Furious Rally Pauses As Sentiment Turns Metaworse Amid Record Earnings Barrage

Furious Rally Pauses As Sentiment Turns Metaworse Amid Record Earnings Barrage

One day after the Nasdaq 100 posted its biggest jump since…

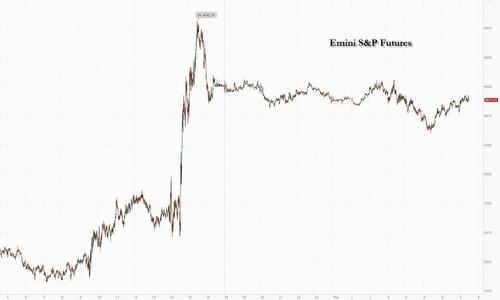

One day after the Nasdaq 100 posted its biggest jump since November 2020 when the market exploded higher after it interpreted Powell's forward guidance purge and comment that it is "likely appropriate to slow rate increases at some point" as more dovish than expected, US stocks were set to pull back as downbeat earnings and a dire outlook from bad to Metaworse weighed on demand. Futures contracts on the technology-heavy Nasdaq 100 dropped 0.5% by 7:15 a.m. in New York, after the underlying gauge rallied 4.3% in the previous session. S&P 500 futures were down 0.2% after the benchmark index jumped to its highest level in seven weeks. Treasury yields were little changed and the dollar and bitcoin edged up.

In premarket trading, Facebook parent Meta tumbled after it reported its first-ever quarterly sales decline as ad spend by businesses cooled, leading to a far worse than expected forecast. Qualcomm also slipped as it issued a lackluster forecast. Renewable energy companies soared in Europe and premarket trading following a deal by Democrats and Senator Manchin to advance a bill that will spend hundreds of billions of dollars on energy security and climate change. Vestas Wind Systems A/S surged more than 14% as oil also rose. Spirit Airlines Inc. rose in premarket on a deal with JetBlue Airways Corp. Among other individual movers, Best Buy dropped in premarket trading as analysts slashed their price targets on the retailer after it cut its profit and sales outlook. Ford Motor on the other hand, jumped after reporting better-than-expected adjusted earnings per share for the second quarter. Here are some other notable premarket movers:

- Qualcomm (QCOM US) shares fall 4.5% in premarket trading after the chipmaker issued a lackluster forecast for the current quarter as it expects weakening economy to weigh on consumer spending on mobile devices. Watch shares of US chipmakers and semiconductor capital equipment stocks, including Lam Research (LRCX US), Applied Materials (AMAT US), Nvidia (NVDA US), Advanced Micro Devices (AMD US), Intel (INTC US), after Samsung’s quarterly profit missed estimates and Qualcomm’s forecast.

- Meta Platforms (META US) shares are down 5.9% in premarket trading, after the Facebook parent reported its first- ever quarterly sales decline as ad spend by businesses cooled.

- Ford (F US) shares jumped as much as 7.7% in US premarket trading after the carmaker’s adjusted earnings per share for the second quarter beat the average analyst estimate.

- Solar energy and renewables stocks gain in US premarket trading after Senator Joe Manchin and Senate Majority Leader Chuck Schumer struck a deal on a tax and energy policy bill.

- First Solar (FSLR US) +10%, SunRun (RUN US) +12%, Enphase Energy (ENPH US) +3.6%, SolarEdge (SEDG US) +4.0%

- Etsy (ETSY US) rises 6.1% in premarket trading on Thursday after the company posted stronger-than-expected second- quarter results, with most analysts seeing the online retailer retaining its market-share gains made during the pandemic

- ServiceNow (NOW US) shares fall 7.5% in US premarket trading, after the software company cut its full-year revenue forecast due to a stronger dollar and a potential pull back in demand.

- Spirit Airlines (SAVE US) shares climb 4.5% in premarket trading as JetBlue Airways is said to be close to an agreement to buy the carrier.

- Best Buy (BBY US) shares drop 4.4% in US premarket trading as analysts slashed their price targets on the retailer after it cut its profit and sales outlook, with brokers blaming the macroeconomic backdrop.

- Teladoc Health (TDOC US) shares fall about 25% in premarket trading after the virtual- care company’s 3Q Ebitda guidance came in below expectations, with analysts saying the outlook for Teladoc is likely to be revised downward.

- Community Health Systems Inc. (CYH US) shares plummet 52% in premarket trading after the hospital company reported a surprise loss per share for the second quarter.

US stocks have rallied in July, putting the S&P 500 Index on course for its biggest monthly gain since October 2021, as the market finally grasps what we have been saying since January, namely that the weaker macroeconomic will prompt the central bank to "pivot" to easier policy, coupled with bets that much of the bad news was now priced in. It could get even worse, er better, today when the US reports Q2 GDP which may confirm that the world's largest economy is in a technical recession further shortening the Fed tightening phase.

To be sure, the knee-jerk relief in markets on possible crumbs of comfort from the Fed outlook echoes a pattern seen after earlier hikes. Those bouts of optimism stumbled on recession risks from a global wave of monetary tightening, Europe’s energy woes and China’s property sector and Covid challenges. “We do feel the hikes are going to slow from these levels,” Laura Fitzsimmons, JPMorgan Australia’s executive director of macro sales, said on Bloomberg Television. But financial-industry participants are skeptical about the pricing indicating Fed rate cuts in 2023, she added.

“As the tug-of-war between inflation and recession fears plays out in the second half of the year, we expect to see highly volatile markets,” Richard Flynn, UK Managing Director at Charles Schwab, wrote in a note.

All eyes have also been on corporate earnings for signs of resilience in profit margins to surging inflation and weaker sentiment. A record number of US and European firms worth more than $9.4 trillion will report their results on Thursday.

Of these $6.8 trillion are 55 S&P500 companies if constituents of the Nasdaq 100 are included. That comes on the heels of the Fed raising rates by 75 basis points for a second month, saying such a move is possible but that the pace of hikes will slow at some point. Chair Jerome Powell said policy will be set meeting-by-meeting as he tries to control rising prices amid signs of an economic slowdown. Big Tech will be a particular focus again with results from Amazon, Apple and Intel.

“We see the earning season as a mixed bag and it’s not necessarily very good news looking forward because we have an economic momentum that is this decelerating very fast and we also have central banks all around the world hiking interest rates,” Geraldine Sundstrom, portfolio manager for asset allocation strategies at Pimco, said on Bloomberg TV.

“For financial markets, the risk of the Fed taking an overly aggressive stance has eased over the past week due to mixed growth and inflation data,” said Gurpreet Gill, macro strategist of fixed income and liquidity solutions at Goldman Sachs Asset Management. “Growing evidence of slowing demand has curbed the need for speed –- hence the Fed did not provide forward guidance on its policy path.”

The dovish Fed euphoria also helped lift European stocks, which initially faded a strong opening bounce only to recover all gains. Euro Stoxx 600 rose 0.5%, with the FTSE MIB outperforming, adding 0.8%, IBEX lags, dropping 1.3%. Telecoms, food & beverages and utilities are the worst-performing sectors. The Stoxx 600 Basic Resources index rose as much as 3.6%, the top-performing sub-index in the benchmark, following well-received results and with metals prices gaining. ArcelorMittal jumped following a cash flow beat and new buyback in its results, while Anglo American gains as its earnings and dividend both topped expectations. Other steel stocks SSAB, Voestalpine higher after ArcelorMittal and after beat from Acerinox. Copper miners KGHM and Antofagasta the biggest gainers with copper price up for fifth day. Here are some of the most notable market movers:

Shell rises as much as 2.2% after the company reported what RBC Capital Markets described as strong results and announced that it will repurchase a further $6 billion of shares in the third quarter.

- Renewable energy companies’ shares soared following a deal by US senators to advance a bill that will spend hundreds of billions of dollars on energy security and climate change. Vestas Wind Systems stock gained as much as 15%, Nordex +12%, Orsted +6.5%, SMA Solar +7.6%, Meyer Burger +9.3%

- Schneider Electric shares were up as much as 5.2% after it reported a strong set of results; analysts welcome the increased FY growth targets and the company’s ability to pass on inflation.

- Diageo rises as much as 2.7% after the British distiller’s FY22 organic sales beat estimates. The group reiterated its medium-term guidance even as it expects a challenging environment for FY23.

- Stellantis shares gain as much as 4.3%, after the carmaker reported 1H results that Jefferies called “impressive and clean.”

- TotalEnergies declines as much as 3.8%, after its plan to maintain the pace of buybacks disappointed some analysts amid expectations for accelerated share repurchases in the industry.

- Airbus shares fall as much as 6.6% in Paris after the aircraft maker cut its full-year delivery projections and pushed back ramping up the A320 build rate to 65 a month from summer 2023 until early 2024.

- Nestle shares drop as much as 2.2% after the company cut its margin outlook for the year. The results are “mixed,” given the sales beat and increased FY organic revenue forecast, but there are questions around margin, according to analysts.

- Fresenius Medical Care shares slide as much as 15% after the dialysis services firm issued a guidance downgrade that showed significant cost pressures on many fronts, Truist says in a note.

Ironically, as Europe edges toward a full-blown energy crisis and recession, its manufacturing giants are raking in the cash. Luxury-car leader Mercedes-Benz joined Europe’s biggest chemicals maker BASF, Swiss building-materials producer Holcim, shipping company Hapag-Lloydand others to report a jump in profit and raise earnings forecasts for the year.

The results offered a stark contrast to the wave of grim economic news sweeping across Europe. Confidence in the euro-area fell to the weakest in almost 1 1/2 years as fears of energy shortages haunt consumers and businesses, and the European Central Bank’s first interest-rate increase in a more than decade feeds concerns that a recession is nearing.

Earlier in the session, Asian stocks also advanced after the Federal Reserve said it will slow the pace of interest-rate increases at some point. The MSCI Asia Pacific Index climbed as much as 1.1%, driven by gains in material and energy stocks. Equity benchmarks in the Philippines and New Zealand led gains in the region as a weakening dollar boosted risk appetite. “The stock markets may reverse their recent falls” following the Fed’s decision, said Heo Pil-Seok, chief executive officer at Midas International Asset Management in Seoul.

“Starting today, we should see if there’s any changes in foreign fund flows, as outflows have somewhat eased recently,” he said, adding however that the stock rally may be short-lived as investors remain cautious on earnings. Gains in Asia were small relative to the rally in US stocks overnight, as investors monitored the latest local earnings along with China’s property crisis and the Covid situation. Asian tech bellwether Samsung Electronics provided a weak demand forecast Thursday, citing uncertainties following a rare earnings miss. Chinese benchmarks were flat amid the Politburo meeting and a possible call between Xi Jinping and Joe Biden.

Elsewhere, traders are awaiting a phone call between President Joe Biden and China’s Xi Jinping, which could touch on US tariffs and other points of tension.

Japanese equities climbed, following US peers higher on relief after the Federal Reserve raised interest rates by 75 basis points and indicated that monetary policy tightening will eventually slow down. The Topix rose 0.2% to 1,948.85 as of the market close in Tokyo, while the Nikkei 225 advanced 0.4% to 27,815.48 as the yen gained against the dollar, weighing on exporters such as Toyota. Recruit Holdings Co. contributed the most to the Topix’s gain, increasing 4.4%. Out of 2,169 shares in the index, 1,406 rose and 652 fell, while 111 were unchanged. “It does seem as if the market bottomed out at the end of June,” said Hitoshi Asaoka, a strategist at Asset Management One. “There is a sense that a rise in interest rates is receding worldwide and stocks are also calming down along with that.” Fed Hikes by 75 Basis Points as Powell Sees No US Recession Now

In FX, the Bloomberg dollar spot index revered a drop of 0.6% to trade higher. SEK and DKK are the weakest performers in G-10 FX, JPY maintains outperformance, trading at 135.33/USD. The yen was around 135.40 per dollar, after strengthening more than 1% to 135.11 in Asia, extending an overnight rise to hit a three-week high. It jumped by a similar amount against the euro and the Australian dollar.

In rates, Treasury yields were little changed to 3bps lower in European trading after dropping on Wednesday. The Treasury curve extended Wednesday’s post-FOMC steepening move as short end leads recovery from losses during European morning. Declines followed a large downside options trade, while gilts and bunds have underperformed over the London session. Focal points of US session include first estimate of 2Q GDP and 7-year note auction.US long-end yields remain cheaper by ~2bp while front-end and belly yields are richer on the day, steepening 2s10s by ~2bp, 5s30s by ~3bp; 10-year yields around 2.79% are little changed with bunds cheaper by ~2bp, gilts by ~4bp. Bunds lag following German regional CPI data, with national gauge due at 8am ET. German curve steepens with two-year yields lower after some state inflation gauges slow, while rates at the longer end rise. US 10-year yields are steady at 2.79%.

In commodities, WTI drifts 1.7% higher to trade below $99. Spot gold rises roughly $10 to trade near $1,745/oz. Most base metals trade in the green; LME zinc rises 3%, outperforming peers.

Looking the day ahead, in addition to the US GDP we get core PCE, consumption, and jobless claims in the US. In Europe, German CPI and France PPI are due with the first German regional numbers out just after we press send this morning. Our economists expect MoM CPI at +0.8% in Germany, and +0.5% on the EU harmonized MoM measure.

Market Snapshot

- S&P 500 futures down 0.3% to 4,011.25

- STOXX Europe 600 up 0.2% to 428.98

- MXAP up 1.0% to 160.34

- MXAPJ up 0.8% to 524.61

- Nikkei up 0.4% to 27,815.48

- Topix up 0.2% to 1,948.85

- Hang Seng Index down 0.2% to 20,622.68

- Shanghai Composite up 0.2% to 3,282.58

- Sensex up 1.7% to 56,792.04

- Australia S&P/ASX 200 up 1.0% to 6,889.75

- Kospi up 0.8% to 2,435.27

- German 10Y yield little changed at 0.98%

- Euro little changed at $1.0206

- Gold spot up 0.7% to $1,746.23

- U.S. Dollar Index down 0.18% to 106.26

Top Overnight News from Bloomberg

- Chair Jerome Powell said the Federal Reserve will press on with the steepest tightening of monetary policy in a generation to curb surging inflation, while handing officials more flexibility on coming moves amid signs of a broadening economic slowdown.

- The yen catapulted higher against major peers on Thursday as lowered expectations for rate hikes caused hedge funds to cover short bets from one of the biggest global macro trades of the year.

- US Stocks Set to Dip After Biggest Tech Gain Since November 2020

- Meta Disappoints With Forecast Miss, First-Ever Revenue Drop

- China Leaders Call for ‘Best’ Growth Outcome at Key Meeting

- US Offers Russia to Swap Jailed Basketball Star for Arms Deale

- US Aircraft Carrier Enters South China Sea Amid Taiwan Tensions

- US Offers Russia to Swap Griner and Whelan for Arms Dealer Bout

- Barclays Latest Bank to Make Provision for US WhatsApp Fine

- Yen Roars Back as Hedge Funds Cut and Run From Big Macro Short

- China-US Deal Needed Soon to Avoid Delistings, Gensler Says

- Alibaba’s Gains From Primary Listing Plan Wiped out in Two Days

- Samsung’s Profit Is Latest Tech Casualty to Recession Fears

- Senate Deal Includes EV Tax Credits Sought by Tesla, Toyota

- Manchin Backs $369 Billion Energy-Climate Plan, Rejects SALT

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks eventually traded higher across the board following the firm lead from Wall Street. ASX 200 saw firm gains across its Tech, Gold, and Mining sectors. Nikkei 225 gained in early trade and briefly topped the 28k mark before recoiling as the JPY saw a sudden bout of strength. KOSPI benefited from Samsung Electronics' rise post-earnings, although the firm echoed recent remarks from SK Hynix regarding weaker H2 memory demand. Hang Seng moved on either side of breakeven but later saw an upside bias as Hong Kong Finance Secretary said Hong Kong's H2 economic performance will be better than H1. Shanghai Comp eventually gained despite the recent cautious commentary from Chinese President Xi.

Top Asian News

- Chinese Politburo says it will keep economic operations in a reasonable range.

- Australian Treasurer Chalmers said the final budget outcome for 2021/22 likely to show a dramatically better-than-expected outcome.

- Samsung Electronics (005930 KS) - Q2 2022 (KRW): Revenue 772tln (Co. exp. 77tln); operating profit 14.1tln (exp. 14tln). Net profit 11.1tln (exp. 10.3tln); Chip operating profit 9.98tln (exp. 11.08tln); expects weaker H2 phone/PC memory chip demand.

- South Korean President Yoon has ordered to take steps against illegal activities regarding stock short selling, via Yonhap.

- Hong Kong Finance Secretary said Hong Kong's H2 economic performance will be better than H1; property market fundamentals remain sound. Hong Kong Monetary Chief expects overnight and one-month interbank rate to continue to rise at a much faster pace; says HKD has been stable and has been operating in an orderly manner; public should be prepared for interbank rate to climb further, via Reuters.

- PBoC injected CNY 2bln via 7-day reverse repos with the maintained rate of 2.10% for a net drain of CNY 1bln.

- PBoC set USD/CNY mid-point at 6.7411 vs exp. 6.7425 (prev. 6.7731).

- Japanese government spokesperson says there is currently no plan to impose restrictions on people's movements following increasing COVID cases; Tokyo COVID cases reach 40,406 vs. previous record of 34,995.

European bourses are modestly softer, Euro Stoxx 50 -0.10%, but relatively contained now after fading initial gains from the FOMC-inspired upside. Amid numerous earnings updates from Europe & in the US aftermarket. US futures are relatively stable but continue to post modest losses with the NQ -0.8% lagging amid pre-market downside in Meta post-earnings, -6.0%. Meta Platforms Inc (META) Q2 2022 (USD): EPS 2.46 (exp. 2.59), Revenue 28.82bln (exp. 28.95bln), Advertising revenue 28.15bln (exp. 28.53bln). Outlook reflects continuation of weak advertising demand environment it experienced throughout Q2. Guidance assumes FX will be about a 6% headwind to Y/Y total revenue growth in Q3. Co. said the economic downturn will have a broad impact on digital advertising business, says the situation seems worse than it did a quarter ago. -6.0% in the pre-market. Jack Ma intends to relinquish control of Ant Group, via WSJ sources; to transfer some voting power to executives, could push-back IPO timing by over a year.

Top European News

- German consumer energy bill to increase by EUR 1k/year, following a cost shift, via Bloomberg; Effective from October 1st, via Reuters sources; levy will cover 90% of costs. Subsequently, German Economy Minister says the gas level would cost several hundred EURs per household.

- India to Restart Ukraine Sunflower Oil Imports as Trade Eases

- Wind, Solar Stocks Surge After US Energy Bill Agreement

- Vanguard Europe MD Says Climate Is Now ‘the Most Material Risk’

- Schroders Up; Jefferies Says Results Show Resilience of Platform

- EDF Posts $1.3 Billion Loss as State Readies Nationalization

- Turkey Raises 2022 Inflation Forecast to 60.4% on Imports, Lira

Central Banks

- BoJ Deputy Governor Amamiya said we must not loosen our grip in keeping monetary policy easy as there is no prospect yet of sustainably meeting the 2% inflation target. He added that consumer sentiment has been worsening due to rising energy and food prices. BoJ must be vigilant to financial and forex moves and their impact on economy and prices.

- ECB's Visco refrains from saying whether markets should expect a 25bps or 50bps hike in September; not prepared to say the ECB would go for 50bps in September in order to reach its target quicker. Adds, the ECB doesn't really know where its target is.

- BoK to strengthen monitoring of FX and capital flows following the FOMC hike, according to Bloomberg.

- HKMA raised its base rate by 75bps to 2.75%, as expected, following the earlier Fed rate hike.

- NBH hikes the one-week deposit rate to 10.75% (prev. 9.75%) at tender.

- CBRT Governor says the bank has enough FX reserves to meet high energy costs and reserves continue to increase.

FX

- Fed leaves Dollar in limbo with no firm forward guidance and reliant on unfolding macro fundamentals, DXY depressed within 106.580-050 range vs pre-FOMC high of 107.430.

- Yen outperforms on prospect of less BoJ vs Fed policy divergence, USD/JPY sub-135.50 and key Fib level.

- Kiwi outpaces Aussie as NZ business outlook and activity turn less downbeat, while Australian retail sales miss consensus and slow to softest pace in 2022 so far; AUD/NZD retreats through 1.1150 as AUD/USD and NZD/USD hover just under 0.7000 and 0.6300 respectively.

- Pound extends gains against Euro through 0.8400 and chart trend line, but both fade from post-FOMC peaks vs Buck, Cable unable to reach 1.2200 and EUR/USD fails to hold above 1.0200.

- Lira and Forint flounder irrespective of supportive CBRT rhetoric and NBH raising 1-week deposit rate by 100bp, USD/TRY touches 17.9300 in wake of jump in year end Turkish CPI forecast and EUR/HUF approaches 408.00.

Fixed Income

- Bonds remain volatile post-Fed, but curve steepening the clear trend as markets reset rate expectations to data rather than forward guidance.

- Bunds choppy within wide 154.75-155.87 extremes, Gilts between 116.70-117.19 parameters and T-note from 119-23+ to 120-08+.

- US Treasuries also conscious of looming 7 year supply after potentially pivotal Q2 GDP and jobless claims.

Commodities

- WTI and Brent are firmer by over 1.5% on the session after spending much of the European morning relatively contained.

- European gas prices are significantly more contained when compared to price action earlier in the week but remain at elevated levels comfortably above EUR 200/MWh for TTF.

- Gazprom continues shipping gas to Europe via Ukraine, Thursday's volume is 42.1MCM (vs Monday's 42.2MCM).

- Shell (SHEL LN) has cut gas use at the Rotterdam Pernis (404k BPD) facility by 40% and at German sites by ~70%, due to the ongoing gas situation.

- India's gold demand in H2 is seen falling Y/Y due to lower disposable income; H1 gold demand rose 42% Y/Y, according to World Gold Council.

- Magnitude 6.3 earthquake hits Tocopilla in Chile, according to the EMS; 5.5 magnitude earthquake occurs near Nicaragua coast, via EMSC.

- Nornickel Q2 production: Nickel 48k tonnes, Palladium 709/koz, via Reuters.

- Spot gold is bid by just over USD 10/oz but, again, remains subject to USD action as while the index is bid it has dipped markedly.

- Amidst the USD’s relative weakness, base metals are similarly supported.

US Event Calendar

- 08:30: 2Q GDP Annualized QoQ, est. 0.5%, prior -1.6%

- Personal Consumption, est. 1.2%, prior 1.8%

- PCE Core QoQ, est. 4.4%, prior 5.2%

- GDP Price Index, est. 8.0%, prior 8.2%

- 08:30: July Initial Jobless Claims, est. 250,000, prior 251,000

- Continuing Claims, est. 1.39m, prior 1.38m

- 11:00: July Kansas City Fed Manf. Activity, est. 4, prior 12

DB's Jim Reid concludes the overnight wrap

Just before the June FOMC, the surprise last minute leak that the Fed were about to hike rates by 75bps shocked yields much higher and equities much lower. However last night's routine 75bps July FOMC hike was cheered to the rafters by the equity market with yields also falling, especially at the front end. So how times change! Today we could see confirmation of the start of a technical recession in US with Q2 GDP out, and also German CPI which might show some signs of falling before we think it hits new highs again in the autumn. So a busy day.

Back to the Fed and the expected 75bps hike brings the rate into territory that some Committee members may deem ‘neutral’ (Our full US econ review, here). The statement maintained guidance that the Committee sees further rate hikes, and thus moves into restrictive territory, as appropriate, even as the statement opened by acknowledging that some activity data had softened. Nothing in the statement came as a particular surprise, leaving equities and rates little changed upon release with the bulk of the rally after the press conference started.

At the press conference, the Chair left open the possibility of another super-charged 75bp hike (or larger) in September, but demurred on providing forward guidance, saying that the Committee would be making policy decisions on a meeting-per-meeting basis. A tacit acceptance of what they have already been doing, to an extent. Nevertheless, the Chair did note that the SEP from June, that shows policy getting to between 3% and 3.5% by the end of year, and a terminal rate of 3.8% was probably still the best guide for the path of policy.

Despite the continued insistence on more hikes being necessary, and inflation being much too high, markets instead latched onto the fact that the Committee was cognisant of the signs of slowing growth in the economy, and that the Fed would logically slow the path of tightening at some point. Upon this, markets priced in a shallower policy path, which saw 2yr Treasuries -5.5bps lower on the day, with 10yr yields down -2.2bps, and no more rate hikes in 2023 after hitting a terminal rate of 3.3%. What was left unsaid is that slowing growth has to translate to slowing inflation for the FOMC to pivot policy. That cuts are being priced in within six months when inflation is still climbing from lofty levels seems too optimistic. However this very much fits it with the current market narrative so this doesn't feel the time to fight it.

That optimistic pricing path drove US equities through the roof after the FOMC, with the NASDAQ ending the day +4.06% higher, climbing around +1.58% after the FOMC events, it’s best daily return since April 2020, while the FANG+ was up +5.30%, its best day in two months. Tech stocks outperformed given the sensitivity of their valuations to rate policy, but the broad S&P 500 climbed +2.62% as well, with every sector in the green.

After the FOMC, Meta missed analyst estimates, posting its first ever decline in sales over a quarter, and traded around -4.5% lower in after-hours trading. In the release the company also noted hiring has slowed this year much like its other mega cap brethren. This morning, S&P 500 futures are trading -0.14% lower, with Meta having taken some shine out of the post-FOMC glow.

Elsewhere overnight, Senator Joe Manchin reportedly reached a deal with Senate Majority Leader Chuck Schumer on a tax and spending plan focused on climate spending, capping health care costs, while raising additional tax revenue. This will be a huge story out of Washington heading into the fall midterms, and the overall impact of the bill – which is being structured to pass through the reconciliation process and thus with a simple majority – will be assessed over coming days as more people get eyes on it. An announcement that came out of the blue after Senator Manchin shot down reconciliation efforts in light of growing inflation time and again. One we will surely be talking about more over the near-term.

Ahead of the FOMC, equities were higher on both sides of the Atlantic on buoyant sentiment following optimistic forecasts from tech giants Microsoft and Alphabet the night before. European equities closed modestly higher across the board, with the STOXX 600 closing up +0.47%, the DAX +0.53% higher, and the CAC up +0.75%. The big focus in Europe remained on the gas situation. A German government spokesperson acknowledged there had been a reduction of gas supplies from Russia and noted there was no technical reason for Russia to cut supplies. European natural gas futures climbed another +2.54% on the day to €205.

Core European and Treasury yield curves were flatter heading into the Fed, with 2yr bund yields climbing +8.7bps and 10yr bunds +2.0bps higher to 0.94%. The spread widening in BTPs continued, with 10yr BTPs +5.5bps wider to bunds at 236bps, just under 5bps from their widest levels reached in mid-June.

Meanwhile, Treasury yields were lower across the curve, with the curve even more inverted. The data out before the Fed was never going to be the main driver of rates on the day, and they painted a mixed picture. Housing continued its torrid run, with pending home sales down -8.6% MoM versus expectations of -1.0%. Meanwhile, Durable Goods Orders expanded 1.9% versus -0.4% expectations, while inventories increased 1.9% as well versus 1.5% expectations. Those data helped some GDP trackers, with the Atlanta Fed’s nowcast for 2Q GDP increasing to -1.2% from -1.6% following the data. We get the first advance reading of US 2Q GDP today, but know today’s reading will be subject to many revisions before we have the final figure. 10yr TSY yields are little changed at 2.78% as we go to press this morning.

Brent crude futures climbed +2.13% to $107/bbl, following EIA data that showed inventories fell by 4.52mln barrels, while demand for gasoline in the US looks more robust than some recent survey measures have suggested, putting more upward pressure on energy. Finally, a Biden aide said the Iran deal was not likely to return in the near future, effectively keeping potential additional supply from hitting the market for longer.

Asian equity markets are trading higher this morning following the Fed. Stocks in mainland China are gaining with the Shanghai Composite (+0.89%) and the CSI (+0.95%) both up whilst the Nikkei (+0.32%), the Hang Seng (+0.20%) and the Kospi (+0.97%) all edging higher.

Early morning data showed that retail sales in Australia rose +0.2% m/m in June, its slowest pace this year and down from May’s downwardly revised +0.7% pace of growth and falling short of markets expectations of a +0.5% increase. The soft data represents that soaring inflation and rising interest rates may be finally hampering consumer demand.

To the day ahead, in addition to the US GDP we get core PCE, consumption, and jobless claims in the US. In Europe, German CPI and France PPI are due with the first German regional numbers out just after we press send this morning. Our economists expect MoM CPI at +0.8% in Germany, and +0.5% on the EU harmonized MoM measure.

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

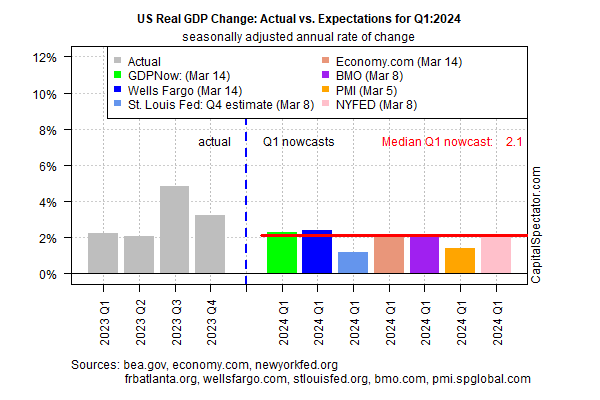

US Economic Growth Still Expected To Slow In Q1 GDP Report

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A