Futures, Global Markets Rebound On Booster Shot Of Hope Santa Rally May Arrive Yet

Futures, Global Markets Rebound On Booster Shot Of Hope Santa Rally May Arrive Yet

Perhaps catalyzed by Goldman’s persistent bullishness (see "As Markets Slide, Here Is Goldman’s Bull Case: $125 Billion In January Inflows"), or perhaps it…

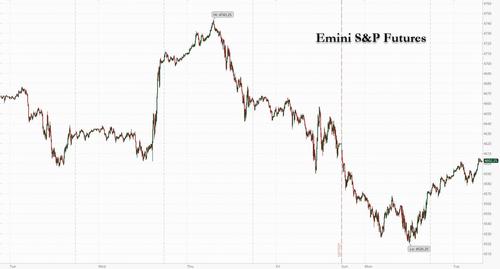

Perhaps catalyzed by Goldman's persistent bullishness (see "As Markets Slide, Here Is Goldman's Bull Case: $125 Billion In January Inflows"), or perhaps it was just a booster shot of optimism that vaccines will keep the omicron outbreak in check coupled with hope for a revival of Joe Biden’s $2 trillion economic package (see "Here Is The "Fallback Plan" Manchin Would Support... And Why Goldman Thinks It Wouldn't Move The Needle"), or maybe the Santa rally decided to make a scheduled appearance (it usually begins on Dec 21) but on Tuesday US futures, Asian markets and European bourses all rebounded after three days of steep selling. Emini S&P futures were up 1% or 44.50 points, Nasdaq futures were up 170 points ot 1.09% and Dow futures were up 314 points or 0.9% as the recent bout of turbulent moves continues. Europe's Estoxx50 was higher by 1.3% as the mining sector climbed 2.4%. Asia stocks closed higher bolstered by a rebound in Japan (+2.1%) and a rally in Chinese property developers. 10Y yields rose above 1.45%, the dollar was flat and cryptos jumped, with bitcoin trading close to $50,000 again and ether above $4000.

Markets have been whipsawed going into the holiday season as investors assess economic risks from the spread of the omicron virus variant and a hawkish central-bank pivot. While sentiment took a hit after Democratic Senator Joe Manchin rejected President Joe Biden’s tax-and-spending package on Sunday, a call between the two has stoked optimism the deal isn’t dead, prompting speculation that the Fed may have no choice but to delay its tightening campaign as $1.75 trillion in fiscal stimulus won't be coming.

Also collapse of BBB - i.e., loss of $1.75T in fiscal stimulus - means Fed will have to ease monetary stimulus tightening. Expect Fed speakers to address this in coming days https://t.co/hDq6cPIcgA

— zerohedge (@zerohedge) December 21, 2021

Reversing a dismal trend, China’s developer stocks jumped the most in a month and traders are not certain of the catalyst. In Europe, electricity prices leaped to a record as a shortage of natural gas put pressure on power grids already struggling with nuclear outages and freezing temperatures.

In the latest Omicron news, Biden will send 500 million free coronavirus tests to homes starting in January and send the military to help overwhelmed hospitals amid a resurgence of omicron cases. In a speech later today, Biden will encourage schools to remain open and is not expected to call for lockdowns.

Looking at the premarket, Micron climbed 7.6% after the largest U.S. maker of memory chips forecast second-quarter sales that beat analyst estimates. Wells Fargo says the guidance and commentary “could provide confidence in fundamental bottom” for fiscal year 2022. Nike rose 3.2% before the bell after the company’s sales beat analysts expectations, despite its business in China plummeting last quarter. Analysts said the company can overcome Covid-related hurdles. Here are some of the other big movers today:

- Crypto-exposed stocks rebound in U.S. premarket trading on Tuesday as Bitcoin rises amid a volatile period for the digital currency. Marathon Digital (MARA US) and Riot Blockchain (RIOT US) rise 5.2% and 4.6%, respectively.

- Renewable stocks and EV makers rise in premarket trading, set to rebound from the previous session’s losses, amid hopes that talks will revive President Joe Biden’s economic package. Tesla (TSLA US) gains 1.1%, Nikola (NKLA US) adds 1.5%.

- DBV Technologies ADRs (DBVT US) fall 16% premarket after the company informed the U.S. FDA it plans to start a pivotal Phase 3 clinical study for a modified Viaskin Peanut patch in children. Kempen says the development is “far from favorable” as it means increased clinical risks and investment.

- Aldeyra Therapeutics (ALDX US) shares fell 36% in after-market trading after the biotech company said it did not meet its primary goal for treating ocular redness in the Phase 3 trial of its Tranquility drug.

- Braze (BRZE US) climbed 13% in extended trading after giving a revenue forecast for fiscal 2022 that exceeded the average analyst estimate. The software company also provided a narrower-than-projected outlook for full-year adjusted loss.

Meanwhile in Europe, stocks also bounced back from the worst drop in three weeks amid optimism that growth can overcome risks from the omicron variant. The Stoxx Europe 600 Index rose 1.1% as of 730am ET, with miners and energy pacing gains as commodities recovered. The technology sector got a boost from Micron Technology Inc.’s upbeat forecast. The Traditional Year-End Rally Might Be Canceled: Taking Stock Investors are monitoring virus and lockdown news as British Prime Minister Boris Johnson held off introducing stricter coronavirus rules in the country, but left open the prospect they’ll be needed soon. The number of Londoners hospitalized with the virus is rising sharply. “Omicron is seen as causing a pause in the recovery but it’s clearer that the variant is more contagious but less lethal,” said Francisco Simon, head of discretionary tactical asset allocation for global multi-asset solutions at Santander Asset Management. “Omicron and hawkishness are the main drivers of the market moves in this year end.” European shares have fallen from record highs in recent weeks amid concern about Covid-19 hurting the economic recovery and as central banks turn more hawkish in response to surging inflation. Also helping sentiment today was optimism that President Joe Biden hasn’t given up on his roughly $2 trillion Build Back Better plan after Senator Joe Manchin rejected it. Among individual moves, Bollore SA jumped after getting an approach for its African transport and logistic business, while Zur Rose Group AG slumped amid further delays in making e-prescriptions mandatory in Germany.

Asian stocks gained as dip-buyers emerged following a two-day selloff that pushed the regional benchmark to a 13-month low amid concerns on the omicron variant’s spread and U.S. monetary and fiscal policy. The MSCI Asia Pacific Index advanced as much as 1.3% Tuesday, driven by gains in the technology and consumer discretionary sectors. Asian semiconductor-related stocks rose after U.S. memory-chip maker Micron gave a strong forecast while property-developer stocks gained in Hong Kong and China amid signs of policy support. There was marked improvement in sentiment after the recent bout of risk-off trading sparked by worries about renewed mobility restrictions, higher U.S. interest rates and prospects for Joe Biden’s economic agenda. U.S. stock futures climbed during Asian trading hours, and there were reports of talks between Biden and Senator Joe Manchin that could draw the latter’s support for the president’s plan.

“With no news of note hitting the wires, it appears that short-covering in U.S. index futures has been enough to attract the fast money back into local markets in a classic follow-the-leader move,” Jeffrey Halley, senior market analyst at Oanda Asia Pacific, wrote in a note. Japan led gains around the region, with the Nikkei 225 closing up 2.1% as the government raised its monthly view of the economy for the first time since the summer of 2020. Shares also rose in Australia, where the central bank presented an upbeat view of the economy. Tencent and Meituan were among the biggest contributors to the MSCI Asia Pacific Index’s gains.

Indian stocks tracked Asian and European peers higher, recovering from a sharp selloff in previous sessions, even as concerns continue to rise over the central bank’s liquidity-withdrawal measures. The S&P BSE Sensex rose 0.9% to 56,319.01 in Mumbai, after posting its biggest two-day plunge in eight months on Monday. The benchmark gained as much as 1.9% during the session but pared its advance, dragged by financial stocks including Axis Bank and Bajaj Finance. The NSE Nifty 50 Index also advanced by a similar magnitude. All 19 sector sub-indexes compiled by BSE Ltd. climbed, led by a gauge of basic materials companies. Foreign investors in India have net sold $1.2b of local stocks this month through Dec. 17, ahead of the holiday season on back of rising volatility in global equities. In a surprise move, the Reserve Bank of India removed funds worth 2 trillion rupees ($26.3 billion) using a 3-day reverse repo auction Monday, signaling efforts to take out excess liquidity from the banking system. “The market mood remains negative,” said Prashant Tapse, an analyst with Mehta Equities. Foreign investors will likely remain sellers of Indian stocks for few weeks due to lack triggers, he added. “Immediately we may not see any reversal in FII selling, may be some change in January, ahead of the federal budget presentation.”

In FX, the Bloomberg Dollar Spot Index inched lower as it continued to pare Friday’s gain and the greenback weakened against all of its Group-of-10 peers apart from the franc and the yen; the Treasury curve steepened a second day and yields rose across all tenors. The euro pared gains after rising beyond $1.13 and European bonds underperformed Treasuries. The pound rose, erasing Monday’s losses against the dollar, as risk appetite improved. Domestic focus remains on the likelihood of stricter coronavirus restrictions amid the rapid spread of omicron. Australia’s sovereign curve steepened further as minutes of the RBA’s December meeting saw an end to QE by May 2022. Aussie dollar consolidated with a bounce in iron ore and stocks. The yen eased as U.S. yields extended their climb ahead of a 20-year Treasury auction later in the day. Bonds tracked U.S. debt’s weakness.

Turkey’s lira swung wildly after rallying nearly 50% this week, as investors weighed the sustainability of government measures to shore up the currency. Turkey’s emergency measures to bolster the volatile lira are in effect an interest rate hike in disguise, leaving the government budget more vulnerable to future currency shocks; here’s how it works. Japanese day traders’ affection for the Turkish lira is getting seriously tested, with the currency’s extreme volatility leaving the hardiest speculators hanging in there. China’s central bank fixed the yuan’s daily reference rate at a level weaker than expected by analysts, signaling that the authorities want to slow the pace of currency’s appreciation.

In rates, Treasuries continued their decline, with the 10Y yield rising to 1.45%, led by the long-end of the curve following a wider bear steepening move across bunds and gilts. Risk-on backdrop sees stocks trade higher, unwinding portion of Monday’s losses while U.S. $20b 20-year bond sale may also be weighing on long-end. Treasury yields are cheaper by up to 2bp from 10-year out to 30-year sectors, steepening 2s10s, 5s30s spreads by 0.8bp and 0.5bp; German 10-year bonds lag by 1.5bp vs. Treasuries, while German 5s30s spread is wider by 3.2bp on the day. U.S. auctions resume with $20b 20-year bond reopening at 1pm ET; WI yield around 1.92% is 14.5bp richer than November stop-out, which tailed the WI by 1.4bp.

In commodities, crude futures hold in the green. WTI rallies over a percent, regaining a $69-handle, Brent climbs back above $72. Spot gold pops small higher, stalling just shy of $1,800/oz. Base metals are well bid with LME aluminum and zinc outperforming.

Looking at the day ahead now, data releases include the UK public finances for November, Germany’s GfK consumer confidence reading for January, the US current account balance for Q3, and the Euro Area’s advance consumer confidence reading for December. Central bank speakers include the ECB’s Kazimir, whilst President Biden is set to deliver a speech on Covid.

Market Snapshot

- S&P 500 futures up 0.7% to 4,588.50

- STOXX Europe 600 up 0.9% to 471.50

- MXAP up 1.1% to 189.85

- MXAPJ up 1.0% to 613.11

- Nikkei up 2.1% to 28,517.59

- Topix up 1.5% to 1,969.79

- Hang Seng Index up 1.0% to 22,971.33

- Shanghai Composite up 0.9% to 3,625.13

- Sensex up 0.8% to 56,266.97

- Australia S&P/ASX 200 up 0.9% to 7,355.05

- Kospi up 0.4% to 2,975.03

- German 10Y yield little changed at -0.35%

- Euro up 0.2% to $1.1299

- Brent Futures up 0.2% to $71.65/bbl

- Gold spot up 0.3% to $1,796.73

- U.S. Dollar Index down 0.20% to 96.36

Top Overnight News from Bloomberg

- Anyone gearing up for bond yields to surge in 2022 should think again. A global glut of saved cash has the potential to restrain an increase in rates, even as central banks dial back their pandemic stimulus

- ECB Governing Council member Peter Kazimir says there’s still a long way to go to reach monetary-policy normalization following last week’s confirmation of an exit from pandemic bond-buying

- European electricity prices surged to a fresh record as the region scrambled to keep the lights on in France, the region’s second-biggest market

- Boris Johnson’s government suggested there won’t be new coronavirus restrictions imposed before Christmas, as ministers stressed the need to balance public health with protecting the U.K. economy

- U.K. debt costs are rising at the fastest pace since the aftermath of the global financial crisis, a potential headache for Chancellor Rishi Sunak as he faces pressure to spend more to help businesses weather the impact of the omicron variant

- President Joe Biden will send 500 million free coronavirus tests to Americans’ homes beginning next month and dispatch the military to shore up overwhelmed hospitals as the U.S. confronts a resurgent pandemic

- President Joe Biden spent time on Friday with an aide who tested positive for coronavirus infection three days later but has so far tested negative himself, White House Press Secretary Jen Psaki said in a statement

- The omicron variant accounted for 73% of all sequenced Covid-19 cases in the U.S., surging from around 3% last week, according to the latest federal estimates

- Some of the world’s biggest banks are paring back their Libor transition programs after collectively spending billions of dollars on the seismic shift away from the discredited rate

- The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020, according to Bloomberg Intelligence data. Assets soared to $63 billion, compared to $24 billion at the start of the year

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded with gains across the board following the downbeat lead from Wall Street which saw all the majors post relatively broad-based losses, with some mild underperformance in the Russell 2000. Reopening plays were among the biggest losers, although Micron shares rose over 7% at one point amid blockbuster earnings. US equity futures resumed trade firmer and held onto mild gains overnight, but the upward momentum briefly paused after the US reported its first death attributed to the Omicron variant. Back to APAC, the ASX 200 (+0.9%) was supported by gains in some large-cap miners, although Pilbara Minerals shares slumped over 7% after cutting FY22 production and shipment guidance while announcing average sales price is expected at the higher end of prior guidance. The Nikkei 225 (+2.1%) outperformed as it nursed some of yesterday’s losses and reclaimed the 28k level to the upside. The KOSPI (+0.4%) initially traded between gains and losses before conforming to the mild positive tone. The Hang Seng (+1.0%) and Shanghai Comp (+0.9%) were also firmer in holiday-thinned trade, with major macro newsflow from the region light, although large Chinese tech names were spooked by further crackdown concerns after a Chinese social media influencer was hit with a USD 210mln for tax evasion. In fixed income, US 10yr Futures traded with a mild downside bias as stocks remained in the green, with 10yr JGB futures following suit from its US counterpart.

Top Asia News

- China Influencer Crackdown Exposes Loophole Used to Hide Wealth

- Thailand Halts Quarantine-Free Entry as Omicron Tops Tourism

- Chinese Developer Stocks Jump Most in a Month: Evergrande Update

- Pakistan’s Imran Khan Concedes Election Loss in Stronghold Area

European bourses kicked the session off with gains of around 1.0% across the board, in-fitting with the lead from futures and APAC trade. News flow has been exceptionally quiet, and the economic releases docket is thin. Catalysts are also thin, but traders are predominantly keeping an eye on COVID updates and geopolitics. Sectors are all in the green and the breakdown initially had some of yesterday’s laggards – including Travel & Leisure – trading towards the top of the pack; however, since then, the best performing sectors are now Basic Resources as metals prices pick up, and Technology after US chipmaker Micron’s update afterhours on Monday; Micron (+6.6% premarket) beat on top- and bottom-lines, and expects that the chip shortage will moderate throughout 2022. Elsewhere on the earnings front, Nike (+3.4% premarket) also reported after the US close, and its decent report is buoying other industry retailers like JD Sports (+4.5%). Finally, while the majority of European movers are dictated by the above macro action/US earnings, Zur Rose (-9.5%) is the notable laggard after reports that Germany has postponed digital prescriptions.

Top European News

- Kazimir: Last Week Started Long Path to ECB Policy Normalization

- Kitron Surges 10% After Buying EMS Provider for DKK600m

- U.K. Holds Off Pre-Christmas Virus Curbs With Eye on Economy

- Turkey to Announce Details of Lira Deposit Support on Tuesday

In FX, the Greenback looks a bit more vulnerable as the broad risk tone improves to set up a turnaround Tuesday of sorts, but US Treasuries trade largely flat in contrast to their EU equivalents, irrespective of looming 20 year issuance that might need a decent concession to ensure a warm reception in restrained pre-Xmas/New Year holiday trade. Moreover, the index appears to be losing momentum around the 96.500 mark after a less pronounced bounce between 96.543-337 parameters, while crude oil, precious metals and even the friendless Turkish Lira have reclaimed lost ground against the Buck. In fact, the TRY staged a very impressive comeback to circa 11.7170 at best from 18.3600+ at one stage yesterday as President Erdogan backed up words with action when he announced multiple measures aimed at curbing volatility (depreciation) in the currency, details of which will be divulged by the Finance Minister from 11.00GMT.

- NZD/GBP - Far from zeros to heroes, but the Kiwi and Pound are faring much better than they were at various times during Monday’s bouts of aversion, as Nzd/Usd hover just under 0.6750 and Cable crests 1.3250 near a Fib retracement, regardless of ongoing pandemic issues that are plaguing both nations. On that note, New Zealand has been forced to delay its staged border reopening to February from January, while the UK awaits more data before deciding whether to impose a circuit breaker after Boxing Day.

- AUD/EUR - The next best majors, or beneficiaries of their US peer’s pullback as the Aussie regains a firmer footing above 0.7100 and the Euro mounts another attempt to breach 1.1300 convincingly. However, Eur/Usd faces further option expiry-related resistance to augment any psychological reluctance to break beyond the round number as 1.3 bn rolls off from 1.1295 to 1.1300, while Aud/Usd may be hampered by RBA minutes underlining its dovish-leaning stance.

- CAD/JPY/CHF - All narrowly mixed vs their US counterpart as the Loonie wanes alongside WTI in the run up to Canadian retail sales and new house prices, while the Yen is back below 113.50 even though media reports suggest that the Japanese Government is mulling an upgrade to its fiscal 2022 real GDP growth forecast to 3.0% or more vs 2.2% previously. Elsewhere, the Franc is eyeing 0.9200 again in wake of Swiss trade data showing a record surplus.

- SCANDI/EM/PM - No real reaction to rather conflicting Swedish sentiment indicators or stagflationary NIER forecasts for 2022 CPIF and GDP as Eur/Sek straddles 10.3100, but the Nok is deriving some traction from the aforementioned stabilisation in Brent to test 10.17000 vs lows approaching 10.2200 against the Eur. Meanwhile, the Cnh and Cny have gleaned impetus from a firmer PBoC midpoint fix and the Rub via Brent plus the RIA asserting a possibility of Russia and the US striking an understanding on security guarantees. Conversely, the Zar has not received a fillip from Gold holding at the 100 DMA and inching towards Usd 1800/oz.

In commodities, WTI and Brent are conforming to the broader risk themes, and are directionally in-tune with European equities, though magnitudes are somewhat more contained. Currently, WTI and Brent reside around USD 69.00/bbl and USD 72.00/bbl respectively - note, the complex has become increasingly choppy as the session progresses. News flow for the complex has been limited; US/Russia geopolitics has gained some attention this morning though essentially echoes the constructive sentiment from the US on Monday. Elsewhere, natgas prices are bid on supply-side dynamics: Gascade data initially showed that flows to Germany via the Yamal-Europe pipeline had stopped. Subsequently, the Polish operator confirmed that the pipeline had recommenced activity but in reverse mode from Germany to Poland, which the Kremlin described as ‘commercial’ and unrelated to Nord Stream 2. In metals, spot gold and silver are supported given USD’s (limited) downside, though the yellow metal remains capped by USD 1800/oz at the time of writing. Elsewhere, base metals are bolstered on the firmer risk tone that has continued from APAC hours while Iron Ore prices were bid in China, action that was attributed to demand from the property sector.

US Event Calendar

- 8:30am: 3Q Current Account Balance, est. -$205b, prior -$190.3b

DB's Jim Reid concludes the overnight wrap

I’m going on my Christmas leave tomorrow so this will be the last edition of the EMR until early January. To echo what Jim said on Friday, thanks for reading over the last 12 months, as well as for all your support and interactions. If you’re looking for some further macro strategy reading over Christmas, feel free to check out the selection of DB Research outlooks for 2022, and you can find all the links for these in a note we put out yesterday (link here).

As we wrap up on 2021, it’s fair to say that it’s been quite the year in financial markets, particularly with inflation proving a much more persistent force than many had expected at the start. But in many ways it’s finishing not too dissimilarly from how it began, with Covid once again dominating the agenda as the Omicron variant continues to spread. Coupled with the news over the weekend that Senator Manchin is now a no vote on the Build Back Better Bill, risk assets sold off across the board yesterday. Indeed, the S&P 500 shed a further -1.14% to bring its losses over the last 3 sessions to more than -3%, marking the first time that’s happened since September.

In terms of the latest on the virus, the indications are pretty much all continuing to point towards tougher restrictions in Europe, while the CDC noted that Omicron now makes up the majority of new cases in the US, which dampened risk appetite. German Chancellor Scholz said yesterday that “We need new restrictions on personal contacts so that we’re well prepared when the new variant of the virus spreads everywhere in Europe”, and he’s set to hold talks with regional leaders today to discuss further measures. Bloomberg reported that a draft seen by them included measures such as closing nightclubs and limiting the number of people at indoor gatherings to 10 from December 28. Here in the UK, there had been speculation earlier in the day that the government were considering imposing further restrictions, but after a cabinet meeting, Prime Minister Johnson didn’t announce any new measures for the time being, but instead said that the data should be kept under review. That comes as the UK’s weekly case average now stands at its highest of the entire pandemic, whilst in London (which is the epicentre of the UK’s outbreak right now) the numbers in hospital have risen by a third over the last week.

In terms of some more positive Covid news, Moderna announced that a booster dose of their vaccine led to a 37-fold increase in neutralising antibodies against the Omicron variant, relative to pre-boost levels. Separately, Novavax’s vaccine was granted a conditional market authorisation by the European Commission, making it the 5th Covid vaccine now authorised in the EU. In terms of what to expect today, President Biden is due to deliver a speech on the pandemic later on, in which he’s expected to announce further steps to deal with the new variant, and it’s also been trailed that he’ll be warning about what the winter will be like for unvaccinated Americans.

Against this gloomy backdrop, the major equity indices all lost ground on both sides of the Atlantic. As mentioned at the top, the S&P 500 fell back -1.14%, with the more cyclical sectors underperforming in line with the broader risk-off moves. To be honest though, it wasn’t a great day for many, with just 78 companies in the entire index moving higher on the day, whilst the NASDAQ shed a further -1.24% to hit a 2-month low. Europe saw some reasonable losses as well, albeit after paring back some of the biggest declines shortly after the open with the STOXX 600 recovering from an intraday low of -2.56%, to “only” close down -1.38%.

The prospect of tougher restrictions and weakening economic demand sent oil prices lower again yesterday, with both Brent Crude (-2.86%) and WTI (-3.85%) seeing sharp declines. But one energy commodity that continued its inexorable rise was European natural gas, with the benchmark future up +7.31% yesterday to another record of €146.93 per megawatt-hour. It comes as temperatures have continued to decline heading into the European winter, and we also got the news that Gazprom hadn’t booked any extra capacity in January for gas flowing through Ukraine. That’s an important story heading through the winter with implications for European growth, and one that will have investors closely following the weather forecasts to work out what might happen.

Overnight in Asia equities have begun to recover, with the Nikkei (+1.89%), Hang Seng (+0.53%), KOSPI (+0.49%), Shanghai Composite (+0.41%) and the CSI (+0.17%) all rising on the back of hopes that Senator Joe Manchin of West Virginia could back a reformulated Build Back Better plan, saying on a West Virginia radio station the ways in which he would support a package. It was also reported by Bloomberg that Biden and Manchin had a further call Sunday night, some hours following Manchin’s move on Fox News Sunday where he announced his opposition. Bear in mind that the passage of the bill would have implications for 2022 growth, as the child tax credit expansion will expire as it stands, which has bolstered US consumer balance sheets. Oil prices have recovered somewhat too, with Brent crude up +0.77% this morning, whilst US and European equity futures have moved higher as well, with those on the S&P 500 (+0.58%) and the DAX (+0.92%) both advancing.

In other news yesterday, it was announced that Joachim Nagel was set to take over as the next Bundesbank President, succeeding Jens Weidmann who’s leaving after over a decade at the helm. Nagel is currently the Deputy Head of Banking at the Bank for International Settlements, but has also been on the Executive Board at the Bundesbank previously. His appointment is one of the first by the new coalition government in Germany, and Nagel will arrive at the post with German inflation at its highest in years, with annual CPI inflation having climbed to +6.0% on the EU-harmonised measure in November.

Finally in sovereign bond markets, there was a modest move higher in longer-dated European yields, with those on 10yr bunds (+1.0bps), OATs (+1.3bps) and gilts (+1.3bps) all rising. Those on 10yr Treasuries (+2.0bps) were saw a slightly bigger increase, but a decline among shorter-dated yields meant there was a steepening in the yield curve, with the 2s10s slope up +2.6bps.

To the day ahead now, and data releases include the UK public finances for November, Germany’s GfK consumer confidence reading for January, the US current account balance for Q3, and the Euro Area’s advance consumer confidence reading for December. Central bank speakers include the ECB’s Kazimir, whilst President Biden is set to deliver a speech on Covid.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges