Uncategorized

Futures Flat As Fractured Debt Ceiling Discussions Resume

Futures Flat As Fractured Debt Ceiling Discussions Resume

US futures are flat as we start a new week and inch closer to the debt ceiling x-date:…

US futures are flat as we start a new week and inch closer to the debt ceiling x-date: as a reminder, according to Janet Yellen the US could be in default in just 10 days. At 8:00am ET , S&P futures were up 0.1%, near session highs, after trading in a narrow range overnight; the tech-heavy Nasdaq was pressured by losses on semiconductor stocks after China said products from Micron Technology had failed a cybersecurity review. Micron shares dropped more than 5% in New York premarket trading, dragging down other chipmakers, including Nvidia and Qualcomm. Asian markets are higher, while European stocks trade near session lows. Bond yields are higher, rebounding from session lows, while the USD is slightly in the green with commodities also erasing earlier losses. MegaCap Tech names are up slightly pre-market. McCarthy and Biden spoke on Sunday and will resume negotiations today. Fed’s Kashkari, a Fed dove turned hawk (and soon to turn dove again) is now open to holding rates steady in June; OIS now sees more than 80% odds of a pause at the June mtg. Biden expected ties with China to improve very shortly and considers lifting sanctions on Chinese Defense Minister.

In premarket trading, Micron dropped 4.3%, leading fellow US semiconductor stocks, lower, after China said that the memory- chipmaker’s products have failed to pass a cybersecurity review in the country and banned it as a supplier. Meta Platforms fell more than 1.5%, after being hit with a record €1.2 billion ($1.3 billion) European Union privacy fine. Apple slipped 1% as Loop Capital downgrades to hold, saying it sees a revenue downside risk. WeWork gained 4.8% as the beleaguered real estate company recouped some of the declines from last week’s four-session losing streak; for context it is trading at 22 cents a share. Here are some other notable premarket movers:

- Avrobio soars 63% on plans to sell its cystinosis gene therapy program for $87.5 million in cash.

- DraftKings gains 3.1% after UBS upgrades its rating to buy based on stronger revenue growth and greater flow through to Ebitda.

- Foot Locker is down 2.3% as Citi downgraded its rating to neutral following the athletic retailer’s significant guidance cut on Friday.

- Intercept Pharmaceuticals shares tumble 15% after the company’s obeticholic acid failed to win the support of a panel of FDA advisers.

- Meta Platforms shares are down 1% as the company was hit by a record $1.3 billion European Union privacy fine and given a deadline to stop shipping users’ data to the US after regulators.

- Nike slips 2.1% after Williams Trading cuts the recommendation on the sportswear company to sell on the expectation that the US business will remain challenged through at least the first half of fiscal 2024.

- PacWest Bancorp one of the regional US lenders that was engulfed in turmoil earlier this month, rises 4% after agreeing to sell a $2.6 billion portfolio of 74 real estate construction loans as part of its plan to shore up liquidity.

- Revolve Group (RVLV) declines 2.5% after TD Cowen downgrades its recommendation on the e- commerce retailer, saying the company’s growth has cooled and that it sees limited near-term catalysts.

- VectivBio rises 39% after agreeing to be purchased by Ironwood for $17/share in an all-cash transaction.

- Zions Bancorp gains 2% as Hovde Group initiated coverage with an outperform, saying “misplaced fears” drove a discounted valuation.

The question for investors is whether US politicians will be able to reach a deal to raise the debt limit before the government runs out of money. Stocks gave up gains late on Friday after Republicans temporarily walked out. The urgency of the situation was underscored on Sunday by Treasury Secretary Janet Yellen, who said the chances are “quite low” that the US can pay all its bills by mid-June.

“There is a lot of showmanship around the debt ceiling,” said Sarah Hewin, senior economist at Standard Chartered Plc in London. “The closer we get to June 1 without a resolution, the greater the risk of an accident so there is a lot of potential for markets to get concerned."

The debt-ceiling risks as well as concern for the US economy have induced investors to boost bearish positions on the S&P 500 to the highest since 2007.

European stocks are lower as investors remain hesitant amid the ongoing US debt-ceiling negotiations. The Stoxx 600 is down 0.3%, trading near session lows with telecommunication and utilities the best-performing sectors. Greek markets were a bright spot after Sunday’s national election resulted in a strong showing for Prime Minister Kyriakos Mitsotakis, signaling that investment-friendly policies will continue. Here are the most notable European movers:

- Ryanair shares rise as much as 2.5% after it reported a beat on net income in its FY results, driven by the low-cost airline’s better-than-expected pricing in 4Q, up around 26% versus 2019, says Citi. Analysts also welcome the confident outlook.

- Dassault Systemes shares gain as much as 3.6% to the highest level since September. Stifel says in a note that strong software sales at Siemens, which reported earnings last week, bode well for Dassault Systemes.

- Man Group shares rise as much as 2%, touching the highest since May 2, after BNP Paribas Exane raised the hedge fund manager to neutral from underperform on a more balanced risk-reward.

- Begbies Traynor shares rise as much as 2.3% after the restructuring advisory firm releases a pre-close statement which Canaccord says indicates a strong finish to the year.

- Polymetal shares slump as much as 37% after the London- listed gold miner’s Russian unit was sanctioned by the US. Top Russian gold miner Polyus PJSC and Polymetal JSC, Polymetal International’s Russian unit, were targeted.

- Dechra shares fall as much as 8.7%, the most since February, after the UK pharmaceuticals firm said it has experienced a “more volatile and challenging” trading environment during the January to April period than previously predicted.

The benchmark Athens Stock Exchange General Index jumped to its highest level in almost a decade. The premium investors demand to hold Greek 10-year debt compared with super-safe bonds of Germany, fell to the lowest in more than a year while the cost of insuring exposure to Greek debt fell sharply, according to data from S&P Markit.

The MSCI Asia-Pacific Index closed higher by 0.7% for the day. A sub-gauge for technology stocks gained 2.2%, its biggest jump since March 31, tracking similar gains in peers in Asia and the US. Metal stocks surged after US President Joe Biden hinted at improving ties with China, which lifted outlook for the sector. Investors are keen to see however on how China’s economy is faring after its knee-jerk rebound following the removal of Covid curbs. Iron ore futures dropped for the third day in a row on signs of disappointing steel demand from the construction sector, while the most recent batch of industrial and retail sales data was unexpectedly soft.

- Hang Seng and Shanghai Comp. traded higher albeit with the mainland choppy after mixed commentary from the G7 and frictions related to China’s ban on Micron from key infrastructure, while the PBoC provided no surprises and kept its benchmark lending rates unchanged with the 1-year and 5-year LPRs kept at 3.65% and 4.30%, respectively.

- Nikkei 225 was indecisive as the momentum from its recent rally to 33-year highs initially waned and with the mood also clouded by the surprise contraction in Machinery Orders, although the index later caught a second wind and broke above the 31,000 level.

- Indian stocks rose after a rally in technology and base metal firms helped key stock gauges end higher for the second successive day on Monday. The S&P BSE Sensex rose 0.4% to 61,963.68 in Mumbai, while the NSE Nifty 50 Index advanced 0.6% to 18,314.40. Shares of Adani Group soared, extending their gains from Friday, after the SEBI told a Supreme Court-appointed panel that it found no conclusive evidence of stock price manipulation in the conglomerate’s stocks. Flagship Adani Enterprises jumped 18.9% and the market value of the entire group swelled by $9.7 billion. Infosys Ltd. contributed the most to the index gain, increasing 1.9%.

- ASX 200 was subdued amid weakness in financials although losses were cushioned amid the improving trade environment between Australia and its largest trading partner as evidenced by an 89% rise in coal exports to China.

In FX, the Bloomberg Dollar Spot Index is down 0.1% while the Swiss franc is the clear outperformer among the G-10s, rising 0.5% versus the greenback. The Aussie dollar is the weakest.

Money markets bet on 5bps of Fed tightening in June but add to easing wagers beyond after Minneapolis Fed President Neel Kashkari said in an interview with Dow Jones that he may support holding interest rates at current levels in June. His comments echoed remarks from Fed Chair Jerome Powell that gave a clear signal he is inclined to pause interest-rate increases next month. “Cracks may be showing in the FOMC’s rate hike path, and markets are pricing the new information in,” said Mingze Wu, an FX trader at StoneX Group.

In rates, treasuries are flat with the US 10-year yield unchanged at 3.67%, with yields rising modestly from session lows of 3.65%; 2s10s, 5s30s spreads are steeper by ~1bp. Bunds and gilts are also in the green. Sentiment continues to take cues from debt-ceiling negotiations, with President Joe Biden and Republican House Speaker Kevin McCarthy planning to meet Monday. On Sunday, Secretary Janet Yellen said the chances are “quite low” that the US can pay all its bills by mid-June. IG issuance slate includes NWB 5Y SOFR; expectations are for $15b to $20b in new bond sales this week, concentrated on Monday. Treasury auctions this week include 2-, 5- and 7-year sales over Tuesday, Wednesday and Thursday. Three-month dollar Libor -1.80bp at 5.37471%.

In commodities, crude futures are little changed with WTI trading near $71.55. Spot gold rises 0.1% to around $1,980

Bitcoin is essentially unchanged trading around $27K, as specifics remain somewhat light and the broader markets focus on a number of moving parts but primarily the US debt ceiling, with Biden and McCarthy to speak today at some point.

There is nothing on today's economic calendar, later this week we get the latest FOMC minutes release, revisions to 2Q GDP and the PCE deflator.

Market Snapshot

- S&P 500 futures little changed at 4,205.00

- MXAP up 0.7% to 163.16

- MXAPJ up 0.5% to 515.79

- Nikkei up 0.9% to 31,086.82

- Topix up 0.7% to 2,175.90

- Hang Seng Index up 1.2% to 19,678.17

- Shanghai Composite up 0.4% to 3,296.47

- Sensex up 0.3% to 61,926.65

- Australia S&P/ASX 200 down 0.2% to 7,263.25

- Kospi up 0.8% to 2,557.08

- STOXX Europe 600 up 0.2% to 469.60

- German 10Y yield little changed at 2.41%

- Euro little changed at $1.0802

- Brent Futures little changed at $75.52/bbl

- Gold spot down 0.0% to $1,976.92

- U.S. Dollar Index little changed at 103.23

Top Overnight News

China said it uncovered “relatively serious” cybersecurity risks in Micron products sold in the country, and warned makers of key infrastructure to avoid using the company’s memory chips. BBG

The EU has said the bloc will push ahead with plans to jointly buy hydrogen and critical raw materials after its first attempt at aggregated gas purchases was oversubscribed. FT

China left its 5 and 1-year Loan Prime Rates unchanged, a move that was widely expected. RTRS

Ukrainian President Volodymyr Zelenskiy suggested his country was losing control of Bakhmut after months of fierce fighting but downplayed Russian claims it now fully occupied the eastern city. BBG

G-7 leaders struggled to win over swing nations being courted by China and Russia at a weekend summit in Japan. A surprise visit from Volodymyr Zelenskiy gave him a chance to appeal to those who've been neutral on the war. He met with India's Narendra Modi and Indonesia's Joko Widodo, but a meeting with Brazil's Lula da Silva fell through. BBG

Treasury Secretary Janet Yellen said the US is unlikely to reach mid-June and still be able to pay its bills, underscoring the urgency of the White House reaching a deal with Republicans to raise the debt limit. BBG

Auto inventory levels are back on the rise following years of shortages thanks to normalizing supply chain conditions and improved production. WSJ

Fed now seen cutting rates in Q1:24 instead of Q4:23 according to an updated survey from the National Association for Business Economics (NABE). RTRS

Minneapolis Fed President Neel Kashkari said he is open to doing nothing at the June meeting given that inflation is coming down and amid all the bank uncertainty, but opposes any declaration stating rate hikes are definitively done. WSJ

Outflows from US equities, inflows to other assets. Cash, Bonds, and non-US stocks offer compelling alternatives to US stocks...

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive but with price action rangebound amid cautiousness as the debt limit deadline draws closer and following last week’s more balanced comments from Fed Chair Powell. ASX 200 was subdued amid weakness in financials although losses were cushioned amid the improving trade environment between Australia and its largest trading partner as evidenced by an 89% rise in coal exports to China. Nikkei 225 was indecisive as the momentum from its recent rally to 33-year highs initially waned and with the mood also clouded by the surprise contraction in Machinery Orders, although the index later caught a second wind and broke above the 31,000 level. Hang Seng and Shanghai Comp. traded higher albeit with the mainland choppy after mixed commentary from the G7 and frictions related to China’s ban on Micron from key infrastructure, while the PBoC provided no surprises and kept its benchmark lending rates unchanged with the 1-year and 5-year LPRs kept at 3.65% and 4.30%, respectively.

Top Asian News

- PBoC 1-Year Loan Prime Rate (May) 3.65% vs. Exp. 3.65% (Prev. 3.65%); 5-Year Loan Prime Rate (May) 4.30% vs. Exp. 4.30% (Prev. 4.30%)

- China’s cyberspace regulator said its review found that Micron Technology’s (MU) products have serious network security problems causing risks to China’s information infrastructure and announced that operators of critical information infrastructure in China should stop purchasing Micron Technology’s products, according to Reuters.

- US Commerce Department said they firmly oppose China's restrictions on Micron (MU) which have no basis in fact and that China's action along with recent raids targeting other US firms is inconsistent with China's assertions that it is opening its markets. It also stated that the US will engage directly with Chinese authorities to detail the US position and clarify China's actions, while the US will also engage with key allies and partners to ensure close coordination to address distortions of the memory chip market caused by China's actions.

- Japan Business Lobby Keidanren Chief says this years inflation is facilitated by a weak JPY and energy cost increase, does not expect inflation from 2024 onward to be "that extreme".

European bourses are mixed/flat, Euro Stoxx 50 -0.1% with the focus on upcoming debt ceiling discussions amid numerous broader incremental updates/developments ahead of Central Bank speak. Sectors are similarly mixed and lacking in breadth while Ryanair and Volvo are bolstered post earnings and a sizeable truck order respectively. Stateside, futures are contained but diverging slightly with the ES & NQ under modest pressure given the below Meta update and attention on Micron (-6.2% pre-market) after China's cyberspace review (see APAC section); conversely, the RTY is holding just above the neutral mark. Meta (META) has been fined USD 1.3bln over data transfers to the US. Initially reported via the WSJ and subsequently confirmed by the IDPC. Meta -0.8% in pre-market. Subsequently, Meta says it will appeal the fine and there is no immediate disruption to Facebook within Europe. JPMorgan (JPM) raises FY23 Net Interest Income view to USD 84.0bln ex-CIB markets (prev. it was guiding for USD 81bln, market-dependent).

Top European News

- UK PM Sunak reportedly opened the door into a sleaze probe on Home Secretary Suella Braverman and will discuss the speeding points row with the Prime Minister’s Independent Adviser on Ministers' Interests Laurie Magnus, according to The Sun’s Political Editor Cole.

- Greece’s ruling New Democracy Party held a significant lead against rivals in the early vote count and is set to win 145 of the 300 seats in parliament vs 71 seats for the leftist Syriza party, although a second round of voting is the most likely outcome with no clear majority, according to Politico and Reuters. There were also comments from PM Mitsotakis who said the election victory shows that New Democracy has the people’s approval to rule as a one-party government and that the mandate is a strong government, while he added that only strong governments can dare the changes needed. Click here for newsquawk analysis.

- Since, Mitsotakis has called for a new vote potentially on June 25th.

- Moody’s affirmed Portugal at Baa2; Outlook Revised to Positive from Stable.

- German DIHK survey shows that the despite the economy showing resilience in a challenging environment thus far in 2023, growth will remain muted; maintains the forecast for economic stagnation this year.

FX

- Franc outperforms as bond yields retreat and US debt ceiling impasse rolls on, USD/CHF eyeing 0.9850 from a peak just shy of 0.9000.

- DXY hovering around 103.000 ahead of more Fed speakers that may err towards June rate pause like Chair Powell and Kashkari.

- Euro pivots Fib and 100 DMA close to 1.0800 vs Greenback, but capped by expiries.

- Yen contains losses beneath 138.00 against Buck irrespective of bleak Japanese machinery orders.

- Kiwi elevated awaiting 25 bp hike from RBNZ, as NZD/USD hovers near 0.6300 and AUD/NZD cross sits sub-1.0600.

- PBoC set USD/CNY mid-point at 7.0157 vs exp. 7.0141 (prev. 7.0356)

Commodities

- Crude benchmarks are softer intraday but have lifted off APAC lows with catalysts light and the move is perhaps a factor of broader macro concern over the US debt limit.

- Currently, WTI and Brent are lower by around USD 0.20/bbl but remain towards the top-end of circa. USD 1.50/bbl parameters.

- Spot gold is little changed while base metals are slightly softer given the firmer USD, the yellow metal is being cushioned from USD-pressure somewhat by the broader risk tone.

- EU plans more joint purchasing after the success of the common gas scheme, according to FT

Fixed Income

- Bonds push recovery envelope further before waning around 2.40% in Bunds, just shy of 99.00 in Gilts and 114-00 for the 10 year T-note.

- GGBs and PGBs underpinned by political and positive ratings outlook respectively while the EU receives a relatively warm welcome for 2028 and 2034 debt offerings.

Geopolitics

- Russia said its troops have taken control of the Ukrainian city of Bakhmut and Russian President Putin congratulated the Wagner group and the Russian army for the ‘liberation’ of the city, while Wagner group chief Prigozhin said they captured the entire territory of Bakhmut as promised and will be leaving the conflict zone on May 25th, according to TASS, Interfax and Reuters.

- Ukrainian President Zelensky said he is confident Ukraine will get F-16 fighter jets from the West and said Kyiv’s peace formula has the potential to stop future aggressors. Zelensky also stated he is grateful for American support and the training mission which will give them a stronger battlefield position, while he appeared to have confirmed the loss of Bakhmut in which he noted that the city is destroyed and responded that he thought ‘no’ when asked if Bakhmut was still in Ukraine’s hands, according to Reuters.

- Ukrainian Deputy Defence Minister said Kyiv’s troops have partly encircled Bakhmut along the flanks and still control part of the city, while a top Ukrainian general said Ukraine controls an insignificant part of the city but added it is enough to enter the city when the situation changes and that Ukraine’s advances on flanks around Bakhmut are effectively nearing a tactical encirclement of Russian forces, according to Reuters.

- US President Biden said Russians have suffered over 100k casualties in Bakhmut and that he has flat assurance from Ukrainian President Zelensky that Ukraine will not use F-16s to go into Russian geographic territory. President Biden also made it clear he is not prepared to trade certain items with China because of concern it would build weapons of mass destruction and he is not going to ease China sanctions but added that they are currently under negotiation on whether to lift sanctions on China’s Defence Minister, according to Reuters.

- Russia’s Deputy Foreign Minister commented regarding Western plans to supply F-16s to Ukraine that the West is pursuing an escalatory path fraught with colossal risks for them.

- Russia's ambassador to the US said the transfer of F-16 fighters to Ukraine would raise questions about NATO's involvement in the conflict and said any Ukrainian strikes on Crimea are attacks on Russia and that Washington should be aware of Russia's response, according to Reuters.

- Explosions were reported in Odesa and Zaporizhzhia Oblast amid drone activity, while it was also reported that Russia launched an overnight air attack on Ukraine's Dnipro, according to the Governor.

- Taiwan President Tsai said they have shown the world the determination to defend themselves and that the world’s support for a democratic Taiwan is unprecedented, while she said they will maintain the status quo of peace and stability in the Taiwan Strait and said no one can change the status quo with the use of force. Furthermore, Tsai said the US arms aid for Taiwan addresses weapon delivery delays related to the pandemic and commented that they welcome visitors to Taiwan from Hong Kong, Macau and China.

- US, Japan and South Korea’s leaders discussed how to take trilateral cooperation to new heights including in the face of North Korea’s illicit nuclear and missile threats, while US President Biden invited the Japanese and South Korean leaders for a trilateral meeting in Washington, according to Reuters citing the White House.

- South Korean President Yoon announced that South Korea and Germany will sign a military information-sharing pact and will closely cooperate on North Korean denuclearisation, while Yoon said that South Korea will carefully review the list of non-lethal weapons requested by Ukrainian President Zelensky, according to Reuters.

- Sudan’s army and paramilitary RSF agreed to a 7-day humanitarian truce and ceasefire on Saturday which takes effect after 48 hours, according to Reuters sources.

- Russia's Wagner group founder says their forces will be leaving Ukraine's Bakhmut region from May 25th until June 1st.

- "The Irish minister for foreign affairs Micheal Martin has said Ireland is open to changes that could see a shift away from the veto on some EU foreign policy and defence issues.", according to RTE's Connelly.

G7

- G7 Final Communique stated they will support Ukraine for as long as it takes and called on China to press Russia to stop its military aggression immediately, while it noted that a growing China that plays by international rules would be of global interest and that the G7 is not seeking a policy designed to harm China or hinder its economic progress and are not decoupling nor turning inwards. G7 also stated that there is no legal basis for China’s expansive maritime claims in the South China Sea and they oppose China’s militarisation activities in the region, while the G7 nations established a new initiative to counter economic coercion dubbed the Coordination Platform on Economic Coercion.

- US President Biden said the G7 is united in its approach to China and that they are not looking to de-couple from China but are looking to de-risk and diversify which means resisting economic coercion. Biden also stated they should have an open hotline with China and that everything changed after the spy balloon incident but thinks there will be another shift and expects relations with China to thaw soon which will allow more conversations. Furthermore, President Biden said they will not tell China what it can do but will put Taiwan in a position to defend itself and noted there is agreement among US allies that if China were to do something on Taiwan unilaterally, there would be a response, according to Reuters.

- China’s Foreign Ministry said China expresses strong dissatisfaction regarding the G7 Final Communique and lodged solemn representations with summit host Japan, while China's Vice Foreign Minister summoned the Japanese ambassador over actions at the G7, according to Reuters.

- China’s Embassy in Britain urged for the G7 to disregard Cold War mentality and to stop interfering in other countries' affairs and called on the British side to stop slandering and smearing China to avoid further damage to China-UK relations, according to Reuters.

- German Chancellor Scholz said they want de-risking and to diversify but added that nobody has an interest to curb growth in China and that they will make sure big investments in China from the US, Japan, Britain, France, Italy and Germany will continue so that they have supply chains in China and export goods to China, according to ZDF.

US Event Calendar

- Nothing major scheduled

Central Bank Speakers

- 08:30: Fed’s Bullard Speaks on US Economy and Monetary Policy

- 11:05: Fed’s Bostic and Barkin Discuss Technology- Enabled...

- 11:05: Fed’s Daly Speaks at NABE/Bank of France Economic Symposium

DB's Jim Reid concludes the overnight wrap

This morning Head of DB Research David Folkerts-Landau has launched our AI week on my Thematic team with a 2-3 pager on why the AI hype cycle is in overdrive but why it's (mostly) justified. Three things are different this time: the general nature of the technology, the low barriers to entry and the unprecedented speed of adoption. This will lead to waves of repercussions for society, and if harnessed correctly, productivity gains. See David's intro to the series here. Henry and I will be publishing the first full note in the series later this morning looking at what history tells us about what major technological advancements over the last few centuries have meant for jobs. In every technological cycle there are always fears of human labour being extremely vulnerable. This time is no different, but history suggests a different outcome. Look out for our piece later. I'll highlight it in my CoTD later.

Moving onto this week, clearly the debt ceiling will dominate. The latest is that President Biden and House Speaker Kevin McCarthy will meet at the White House today to resume negotiations. There was a slightly more positive tone from both sides after a phone call between the two yesterday. This follows the GOP walking out on talks late Friday. Yellen said over the weekend that the chances that the US can pay its bills by mid-June are "quite low".

Outside of this story, the highlights for the week ahead include the global flash PMIs tomorrow and the US PCE inflation release on Friday. The details of the University of Michigan Survey the same day are going to be interesting as 5-10yr inflation expectations spiked from 2.9% to 3.2% earlier this month in the prelim reading, a level that hasn't been exceeded since 2007. This often gets revised down in the final print but if not, it could mark a firming of inflation at the consumer level. Watch for any upward revisions to Q1 US GDP on Thursday after recent better than expected data. Also on the data front we have UK inflation on Wednesday (last month shocked to the upside at 10.1% - 8.2% expected this week), various sentiment data in Europe and the Tokyo CPI in Japan on Friday.

From central banks, as the June FOMC slowly comes into view and with an increasing possibility of a hike that was all but ruled out 1-2 weeks ago, there are lots of Fed speakers, especially early in the week (see in the calendar at the end), and also the release of the FOMC meeting minutes on Wednesday. This might help show how high the bar is for the Fed to add more hikes.

Although earnings season is drawing to a close, Nvidia on Wednesday could be worth watching. Nvidia is up +112% in 2023 and has a market cap of $773bn highlighting why AI is becoming a huge topic and one that also moves macro markets. Nvidia is trading on heroic valuations which time will tell if they are justified.

The day by day weekly calendar is at the end as usual for a fuller list of what's coming up.

Asian equity markets have shrugged off Friday’s GOP talks walkout losses on Wall Street following comments by President Biden during the G-7 summit that he sees US-China relations improving “very shortly”. Across the region, the Hang Seng (+1.32%) is leading gains with the KOSPI (+0.83%), the CSI (+0.39%), the Shanghai Composite (+0.11%) and the Nikkei (+0.10%) also up. S&P 500 futures (-0.03%) are trading just below flat with 10yr USTs -2.3bps lower, trading at 3.65%, as we go to press.

Early morning data showed that Japanese core machinery orders unexpectedly dropped -3.9% m/m in March (v/s +0.4% expected, -4.5% in February), contracting for the second month in a row. Elsewhere, the People’s Bank of China (PBOC) kept their benchmark lending rates unchanged for a ninth straight month, keeping the one-year loan prime rate intact at 3.65% while the five-year rate, a reference for mortgages, was also held at 4.3%, as expected.

Looking at last week now and there were a number of fascinating themes. For most of the week there was growing optimism that US leaders were getting closer to reaching a deal on the US debt ceiling. However, on Friday, debt limit talks hit a wall as the GOP negotiators walked out on negotiations. This turn in events erased some of the earlier positive sentiment, and the x-date sensitive 1M T-bills sold off, with yields rising +2.6bps on Friday to 5.325%, leaving 1M yields down -9.5bps on the week. At one point Friday, 1M yields rose as much as +10.8bps to over 5.40% before coming back in over the last two hours of trading.

This all came while Chairman Powell stated in a speech on Friday that “rates may not need to rise as high given credit stress”, with the Fed to remain data dependent. In his prepared remarks he noted that “we can afford to look at the data and the evolving outlook to make careful assessments,” which seemed to indicate a pause in June is the most likely scenario. This was in some contrast to the more hawkish sentiment that came from Fed speak earlier in the week. Turning back to the banking sector, CNN reported that Treasury Secretary Yellen told bank CEOs that more mergers of large lenders may be needed looking ahead as sector stress continues.

Off the back of all this, the Fed rate priced in for June’s meeting by Fed fund futures fell back -4.3bps to 5.124% on Friday, although remained +2.6bps up on the week. The expected rate for July also slipped -1.0bps on Powell’s comments but gained +12.8bps in weekly terms, with markets seeing a Fed pause increasingly on the cards but not a July cut anymore. There was a -1.1bps fall for the expected rate for the final meeting of the year in December, but it was up +25.3bps on the week, pricing in -48.9bps of rate cuts by year end.

Against this backdrop, US fixed income whipsawed on Friday, with US 10yr yields down at the open before gaining +2.7bps to 3.673% after news on the debt ceiling, and up +21.0bps on the week, its greatest weekly increase since the week before last Christmas. US 30yr yields also climbed +2.3bps on Friday, up +13.8bps in weekly terms. The more policy sensitive 2yr yields traded largely flat on Powell’s comments, up +1.4bps on Friday, and +27.9bps in weekly terms. 10yr bund yields fell back -1.8bps on Friday, but were likewise up +15.1bps week-on-week.

With these developments, a risk-off sentiment weighed on US equity markets on Friday. The S&P 500 fell back -0.14% on Friday, although earlier gains left the index up +1.65% week-on-week. The NASDAQ slipped -0.24% on Friday but gained +3.04% last week as the tech sector outperformed. The likes of NVIDIA, Tesla and Meta were up +10.32%, +7.24% and +5.06% week-on-week respectively. Renewed concerns over banking sector stresses following earlier comments from Powell and Yellen saw the S&P 500 banks -0.71% on Friday (+4.63% on the week). The regional banking KBW index also fell -0.98% but was up +5.81% week-on-week after strong risk-on sentiment earlier in the week.

Over in Europe, markets finished the week up, with the STOXX gaining +0.72% on the week (+0.66% on Friday). The German Dax closed up +2.27% week-on-week (+0.69% on Friday) to all-time highs, its largest weekly up-move since before the mid-March banking stress.

Finally, turning to commodities, oil saw its best week since early April, breaking its four-week streak of weekly losses, as risk sentiment improved following debt ceiling reassurances from the White House. Wildfires in Alberta, Canada, had also disrupted oil output, adding tightness to supply. Brent crude gained +1.90% on a weekly basis (-0.37% on Friday), up to $75.58/bbl. WTI crude gained +2.16% last week despite the pullback (-0.43%) on Friday.

Uncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

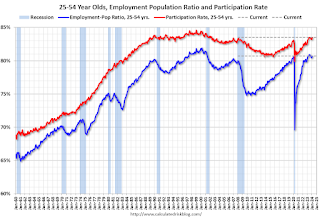

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

Uncategorized

Immune cells can adapt to invading pathogens, deciding whether to fight now or prepare for the next battle

When faced with a threat, T cells have the decision-making flexibility to both clear out the pathogen now and ready themselves for a future encounter.

How does your immune system decide between fighting invading pathogens now or preparing to fight them in the future? Turns out, it can change its mind.

Every person has 10 million to 100 million unique T cells that have a critical job in the immune system: patrolling the body for invading pathogens or cancerous cells to eliminate. Each of these T cells has a unique receptor that allows it to recognize foreign proteins on the surface of infected or cancerous cells. When the right T cell encounters the right protein, it rapidly forms many copies of itself to destroy the offending pathogen.

Importantly, this process of proliferation gives rise to both short-lived effector T cells that shut down the immediate pathogen attack and long-lived memory T cells that provide protection against future attacks. But how do T cells decide whether to form cells that kill pathogens now or protect against future infections?

We are a team of bioengineers studying how immune cells mature. In our recently published research, we found that having multiple pathways to decide whether to kill pathogens now or prepare for future invaders boosts the immune system’s ability to effectively respond to different types of challenges.

Fight or remember?

To understand when and how T cells decide to become effector cells that kill pathogens or memory cells that prepare for future infections, we took movies of T cells dividing in response to a stimulus mimicking an encounter with a pathogen.

Specifically, we tracked the activity of a gene called T cell factor 1, or TCF1. This gene is essential for the longevity of memory cells. We found that stochastic, or probabilistic, silencing of the TCF1 gene when cells confront invading pathogens and inflammation drives an early decision between whether T cells become effector or memory cells. Exposure to higher levels of pathogens or inflammation increases the probability of forming effector cells.

Surprisingly, though, we found that some effector cells that had turned off TCF1 early on were able to turn it back on after clearing the pathogen, later becoming memory cells.

Through mathematical modeling, we determined that this flexibility in decision making among memory T cells is critical to generating the right number of cells that respond immediately and cells that prepare for the future, appropriate to the severity of the infection.

Understanding immune memory

The proper formation of persistent, long-lived T cell memory is critical to a person’s ability to fend off diseases ranging from the common cold to COVID-19 to cancer.

From a social and cognitive science perspective, flexibility allows people to adapt and respond optimally to uncertain and dynamic environments. Similarly, for immune cells responding to a pathogen, flexibility in decision making around whether to become memory cells may enable greater responsiveness to an evolving immune challenge.

Memory cells can be subclassified into different types with distinct features and roles in protective immunity. It’s possible that the pathway where memory cells diverge from effector cells early on and the pathway where memory cells form from effector cells later on give rise to particular subtypes of memory cells.

Our study focuses on T cell memory in the context of acute infections the immune system can successfully clear in days, such as cold, the flu or food poisoning. In contrast, chronic conditions such as HIV and cancer require persistent immune responses; long-lived, memory-like cells are critical for this persistence. Our team is investigating whether flexible memory decision making also applies to chronic conditions and whether we can leverage that flexibility to improve cancer immunotherapy.

Resolving uncertainty surrounding how and when memory cells form could help improve vaccine design and therapies that boost the immune system’s ability to provide long-term protection against diverse infectious diseases.

Kathleen Abadie was funded by a NSF (National Science Foundation) Graduate Research Fellowships. She performed this research in affiliation with the University of Washington Department of Bioengineering.

Elisa Clark performed her research in affiliation with the University of Washington (UW) Department of Bioengineering and was funded by a National Science Foundation Graduate Research Fellowship (NSF-GRFP) and by a predoctoral fellowship through the UW Institute for Stem Cell and Regenerative Medicine (ISCRM).

Hao Yuan Kueh receives funding from the National Institutes of Health.

stimulus covid-19 yuan vaccine stimulusUncategorized

Stock indexes are breaking records and crossing milestones – making many investors feel wealthier

The S&P 500 topped 5,000 on Feb. 9, 2024, for the first time. The Dow Jones Industrial Average will probably hit a new big round number soon t…

The S&P 500 stock index topped 5,000 for the first time on Feb. 9, 2024, exciting some investors and garnering a flurry of media coverage. The Conversation asked Alexander Kurov, a financial markets scholar, to explain what stock indexes are and to say whether this kind of milestone is a big deal or not.

What are stock indexes?

Stock indexes measure the performance of a group of stocks. When prices rise or fall overall for the shares of those companies, so do stock indexes. The number of stocks in those baskets varies, as does the system for how this mix of shares gets updated.

The Dow Jones Industrial Average, also known as the Dow, includes shares in the 30 U.S. companies with the largest market capitalization – meaning the total value of all the stock belonging to shareholders. That list currently spans companies from Apple to Walt Disney Co.

The S&P 500 tracks shares in 500 of the largest U.S. publicly traded companies.

The Nasdaq composite tracks performance of more than 2,500 stocks listed on the Nasdaq stock exchange.

The DJIA, launched on May 26, 1896, is the oldest of these three popular indexes, and it was one of the first established.

Two enterprising journalists, Charles H. Dow and Edward Jones, had created a different index tied to the railroad industry a dozen years earlier. Most of the 12 stocks the DJIA originally included wouldn’t ring many bells today, such as Chicago Gas and National Lead. But one company that only got booted in 2018 had stayed on the list for 120 years: General Electric.

The S&P 500 index was introduced in 1957 because many investors wanted an option that was more representative of the overall U.S. stock market. The Nasdaq composite was launched in 1971.

You can buy shares in an index fund that mirrors a particular index. This approach can diversify your investments and make them less prone to big losses.

Index funds, which have only existed since Vanguard Group founder John Bogle launched the first one in 1976, now hold trillions of dollars .

Why are there so many?

There are hundreds of stock indexes in the world, but only about 50 major ones.

Most of them, including the Nasdaq composite and the S&P 500, are value-weighted. That means stocks with larger market values account for a larger share of the index’s performance.

In addition to these broad-based indexes, there are many less prominent ones. Many of those emphasize a niche by tracking stocks of companies in specific industries like energy or finance.

Do these milestones matter?

Stock prices move constantly in response to corporate, economic and political news, as well as changes in investor psychology. Because company profits will typically grow gradually over time, the market usually fluctuates in the short term, while increasing in value over the long term.

The DJIA first reached 1,000 in November 1972, and it crossed the 10,000 mark on March 29, 1999. On Jan. 22, 2024, it surpassed 38,000 for the first time. Investors and the media will treat the new record set when it gets to another round number – 40,000 – as a milestone.

The S&P 500 index had never hit 5,000 before. But it had already been breaking records for several weeks.

Because there’s a lot of randomness in financial markets, the significance of round-number milestones is mostly psychological. There is no evidence they portend any further gains.

For example, the Nasdaq composite first hit 5,000 on March 10, 2000, at the end of the dot-com bubble.

The index then plunged by almost 80% by October 2002. It took 15 years – until March 3, 2015 – for it return to 5,000.

By mid-February 2024, the Nasdaq composite was nearing its prior record high of 16,057 set on Nov. 19, 2021.

Index milestones matter to the extent they pique investors’ attention and boost market sentiment.

Investors afflicted with a fear of missing out may then invest more in stocks, pushing stock prices to new highs. Chasing after stock trends may destabilize markets by moving prices away from their underlying values.

When a stock index passes a new milestone, investors become more aware of their growing portfolios. Feeling richer can lead them to spend more.

This is called the wealth effect. Many economists believe that the consumption boost that arises in response to a buoyant stock market can make the economy stronger.

Is there a best stock index to follow?

Not really. They all measure somewhat different things and have their own quirks.

For example, the S&P 500 tracks many different industries. However, because it is value-weighted, it’s heavily influenced by only seven stocks with very large market values.

Known as the “Magnificent Seven,” shares in Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla now account for over one-fourth of the S&P 500’s value. Nearly all are in the tech sector, and they played a big role in pushing the S&P across the 5,000 mark.

This makes the index more concentrated on a single sector than it appears.

But if you check out several stock indexes rather than just one, you’ll get a good sense of how the market is doing. If they’re all rising quickly or breaking records, that’s a clear sign that the market as a whole is gaining.

Sometimes the smartest thing is to not pay too much attention to any of them.

For example, after hitting record highs on Feb. 19, 2020, the S&P 500 plunged by 34% in just 23 trading days due to concerns about what COVID-19 would do to the economy. But the market rebounded, with stock indexes hitting new milestones and notching new highs by the end of that year.

Panicking in response to short-term market swings would have made investors more likely to sell off their investments in too big a hurry – a move they might have later regretted. This is why I believe advice from the immensely successful investor and fan of stock index funds Warren Buffett is worth heeding.

Buffett, whose stock-selecting prowess has made him one of the world’s 10 richest people, likes to say “Don’t watch the market closely.”

If you’re reading this because stock prices are falling and you’re wondering if you should be worried about that, consider something else Buffett has said: “The light can at any time go from green to red without pausing at yellow.”

And the opposite is true as well.

Alexander Kurov does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

dow jones sp 500 nasdaq stocks covid-19-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges