Government

Futures Drifts As Gold Soars

Futures Drifts As Gold Soars

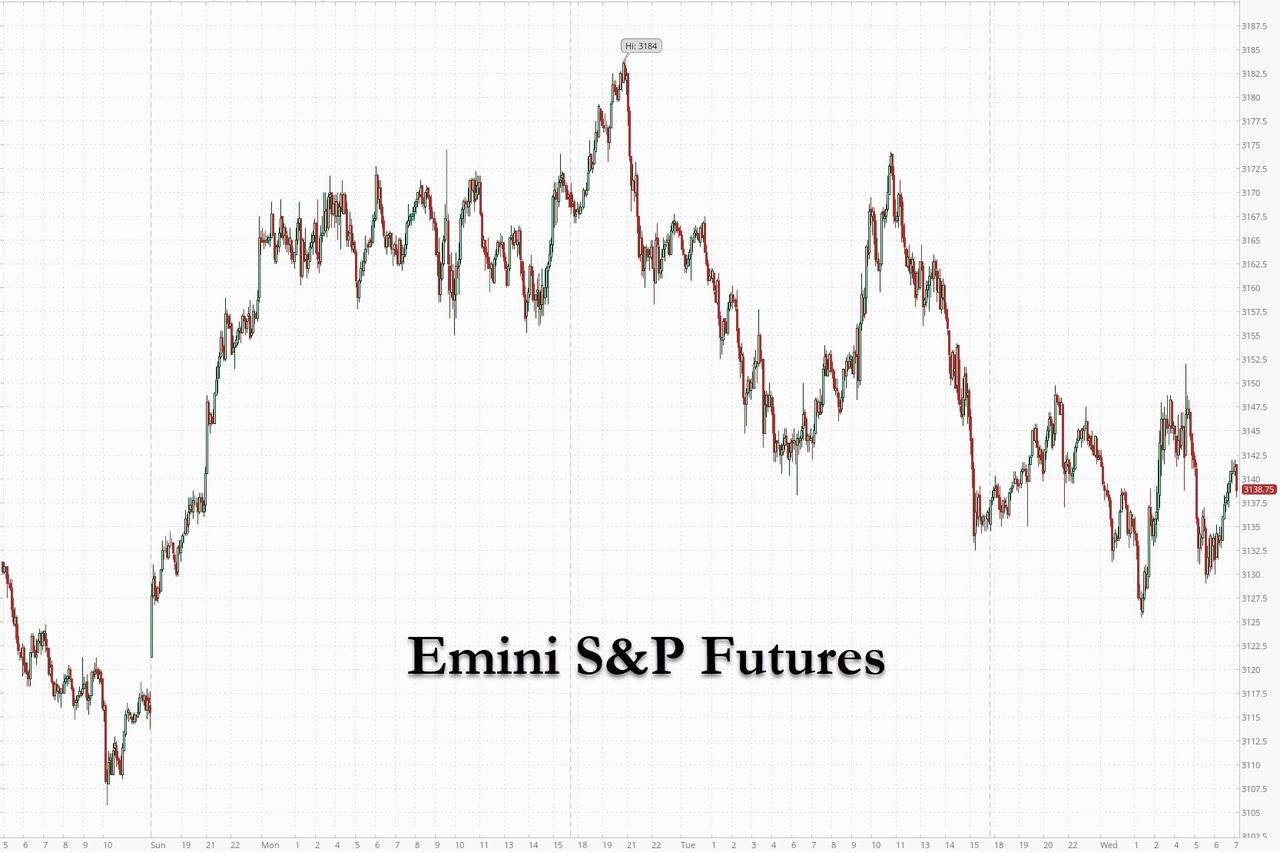

S&P futures traded in a narrow range even as European stocks slid amid new tensions between Washington and Beijing, as well as worries that an alarming rise in coronavirus caseloads across the country pose a risk to the recovery in business activity and will hit consumer spending. The dollar was flat as gold continued its surge, rising above $1,800 and rapidly approaching its Sept 2011 all time high.

Global markets have been struggling for traction ever since the Fed's balance sheet started shrinking modestly in mid-June...

... after a sharp rally last week amid concern it’ll take a long time for the broader economy to recover from the pandemic. Many Americans are planning to spend less on things like movies, event tickets or at bars, even as states allow businesses to start re-opening, according to Bloomberg.

On Tuesday the Nasdaq notched yet another intraday record high but all the three main stock indexes finished lower as investors booked profits following a strong run after a batch of upbeat data strengthened the case for a bounce back in economy.

European shares gave up gains early in the trading session after Hungarian Prime Minister Viktor Orban said regional leaders will probably fail to agree on a massive spending plan aimed at reviving their economies. Negotiations at a summit next week will be "very tough" and will likely need to continue throughout the summer, he said.

“It’s not unusual for stocks to take a breather at this point,” Susan Schmidt, a portfolio manager at Aviva Investors, said on Bloomberg TV. “We could see ourselves in a bit of a trading range in the next couple of weeks,” before U.S. earnings season ramps up.

Asian stocks were little changed, with communications rising and industrials falling, after falling in the last session. Most markets in the region were up, with Jakarta Composite gaining 1.8% and the Shanghai Composite rising 1.7%, its seventh daily rise in a row to the highest level since the 2018 start of the U.S.-China trade war, with Nanjing Iron & Steel and Jilin Yatai posting the biggest advances.

Trading volume for MSCI Asia Pacific Index members was 69% above the monthly average for this time of the day. The Topix declined 0.9%, with Teac and Airtech Japan falling the most. Australia's S&P/ASX 200 dropped 1.5%. Emerging-market equities resumed gains, heading for the highest level since February.

China stocks rose even as HSBC Holdings slumped after a report that some of Donald Trump’s advisers proposed a move to destabilize Hong Kong’s currency peg to the dollar as a way of punishing China.

Meanwhile, China on Wednesday said it will restrict visas for U.S. officials for what it called “egregious” behavior over Tibet, reciprocating a move announced by Secretary of State Michael Pompeo a day earlier.

Eastern European currencies weakened, while gains for the Mexican peso and South African rand limited losses on the MSCI Inc.’s gauge for emerging-market exchange rates. Stock market gains in China have even pushed the country’s financial publications to caution investors about overheating. But as The Trump administration is said to be considering options to punish China for recent moves to chip away at Hong Kong’s political freedoms, markets “appear to be learning to look past the noise,” according to Credit Agricole’s Eddie Cheung. “While valuations would suggest that there is ground for China’s markets to continue to rally, it remains to be seen whether that alone can continue to be a driving force regionally, especially with Western markets trading more tentatively,” the Hong Kong-based strategist said in note.

In rates, Treasuries were slightly weaker across the curve on low volumes, with long-end yields higher by 1bp and front end little changed. Price action creates small concession in 7- to 10-year sector for $29b 10-year note auction at 1pm ET that may draw a record low yield. Treasury 10-year yields hover around 0.65% ahead of auction, steepening 2s10s by 0.8bp; bunds outperform by 3.5bp vs. Treasuries, gilts by 2.5bp. Futures volumes as of 7am ET were 70% to 90% of 20-day average levels across the curve, Bloomberg reported. German Bunds bull-flattened, outperforming Treasuries.

In FX, the dollar erased a decline as investors measured signs of renewed political tension between the U.S. and China. Hong Kong’s Dollar remained at the strong end of its established trading range after a report that advisers to President Trump suggested undermining the currency’s peg to the greenback after Beijing’s moves to curb the island’s political freedoms. Australia’s dollar weakened against all of its Group-of-10 peers after rising infection rates in the nation’s second-most populous state and S&P Global Ratings warned that the return to lockdown in Victoria would put pressure on its economic recovery. “From an economic point of view, this is potentially disastrous,” said Michael McCarthy, chief market strategist with CMC Markets Asia Pacific. "Forex traders are certainly expressing their growth outlook worries by selling the Aussie, and we’re likely to see support for the havens like the dollar, yen and Swiss franc."

In commodities, the biggest mover was once again gold, which continues its tremendous ascent, topping $1,800 an ounce, with silver needing to catch up.

Upside in WTI and Brent front month contracts were hampered by a surprise build in private inventories (crude stocks +2mln vs. Exp. -3.1mln), and the relevant headlines overnight were also on the bearish side with ADNOC set to boost oil exports next month and Total’s Port Arthur refinery said to be running at 60% capacity due to subdued demand.

Looking at the day ahead now, we have central bank speakers including ECB Vice President de Guindos and the Fed’s Bostic, while data releases from the US include consumer credit for May and the weekly MBA mortgage applications.

Market Snapshot

- S&P 500 futures up 0.2% to 3,143.25

- STOXX Europe 600 down 0.3% to 367.88

- MXAP up 0.07% to 164.44

- MXAPJ up 0.5% to 544.63

- Nikkei down 0.8% to 22,438.65

- Topix down 0.9% to 1,557.23

- Hang Seng Index up 0.6% to 26,129.18

- Shanghai Composite up 1.7% to 3,403.44

- Sensex up 0.04% to 36,687.46

- Australia S&P/ASX 200 down 1.5% to 5,920.30

- Kospi down 0.2% to 2,158.88

- German 10Y yield fell 1.6 bps to -0.445%

- Euro up 0.1% to $1.1286

- Italian 10Y yield fell 3.6 bps to 1.077%

- Spanish 10Y yield fell 1.0 bps to 0.415%

- Brent futures down 0.2% to $43/bbl

- Gold spot up 0.2% to $1,797.93

- U.S. Dollar Index up 0.1% to 97

Top Overnight News

- Some top advisers to President Donald Trump want the U.S. to undermine the Hong Kong dollar’s peg to the U.S. dollar as the administration considers options to punish China for the recent imposition of a security law in the former British colony.

- The threat of U.S. action to undermine Hong Kong’s longstanding U.S. dollar peg is highly unlikely to become reality given the practical difficulties of pursing such a path and the damage it would do to U.S. interests, economists say.

- HSBC Holdings Plc, which draws more than two-thirds of its pretax income from Hong Kong, slumped as advisers to U.S. President Donald Trump were also said to be discussing measures against banks there.

- Boris Johnson warned Germany’s Angela Merkel that the U.K. is ready to do without a trade deal if the European Union wasn’t prepared to compromise.

- Japan’s investors are flocking to Australia’s sovereign bond market, lured by cheaper currency-hedging costs and some of the highest yields among developed nations.

Asian equity markets were mixed as attempts to shrug off the weak handover from global peers were somewhat hindered by the record infection rates stateside and a slew of punchy US-China related headlines. ASX 200 (-1.5%) was subdued as Australia’s 2nd largest city heads into a 6-week lockdown and with the declines in the index led by notable losses in consumer stocks and financials, while Nikkei 225 (-0.8%) was pressured by the ongoing virus flare up in Tokyo where more than 100 new cases were reported for a 6th consecutive day, but with downside stemmed after data showed the largest increase in bank lending on record. Hang Seng (+0.6%) and Shanghai Comp. (+0.7%) were supported as the latest coronavirus updates from Beijing showed zero new cases for a 2nd consecutive day although caution was also observed on the inauguration day of China’s national security office in Hong Kong and as reports continued to suggest increasing tensions between the world’s largest economies. This includes confirmation by US President Trump that he is looking at banning TikTok in the US and his administration also warned the Railroad Retirement Fund against Chinese investments due to risks of additional sanctions, while the White House is considering executive actions which involve targeting Chinese businesses operating in the US and aides were also said to propose undermining the USD/HKD peg although this was not put forward to President Trump and certain officials have opposed the idea. Finally, 10yr JGBs were initially copy as they conformed to the unsettled overnight tone across asset classes, but eventually edged only marginal gains amid a subdued risk tone in Tokyo and the BoJ’s presence in the market for JPY 870bln of government bonds with up to 5yr maturities.

Top Asian News

- AirAsia Is Said to Weigh Raising $234 Million Via Rights Issue

- Itochu Makes $5.4 Billion Bid for Rest of Japan’s FamilyMart

- Hong Kong’s Resilient Markets Just Knocked Down Another Big Test

- Singapore in Survival Mode Looks to Reinvent Itself. Again

European stock markets initially attempted to nurse losses seen at the open before losing steam as the mid-week session goes underway [Euro Stoxx 50 -0.9%], following on from a mixed APAC lead overnight. Fresh fundamental newsflow has been light for the session, with the calendar also sparse, albeit key risk events, aside from COVID-19 US-China headlines, could include UK Chancellor Sunak’s fiscal unveiling alongside the European Commission’s potential compromise recovery fund proposal. Sectors are all in negative territory with a clear defensive bias, with the detailed breakdown also painting a similar picture. Financial names underperform, likely on the back of HSBC (-4.0%) amid reports President Trump’s aides were said to propose undermining the USD/HKD peg, although the idea had not been put forward to President Trump and certain officials opposed the idea. In terms of other individual movers, Nokia (-7.5%) shares extend on losses amid a negative broker move coupled with speculation that Verizon may be dropping the Co. as a 5G partner, Nokia stated that it continues working with Verizon amidst these reports. On the flip side, Deutsche Post (+0.8%) remains buoyed after reporting an improvement in Q2 prelim figures whilst noting FY22 EBIT in the least favourable case of EUR 4.7bln and the most favourable case in excess of EUR 5.3bln.

Top European News

- Serbia’s Vucic Sees Rising Risk of Regional Conflict in Europe

- Volkswagen Management Tumult Spills Over to Truck Subsidiary

- Medtronic Is Said to Make Offer for Medical Device Maker Intersect

- Analysts Applaud Deutsche Post Earnings, Dividend Proposal

In FX, the Dollar and its G10 currency counterparts are stuck in a rut after 2 volatile sessions, but ultimately no clear direction amidst fluctuating and flaky risk sentiment on coronavirus updates interspersed with economic data and surveys supporting the recovery from first wave pandemic lows. Major pairings are muted and the subdued state of affairs exemplified by the DXY showing little sign or inclination to stray too far either side of the 97.000 level that has been magnetic of late. Moreover, Wednesday’s agenda does not bode well in terms of market-moving potential, barring any surprises from UK Chancellor Sunak and/or an unscheduled event given a blank US agenda beyond weekly mortgage applications and then consumer credit.

- CHF/EUR/CAD - All marginally firmer against the Greenback, but within relatively tight confines as noted above, as the Franc hovers just below 0.9400, Euro shy of 1.1300 where a hefty 1.9 bn option expiry resides and Loonie pivots 1.3600 ahead of Canadian housing starts and an update from Finance minister Morneau on the economy in context of measures taken to combat COVID-19.

- JPY/XAU/NZD/GBP/AUD - The Yen remains tethered between 107.70-40 parameters with a light underlying bid that is also apparent in Gold as bullion continues its assault on Usd 1800/oz, while the Kiwi is still straddling 0.6550 and fractionally outpacing the Aussie around 1.0600 in cross terms due to the return to lockdown in Melbourne. As such, Aud/Usd is capped circa 0.6950 in similar vein to Cable on the 1.2550 axis in advance of the aforementioned Economic Update. Note, contacts are touting stops at 1.2530 that are currently being tested and could be filled in conjunction with the absorption of offers in Eur/Gbp close to 0.9000.

- SCANDI/EM - Not much lasting reaction to weaker than forecast Norwegian GDP data hot on the heels of a drop in manufacturing output yesterday, with Eur/Nok flitting either side of 10.7000 and Eur/Sek likewise around 10.4300. However, more pronounced activity in the Hkd overnight following reports that the US may target the peg in response to China’s security legislation with the HKMA forced into concerted intervention.

In commodities, a choppy session thus far for the crude complex, albeit prices remain somewhat flat and within tight ranges amid a lack of notable catalysts. Overnight, upside in WTI and Brent front month contracts were hampered by a surprise build in private inventories (crude stocks +2mln vs. Exp. -3.1mln), while the relevant headlines overnight were also on the bearish side with ADNOC set to boost oil exports next month and Total’s Port Arthur refinery said to be running at 60% capacity due to subdued demand. On the flip side, EIA lifted 2020 world oil demand growth forecast by 190k BPD (to 8.15mln BPD Y/Y fall) but cut 2021 world oil demand growth view by 190k BPD (to 6.99mln BPD Y/Y increase) – with participants awaiting the IEA report on Friday. Looking ahead, aside from COVID-19 headlines and sentiment-driven moves, the complex will likely eye the weekly DoE release for confirmation of the Private Inventory data, whilst State-side production will also be in focus as some believe output has bottomed. Elsewhere, spot gold has extended on gains but has decoupled from its safe-haven status, whilst Dollar dynamics also provided little influence on prices. The yellow metal has eclipsed the 1800/oz mark for the first time since 2012 before immediately running into selling pressure at the key figure. Copper meanwhile briefly topped USD 2.8/lb to levels last seen in January amid supply woes coupled with hopes of a rebounding Chinese economy.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -1.8%

- 3pm: Consumer Credit, est. $15.0b deficit, prior $68.8b deficit

DB's Jim Reid concludes the overnight wrap

Yesterday I boasted about nearly 5 year old Maisie winning a race at Sports Day. I’ve since got the video from the school and I must admit if I was another parent I would be questioning whether she false started. Put kindly she anticipated the “B” of the Bang a bit too perfectly. Still a victory is a victory. On that the latest in my 15 month journey to remodel my golf swing left me finishing 3rd last in the first cup competition at my club after lockdown on Sunday. It was my worst round since I was 11. You may say that at least I wasn’t last. However I should add that the two below me were octogenarians who were only too delighted to be out after isolating during lockdown. Meanwhile I’ve been practising hard most evenings where I can. I have a heart to heart planned with my golf coach tomorrow night to see if there is any light at the end of the tunnel. He says I’m on the verge of a major breakthrough. I feel I’m on the edge of a breakdown.

Markets broke down yesterday, albeit nowhere near as much as my golf swing. A drip-feed of negative stories on the economic outlook as well as covid headlines from all around the world dampened investor sentiment. By the end of the session, the S&P 500 had fallen -1.08%, and unable to reach a 6th successive move higher which would have been a first since April 2019. Over 85% of the index was lower on the day, with the worst performing industries being energy (-3.18%) and banks (-3.16%). Tech stocks outperformed slightly, with the NASDAQ down -0.86%. The Dow Jones was the worst performer, down -1.51% (Boeing -4.8% and Goldman Sachs -3.9%). Bourses also fell across Europe with the STOXX 600 (-0.61%) and DAX (-0.92%) lower. Just like with the S&P, European banks were among the worst performers, with the STOXX Banks index down by -1.34%.

Markets in Asia are a bit more mixed this morning. While we’ve seen modest declines for the Nikkei (-0.24%), Kospi (-0.29%) and ASX (-0.61%), the Shanghai Comp (+0.74%) and Hang Seng (+0.34%) are up along with S&P 500 futures (+0.20%). The main talking point overnight has been a Bloomberg story suggesting that some top advisers in the Trump administration are weighing proposals to undermine Hong Kong’s dollar peg to the greenback as a way of penalizing China. However, the report added that the idea has not been pitched to senior levels of the White House which suggests that it hasn’t gained serious traction yet.

Back to yesterday and after Senate Majority Leader McConnell signalled a willingness to pass another stimulus bill with case numbers rising across the country, the White House announced they want the package by the first week of August. Vice President Pence’s top aide said, “we want to make sure that people that are still unemployed or hurting are protected but at the same time, we want to take into consideration the fact the economy is bouncing back and want to try to contain the amount of spending.” This is aligned with Senate Republicans who want to keep the overall price tag south of $1 trillion. President Trump said that there would be another round of stimulus checks for Americans, though it will likely be even more targeted this time around. With some states pausing reopening and even re-entering shutdowns, additional stimulus is likely needed in order for economic data to continue improving.

Meanwhile, the slowdown in reopenings continues to be driven by the US seeing high numbers of new cases. Texas had over 10,000 new cases in one day for the first time yesterday, with cases rising 5% compared to a weekly average of 3.9%. Daily increases in some other recent hot spots were below the weekly average, which while encouraging may still be experiencing after-effects of the holiday weekend. Florida reported a 3.6% rise in new cases, under the 5% 7-day average, however the 7-day rolling total of 61,360 cases was the highest yet. Fatalities rose by 1.7%, with the 7-day average at just under 48 per day. Arizona meanwhile recorded a record 98 new fatalities yesterday, however the data has clearly seen big lags on Sunday and Monday in the past. Overall the 7 day average of covid fatalities in the state is roughly 40 per day, while cases are rising by just under 3700 per day. When New York state was at 3700 and 8700 (similar to Florida now), it was seeing around 85 and 630 deaths per day, and so both Arizona and especially Florida are seeing better case fatality rates at this time. However, this could change and requires a high level of scrutiny as hospital conditions and capacity constraints are going to be different in different regions. Speaking of New York, the state continues to add more regions to its quarantine list, which is now 19 states long, with Delaware, Kansas and Oklahoma travellers all being asked to isolate for 14 days upon arriving. Overnight, the US Department of Health and Human Services has said that it is ramping up coronavirus testing in Louisiana, Texas and Florida as health officials attempt to get a firm grasp on how the fast-moving pandemic is evolving.

For more details on the current US virus outbreak and what it could mean for upcoming policy decisions, you can join a conference call today at 11:00 EDT/16:00 UK time hosted by our chief US economist Matt Luzzetti. He will be joined by two guest speakers to discuss the outlook for health policy and small businesses. You can find the full details here.

Back to markets and it’s fair to say that the huge pre-covid momentum into ESG was temporarily sidetracked by the pandemic. However this is undoubtedly a multi-year trend and there are signs the topic is springing back to life. Here at Deutsche Bank Research we have launched dbSustainability, a new offering with research reports focused on sustainability issues and spanning thematic, macro, quantitative and individual company analysis. Recent reports include; ‘ESG through the pandemic’. Luke Templeman, Thematic Research (link to report and video), ‘Decarbonisation: Can Mining & Steel sustain in a low carbon world?’ from Head of European Mining And Metals, Liam Fitzpatrick (link to report) and from Juliana Lee, Chief Economist, Asia, ‘Asia Thematic Analysis:Households' ESG action’ (link to report). We will continue to put out research under this banner so best to let Luke.Templeman@db.com on my team know if you want to be added to any future reports. He is on hols but he’ll pick up and add you on Monday.

In terms of those economic stories we alluded to earlier, we firstly had some underwhelming numbers on German industrial production, which saw just a +7.8% increase in May. This was lower than the +11.1% rebound expected and still leaves IP -19.3% below its levels a year earlier. Furthermore, it comes just a day after some worse-than-expected data on factory orders, adding to fears that the German recovery won’t be as rapid as hoped for. Next, we had the European Commission’s summer economic forecasts, which revised down their economic forecasts for Euro Area growth both this year and next. They now see the economy contracting by -8.7% this year compared with -7.7% before back in May. And 2021 growth was revised down two-tenths to +6.1%. And finally, we had a warning from Atlanta Fed President Bostic in the FT yesterday, who said that the high-frequency data had pointed to a “levelling off” in activity. We also heard from the Fed’s Vice Chairman Clarida later who said that the Fed can turn to additional forward guidance and asset purchases if the economy needs more aid and Cleveland Fed President Loretta Mester said that “If we don’t get further fiscal support, things won’t come back as well as they could” while adding, with disruption from the virus lasting longer than expected, “this is a period where we need to be supporting both individuals and businesses who but for the pandemic would have been healthy.”

Given this negative newsflow yesterday, safe havens performed relatively strongly, and gold hit another milestone as it closed above its 2012 peak to reach an 8-year high of $1795/oz. Other metals performed reasonably well too, with copper up +0.78% to advance for a 6th successive session. Over in fixed income, there was clear differentiation in core sovereign bonds, with yields on 10yr Treasuries down -3.6bps and those on bunds up +0.2bps. However that mostly reflected a post European close rally for USTs. There was a further narrowing in peripheral spreads however, with yields on Italian 10yr debt over bunds falling by -3.8bps to 163bps, their tightest level since late March, and Greek spreads down -3.7bps to their tightest since late February.

Here in the UK, sterling was the strongest performing of the G10 currencies yesterday, as it strengthened by +0.46% against the US dollar. It comes ahead of Chancellor Sunak’s much-awaited “Summer Economic Update” before the House of Commons today, in which he’s expected to announce a package of measures to aid the economic recovery. We’ve already had some announcements in recent days, with Prime Minister Johnson announcing last week that £5bn of capital investment projects would be brought forward, as well as a subsequent £1.57bn package for the arts. Our UK economists’ base case is that Sunak will broadly stick to the mandate set out by PM Johnson last week, possibly topping up the package by another 0.2% of GDP, focusing particularly on apprenticeship schemes, and modest wage subsidies to get furloughed employees back into work. There’s certainly been a fair amount of speculation in the media as to what to expect, including reports that a Stamp Duty holiday could be announced on homes under £500k.

Elsewhere in Europe, we heard from ECB Executive Board member Schnabel, who said in an interview that positive confidence indicators “suggests that the recession could turn out somewhat milder than expected”. She also waded in to the debate on the EU recovery fund, saying to the Dutch newspaper NRC Handelsblad that “If most of the fund is made up of loans, this could create a public debt overhang after the crisis. That could then cause problems of its own.” It comes ahead of the summit of EU leaders in just over a week, which is scheduled to begin on 17 July.

There wasn’t a great deal of other data yesterday, though the number of job openings in the US unexpectedly increased in May to 5.397m (vs. 4.5m expected), while the number of hirings rose to a record high of 6.487m. Furthermore, in a sign of the labour market recovery, the quits rate of voluntary separations that generally correlates with economic strength ticked up to 1.6% from 1.4% the previous month, even if it still remained some way down from the 2.3% recorded in February. Our US Economist Matt Luzzetti noted that private quits rate is a good leading indicator for wage growth and it remained low at 1.8%, down from a 2.6% peak late last year. This indicated that there could be a collapse in wage growth in the coming months. The ratio of unemployed people per job opening remained elevated in May, with 3.9 unemployed per job opening. This compares to a sub-1.0 figures late last year, however it is well below GFC levels of over 6.0. Lastly, he noted that change in job openings can proxy for employment data and that doing so would suggest that job loss was much more extreme in March, less extreme in April, and not as robust in May, with 2.4m jobs created vs the NFP tally of 3.2m.

To the day ahead now, and one of the highlights will be the previously mentioned UK economic statement from Chancellor Sunak. Central bank speakers today include ECB Vice President de Guindos and the Fed’s Bostic, while data releases from the US include consumer credit for May and the weekly MBA mortgage applications.

Government

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex