Futures Rebound From Overnight Slide As Cryptos Jump

Futures Rebound From Overnight Slide As Cryptos Jump

While a far cry from yesterday’s morning rout, global stocks struggled for traction on Thursday after a jittery session on Wall Street where cryptocurrencies crashed and a hint of tapering.

While a far cry from yesterday's morning rout, global stocks struggled for traction on Thursday after a jittery session on Wall Street where cryptocurrencies crashed and a hint of tapering talk from the U.S. Federal Reserve drove selling in the bond market and lifted the safe-haven dollar.

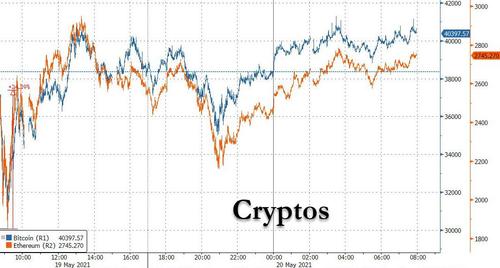

S&P futures dropped overnight for the 4th straight session after minutes from Fed’s meeting last month showed some officials were open to a debate at “upcoming meetings” on scaling back bond purchases if the U.S. economy continued to progress rapidly, while the ongoing rout in cryptos has not helped sentiment, and just like cryptos futures rebounded from their worst levels (yes, we once again live in a bizarro cojoined world where moves in cryptos move the broader market).

At 7:30 a.m. ET, Dow e-minis were down 100 points, or 0.32%, S&P 500 e-minis were down 8.25 points, or 0.20%, and Nasdaq 100 e-minis were down 7 points, or 0.06%. Treasuries were flat, the dollar and oil dropped.

"It's not just crypto – although that is the poster child of this movement – but SPACs, recent IPOs, ARK Innovation and Tesla, to name a few, have all lost their bid," said Chris Weston, head of research at brokerage Pepperstone in Melbourne. "For me, the overriding factor is liquidity and the timing of lower liquidity and that is having huge ramifications - we are debating, not just a slower pace of central bank asset purchases (QE), but when QE comes to an end."

The biggest premarket loser was Cisco Systems Inc, down 6% premarket, after the company said its profitability is being squeezed by the cost of securing components needed to meet a surge in orders driven by a rebound in spending on computer networks. Other notable movers included:

- Advaxis (ADXS) jumps 6% in U.S. premarket trading after the company said updated data from Phase 1/2 trials of a combination of its ADXS-503 drug with Keytruda, a medicine used to treat cancer, showed a disease control rate of 44%.

- Cryptocurrency-exposed stocks including Marathon Digital (MARA), Riot Blockchain (RIOT) and Coinbase (COIN) rise, with Bitcoin trading slightly higher following a wild ride for the token and other digital assets on Wednesday.

- Esports company Super League Gaming (SLGG) rises 9.6% in U.S. premarket trading amid touts for the company on Reddit.

- VistaGen (VTGN) Therapeutics jumps 15% in premarket trading after Baird started coverage with an outperform rating and price target that implies a nearly three-fold gain in the stock.

Stocks were spooked on Wednesday after the latest FOMC minutes showed Fed policymakers discussed tapering of bond purchases last month. However, many analysts viewed the statement as old news as economic data since then has showed an unexpected slowdown in the labor market, fanning inflation worries. Which is why today's initial claims data will be closely watched: it is expected to show the number of Americans filing for unemployment benefits fell to 450,000 in the week ended May 15, down for the third straight time in what could be the latest evidence of U.S. worker shortage.

"This is very much the market view, really," ING economist Rob Carnell said on the phone from Singapore, with traders expecting strong hints over summer that the taper is coming and that policy support could start to ease in December. "This is taking us to where we think we're going to go, and perhaps this removes a little bit of uncertainty around that - so you get a slight increase in bond yields and the dollar rallying a little bit."

European markets rebounded from session lows, the Stoxx Europe 600 rising 0.5% with miners and energy stocks leading losses among sectors, while financial services and technology advanced the most. Here are some of the biggest European movers today:

- Nordic Semi shares surge as much as 13%, their best day in more than eight months, following a report that STMicro is interested in the Norwegian firm. Analysts said a deal would make sense, and noted that Nordic Semi is a competitor of Dialog Semi, a company that STMicro was speculated to be looking at acquiring earlier in the year. STMicro shares give up earlier gains to trade 0.2% lower in Milan.

- Dometic shares gain as much as 7%, most since November last year, after Carnegie raised the price target to SEK200 from SEK160.

- InPost shares rose as much as 4% after the Polish parcel locker company’s strong 1Q earnings and an acceleration of expansion amid rising e-commerce volumes in InPost’s home country prompted analysts to boost their target prices for stock.

- Prosus shares rise as much as 3.5% in Amsterdam and Naspers climbs after Chinese online titan Tencent reported 1Q results that beat estimates for revenue and net income. Cape Town-based tech investor Naspers holds a 29% stake in Tencent through Prosus.

- Trainline shares sink as much as 33% in London after Britain set out plans for an overhaul of its rail network, with analysts highlighting potential fears about competition for the online rail-ticket platform.

- CTS Eventim shares fall as much as 7.1%, the most since January, after the event ticketing firm delivered a sharp decline in 1Q sales and earnings as expected, according to analysts at Baader and Commerzbank.

Earlier in the session, Asian stocks fell for a second day, weighed down by losses in materials shares as investor focus switched back to concerns on inflation. Australian miner BHP Group and Korean steelmaker Posco were among the biggest drags on the MSCI Asia Pacific Index. Energy fell the most among the regional benchmark’s 11 industry groups. Commodities prices weakened amid continued worry over inflation and as Federal Reserve meeting minutes revealed the central bank could be considering tapering its asset purchases as soon as next month. The Chinese government added to the pressure as it signaled concern over the impact of rising commodity prices on consumers. Asian stock losses were limited by gains in tech names, including Tencent, which was due to report earnings later in the day. Its results are expected to affirm the resilience of the world’s largest game-publishing business as the pandemic recedes. Taiwanese stocks fell for the seventh loss in nine sessions after officials expanded pandemic-linked restrictions to the entire island to quell the recent surge in Covid-19 cases. Australia’s key equity gauge led gainers across the region, rebounding from its worst selloff in three months on Wednesday

Chinese shares edged higher, as financial stocks rebounded from their biggest plunge this month while consumer staple firms also gained. The CSI 300 Index closed 0.3% higher, led by gains in banks, pork producers and home appliances makers. China Life and China Merchants Bank were among the biggest point contributors to the main index, along with Kweichow Moutai and Wens Foodstuffs. A subgauge of energy stocks tumbled by the most in nearly two months while materials equities retreated for a second day after the government renewed a call to curb commodity price increases. PetroChina and Zijin Mining were some of the biggest drags on the benchmark. Further increases are likely to be limited following the government’s call, which could ease cost pressures for home appliance makers that use materials like copper, said Dai Ming, a fund manager at Huichen Asset Management.

Japanese stocks edged higher as a deceleration of the yen’s strength supported investor sentiment in the face of growing concerns that the Federal Reserve is moving toward scaling back asset purchases. Electronics makers and service-related companies provided the biggest lifts to the Topix, which rose by less than one point. Tokyo Electron Ltd. and Advantest Corp. lifted the Nikkei 225 Stock Average, helping the gauge to limit its slump from a February peak to less than 8%. The yen was steady after halting a four-day rally against the dollar on Wednesday. U.S. stock futures fell slightly during Asia trading hours. Shares on Wall Street closed mixed Wednesday as minutes showed Fed officials were cautiously optimistic about the U.S. recovery at their April meeting, with some signaling they’d be open “at some point” to discussing scaling back bond purchases. “From the Fed minutes, it’s highly likely now that the debate on tapering will take place in the very near future,” said Takashi Ito, an equity market strategist at Nomura Securities. “Bonds will be sold off and the dollar will appreciate which will be a tailwind for Japanese stocks.”

In FX, the dollar scraped itself off a four-month low to hover around $1.2183 per euro. The Bloomberg Dollar Spot Index trimmed a rally spurred by the Fed minutes Wednesday, where officials hinted they might soon talk about slowing down their bond purchases. The greenback was weaker against the Swiss franc and Japanese yen; commodity currencies edged lower, led by the Norwegian krone. The Treasury curve bull flattened modestly and 10-year yields inched lower to 1.65%. The euro climbed to trade around the $1.22 handle before paring the move; Bund yields edged higher in a catch-up with Treasuries, while the pound traded in a narrow range. The Australian dollar rose after mixed data on the labor market spurred short covering. Bitcoin dropped as much as 8.7% but subsequently climbed to trade around the $40,000 mark, while Ether slumped as much as 15% but later reversed that decline.

“Tomorrow’s PMI releases are more important than any of today’s bits and bobs of data,” said Kit Juckes, chief FX strategist at Societe Generale. “As long as the Fed is talking about talking about tapering, Treasuries are likely to remain stuck in their range and the dollar’s path of least resistance is to go on falling, albeit slowly”

In rates, the yield on benchmark 10-year U.S. Treasuries rose 4.1 basis points overnight to 1.6830% and dipped to 1.6676% early in Tokyo trade having retraced a portion of Wednesday’s slide spurred by mention of asset purchase tapering in FOMC April meeting minutes. Treasury 10-year yields around 1.67%, outperforming bunds and gilts by 2bp-3bp as European bonds close gap opened by Wednesday’s Treasury selloff during U.S. afternoon. In 10-year note futures, the selloff stalled around 132-00, where there’s large options open interest. During Asia session demand for belly of the curve boosted futures volume. $13b 10-year TIPS reopening is ahead at 1pm ET.

In commodities, oil reversed an earlier gain, extending a three-week low after Iran’s president said the broad outline of a deal to end sanctions on its oil had been reached. Elsewhere industrial commodities fell sharply on Thursday after China said it would strengthen its management of supply and demand to curb unreasonable rises.

Dalian iron ore futures fell 7% in early trade and coal futures fell 8% , triggering a downside limit.

Bitcoin regained some lost ground to trade near $40,000, a day after a brutal selloff. Crypto-exchange operator Coinbase Global, miners Riot Blockchain and Marathon Digital Holdings rebounded between 1% and 2% in sympathy with the digital coin.

To the day ahead now, and the data highlights from the US include the weekly initial jobless claims, the leading index for April, and the Philadelphia Fed’s business outlook for May. Otherwise, there’s the German PPI reading for April. From central banks, we’ll hear from ECB President Lagarde, and the ECB’s Lane and Holzmann, the Fed’s Kaplan, BoE Deputy Governor Cunliffe and BoC Governor Macklem. Finally, earnings releases include Applied Materials, EasyJet and Royal Mail.

Market Snapshot

- S&P 500 futures down 0.43% to 4,094.00

- STOXX Europe 600 down 0.03% to 436.28

- MXAP little changed at 203.44

- MXAPJ little changed at 681.74

- Nikkei up 0.2% to 28,098.25

- Topix little changed at 1,895.92

- Hang Seng Index down 0.5% to 28,450.29

- Shanghai Composite down 0.1% to 3,506.94

- Sensex little changed at 49,879.64

- Australia S&P/ASX 200 up 1.3% to 7,019.56

- Kospi down 0.3% to 3,162.28

- Brent Futures down 1.41% to $65.72/bbl

- Gold spot up 0.14% to $1,872.29

- U.S. Dollar Index down 0.12% to 90.082

- German 10Y yield rose 1.3 bps to -0.097%

- Euro up 0.12% to $1.2190

Top Overnight News from Bloomberg

- As bunds slumped this week, investors piled into new short positions using 10-year futures contracts. Longest-maturity bonds bore the brunt of the adjustment, with traders hedging their exposure to securities most exposed to higher interest rates

- Like the U.S., where April’s payroll growth fell far short of expectations, Europe will struggle to match workers with jobs. That’s despite unemployment at more than 7% in the European Union -- and more than twice as high in Greece and Spain -- which isn’t predicted to return to pre-crisis levels before 2023

- UBS Group and Nomura Holdings were handed the biggest fines as European Union antitrust regulators levied a 371 million-euro ($452 million) penalty on banks for colluding on euro government bond trading during the region’s sovereign debt crisis

- Israel and Hamas were near a possible cease-fire deal, media reports said, after U.S. President Joe Biden urged Israeli Prime Minister Benjamin Netanyahu to wind down the conflict

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded mixed with the region cautious following the mostly negative lead from the US where risky assets took an early hit alongside crypto turmoil and commodity losses. FOMC Minutes which were viewed as hawkish after a number of participants suggested the potential for tapering discussions if rapid progress is made towards the Fed’s goals. ASX 200 (+1.3%) was positive with the index led higher by strength in tech following similar outperformance stateside and with most sectors proving to be resilient aside from the mining and energy industries due to the recent slump in underlying commodity prices. Nikkei 225 (+0.2%) swung between gains and losses with the index indecisive after the recent whipsawing in its currency and despite the mostly better-than-expected data releases in which Machinery Orders were mixed but trade figures topped forecasts and showed the fastest pace of increase in Exports since 2010. Hang Seng (-0.5%) and Shanghai Comp. (-0.1%) were lower amid notable losses in commodity-related shares as metal futures in Shanghai slumped following recent comments from China's Cabinet which stated it is paying great attention to the negative impact from surging commodity prices and will curb unreasonable price increases, as well as a crackdown on abnormal transactions. The PBoC also announced its latest decision on the Loan Prime Rates which were maintained at 3.85% and 4.65% for the 1yr and 5yr benchmarks, respectively, although this was widely expected given that the central bank recently maintained the rate on its Medium-term Lending Facility which is seen as an indicator of the central bank's intentions for the LPR. Finally, 10yr JGBs traded rangebound amid the indecisive risk tone in Japan although have largely ignored the slump in USTs that was triggered by the FOMC Minutes, while the BoJ were also present in the market for nearly JPY 1tln of JGBs consisting mostly of 1yr-3yr and 5yr-10yr maturities.

Top Asian News

- Billionaire Founder of Chinese Property Giant KE Dies of Illness

- Huarong Bond Losses Spread Onshore, Risking Downward Spiral

- China Ratchets Up Price Warnings as Inflation Fears Mount

- Macquarie, PGGM Said to Seek Bidders for $2 Billion One Rail

Bourses in Europe now see mixed trade as the mild optimism seen across the board at the cash open somewhat faded (Euro Stoxx 50 +0.3%) in the aftermath of the hawkishly perceived FOMC minutes and amid a distinct lack of fresh catalysts throughout the European morning, with a similarly mixed session also experienced during APAC hours. US equity futures were treading water overnight and during early European hours, but the contracts have been erring lower in recent trade in a move that coincided with losses in the crude complex. Back to Europe, sectors have also shifted from the positive open to a more mixed picture with defensives largely faring better than cyclicals peers, whilst Tech benefits from the recent pullback in yields and Industrials reap the rewards from the weaker base metal prices whilst Basic Resources reside at the foot of the pile alongside Oil & Gas and Banks. In terms of individual movers, Trainline (-23.0%) plumbs the depths as its leading position has come under trader from a “one-stop” ticket booking app by state-owned Great British Railways. Telecom Italia (-1.5%) and easyJet (-2.5%) are lower post-earnings. Meanwhile, STMicroelectronics (+0.3%) is modestly firmer amid pre-market reports that it was mulling a USD 1.3bln bid for Nordic Semiconductor (+5.1%), albeit the latter downplayed any knowledge of such a deal.

Top European News

- Blackstone Agrees to Buy U.K.’s St. Modwen for $1.7 Billion

- Deutsche Bank Speeds Up Sustainability Push as Lenders Go Green

- Swiss Trader Accused of Laundering Mafia Money With Diamonds

- Virgin and O2 Clinch U.K. Approval for $44.4 Billion Deal

In FX, the boost for the Dollar via Fed minutes that were deemed to be hawkish on the basis that a number of members believe it could be apt over the course of coming meetings to start a discussion about scaling back QE did not last long. In truth, this should hardly be a shock let alone surprise given that policy guidance has been premised or contingent on clear evidence of ‘substantial’ movement toward those goals for some time, so after the initial knee-jerk amidst extended bear-steepening in US Treasuries on the back of a tepid 20 year auction, the Buck has already topped out and reversed course in tandem with USTs. The DXY managed to clamber just above Tuesday’s best (90.204), but faded well ahead of the w-t-d peak (90.429) before retreating through 90.000 again and is now hovering within a 90.230-89.965 band awaiting jobless claims data and the Philly Fed survey.

- AUD/NZD - The Aussie was labouring in wake of a somewhat disappointing employment report and more pronounced retracement in industrial metals overnight, but has rebounded from the low 0.7700 area vs its US counterpart to 0.7750+ levels between an array of decent option expiries spanning 0.7730-85 – see 7.23GMT post on the Headline Feed for details and other expiry interest rolling off at the NY cut today. Similarly, the Kiwi has regrouped to hover near the upper end of 0.7200-0.7157 parameters, but having gleaned little lasting encouragement from upbeat NZ fiscal forecasts and accompanying comments by Finance Minister Robertson who claims that the longer term (adverse) effects of COVID-19 are not as bad as had been envisaged.

- CHF/JPY/EUR - All taking advantage of the Greenback’s rather abrupt fall from grace, with the Franc paring declines almost 0.9050 to retest resistance/offers around 0.9000, the Yen back over 109.00 and Euro eyeing 1.2200 again following a deeper pull-back to circa 1.2169. Eur/Usd is also gleaning more traction via further Eurozone/US yield spread convergence and perhaps 1.3 bn expiries at the 1.2175 strike.

In commodities, WTI and Brent front month futures have resumed their respective declines after a night of consolidation as further positive/constructive noise emanates from the JCPOA talks, with the Iranian President suggesting that agreements some key issues have been ironed out and the US “have agreed to lift all major sanctions, including oil sanctions, petrochemical, shipping, insurance, Central bank, and other banks”, although other issues will be discussed. The sides will be taking a break today and resume talks next week. In terms of market implication, ING believes that the oil market can handle both Iranian oil alongside OPEC+ supply, "We are assuming that Iranian supply returns to 3mln BPD by 4Q21", whilst the most optimistic scenario (according to reports citing the Iranian National Oil Co), suggests that Iran could ramp up production to almost 4mln BPD in three months. Nonetheless, OPEC+ members will have to consider any deal when tweaking output quotas as Iran, Venezuela, and Libya are currently exempt from the output restrictions – with the group also poised to meet next week. Elsewhere, the COVID situation in Asia remains a grey cloud over the oil complex as India, Taiwan, and Japan see tighter COVID-related measures, and with the vaccine uptake in the East also lagging vs the West. WTI July resides just north of USD 62/bbl (vs high USD 63.95/bbl) while its Brent counterpart dips below USD 65.50/bbl (vs high USD 67.17/bbl). Meanwhile, Precious metals have been uneventful thus far and largely moving in tandem with the Dollar, with spot gold in a tight range near USD 1,875/oz and spot silver similarly constrained north of USD 27.50/oz. Attention overnight turned to base metals after heavy losses were seen in Chinese commodity prices at the reopening of trade, whereby Dalian iron ore futures slumped 7%, and Shanghai Rebar and Hot-Rolled Coil futures also suffering similar losses as China’s Cabinet yesterday stated it will step up efforts to curb the rising prices with CPI follow-through cited as a concern. LME copper meanwhile, has been drifting lower in recent trade as the red metal trades on either side of USD 10,000/t, with threats of prolonged strikes at BHP’s Escondida mine cushioning losses.

US Event Calendar

- 8:30am: May Initial Jobless Claims, est. 450,000, prior 473,000; Continuing Claims, est. 3.63m, prior 3.66m

- 8:30am: May Philadelphia Fed Business Outl, est. 41.0, prior 50.2

DB's Jim Reid concludes the overnight wrap

It was a fascinating day for markets yesterday, with Bitcoin earlier being down more than -30% at one point, whilst US real yields rose +9bps following the release of the Fed minutes showing that they were thinking about thinking about tapering. Even before this, risk assets had already been on track to close lower amidst continued worries over the return of inflation, but the rout in cryptocurrencies generated the biggest headlines amidst a widespread slump that knocked billions of dollars from their market value. As we went to press yesterday, Bitcoin had already fallen beneath the $40,000 mark after the People’s Bank of China reiterated that digital tokens couldn’t be used as a form of payment. But the bottom really came out in the early afternoon in Europe, when the cryptocurrency slid all the way down to $30,017, leaving it down more than -30% on the day, before it recovered later in the session to “only” close -11.45% lower, which was still its worst daily performance since late February. Furthermore, at the lows yesterday Bitcoin stood at less than half its intraday high of $64,870 just over a month ago.

There wasn’t a single catalyst behind the moves, but since its April peak there’ve been a number of headwinds for Bitcoin, and the latest Chinese move on the issue has played into broader concerns that regulators more widely could move to clamp down on the usage of cryptocurrencies, not least following the Colonial pipeline attack which led to a ransom that was reportedly paid for in crypto. Indeed, the slump yesterday was seen across the asset class, with other cryptocurrencies including Ethereum (-26.29%), Litecoin (-32.53%), and XRP (-30.38%) experiencing massive declines themselves. Meanwhile trading platforms suffered significant disruption amidst the moves, with Coinbase (-5.94%) reporting “intermittent downtime” as the company saw its 6th consecutive daily move lower, while Marathon Digital Holdings fell a similar -5.57%.

We got some further news later on in the US session as the minutes of the latest Fed meeting were released, and the biggest development there was it showed that some officials believe that conversations about tapering are coming. So they have indeed talked about talking about tapering. According to the minutes, “A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.” However, “various participants noted that it would likely be some time until the economy had made substantial further progress toward the Committee’s maximum-employment and price-stability goals.” The S&P 500 whipsawed following the release over the last 2 hours of trading in the US, before finishing just shy of its intraday high. That said it’s worth bearing in mind that a lot of new information has transpired since that meeting, including the jobs report that underwhelmed all expectations, followed by the far stronger-than-expected CPI reading.

Generally risk assets were weaker yesterday with global equities down across the board. The S&P 500 was down as much as -1.61% in the early hours of trading before grinding higher following the European close and those FOMC minutes before finishing the day down “just” -0.29%. It was the 3rd straight losing session, with over 70% of companies seeing their share prices decline. Europe experienced greater losses as the STOXX 600 suffered a -1.51% decline, missing out on the late rally in the US. Energy stocks (-2.53%) led the falls for the S&P, having been buffeted by a significant slide in oil prices as both WTI (-3.25%) and Brent (-2.98%) fell back, while tech stocks were the relative outperformers, with the NASDAQ almost up on the day (-0.03%). In fact, semiconductors (+1.77%), Media (+0.29%) and Software (+0.09%) were 3 of the only 4 industry groups to rise in the S&P yesterday. Volatility also rose for the 3rd session running, with the VIX index up +0.84pts to 22.18pts.

10yr Treasuries were more decisive than equities, with yields moving slightly higher on the day prior to the release of the FOMC minutes before ending the day +3.4bps on the day overall after the FOMC minutes. This was mostly driven by the pickup in real yields (+9.0bps), while inflation expectations as measured by the 10yr breakeven fell -5.5bps on the day – down -3.6bps after the minutes. That’s the largest pick up in real yields since March 12 – the day after President Biden signed the $1.9 trillion stimulus package, and market expectations of future Fed hikes also moved higher on the day, pricing in another 5bps of hikes by the end of 2023. Over in Europe, sovereign bonds had a divergent performance earlier in the day, with peripheral spreads widening in line with the losses elsewhere for risk assets. Yields on 10yr Italian BTPs were up +1.0bps to a 10-month high, while those on 10yr bunds (-0.6bps) and gilts (-2.0bps) fell back somewhat.

Markets have generally moved lower in Asia overnight following the Fed minutes, with the Shanghai Comp (-0.29%), KOSPI (-0.44%) and the Hang Seng (-0.66%) all losing ground, though the Nikkei (+0.08%) has experienced modest gains. Separately the Wall Street Journal reported that a ceasefire could be reached between Israel and Hamas as soon as tomorrow, which echoes what Israel’s Channel 12 has also said, though there’s no official confirmation of that yet. Meanwhile S&P 500 futures (-0.06%) are pointing to a 4th consecutive loss for the index, and yields on US Treasuries have begun to retrace some of yesterday’s moves with a -0.9bps decline this morning. Finally, Bitcoin has recovered some of yesterday’s losses, and at time of writing is up +3.41%.

Another release yesterday was the ECB’s latest Financial Stability Review, which said that financial markets had “exhibited remarkable exuberance”, referring in particular to equity markets as US yields moved higher. The report also said that “Spreads on euro area non-financial corporate bonds remain at risk of an abrupt repricing, in particular for the high-yield segment”. And presciently it mentioned crypto-assets, saying that the “surge in bitcoin prices has eclipsed previous financial bubbles like the “tulip mania” and the South Sea Bubble in the 1600s and 1700s”, although the financial stability risks “appear limited at present”.

On the pandemic the picture continued to move in a better direction at the global level with the number of new cases still declining. In positive news yesterday, there was a brightening picture in New York State, where the 7-day average positivity rate fell to 1.06%, which is its lowest since September 27. Furthermore in the UK, it was confirmed that more than 70% of the adult population have now received a first vaccine dose, with almost 40% having received a second one as well. And France loosened restrictions yesterday with outdoor dining, cinemas and museums reopened. However, the rising pressure in Asia remained, with Malaysia reporting a record 6,075 new cases yesterday, while the number of deaths in India rose by a record 4,529, even though the rate of new case growth there has now begun to fall.

In terms of yesterday’s data, the main highlight came from the UK where CPI inflation rose to +1.5% in March as expected, up from +0.7% in February, and the fastest pace of price growth in more than a year. Another notable release came from the UK house price index, with average house prices up +10.2% year-on-year in March, marking the fastest pace of house price growth since August 2007, just before the global financial crisis.

To the day ahead now, and the data highlights from the US include the weekly initial jobless claims, the leading index for April, and the Philadelphia Fed’s business outlook for May. Otherwise, there’s the German PPI reading for April. From central banks, we’ll hear from ECB President Lagarde, and the ECB’s Lane and Holzmann, the Fed’s Kaplan, BoE Deputy Governor Cunliffe and BoC Governor Macklem. Finally, earnings releases include Applied Materials, EasyJet and Royal Mail.

Government

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

CDC Warns Thousands Of Children Sent To ER After Taking Common Sleep Aid

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

A U.S. Centers for Disease Control (CDC) paper released Thursday found that thousands of young children have been taken to the emergency room over the past several years after taking the very common sleep-aid supplement melatonin.

The agency said that melatonin, which can come in gummies that are meant for adults, was implicated in about 7 percent of all emergency room visits for young children and infants “for unsupervised medication ingestions,” adding that many incidents were linked to the ingestion of gummy formulations that were flavored. Those incidents occurred between the years 2019 and 2022.

Melatonin is a hormone produced by the human body to regulate its sleep cycle. Supplements, which are sold in a number of different formulas, are generally taken before falling asleep and are popular among people suffering from insomnia, jet lag, chronic pain, or other problems.

The supplement isn’t regulated by the U.S. Food and Drug Administration and does not require child-resistant packaging. However, a number of supplement companies include caps or lids that are difficult for children to open.

The CDC report said that a significant number of melatonin-ingestion cases among young children were due to the children opening bottles that had not been properly closed or were within their reach. Thursday’s report, the agency said, “highlights the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight,” including melatonin.

The approximately 11,000 emergency department visits for unsupervised melatonin ingestions by infants and young children during 2019–2022 highlight the importance of educating parents and other caregivers about keeping all medications and supplements (including gummies) out of children’s reach and sight.

The CDC notes that melatonin use among Americans has increased five-fold over the past 25 years or so. That has coincided with a 530 percent increase in poison center calls for melatonin exposures to children between 2012 and 2021, it said, as well as a 420 percent increase in emergency visits for unsupervised melatonin ingestion by young children or infants between 2009 and 2020.

Some health officials advise that children under the age of 3 should avoid taking melatonin unless a doctor says otherwise. Side effects include drowsiness, headaches, agitation, dizziness, and bed wetting.

Other symptoms of too much melatonin include nausea, diarrhea, joint pain, anxiety, and irritability. The supplement can also impact blood pressure.

However, there is no established threshold for a melatonin overdose, officials have said. Most adult melatonin supplements contain a maximum of 10 milligrams of melatonin per serving, and some contain less.

Many people can tolerate even relatively large doses of melatonin without significant harm, officials say. But there is no antidote for an overdose. In cases of a child accidentally ingesting melatonin, doctors often ask a reliable adult to monitor them at home.

Dr. Cora Collette Breuner, with the Seattle Children’s Hospital at the University of Washington, told CNN that parents should speak with a doctor before giving their children the supplement.

“I also tell families, this is not something your child should take forever. Nobody knows what the long-term effects of taking this is on your child’s growth and development,” she told the outlet. “Taking away blue-light-emitting smartphones, tablets, laptops, and television at least two hours before bed will keep melatonin production humming along, as will reading or listening to bedtime stories in a softly lit room, taking a warm bath, or doing light stretches.”

In 2022, researchers found that in 2021, U.S. poison control centers received more than 52,000 calls about children consuming worrisome amounts of the dietary supplement. That’s a six-fold increase from about a decade earlier. Most such calls are about young children who accidentally got into bottles of melatonin, some of which come in the form of gummies for kids, the report said.

Dr. Karima Lelak, an emergency physician at Children’s Hospital of Michigan and the lead author of the study published in 2022 by the CDC, found that in about 83 percent of those calls, the children did not show any symptoms.

However, other children had vomiting, altered breathing, or other symptoms. Over the 10 years studied, more than 4,000 children were hospitalized, five were put on machines to help them breathe, and two children under the age of two died. Most of the hospitalized children were teenagers, and many of those ingestions were thought to be suicide attempts.

Those researchers also suggested that COVID-19 lockdowns and virtual learning forced more children to be at home all day, meaning there were more opportunities for kids to access melatonin. Also, those restrictions may have caused sleep-disrupting stress and anxiety, leading more families to consider melatonin, they suggested.

The Associated Press contributed to this report.

International

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

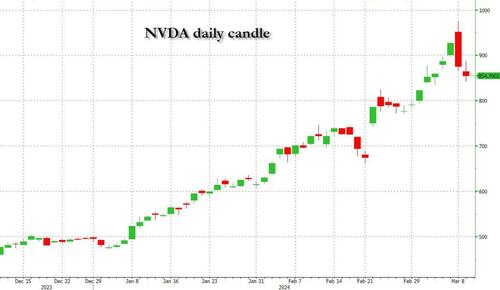

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Government

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

International4 days ago

International4 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges