as much as 4.4% after the steelmaker’s results, with Citi saying the update has a positive tone despite the numbers missing estimates.

- Siemens shares rise as much as 2.8% with analysts saying the German industrial group’s update was encouraging, with its dividend among the main positives.

- Johnson Matthey shares plummet as much as 20% after the company warned on its current trading and said it will exit its battery business.

- Burberry shares slump as much as 10% after the luxury goods company’s comparable store sales missed market expectations, with analysts saying consensus estimates are likely to remain unchanged, and the focus will be on the upcoming management change.

Earlier in the session, Asia’s regional benchmark declined, on track for a third day of losses, after monthly U.S. consumer prices rose at the fastest annual pace since 1990, raising concerns over costs and monetary policy moves. The MSCI Asia Pacific Index slid as much as 0.6%, before paring most of the losses, with several tech hardware stocks weighing on the benchmark and Tencent the biggest drag after its 3Q revenue missed analyst estimates. Still, the Hang Seng Tech Index ended the day higher after Reuters reported that Didi Global is getting ready to relaunch apps in China by the end of the year. Investors have been cautiously eyeing inflation data as the next market catalyst amid the ongoing pandemic. China helped lead Asian stocks lower Wednesday after reporting a spike in producer prices.

“The inflation number spoke to scope for greater and longer-lasting tightening, which understandably hurt the tech sector,” said Ilya Spivak, head of Greater Asia at DailyFX. “The vulnerability there is to longer-term financing, because near-term is pretty well locked in for the most part,” he said. India, Taiwan and the Philippines posted the steepest declines Thursday, while Australian equities slid after unemployment unexpectedly jumped in October. China was the top performer as property developers rallied, while Japan’s benchmarks posted their first rise in five sessions as the yen weakened.

Japanese equities rose, rebounding after after a four-day loss, as electronics and auto makers climbed while the yen weakened. Trading houses and machinery makers were also among the biggest boosts to the Topix, which rose 0.3%. Fanuc and SoftBank Group were the biggest contributors to a 0.6% gain in the Nikkei 225. The yen slightly extended its 0.9% overnight loss against the dollar. Tokyo shares fluctuated in early trading after U.S. stocks fell by the most in a month and Treasury yields spiked. Labor Department data showed consumer prices rose last month at the fastest annual pace since 1990, putting pressure on the Federal Reserve to end near-zero interest rates sooner than expected “Investors had been selling value stocks and buying up growth stocks, but now that’s being reversed,” said Mamoru Shimode, chief strategist at Resona Asset Management. Going forward “the environment will be a favorable one for Japanese equities,” he said, noting the local market’s underperformance against global peers.

In rates, Treasury futures are mixed with a curve-flattening bent, remaining near low end of Wednesday’s range, when above-estimate CPI and poor 30-year bond auction caused a selloff across the curve. As noted above, the Cash Treasuries market is closed Thursday for Veteran’s Day. Treasury 10-year yields closed Wednesday at 1.549%, nearly 10bp higher on the day; EGBs and gilts are slightly richer on the day out to the 10-year sector, while curves are mildly steeper. Wednesday’s price action in the U.S. sent ripples through European markets, which now price 20bps of ECB rate hikes in December 2022 for the first time since the start of the month. Euribor futures add 4-6 ticks in red and green packs. Bunds and gilts bear steepen gently. Peripheral spreads widen at the margin. Short end Italy underperforms despite a decent reception at today’s auctions.

In FX, the Bloomberg Dollar Spot Index reached its strongest level in a year and the greenback advanced against all of its Group-of-10 peers, with the biggest losses seen among some commodity currencies. Cable inched lower to trade below $1.34 for the first time since December 2020. The U.K. economy grew more strongly than expected in September after a surge in service industries and construction. GDP rose 0.6% from August, the Office for National Statistics said Thursday. That was quicker than the 0.4% pace anticipated by economists. The Australian and New Zealand dollars were the worst G-10 performers; Aussie fell and Australian sovereign yields trimmed an opening spike after the nation’s jobless rate jumped to 5.2%. The initial move was in line with Treasuries, which plunged after U.S. inflation came in at the hottest since 1990.

In commodities, crude futures fade a pop higher after quiet Asian trade; WTI is little changed near $81.20, Brent stalls below $83. Spot gold rises back toward Wednesday’s best levels, trading near $1,860/oz. Base metals are in the green with LME aluminum outperforming

To the day ahead now, and the main data highlight will be the UK’s preliminary Q3 GDP reading. From central banks, the ECB will be publishing their Economic Bulletin, and speakers include the ECB’s Makhlouf, Schnabel and Hernandez de Cos, along with the BoE’s Mann. Otherwise, the European Commission will be releasing their latest economic forecasts, and it’s the Veterans’ Day Holiday in the United States.

Market Snapshot

- S&P 500 futures up 0.4% to 4,658.25

- STOXX Europe 600 up 0.1% to 484.44

- MXAP little changed at 197.72

- MXAPJ down 0.2% to 647.07

- Nikkei up 0.6% to 29,277.86

- Topix up 0.3% to 2,014.30

- Hang Seng Index up 1.0% to 25,247.99

- Shanghai Composite up 1.2% to 3,532.79

- Sensex down 0.8% to 59,898.81

- Australia S&P/ASX 200 down 0.6% to 7,381.95

- Kospi down 0.2% to 2,924.92

- Gold spot up 0.7% to $1,862.18

- U.S. Dollar Index up 0.19% to 95.03

- German 10Y yield little changed at -0.24%

- Euro down 0.2% to $1.1461

- Brent Futures up 0.7% to $83.18/bbl

Top Overnight News from Bloomberg

- The European Central Bank could stop buying bonds as early as next September if inflation looks to have sustainably returned to the official target, Governing Council member Robert Holzmann said

- China’s efforts to limit fallout from China Evergrande Group’s crisis are gathering steam. A series of articles published in state media in the past few days signal support measures are on the way to help developers tap debt markets, potentially easing a liquidity crunch that began with Evergrande’s meltdown five months ago

- Customers of international clearing firm Clearstream received overdue interest payments on three dollar bonds issued by Evergrande, a spokesperson for Clearstream said

A more detailed look at global markets courtesy of Newsquawk

Asian equity markets traded mixed as positive Chinese developer headlines including news of Evergrande payments, helped the region partially shrug off the losses seen stateside where duration sensitive stocks underperformed as yields surged following a hot CPI print and a soft 30yr auction. ASX 200 (-0.6%) declined with the index led lower by tech and energy which followed suit to the heavy losses in their US counterparts and with disappointing jobs data adding to the headwinds. Nikkei 225 (+0.6%) coat-tailed on the advances in USD/JPY which briefly climbed above the 114.00 level and with a slew of earnings releases providing a catalyst for individual stock prices. Hang Seng (+1.0%) and Shanghai Comp. (+1.2%) were varied with notable strength in property names after Evergrande was reported to have paid the overdue interest on three bonds to avoid a default and with China said to be considering moderating property curbs to help troubled developers unload assets. In addition, the PBoC continued with its mild liquidity efforts and it was also reported that the Biden-Xi virtual meeting is tentatively scheduled for next Monday, although weakness in tech capped upside in the Hong Kong benchmark with shares in index heavyweight Tencent pressured post-earnings as the Beijing crackdown decelerated revenue growth to the slowest pace since the Co. listed in 2004. Finally, 10yr JGBs suffered spillover selling from global peers including T-notes which declined by a point to below 131.00 and with prices also hampered after a weak 30yr auction, while focus in Japan shifted to the enhanced liquidity auction for longer dated government bonds which printed a lower b/c although the highest accepted spread returned positive.

Top Asian News

- Indonesian Stocks Close at Record High on Economic Rebound

- Signs of Easing as Delayed Bond Coupons Paid: Evergrande Update

- Asia Stocks Slip After U.S. Inflation Spike, Weak Tencent Sales

- Kaisa Tells Investors It May Not Make Coupon Payments: REDD

European equities (Eurostoxx 50 -0.1%) broadly trade mixed following on from this week’s firm inflation reports from the US and China. The handover from APAC was also mixed with focus on China amid notable strength in property names after Evergrande was reported to have paid the overdue interest on three bonds to avoid a default. Furthermore, the PBoC continued with its mild liquidity efforts and it was also reported that the Biden-Xi virtual meeting is tentatively scheduled for next Monday. Stateside, futures are a touch firmer (ES +0.2%) in the wake of yesterday’s cash market losses which saw duration sensitive stocks underperform as yields surged. From a macro perspective, Axios reported overnight that inflation concerns could see US Senator Manchin “punt” President Biden's Build Back Better agenda into next year. Eyes on the Wall St. open will be on Tesla after CEO Musk offloaded USD 5bln of stock in the Co. Back to Europe, Goldman Sachs outlook for 2022 sees a price target for the Stoxx 600 of 530 (vs. current 483) which would deliver a total return of around 13% and mark a continuation of the current bull market, albeit at a slower pace. Sectors in Europe are somewhat mixed with Basic Resources a clear outperformer amid broad strength in mining names and following earnings from ArcelorMittal (+2.9%) which sent the Co.’s shares to the top of the CAC. Banking names are also on a firmer footing amid the favourable yield environment post-CPI with Lloyds (+1.3%) and Commerzbank (+3.0%) supported by broker upgrades at Keefe Bruyette and Morgan Stanley respectively. To the downside, Oil & Gas names are softer as the crude complex struggles to recoup recent losses. Retail names have been weighed on by Burberry (-6.2%) post-earnings with the Co. noting that performance in Europe remains under pressure. Renault (-3.1%) sits at the foot of the CAC after Daimler opted to sell its stake in the Co. for USD 364mln. Finally, Johnson Matthey (-16.3%) is the clear laggard in the region after its CEO announced his decision to step down and the Co. announced it is to exit the battery materials business.

Top European News

- U.K. Growth Data Leave December BOE Rate Rise in the Balance

- Scholz Aims to ‘Winter Proof’ Germany Against New Covid Wave

- Kering Says Creative Head Daniel Lee to Leave Bottega Veneta

- Gas Crunch Fuels RWE Profits as Energy Giant Burns Coal

In FX, the Dollar took some time out for reflection and a rest after extending yesterday’s post-US CPI gains with the additional thrust of a supply-related ramp up in Treasury yields following a poor new long bond auction. However, the index could not quite muster enough bullish momentum to touch 95.000 until APAC buyers got a chance to respond to the strength of the inflation data and bear-steepening reaction in debt markets that evolved after initial bear-flattening. The DXY subsequently reset, refuelled and cleared the psychological barrier more convincingly, at 95.101 before fading again as several basket components found underlying bids and technical support around key levels, but still seems bid and upwardly mobile in thinner trading volumes due to Veteran’s Day.

- NZD/AUD - Perhaps perversely given overnight macro fundamentals, the Kiwi is lagging down under with Aud/Nzd cross elevated near 1.0400, though this could be in recognition of a sharp retreat in NZ food prices and mitigating factors leading to Aussie labour metrics missing consensus by some distance right across the board. Whatever the rationale, Nzd/Usd is lower than Aud/Usd in absolute terms even though the former is holding above 0.7100 and latter has now lost 0.7300+ status.

- CAD - Weaker WTI crude (in relative terms rather than on the day per se) is not helping the Loonie’s cause after it managed to contain losses on Wednesday, as Usd/Cad hovers near the top of a 1.2535-1.2473 range awaiting the BoC’s Q3 Senior Loan Officer Survey tomorrow for further direction from a Canadian perspective.

- CHF/EUR/JPY/GBP - All giving up more ground to the Greenback, but to varying degrees with the Franc trying to keep sight of 0.9200, the Euro defend 1.1450 having closed below 1.1500 and a key Fib retracement just shy of the round number, the Yen stay within touching distance of 114.00 and Sterling stop the rot after letting go of the 1.3400 handle again. On that note, a late December 2020 low in Cable at 1.3361 remains intact ahead of 1.3350 for semi-sentimental reasons and then a deep channel trendline from 1.3330-20, while Usd/Jpy has scope to be drawn to decent option expiry interest at 113.70 (1.6 bn) if not similar size spanning 113.60-00.

In commodities, WTI and Brent have been choppy this morning with catalysts limited and conditions thinner than normal on account of Veteran’s Day. Price action thus far has seen the benchmarks print a range in excess of USD 1.00/bbl in a narrow timespan, note, that these parameters remain comfortably within yesterday’s levels; currently, both WTI and Brent are at the lower-end of this band as any initial attempt at a recovery has fizzled out with the USD likely a factor. While newsflow directly for the complex has been sparse attention remains on the monthly oil surveys, COVID-19 and geopolitics. Firstly, the OPEC MOMR is scheduled for release today and as a reminder the EIA STEO, under greater focus given US crude/SPR watch, raised 2021 world oil demand growth forecast by +60k BPD to 5.11mln BPD Y/Y increase this week, but cut its 2022 forecast by 130k BPD to 3.35mln BPD Y/Y increase. On COVID, the demand-side is attentive to increasing cases in areas such as Germany with the effective Chancellor-in-waiting Scholz saying further measures will be needed through Winter; additionally, the Netherlands outbreak team are recommending a short lockdown and Beijing has implemented various local measures. Finally, geopolitics is attentive to the situation in Belarus after Lukashenko said they will respond to any sanctions and has suggested closing gas and goods transit through the area. Moving to metals, spot gold and silver remain towards the top-end of yesterday’s parameters, but are only modestly firmer on the session, as newsflow has been slim and the USD’s more gradual upside and lack-of cash UST action is providing a respite from yesterday’s upside. Action that saw spot gold supported by almost USD 40/oz from opening levels. Elsewhere, ArcelorMittal’s earnings update featured a forecast for global steel demand to increase between 12-13% this year excluding China given a softening of real demand.

US Event Calendar

- 9:45am: Nov. Langer Consumer Comfort, prior 49.2

Central Banks

- Nothing major scheduled

DB's Jim Reid concludes the overnight wrap

Yesterday was one of those days to just go “wow” at. The headline YoY US CPI rate of 6.2% was the highest since the 6.3% in 1990, which means that unless you’re at least 50 this will be the highest US inflation print of your career. In fact, apart from 2 months in 1990 at 6.3%, you’d have to go back to 1982 to find a higher print. So you’d have to probably be at least 60 to remember anything like this in your work life, other than that brief spike in 1990.

In more detail, for the 6th time in the last 8 months, the headline print came in above the consensus estimate on Bloomberg, with prices up by +0.9% on a month-on-month basis (vs. +0.6% expected). If you look at the reading to two decimal places, it was actually the strongest monthly inflation since July 2008, so hardly a sign that those pressures have been dimming as we move towards year end. We’ll go through some of the moves in more depth below, but markets didn’t react well to the prospect of a more inflationary future, with both bonds and equities moving lower as investors moved to price in earlier and a more rapid pace of future rate hikes by the Fed. A horrible 30 year auction 4.5 hours later cemented a big rise in yields on the day. Note US bond markets are closed today for Veterans Day. Equities remain open but trading will be thin.

Just completing the inflation picture, the October price rise was a fairly broad-based one that included upward pressure across all the main categories, including components that are tied to more persistent inflation. Admittedly, a big driver was energy inflation (+4.8% on a monthly basis), but even if you stripped out the more volatile factors, core inflation was still up +0.6% (vs. +0.4% expected), sending the annual core inflation measure up to its highest since 1991, at +4.6% (vs. +4.3% expected). There were also further signs of pressure from the housing categories, with owners’ equivalent rent (+0.44%) seeing its largest monthly increase since June 2006. This housing inflation is coming in bang on script (see page 19 of my 1970s chart book here). Medical care services (+0.49%) was also a big contributor to the upside surprise. The broad-based price gains drove trimmed mean and median CPI, measures of underlying trend inflation, to their highest levels since 1983.

There’ll understandably be questions for the Fed off the back of this release, and markets responded by bringing forward their pricing of the first rate hike to the July 2022 meeting. In fact, by the close of trade, roughly an extra 13bps of hikes were priced in by end-2022 relative to the previous day. It’s also worth noting that the latest CPI release means that the real fed funds rate in October was beneath -6%, which is lower than at any point in the 1970s, where the bottom was -5% (see page 3 in the same 1970s chart book and draw the line down another few tenths of a basis point). So by this measure, monetary policy is even more accommodative now than it was back then, in a decade that saw inflation get progressively out of control. For more on those 1970s comparisons, take a look at our full note from last month (link here.)

Treasuries understandably sold off, led by the front end and belly of the curve, as investors brought forward the likely timing of future rate hikes. 5yr Treasuries increased +13.5bps (the biggest one-day increase since February), and 10yrs +11.4bps (largest increase since September). The yield curve flattened, with 5s30s down -4.9bps to 68.5bps, the flattest since March 2020. Longer-dated yields were drifting higher through the New York session but accelerated after a 5.2bp tail in the 30yr Treasury auction. The tail was the highest since 2011, and primary dealer takedown was almost 2 standard deviations above average over the last year. Unlike after less-than-stellar auctions earlier this year, bonds stabilised for the rest of the day, with the 30yr +8.6 bps higher, only +1.7bps above pre-auction trading. After all, 30yr yields have rallied 26.0bps since early October, inclusive of today’s poor auction, as there has been some long-end duration demand. Indeed, even with the policy rate repricing, 5y5y rates, one proxy for long-run or terminal policy rates, remain below 2%, after increasing just +6.2bps. This is also manifest in record low real yields through the curve. 10yr real yields initially sunk to an all-time low intraday at -1.253% after the CPI print before ultimately increasing +3.0bps on the day to -1.17%. Likewise, 5yr real yields touched -1.97% in the aftermath of the CPI print, and closed the day +2.5bps higher than Tuesday’s close at -1.88%.

With nominal yields outpacing real yields, inflation compensation increased across the curve: 5yr breakevens increased +11.1bps to 3.10%, an all-time high, whilst 10yr breakevens increased +6.4bps to a post-2006 high of 2.71%. Gold (+0.97%), and other precious metals, including silver (+1.37%) and platinum (+0.75%) gained, as did Bitcoin, which clipped another all-time high, $68,992, intraday. The dollar (+0.90%) also benefitted.

The continued prevalence of high inflation is having increasing political ramifications, and President Biden put out a statement following the release, commenting on the inflation data (as well as the more positive weekly jobless claims). He said that reversing the trend in inflation was “a top priority for me” and laid a decent chunk of the blame at rising energy costs. He said that he’d directed the National Economic Council to look at further ways of reducing energy costs, and that he’d also “asked the Federal Trade Commission to strike back at any market manipulation or price gouging in this sector”. However, we also heard from moderate Democratic senator Joe Manchin of West Virginia, who tweeted that “the threat posed by record inflation to the American people is not ‘transitory’ and is instead getting worse. … DC can no longer ignore the economic pain Americans feel every day.” Manchin is a key swing vote on Biden’s Build Back Better Plan, and he has already influenced cutting the bill from the $3.5tn initially envisaged to a framework half that size, due in part to the potential inflationary impact of additional spending. From the Fed however, the only signal we got came from San Francisco Fed President Daly (one of the most dovish FOMC members), who gave an interview with Bloomberg TV shortly following the CPI print. She notably referred to inflation as “eye-popping”, but demurred when asked about changing the course of Fed policy, asserting that it would be premature to “start changing our calculations about raising rates” or to accelerate the pace of tapering.

Higher inflation and pricing of aggressive Fed tightening was not a good combination for US risk. The S&P 500 fell -0.82% in its second consecutive decline (which feels like its own record after the recent run), and was down more than a percent intraday. Energy (-2.97%) led the declines (more below) but, tech (-1.68%) and communication services (-1.25%) each declined more than a percent due to the increase in discount rates. Commensurate with the big rate selloff, the Nasdaq (-1.66%) also underperformed. Meanwhile, European equities outperformed, with the STOXX 600 up +0.22% to reach an all-time high, just as the DAX (+0.17%) and the CAC 40 (+0.03%) also hit new records. To be fair, US equities were only slightly down on the day when European bourses closed. Sovereign bonds echoed the US moves however, and a selloff across the continent saw yields on 10yr bunds (+4.9bps), OATs (+6.8bps) and BTPs (+9.5bps) all move higher.

Stocks in Asia are trading mixed overnight with CSI (+0.89%) leading the pack, followed by the Shanghai Composite (+0.59%), and the Nikkei (+0.56%) in the green while the Hang Seng (-0.16%) and KOSPI (-0.59%) have lost ground. Staying on inflation, Japan’s PPI for October came out at 8.0% year-on-year (7.0% consensus and 6.3% previous), the highest since 1981. Elsewhere, in Australia the unemployment rate for October saw a big surprise, jumping to 5.2% (4.9% consensus, 4.6% previous) as many people re-entered the labour force after lockdowns. The participation rate rose to 64.7% from 64.5% in September. Futures are indicating a muted start to the day in the US & Europe with S&P 500 futures (+0.08%) up but DAX futures (-0.28%) catching down with the late US sell-off.

One solace on the inflation front was a decline in energy prices yesterday, with both Brent crude (-2.52%) and WTI (-3.34%) losing ground. That followed 3 consecutive gains and came after the US EIA reported that crude oil inventories had risen by +1.00m barrels last week. There was also another decline in natural gas prices, with US futures falling -1.99% in their 4th consecutive decline, whilst European futures were down -4.06%.

Looking at yesterday’s other data, the weekly initial jobless claims for the US over the week through November 6 fell to 267k (vs. 260k expected). That’s their 6th successive weekly decline and takes the measure to a post-pandemic low.

To the day ahead now, and the main data highlight will be the UK’s preliminary Q3 GDP reading. From central banks, the ECB will be publishing their Economic Bulletin, and speakers include the ECB’s Makhlouf, Schnabel and Hernandez de Cos, along with the BoE’s Mann. Otherwise, the European Commission will be releasing their latest economic forecasts, and it’s the Veterans’ Day Holiday in the United States.

International

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal…

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal immigrants are flooding into U.S. hospitals for treatment and leaving billions in uncompensated health care costs in their wake.

The House Committee on Homeland Security recently released a report illustrating that from the estimated $451 billion in annual costs stemming from the U.S. border crisis, a significant portion is going to health care for illegal immigrants.

With the majority of the illegal immigrant population lacking any kind of medical insurance, hospitals and government welfare programs such as Medicaid are feeling the weight of these unanticipated costs.

Apprehensions of illegal immigrants at the U.S. border have jumped 48 percent since the record in fiscal year 2021 and nearly tripled since fiscal year 2019, according to Customs and Border Protection data.

Last year broke a new record high for illegal border crossings, surpassing more than 3.2 million apprehensions.

And with that sea of humanity comes the need for health care and, in most cases, the inability to pay for it.

In January, CEO of Denver Health Donna Lynne told reporters that 8,000 illegal immigrants made roughly 20,000 visits to the city’s health system in 2023.

The total bill for uncompensated care costs last year to the system totaled $140 million, said Dane Roper, public information officer for Denver Health. More than $10 million of it was attributed to “care for new immigrants,” he told The Epoch Times.

Though the amount of debt assigned to illegal immigrants is a fraction of the total, uncompensated care costs in the Denver Health system have risen dramatically over the past few years.

The total uncompensated costs in 2020 came to $60 million, Mr. Roper said. In 2022, the number doubled, hitting $120 million.

He also said their city hospitals are treating issues such as “respiratory illnesses, GI [gastro-intenstinal] illnesses, dental disease, and some common chronic illnesses such as asthma and diabetes.”

“The perspective we’ve been trying to emphasize all along is that providing healthcare services for an influx of new immigrants who are unable to pay for their care is adding additional strain to an already significant uncompensated care burden,” Mr. Roper said.

He added this is why a local, state, and federal response to the needs of the new illegal immigrant population is “so important.”

Colorado is far from the only state struggling with a trail of unpaid hospital bills.

Dr. Robert Trenschel, CEO of the Yuma Regional Medical Center situated on the Arizona–Mexico border, said on average, illegal immigrants cost up to three times more in human resources to resolve their cases and provide a safe discharge.

“Some [illegal] migrants come with minor ailments, but many of them come in with significant disease,” Dr. Trenschel said during a congressional hearing last year.

“We’ve had migrant patients on dialysis, cardiac catheterization, and in need of heart surgery. Many are very sick.”

He said many illegal immigrants who enter the country and need medical assistance end up staying in the ICU ward for 60 days or more.

A large portion of the patients are pregnant women who’ve had little to no prenatal treatment. This has resulted in an increase in babies being born that require neonatal care for 30 days or longer.

Dr. Trenschel told The Epoch Times last year that illegal immigrants were overrunning healthcare services in his town, leaving the hospital with $26 million in unpaid medical bills in just 12 months.

ER Duty to Care

The Emergency Medical Treatment and Labor Act of 1986 requires that public hospitals participating in Medicare “must medically screen all persons seeking emergency care … regardless of payment method or insurance status.”

The numbers are difficult to gauge as the policy position of the Centers for Medicare & Medicaid Services (CMS) is that it “will not require hospital staff to ask patients directly about their citizenship or immigration status.”

In southern California, again close to the border with Mexico, some hospitals are struggling with an influx of illegal immigrants.

American patients are enduring longer wait times for doctor appointments due to a nursing shortage in the state, two health care professionals told The Epoch Times in January.

A health care worker at a hospital in Southern California, who asked not to be named for fear of losing her job, told The Epoch Times that “the entire health care system is just being bombarded” by a steady stream of illegal immigrants.

“Our healthcare system is so overwhelmed, and then add on top of that tuberculosis, COVID-19, and other diseases from all over the world,” she said.

A newly-enacted law in California provides free healthcare for all illegal immigrants residing in the state. The law could cost taxpayers between $3 billion and $6 billion per year, according to recent estimates by state and federal lawmakers.

In New York, where the illegal immigration crisis has manifested most notably beyond the southern border, city and state officials have long been accommodating of illegal immigrants’ healthcare costs.

Since June 2014, when then-mayor Bill de Blasio set up The Task Force on Immigrant Health Care Access, New York City has worked to expand avenues for illegal immigrants to get free health care.

“New York City has a moral duty to ensure that all its residents have meaningful access to needed health care, regardless of their immigration status or ability to pay,” Mr. de Blasio stated in a 2015 report.

The report notes that in 2013, nearly 64 percent of illegal immigrants were uninsured. Since then, tens of thousands of illegal immigrants have settled in the city.

“The uninsured rate for undocumented immigrants is more than three times that of other noncitizens in New York City (20 percent) and more than six times greater than the uninsured rate for the rest of the city (10 percent),” the report states.

The report states that because healthcare providers don’t ask patients about documentation status, the task force lacks “data specific to undocumented patients.”

Some health care providers say a big part of the issue is that without a clear path to insurance or payment for non-emergency services, illegal immigrants are going to the hospital due to a lack of options.

“It’s insane, and it has been for years at this point,” Dana, a Texas emergency room nurse who asked to have her full name omitted, told The Epoch Times.

Working for a major hospital system in the greater Houston area, Dana has seen “a zillion” migrants pass through under her watch with “no end in sight.” She said many who are illegal immigrants arrive with treatable illnesses that require simple antibiotics. “Not a lot of GPs [general practitioners] will see you if you can’t pay and don’t have insurance.”

She said the “undocumented crowd” tends to arrive with a lot of the same conditions. Many find their way to Houston not long after crossing the southern border. Some of the common health issues Dana encounters include dehydration, unhealed fractures, respiratory illnesses, stomach ailments, and pregnancy-related concerns.

“This isn’t a new problem, it’s just worse now,” Dana said.

Medicaid Factor

One of the main government healthcare resources illegal immigrants use is Medicaid.

All those who don’t qualify for regular Medicaid are eligible for Emergency Medicaid, regardless of immigration status. By doing this, the program helps pay for the cost of uncompensated care bills at qualifying hospitals.

However, some loopholes allow access to the regular Medicaid benefits. “Qualified noncitizens” who haven’t been granted legal status within five years still qualify if they’re listed as a refugee, an asylum seeker, or a Cuban or Haitian national.

Yet the lion’s share of Medicaid usage by illegal immigrants still comes through state-level benefits and emergency medical treatment.

A Congressional report highlighted data from the CMS, which showed total Medicaid costs for “emergency services for undocumented aliens” in fiscal year 2021 surpassed $7 billion, and totaled more than $5 billion in fiscal 2022.

Both years represent a significant spike from the $3 billion in fiscal 2020.

An employee working with Medicaid who asked to be referred to only as Jennifer out of concern for her job, told The Epoch Times that at a state level, it’s easy for an illegal immigrant to access the program benefits.

Jennifer said that when exceptions are sent from states to CMS for approval, “denial is actually super rare. It’s usually always approved.”

She also said it comes as no surprise that many of the states with the highest amount of Medicaid spending are sanctuary states, which tend to have policies and laws that shield illegal immigrants from federal immigration authorities.

Moreover, Jennifer said there are ways for states to get around CMS guidelines. “It’s not easy, but it can and has been done.”

The first generation of illegal immigrants who arrive to the United States tend to be healthy enough to pass any pre-screenings, but Jennifer has observed that the subsequent generations tend to be sicker and require more access to care. If a family is illegally present, they tend to use Emergency Medicaid or nothing at all.

The Epoch Times asked Medicaid Services to provide the most recent data for the total uncompensated care that hospitals have reported. The agency didn’t respond.

Continue reading over at The Epoch Times

Uncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

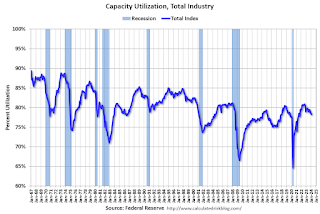

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex