Uncategorized

Futures Extend Gains As FOMO Spreads After China Eases Covid Measures

Futures Extend Gains As FOMO Spreads After China Eases Covid Measures

One day after its best day since April 2020, when the S&P500 added…

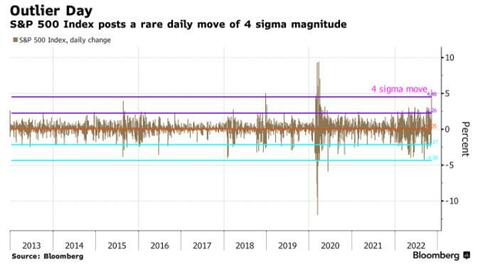

One day after its best day since April 2020, when the S&P500 added 5.5%, or a near-record $1.8 trillion in market cap in one day, a rare 4-sigma move that has only occurred 10 times over the past decade, which essentially showed how wrong-footed the market was ahead of the inflation surprise....

... the index was set to extend its gains as a FOMO panic started to spread among traders fueled by a softer-than-expected US inflation print and as China reduced the amount of time travelers and close contacts of virus cases must spend in quarantine, and pulled back on testing, in a significant calibration of the Covid Zero policy that has upended the world’s second-largest economy and raised public ire.

Contracts on the US stock benchmark advanced 0.3% to 3,974 at 730 a.m. in New York, having earlier risen as high as 3,997. Nasdaq 100 futures also gained 0.7%, while Treasury futures weakened, with the cash market closed for the Veteran's Day holiday. Commodities also rallied while the dollar retreated for a second day.

Overnight Beijing announced that travelers into China will be required to spend only five days in a hotel or government quarantine facility, down from ten, followed by three days confined to home, according to a National Health Commission statement Friday. The latest news on China’s Covid policy tweaks “plays with the grain of the post-US CPI moves down in the dollar,” said Ray Attrill, head of FX strategy at National Australia Bank Ltd. in Sydney. “The dollar is highly attuned to swings in risk sentiment, and for now that means dollar down.”

In US premarket trading, Chinese stocks listed in the US soared after Beijing made significant changes to the stringent Covid Zero policy that has bogged down the economy and dented appetite for the country’s equities. Alibaba and JD.com both advanced at least 3.6%. Amazon.com Inc. and Nvidia also extended their Thursday gains with major US technology and internet firms. Health insurance provider GoHealth Inc slumped as much as 22%, on track for the worst day in three months if the move holds, after the firm’s net revenue for the third quarter missed analyst estimates. Here are some other premarket news:

- Doximity shares jumped as much as 19% in US premarket trading after its earnings beat expectations, putting the online healthcare platform on track for its best day in nine months if the move holds. Analysts were encouraged to see the company reiterating its guidance for the full-year amid robust demand from hospital clients.

- GoHealth shares slumped as much as 22% in US premarket trading, on track for the worst day in three months if the move holds, after the health insurance provider’s net revenue for the third quarter missed analyst estimates. The company held off providing full-year 2022 guidance after suspending it back in August, contributing to an uncertain outlook. GoHealth’s shares had bounced 16% this week ahead of its release, though remain down 87% for the year.

- Matterport shares surged as much as 32% in US premarket trading, with the stock set for its biggest gain since its July 2021 IPO, after the 3D camera maker’s results beat demonstrated the company is holding up well amid a difficult real estate market. Demand for its latest products set it up well for next year, analysts noted, while Matterport also narrowed its revenue guidance for the year. Its shares are down 85% year-to- date.

- Shares in cryptocurrency-exposed companies edged lower on Friday, with the price of Bitcoin under pressure amid the unfolding crisis at FTX. Coinbase -0.2%, Riot Blockchain -0.7%.

- Snail shares climb 83% premarket after the company announced a $5m-stock buyback plan. The repurchase plan represents 5.8% of the company’s current market value, data compiled by Bloomberg show.

- AirSculpt Technologies (AIRS US) shares plunged as much as 26% in US premarket trading, putting the stock on track to hit its lowest level since its initial public offering, after the provider of a type of liposuction to remove unwanted fat cut its year outlook.

The S&P 500 and Nasdaq 100 are poised for their best week since June, after official US data showed the consumer price index rose 7.7% in October from a year before, its smallest annual advance since the start of 2022 That fueled bets that the Federal Reserve would rethink how fast it needs to move with interest rate hikes, and also lowered the terminal Fed Funds rate to 4.90% suggesting less than 4 rate hikes are left until the Fed halts tightening.

The positive mood was reinforced after China reduced the amount of time travelers and close contacts must spend in quarantine, scrapped flight bans and pulled back on testing, in a significant calibration of the Covid Zero policy that has isolated the world’s second-largest economy. Chinese stocks listed in the US soared in premarket trading.

Thursday's data not only spurred short covering as bearishly positioned investors bought back into the market, but it prompted the biggest one-day gain in such hated indexes as Goldman's Non-Profitable Tech which exploded over 15% higher in one single day!

“Markets were not ready for good news, which is the key takeaway from yesterday’s market reaction. But having said that, inflation is still 7.7%. It doesn’t make a huge difference compared to 7.9% for the US consumer, and so the pressure is still very much there,” said Maurice Gravier, chief investment officer for the wealth management division of Emirates NBD Bank PJSC in Dubai.

Gravier expects volatility to continue until there is clarity about a Fed pause, which he says is slated for the middle of next year, he told Bloomberg TV.

In Europe, consumer products, miners and real estate are the strongest performing sectors. Euro Stoxx 50 rises 0.7%. CAC 40 outperforms peers, adding 0.8%, FTSE 100 lags, dropping 0.3%. Sterling reclaims $1.17. Here are the biggest European movers:

- Richemont reported 1H operating profit that beat estimates, as growth for the maker of Cartier jewelry and watches was led by retail. Shares rise as much as 21%, the most since October 2008, boosted along with peers as China eased some Covid measures.

- Prudential jumps as much as 9.5% to hit its highest level since Aug. 16, gaining alongside China-exposed sectors like luxury and mining

- European real estate stocks extend gains, following a surge in the previous session after US inflation data fueled optimism that the Fed might slow the pace of interest rate hikes. German landlord Aroundtown is among the biggest contributors to the gain at 10%

- Casino gains as much as 21% after the French grocer bought back €67m of Quatrim 2024 senior secured notes in the market, while as a highly indebted stock it also benefits from some relief following US inflation data.

- Defensive sectors retreat in Europe after Thursday’s softer-than-expected US inflation data and the easing of Covid restrictions in China triggered a market rotation into cyclical and growth stocks such as technology and retail. Thales is among the stocks leading the decline at 7.3% and Saab at 6.8%

- DKSH is initiated with a neutral rating and CHF70 PT at Credit Suisse, with the broker saying the risk-reward looks balanced for the distribution group. DKSH shares fall as much as 7.3%, the most since July.

- ACS declined as much as 3.7% on Friday after the Spanish infrastructure company reported earnings Thursday evening, which Renta 4 said showed pressure in the construction business margin.

- GSK is among the biggest laggards on the Stoxx 600 Health care subindex, falling as much as 5.5%, after UBS downgraded the shares to sell from hold, citing “uncertain times ahead still,” and seeing an “unattractive earnings scenario” after 2026.

Asian stocks also traded higher with gains as the region followed suit to the post-CPI global stock surge, while the adjustment of COVID protocols in China including a shorter quarantine for close contacts provided a late tailwind. Hang Seng and Shanghai Comp conformed to the heightened risk appetite with the Hong Kong benchmark frontrunning the advances as it gained by more than 1,000 points, while the mainland was also boosted in late trade on China relaxing its COVID protocols. Nikkei 225 jumped above the 28,000 level amid the risk-on mood and as participants digested a deluge of corporate earnings which have largely influenced the list of best and worst performers for the index.

Australian stocks soared to post the third weekly gain: the S&P/ASX 200 index rose 2.8% to close at 7,158.00, the highest since June 6, with technology and real estate shares rallying most. The benchmark gained for a third straight week. The move followed a broad-based rally in Asian stocks after slower-than-projected US inflation spurred bets the Federal Reserve will moderate its aggressive rate-hike path. In New Zealand, the S&P/NZX 50 index rose 2% to 11,311.76.

In FX, the dollar extended Thursday’s steep drop, falling against most Group-of-10 peers and hitting its lowest against the yen since late August after China eased some of its quarantine restrictions for inbound travelers, helping to boost demand for higher-risk currencies. The Bloomberg Dollar Spot Index dropped 0.9% after closing down 2% Thursday for its biggest fall since March 2009, when a softer CPI reading saw traders pull back bets on US rate hikes.

- USD/JPY fell as much as 1.6%, pushing below the psychologically key 140 level

- The euro rose to a three-month high of 1.0279 and headed for its best week since March 2020. Short-term bets turn bullish for the first time since Feb. 11 as shorts trim exposure

- The pound was among the worst-performing G-10 currencies. The gilt curve twist-steepened very modestly

- Australian dollar recovered from selling driven by leveraged funds trimming longs before the weekend. Bonds give back some of their opening gains in the wake of a softer core CPI reading that saw markets reprice the Federal Reserve’s terminal rate lower

In rates, cash treasury trading is closed for Veteran's day; Treasury futures are open and are slightly lower on the day but remain near the top of the session range from Thursday, when the curve aggressively bull steepened following a lower-than-estimated CPI report. US futures losses are led by long-end of the curve, where long- bond contracts are around 21 ticks lower vs. Thursday close -- 10-year futures around 112-08+, remain close to Thursday session highs. Gilts also lower on the day; BOE announced Thursday that the unwinding of emergency bond purchases will begin Nov. 29. Bunds are lower on the day, feeding through to weakness in Treasury futures, with German yields cheaper by 5.5bp to 9.5bp across the curve with losses led by belly. The German curve bear-flattened, while Italian bonds underperformed their German peers, with the 2-year yield rising by around 16bps. Money markets add to ECB tightening wagers ahead of a large slate of ECB speakers

Commodities from oil to iron ore and copper jumped after China eased some Covid restrictions, raising hopes over a demand recovery in the world’s second-biggest economy. Saudi Arabia’s energy minister said OPEC+ will remain cautious on oil production, weeks after the group angered the US by lowering output. WTI drifts 2.4% higher to trade around $88.53; commodities widely surge after China eased some Covid restrictions. Spot gold rises roughly $6 to above $1,762/oz

In crypto, Bitcoin is modestly softer intraday but holds onto USD 17,000+ status. FTX CEO Bankman-Fried is facing an SEC probe related to his crypto empire, according to Bloomberg. Crypto exchange BlockFi tweeted that it is unable to operate business as usual and is pausing client withdrawals, citing a lack of clarity from FTX.com.

Looking to the day ahead now, and data releases include the University of Michigan’s preliminary consumer sentiment index for November in the US, along with the UK’s GDP reading for Q3. From central banks, speakers will include the ECB’s Vice President de Guindos, Holzmann, Panetta, Lane, de Cos, Centeno and Nagel, along with the BoE’s Haskel and Tenreyro. Finally, the EU Commission will be releasing their latest economic forecasts.

Market Snapshot

- S&P 500 futures up 0.5% to 3,979.75

- STOXX Europe 600 up 0.3% to 433.01

- MXAP up 4.8% to 150.99

- MXAPJ up 5.5% to 485.10

- Nikkei up 3.0% to 28,263.57

- Topix up 2.1% to 1,977.76

- Hang Seng Index up 7.7% to 17,325.66

- Shanghai Composite up 1.7% to 3,087.29

- Sensex up 2.0% to 61,803.85

- Australia S&P/ASX 200 up 2.8% to 7,157.95

- Kospi up 3.4% to 2,483.16

- Brent Futures up 2.3% to $95.80/bbl

- Gold spot up 0.4% to $1,761.68

- U.S. Dollar Index down 0.63% to 107.53

- German 10Y yield up 2.9% to 2.068

- Euro up 0.4% to $1.0249

Top Overnight News from Bloomberg

- The yuan has swung violently from one end of its tightly-managed trading band to the other like never before, as optimism toward a pivot from Covid-Zero evaporated concern about President Xi Jinping’s consolidation of power

- SNB Governing Board member Andrea Maechler expects inflation in Switzerland to stay elevated for at least two more years, she told newspaper L’Agefi

- UK Prime Minister Rishi Sunak faces an extraordinary balancing act in his autumn budget next week. He needs to appease financial markets with a package of spending cuts and tax increases, while also winning over disgruntled voters

- Chancellor of the Exchequer Jeremy Hunt is preparing to cut planned public spending growth to 2% or lower after 2024-25, compared to a previous provisional plan of 3.7% growth, according to a person familiar with his thinking

- The BOE signaled it will move cautiously in selling off the £19 billion ($22 billion) of UK government bonds it snapped up in emergency action in recent weeks, outlining a “demand-led” approach to the sales

- A decade ago this week, former UK chancellor George Osborne declared that income from bonds the Bank of England acquired under its quantitative-easing program could be used to reduce government debt. Now, the government expects to send £11 billion ($12.8 billion) to the central bank to cover an anticipated shortfall on the portfolio in the months to April

- German lawmakers approved next year’s federal finance plan including net new borrowing of €45.6 billion ($46.6 billion), according to documents seen by Bloomberg

- EU officials in Brussels on Friday slashed their forecast for growth next year, predicting barely any expansion, and raised all their projections for consumer prices. They reckon the economy is now shrinking and will keep contracting during the first quarter

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with firm gains as the region followed suit to the post-CPI global stock surge, while the adjustment of COVID protocols in China including a shorter quarantine for close contacts provided a late tailwind. ASX 200 was led by tech and the real estate sector amid the lower yield environment. Nikkei 225 jumped above the 28,000 level amid the risk-on mood and as participants digested a deluge of corporate earnings which have largely influenced the list of best and worst performers for the index. Hang Seng and Shanghai Comp conformed to the heightened risk appetite with the Hong Kong benchmark frontrunning the advances as it gained by more than 1,000 points, while the mainland was also boosted in late trade on China relaxing its COVID protocols.

Top Asian News

- China's National Health Commission released adjusted protocols for COVID prevention and control with quarantine for close contacts cut to 5 days centralised isolation and 3 days home quarantine from 7 days centralised isolation and 3 days home quarantine. China is also to cut COVID quarantine for inbound travellers from 10 days to 8 days and it cancelled the circuit breaker for inbound flights, according to Reuters.

- China disease control researcher earlier said that China is to continually improve its COVID-19 policies and will not relax them while the virus mutates and the epidemic situation changes, according to Reuters.

- Haizhu district of Guangzhou extended its COVID lockdown until November 13th, according to Reuters.

- China is expected to take additional measures to support the economy by conducting the largest cash injection this year through MLF loans or by reducing RRR, according to Bloomberg.

- US customs said it had seized 1,053 shipments of solar equipment since June under the China forced labour ban, while the shipments are primarily from Longi (601012 CH), Trina (688599 CH) and Jinkosolar, according to Reuters.

- Arm IPO unlikely to take place by March 2023, according to Softbank (9984 JT) sources cited by Reuters.

Major bourses in Europe are mostly firmer following CPI-induced optimism which saw further gains on Wall Street after the European cash close, with the sentiment then reverberating in APAC before seeing another boost on reports that China is easing its COVID measures. Sectors in Europe are mostly in the green with the laggards comprising of defensives, whilst the top performers include Tech, Real Estate, Retail, and Basic Resources. US equity futures are trading sideways with modest gains across the board, with futures holding onto yesterday's upside.

Top European News

- UK Real Estate Slumped to Worst Quarter Since 2009 as Rates Bite

- Richemont Surges on Record Profit and China’s Covid Easing

- European Gas Prices Soften as Storage Fill Limits Rationing Risk

- European Mining Stocks Jump as Metals Gain on China Covid Easing

- United Internet Said to Pick IPO Banks for Web Hosting Unit

- European Stocks Set for Best Week Since March on Fed Bets, China

FX

- DXY remained downtrodden amidst further fallout, or capitulation on the back of October’s comparatively soft CPI data that ramped up Fed pivot expectations.

- G10s are firmer across the board against the Dollar, with the Japanese Yen the outperformer as USD/JPY fell under 140.00.

- The Yuan stands as the EM outperformer after China said it will ease some COVID measures.

Fixed Income

- US Treasuries are hovering midway between its 112-18/03+ overnight range ahead of prelim UoM sentiment and inflation expectations.

- Gilts pared more losses to get within 2 ticks of 105.00 having been down to 104.06.

- Bunds have recovered from a deeper low, at 139.38 and perhaps on technical grounds as 139.35 represents a 50% Fib retracement of Thursday’s rally.

Commodities

- WTI and Brent are extending the gains seen overnight which were sparked by China easing its COVID measures.

- Saudi Energy Minister said OPEC+ will remain cautious on production, via Bloomberg; OPEC+ will not lose sign of what the oil market needs.

- Chinese refiners will reportedly reduce Saudi crude oil term volume loading in December, according to sources cited by Reuters.

- Spot gold extends its gains above its 100 DMA (1,714/oz) and above the USD 1,750/oz mark as the Dollar crumbles.

- Base metals also firmer across the board with added tailwinds from China’s easing of COVID measures – 3M LME copper eyes USD 8,500/t to the upside from a USD 8,271/t intraday base.

Geopolitics

- Russian Kremlin said goals of the special military operation can be achieved with peace talks but peace talks are not possible due to the Ukrainian position. Russian Kremlin said grain deal contacts ongoing, number of issues need to be resolved, via Reuters.

- US Secretary of State Blinken tweeted that he has directed another USD 400mln worth of arms and equipment from Department of Defense inventories to Ukraine.

- US issued a general licence authorising certain transactions relating to energy with some Russian banks. It was also reported that insurers said gaps in the G7/EU Russian oil price cap plan could leave tankers stranded at sea and disputes over compliance with the oil price cap could lead to a loss of insurance cover and refusal to discharge, according to Reuters.

- Chinese President Xi will meet with US President Biden, according to the Chinese Foreign Ministry.

- US Treasury Secretary Yellen is to meet which PBoC Governor Yi Gang on the sidelines of the G20; to discuss global economic situation and hopes to learn more about China's property sectors; Yellen to update Yi on US economic conditions, via Reuters.

- Russian President Putin to skip the APEC summit (13-17th Nov), according to a Thai official

- Russian Deputy Foreign Minister said Russia-US Commission on New START treaty is to meet late November/early December in Cario, according to Ria.

US Event Calendar

- 10:00: Nov. U. of Mich. Sentiment, est. 59.5, prior 59.9

- U. of Mich. Current Conditions, est. 62.8, prior 65.6

- U. of Mich. Expectations, est. 55.5, prior 56.2

- U. of Mich. 5-10 Yr Inflation, est. 2.9%, prior 2.9%

- U. of Mich. 1 Yr Inflation, est. 5.0%, prior 5.0%

DB's Jim Reid concludes the overnight wrap

If ever we needed proof that the market is absolutely desperate for some good news on inflation, yesterday proved it in spades with the market moves up there with the most remarkable since the pandemic began thanks to a -0.2% miss in both headline and core inflation. Both measures missed by that much as recently as July so we have been here before not long ago, but one has to go back to August 2014 to find the last time both headline and core both missed by at least -0.2% before that.

Having said that it's still a long, long, long path ahead towards anything resembling normal inflation, but with monthly core CPI running at its slowest pace in over a year, investors immediately latched onto hopes that the Fed wouldn’t need to be as aggressive in raising rates, leading to a massive surge across all the major asset classes. For instance, yields on 2yr Treasuries (-24.7bps) saw their largest daily decline since 2008, the S&P 500 (+5.54%) had its best day since April 2020, and the dollar index (-2.12%) suffered its worst daily performance since 2015. So definitely one for the history books.

I don't think there is anything inconsistent in saying that markets continue to be set up for a rally (technicals, seasonals, better European near-term energy outlook etc.) while also thinking next year could ultimately be pretty bad. Back in April when we first said we thought the US would be in recession by the middle of 2023, the consensus expectation for CPI by Q4 2022 was 4.5%. The headline rate was still 7.7% yesterday. So our conviction remains the same.

Indeed, even with the surge in risk sentiment, the Fed’s preferred yield curve measure (18m3m – 3m) for predicting the cycle spectacularly entered inversion territory yesterday, falling -37.1bps to -13.7bps. When quizzed in the past about the veracity of 2s10s (my preferred yield curve signal), Chair Powell has deflected its recessionary signal, claiming it’s confounded with a number of other variables. Instead, the Fed’s preferred measure strips out the noise and sharply focuses on the near-term policy path, where inversion implies policy rate cuts due to recession. One wonders how he would respond now to questions on yesterday’s inversion.

When it comes to the full details of that report, monthly headline CPI surprised to the downside at +0.4% (vs. +0.6% expected), meaning that the year-on-year number ticked down to +7.7% (vs. +7.9% expected), thus continuing its descent from its June peak of +9.1%. What was even better from a market perspective was the deceleration in core CPI as well, where the monthly reading fell to +0.3% (vs. +0.5% expected). In fact, with core at +0.27% to two decimal places, that’s actually the slowest since September 2021, so an encouraging sign. And in turn, the year-on-year measure for core fell to +6.3% (vs. +6.5% expected), moving off its recent peak in September. One last piece of good news was that the decline in inflation was broad-based rather than being driven by outliers, and the Cleveland Fed’s trimmed mean measure saw its slowest monthly growth since April 2021 at +0.37%.

Even with an optimistic CPI report, Chair Powell has highlighted one of the most persistent sources of inflationary pressures would come from a too-hot labour market. There, yesterday, we got the Atlanta Fed wage growth tracker which showed still sturdy wage gains, with the 3m moving average of yoy wage growth increasing +0.1% to 6.4%. That’s below the 6.7% peak, but above every other print on record outside of recent data. So, progress will be long in coming, and won’t be helped if financial conditions exhibit large knee-jerk easing trends in response to any optimistic news.

For now though with inflation surprising on the downside, investors moved to dramatically reprice their expectations for Fed tightening over the months ahead. In the near term, futures raised the chances that the Fed will slow down the pace of rate hikes to 50bps next month, moving away from the jumbo 75bps pace of the last 4 meetings. Indeed, the amount of hikes priced for the December meeting came down -5.5bps on the day, leaving it at just 50.9bps now. Looking further out, the terminal rate priced for Q2 came down from 5.04% the previous day to 4.89%. And when it comes to end-2023, the rate priced in came down by an even larger -31.4bps to 4.38%, signalling that investors are becoming more confident about the odds of rate cuts as we move deeper into next year.

In response to the CPI release, Fed officials struck their usual cautious tone, with San Francisco Fed President Daly saying it was “far from a victory”, and Dallas Fed President Logan saying it was “a welcome relief, but there is still a long way to go”. And to be fair to them, annualised CPI inflation was still running at +5.4% in October, so there are grounds for caution in spite of the market optimism. Nevertheless, Logan validated market expectations that we’re about to see a downshift in rate hikes, saying that “I believe it may soon be appropriate to slow the pace of rate increases so we can better assess how financial and economic conditions are evolving”, although she also said she believes “a slower pace should not be taken to represent easier policy”. Philadelphia Fed President Harker struck a similar tone on slowing down, saying he expected they would “slow the pace of our rate hikes as we approach a sufficiently restrictive stance”.

As investors moved to expect a more dovish Fed over the coming months, Treasuries surged across the board, with the 2yr yield (-24.7bps) seeing its largest daily decline since 2008, to close at 4.33%. Those declines were driven by a mixture of lower real rates and inflation breakevens, and the 10yr yield (-28.0bps) also saw its biggest daily decline since March 2020 at the height of the pandemic. This sense that central banks were about to be more dovish was evident in Europe too, and downgraded expectations of future ECB tightening sent yields on 10yr bunds (-16.2bps), OATs (-19.0bps) and BTPs (-27.9bps) sharply lower as well.

Equities surged alongside bonds on the back of these hopes about a central bank pivot. In fact, the S&P 500 (+5.54%) had its best daily performance since April 2020, which for now makes this rally an even more aggressive version of the other 6 Fed pivot trades we’ve identified over the last 12 months. Every sector group advanced on the day, but the cyclicals strongly outperformed, and the NASDAQ (+7.35%) had its best performance since March 2020. Unsurprisingly, the FANG+ Index outperformed even more, given the sensitivity of underlying valuations in the index to discount rates, increasing +9.39%, its best day since March of this year. That coincided with a marked reduction in the VIX index of volatility, which fell -2.56pts to a 2-month low of 23.5pts. In Europe there was also a marked turnaround, with the STOXX 600 leaping from marginally positive territory just prior to the report to end the day up +2.75%.

Ironically we were seeing risk assets pretty nervous prior to CPI given all that was going on in the crypto space. The latest here was that Alameda Research, the hedge fund linked to FTX – the crypto exchange whose issues started this week’s crypto route – would be winding down, while there was back and forth about whether FTX would ultimately be rescued. However a soft CPI shunted this into the weeds as Bitcoin closed +13.20% at $17,808, notably above the low during the Asian session of $15,618.

Whilst risk parity was having a great day, there were some marked shifts in FX, where the dollar index (-2.12%) fell to its worst daily performance since 2015, slumping against every other G10 currency. The Japanese Yen was a particular outperformer, gaining +3.90% on the day versus the dollar, as was the British pound which strengthened +3.15% to levels not seen since before the government’s mini-budget. Those moves leave the dollar index at its lowest closing level since mid-August, before Fed Chair Powell delivered his hawkish speech at Jackson Hole.

This morning, equity markets in Asia are matching the upbeat mood, extending the overnight rally on Wall Street. Across the region, the Hang Seng (+7.06%) is leading gains with the Hang Seng Tech Index (+8.36%) echoing that outperformance we saw from US tech stocks, whilst other indices including the KOSPI (+3.36%), the Nikkei (+2.95%), the CSI (+2.86%) and the Shanghai Composite (+2.06%) are all noticeably higher. That was supported by the positive US inflation news, but there were also some developments on the Covid situation in China that bolstered sentiment, since they cut the quarantine time for inbound travellers to 8 days from 10, and also reduced the quarantine time for close contacts to 8 days as well, even as the total number of daily cases moved above 10,000 for the first time since April. Otherwise, US equity futures are pointing higher this morning, with those on the S&P 500 up +0.40%, and the Japanese Yen (-0.43%) has fallen back slightly against the US Dollar after its +3.90% rise in the previous session. That follows data showing that Japan’s producer prices inflation fell to +9.1% year-on-year in October (vs. +8.8% expected), marking the slowest pace of growth since January.

Turning to the midterm election results, we didn’t get much in the way of updates yesterday, and the question of which party ends up controlling each chamber in Congress remains unconfirmed. However, as was the case 24 hours ago, it continues to look as though the Democrats have the stronger chance in the Senate. Indeed, it’s possible that the Democrats hit the 50-mark before the Georgia runoff on December 6 if they can win the two other races in Nevada and Arizona. Meanwhile in the House, the Republicans continue to have the edge, since although they’re not at the 218-majority mark just yet, they’re leading in enough of the outstanding districts to give them a narrow majority as it stands.

Back in Europe, our research colleagues in Frankfurt published their latest gas supply monitor yesterday, where they see an increased likelihood that Germany will be able to avoid rationing this winter. The key risk factors to that are a cold winter spell or pipeline disruptions that affect gas demand and supply respectively. It also looks forward to the EU energy ministers’ meeting on November 24, and points out that the EU Commission could present elements of its gas price cap proposal as early as today for a meeting of EU ambassadors, which is unlikely to include a hard cap but could still pave the way for a compromise. You can see the full report here.

Looking at yesterday’s other data releases, the US weekly initial jobless claims rose to 225k (vs. 220k expected) in the week ending November 5, which leaves the 4-week moving average at 218.75k (vs. 219k previously).

To the day ahead now, and data releases include the University of Michigan’s preliminary consumer sentiment index for November in the US, along with the UK’s GDP reading for Q3. From central banks, speakers will include the ECB’s Vice President de Guindos, Holzmann, Panetta, Lane, de Cos, Centeno and Nagel, along with the BoE’s Haskel and Tenreyro. Finally, the EU Commission will be releasing their latest economic forecasts.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges