Uncategorized

Futures At Session High, Just Shy Of 4,000, Ahead Of CPI

Futures At Session High, Just Shy Of 4,000, Ahead Of CPI

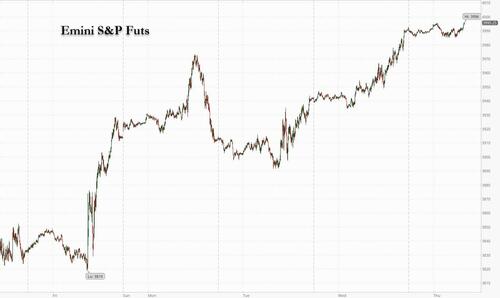

US futures are trading near session highs after earlier fluctuating between gains…

US futures are trading near session highs after earlier fluctuating between gains and losses ahead of make-or-break inflation data which many expect will show price pressures continuing to ease. S&P 500 futures traded 0.1% higher as of 7:30am ET, just shy of 4,000, one day after the S&P 500 clocked this year’s first back-to-back gains on Tuesday and Wednesday. The gains stem from bets that cooling inflation ill give the Federal Reserve room to slow its pace of rate hikes, a take substantiated by Boston Fed chief Susan Collins, who said she was leaning toward a quarter-point move at the bank’s Feb. 1 meeting. Treasuries steadied after gains in Wednesday’s session, with the 10Y trading at 3.52%, while a gauge of dollar strength edged lower as investors looked beyond the drumbeat of hawkish comments from Federal Reserve officials. The yen rallied on a report that the Bank of Japan will look into the side effects of its ultra-loose monetary policy. Commodities are mostly higher with the dollar weaker.

Yesterday, the Fed’s Collins supported a 25bps hike, inline with market expectations coming into CPI. US air traffic was disrupted by a FAA system outage but is back online; US reopening names continue to rally, once again in sympathy with China. Media is flagging the rallies in meme stocks, which may mean that the retail investor is coming back to the market after having sold a near record >$3bn last week. Today’s focus is on the CPI print and the balance of this note includes analysis of the print with views from around the firm, including monetization methods.

“Markets are positioned for a CPI reading which will not disturb their march forward”, said Andrea Tueni, head of sales trading at Saxo Banque France. But “the last three publications generated a lot of volatility across markets so there’s a lot at stake,” he added.

Among premarket movers, Tesla fell 2% after Bloomberg reported that an expansion of the company’s plant in Shanghai has been delayed, putting a roadblock in the way of its ambitions to increase its market share in China. Bed Bath & Beyond shares surged another 26%, extending Wednesday gains, after a rally in other so-called meme stocks. Here are other notable premarket movers:

- Spotify shares fall 2.2%, Roku (ROKU US) declines 3.1%, Unity Software (U US) down 2.8% after Jefferies downgraded them in a note on US media outlook, while upgrading Netflix and JAKKS. Netflix shares gain 1.6% after Jefferies raised the recommendation to buy from hold, citing upside surprises to 2024 operating margin.

- Tesla fell 1.2%, erasing earlier gains, after Bloomberg reported that an expansion of the US electric carmaker’s plant in Shanghai has been delayed.

- Bed Bath & Beyond shares surge 21% in US premarket trading, extending Wednesday gains after a rally in other so-called meme stocks.

- Marathon Digital shares advance 8.6%, leading cryptocurrency-exposed stocks higher as Bitcoin rallies to break back above the $18,000 level, extending gains for a ninth consecutive session — its longest streak since July 2020.

- Oramed’s US shares plunge 71% after the company’s experimental oral insulin failed in a late-stage clinical trial of Type 2 diabetes patients.

- Keep an eye on chemicals after KeyBanc Capital Markets said that it sees a favorable risk skew in the sector’s stocks for 2023, although with only modest upside. The broker downgrades DuPont de Nemours to sector weight.

- Citi says it continues to favor US exchange operators over brokers into 2023, in a note cutting Virtu Financial (VIRT US) to neutral.

Every aspect of Thursday’s CPI report will be scrutinized, with extra attention on core inflation, which excludes food and energy and is seen as a better indicator than the headline measure. The projected 5.7% increase would be well above the Fed’s goal, helping explain its intention of keeping rates higher for longer. But the year-over-year price growth would also show moderation.

“Core inflation remains well above target,” said Ronald Temple, chief market strategist at Lazard Ltd. “Having been late to act, the Fed is unlikely to pause the tightening cycle until inflation is definitively under control.”

There was a note of caution in the morning note from JPM's Market Intelligence team, which warned that most of a CPI miss may already be priced in:

The SPX is +4.2% since last Friday, leading to multiple conversations as to whether a cooler CPI print is priced in. That seems to be the view from my client conversations, with most thinking we see a spike on the print and then fade from there. Their rationale? The print will confirm the deflationary narrative, but it will not be low enough to materially reprice bonds lower. To clarify, this CPI print should not change Fed expectations for 25bps hikes in both February and March. Further, any subsequent Fedspeak is likely to be hawkish given that financial conditions are now looser than at Jackson Hole (is it possible that the Fed could keep 2023 meetings as “live meetings” after they pause?). While recognizing that inflation expectations are lower now, the Fed’s concern is likely to be that, given the relative strength of the US Consumer, that you could see inflation accelerate higher if lending conditions ease.

Thinking about today’s session, I do think there is still the ability for the market to experience another rally despite the moves coming into the print. Longer-term, earnings are the next key catalyst and if Q4 GDP is stronger than expected, this should be reflected in earnings since EPS growth tends to be more correlated to nominal growth rather than real growth.

European equity indexes rose with the Stoxx 600 up 0.7% and reaching highest since last April as traders bet US inflation will show further signs of cooling. The CAC and FTSE have gain 0.6% while the DAX adds 0.5%. Real estate, autos and travel are the strongest performing sectors. Here are the biggest European movers:

- Whitbread jumps as much as 4.9%, hitting the highest since February 2022, with analysts saying its “positive” trading update implied improvements in 2023 and 2024 performance

- Vodafone shares rise 3% after BofA upgraded to buy, saying easing energy costs and the telecom’s improving price traction should result in positive revision to earnings estimates

- Asos shares soar the most since October, after the struggling fast-fashion retailer said it was making headway in plans to turn around its performance

- Boozt gains as much as 11%, rebounding from the previous day’s 9.9% plunge, after the Swedish online retailer beat expectations in its 4Q report; a “positive relief,” DNB says

- Logitech shares drop as much as 19% in early trading, the most since April 2011, after its second guidance cut in three quarters. The moves pull peers, including GN Store Nord and Demant, lower

- Ubisoft shares tumble as much as 22% after forecasting an operating loss, delaying the Skull & Bones title for a sixth time, and saying recent game launches “have not performed as well as expected”

- Halfords drops as much as 24%, the most since June 2022, as Peel Hunt trimmed its rating to add from buy, noting labor shortages and cost pressures couuld squeeze profit

- Signify shares slumped as much as 6% after the company lowered its full-year guidance once again on Covid-19 disruptions in China

Earlier in the session, Asian stocks advanced, as miners in Australia climbed on demand optimism ahead of highly-awaited US inflation data. The MSCI Asia Pacific Index rose as much as 0.8% to the highest since August before paring. Japan’s MUFJ, AIA in Hong Kong and Australia’s BHP boosted the index the most while the Chinese tech rally took a pause. The stock benchmark in Australia was a notable winner in the region, advancing 1.2% to the highest in five weeks, as miners rallied amid hopes China’s reopening will spur demand for metals. Equities in Japan posted moderate gains helped by financials after a report said the Bank of Japan is reviewing the side effects of its ultra-easy monetary policy. Benchmarks in Hong Kong and mainland China fluctuated between gains and losses as traders digested Chinese inflation data. Trading volume was 14% lighter than average ahead of key consumer price data from the US due later Thursday.

“Continued rerating triggered by improved sentiment is carrying markets higher,” said Lorraine Tan, director of equity research at Morningstar Asia. “Inflation pressure is easing and interest rates should be peaking within the next six months.” While consensus view is that US prices have peaked, investors will scrutinize the upcoming inflation report for any indication of the Federal Reserve’s future rate hike path. Asian equities have outperformed US peers so far 2023 amid reversals in the dollar strength and China’s Covid Zero policy. Easing concerns over China’s regulatory risks and property sector have also lured investors back to the region. “A lot of things that have been bothering me were reversed,” Ajay Kapur, head of APAC and Global EM strategy at Bank of America Securities, told Bloomberg TV, referring to China’s policy turnaround in November. “I’m still quite constructive.” Elsewhere in Asia, the Indonesian benchmark rose, one day after entering a technical correction.

Japanese stocks edged higher as investors assessed reports on the Bank of Japan’s plans and awaited US inflation data that may influence Federal Reserve policy. The Topix rose 0.4% to close at 1,908.18, while the Nikkei was little changed at 26,449.82. The yen gained 0.7% against the dollar after a Yomiuri report that the BOJ is considering further policy tweaks at its meeting next week. Mitsubishi UFJ Financial Group contributed the most to the Topix gain, increasing 5% after the Yomiuri report. Out of 2,162 stocks in the index, 786 rose and 1,257 fell, while 119 were unchanged. “US CPI is definitely one factor to watch, but the BOJ’s YCC change last December still has a lingering effect,” said Hiroshi Matsumoto, senior client portfolio manager at Pictet Asset Management. “It seems that stocks had been oversold on the policy change, and the market is still recovering from it.”

Australia stocks jumpe to a five week high, buoyed by miners. The S&P/ASX 200 index rose 1.2% to close at 7,280.40, its highest level since Dec. 6. The benchmark outperformed regional stock gauges, boosted by banks and miners. Materials shares have been climbing on bets that China’s reopening will fuel demand for metals. Read: China Reopening Sends Australian Mining Stocks Near Record High In New Zealand, the S&P/NZX 50 index rose 0.2% to 11,664.88.

India’s benchmark stock index dropped for a third day ahead of key economic data including retail inflation. Bharti Airtel and Reliance Industries declined amid rising worries over the impact of 5G services on telecom companies’ pricing recovery. The S&P BSE Sensex fell 0.3% to 59,958.03 in Mumbai, while the NSE Nifty 50 Index declined 0.2%. For the week, the benchmark gauge is flat, helped by a sharp rally on Monday. Small and mid-cap stock gauges also declined. BSE Ltd.’s 20 sector sub-gauges were mixed, with capital goods firms leading the advance while oil & gas companies were worst performers. Software exporter Infosys, which reported December quarter earnings after close of trading, posted higher-than-expected profit, while raising sales forecast. Consumer price inflation probably rose 5.9% in December from a year ago, according to a Bloomberg survey, and little changed from the previous month. Data for industrial output in November will also be released after close of markets.

In Fx, the Bloomberg Dollar Index is down 0.2% with the JPY a clear outperformer among the G-10’s. SEK is the weakest. The Bloomberg Dollar Spot Index extended losses in the European session as the yen rallied by as much as 1.2%, to 130.89 per dollar. The greenback traded mixed against the other Group-of-10 peers, with moves confined to narrow ranges.

- The yen’s rally followed after the Yomiuri newspaper said policy makers will consider adjusting their bond purchases and make further policy tweaks if they believe they are necessary, without giving any attribution. The cash 10-year yield remained pinned against the 0.50% ceiling while the 15- year yield added 8bps

- The euro inched up to a day high of 1.0775. Bunds climbed, led by the belly, and Italian bonds outperformed. Money markets added to ECB tightening wagers, paring some of Wednesday’s late declines after policymakers Rehn and De Cos warned of significant rate hikes

- The pound traded higher against the dollar. The Bank of England’s Catherine Mann is due to speak Thursday, with money markets easing wagers on the scope for further rate hikes

In rates, the treasuries curve extends Wednesday’s flattening move with long-end outperforming ahead of 30-year auction, following a wider rally across core European rates led by gilts. US session events include December CPI report and several Fed speakers. US long-end yields richer by about 3bp, flattening 2s10s, 5s30s spreads by 1.5bp and 2bp vs Wednesday’s close; the 10-year trades around 3.52%, trailing bunds by 2.5bp, gilts by 5.5bp in the sector. UK gilts outperform as deteriorating macro backdrop continues to take BOE rate-hike premium out of the UK swaps market. In US, December inflation data is expected to build a case for a downsized 25bp rate hike at the February policy meeting. The US auction cycle concludes with $18bn in 30-year reopening at 1pm; Wednesday’s 10- year auction stopped through by 0.5bp with strong participation metrics. WI 30-year yield at ~3.640% is ~13bp cheaper than December’s result reflecting curve-steepening in the interim. UK and German bonds are marginally higher having pared most of their earlier advance.

In commodities, oil rose for a sixth day on hopes US inflation is cooling and as China’s crude buying ramps up before the Lunar New Year holidays. WTI was up 0.9% to trade above $78. Spot gold rises roughly $8 to trade near $1,884/oz. Base metals are mixed.

In crypto, bitcoin rose above the $18k mark, with today's action bringing it back towards its 14th December best, which itself is just shy of USD 18.5k. Coinbase is reportedly considering exiting the Japanese market, via Nikkei.

Looking the day ahead now, the main data highlight will be the US CPI release for December, whilst other data includes the weekly initial jobless claims. From central banks, we’ll hear from the Fed’s Harker, Bullard and Barkin, as well as the BoE’s Mann, and the ECB will be publishing their Economic Bulletin.

Market Snapshot

- S&P 500 futures little changed at 3,990.25

- MXAP up 0.7% to 163.37

- MXAPJ up 0.3% to 537.24

- Nikkei little changed at 26,449.82

- Topix up 0.4% to 1,908.18

- Hang Seng Index up 0.4% to 21,514.10

- Shanghai Composite little changed at 3,163.45

- Sensex down 0.2% to 59,967.65

- Australia S&P/ASX 200 up 1.2% to 7,280.40

- Kospi up 0.2% to 2,365.10

- STOXX Europe 600 up 0.6% to 450.19

- German 10Y yield little changed at 2.17%

- Euro little changed at $1.0766

- Brent Futures up 0.4% to $82.99/bbl

- Brent Futures up 0.4% to $82.99/bbl

- Gold spot up 0.4% to $1,883.84

- U.S. Dollar Index down 0.14% to 103.04

Top Overnight News from Bloomberg

- Overnight volatility remains high in the majors as traders await the release of the US CPI data. While dollar-topside bets lose traction across, it’s the shift in the pound’s volatility skew that gains attention while yen bullish exposure meets another catalyst

- The euro’s rally against the dollar has stalled over the past month at resistance around its May high. Bulls are hoping Thursday’s US inflation data will provide enough ammunition for it to breach that barrier and resume its progress toward $1.10

- Consumers’ expectations for inflation over the next 12 months declined to 5% in November from 5.4% in October, the ECB said Thursday in a statement summarizing the results of its monthly survey

- Kazakhstan said local brokerages that snapped up Russian sovereign debt last year did so largely on behalf of clients who were Kazakh and Russian residents

- Britain’s markets watchdog has warned of potential “systemic defaults” among wholesale brokers in the City of London that may be unfit to weather sudden shocks and longer periods of stress

- HSBC Holdings Plc lost its bid to topple a reputation-bruising decision that it illegally rigged the Euribor benchmark, in a setback that removes part of the gloss from a procedural victory that overturned millions of euros in European Union fines

- China hasn’t updated its daily Covid reports for three days, adding to global concerns that the information vacuum is masking the true impact of the world’s biggest outbreak.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as the major indices failed to fully sustain the early momentum from Wall St. ASX 200 was led higher by outperformance in the commodity-related industries and the top-weighted financial sector, while the latest trade data showed a wider trade surplus. Nikkei 225 faded early gains after a report that the BoJ is to review the side effects of its monetary easing. Hang Seng and Shanghai Comp swung between gains and losses with the Hong Kong benchmark initially boosted by the reopening play which helped energy, auto and casino names. However, Chinese markets then failed to sustain the early moment amid losses in tech and as participants digested mixed inflation data from the mainland in which CPI matched estimates but factory gate prices fell by more than expected.

Top Asian News

- PBoC injected CNY 65bln via 7-day reverse repos with the rate kept at 2.00% and CNY 52bln via 14-day reverse repos with the rate kept at 2.15% for a CNY 115bln net daily injection.

- US and Taiwan intend to focus on five areas this weekend during their first round of negotiations towards a trade agreement and indicated a readiness for subset deals as the sides make progress, according to WSJ.

- BoJ is to review the side effects of its massive monetary easing at its policy meeting next week due to skewed interest rates in markets despite last month's tweak in its bond yield control policy, according to Yomiuri.

- TSMC Offers Mixed Outlook, Lower Spending for Tough Year Ahead

- China’s Covid Zero Enforcement Army Faces Unpaid Wages, Job Loss

- Fosun Is Said to Weigh Sale of Belgian Diamond-Grading Firm IGI

- HSBC Loses Fight at EU Top Court Over Euribor Rigging Charge

European bourses are firmer across the board, Euro Stoxx 50 +0.5%, though price action has been fairly contained in slim pre-CPI newsflow. US futures are essentially unchanged, ES -0.1%, ahead of December's CPI and Fed speak before and after the key data. TSMC (2330 TT) Q4 (TWD) net 295.9bln (exp. 289.4bln), rev. 625.5bln (prelim. 625.5bln), says smartphone and PC demand dropped more severely than expected. Guides Q1 (TWD) rev. 16.7bln-17.5bln (exp. 16.4bln) and sees H1 revenue down mid-to-high single digit percentage. Tesla's (TSLA) expansion of its Shanghai plant has been delayed, according to Bloomberg sources; cites concerns in Chinese government over CEO Musk's Starlink having such a large presence in China.

Top European News

- ECB Consumer Expectations Survey: Inflation is seen at 5% (vs. prev. view of 5.4%) over the next 12 months; 3 year inflation is seen at 2.9% vs. prev. view of 3.0%.

- UK and EU are preparing to enter an intense phase of negotiations from next week, via Bloomberg citing sources; aim of this is to move into the negotiating "tunnel", ahead of the April N. Ireland agreement anniversary.

- A Third of Dublin’s Office Supply Dormant After Cuts

- Arbonia Falls After Margin Warning; Modest Downgrade Needed: ZKB

- Apollo-Backed Gaming Firm Lottomatica Weighs $1 Billion IPO

- RBC Sees Tough Year For Business Services, Cuts Three Stocks

FX

- Yomiuri Yen revival keeps Greenback grounded awaiting US CPI data.

- USD/JPY probes 131.00 vs almost 133.00 on Wednesday and DXY tethered to pivotal 103.000 level.

- Pound perks up on 1.2100 handle as Dollar drifts, Euro consolidates around 1.0750 axis and Aussie pivots 0.6900 with support from a wider than forecast trade surplus.

- PBoC set USD/CNY mid-point at 6.7680 vs exp. 6.7698 (prev. 6.7756)

- S. African Finance Minister says they want to resolve the Eskom issue ASAP, part of this is sorting the balance sheet. Appropriate announcement will be made on February 22nd.

Fixed Income

- Bonds wane after an early bull run to and through new big figure levels for Bunds and Gilts at 138.45 and 104.14 respectively.

- US Treasuries more reserved ahead of inflation report as T-note holds just under w-t-d peak and resistance within a 114-11/22 range.

Commodities

- Upside for the crude space has occurred this morning seemingly without a fresh specific catalyst or driver, with the space perhaps taking advantage of a pre-CPI softening in the USD and the somewhat constructive European risk tone.

- Lifting WTI Feb’23 to a new WTD peak of USD 78.29/bbl, though this is someway shy of last week’s USD 81.50/bbl best.

- China's customs officials in the Guangdong province reportedly received notice from the local gov't that they can clear Australian coal shipments, via WSJ citing sources.

- Morgan Stanley expects Brent prices to remain range-bound for remainder of Q1, around current USD 80-85/bbl range.

- Spot gold is similarly taking advantage of the USD’s pullback but remains slightly shy of yesterday’s USD 1886/oz best thus far, while base metals are softer across the board.

- Magnitude 6.4 earthquake strikes Coquimbo, Chile, according to EMSC.

Geopolitics

- US Defence Secretary Austin said China's military is engaging in provocative behaviour around Taiwan to try to establish a new normal, but added that he seriously doubts Chinese provocations are a prelude to an imminent invasion of Taiwan, according to Reuters.

- Taiwan's Defence Ministry said five Chinese air force planes crossed the Taiwan Strait median line in the past 24 hours, according to Reuters.

US Event Calendar

- 08:30: Dec. CPI MoM, est. -0.1%, prior 0.1%

- CPI YoY, est. 6.5%, prior 7.1%

- CPI Ex Food and Energy MoM, est. 0.3%, prior 0.2%

- CPI Ex Food and Energy YoY, est. 5.7%, prior 6.0%

- Real Avg Hourly Earning YoY, prior -1.9%, revised -2.1%

- Real Avg Weekly Earnings YoY, prior -3.0%, revised -3.3%

- 08:30: Jan. Initial Jobless Claims, est. 215,000, prior 204,000

- Continuing Claims, est. 1.71m, prior 1.69m

- 14:00: Dec. Monthly Budget Statement, est. -$65b, prior -$21.3b

Central Bank Speakers

- 08:45: Fed’s Harker Discusses the Economic Outlook

- 11:30: Fed’s Bullard Discusses the US Economy and Monetary Policy

- 12:40: Fed’s Barkin Speaks in Richmond

DB's Jim Reid concludes the overnight wrap

Morning from Copenhagen on a big day for global markets. Both the worst and best days for the S&P 500 in 2022 came on days of a CPI release. As such, it's inevitable that today’s US CPI has the ability to shape the next month.

Indeed, after a long run of inflation surprising on the upside, the latest releases have seen two downside surprises on CPI in a row for the first time since the pandemic, which has led to growing hopes that the Fed might achieve a soft landing after all. Furthermore, core inflation has also been increasingly subdued, with the most recent number for November showing monthly core inflation at a 15-month low. Those readings helped to bolster the case for the Fed to downshift their rate hikes last month, and if we did get a third downside surprise today, clearly that would add further fuel on market speculation about a Fed pivot later in the year.

In terms of what to expect today, our US economists think that falling gas prices over December will take headline CPI into negative territory at just -0.15% on the month (vs. -0.1% consensus). They also expect core CPI to remain subdued at +0.22% on a monthly basis (vs. +0.3% consensus), which would be only slightly above the 15-month low of +0.20% in November. If those forecasts are right, then that would take year-on-year growth in CPI down to +6.3% (vs. +6.5% consensus), its lowest in over a year, whilst core CPI would be down to +5.6% (vs. +5.7% consensus). As ever, the individual components will be in focus, particularly the stickier ones that change less frequently.

Ahead of that release, growing optimism about the inflation outlook led to a major rally in sovereign bonds yesterday, particularly in Europe. For instance, yields on 10yr OATs (-14.1bps), BTPs (-18.7bps) and gilts (-14.8bps) all plummeted, and although there was a contract roll on the 10yr bund, the generic series on Bloomberg was also down -10.4bps. In part that was driven by a fresh decline in natural gas prices, which were down -5.56% yesterday to €65.45/MWh, just above their one-year closing low last week.

That rally got further support later in the session by a Bloomberg report which said that German Chancellor Scholz was supportive of a new joint EU financing instrument to help the EU compete against US green subsidies. That helped spreads tighten in particular, with the gap between Italian and German 10yr yields now down to 183bps, which is down by a significant -28.9bps since the start of the year. And the optimism was also clear from other European assets, with the Euro closing at its highest level since May at $1.076, just as the iTraxx Crossover index tightened -10.0bps to levels last seen in April.

In the US, Treasuries rallied as investors looked forward to the CPI release, with 10yr yields down -7.9bps to 3.539% and are down another -1.5bps in Asia at 3.524%. However, the moves have been much more subdued at the front end, with the 2yr yield only down -2.9bps (unch overnight), and there was little sign from Fed funds futures that investors were adjusting their policy outlook either. Indeed, the terminal rate priced in for June was little changed ahead of the CPI today, up just +0.4bps to 4.947%. The lack of movement was despite Boston Fed President Collins saying that she was leaning toward downshifting to a 25bps hike in the February meeting.

For equities, this benign economic backdrop led to further advances, with the S&P 500 up another +1.28%. 22 of 24 industry groups finished up on the day with 80% of overall constituents gaining yesterday. Tech stocks outperformed in that, with the NASDAQ (+1.76%) advancing for a 4th consecutive session for the first time since September. As an example of the swing back, Tesla (+3.68% yesterday) is now up +13.99% from the recent lows on January 3rd. Back in Europe, there were similar gains, with the STOXX 600 (+0.38%), the DAX (+1.17%) and the CAC 40 (+0.80%) all seeing robust advances, which brought the YTD performance for the DAX up to +7.36%.

Asian equity markets have failed to extend the overnight gains on Wall Street though with the Hang Seng (-0.33%), the Shanghai Composite (-0.23%) and the CSI (-0.08%) surrendering their opening gains whilst the Nikkei (+0.10%) and the KOSPI (+0.34%) are just in positive territory. Outside of Asia, US stock futures are fluctuating between gains and losses with contracts on the S&P 500 (+0.04%) just above flat while those on the NASDAQ 100 (-0.05%) trading fractionally lower ahead of the key inflation report.

Data overnight from China showed that inflation accelerated to +1.8% y/y in December, in line with market expectations, driven by rising food prices despite economic activity remaining soft due to Covid. It followed the prior month’s reading of +1.6%. However, factory gate prices (producer prices) dropped -0.7% y/y in December (v/s -0.1% expected), but up from a fall of -1.3% in November. Elsewhere, Australia’s trade surplus unexpectedly grew in November to A$13.20 billion (v/s +A$11.30 billion expected), compared with last month’s revised reading of A$12.74 billion. The figure was at its highest level since a record high hit in June.

In the FX market, the Japanese yen (+0.77%) is strengthening against the dollar this morning, trading at $131.43 following the news that the Bank of Japan (BOJ) will review the side-effects of its ultra-loose policy at next week’s policy meeting.

Elsewhere, several commodities have put in a pretty decent performance over the last 24 hours. For instance, Brent crude oil prices were back up by +3.21% to $82.67/bbl, having risen every day so far this week. They are up another +0.17% in Asia. Separately, copper prices were up +2.17% last night to their highest level since June, having been supported by growing optimism about Chinese demand given the reopening.

Lastly, there wasn’t much data of note yesterday, although Italian retail sales for November unexpectedly grew by +0.8% (vs. -0.3% expected).

To the day ahead now, and the main data highlight will be the US CPI release for December, whilst other data includes the weekly initial jobless claims. From central banks, we’ll hear from the Fed’s Harker, Bullard and Barkin, as well as the BoE’s Mann, and the ECB will be publishing their Economic Bulletin.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire