Futures Fall, Yields Rise Ahead Of Econ Data Onslaught

Futures Fall, Yields Rise Ahead Of Econ Data Onslaught

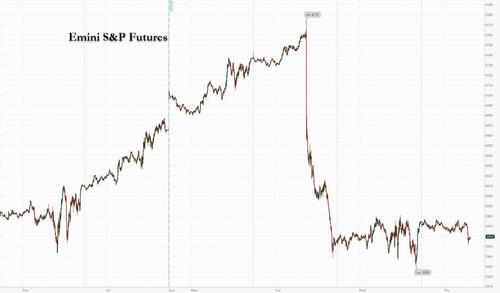

Extremely illiquid US equity futures (top of book depth is between $1-2MM) dropped…

Extremely illiquid US equity futures (top of book depth is between $1-2MM) dropped after trading flat for much of the overnight session, ahead of a packed data slate today including retail sales, industrial production and capacity utilisation for August, the Empire State manufacturing survey and the Philadelphia Fed business outlook for September, and the weekly initial jobless claims, as Treasury and Bund yield rose after Russian energy supplier Gazprom warned that nearly full EU gas inventories can’t guarantee a safe winter with money markets raise tightening wagers, pricing as much as 193bps of ECB hikes by July versus 186bps on Wednesday (and as much as 210bps of Fed hikes by March). As of 7:15am ET, S&P 500 futures slipped 0.1% after a tumultuous few days of trading following the consumer price index reading; Nasdaq 100 futures fell 0.4%. Both underlying indexes had slumped on Tuesday after the report, nearly erasing a four-day rally, before slightly rebounding on Wednesday. European stocks were flat, while the MSCI Asia Pacific Index reversed earlier gains to trade down. The dollar resumed its rise while the yuan dropped below the critically important 7.00 level against the greenback. Ethereum completed the merge and traded around $1600 without any big moves in either direction.

In US premarket trading, Netflix advanced 2.2% after Evercore ISI raised the stock to outperform from in-line, saying that Netflix’s launch of an ad-supported plan is one of the biggest catalysts in the internet sector over the next 12 months. Meanwhile, railway operators Union Pacific Corp and CSX Corp gained after the US government said railroad companies and unions representing more than 100,000 workers reached a tentative agreement in a breakthrough that looks to avert a labor disruption that risked adding supply-chain strains to the world’s largest economy. Here are some other notable premarket movers

- Danaher (DHR US) shares rise 4.2% in premarket trading after the company says it will spin off environmental and applied solutions unit. Analysts responded positively to the news, saying a more streamlined Danaher has potential to unlock value.

- Union Pacific (UNP US) shares rise 4.7% in premarket trading as US railroad companies and unions representing more than 100,000 workers reached a tentative agreement, the government said, a breakthrough that looks to avert a labor disruption.

- Yum China Holdings (YUMC US) shares advance 3.2% in US premarket trading after the Chinese megacity of Chengdu said it had controlled the spread of Covid-19 and would start easing the lockdown.

- Devon Energy (DVN US) declines 1% in premarket trading as the stock was cut to neutral at JPMorgan in note titled ‘E&P Fall Playbook,’ while EOG Resources (EOG US), Permian Resources (PR US) and Vermilion Energy (VET CN) shares were upgraded.

- Watch US cryptocurrency-exposed stocks as digital tokens traded in tight ranges Thursday while Ethereum completed the crypto world’s biggest and most ambitious software upgrade to date. Keep an eye on shares including Coinbase (COIN US), Marathon Digital (MARA US), Riot Blockchain (RIOT US), Ebang (EBON US).

- Watch department store shares as Jefferies says there are still selective opportunities within the sector, upgrading Nordstrom (JWN US) to buy and downgrading Kohl’s (KSS US) to hold.

- Keep an eye on hotel operators as Berenberg upgraded Marriott (MAR US), Hyatt (H US) and Hilton Worldwide (HLT US) shares to buy, saying the accelerating recovery in lodging performance hasn’t yet been reflected in share prices of these companies.

- Watch Phillips 66 (PSX US) stock as it was cut to peer perform at Wolfe, which said that competitors are better positioned to deliver catalysts for shareholder returns.

Traders have been extremely focused on US economic data, with a decline in producer prices providing some relief after Tuesday’s consumer inflation jolt saw wagers for rate increases ratchet higher and stocks slump the most in two years. Investors are now bracing for the Fed’s meeting next week, with some concerned that the central bank can hike rates by as much as 100 basis points. Meanwhile, all eyes will be on fresh jobs, manufacturing and retail numbers later Thursday for further clues on the path of monetary policy.

“It still seems unlikely the Fed will go by more than 75 basis points at this point despite the collective freakout of the past couple of days,” said Michael Hewson, chief market analyst at CMC Markets UK. Retail sales figures “could reinforce this hawkish narrative if we get another strong number.”

Swaps traders are pricing in a 75 basis point hike when the Fed meets next week, with odd for a full-point move dropping to 20% from almost 50% two days ago, after JPM said that it is unlikely that the Fed will rise a full percent. The continued rise in rate-sensitive Treasuries deepened the curve inversion to a level unseen this century.

Meanwhile, Bridgewater's Ray Dalio came out with a gloomy prediction for stocks and the economy. A mere increase in rates to about 4.5% would lead to a nearly 20% plunge in equity prices, he wrote in a LinkedIn article dated Tuesday, which is odd since the market is already pricing in rates rising to well over 4%. But then again "cash is trash" or something...

“Markets seem torn between a bearish sentiment on one hand, supported by lingering macro threats in a tighter liquidity environment, and dip buyers on the other who continue to bet on the inflation peak,” said Pierre Veyret, an analyst at ActivTrades. “Most benchmarks aren’t registering strong and significant bullish corrections following Tuesday’s sell-off, but continue to trade sideways in a volatile manner, which highlights the ‘wait and see’ situation ahead of today’s new batch of US data, tomorrow’s EU CPI report and next week’s Fed decision on rates.”

In Europe, the Stoxx 50 index rose 0.2%. FTSE 100 outperforms peers, adding 0.5%, CAC 40 underperforms. Banks, miners and health care are the strongest-performing sectors. European banks rose to a three-month high on Thursday, with Spanish banks among the best performers after a local website said the government is open to modifying the tax it plans to impose on windfall profits. Also boosting sentiment on the sector, Morgan Stanley upgraded its view on European banks to attractive

Earlier in the session, Asian stocks extended their recent weakness as investors remained cautious over tighter Federal Reserve policy, with losses in China weighing on the regional benchmark. The MSCI Asia Pacific Index erased earlier gains to fall as much as 0.4%, on track to fall for a third day. Financials and energy shares advanced the most, while technology stocks were the biggest drag. Chinese stocks led declines in the region as a meeting between President Xi Jinping and Vladimir Putin nears, an event that traders say raises geopolitical risks. Meanwhile, the People’s Bank of China’s kept its key rate unchanged while draining liquidity from the banking system. An easing of lockdown in the Chinese megacity of Chengdu was insufficient to provide reassurance. Asian markets were jittery ahead of the Fed’s policy decision next week, though a month-on-month decline in US producer prices offered some relief. Traders are expecting an outsized interest rate increase by the Fed to curb persistent inflation.

“Overall risk sentiments will continue to carry a cautious tone,” Jun Rong Yeap, a market strategist at IG Asia Pte, wrote in a note. “The absence of any clear resolution in China’s Covid-19 policy and uncertainty on further moderation in economic conditions ahead remain a weighing block for risk sentiments.” Markets in Japan, Australia and Hong Kong were among those in the green.

Japanese equities edged higher as investors assess the Fed’s hawkish stance and await further data that would provide clearer signals on the direction of the global economy. The Topix Index rose 0.2% to close at 1,950.43, while the Nikkei advanced 0.2% to 27,875.91. Sony Group Corp. contributed the most to the Topix Index gain, increasing 0.9%. Out of 2,169 stocks in the index, 1,100 rose and 926 fell, while 143 were unchanged. “US stocks have calmed down and there is a sense of relief buying,” said Masayuki Otani, a chief market strategist at Securities Japan. “But there is still a wait-and-see mood ahead of next week’s FOMC meeting and US retail sales to be announced tonight, Japan time.”

Australia's S&P/ASX 200 index rose 0.2% to close at 6,842.90, boosted by gains in energy shares and banks. Australian unemployment unexpectedly rose in August, the first increase in 10 months, a result that supports the Reserve Bank’s signal of a potential shift to smaller interest-rate increases. In New Zealand, the S&P/NZX 50 index was little changed at 11,658.94. Shares of Wellington-listed Pushpay fell 11%, after a report that a pending buyout of the digital payments firm may be nearing collapse.

In Fx, the Bloomberg dollar spot index is flat. NOK and JPY are the weakest performers in G-10 FX, as CHF and EUR outperform. Asian currencies remained at risk from a strong greenback. The offshore yuan weakened above 7 per dollar for the first time since July 2020. The yen declined to trade around 143.6 per dollar after it rallied away from just under the closely-watched 145 level Wednesday on signs the Bank of Japan was preparing an intervention. Ominously, despite the plunge in the yen, Japan’s trade hit a record deficit in August.

- The euro traded little changed, slightly below parity against the dollar.

- The pound led G-10 losses, with focus turning to next week’s Bank of England decision. Demand for one- week sterling-dollar downside protection covering the BOE meeting is around the least since before the Feb. decision, perhaps reflecting the drop in spot. Cable one-week implied volatility touches 14.5%, a level unseen since Sept. 9, when the meeting was delayed

- The yen fell as wariness over potential FX intervention from Japan receded, undermined by Japan’s trade deficits and expectations the US Fed will retain its hawkish stance. The government bond yield curve steepened after a weak 20-year auction

- Japan’s unadjusted trade deficit expanded to 2.82 trillion yen ($19.7 billion) last month, the finance ministry reported Thursday. The gap was far larger than economists’ estimates and extends the sequence of red ink to 13 months, the longest stretch since 2015

- Australia’s sovereign bonds extended opening declines after a government report showed employers added workers last month, even as the jobless rate rose. The Aussie traded in a tight range

In rates, Treasury futures traded near session lows after grinding lower during Asia session and European morning, leaving yields cheaper by about 5bp across long-end of the curve. US 10-year yields trade around 3.45%, cheaper by nearly 5bp vs Wednesday’s close; front-end outperforms slightly; 2-year German yields cheaper by 8bp on the day following hawkish remarks by ECB policy makers Holzmann and Kazaks late Wednesday. US session features packed economic data slate headed by retail sales. Corporate bond sales may go forward after some issuers stood down over past two days.

European bonds slipped: Bunds, Italian bonds fell as money markets wagered on a faster ECB tightening pace following hawkish remarks from policy makers Holzmann and Kazaks late Wednesday. Bund yields rise between 4-2bps across the curve. Gilts outperform bunds and USTs. Treasury 10-year yield up 3.8bps to 3.44%.

In commodities, oil fluctuated as traders grappled with concerns about global demand and assessed comments from the US on refilling strategic reserves. WTI trades within Wednesday’s range, falling 0.2% to near $88.33. Natural gas increased as traders assessed Europe’s steps to contain the energy crisis, with governments making plans to shut down power in some places to avoid a total collapse of the system this winter. Spot gold falls roughly $10 to trade near $1,687/oz. Spot silver loses 1.1% to around $19.

Bitcoin meanders around USD 20k and Ethereum fell under USD 1.6k after completing the Ethereum Merge.

To the day ahead now, and data releases from the US include retail sales, industrial production and capacity utilisation for August, the Empire State manufacturing survey and the Philadelphia Fed business outlook for September, and the weekly initial jobless claims. From central banks, we’ll hear from ECB Vice President de Guindos and the ECB’s Centeno. Lastly, earnings releases include Adobe.

Market Snapshot

- S&P 500 futures little changed at 3,949.25

- STOXX Europe 600 up 0.2% to 418.54

- MXAP down 0.3% to 152.10

- MXAPJ down 0.2% to 499.22

- Nikkei up 0.2% to 27,875.91

- Topix up 0.2% to 1,950.43

- Hang Seng Index up 0.4% to 18,930.38

- Shanghai Composite down 1.2% to 3,199.92

- Sensex down 0.5% to 60,020.39

- Australia S&P/ASX 200 up 0.2% to 6,842.89

- Kospi down 0.4% to 2,401.83

- German 10Y yield little changed at 1.75%

- Euro little changed at $0.9980

- Gold spot down 0.5% to $1,688.07

- U.S. Dollar Index little changed at 109.73

Top Overnight News from Bloomberg

- Shortly before invading Ukraine in February, Vladimir Putin and Xi Jinping declared a “no limits” friendship. Yet even as Russian forces suffer humiliating losses on the battlefield, Putin shouldn’t expect much help from Xi at their first meeting since the invasion

- China is considering allowing its oil refiners to export more fuel in an attempt to revive its economy, in what would be a reversal from a focus on minimizing emissions

- Investors in high-risk emerging-market debt are finally seeing positive returns as fears of an economic meltdown ease. In a reversal of fortunes from the first half of the year, junk- rated emerging corporate and sovereign bonds in dollars have returned 7.2% in the past two months, according to Bloomberg indices. That follows a brutal 18% slide until June, marking the worst year since the 2008 credit crisis

- Germany will likely face “waves” of gas shortages this winter, Klaus Mueller, president of the country’s energy regulator, told Handelsblatt in an interview published on Thursday

- Swedish long-term inflation expectations staying put in July offered a rare piece of good news for the country’s central bank, which looks set to step up interest-rate hikes after a string of higher-than-expected inflation outcomes

- Swedish right-wing opposition parties are intensifying negotiations on forming a new government, after Prime Minister Magdalena Andersson announced her resignation on Wednesday

A more detailed look at global markets courtesy of Newsquawk

Asia stocks mostly traded with mild gains after the slight reprieve on Wall Street where inline PPI data provided some solace from inflationary woes, although mixed data and hawkish central bank expectations scuppered a broad recovery. ASX 200 was led higher by outperformance in energy and financials but with upside capped after the miss on jobs data. Nikkei 225 eked mild gains as expectations of looming stimulus and looser border controls offset the mixed trade data. Hang Seng and Shanghai Comp were mixed despite the latest policy support pledges by China including an extension of tax reliefs for small firms and a CNY 200bln relending facility by the PBoC, while the easing of lockdown restrictions in some cities also failed to spur risk appetite as participants digest the PBoC MLF announcement in which it partially rolled over maturing loans and maintained the rate at 2.75%, as expected.

Top Asian News

- PBoC injected CNY 400bln vs CNY 600bln maturing via 1-year MLF with the rate kept at 2.75%.

- PBoC set USD/CNY mid-point at 6.9101 vs exp. 6.9153 (prev. 6.9116).

- Singapore to Create Up to 20,000 Finance Jobs in Five Years

- Iron Ore Steadies as Easing of Chengdu Curbs Spurs Optimism

- China Holds Key Rate, Withdraws Liquidity Amid Yuan Defense

- Aluminum Leads Metals Up With China Energy Woes Hitting Supplies

- Korea’s Housing Market Falls Most Since Global Financial Crisis

- South Korea FX authorities were reportedly seen selling USD to curb the KRW's fall, according to multiple dealers cited by Reuters.

- China Securities Journal said the domestic economy is poised for a rebound in Q3.

- Japan will drop a ban on individual tourist visits and remove a cap on daily arrivals with PM Kishida expected to announce changes in the coming days, according to Nikkei.

European bourses modestly extended on the gains seen at the open despite a lack of fresh fundamental catalysts, but ahead of Q3 quad-witching tomorrow. European sectors are mostly firmer but with no defensive/cyclical bias. Stateside, US equity futures trade sideways with a mild upside bias and a relatively broad-based performance seen across the major contracts.

Top European News

- Europe Gas Surges as Traders Weigh Efficacy of EU’s Intervention

- Stellantis May Make Own Energy as Europe Braces for ‘Chaos’

- Eni CEO Says Italy Can Make It Through Winter Without Russia Gas

- Ericsson Drops on Credit Suisse Double Downgrade; Nokia Raised

- Iron Ore Steadies as Easing of Chengdu Curbs Spurs Optimism

FX

- DXY has been waning off its 109.92 best towards 109.50, but the Buck extended gains against some EM currencies.

- Divergence is seen between the traditional havens, with CHF gaining and JPY among the laggards.

- The rest of the G10s are trading relatively flat against the USD.

Fixed Income

- Choppy and erratic price action is seen in the complex.

- The short end of the UK rate curve stages a more emphatic and impressive recovery to the extent that the ripples are reaching Gilts

- Bunds sit midway between 143.63-142.83 parameters, OATs and Bonos have recouped some pre-French and Spanish auction downside

- T-note is lagging within a 114-20+/115-01 range ahead of a very busy US agenda.

Commodities

- WTI and Brent are choppy after settling higher yesterday,

- Spot gold meanders just above its YTD low (USD 1,680.25/oz) and the 2021 trough at 1,676.10.

- Base metals are flat/mixed in directionless trade, with 3M LME Copper in a tight range under USD 8,000/t.

- Russia's Gazprom says demand rises for long-term Russian gas export contracts including from Europe, via Al Jazeera

US Event Calendar

- 08:30: Sept. Initial Jobless Claims, est. 227,000, prior 222,000

- Continuing Claims, est. 1.48m, prior 1.47m

- 08:30: Aug. Import Price Index MoM, est. -1.3%, prior -1.4%; YoY, est. 7.7%, prior 8.8%

- Export Price Index MoM, est. -1.1%, prior -3.3%; YoY, est. 12.4%, prior 13.1%

- 08:30: Aug. Retail Sales Advance MoM, est. -0.1%, prior 0%

- Retail Sales Ex Auto MoM, est. 0%, prior 0.4%

- Retail Sales Ex Auto and Gas, est. 0.5%, prior 0.7%

- Retail Sales Control Group, est. 0.5%, prior 0.8%

- 08:30: Sept. Philadelphia Fed Business Outl, est. 2.2, prior 6.2

- 08:30: Sept. Empire Manufacturing, est. -12.9, prior -31.3

- 09:15: Aug. Industrial Production MoM, est. 0%, prior 0.6%

- Capacity Utilization, est. 80.2%, prior 80.3%

- Manufacturing (SIC) Production, est. -0.1%, prior 0.7%

- 10:00: July Business Inventories, est. 0.6%, prior 1.4%

DB's Jim Reid concludes the overnight wrap

Following Tuesday’s dramatic slump after the US CPI release, global markets have shown signs of stabilising over the last 24 hours. It was hardly a great performance and was more driven by the absence of bad news rather than any actively good news, but the S&P 500 did manage to recover +0.34% on the day after its worst session in over two years. Treasuries also steadied to an extent, with some support from the fact that the PPI release yesterday wasn’t as bad as some had feared. Nevertheless, there are still a number of headwinds as markets turn their attention towards next week’s all-important FOMC meeting, and investors are continuing to price in an increasingly hawkish response from central banks across the world.

When it comes to that FOMC meeting next week, futures are still fully pricing in a third consecutive 75bps hike, but equities were supported by the fact that a bumper 100bps move is now perceived as less likely than it was shortly after the CPI release. In fact, looking at Fed funds futures, the peak pricing for next week’s meeting has come down from an intraday high of 87.0bps on Tuesday to 81.3bps by yesterday’s close. But while a 100bps hike next week is being seen as less likely, if you look beyond next week, it’s clear that markets are still expecting the Fed to remain hawkish, with the peak rate priced in for March 2023 actually rising by +7.3bps on the day to 4.39%, which implies more than 200bps of further tightening on top of where we already are.

Those diminishing expectations of a 100bps move were in part thanks to a somewhat weaker-than-expected PPI print from the US. Unlike the CPI, the headline monthly reading was in line with expectations and showed a -0.1% decline in prices, with the year-on-year measure falling back to +8.7% (vs. +8.8% expected). Against that backdrop, yields on 10yr Treasuries fell by -0.4bps to 3.41%, moving off from their intraday peak of 3.47% at one point, and yields have only seen a modest rise of +1.7bps again this morning. The decline was driven by lower real yields, with the 10yr yield down -3.4bps on the day to 0.93%, coming off its post-2019 closing peak from the previous session.

That decline in Treasury yields echoed what we saw in Europe yesterday, where those on 10yr bunds (-1.4bps) and OATs (-1.0bps) both moved lower. We did have some ECB speakers yesterday, including France’s Villeroy, who said that for the Euro Area “R* can be estimated as being as below or close to 2% in nominal terms, and we could be there by the end of the year”. Meanwhile, ECB chief economist Lane said that “it was appropriate to take a major step that frontloads the transition from the prevailing highly-accommodative level of policy rates towards levels that will support a timely return of inflation to our target.” As with the Fed, markets were pricing an increasingly hawkish profile of rate hikes, and by yesterday’s close a further 135bps rate hikes were expected at the two remaining meetings this year.

Staying on Europe, we heard more on the EU’s energy plans for the winter ahead in Commission President Von der Leyen’s State of the Union address yesterday. The measures proposed included a temporary revenue cap on “inframarginal” electricity producers, which would be set at €180 per megawatt-hour, with surplus revenues above the cap used to support energy consumers. In addition, there was a windfall tax proposal on other activities in the oil, gas, coal and refinery sectors which would be applied on 2022 profits that are more than 20% above the average profits over the most recent 3 years. In the meantime, we heard that France would be capping the increase in energy prices for households to 15% from January, and the country’s power-grid operator said that they may have to issue alerts to encourage a reduction in energy consumption over the next six months. European natural gas futures continued to rebound from their one-month low on Monday, gaining +9.70% to €218 per megawatt-hour.

With oil and gas prices putting in a strong performance yesterday, that meant that the energy sector outperformed other equities on both sides of the Atlantic, supporting the S&P 500 to make its +0.34% gain on the day. Otherwise, tech stocks were another outperformer as they recovered some of their Tuesday losses, with the NASDAQ advancing +0.74%. Over in Europe, equities caught up with the late US losses from the previous session, and the STOXX 600 (-0.87%) and the DAX (-1.23%) lost ground for a second day running.

Here in the UK, gilts outperformed after the latest CPI release for August came in slightly below expectations. That marked a contrast with the upside surprise from the US the previous day, since year-on-year CPI fell to +9.9% (vs. +10.0% expected). However, there were similarities to the US in that some of the details were much less positive, with core CPI rising to +6.3% (vs. +6.2% expected). However, that didn’t stop gilts outperforming their counterparts elsewhere, with 10yr yields down -3.8bps on the day.

Overnight in Asia, the major equity indices have also stabilised for the most part, with the Hang Seng (+0.46%) and the Nikkei (+0.17%) advancing after their sharp losses during the previous session, although the Kospi (-0.25%) has moved lower once again. The biggest underperformer are equities in mainland China this morning, where the Shanghai Composite (-1.01%) and the CSI 300 (-0.71%) have built on the previous day’s losses after the People’s Bank of China kept its one-year medium-term lending facility rate unchanged at 2.75% after being lowered by 10bps in August. Furthermore, they withdrew a net 200bn yuan via the MLF from the banking system as expected.The PBOC’s announcement to squeeze liquidity indicates their concern over capital outflows as the central bank is trying to reduce pressure on the yuan emanating from a divergent monetary policy with the Fed.

Otherwise in overnight trading, US stock futures are slightly higher with those on the S&P 500 (+0.06%) and NASDAQ 100 (+0.05%) both advancing ahead of numerous economic indicators coming out today, including retail sales and industrial production for August. Speaking of data, Japan recorded a record trade deficit of 2.82tn yen in August (vs. 2.39tn yen expected) after higher energy prices and the weaker yen pushed up import costs.

Elsewhere, our colleagues in the European Leveraged Finance Research team have just published their quarterly top trade ideas. You can find the report here.

To the day ahead now, and data releases from the US include retail sales, industrial production and capacity utilisation for August, the Empire State manufacturing survey and the Philadelphia Fed business outlook for September, and the weekly initial jobless claims. From central banks, we’ll hear from ECB Vice President de Guindos and the ECB’s Centeno. Lastly, earnings releases include Adobe.

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

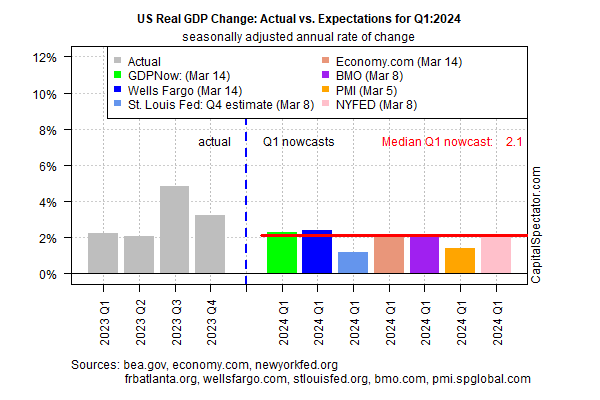

US Economic Growth Still Expected To Slow In Q1 GDP Report

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A