Futures Crater As Fedex Ushers In The Global Recession On $3.2 Trillion Triple Witch Day

Futures Crater As Fedex Ushers In The Global Recession On $3.2 Trillion Triple Witch Day

Another day, another selloff, this time one driven…

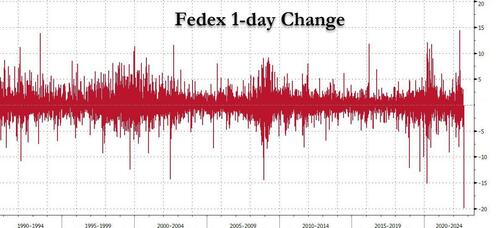

Another day, another selloff, this time one driven by a catastrophic repricing by Fedex, which has plunged by the most ever this morning, down 20% and losing over $11BN in market cap...

... after pulling guidance and effectively warning that the entire world - and especially China - is in a recession. The fact that it is a $3.2 trillion opex today which guarantees even more volatility in the coming weeks...

... or that buyback blackout period begins today probably isn't helping, and sure enough, we end the week in a mirror image to how we started it, with equities extending declines with an index of global stocks on track for the worst week since June, while the dollar continued its relentless ascent, trading back to all time highs. S&P futures were down 0.8% at 730am, dropping to the lowest level in 2 months, while Nasdaq 100 lost more than 1%, as Europe headed for a fourth day of losses, and Asian was a sea of red led by China.

In premarket trading, besides the implosion in Fedex, Uber shares slid 5.3% in US premarket trading after the ride-hailing company said it has shut down internal Slack messaging as it investigates a cybersecurity breach. Bank stocks are also lower alongside S&P 500 futures, while the US 10-year Treasury yield advances. In corporate news, Credit Suisse’s securitized products group has drawn interest from Apollo Global Management and BNP Paribas, according to people with knowledge of the matter. Here are some other big premarket movers:

- FedEx (FDX US) shares plunged 20% in US premarket trading after the package delivery giant pulled its fiscal 2023 earnings forecast, triggering a raft of downgrades from analysts, including at KeyBanc and JPMorgan. Amazon (AMZN US) and UPS (UPS US) also fell.

- Adobe (ADBE US) shares fall another 2.3% in premarket trading, one day after its market value shrunk by $29.5 billion on an announcement to buy software design startup Figma. More analysts slashed ratings and price targets.

- Cryptocurrency- exposed stocks are likely to be active on Friday with Bitcoin dropping below $19,800 after SEC Chair Gary Gensler signaled that a feature of the network’s software could lead to tokens being considered securities by the commission.

- In the US premarket trading hours, Marathon Digital (MARA US) -3.2%, Coinbase (COIN US) -2.0%, Riot Blockchain (RIOT US) -3.4%

- Watch Alcoa (AA US) as Morgan Stanley upgrades the stock and several peers, noting that value begins to show within Americas metals and mining shares, but cautioning that uncertainty remains.

- International Paper (IP US) slides 5.6% in US premarket trading after Jefferies downgraded the stock as well as shares in Packaging Corp of America (PKG US) to underperform in reflection of the “massive inventory glut in containerboard.” The broker stays at hold for Westrock (WRK US), noting that valuation is already depressed.

Policy-sensitive two-year Treasury yields extended a rise to the highest since 2007, deepening the curve inversion that’s seen as a recession signal. The latest US economic data painted a mixed picture for the economy that backed the view for hawkish monetary policy. Swaps traders are pricing in a 75 basis-point hike when the Federal Reserve meets next week, with some wagers appearing for a full-point move.

“Everything points to another 75 basis-point rate hike by the Fed when it meets next week. The likelihood that it will have to go ‘big’ again in November is elevated, too,” said Raphael Olszyna-Marzys, an economist at Bank J Safra Sarasin. “What’s more, its new projections should indicate that the fight against inflation will be more painful than previously acknowledged.”

Market participants will face additional volatility on Friday from the quarterly expiry event known as triple witching, with contracts for stock index futures, stock index options and stock options all expiring, while re-balancing of major equity indexes also takes place.

In Europe, the Stoxx 50 slumped 1.4%, headed for a 4th day of losses. The FTSE 100 is flat but outperforms peers, DAX lags, dropping 1.7%. Industrials, construction and autos are the worst-performing sectors as are mining stocks which as iron ore slid amid concerns over demand in China, while aluminum fell on the back of record Chinese output. European mail and parcel delivery companies took a hit in the aftermath of the Fedex warning, led by Deutsche Post AG, down as much as 7.6%. The UK’s benchmark outperformed as the British pound sank to its weakest level against the dollar since 1985.

All industry groups are in the red. Here are the biggest European movers:

- Jupiter Fund Management jumps as much as 4.2% after being upgraded to neutral at UBS. Separately, the FT reported that the new CEO will restructure the company after an operational review

- Krones rises as much as 1.6% on Friday, with Baader Helvea saying the company showed “huge confidence” during recent capital markets day at the Drinktec trade fair in Munich

- Ariston shares soar as much as 11%, the most intraday since March 14, after the company agreed to buy 100% of Centrotec Climate Systems for EU703m in cash and ~41.42m Ariston shares

- Capita shares rise as much as 9.3% amid a contract extension with Barnet Council and the sale of subsidiary Pay360 for GBP150 million to Access PaySuite

- UK and EU real estate shares slip after both Goldman Sachs and JPMorgan published bearish reviews of the sector. Land Securities falls as much as 5.1% in London after being cut to sell at Goldman

- European mail and parcel delivery companies take a hit, led by Deutsche Post, down to July 2020 lows, after US peer FedEx withdrew its earnings forecast on worsening business conditions

- Mining stocks are among the biggest underperformers in Europe on Friday as iron ore slid amid concerns over demand in China, while aluminum fell on the back of record Chinese output

- Telecom Italia shares drop to a record low after Barclays cut the carrier to underweight from equal-weight, citing a more complex investment case amid political uncertainties in Italy

- Uniper plunges to its lowest level on record, with shares down as much as 16%, after people familiar with the matter said Germany is in advanced talks to take it over

- Virbac falls as much as 10% after the French veterinary-products company reported 1H results that showed inflation is weighing on profit margins

Earlier in the session, Asian stocks headed for a fifth-straight weekly decline as markets remained volatile ahead of the Federal Reserve’s interest-rate decision next week, with the Xi-Putin meeting adding renewed geopolitical concerns. Stocks slumped in Japan, Hong Kong and mainland China, with little impact on sentiment from Chinese industrial-production and retail-sales data that beat expectations. The MSCI Asia Pacific Index fell as much as 1.3% on Friday, following weakness in US shares, led by technology and consumer discretionary stocks. China’s CSI 300 Index slumped the most in more than four months as the yuan weakened past 7 per dollar, offsetting upbeat August economic data, with the government ramping up stimulus to counter a slowdown. Russia’s President Vladimir Putin met with Chinese leader Xi Jinping for the first time since the war in Ukraine began, underscoring increasing risks as Beijing continues to show support for Moscow.

The Covid-Zero policy in China, a property crisis and the outcome of a US audit inspection will “keep the market in a relatively volatile state,” Laura Wang, chief China equity strategist at Morgan Stanley, said in a Bloomberg TV interview. The brokerage expects earnings growth for mainland companies “to decline to around mid-single digit” from Covid resurgence and lockdowns. India and Australia were among the region’s worst performers. Losses accelerated in afternoon trading as the dollar strengthened. Asian equities suffered a tumultuous week, falling more than 2% as risk assets took a hit from faster-than-expected US inflation, which fueled expectations for more aggressive monetary tightening by the Fed. A strong dollar and higher Treasury yields added to the headwinds. The regional stock benchmark is edging toward its lowest close since May 2020.

Japanese stocks declined as concerns of a potential global economic slowdown and higher US interest rates damped demand for risk. The Topix fell 0.6% to 1,938.56 as of the market close in Tokyo, while the Nikkei 225 declined 1.1% to 27,567.65. Keyence Corp. contributed the most to the Topix’s loss, decreasing 3.8%. Out of 2,169 stocks in the index, 589 rose and 1,501 fell, while 79 were unchanged. “The US interest rate hike will probably be 0.75 point, but there is still a strong sense of uncertainty about future hikes,” said Takeru Ogihara, a chief strategist at Asset Management One. Summers Expects Fed to Raise Rates Above 4.3% to Curb Inflation

The index for developing-nation equities fell to its lowest level in more than two years on Friday. A three-day slide has shaved $422 billion off MSCI’s EM stock index. The gauge fell as much as 1.5%, led by health care stocks. The EM equity gauge is down 5.5% this quarter, on track for a fifth consecutive drop, a record since Bloomberg began monitoring the data.

In FX, the Bloomberg Dollar Spot Index rose as the greenback strengthened against all of its Group-of-10 peers apart from the yen which is marginally up, trading at the 143/USD level. Pound at 1.13/USD, the lowest since 1985, underperforming G-10 peers.

- The euro fell a first day in three, trading once again below parity against the dollar. Bunds, Italian bonds slid, putting their 10-year yields on course to climb for a seventh week as traders continued to amp up ECB tightening bets, pricing as much as 200bps of rate hikes by July. The euro volatility skew shifts higher this week and especially on longer tenors, suggesting that bearish sentiment wanes. This seems to be down to demand for topside strikes and not unwinding of shorts given move in the tails

- The pound was the worst G-10 performer and fell below $1.14 for the first time since 1985. UK retail sales fell at the sharpest pace in eight months in August as a worsening cost-of-living crisis and plunging confidence forced consumers to cut back on spending. The 1.6% drop was more than three times the decline predicted by economists. Monday is a national bank holiday in the UK

- The Australian dollar tumbled to the lowest level since the early days of the Covid pandemic as risk aversion swept across markets. Three-year yield touched as high as 3.44% after National Bank of Australia raised its forecast to a 50bps hike in October. Reserve Bank of Australia Governor Philip Lowe said a few hikes would be needed to tame inflation, though the case for outsized interest-rate increases has “diminished” now that the cash rate is approaching “more normal settings”

- Japan’s longer-maturity bonds extended declines after Thursday’s weak 20-year auction. Japanese markets will be shut Monday and Friday next week for national holidays

Meanwhile, the offshore yuan remained on the weaker side of 7 to the dollar, even as the People’s Bank of China set the reference rate for the currency stronger-than-forecast for a 17th straight day. “While China activity showed some improvement this morning, equity investors really want to see substantial easing in China’s policies related to Covid to turn a bit more constructive,” said Chetan Seth, Asia-Pacific equity strategist at Nomura Holdings Inc. in Singapore. “That has not happened.”

In rates, the 10Y Treasury yield up 3bps to around 3.47%, gilts 10-year yield is flat at 3.16%, while bunds 10-year is also up 0.2bps at 1.79%. Treasuries remained lower after a bund-led selloff during European morning, with losses led by front-end of the curve as 2-year yields exceed Thursday’s highs, peaking near 3.92%. Further out, 5s30s breached Thursday’s low (reaching -21.1bp) to reach most inverted level since 2000. Yields are cheaper by more than 3bp across front-end of the curve with 2s10s spread flatter by ~2bp on the day; 10-year yields around 3.47%, trading broadly in line with bunds while gilts outperform by 2.5bp in the sector. US curve flattening persists as Fed rate expectations continue to grind higher; OIS markets price in a peak policy rate of around 4.5% for March 2023

In commodities, WTI and Brent are oscillating around the unchanged mark with the complex initially under pressure from the overall risk aversion. Kazakhstan energy ministry expects to stick to its oil production plans of 85.5mln tonnes this year; says Kashagan oilfield will resume output "in October at best." Spot gold is flat after the yellow metal took out the 2021 low (USD 1,676/oz) yesterday with clean air seen below until the COVID low of USD 1,450/oz.

Bitcoin is flat around USD 19,750 whilst Ethereum remains pressured under USD 1,500.

To the day ahead now, and data releases from the US include the University of Michigan’s preliminary consumer sentiment index for September, as well as UK retail sales for August. Meanwhile from central banks, we’ll hear from ECB’s President Lagarde, as well as the ECB’s Rehn and Villeroy.

Market Snapshot

- S&P 500 futures down 1.0% to 3,863.75

- STOXX Europe 600 down 1.2% to 409.92

- MXAP down 1.3% to 150.15

- MXAPJ down 1.6% to 490.96

- Nikkei down 1.1% to 27,567.65

- Topix down 0.6% to 1,938.56

- Hang Seng Index down 0.9% to 18,761.69

- Shanghai Composite down 2.3% to 3,126.40

- Sensex down 1.8% to 58,881.76

- Australia S&P/ASX 200 down 1.5% to 6,739.08

- Kospi down 0.8% to 2,382.78

- German 10Y yield little changed at 1.78%

- Euro down 0.4% to $0.9961

- Gold spot down 0.5% to $1,656.63

- U.S. Dollar Index up 0.34% to 110.11

Top Overnight News from Bloomberg

- A surging dollar is now the only possible hedge for what’s turning into the biggest destruction of shareholder value since the global financial crisis

- “The growing risk of recession in the euro area and the steadily increasing labor participation rate might also be factors that have kept wages in check,” European Central Bank Governing Council member Olli Rehn said in Helsinki

- “The slowdown of the economy is not going to ‘take care’ of inflation on its own,” European Central Bank Vice President Luis de Guindos tells Expresso newspaper in an interview. “We need to continue the normalization of monetary policy”

- The French inflation rate will peak between now and the beginning of next year near the current level, “around 6% or a little more,” Bank of France Governor Francois Villeroy de Galhau said

- A shortage of high-quality assets in the euro area is keeping a lid on short- term borrowing costs, a development that could endanger the ECB’s effort to tighten financial conditions

- Global equity funds saw inflows driven by US stocks in the week to Sept. 14, according to a Bank of America note, citing EPFR Global data

- China has ample monetary policy room and abundant policy tools, PBOC’s monetary policy department writes in an article that reviews the country’s monetary policies in the past five years

- China’s economy showed signs of recovery in August. Industrial production, retail sales and fixed-asset investment all grew faster than economists expected last month. The urban jobless rate slid to 5.3%, while the youth unemployment rate fell from a record high

- Japan’s increasingly incongruous policy stance aimed at securing both stable growth and inflation is adding to the likelihood of further yen losses, even as officials warn of possible intervention

- India’s sovereign bonds are defying a worldwide rout, as banks and foreign funds rushed to buy the high-yielding debt in anticipation that they will be included in global indexes

- Germany is taking control of Russian oil major Rosneft PJSC’s German oil refineries and is nearing a decision to take over Uniper SE and two other large gas importers as it tries to avoid a collapse of its energy industry

A more detailed look at global markets courtesy of Newsquawk

Asia stocks fell despite better-than-expected Chinese activity data as the region took its cue from the losses in the US after mixed data and as markets continued to adjust to a more aggressive Fed rate path. ASX 200 was pressured as energy and miners led the broad retreat after recent losses in commodity prices. Nikkei 225 suffered from the downbeat mood and with the 10yr JGB yield stuck at the top of the BoJ’s target. Hang Seng and Shanghai Comp conformed to the risk aversion with the latest Industrial Production and Retail Sales data failing to spur risk appetite despite both surpassing estimates.

Top Asian News

- Chinese NBS said China is to coordinate economic development and COVID control, while it added that the economy continued a recovery trend in August and some factors exceeded expectations but also noted that the recovery in domestic demand still lags behind the recovery in production and that the property market faces downward pressure despite some positive changes. China's stats bureau also commented that the economy was affected by COVID flare-ups in August but the flare-ups impact was limited and that policies to stabilise growth are gaining traction although noted that China's economy faces more difficulties this year than in 2020.

- Chinese President Xi says China's economy remains resilient and full of potential

- Japanese Finance Minister Suzuki reiterated it is important for FX to move stably reflecting economic fundamentals and that sharp FX moves are undesirable, while he is concerned about sharp, one-sided JPY weakening and they will take necessary action without ruling out any options if sharp yen moves persist.

- Japan is to use JPY 3.5tln in reserve funds for economic measures, according to Kyodo News

- RBA Governor Lowe said the RBA is committed to returning inflation to the 2-3% target range over time and is seeking to do this in a way that keeps the economy on an even keel, while the Board expects further increases will be required to bring inflation back to target but they are not on a pre-set path. Lowe stated that with inflation as high as it is, they need to make sure that inflation returns to target in a reasonable time and will do what is necessary to make sure that higher inflation does not become entrenched. Furthermore, Lowe said at some point will not need to hike by 50bps and they are getting closer to that point, while they will consider hiking by 25bps or 50bps at the next meeting but also stated that rates are still too low right now.

- South Korean President Yoon and US President Biden are expected to discuss currency swap during a summit, according to Yonhap.

- South Korean Parliament Speaker Kim says need to promptly advance South Korean and Chinese trade negotiations

Euro-bourses see the deepest losses whilst the FTSE 100 is cushioned by the slide in the Pound. European sectors are all lower and portray a clear defensive bias, with Healthcare at the top of the bunch. Stateside, US equity futures have been trundling lower with the NQ underperforming vs the ES, YM and RTY.

Top European News

- No Movies. No McDonald’s. Britain Shuts for Queen’s Funeral

- WHO Panel Advises Against GSK, Regeneron Drugs for Covid

- AstraZeneca Gets Nod From EU for Evusheld and Respiratory Drug

- Telecom Italia Falls to Record Low Amid Barclays Downgrade

- Uniper Plunges to Lowest Level Ever on Nationalization Reports

- Cold War Relic Threatens Plans to Ditch Russian Oil

FX

- GBP extended losses in wake of significantly weaker than forecast ONS retail sales data, with Cable sliding to the lowest level since 1985.

- DXY reclaimed 110.00-status as Sterling continued sliding, and now oscillates around the round figure.

- JPY stands as the outperformer, as USD/JPY hold within yesterday’s extremes amid the risk aversion and recent verbal jawboning.

- Chinese FX regulator says it is hard to predict short-term volatility in exchange rate, and urges companies not to bet on the exchange rate, according to state media

- South Korean Authorities are reportedly suspected of "smoothing operations" in USD/KRW trading, according to Reuters citing South Korean FX dealers.

Fixed Income

- Bunds have staved off pressure on 142.00 within a 142.15-143.04 range.

- Gilts traded above par briefly between 104.93-105.50 extremes (+17 ticks at one stage).

- 10yr T-note is almost flat ahead of preliminary Michigan sentiment which will be watched closely for inflation expectations.

Commodities

- WTI and Brent are oscillating around the unchanged mark with the complex initially under pressure from the overall risk aversion.

- Kazakhstan energy ministry expects to stick to its oil production plans of 85.5mln tonnes this year; says Kashagan oilfield will resume output "in October at best"

- Spot gold is flat after the yellow metal took out the 2021 low (USD 1,676/oz) yesterday with clean air seen below until the COVID low of USD 1,450/oz.

- Base metals meanwhile are softer across the board as the Dollar remains firm, but LME nickel bucks the trend with reports via Bloomberg also suggesting LME is being sued by hedge funds, including AQR, in the London High Court

US Event Calendar

- 10:00: Sept. U. of Mich. Sentiment, est. 60.0, prior 58.2

- 10:00: Sept. U. of Mich. Current Conditions, est. 59.4, prior 58.6

- 10:00: Sept. U. of Mich. Expectations, est. 59.0, prior 58.0

- 10:00: Sept. U. of Mich. 1 Yr Inflation, est. 4.6%, prior 4.8%

- 10:00: Sept. U. of Mich. 5-10 Yr Inflation, est. 2.8%, prior 2.9%

- 16:00: July Total Net TIC Flows, prior $22.1b

- 16:00: July Net Foreign Security Purchases, prior $121.8b

DB's Jim Reid concludes the overnight wrap

Two weeks after coping with a manic birthday party for two manic 5 year old twins, we repeat the whole thing this weekend as my daughter Maisie turns 7 today and has a OTT Harry Potter themed party tomorrow at our house. I have a costume which I'm hoping will be cooler than the 10ft giant inflatable diplodocus outfit I had for the twins’ party. If you don’t believe me photos are available. Many people have kindly asked how Maisie is after being diagnosed with a rare hip disease called Perthes over 12 months ago. The answer is she is coping well but still needs to be in a wheelchair until the doctors see any sign that the hip ball is regrowing. We’re crossing our fingers that there might be signs at the next scan in December. At the moment it’s still slowly disintegrating. She’s had great news this week as she’s got accepted at a very young age into a prestigious artistic swimming club. Because of her regular rehab in the pool, and a natural talent even before her condition became apparent, she is phenomenal in the water. She is a stage 7 swimmer which on average is for around 10/11 year olds and used to love gymnastics before her incapacitation. So for a sport that I’ve perhaps always previously seen as one of my least favourite, I’m now a synchronised swimming convert ahead of her first session this Sunday. I suspect I'll stick to golf for myself though and won't be buying the nose peg.

It was another synchronised sell off for both bonds and equities yesterday as investors moved to price in yet more rate hikes from central banks, raising market fears about a hard landing ahead. Those moves were prompted by a decent batch of US employment data, which added to the sense that the Fed could afford to keep hiking rates for the time being. But the prospect of more aggressive rate hikes proved bad news for equities, with the S&P 500 (-1.13%), its lowest level since July, more than reversing the previous day’s partial rebound that followed its worst daily performance for two years on Tuesday. In the meantime, sovereign bonds embarked on a further selloff and multiple recessionary indicators were flashing with increasing alarm, including the 2s30s Treasury yield curve that by the close was more inverted than at any time since 2000.

Before we get onto the details however, we should point out that DB’s US economists, led by Matt Luzzetti, have also revised their expectations for the Fed funds rate following the latest inflation data, and now see the terminal rate some way beyond market pricing at 4.9% in Q1 2023 (link here). Matt has been consistently the highest on the street for economists in recent months and this upgrade is now closer to the 5-6% range that David Folkerts-Landau, Peter Hooper and I said was necessary to tame inflation in our “What’s in the tails?” note (link here) back in April. Today’s UoM inflation expectations series is going to be the last important release before next week’s FOMC, especially after this week’s messy CPI data. Year-ahead inflation expectations have been edging down of late but the upside surprise in June a few hours after a blockbuster CPI beat cemented the last minute 75bps hike. With +80.5bps priced in next week, it will be interesting to see if the expectations data move pricing any closer to 75 or 100bps, and if not, whether the Fed tries to influence pricing with a leak so the meeting isn't as “live”, or if they feel comfortable heading into the meeting with some split probability priced. While we're on the revision path, a reminder that our 10yr Bund forecast was upgraded to 2.25% late on Wednesday. See here for more.

Against this rates higher backdrop, markets were revising their expectations in a hawkish direction following strong labour market data. In particular, the US weekly initial jobless claims for the week ending September 10 fell for a 5th consecutive week to 213k (vs. 227k expected), and the previous week was also revised down by -4k. The release added to the sense that the recent economic resilience over the late summer was proving to be more than just one data point, and it’s worth noting that the 213k reading was the lowest since May. Piling on, retail sales MoM increased 0.3% versus -0.1% expectations. As with most things macro related lately, there is a flipside, however. The core retail sales figure fell -0.3% versus expectations it would be flat, while the control group, which has outsize influence in GDP consumption tabulations, was flat MoM, versus expectations of a 0.5% expansion. Indeed, the Atlanta Fed’s GDPNow tracker downgraded 3Q GDP estimates to 0.5% from 1.3% following the print. Recession talk will only bubble up with more with revisions like that. But overall a messy set of data yesterday.

The recent inflation surprises has proven bad news for risk assets since it’s seen as giving the Fed the green light for faster rate hikes. In response, the terminal rate priced in for March 2023 rose +7.8bps yesterday to 4.46%, and that in turn led to another selloff for Treasuries. By the close, the 2yr yield was up +7.7bps to its highest level since the GFC, whilst the 10yr yield rose +4.5bps to 3.45%. In Asia the 2yr yield is up another couple of bps, with 10yr yields flat, further inverting the 2s10s curve to -44.5 bps as we go to press. Higher real yields were behind the latest moves, with the 10yr real yield crossing 1.0%, hitting a post-2018 high. And in Europe it was much the same story, with yields on 10yr bunds (+5.3bps), OATs (+3.6bps) and BTPs (+5.7bps) all moving higher as well.

Yesterday’s losses were spread across multiple asset classes, and equities took a tumble given those fears about faster rate hikes. The S&P 500 shed -1.13% as part of a broad-based decline, and the impact of higher interest rates was evident from the sectoral breakdowns, as tech stocks including the NASDAQ (-1.43%) struggled, whereas the banks in the S&P 500 advanced +1.54%. Europe experienced a similar pattern, with the STOXX 600 (-0.56%) losing ground for a third day running, in contrast to the STOXX Banks index (+1.98%) which hit a three-month high.

One more positive piece of news on the inflation side was that a deal was reached to avert an upcoming US rail strike, which would have had a significant impact on supply chains had that gone ahead. A sign of its potential impact was that even the White House was involved, with President Biden joining the meeting virtually on Wednesday evening. The news helped a number of key commodities to fall back in price, including US natural gas futures which ended the day -8.67% lower, whilst WTI oil was also down -3.82% at $85.10/bbl.

Asian equity markets are weaker again this morning, heading for a fifth consecutive weekly drop amid further weakness in US equities overnight. As I type, the CSI (-1.13%) and the Shanghai Composite (-0.97%) are trading in negative territory with stronger than expected economic data failing to boost risk sentiment. Elsewhere, the Nikkei (-1.08%), Kospi (-1.03%) and the Hang Seng (-0.55%) are also sliding. Looking ahead, stock futures in the DM world are pointing to additional losses with contracts on the S&P 500 (-0.71%), NASDAQ 100 (-0.88%) and DAX (-0.70%) all moving lower.

We have early morning data from China with retail sales standing out as it jumped +5.4% y/y in August (v/s +3.3% expected), up from +2.7% in July. The uptick in retail sales was primarily visible in the restaurant/catering sectors, an industry typically sensitive to lockdowns. Other activity series showed that industrial production grew +4.2% y/y in August, which is an improvement from July’s +3.8% increase. Also, fixed asset investment for the first eight months of the year rose by +5.8%, above the +5.5% increase forecast. However, there were some disappointing signs elsewhere as new home prices slid for the 12th consecutive month, falling -0.29% m/m in August against a -0.11% decline previously, indicating that the recently rolled-out measures failed to revive demand.

Staying on China, the People’s Bank of China (PBOC) continued its currency defense after the yuan weakened past the key level of 7 per US dollar for the first time in two years amid the relentless dollar rally. The central bank for the 17th straight day intervened while fixing the yuan 456 pips stronger than the average Bloomberg estimate to help prevent the currency’s slide.

Back to wrapping up the rest of yesterday’s data, US industrial production was down -0.2% in August (vs. unch expected), and the Philadelphia Fed’s business outlook for September fell to -9.9 (vs. 2.3 expected). However, the Empire State manufacturing survey for September rose to -1.5 (vs. -12.9 expected), rebounding from its worst month since the Covid pandemic.

To the day ahead now, and data releases from the US include the University of Michigan’s preliminary consumer sentiment index for September, as well as UK retail sales for August. Meanwhile from central banks, we’ll hear from ECB’s President Lagarde, as well as the ECB’s Rehn and Villeroy.

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

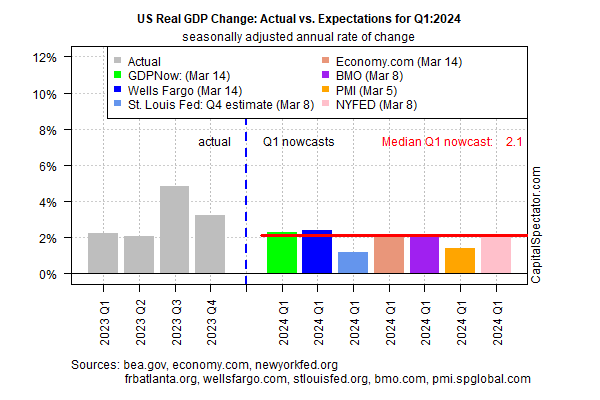

US Economic Growth Still Expected To Slow In Q1 GDP Report

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A