Uncategorized

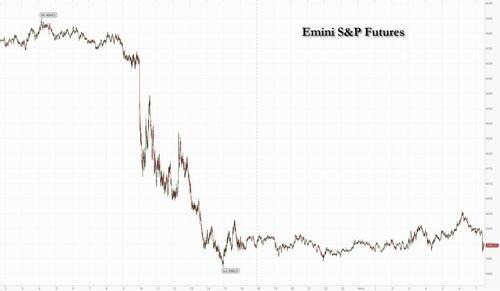

Futures Rebound After Powell-Inspired Rout

Futures Rebound After Powell-Inspired Rout

US stock futures were muted on Wednesday, swinging between modest gains and losses, one day after…

US stock futures were muted on Wednesday, swinging between modest gains and losses, one day after a market rout was sparked by yesterday’s warning from Fed Chair Jerome Powell that the pace of interest-rate increases may need to re-accelerate. S&P 500 futures down up 0.1% by 7:45 a.m. ET while Nasdaq futures were modestly in the green, showing marginal improvements in investor sentiment after Tuesday’s selloff, when the S&P 500 suffered the biggest decline in two weeks. The Bloomberg Dollar Spot Index was little changed near the highest in more than two months, as treasury yields climbed across the curve, pulling global bond markets along with them. Oil was flat while gold and Bitcoin fell extended their fall.

In US premarket movers, Crowdstrike rose after the cybersecurity software company reported results and a forecast that beat expectations. WeWork shares also gained after Bloomberg News reported that the workspace rental company is in talks to raise hundreds of millions in capital to support the business. Meanwhile, Tesla dropped after Berenberg downgraded the electric vehicle maker to hold from buy, saying the shares now have less upside potential and more limited room for disappointment; also impacting Tesla was an AP report that the NHTSA had opened a probe for steering wheels that can fall off. Here are other notable premarket movers:

- Edwards Lifesciences slides 2% after Wells Fargo cut the recommendation on the medical technology stock to equal-weight from overweight.

- Maxeon Solar jumps 14.7% after the renewable energy equipment provider delivered 4Q results and a bullish first quarter forecast that beat estimates. Morgan Stanley analysts say margin and order improvements are happening quicker than expected.

- Rigel Pharmaceuticals surges 32% after the biotech’s earnings per share and total revenue for the fourth quarter beat analyst estimates. While analysts said that Rigel’s update was in line with January’s pre-announcement, they were positive on the prospects for the company’s two lead commercial treatments, a leukemia drug and a treatment of thrombocytopenia.

- Shoals Technologies Group falls 8% after an offering of 24.5m class A shares by holders priced at $24.70 via Morgan Stanley.

- SoundHound AI shares fell 11% after the artificial intelligence company reported wider net losses for the fourth quarter.

- WeWork shares gain 7% after the workspace rental company was said to be in talks to raise hundreds of millions in capital to support the business.

- Zymeworks jumps 9% after the biotech company’s revenue for the fourth quarter beat estimates, with Stifel highlighting that net income was better than expected and that the development of the company’s esophagus cancer drug is on track.

US stocks dropped on Tuesday after Powell said the ultimate level of interest rates is likely to be higher than previously anticipated after economic data came in stronger than expected. Powell speaks to Congress again later in the day, and for the March 21-22 Fed meeting futures trading suggests a 50 basis-point rate increase is more likely than 25 — the magnitude of the Fed’s last move, although JPMorgan’s Bob Michele says a Fed reversion to 50 bp hikes would be "pretty confusing." Meanwhile, money markets are now pricing US interest rates to rise above 5.6% later this year.

“We would be foolhardy to expect we can’t reach 6% on Fed rates, and clearly that has an impact on asset markets across the globe,” Rabobank strategist Jane Foley told Bloomberg Television. If the Fed has to work harder to get inflation down, “that certainly does imply recession,” she added.

“The market now seems fairly convinced that there will be some sort of recession, but the employment data is still very strong,” said Roger Lee, head of UK equities at Investec Bank PLC. “There is this dilemma in the market; clearly recession risk is going up, because interest rate expectations are going up, but cyclicals have performed well this year, and that’s inconsistent with the yield inversion. There’s a tension there in the market causing a lot of uncertainty.”

Following the Tuesday selloff, the S&P 500 fell below 4,000, and a break below the 3,900 level can lead to an increase in selling pressure as this level has been a significant turning point for the US benchmark since May 2022, according to JPMorgan traders. It will all depend on the data, however: with US housing and employment data coming later today, and jobs data on Friday, investors will likely look to these as the next gage of probability for the path of interest rates. Meanwhile, rising US treasury yields are also putting further pressure on equities markets, with yield on the 2-year treasury note reaching 5% on Tuesday for the first time since 2007.

“In the US, bond yields versus S&P 500 yield are virtually the same, so equities look unattractive,” said Joachim Klement, strategist at Liberum Capital Ltd. “In the US, the risk premium for holding stocks has declined to levels seen around 2008, very low. Whereas in Europe, it is at levels pretty similar to 2015-16. That’s simply a reflection of the fact that Europe and UK haven’t hiked as aggressively as the US.”

European stocks were on course for a third consecutive decline following Fed Chair Jerome Powell’s hawkish message. The Stoxx 600 is down 0.3% with real estate, chemicals and utilities the worst-performing sectors. Here are the most notable European movers:

- Adidas shares drop as much as 2.4% after the sportswear maker slashed its dividend, missing analyst estimates, with analysts also disappointed by the lack of firm medium-term targets

- Darktrace shares fall 7.1% at London open after the UK cybersecurity firm, under attack by short seller Quintessential Capital Management, reduced forecast for free cash flow

- Thales shares drop as much as 3.7% after the French defense company’s fourth-quarter earnings, with strong free cash flow offset by weaker guidance for cash in 2023

- London Stock Exchange Group falls as much as 2.6% after Blackstone, Thomson Reuters and other investors sold about $2 billion of shares at a discount

- Geberit shares fall as much as 4.5% after it reported a 4Q Ebitda that Morgan Stanley called “a touch light,” saying that destocking challenges at wholesalers are reduced but ongoing

- Admiral drops as much as 9.4%, reaching its lowest in four months, after delivering results which analysts say show headwinds in motor insurance similar to its peers

- Restaurant Group slumps as much as 14% after results from the Wagamama parent that analysts said were largely in line with expectations

- Legal & General shares fall as much 2.2% as Morgan Stanley highlighted frailty in the UK financial services firm’s underlying full-year earnings, even as solvency looks robust

- Fincantieri plunges as much as 9.3%, the most intraday since July 27, after the Italian shipbuilder released full-year results and an outlook for 2023 that came in below expectations

- Continental shares gain as much as 7.4% after the German auto-parts maker projected an adjusted Ebit margin of about 5.5% to 6.5% for this year, an improvement from the 5% it reported in 2022

- TeamViewer rises 3.4% after Kepler Cheuvreux upgrades, citing improving free cash flow outlook as the software company is set to end sponsorship for Manchester United football club

- Quilter shares jump as much as 6.7%, the most in more than three months, after the wealth management firm reported full-year results that analysts said were stronger than anticipated

Sanford C. Bernstein strategists led by Sarah McCarthy said that while the equity risk premium has fallen in recent years, European stocks are still more attractive relative to bonds but that’s no longer the case in the US. BlackRock Inc. and Schroders Plc are among those who are weighing in on the debate of what will happen if US rates peak at 6%.

Earlier in the session, Asian equities also fell as hawkish comments from the Federal Reserve hurt appetite for risk assets, with China’s technology shares bearing the brunt of the selloff. The MSCI Asia Pacific Index declined as much as 1.5%, the most in three weeks, dragged by Tencent, Alibaba and Meituan. Fed Chair Jerome Powell told the Senate Banking Committee that the ultimate level of interest rates is likely to be higher than previously anticipated. Traders have since hiked their estimates on the terminal rate, with expectations for it to peak at about 5.6% in September. Stock gauges in Hong Kong and South Korea led losses in the region, while Japanese benchmarks were in positive territory. Still, regional emerging markets should get some buffer from lower inflation and close-to-peak interest rates.

Developed market “tightening will lead to slower growth and, ultimately, to cyclical recessions in the US, Europe and the UK later this year or next year,” said Matthew Quaife, head of multi asset investment management for Asia at Fidelity International. Emerging Asia, on the other hand, has the advantages of “falling inflation, peak monetary tightening, and attractive valuations,” he wrote in a note. The MSCI Asia gauge has been falling for two days, with sentiment shaky after a selloff in February stalled its rebound. The measure is struggling to cross its 50-day moving average amid concerns over the Fed’s policy path and a lack of major catalysts from the National People’s Congress in China.

Japanese stocks climbed after Federal Reserve Chair Jerome Powell’s hawkish remarks on interest rates weakened the yen to its lowest in more than two months. The Topix Index rose 0.3% to 2,051.21 as of the market close in Tokyo, while the Nikkei advanced 0.5% to 28,444.19. Sony Group Corp. contributed the most to the Topix Index gain, increasing 0.6%. Out of 2,160 stocks in the index, 1,436 rose and 615 fell, while 109 were unchanged.

In Australia, the S&P/ASX 200 index fell 0.8% to close at 7,307.80, weighed by declines in mining and energy shares. The broad-based selloff comes after hawkish rhetoric from Federal Reserve Chair Jerome Powell hurt appetite for risk taking. Meanwhile, the RBA has a “completely open mind” about its April policy meeting and will be guided by key economic data on whether to raise interest rates further or pause tightening, Governor Philip Lowe said at a conference in Sydney. Read: RBA’s Lowe Has ‘Open Mind’ on April Rate Pause, Says Data Is Key In New Zealand, the S&P/NZX 50 index fell 0.5% to 11,855.54.

Stocks in India were among few gainers in Asia as the benchmark Sensex advanced for a third consecutive session, helped by gains in index-heavy ITC and Larsen & Toubro. All of 10 companies controlled by the Adani Group advanced after prepayment of $902 million worth of borrowings by the founding family. The S&P BSE Sensex erased a loss of as much as 0.6% to close 0.2% higher at 60,348.09 in Mumbai. The NSE Nifty 50 Index advanced by a similar measure. Thirteen of the 20 sector sub-gauges rose, led by utilities and power companies. Realty stocks were the worst performers. Tobacco and consume goods makers ITC contributed the most to the Sensex’s gain, increasing 1.1%. Out of 30 shares in the Sensex index, 17 rose, while 13 fell.

In FX, the Bloomberg Dollar Spot Index was little changed as the greenback traded mixed against its Group-of-10 peers. Rabobank’s Jane Foley predicted that dollar strength would filter through to emerging economies, which could find themselves having to tighten policy further. “That leads to the impression global growth will also be slowing,” she said.

- The euro was little changed at $1.0542 after earlier falling to $1.0525, the weakest level in two months and close to year-to-date lows. Still, options traders don’t expect another big move over the next five trading days.

- Scandinavian and Antipodean currencies were the best G-10 performers, reversing earlier losses

- The yen was the worst G-10 performer and fell for a third day ahead of the BOJ’s monetary policy meeting later this week. Options traders trimmed hedges against gains in the yen, with 1-week risk reversals rebounding from near the lowest levels in almost nine months; 1- week implied volatility reached its highest level since mid- January. Super-long government bonds declined following weaker- than-expected auction results of 30-year debt yesterday

- A decline in China’s yuan saw the central bank signal its intention to support the currency.

In rates, treasury yields were slightly higher, erasing a bigger spike earlier in the session which briefly pushed the 10Y back over 4.0%, with losses led by front-end as two-year yields rise another 3bps at 5.04% after Tuesday’s aggressive flattening move was extended during Asia session and European morning. 2-year yields cheaper by 3.4bp, deepening inversion of 2s10s by 3bp to -107bps with 5s30s flatter by 1.6bp; 10-year yields around 3.97% slightly cheaper vs Tuesday’s close with bunds and gilts outperforming by 2bp and 3bp in the sector. 2s10s spread reached -107.9bp, a new four-decade lows, while 5s30s breached last year’s low reaching -47.4bp, deepest inversion since 2000.

UK and German two-year yields are both higher by 3bps; in UK, money markets price in a 5% BOE peak rate for the first time since October, while core European front-end trades cheaper tied to Treasuries repricing. Bunds and Italian bonds saw minor yield upticks in the front end of the curves while they were little changed further out. In the US, the Treasury auction cycle continues with $32b 10-year note reopening at 1pm, concludes with $18b 30-year reopening Thursday. WI 10-year at 3.975% is above auction stops since November and ~36bp cheaper than February’s result.

In commodities, oil held onto its losses following Powell's hawkish coments; WTI hovered around $77.50. Diversey Holdings and Permian Resources are among the most active resources stocks in early premarket trading, gaining 39% and falling 4.1% respectively. Gas markets are mixed with TTF firmer while Henry Hub is softer but remains above the USD 2.50/MMBtu mark. Spot gold is flat near $1,1814

Looking to the day ahead now, we’ll hear from Fed Chair Powell again, who’s appearing before the House Financial Services Committee. Otherwise, we’ll hear from the Fed’s Barkin, ECB President Lagarde, the ECB’s Panetta and the BoE’s Dhingra. There’s also a policy decision from the Bank of Canada. On the data side, at 7 a.m., we got mortgage applications data which showed a 7.4% bounce after last week's 5.7% drop, followed by the ADP employment report at 8:15 a.m. and JOLTs job openings figures are 10 a.m. The US will sell $32 billion of 10-year notes at 1 p.m. In Canada, the central bank is due to deliver a rate decision at 10 a.m. New York time. Over in Europe, we got German industrial production (which beat) and retail sales (which missed) for January.

Market Snapshot

- S&P 500 futures little changed at 3,990.50

- MXAP down 1.1% to 159.95

- MXAPJ down 1.4% to 516.16

- Nikkei up 0.5% to 28,444.19

- Topix up 0.3% to 2,051.21

- Hang Seng Index down 2.4% to 20,051.25

- Shanghai Composite little changed at 3,283.25

- Sensex up 0.1% to 60,295.62

- Australia S&P/ASX 200 down 0.8% to 7,307.77

- Kospi down 1.3% to 2,431.91

- STOXX Europe 600 down 0.2% to 459.59

- German 10Y yield little changed at 2.71%

- Euro little changed at $1.0540

- Brent Futures down 0.2% to $83.09/bbl

- Gold spot up 0.0% to $1,814.19

- U.S. Dollar Index up 0.11% to 105.73

Top Overnight News from Bloomberg

- BOE policy maker Swati Dhingra cautioned against raising interest rates further, saying that doing so could damage an already weak UK economy

- Ignazio Visco openly criticized ECB colleagues for making statements about future increases in borrowing costs when officials had agreed not to give such guidance

- Riksbank’s First Deputy Governor Anna Breman said there’s a risk that it will take longer to get Swedish inflation back to target than earlier expected and there needs to be a broader fall in inflation pressures for the central bank to stop tightening

- UK Prime Minister Rishi Sunak’s deal to solve the bitter dispute with the EU over Northern Ireland’s trading arrangements has sparked hope in the City of London that the two sides could finally formalize a pledge to work together on setting rules for banks and financial markets

- Hungary’s headline inflation, the EU’s fastest, slowed for the first time in 19 months, to 25.4% in February from 25.7% the month before. The data matched the estimate in a Bloomberg survey

- Japan’s bond market dysfunction has only worsened since the central bank doubled its cap on benchmark yields in December, keeping speculation alive that Governor Haruhiko Kuroda may surprise investors one last time on Friday

- Japanese investors became net buyers of US sovereign bonds for the first time in five months in January, according to the Asian nation’s latest balance-of- payments data released Wednesday

- The surge in government bond yields over the past year is boosting the potential allure of debt for investors, even as it heightens the risk that governments will get overwhelmed by the soaring cost of servicing what they owe

- Australia’s central bank has a “completely open mind” about its April policy meeting and will be guided by key economic data on whether to raise interest rates further or pause tightening, Governor Philip Lowe said

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly lower amid headwinds from Wall St where risk assets suffered after Powell's hawkish testimony in which he put a 50bps hike for March in play and flagged higher terminal rate projections. ASX 200 was negative with the declines led by underperformance in the commodity-related sectors, in particular, energy after a slump in underlying oil prices, while comments from RBA Governor Lowe failed to appease investors despite opening the door for a pause at the next meeting as he also noted that it will depend on the data and that further tightening is likely to be required to return inflation to the target. Nikkei 225 bucked the trend with the index kept afloat on currency effects and as record current account and trade deficits in Japan add to the case for a slow exit from the BoJ’s ultra-easy policy. Hang Seng and Shanghai Comp. conformed to the downbeat mood with Hong Kong heavily pressured by weakness in property stocks and tech amid the higher global yield environment and considering that the HKMA would have to move in lockstep should the Fed turn more aggressive. Foxconn (2317 TT) is reportedly in discussions with the Indian gov't about setting up a plant on its own, without any gov't assistance, via Economic Times.

Top Asian News

- US House Speaker McCarthy confirmed plans to meet with Taiwanese President Tsai in the US this year but stressed the meeting doesn't preclude a trip to Taiwan later, according to Bloomberg. Taiwan's Presidential Office also said authorities are making plans and preparations for President Tsai's foreign visit this year and will announce when decisions are made, according to Reuters.

- US CDC is to lift COVID-19 testing travel restrictions from China on Friday, according to a Reuters source. South Korea is also to lift the pre-departure COVID-19 test requirements for travellers from China starting on March 11th, according to health authorities.

- Chinese Embassy in Germany commented on the report that Germany could ban Huawei and ZTE from parts of 5G networks in which it stated that China is very puzzled and strongly dissatisfied with the rash decision by Germany with no factual basis if the report is true, according to Reuters.

- Japanese Ministry of Finance said the January trade deficit was the largest on record and that the trade deficit tends to swing during the export-slowing month of January due in part to the Lunar Year Holidays in China, according to Reuters.

- RBA Governor Lowe said they are closer to the point where it will be appropriate to pause and the timing of the pause will be determined by data and assessment of the outlook, while he added further tightening is likely to be required to return inflation to the target. Lowe also stated there will be several data releases before the next board meeting and if the data suggests a pause, they will do that but if the data suggests to keep going, then that is what they will do and will have a completely open mind at board meetings.

European bourses are mixed within very narrow parameters with sentiment generally tentative post-Powell and ahead of US ADP and numerous Central Bank speakers. Stateside, futures are in-fitting with their European peers, ES +0.1%, with Powell due to testify to the House in which he is likely to repeat Tuesday's hawkish Senate testimony. China PCA Retail Passenger Vehicle Sales (Feb): 10.4% Y/Y (vs prelim 9.0% Y/Y; vs -37.9% Y/Y in January); CPCA says Tesla (TSLA) exported 40.5k China-made vehicles in February (prev. 39.2k MM)

Top European News

- BoE's Dhingra says overtightening poses a more material risk at this point, through potential negative impacts from increased borrowing costs and reduced supply capacity going forwards. A prudent strategy would hold policy steady amidst growing signs external price pressures are easing, and be prepared to respond to developments in price evolution. "My conclusion is that, given little evidence of further cost-push inflation, further tightening is a bigger risk to output and the medium-term inflation target." Adds, the FX rate is less concerning than other factors.

- UK Chancellor Hunt is considering providing British firms with additional tax relief on investment spending in an attempt to boost economic growth, according to Bloomberg sources.

- Ireland Central Bank said significant uncertainty remains for inflation and it cut its 2023 HICP forecast to 5.0% from 6.3% but raised its 2024 forecast to 3.2% from 2.8%.

- ECB's Visco says monetary policy will need to remain prudent and should be guided by data as it comes available; adds, he does not appreciate colleagues statements on future and prolonged increases in interest rates.

- ECB insider says slowing hikes to 25bps, but hiking for longer could be a compromise, Econostream reports.

- Traffic on the French part of the Rhine River is at a standstill due to strikes, and international traffic has been disrupted, according to a union.

FX

- The DXY continues to pick up and has made a fresh YTD peak of 105.88 (prev. 105.63, from Jan. 6th) post-Powell; amidst this, and as the index pauses off highs, G10 peers are mixed overall.

- JPY is the standout laggard given yield action and pre-BoJ where Kuroda is expected to maintain the ultra-accommodative stance at his last meeting, USD/JPY at the mid-point of 137.09-137.91 parameters and above the 137.44 200-DMA.

- Outperforming is the AUD, though the upside comes in the context of the magnitude of downside experienced earlier in the week post-RBA and exacerbated by Powell; AUD/USD inching above 0.66, NZD around 0.61.

- CAD is essentially unchanged pre-BoC (newsquawk preview available) with an unconditional pause expected though options imply 60pips of break-even for the event.

- GBP was unfazed by BoE's Dhingra, who largely reiterated her stance from the February meeting by saying a prudent strategy would be to hold policy steady, remarks which are less-dovish than peer Tenreyro who has said a reduction is a possibility, though hasn't specified when.

- PBoC set USD/CNY mid-point at 6.9525 vs exp. 6.9551 (prev. 6.9156)

Fixed Income

- Benchmarks are attempting to tick higher, though are within a handful of ticks of the unchanged mark, in what is more an attempted consolidation than any concerted upside given the magnitude of Tuesday's action.

- Currently, Bunds are at the top-end of 130.77-131.39 parameters with Gilts attempting to mount 100.00 as Dhingra makes the case, once again, for no further tightening.

- Stateside, Treasuries are similarly attempting to grind higher ahead of Powell part 2, data and 10yr supply; yields mixed and inverting further with the short-end firmer and long-end slightly softer.

Commodities

- WTI and Brent front-month futures remain subdued around yesterday’s worst levels after both contracts settled lower by almost USD 3.00/bbl following the Powell-induced selloff.

- Gas markets are mixed with TTF firmer while Henry Hub is softer but remains above the USD 2.50/MMBtu mark.

- US Energy Inventory Data (bbls): Crude -3.8mln (exp. +0.4mln), Cushing unchanged, Gasoline +1.8mln (exp. -1.9mln), Distillate +1.9mln (exp. -1mln).

- Strikes are continuing at Exxon's (XOM) Port Jerome (270k BPD) and Fos Sur Mer (140k BPD) French refineries, via Union; action which is blocking fuel deliveries.

- Spot gold is essentially unchanged after Tuesday's marked selloff with the yellow metal above late-February lows and the 100-DMA of USD 1806/oz; base metals mixed, overall.

Geopolitics

- Russian embassy to the US said US media leaks on sabotage of the Nord Stream pipelines are intended to confuse. Furthermore, Kremlin spokesperson Peskov said the Kremlin is wondering how US officials can suggest anything regarding the 'terrorist' attack on Nord Stream without an investigation, while he suggested it is strange and smells of a 'monstrous crime', according to RIA.

US Event Calendar

- 07:00: March MBA Mortgage Applications, prior -5.7%

- 08:15: Feb. ADP Employment Change, est. 200,000, prior 106,000

- 08:30: Jan. Trade Balance, est. -$68.7b, prior -$67.4b

- 10:00: Jan. JOLTs Job Openings, est. 10.5m, prior 11m

- 14:00: Fed Releases Beige Book

Central Banks

- 08:00: Fed’s Barkin Speaks in Columbia, South Carolina

- 10:00: Powell Appears Before House Financial Service Committee

- 14:00: Fed Releases Beige Book

DB's Jim Reid concludes the overnight wrap

Morning from a surprisingly snowy Surrey this morning. My commute into London is going to be interesting as soon as I send this. Even rarer than snow in Southern England in March, it was another landmark day in markets yesterday, especially for the yield curve, as the US front end hawkishness revved up yet another gear after Powell's first testimony of the week. US terminal has now gone past our street leading 5.6% forecast and closed at 5.624% (+14.8bps) last night (5.66% this morning). With US 2yr yields up +12.2bps and 10yr yields +0.06bp we saw a significant further inversion and the curve closed below -100bps (-104.9bps) for the first time since 1981. 2 and 10yr yields are up another +5.5bps and +3bps overnight with the curve breaking through -107bps.

Bear in mind that on all the previous occasions that the 2s10s has been more than -100bps inverted since data is available from the early 1940s (1969, 1979, 1980 and 1981) a recession has either been underway, or has occurred within a maximum of 8 months. To highlight the rarity of such an occurrence, there have only been 7-month end closes lower than -100bps in 80 years of available data. So we are in rarefied air.

In terms of the specifics of Powell's comments, the biggest takeaway was his openness to larger hikes again, saying that “we would be prepared to increase the pace of rate hikes” if the data indicated. And he also pointed to a higher terminal rate as well, saying that “the ultimate level of interest rates is likely to be higher than previously anticipated.”

Those remarks from Powell mark a significant pivot for the Fed. Last year they signalled and then delivered a slowdown in rate hikes, moving away from four consecutive 75bp moves to 50bps in December, and then 25bps at the last meeting. Up to that point, all the indications had been that they wanted to move cautiously and assess the cumulative impact of what they’d delivered so far. In essence, the signal was that any further hikes would be at a 25bps pace until they stopped. But yesterday’s testimony explicitly opened the door to a more hawkish reaction function, which throws open several tail outcomes that had previously been closed off. See our economists' review of his comments yesterday, and what it might mean for Fed policy here. Powell speaks again today at the House Finance Committee but it's hard to see much new news coming after yesterday's remarks. The JOLTS data today might be the most important event for monetary policy.

With a larger hike now in play for the next meeting, futures adjusted accordingly and a +40.7bps move is now priced in for March. That’s closer to 50 than 25, so it implies that investors view a 50bps move as the more likely outcome now. However, remember that before the next meeting in two weeks time, we’ve still got another jobs report on Friday as well as the CPI print next week, so there’s still plenty of evidence that could easily tip the 25 vs 50 debate one way or the other.

With more Fed hikes being priced in, as already briefly mentioned, Treasuries experienced a significant selloff, with the 2yr yield (+12.2bps) hitting 5.0% for the first time since June 2007 and closing at 5.01%. That said, for 10yr Treasuries, yields were basically flat on the day (+0.06bps) with the dramatic flattening likely pricing in the higher risk of a policy error and hard landing. The increase in fed futures pricing also saw inflation expectations reprice lower with the US 2y breakevens falling -10.4bps to 3.28%. That was the first meaningful drop since the first week of February when it was at 2.3%.

The prospect of more rate hikes took the steam out of the recent equity rally, with the S&P 500 (-1.53%) ending its run of three consecutive advances with its largest daily loss in two weeks. The declines were incredibly broad-based, with just 30 companies in the entire index moving higher on the day. Similarly to the day before, non-cyclical industries outperformed with consumer staples (-1.0%) the “best” performing sector while cyclicals such as banks (-3.6%), autos (-2.8%), and materials (-2.0%) declined. There were similar losses for both the NASDAQ (-1.25%) and the Dow Jones (-1.72%) as well. In Europe the STOXX 600 fell -0.77% and missed the last 0.5pp of the US equity sell-off.

Unlike in the US however, European sovereign bonds actually put in a fairly strong performance. For instance, yields on 10yr bunds (-5.7bps), OATs (-4.7bps) and BTPs (-4.8bps) all saw a substantial decline on the day. That was driven in part by very good news on inflation expectations, with the ECB’s latest Survey of Consumer Expectations showing a decline in January. In particular, median expectations at the 3yr horizon came down to 2.5%, having been at 3.0% in December. That’s their lowest level since May 2022, although there are still big questions as to whether this will prove to be sustained, since the 1yr expectation only fell a tenth to 4.9% (vs. 5.0% in December).

Overnight in Asia, Japanese equity markets are the only bright spot with most of the region otherwise selling off amid the overnight advances in US rates. The Nikkei 225 (+0.44%) is posting solid gains just as the Hang Seng (-2.53%), the Shanghai Composite (-0.48%) and the Kospi (-1.26%) are sliding. US equity futures are steady, with S&P 500 contracts (+0.03%) almost unchanged.

There wasn’t much in the way of data yesterday, but German factory orders unexpectedly grew by +1.0% in January (vs. -0.7% expected). That was driven by a rise in foreign orders of +5.5%, whereas domestic orders fell by -5.3%.

To the day ahead now, and we’ll hear from Fed Chair Powell again, who’s appearing before the House Financial Services Committee. Otherwise, we’ll hear from the Fed’s Barkin, ECB President Lagarde, the ECB’s Panetta and the BoE’s Dhingra. There’s also a policy decision from the Bank of Canada. On the data side, releases from the US include the ADP’s report of private payrolls for February, the JOLTS job openings for January, and the trade balance for January. Over in Europe, there’s also German industrial production and retail sales for January.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

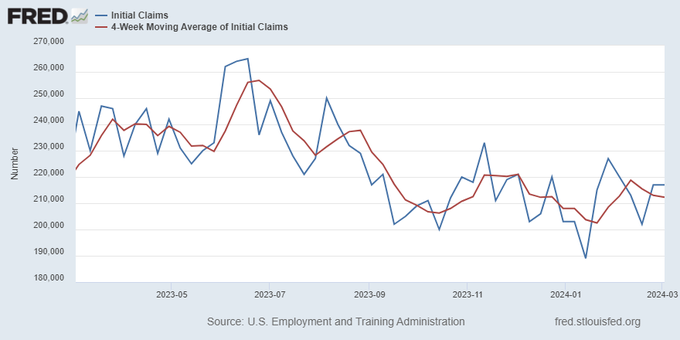

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

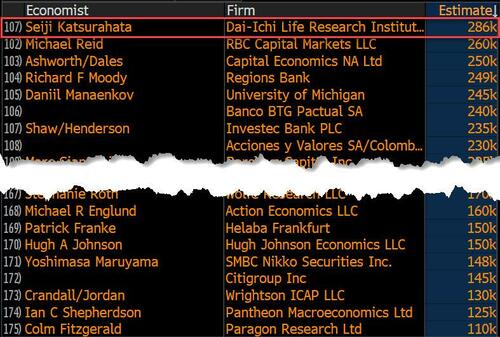

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire