Government

Futures Bounce, Gilts Tumble In BOE-Driven Rollercoaster Session

Futures Bounce, Gilts Tumble In BOE-Driven Rollercoaster Session

US stocks were set to bounce, ending a brutal five-day losing streak, amid…

US stocks were set to bounce, ending a brutal five-day losing streak, amid confusion over what the BOE will do in two days, amid hope that tomorrow's CPI print will come in lower than expected, and as Treasury yields eased off multi-year highs - at least initially - and investors put aside concerns that overheating inflation could offer more fodder to hawkish Federal Reserve policy makers amid speculation that things are breaking in far too many markets after it emerged that the Fed had sent a substantial amount of dollars to Switzerland this week in the first material use of the dollar swap facility in 2022. Nasdaq futures gained 0.9% by 7:30 a.m. in New York while S&P 500 futures rose 0.7% a day after the benchmark index nearly erased its October gains, while UK bonds tumbled and the pound rose amid UK policy confusion. While global risk sentiment earlier received a boost from a report suggesting the Bank of England could extend its emergency bond repurchases, a bank spokesperson quashed that speculation and said the program would still end on Friday, leaving traders in the dark as to what will happen.

Meanwhile, Treasury yields and the dollar were little changed as traders await a key US inflation measure due Thursday that’s set to return to a four-decade high, underscoring broad and elevated price pressures that are pushing the Federal Reserve toward yet another large interest-rate hike next month. US investors are also looking to corporate earnings for clues about Fed policy.

Among notable moves in premarket trading, Uber Technologies edged back up after the previous session’s 10% slump that was driven by the Biden administration’s proposal on classifying gig workers’ employment status. Analysts said there was limited near-term risk, given implementation was “far from imminent.” Chip stocks were set to recoup some of this week’s losses stemming from fresh curbs on China’s access to US semiconductor technology. Norwegian Cruise Line Holdings also gained in premarket trading, after UBS raised its recommendation on the stock to buy, amid strong improvement in bookings. PepsiCo gained 1.9% in premarket trading after the company raised its forecast for the full year and said consumers continue to purchase more of its snack foods and soft drinks despite rising inflation.

In the US, investors have been laser-focused on how the Fed might respond to inflation figures due Thursday. While economists expect the consumer price index reading for September to have declined slightly versus a year earlier, a surprise increase could send stocks tumbling, JPMorgan's trading desk warned. Given the Fed has so far shown little sign of toning down its hawkishness, even in the face of a potential economic recession and weaker company earnings, many analysts expect equity bounces to be short-lived.

“In the back of everyone’s mind is tomorrow’s CPI print, with many investors worried that it may be as strong as the jobs report on Friday,” said Neil Campling, head of TMT research at Mirabaud Securities. “Bears are firmly in control and any rallies could be incapable of sustaining a bid for more than a few days.”

“While futures positioning is now slightly less extreme, it is still a very bearish set up into what is seen as a binary market event tomorrow,” said Carl Dooley, head of EMEA trading at Cowen in London. That makes it “natural to see some bear covering, with the remaining bulls having another roll of the dice.”

The big story overnight was the flip-flopping rollercoaster from the BOE: the yield on 30-year gilts rose above 5% for the first time since late September after the Bank of England confirmed its plan to end emergency bond purchases on Friday and a report showed the UK economy shrank unexpectedly in August. Sterling rallied more than 1% after a report from Politico that the government may make further fiscal U-turns.

“The Bank of England is a test case for how hawkish central banks can be without doing damage to financial stability,” said Michael Metcalfe, global head of macro strategy at State Street Global Markets. So far the "test" is failing miserably.

In other news, Q3 earniungs season kicks off on Friday when several top Wall Street banks are set to report including JPMorgan, although analysts have already downgraded estimates for corporate America in recent weeks, a glum outlook by management teams could further pressure stocks. Lori Calvasina, head of US equity strategy at RBC Capital Markets, cut her year-end target for the S&P 500 Index to 3,800 from 4,200 citing a weak economic backdrop through the end of 2023. However, her new target implies a nearly 6% gain from Tuesday’s close.

In European equities, consumer products, chemicals and food & beverages are the strongest-performing sectors. Euro Stoxx 50 rose 0.4% as Spain's IBEX lagged, dropping 0.5% Credit Suisse drops as much as 5.0%, adding to a tumultuous month for the Swiss lender, after Bloomberg reported that the Justice Department is investigating whether it continued to help US clients hide assets from authorities. Here are other notable European movers:

- LVMH rises as much as 3.2% on stronger-than-expected organic revenue growth, signaling that the wealthy are still spending, and allaying fears of a China slowdown from Covid-19 curbs.

- Chr. Hansen climbs as much as 15%, the most since 2012, after the Danish enzymes and food cultures manufacturer reported better- than-expected 4Q results, including a wide topline beat, Jefferies says.

- Leonteq rallies as much as 7.8% after the company responded to a Financial Times report that had driven the stock lower in recent days.

- Bossard rises as much as 4.2% after nine- month sales beat estimates.

- UK domestic stocks underperform amid gilt market volatility following earlier speculation over the timing of an end to the Bank of England’s bond-buying program. Homebuilders, real estate, retail and domestic banks are among biggest decliners with Barclays falling as much as 5.3%.

- Philips slumps as much as 12%, hitting the lowest in more than a decade, after the Dutch medical technology company cut its outlook due to worse-than-expected supply-chain difficulties, prompting analysts to doubt its ability to meet 2022 targets.

- Kloeckner falls as much as 14%, the most intraday since May 2020, after the steel company revised its full-year guidance, which Jefferies said implies a 20%-25% reduction to consensus estimates.

Earlier in the session, Asian equities were mixed after a three-day rout, as Chinese shares rebounded in a volatile trading session, while overall sentiment remained jittery ahead of the release of the US inflation report. The MSCI Asia Pacific Index erased an early-session loss of as much as 0.8% and traded down just 0.1% as of 5:02 p.m. in Hong Kong Wednesday, with financial shares lifting the broader market. Still, the benchmark hovered near a two-year low. Chinese stocks bounced back strongly in afternoon trading as bargain hunters piled into the nation’s battered shares, with the CSI 300 Index closing 1.5% higher, the most in two months. Investors were worried about the Covid-Zero policy and an economic slowdown despite an upbeat set of aggregate financing and loans data released on Tuesday.

“With supportive valuations and better earnings outlook, downside may be limited from current levels,” said Vey-Sern Ling, an analyst at Union Bancaire Privee. Still, “China has too many outstanding issues currently that drag investor sentiment. Investors may not be willing to buy equities given the macro uncertainties.” Sentiment also remained fragile after Bank of England Governor Andrew Bailey said the bank would end emergency gilt purchases as planned this week, in the face of market pressure to expend the program. US consumer price data due Thursday will be crucial in defining the size of the Federal Reserve’s interest-rate hike at the November meeting. Economists expect inflation to top 8% again. “The tightening of US financial conditions, global and China growth slowdowns have sharply weighed on Asian equities this year,” said Rajat Agarwal, Asia equity strategist at Societe Generale SA. “Korea and Taiwan, the two semiconductor-driven markets have been the worst affected. A fading semiconductor cycle, geopolitical issues and more recently the semiconductor exports curbs have pushed the valuations to a more than five-year low on the two markets.” South Korean stocks erased losses to close higher after the central bank pivoted back to half-point interest-rate increases

Japanese stocks closed a directionless day slightly lower, pushing losses to a third day, weighed down by electronics makers. The Topix fell 0.1% to close at 1,869.00, while the Nikkei was virtually unchanged at 26,396.83. Tokyo Electron Ltd. contributed the most to the Topix Index decline, decreasing 4.4%. Out of 2,168 stocks in the index, 908 rose and 1,151 fell, while 109 were unchanged.

Australian stocks snapped a three day rout, led by financial stocks. The S&P/ASX 200 index edged higher to close at 6,647.50 after a three-day drubbing, with traders awaiting US inflation data due Thursday for further clues on Federal Reserve interest rate hikes. Financial stocks gained, led by Bank of Queensland, offsetting losses in mining and energy stocks. Coronado Global Resources was among the top gainers after the coal miner confirmed it’s in talks with Peabody Energy on a merger. In New Zealand, the S&P/NZX 50 index fell 0.8% to 10,873.23.

Stocks in India gained for the first time in four sessions, helped by real estate and consumer goods companies that had seen sharp declines earlier this week. Investors will be monitoring India’s consumer inflation data for September to be released later Wednesday to gauge the outlook for local shares. Software exporter Wipro reported quarterly earnings below consensus estimates. The S&P BSE Sensex rose 0.8% to 57,625.91 in Mumbai, while the NSE Nifty 50 Index was higher by an equal measure. All of BSE Ltd.’s 19 sector sub-indexes advanced.

In FX, the Bloomberg Dollar Spot Index was little changed as the greenback traded mixed versus its Group-of-10 peers. the yen led G-10 losses and slipped to a fresh 24- year low of 146.43 per dollar as traders tested the resolve of Japanese authorities to intervene as key US inflation data may drive further weakness. The British pound led G-10 gains after volatile session. It earlier erased gains against the dollar while gilts extended a decline after the BOE confirmed that the bond-buying scheme will still end on Friday. Sterling had risen after the Financial Times reported that the BOE told lenders it was prepared to extend the program past Oct. 14 end date if market conditions demanded it. Bearish sentiment in the pound is the strongest in two weeks when it comes to short-term bets as hedging costs keep rallying. The euro was steady around $0.97 as Bunds and Italian bonds fell led by the long end of the curve. The Aussie inched lower.

In rates, Treasuries are mixed with the curve steeper as US trading gets under way, led by dramatic steepening in UK bond market after Bank of England Governor Andrew Bailey late Tuesday said the central bank’s bond buying would end this week. Focal points of US session include September PPI and 10-year auction, following cool reception for Tuesday’s 3-year. US yields little changed at front end, the 10Y yield rises by 1bp to 3.95%, steepening 2s10s by ~1.5bp, 5s30s by ~2bp. US auction cycle continues with $32b 10- year note reopening at 1pm New York time, concludes Thursday with 30-year reopening. WI 10-year yield at around 3.96% is above auction stops since 2009 and ~63bp cheaper than last month’s result. UK gilts remain near worst levels of the session with 30-year yields cheaper by ~18bp on the day and UK 2s10s, 5s30s spreads steeper by 30bp and 15bp. Australia’s bonds gained for the first day in five after RBA Assistant Governor Luci Ellis said the central bank’s neutral interest rate is likely to be at least 2.5%, compared with the current cash-rate target of 2.6%.

In commodities, WTI trades within Tuesday’s range, marginally falling to near $89.33. Polish pipeline operator said on Tuesday evening it detected a leak in the Druzhba pipeline; cause is unknown; leak detected in one of two lines, second line is working as normal. Russia's Transfneft said it has received notice from Polish operator PERN about the leak at Druzbha; oil pumping towards Poland continues, according to IFX. Polish top official for energy infrastructure said there are no grounds to believe leak in Druzhba pipeline was sabotage, adds leak was probably caused by accidental damage. Spot gold is modestly firmer as the upside for the Buck remains capped for now, but the yellow metal remains under its 21DMA (USD 1,673.34/oz). LME metals are mixed with copper relatively flat but aluminium is underperforming following a large build in LME warehouse stocks.

To the day ahead now, and data releases include the US PPI reading for September, along with UK GDP and Euro Area industrial production for August. From central banks, we’ll get the FOMC minutes from the September meeting, and hear from the Fed’s Barr, Kashkari and Bowman, ECB President Lagarde, the ECB’s Knot and De Cos, as well as the BoE’s Pill, Haskel and Mann. Finally, earnings releases include PepsiCo.

Market Snapshot

- S&P 500 futures up 0.5% to 3,617.00

- MXAP little changed at 137.63

- MXAPJ little changed at 444.71

- Nikkei little changed at 26,396.83

- Topix down 0.1% to 1,869.00

- Hang Seng Index down 0.8% to 16,701.03

- Shanghai Composite up 1.5% to 3,025.51

- Sensex up 0.6% to 57,503.85

- Australia S&P/ASX 200 little changed at 6,647.54

- Kospi up 0.5% to 2,202.47

- STOXX Europe 600 down 0.2% to 387.21

- German 10Y yield little changed at 2.34%

- Euro up 0.1% to $0.9719

- Brent Futures up 0.3% to $94.55/bbl

- Gold spot up 0.3% to $1,671.92

- U.S. Dollar Index little changed at 113.12

Top Overnight News from Bloomberg

- Giorgia Meloni’s euphoria at winning the Italian election is running into reality as the far-right leader struggles to put together a coalition government and the gas-dependent country’s financial outlook darkens

- Bank of England Governor Andrew Bailey’s blunt warning that fund managers have to cut vulnerable positions before the central bank ends debt purchases is sending a shiver around already fragile global bond markets

- The UK economy shrank unexpectedly in August for the second time in three months, raising the possibility that the country is now in a recession. The 0.3% drop in output was driven by a sharp decline in manufacturing and a small contraction in services

- The Bank of England has warned that some UK households may face a strain over debt repayments that is as great as before the 2008 financial crisis, if economic conditions continue to be difficult

- Bank of England policy maker Jonathan Haskel said one of the key issues ailing the UK economy is lackluster levels of business innovation and productivity

- The European Union is moving closer to proposing a temporary overhaul of the electricity market by limiting prices of gas used for power generation even as pressure mounts for the bloc to impose a broader cap

- Germany’s biggest service-sector union is demanding 10.5% pay increases amounting to at least 500 euros ($486) a month for public-sector employees to avoid real losses amid record inflation

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were subdued with price action indecisive as the region took its cue from the choppy performance and late selling stateside after BoE Governor Bailey rejected industry calls for an extension to Gilt purchases, although a report from FT overnight suggested the contrary. ASX 200 was rangebound with strength in the real estate and the top-weighted financials sector offsetting the losses in tech, utilities and mining-related stocks, while there were also comments from RBA’s Assistant Governor Ellis who suggested nominal rates have already passed neutral and that policy was no longer expansionary. Nikkei 225 lacked conviction following the disappointing Machinery Orders data although the downside was contained with Japan reportedly to draw up economic measures before month-end. Hang Seng and Shanghai Comp. were the worst hit despite the jump in loans and financing data in China with markets constrained by lockdown concerns after China's Xi'an announced to suspend onsite classes for some students and shut other venues, while the Shenzhen Metro suspended three stations due to coronavirus.

Top Asian News

- US permitted at least two non-Chinese chipmakers in China to receive goods and support that are restricted under new US export rules, according to industry sources. It was later reported that SK Hynix (000660 KS) received authorisation from the US Commerce Department to receive equipment for a chip production facility in China for a year without seeking a separate permit from the US, according to Reuters.

- China will be declared an official threat in a new strategic review of Britain's enemies, according to The Sun.

- RBA Assistant Governor Ellis said the neutral rate is a guide rail for policy not a destination and that the real neutral rate is uncertain but should be positive even if low which implies a nominal neutral rate of at least 2.5% for Australia, while Ellis added that policy is no longer in an expansionary place, according to Reuters.

- BoK hiked the base rate by 50bps to 3.00%, as expected and said inflation will remain high in the 5%-6% range for a considerable time. BoK Governor Rhee said board members Joo Sang-Yong and Shin Sung-Hwan dissented at Wednesday's rate decision, while he added that the board's views on the rate hike pace in November differ but added that a majority of board members see the BoK's terminal rate at 3.5%.

European bourses saw a choppy start to the session, but have since titled to the upside as US traders prepare to enter the fray. Sectors are mixed with Consumer Products bolstered by luxury names after LVMH earnings, with Tech following whilst Banks and Real Estate lag. Stateside, US equity futures trade on a firmer footing with the ES back above 3600 as the index futures attempt to claw back some of the lost ground yesterday.

Top European News

- It was reported that the BoE signalled to lenders that it is prepared to prolong bond purchases with officials privately indicating a flexible approach if market volatility flares up, according to FT. It was later reported that BoE affirmed that its bond-buying scheme will end on Friday 14th October, via Bloomberg.

- BoE said the bank has made it clear from the outset its temporary and targeted purchases of gilts will end on October 14th, and beyond Oct 14th, a number of facilities are in place to ease liquidity pressures on LDIs.

- Pensions and Lifetime Savings Association said the announcement by the BoE to purchase index-linked Gilts is a positive additional intervention, while it noted that the concern of pension funds has been that the period of purchasing should not be ended too soon, according to Reuters.

- UK's trade deal with India is reportedly on the verge of collapse after Indian ministers reacted "furiously" to comments by Home Secretary Braverman, according to The Times.

- There is growing speculation that UK PM Truss "could ditch yet more aspects of the mini-budget", according to Politico's Courea, adds "Think we’re looking at “deferring” tax cuts and maybe a further windfall tax”". However, Downing St source said that despite claims, there's no delay to April income tax cut, former Chancellor Sunak's corporation tax hike still is cancelled, according to a Sun reporter.

- ECB's Villeroy said fears of a recession must not derail ECB normalisation and that the current level of inflation requires ECB determination, while he also noted that a short recession is less detrimental than stagflation and said discussion about a 50bps or 75bps hike in October is premature amid volatile markets. Furthermore, Villeroy said the ECB may move more slowly after reaching a neutral rate and the APP unwind could begin earlier than 2024 with partial reinvestments.

FX

- DXY is softer but off worst levels after testing levels close to 113.00 to the downside.

- GBP was volatile but currently stands as the outperformer following speculation over the Government ‘ditching’ or ‘deferring’ more of the tax cut proposals.

- The USD extended its bull run against the JPY to a fresh 2022 and multi-year best beyond prior Japanese intervention levels and 146.00, with little resistance from officials other than the usual verbal interjections

Fixed Income

- Bunds slipped to a fresh intraday low on Eurex at 135.64 for an 81 tick loss on the day having been 9 ticks above par at one stage.

- Gilts remain 100+ ticks adrift within extremes spanning 90.90-92.81 vs yesterday’s 92.83 Liffe close.

- US Treasuries are holding steady before PPI data, 10 year note supply, FOMC minutes and further Fed rhetoric.

Commodities

- WTI and Brent front-month futures are flat intraday but off the worst levels seen overnight.

- NHC said Tropical Storm Karl is expected to strengthen today as it moves slowly over the southwestern Gulf of Mexico.

- Polish pipeline operator said on Tuesday evening it detected a leak in the Druzhba pipeline; cause is unknown; leak detected in one of two lines, second line is working as normal. Russia's Transfneft said it has received notice from Polish operator PERN about the leak at Druzbha; oil pumping towards Poland continues, according to IFX. Polish top official for energy infrastructure said there are no grounds to believe leak in Druzhba pipeline was sabotage, adds leak was probably caused by accidental damage. Germany State of Brandenburg Economy Minister said there was a pressure drop in Druzhba's main pipeline No.2, according to dpa. Polish pipeline operator PERN said supply to German clients is continuing taking into account technical possibilities; Polish refineries are receiving oil in line with nominations.

- SGH Macro said the understanding in Beijing is that Saudi Crown Prince Mohammad bin Salman assured Russia’s President Vladimir Putin that OPEC+ will cooperate to ensure that global crude oil prices do not fall below USD 80/bbl at least until the end of the military conflict between Russia and Ukraine, even if there is a global economic crisis.".

- Spot gold is modestly firmer as the upside for the Buck remains capped for now, but the yellow metal remains under its 21DMA (USD 1,673.34/oz).

- LME metals are mixed with copper relatively flat but aluminium is underperforming following a large build in LME warehouse stocks.

Geopolitics

- US President Biden told CNN that he doesn't think Russian President Putin will use a tactical nuclear weapon.

- US President Biden said the Saudis face consequences after the OPEC+ production cut, according to Bloomberg.

- Two delegations of US congressmen led by Republican Brad Wenstrup and Democrat Seth Moulton have arrived in Taiwan and will stay until Thursday, according to Sputnik.

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications -2.0%, prior -14.2%

- 08:30: Sept. PPI Final Demand MoM, est. 0.2%, prior -0.1%

- Sept. PPI Final Demand YoY, est. 8.4%, prior 8.7%

- Sept. PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.2%

- Sept. PPI Ex Food, Energy, Trade YoY, est. 5.6%, prior 5.6%

- Sept. PPI Ex Food and Energy YoY, est. 7.3%, prior 7.3%

- Sept. PPI Ex Food and Energy MoM, est. 0.3%, prior 0.4%

- 14:00: Sept. FOMC Meeting Minutes

DB's Jim Reid concludes the overnight wrap

Have we got 3 days to avert some kind of financial crisis here in the UK? That seemed to be the implicit message from the BoE governor Bailey last night in Washington in what were extraordinary comments that shook global markets after what was slowly turning into a pretty positive session up until the remarks less than 90 minutes before the US close.

His exact words were “My message to the funds involved and all the firms is you’ve got three days left now…. You’ve got to get this done.” He was referring to the fact that the APF purchases are slated to end on Friday and that there won’t be any extension. Whether that’s the case or not the extra actions from BoE this week and the stern words from Bailey hint at some big issues still for UK pension funds which will scare the market. Bailey’s language was also a little scary elsewhere saying that he’d been up all night addressing UK market issues and that recent market volatility went beyond their bank stress tests. I suppose the problem with all of this is that if you want pension funds to sort all their issues out in the next three days, he may have made their job a lot harder with the explicit public comments as the market will be really concerned there's a bigger problem now than they thought beforehand. This is unlikely to help pension funds delever. So we could be in for some major volatility in UK assets for the next few days. The only caveat is that the FT reported at 5am this morning that the BoE have privately communicated to bankers that it would extend the emergency bond buying program if market conditions required it.

The first reaction to Bailey's comments was felt in Sterling which fell -1.35% from the comments to the close (-0.79% on the day overall) landing at $1.097. Overnight it has rebounded (+0.54%) a bit as I type purely on the FT article I mentioned above. 10yr treasury yields spiked +6.6bps into the close after Bailey having been roughly unchanged immediately before the remarks (after volatile intraday moves) and global equities retreated after their own volatile session. Initially the S&P 500 fell -1.23% after the open, hitting intraday lows that were last matched in November 2020, immediately following Pfizer’s positive Covid trial results, before steadily rallying throughout the day to +0.76%, only to reverse course and nose dive into the close, finishing -0.65% lower following Bailey’s comments. The continued bout of volatility and warnings around broader financial stability saw the Vix index of volatility increase +1.2pts to 33.63pts, its highest levels since immediately before June’s financial conditions easing. Big tech stocks led the way down, with the NASDAQ falling -1.10% to hit its lowest level since July 2020. European stocks may have missed the intraday gyrations and the late US sell-off, but ended up much in the same place, with the STOXX 600 (-0.56%) down for a 5th consecutive session

Back to the UK, earlier, the Bank of England announced they were widening the scope of their daily gilt purchases to include index-linked gilts as well. The move followed some astonishing increases in real yields on Monday, which were so big that they surpassed what we saw during the market turmoil following the mini-budget, with the 10yr index-linked gilt yield rising by an incredible +64.1bps. This widening in the BoE’s intervention is now occurring alongside their existing conventional gilt purchases. 10yr Gilts closed +1.0bps, while real 10yr yields fell back -5.6bps. Nevertheless, nominal 30yr yields increased +10.9bps to 4.78%, and that was before Bailey’s comments after the close.

Elsewhere, today we start the shift back towards inflation with today’s PPI release from the US setting the stage for the all-important CPI reading tomorrow, with those prints having led to some of the biggest selloffs we’ve seen this year. There’s little doubt in markets that the Fed are going to go for another 75bps hike in 3 weeks’ time, particularly after last week’s jobs report, but there’s more uncertainty about the subsequent meetings, and any upside inflation surprises today and tomorrow could put any slowdown in rate hikes even further into the distance. Alternatively softer numbers could help encourage a big rally given bearish risk positioning.

We won’t get the producer price reading until 13:30 London time, but ahead of that we did get the New York Fed’s latest Survey of Consumer Expectations for September, which showed a divergent picture on inflation expectations. At the one-year horizon, expectations fell back to 5.4%, which is their lowest in a year, and some further good news for the Fed. But the longer-term data was somewhat less positive, with three-year expectations ticking back up to 2.9% following three consecutive monthly declines, and five-year expectations advanced to 2.2% following four consecutive monthly declines. Clearly that could just be a blip, but well-anchored inflation expectations have regularly been cited as a reason for the Fed not moving even more aggressively, so any signs that expectations are going in the wrong direction again would raise the prospect of yet more tightening ahead.

In the meantime, Fed officials continued to strike a hawkish note in their remarks yesterday, with Cleveland Fed President Mester saying that “the larger risks come from tightening too little and allowing very high inflation to persist and become embedded in the economy”. Recall, there’s been a brewing philosophical divergence on the Committee about the risks of over-tightening given the long and variable lags of monetary policy, which should gather more steam once we get through the last two FOMC meetings in 2022, so it was instructive to hear an official come down so starkly on the other side of the balance of risks debate. That backdrop saw futures price in a 75bps hike for November as more likely than at any point to date so far, with +73.8bps priced in by the close.

Elsewhere among central bankers, we heard from ECB Chief Economist Lane as well yesterday, although he didn’t reveal much in the way of policy conclusions to draw from. One line was that he said “the ECB’s Governing Council is fully aware that further ground needs to be covered in the next several meetings to exit from the prevailing highly accommodative level of policy rates”. So a clear signal that more rate hikes are coming over the meetings ahead. Against that backdrop, sovereign bonds in Europe had oscillated between gains and losses throughout the day, in line with the volatility seen across global markets. But by the close yields had mostly fallen across the continent, with those on 10yr bunds (-4.1bps) and OATs (-3.0bps) both falling back. 10yr BTPs rose +4.2bps as some of the previous day's excitement over possible joint EU issuance to help with the energy crisis faded.

Asian equity markets are sliding again this morning with the Hang Seng (-1.92%) leading losses followed by the Shanghai Composite (-1.22%) and the CSI (-1.19%) as the rising number of Covid-19 cases has prompted Beijing to impose fresh lockdowns and travel restrictions ahead of the 20th Party Congress. Elsewhere, the Nikkei (-0.14%) is slightly weaker with the Kospi (-0.16%) also moving lower as the Bank of Korea (BOK) raised interest rates by a half percentage point to 3%. The statement indicated that it sees upside risks to its August inflation projection for this year of 5.2%, which warrants additional rate hikes. Additionally, it warned of slower growth with the Korean economy expected to grow next year at a slower pace than the August forecast of 2.1%.

Moving ahead, US stock futures are ticking higher with contracts on the S&P 500 (+0.43%) and the NASDAQ 100 (+0.52%) edging higher with US 10yrs -2bps overnight. In FX, the Japanese yen touched a new 24-yr low of 146.23 against the dollar.

Elsewhere yesterday, the IMF released their latest round of economic projections as the IMF/World Bank annual meetings get underway. In terms of the headlines, they left their 2022 global growth forecast unchanged at +3.2%, but their 2023 forecast was downgraded to +2.7% (vs. +2.9% in July). Those reductions were particularly concentrated in the advanced economies, with Germany seeing one of the biggest downgrades as they’re now forecasting a -0.3% contraction for 2023 (vs. +0.8% in July). They also upgraded their global inflation forecasts, and are now projecting that world consumer prices will have risen by +8.8% in 2022 (vs. +8.3% in July) and +6.5% in 2023 (vs. +5.7% in July).

Finally on the data front, the UK unemployment rate fell to 3.5% (vs. 3.6% expected) in the three months to August, which is its lowest level since 1974. In addition, the number of payrolled employees in September was up +69k (vs. +35k expected).

To the day ahead now, and data releases include the US PPI reading for September, along with UK GDP and Euro Area industrial production for August. From central banks, we’ll get the FOMC minutes from the September meeting, and hear from the Fed’s Barr, Kashkari and Bowman, ECB President Lagarde, the ECB’s Knot and De Cos, as well as the BoE’s Pill, Haskel and Mann. Finally, earnings releases include PepsiCo.

Government

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Government

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While “Waiting” For Deporation, Asylum

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While "Waiting" For Deporation, Asylum

Over the past several…

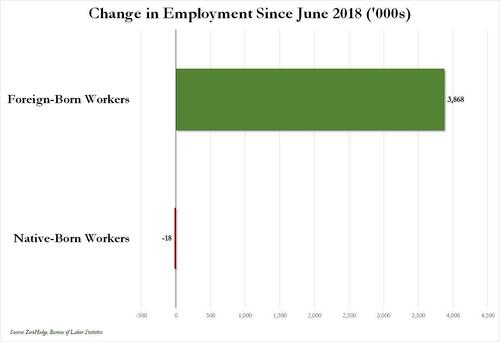

Over the past several months we've pointed out that there has been zero job creation for native-born workers since the summer of 2018...

... and that since Joe Biden was sworn into office, most of the post-pandemic job gains the administration continuously brags about have gone foreign-born (read immigrants, mostly illegal ones) workers.

And while the left might find this data almost as verboten as FBI crime statistics - as it directly supports the so-called "great replacement theory" we're not supposed to discuss - it also coincides with record numbers of illegal crossings into the United States under Biden.

In short, the Biden administration opened the floodgates, 10 million illegal immigrants poured into the country, and most of the post-pandemic "jobs recovery" went to foreign-born workers, of which illegal immigrants represent the largest chunk.

'But Tyler, illegal immigrants can't possibly work in the United States whilst awaiting their asylum hearings,' one might hear from the peanut gallery. On the contrary: ever since Biden reversed a key aspect of Trump's labor policies, all illegal immigrants - even those awaiting deportation proceedings - have been given carte blanche to work while awaiting said proceedings for up to five years...

... something which even Elon Musk was shocked to learn.

Wow, learn something new every day https://t.co/8MDtEEZGam

— Elon Musk (@elonmusk) March 10, 2024

Which leads us to another question: recall that the primary concern for the Biden admin for much of 2022 and 2023 was soaring prices, i.e., relentless inflation in general, and rising wages in particular, which in turn prompted even Goldman to admit two years ago that the diabolical wage-price spiral had been unleashed in the US (diabolical, because nothing absent a major economic shock, read recession or depression, can short-circuit it once it is in place).

Well, there is one other thing that can break the wage-price spiral loop: a flood of ultra-cheap illegal immigrant workers. But don't take our word for it: here is Fed Chair Jerome Powell himself during his February 60 Minutes interview:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants work hard, and Americans are lazy. But much more importantly, since illegal immigrants will work for any pay, and since Biden's Department of Homeland Security, via its Citizenship and Immigration Services Agency, has made it so illegal immigrants can work in the US perfectly legally for up to 5 years (if not more), one can argue that the flood of illegals through the southern border has been the primary reason why inflation - or rather mostly wage inflation, that all too critical component of the wage-price spiral - has moderated in in the past year, when the US labor market suddenly found itself flooded with millions of perfectly eligible workers, who just also happen to be illegal immigrants and thus have zero wage bargaining options.

None of this is to suggest that the relentless flood of immigrants into the US is not also driven by voting and census concerns - something Elon Musk has been pounding the table on in recent weeks, and has gone so far to call it "the biggest corruption of American democracy in the 21st century", but in retrospect, one can also argue that the only modest success the Biden admin has had in the past year - namely bringing inflation down from a torrid 9% annual rate to "only" 3% - has also been due to the millions of illegals he's imported into the country.

We would be remiss if we didn't also note that this so often carries catastrophic short-term consequences for the social fabric of the country (the Laken Riley fiasco being only the latest example), not to mention the far more dire long-term consequences for the future of the US - chief among them the trillions of dollars in debt the US will need to incur to pay for all those new illegal immigrants Democrat voters and low-paid workers. This is on top of the labor revolution that will kick in once AI leads to mass layoffs among high-paying, white-collar jobs, after which all those newly laid off native-born workers hoping to trade down to lower paying (if available) jobs will discover that hardened criminals from Honduras or Guatemala have already taken them, all thanks to Joe Biden.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex